Beruflich Dokumente

Kultur Dokumente

Rental System Used by Ifis: Ijarah

Hochgeladen von

AlHuda Centre of Islamic Banking & Economics (CIBE)Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Rental System Used by Ifis: Ijarah

Hochgeladen von

AlHuda Centre of Islamic Banking & Economics (CIBE)Copyright:

Verfügbare Formate

1

IJARAH

Rental System used by IFIs

November 28- 29, 2013

Ch. Hamad Rasool Bhullar

FCMA, FCIS, FPFA, M.com, DCMA, PGD(Islamic Banking)

2

IJARAH (LEASING) - INTRODUCTION

Ijarah is to offer for a consideration the usufruct of

a thing of value from which benefit can be derived

without consumption, while retaining the

ownership of the leased assets and assuming

risks pertaining thereto

IJARAH AL ASHKAAS Vs IJARAH AL AIYAN

Conventional Lease Vs Islamic Ijarah

Ijarah (Operating Lease)

Ijarah Muntahia Bittamleek

3

It is an Ijarah that ends with the ownership of the asset.

There are several types of Ijarah Muntahia Bittamleek.

These are characterized based on the method by which

the ownership transfers to the user:

For no consideration (through a gift)

For token consideration

For price specified in the lease

For remaining amount (if lease is terminated before period)

Gradual transfer

IJARAH MUNTAHIA BITTAMLEEK

4

ESSENTIALS OF IJARAH

5

IJARAH (LEASING)

The corpus of leased commodity remains in the

ownership of the lessor and only its usufruct is

transferred to the lessee.

Any thing which cannot be used without consuming,

cannot be leased out like money, edibles, fuel, etc.

Only such assets which are owned by the lessor can

be leased out except that a sub-lease is effected by the

lessee with the express permission of the lessor.

Until such time that assets to be leased are delivered

to the lessee, lease rentals do not become due and

payable

6

IJARAH (LEASING)

During the entire term of the lease, the lessor must

retain title to the assets, and bear all risks and rewards

pertaining to ownership.

If any damage or loss is caused to the leased assets

due to the fault or negligence of the lessee, the

consequences thereof shall be borne by the lessee.

The consequences arising from non-customary use of

the asset without mutual agreement will also be borne

by the lessee.

7

IJARAH (LEASING)

The lessee is also responsible for all risks and

consequences in relation to third party liability, arising

from or incidental to operation or use of the leased

assets.

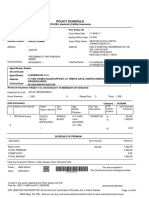

The insurance (Takaful) of the leased asset should be

in the name of lessor and the cost of such Takaful also

borne by him.

A lease can be terminated before expiry of the term

of the lease but only with the mutual consent of the

parties.

8

IJARAH (LEASING)

Either party can make a unilateral promise to buy/sell

the assets upon expiry of the term of lease, or earlier at

a price and at such terms and conditions as are

agreed, provided that the lease agreement shall not be

conditional upon such sale.

Alternatively, the lessor may make a promise to gift the

asset to the lessee upon termination of the lease,

provided the lessee has fulfilled all his obligations.

However, there shall not be any stipulation in the lease

agreement purporting to transfer of ownership of the

leased assets at a future date.

9

IJARAH (LEASING)

The amount of rental must be agreed in advance in an

unambiguous manner either for the full term of the

lease or for a specific period in absolute terms.

Assignment of only the lease rentals is not permissible

except at par value.

Contract of lease will be considered terminated if the

leased asset ceases to give the service for which it

was rented. However, if the leased asset is damaged

during the period of the contract but is capable of being

repaired, the contract will remain valid.

10

IJARAH (LEASING)

A penalty can be agreed ab initio in the lease agreement

for delay in payment of rental by the lessee. In that case,

lessee shall be liable to pay penalty calculated at the

agreed rate in percent per day/annum. However, that

penalty shall be used for the purposes of charity.

However, The Islamic banks can also approach

competent courts for award of damages, at discretion of

the courts, which shall be determined on the basis of

direct and indirect costs incurred, other than opportunity

cost.

Also, security or collateral can be sold by the bank

(purchaser) without intervention of the court.

11

AAOIFI SHARIAH

STANDARD # 9

GUIDLINES

12

Ijarah and Ijarah Muntahia Bittamleek

SHARIAH GUIDLINES

Scope of the standard.

This standard is applicable to operating leases of

properties or to Ijarah Muntahia Bittamleek. Whether

the institution is the lessor or the lessee. This standard

is not applicable to the employment of persons (labor

contract).

Promise to lease (an asset).

It is permissible for the institution to require the lease

promisor (customer) to pay a sum of money to the

institution to guarantee the customers commitment to

accepting a lease on the asset and the subsequent

obligations, provided no amount is to be deducted from

this sum except in proportion to the actual damage

suffered by the institution.

13

Ijarah and Ijarah Muntahia Bittamleek

SHARIAH GUIDLINES

Acquisition of the asset to be leased.

For the validity of an Ijarah contract concerning a

specified asset, the lease contract should be preceded

by acquisition of either the asset to be leased or the

usufruct of that asset.

(a) If the asset or the usufruct thereof is owned by the

institution, which should in principle be the case, an

Ijarah contract may be executed as soon as

agreement is reached by the two parties.

(b) however, if the asset is to be acquired from the

customer, or from a third party, the Ijarah contract

shall not be executed unless and until the institution

has acquired that asset.

14

Ijarah and Ijarah Muntahia Bittamleek

SHARIAH GUIDLINES

Concluding an Ijarah contract.

The lease contract is a binding contract which neither

may terminate or alter without the others consent.

The duration of an Ijarah contract must be specified in

the contract. The period of Ijarah should commence on

the date of execution of the contract, unless the two

parties agree on a specified future commencement

date, resulting in a future Ijarah, that is, an Ijarah

contract to be executed at a future date.

15

Ijarah and Ijarah Muntahia Bittamleek

SHARIAH GUIDLINES

Subject Matter of Ijarah

The leased asset must be capable of being used while

preserving the asset, and the benefit from an Ijarah

must be lawful in Sharia.

The lessor may not stipulate that the lessee will

undertake the major maintenance of the asset that is

required to keep it in the condition necessary to

provide the contractual benefits under the lease. The

lessor may delegate to the lessee the task of carrying

out such maintenance at the lessors cost. The lessee

should carry out operating or periodical (ordinary)

maintenance.

16

Ijarah and Ijarah Muntahia Bittamleek

SHARIAH GUIDLINES

Rules governing lease rentals.

In case the rentals is subject to changes (floating

rentals), it is necessary that the amount of the rentals

of the first period of the Ijarah contract be specified. It

is then permissible that the rentals for subsequent

periods be determined according to a certain

benchmark.

17

Ijarah and Ijarah Muntahia Bittamleek

SHARIAH GUIDLINES

Guarantees and treatment of Ijarah receivables.

Permissible security, of all kinds, may be taken to

secure the rental payments or as security against

misuse or negligence on the part of lessee.

It may be provided in the contract of Ijarah or Ijarah

Muntahia Bittamleek that a lessee who delays payment

for no good reason undertakes to donate a certain

amount or percentage of the rentals due in case of late

payment. Such donation should be paid to charitable

causes under the co-ordination of the institution's

Sharia supervisory board.

18

Ijarah and Ijarah Muntahia Bittamleek

SHARIAH GUIDLINES

Termination of the Ijarah Contract.

The two parties may terminate the Ijarah contract

before it begins to run.

It is permissible to terminate the lease contract by

mutual consent but it is not permissible for one party to

terminate it except in case of force majeure or there is

a defect in the leased asset that materially impairs its

use. Termination is also possible when one party

secures an option to terminate the contract in which

case the party who holds the option may exercise it

during the specified period.

19

Ijarah and Ijarah Muntahia Bittamleek

SHARIAH GUIDLINES

Transfer of the ownership in the leased property in

Ijarah Muntahia Bittamleek.

In Ijarah Muntahia Bittamleek, the method of transferring

the title in the leased asset to the lessee must be

evidenced in a document separate from the Ijarah

contract document, using one of the following methods.

By means of a promise to sell for a token or other

consideration, or by accelerating the payment of the

remaining amount of rental, or by paying the market

value of the leased property.

A promise to give it as gift (for no consideration).

A promise to give it as a gift, contingent upon the

payment of the remaining installments.

20

MECHANISM OF IJARAH

Another popular instrument 15% of the transactions

Easier to understand and implement

Right available to the lessee for purchase

Financier

(Lessor)

Client

(Lessee)

Vendor

Transfer of asset

Beneficial use

of asset

Payment of

purchase price

Lease rentals

21

Risks and Practical I ssues

Credit Risk (Default in rental payments)

Rate of Return Risk

Customer may decline to enter into Ijarah.

Damage to the Asset

Overdue Rentals

Non-Compliance/Violation of contract.

Early Termination

Asset Price Risk

Repair and Maintenance

Running Expenses (depending upon contract)

22

Risks and Practical I ssues

Proper documentation

Sequence of Documentation in Sale and

lease Back.

Time of Transferring asset in Sale and Lease

back

Islamic Lease covers the conditions of

Finance Lease as described in IAS 17.

Accounting & Tax Depreciation Issues.

23

DOCUMENTATION

SPECIAL CARES

IN IMPLEMENTATION OF THE

IJARAH SYSTEM

24

IJARAH AGREEMENT

Ijarah Agreement is the basic document which

contains all terms and conditions pertinent of Ijarah

of particular Asset(s).

Ijarah Agreement shall be signed after the Lessor has

taken the possession the Asset and not earlier.

25

ADDENDUMS TO IJARAH AGREEMENT

Description of the Ijarah Asset

Schedule of of Ijarah Rentals

Receipt of Asset

Demand Promissory Note

26

DESCRIPTION OF IJARAH ASSET

This document contains the detailed description

about the Leased Asset agreed between the

parties e.g Name, Make ,Model,Engine No.,

Chassis No., Registration No. etc etc.

This documents shall be signed signed after

Delivery of asset to the Lessee and not earlier.

27

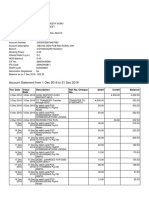

SCHEDULE OF IJARAH RENTALS

This schedule contains a table which shows:

Amount of rental (Monthly/Quarterly/Half Yearly)

Date of Payment of each rental

This schedule will also contain the date on

which first rental is due.

This documents shall be signed signed after Delivery

of asset to the Lessee.

28

RECEIPT OF ASSETS

This document confirms that customer has taken

the possession of Leased Asset as described in

the earlier document Description of Ijarah

Asset.

This document is only signed by the Lessee on

receipt of Asset, as an acknowledgement of

receipt of described asset under Ijarah Contact.

29

PROMISSORY NOTE

After signing of Ijarah Agreement, the amount

of rentals become Debt (Dyan) to the Lessee.

Promissory Note is Lessees acknowledgement

to Debt amount and its promise to pay.

30

UNDERTAKING TO PURCHASE

LEASED ASSET

This documents contains undertaking from the

Lessee that he/it will purchase the Leased

asset on the purchase Price corresponding to

the Purchase Date.

This document contains a schedule which

shows Purchase Price(s) during the Ijarah term

on which the Lessee can purchase the asset by

making lump sum payment.

31

OTHER DOCUMENTS

Undertaking for Personal use of

Ijarah Asset

Trust Receipt

Authorization to Take possession of

Leased Asset

Sale Deed

32

THANK YOU

for

listening with Patience

.

Any further Questions.?

Ch. Hamad Rasool Bhullar

Das könnte Ihnen auch gefallen

- Life, Accident and Health Insurance in the United StatesVon EverandLife, Accident and Health Insurance in the United StatesBewertung: 5 von 5 Sternen5/5 (1)

- Consumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintVon EverandConsumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintNoch keine Bewertungen

- IjaraDokument35 SeitenIjaraAlHuda Centre of Islamic Banking & Economics (CIBE)100% (3)

- Ijara by Hamad RasoolDokument57 SeitenIjara by Hamad RasoolHamad Rasool BhullarNoch keine Bewertungen

- 1 - IjarahDokument31 Seiten1 - IjarahAlishba KaiserNoch keine Bewertungen

- Ijarah: Basic Rules of Ijarah/LeasingDokument6 SeitenIjarah: Basic Rules of Ijarah/Leasingali_zain_7Noch keine Bewertungen

- A SalamDokument3 SeitenA Salamali_zain_7Noch keine Bewertungen

- Types of Al-Ijarah Contracts ExplainedDokument6 SeitenTypes of Al-Ijarah Contracts ExplainedMastura AmitNoch keine Bewertungen

- ACCOUNTING FOR ISLAMIC BANKS: KEY ISSUES IN IJARAH FINANCINGDokument50 SeitenACCOUNTING FOR ISLAMIC BANKS: KEY ISSUES IN IJARAH FINANCINGDeliaFitrianaHidayatNoch keine Bewertungen

- Ijaraha ShortDokument6 SeitenIjaraha ShortMuhammad HasnainNoch keine Bewertungen

- Ijarah LeasingDokument3 SeitenIjarah LeasingHuda Reem MansharamaniNoch keine Bewertungen

- Ijarah Fund: This Way May Be Justified On The Analogy of Simsâr (Broker) For Whom The Fee Based On Percentage Is AllowedDokument9 SeitenIjarah Fund: This Way May Be Justified On The Analogy of Simsâr (Broker) For Whom The Fee Based On Percentage Is AllowedumairNoch keine Bewertungen

- Leasing UnlockedDokument16 SeitenLeasing UnlockedAashi VashistaNoch keine Bewertungen

- Scope and Forms of Ijarah ContractsDokument29 SeitenScope and Forms of Ijarah ContractsKhaliil IsmaaciilNoch keine Bewertungen

- IjarahDokument26 SeitenIjarahMohsen SirajNoch keine Bewertungen

- Ijarah: DR - Muhammad Sohail Shari'ah Compliance DepartmentDokument15 SeitenIjarah: DR - Muhammad Sohail Shari'ah Compliance DepartmentMUHAMMAD TALATNoch keine Bewertungen

- Comparison Between Ijara and Conventional LeasingDokument31 SeitenComparison Between Ijara and Conventional Leasingumar0% (1)

- Transfer of Property Act 1882 regulates property transfersDokument7 SeitenTransfer of Property Act 1882 regulates property transfersharshad nickNoch keine Bewertungen

- Lease Based Contracts Contract of Ijārah (Leasing) : Basic RulesDokument7 SeitenLease Based Contracts Contract of Ijārah (Leasing) : Basic RulesAbdi HiirNoch keine Bewertungen

- International Accounting Standard 17: Definition of 'Lease 'Dokument7 SeitenInternational Accounting Standard 17: Definition of 'Lease 'DuaeZahiraNoch keine Bewertungen

- BA 351 Corporate FinanceDokument22 SeitenBA 351 Corporate FinanceAndualem UfoNoch keine Bewertungen

- IjamanDokument20 SeitenIjamanIqbal Hussain DadiNoch keine Bewertungen

- Leasing (Ijara) FacilityDokument24 SeitenLeasing (Ijara) FacilityAbdiel BanjaryNoch keine Bewertungen

- LeasingDokument7 SeitenLeasingavishkar kaleNoch keine Bewertungen

- Ijarah MechanismDokument5 SeitenIjarah MechanismRezaul Alam100% (1)

- Group2 Lease FinancingDokument24 SeitenGroup2 Lease FinancingMohit Motwani100% (1)

- IJARAH - THE ISLAMIC LEASING SYSTEMDokument39 SeitenIJARAH - THE ISLAMIC LEASING SYSTEMAngela MaymayNoch keine Bewertungen

- TYPES OF LEASES UNDER IAS 17Dokument11 SeitenTYPES OF LEASES UNDER IAS 17Kurrent Toy100% (1)

- Comments On The CMP Documents For Islamic Housing (SHFC) Maharlika J. AlontoDokument6 SeitenComments On The CMP Documents For Islamic Housing (SHFC) Maharlika J. AlontohezeNoch keine Bewertungen

- Leases: Indian Accounting Standard (Ind AS) 17Dokument29 SeitenLeases: Indian Accounting Standard (Ind AS) 17Tawanda MuchenjeNoch keine Bewertungen

- Al Ijarah Essentials GuideDokument15 SeitenAl Ijarah Essentials Guidekamranp1Noch keine Bewertungen

- Exchange Contract ExplainedDokument40 SeitenExchange Contract Explaineduwera sylviaNoch keine Bewertungen

- Leasing TransactionsDokument11 SeitenLeasing Transactionsshilpa_noorithayaNoch keine Bewertungen

- Assignment 3 Islamic FinanceDokument4 SeitenAssignment 3 Islamic FinanceMasoom ZahraNoch keine Bewertungen

- IjarahDokument29 SeitenIjarahiqraNoch keine Bewertungen

- Ijarah 4 Month-CompleteDokument62 SeitenIjarah 4 Month-CompleteHasan Irfan SiddiquiNoch keine Bewertungen

- Introduction To Ijarah: Release DateDokument21 SeitenIntroduction To Ijarah: Release Datewafa shumailNoch keine Bewertungen

- Presentation On Hire Purchase and LeasingDokument25 SeitenPresentation On Hire Purchase and Leasingmanoj80% (5)

- Lease: Section 105Dokument14 SeitenLease: Section 105Deepak PanwarNoch keine Bewertungen

- Ijarah (Islamic Leasing)Dokument26 SeitenIjarah (Islamic Leasing)hina ranaNoch keine Bewertungen

- Leases: Indian Accounting Standard (Ind AS) 17Dokument26 SeitenLeases: Indian Accounting Standard (Ind AS) 17DhanvanthNoch keine Bewertungen

- Ong Lim Sing, Jr. vs. FEB Leasing & Finance CorporationDokument19 SeitenOng Lim Sing, Jr. vs. FEB Leasing & Finance CorporationArya StarkNoch keine Bewertungen

- Types of LeasingDokument26 SeitenTypes of LeasingHimaja SridharNoch keine Bewertungen

- LeasingDokument6 SeitenLeasingShubham DhimaanNoch keine Bewertungen

- Hire Purchase Under ShirkatulDokument33 SeitenHire Purchase Under ShirkatulShad LeeNoch keine Bewertungen

- Hire PurchaseDokument30 SeitenHire PurchaseNidhi BubnaNoch keine Bewertungen

- Hire-Purchase AgreementsDokument4 SeitenHire-Purchase AgreementsSawda GhojariyaNoch keine Bewertungen

- Hire Purchase AgreementDokument9 SeitenHire Purchase AgreementHarshit GuptaNoch keine Bewertungen

- Essential Elements: The Essential Elements of A Lease Are As FollowsDokument8 SeitenEssential Elements: The Essential Elements of A Lease Are As FollowssssNoch keine Bewertungen

- Hire-Purchase Agreements ExplainedDokument8 SeitenHire-Purchase Agreements ExplainedAdv. Govind S. Tehare0% (1)

- Provide A Summary of Understanding of The Following For The Leasing IndustryDokument5 SeitenProvide A Summary of Understanding of The Following For The Leasing IndustryMarielle P. GarciaNoch keine Bewertungen

- Presentation On Hire Purchase and LeasingDokument25 SeitenPresentation On Hire Purchase and Leasingmanoj100% (1)

- Basic Rules Governing Leasing Under Islamic LawDokument4 SeitenBasic Rules Governing Leasing Under Islamic LawmobinnaimNoch keine Bewertungen

- Ifrs 16: Leases Prepared by D ChimangaDokument21 SeitenIfrs 16: Leases Prepared by D ChimangaTaffy Isheanesu BgoniNoch keine Bewertungen

- Definition of Lease:: The Recognition of Assets, Liabilities, Income or Expenses Arising From The Lease, As Appropriate)Dokument19 SeitenDefinition of Lease:: The Recognition of Assets, Liabilities, Income or Expenses Arising From The Lease, As Appropriate)bobo kaNoch keine Bewertungen

- IjarahDokument3 SeitenIjarahsultanatkhanNoch keine Bewertungen

- Financial Leasing Contracts Analyzed in Landmark Philippine Supreme Court RulingDokument15 SeitenFinancial Leasing Contracts Analyzed in Landmark Philippine Supreme Court RulingyakyakxxNoch keine Bewertungen

- Hire-Purchase and Leasing Presentation SummaryDokument27 SeitenHire-Purchase and Leasing Presentation Summarykrishan60Noch keine Bewertungen

- Ahmad Tariq Bhatti: (In Accordance With The Requirements of IAS 17 & FASB Statement 13)Dokument43 SeitenAhmad Tariq Bhatti: (In Accordance With The Requirements of IAS 17 & FASB Statement 13)Ahmad Tariq Bhatti100% (1)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyVon EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNoch keine Bewertungen

- Two Days Specialized Training Workshop On Islamic Banking and Finance - RussiaDokument7 SeitenTwo Days Specialized Training Workshop On Islamic Banking and Finance - RussiaAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Press Release - AlHuda CIBE Signed MOU With Uzbekistan Lessors AssociationDokument2 SeitenPress Release - AlHuda CIBE Signed MOU With Uzbekistan Lessors AssociationAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Press Release - For The Promotion of Halal Industry, Islamic Finance Plays An Important Role: Zubair MughalDokument2 SeitenPress Release - For The Promotion of Halal Industry, Islamic Finance Plays An Important Role: Zubair MughalAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Two Days Specialized Training Workshop On Islamic Banking and FinanceDokument7 SeitenTwo Days Specialized Training Workshop On Islamic Banking and FinanceAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Global Takaful Forum 2019Dokument10 SeitenGlobal Takaful Forum 2019AlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Two Days Specialized Training Workshop On Islamic Banking and Finance in RussiaDokument7 SeitenTwo Days Specialized Training Workshop On Islamic Banking and Finance in RussiaAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Press Release - CIS Islamic Finance ForumDokument3 SeitenPress Release - CIS Islamic Finance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Islamic Banking, Takaful and Islamic Microfinance TrainingDokument7 SeitenIslamic Banking, Takaful and Islamic Microfinance TrainingAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Islamic Banking and Finance Training - UKDokument7 SeitenIslamic Banking and Finance Training - UKAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Press Release - CIS Islamic Banking and Finance ForumDokument2 SeitenPress Release - CIS Islamic Banking and Finance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- CIS - Islamic Banking and Finance ForumDokument9 SeitenCIS - Islamic Banking and Finance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Islamic Micro & Agriculture Finance Trainings - 2019Dokument7 SeitenIslamic Micro & Agriculture Finance Trainings - 2019AlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Islamic Banking, Takaful and Islamic Microfinance TrainingDokument7 SeitenIslamic Banking, Takaful and Islamic Microfinance TrainingAlHuda Centre of Islamic Banking & Economics (CIBE)0% (1)

- Two Days Specialized Training Workshop On Islamic Banking & Finance in Washington, DC. USADokument8 SeitenTwo Days Specialized Training Workshop On Islamic Banking & Finance in Washington, DC. USAAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- African Interest-Free Banking and Finance Forum Inaugurated in Addis Ababa, EthiopiaDokument3 SeitenAfrican Interest-Free Banking and Finance Forum Inaugurated in Addis Ababa, EthiopiaAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Press Release - African Interest-Free Banking and Finance AwardsDokument3 SeitenPress Release - African Interest-Free Banking and Finance AwardsAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- AlHuda CIBE Training Calendar 2019Dokument8 SeitenAlHuda CIBE Training Calendar 2019AlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Islamic Banking, Takaful and Islamic Microfinance TrainingDokument7 SeitenIslamic Banking, Takaful and Islamic Microfinance TrainingAlHuda Centre of Islamic Banking & Economics (CIBE)0% (1)

- Islamic Banking Analysis 2019 by Mr. Zubair MughalDokument2 SeitenIslamic Banking Analysis 2019 by Mr. Zubair MughalAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Press Release - 8th Global Islamic Microfinance ForumDokument3 SeitenPress Release - 8th Global Islamic Microfinance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Islamic Banking & Finance Training Workshop - UKDokument8 SeitenIslamic Banking & Finance Training Workshop - UKAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Press Release - 8th Global Islamic Microfinance ForumDokument2 SeitenPress Release - 8th Global Islamic Microfinance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Two Days Specialized Training Workshop On Islamic Banking, Finance and Islamic Microfinance Training in PhilippineDokument7 SeitenTwo Days Specialized Training Workshop On Islamic Banking, Finance and Islamic Microfinance Training in PhilippineAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- 8th Global Islamic Microfinance ForumDokument18 Seiten8th Global Islamic Microfinance ForumAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Press Release-Islamic Banking Is Rapidly Growing Industry in EthiopiaDokument2 SeitenPress Release-Islamic Banking Is Rapidly Growing Industry in EthiopiaAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Islamic Banking, Finance and Islamic Microfinance Training in UzbekistanDokument8 SeitenIslamic Banking, Finance and Islamic Microfinance Training in UzbekistanAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Press Release - Halal CertificationDokument2 SeitenPress Release - Halal CertificationAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Two Days Specialized Training Workshop On Islamic Banking & Finance at UKDokument8 SeitenTwo Days Specialized Training Workshop On Islamic Banking & Finance at UKAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Two Days Specialized Training Workshop On Islamic Banking & Finance in CanadaDokument7 SeitenTwo Days Specialized Training Workshop On Islamic Banking & Finance in CanadaAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- AlHuda CIBE - International Event Calendar July - Dec, 2018Dokument1 SeiteAlHuda CIBE - International Event Calendar July - Dec, 2018AlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Bank Statement 2Dokument1 SeiteBank Statement 2bc180204979 ALI FAROOQNoch keine Bewertungen

- Claim Statement Form for Credit Life PolicyDokument1 SeiteClaim Statement Form for Credit Life PolicyShivNoch keine Bewertungen

- Ariel MemoDokument4 SeitenAriel MemoChiz-Chiz GesiteNoch keine Bewertungen

- Do The Drill Cash Intaud1Dokument3 SeitenDo The Drill Cash Intaud1ダニエルNoch keine Bewertungen

- House BanksDokument24 SeitenHouse BanksNarsimha Reddy YasaNoch keine Bewertungen

- Suite Talk Web Services Records GuideDokument194 SeitenSuite Talk Web Services Records GuideZettoX0% (1)

- Form of Tender & Conditions of Contract: Nobel House ProjectDokument11 SeitenForm of Tender & Conditions of Contract: Nobel House Projecthashem darwishNoch keine Bewertungen

- LienVietPostBank Profile 2018Dokument16 SeitenLienVietPostBank Profile 2018Hoàng Tuấn LinhNoch keine Bewertungen

- Banking LawDokument15 SeitenBanking LawDiksha OraonNoch keine Bewertungen

- Cases 4-6Dokument3 SeitenCases 4-6Mich PadayaoNoch keine Bewertungen

- GK CAPSULE FOR SBI ASSOCIATE ASSISTANT EXAM 2015Dokument56 SeitenGK CAPSULE FOR SBI ASSOCIATE ASSISTANT EXAM 2015Nilay VatsNoch keine Bewertungen

- Rsbsa-8 7 2015 PDFDokument4 SeitenRsbsa-8 7 2015 PDFRonalene Garbin100% (1)

- GL July KoreksiDokument115 SeitenGL July KoreksihartiniNoch keine Bewertungen

- Star Two vs. Paper CityDokument2 SeitenStar Two vs. Paper CityJewel Ivy Balabag DumapiasNoch keine Bewertungen

- Standard Chartered BankDokument28 SeitenStandard Chartered BankRajni YadavNoch keine Bewertungen

- VW Approved Used Cover BookletDokument18 SeitenVW Approved Used Cover BookletagathianNoch keine Bewertungen

- MEMORANDUM Leobrera vs. BPI PC2 JCBDokument10 SeitenMEMORANDUM Leobrera vs. BPI PC2 JCBdivine_carlosNoch keine Bewertungen

- Account Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument2 SeitenAccount Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceENDLURI DEEPAK KUMARNoch keine Bewertungen

- FILE PlacementAgentsDokument6 SeitenFILE PlacementAgentsgsu2playNoch keine Bewertungen

- Sip Report - Bajaj MBADokument49 SeitenSip Report - Bajaj MBAGaurav MantalaNoch keine Bewertungen

- Investors Perception Towards Investment in Mutual FundsDokument56 SeitenInvestors Perception Towards Investment in Mutual Fundstanya dhamija100% (1)

- Oil & Gas Mini MBA 19-30 March 2012 - Registration Form MacameDokument1 SeiteOil & Gas Mini MBA 19-30 March 2012 - Registration Form Macamethemak76Noch keine Bewertungen

- 3799 - 4000Dokument404 Seiten3799 - 4000DrPraveen Kumar TyagiNoch keine Bewertungen

- Audit Glossary of TermsDokument37 SeitenAudit Glossary of Termsiwona_lang1968Noch keine Bewertungen

- Executive SummaryDokument88 SeitenExecutive SummaryRashmi Ranjan PanigrahiNoch keine Bewertungen

- Statement MAR2022 760347549Dokument60 SeitenStatement MAR2022 760347549Nehal JajuNoch keine Bewertungen

- Gaotian Vs GaffudDokument4 SeitenGaotian Vs GaffudCelinka ChunNoch keine Bewertungen

- Staff - p45Dokument4 SeitenStaff - p45velorutionNoch keine Bewertungen

- Fi Annual 16Dokument198 SeitenFi Annual 16sanchita sharmaNoch keine Bewertungen

- SAP Question BankDokument33 SeitenSAP Question Bankpunithan81Noch keine Bewertungen