Beruflich Dokumente

Kultur Dokumente

On Fdi and Fii

Hochgeladen von

srisaiuniversityOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

On Fdi and Fii

Hochgeladen von

srisaiuniversityCopyright:

Verfügbare Formate

Foreign Direct Investment (FDI)

&

Foreign Institutional

Investment (FII)

Presented By

SAROJ KUMAR

MBA 4

TH

SEM

Background: India Transformed !!

2

India -- the largest Democracy - one of the fastest growing economies in the World!

Slow rate of growth

Bureaucratic

Protected and slow

Weak infrastructure

Yesterday

Today

Strong macro economic fundamentals

Encouraging foreign investment

Outsourcing destination

Growing consumerism

Impetus on infrastructure development

3

What is FDI & FII

Foreign Direct Investment (FDI):

1. FDI stands for Foreign Direct Investment, a component of a country's national financial

accounts.

2. Foreign direct investment is investment of foreign assets into domestic structures,

equipment, and organizations.

3. It does not include foreign investment into the stock markets.

4. FDI is thought to be more useful to a country than investments in the equity of its

companies because equity investments are potentially "hot money" which can leave at

the first sign of trouble, whereas FDI is durable and generally useful whether things go

well or badly.

Foreign Institutional Investment (FII):

1. FII denotes all those investors or investment companies that are not located within

the territory of the country in which they are investing.

2. SEBIs definition of FIIs presently includes foreign pension funds, mutual funds,

charitable/endowment/university funds etc. as well as asset management companies

and other money managers operating on their behalf.

4

4

Distinction between FDI and FII

FDI

1. It is long-term investment

2. Investment in physical assets

3. Aim is to increase enterprise capacity or

productivity or change management

control

4. Leads to technology transfer, access to

markets and management inputs

5. FDI flows into the primary market

6. Entry and exit is relatively difficult

7. FDI is eligible for profits of the company

8. Does not tend be speculative

9. Direct impact on employment of labour

and wages

10.Abiding interest in mgt.

FII

1. It is generally short-term investment

2. Investment in financial assets

3. Aim is to increase capital availability

4. FII results in only capital inflows

5. FII flows into the secondary market

6. Entry and exist is relatively easy

7. FII is eligible for capital gain

8. Tends to be speculative

9. No direct impact on employment of labour

and wages

10.Fleeting interest in mgt.

5

Overview

Foreign Direct Investment Policy

6

Foreign Direct Investment (FDI) cross border investment with an objective to

establish lasting interest

Objective - to encourage FDI to promote industrial & socio-economic development;

supplement domestic capital/ technology

Foreign investment in India is regulated by Government of Indias FDI policy. The FDI

guidelines administered by the Ministry of Commerce and Industry.

Department of Industrial Policy & Promotion (DIPP), Foreign Investment Promotion

Board (FIPB) and Secretariat of Industrial Assistance (SIA) regulate the FDI Policy

GoI has set up the Foreign Investment Implementation Authority (FIIA) to facilitate quick

translation of Foreign Direct Investment (FDI) approvals into implementation, to provide

a one-window to foreign investors by helping them obtain necessary approvals, sort out

operational problems and meet with various Government agencies

Administrative and compliance aspects of FDI monitored by RBI

Since 1991, policy has been liberalized substantially to facilitate foreign investment

7

8

Recent Developments

Setting the context

9

Contribution of FDI in Indias economic development is an acknowledged

fact.

From inception policy subject to extensive amendments from time to time

through Press Notes, circulars and clarifications

Press Note 2,3 and 4 of 2009 issued to provide clarity on indirect FDI and

downstream investment

FM stressed the need for a consolidated FDI policy in Budget 2010-11

Draft consolidated policy issued in late 2009 for public comments

Consolidated FDI policy issued effective from 1 April, 2010

Consolidated FDI Policy

Salient Features

1

0

Consolidated document of all foreign investment policies /regulations under

FEMA, Press Notes, Press Releases and Clarifications issued by DIPP

Underlying rationale to promote FDI through a policy framework that is

transparent, predictable, simple and clear and which reduces regulatory burden

As an investor friendly measure, a new Circular is proposed to be issued every

six months

Press Notes/Press Releases/Clarifications on FDI in force as of 31 March 2010 will

stand rescinded. Savings for actions taken under earlier press notes

Use of chapters, headings and definitions

Two kinds of foreign investment (i) FDI and (ii) Foreign Portfolio Investment

(FPI)

FDI strategic long term relationship and establish a lasting interest

FPI no intention to influence the management of the investee entity

Sector Specific Guidelines

Prohibited sectors

1

1

FDI not allowed in the following:

Retail trading (except single brand)

Atomic Energy

Lottery business

Gambling & Betting

Chit fund and Nidhi company

Trading in Transferable Development Rights

Real Estate business or construction of Farm Houses

Sectors not opened for private sector investments

Prohibition extended to foreign technology collaboration including licensing for franchisee,

trademark, brand name or management contract for lottery, betting and gambling business

Sector Specific Guidelines

Private sector banks/ Civil Aviation

1

2

No change in existing conditions

FDI permitted under automatic route upto 49% and thereafter upto 74% under Approval Route

Banks

Civil Aviation

No change in existing conditions

FDI in Non-scheduled air transport services/ non-schedule airlines, Chartered and Cargo airlines

permitted under automatic route upto 49% and thereafter upto 74% under Approval Route

1

3

FOREIGN INSTITUTIONAL INVESTORS

FOREIGN INSTITUTIONAL INVESTORS

What are Foreign

Investors looking for

1

4

Good projects

Demand Potential

Revenue Potential

Stable Policy

Environment/Political

Commitment

Optimal Risk Allocation

Framework

Rate of interest

Speculation

Profitability

Costs of production

Economic conditions

Government policies

Political factors

Factors affecting foreign

investment

Foreign Institutional

Investors

1

5

FIIs can individually purchase upto 10% and collectively upto 24% of the paid-up share

capital of an Indian company

This limit of 24% can be increased to sectoral cap/ statutory limit applicable to the Indian

company by passing a board resolution/shareholder resolution

FIIs can purchase shares through open offers/private placement/stock exchange

Shares purchased by FII through stock exchange cannot be sold through a private

arrangement

Proprietary funds, foreign individuals and foreign corporate can register as a sub- account and

invest through the FII. Separate limits of 10% / 5% is available for the sub-accounts

FIIs can raise money through participatory notes or offshore derivative instruments for

investment in the underlying Indian securities

FIIs in addition to investment under the FII route can invest under FDI route

Advantages of FII

1

6

Enhanced flows of equity capital

FIIs have a greater appetite for equity than debt in their asset structure. It improve

capital structures.

Managing uncertainty and controlling risks.

FII inflows help in financial innovation and development of hedging instruments.

Improving capital markets.

FIIs as professional bodies of asset managers and financial analysts enhance

competition and efficiency of financial markets.

Equity market development aids economic development.

By increasing the availability of riskier long term capital for projects, and increasing firms

incentives to provide more information about their operations, FIIs can help in the

process of economic development.

Improved corporate governance.

FIIs constitute professional bodies, improve corporate governance.

Disadvantages of FII

1

7

Problems of Inflation

Problems for small investor

Adverse impact on Exports

Hot Money

1

8

"If there is one place on the

face of this Earth where all

the dreams of living men have

found a home when man

began the dream of existence,

it is India".

Romain Rolland,

French philosopher

Das könnte Ihnen auch gefallen

- The Binary Institute Binary Options Trading Ebook PDFDokument44 SeitenThe Binary Institute Binary Options Trading Ebook PDFadventurer0512100% (1)

- Kahoot - SWOT AnalysisDokument3 SeitenKahoot - SWOT AnalysisSami Shahid Al IslamNoch keine Bewertungen

- Lahore School of Economics Financial Management II Assignment 6 Financial Planning & Forecasting - 1Dokument1 SeiteLahore School of Economics Financial Management II Assignment 6 Financial Planning & Forecasting - 1AhmedNoch keine Bewertungen

- Strategic Audit Factor Analysis WorksheetDokument10 SeitenStrategic Audit Factor Analysis Worksheetenricochrstian100% (1)

- Section 2 From Idea To The Opportunity Section 2 From Idea To The OpportunityDokument12 SeitenSection 2 From Idea To The Opportunity Section 2 From Idea To The OpportunityJAYANT MAHAJANNoch keine Bewertungen

- Mission Statements of NikeDokument12 SeitenMission Statements of Nikemkam212Noch keine Bewertungen

- Gourmet Marketing Plan PDFDokument39 SeitenGourmet Marketing Plan PDFAdnan AzizNoch keine Bewertungen

- Case Study EtradeDokument28 SeitenCase Study EtradeZulnaim RamziNoch keine Bewertungen

- SYBFM Equity Market II Session I Ver 1.2Dokument84 SeitenSYBFM Equity Market II Session I Ver 1.211SujeetNoch keine Bewertungen

- Director Investment Banking in NYC NY Resume Pascal KabembaDokument2 SeitenDirector Investment Banking in NYC NY Resume Pascal KabembaPascalKabemba100% (1)

- Assignment No 6 (BP)Dokument2 SeitenAssignment No 6 (BP)Bernadette AnicetoNoch keine Bewertungen

- Co-Branding:: Bayerische Motoren Werke AG BMWDokument3 SeitenCo-Branding:: Bayerische Motoren Werke AG BMWdaniyalNoch keine Bewertungen

- KPO Vs BPODokument8 SeitenKPO Vs BPOSwapnil KulkarniNoch keine Bewertungen

- 1 How Has Samsung S Business Model and Strategies Changed OverDokument1 Seite1 How Has Samsung S Business Model and Strategies Changed OverAmit PandeyNoch keine Bewertungen

- Investment and Portfolio Management, Chapter 1 Introduction To InvestmentDokument8 SeitenInvestment and Portfolio Management, Chapter 1 Introduction To InvestmentAmbachew MotbaynorNoch keine Bewertungen

- Advantages of The Formula PlanDokument3 SeitenAdvantages of The Formula PlanTanvi JawdekarNoch keine Bewertungen

- Accn24b-Ppt - Strategic Audit of A Corporation - Group9Dokument63 SeitenAccn24b-Ppt - Strategic Audit of A Corporation - Group9Herald Vincent RamosNoch keine Bewertungen

- Gourmet BakersDokument17 SeitenGourmet BakersSULEMANNoch keine Bewertungen

- Cash Flow Statement Analysis Hul FinalDokument10 SeitenCash Flow Statement Analysis Hul FinalGursimran SinghNoch keine Bewertungen

- Three (3) Major Decisions The Finance Manager Would TakeDokument11 SeitenThree (3) Major Decisions The Finance Manager Would TakeJohn Verlie EMpsNoch keine Bewertungen

- 5.1 Receivable ManagementDokument18 Seiten5.1 Receivable ManagementJoshua Cabinas100% (1)

- Financial System - IntroductionDokument31 SeitenFinancial System - IntroductionVaidyanathan RavichandranNoch keine Bewertungen

- Analysis Group 4Dokument5 SeitenAnalysis Group 4Clarise DatayloNoch keine Bewertungen

- Anheuser Busch and Harbin Brewery Group of ChinaDokument17 SeitenAnheuser Busch and Harbin Brewery Group of Chinapooja87Noch keine Bewertungen

- Global MarketingDokument3 SeitenGlobal MarketingVishal parmar80% (5)

- Questionaire - About Role of Financial Statement On Investment Decision MakingDokument4 SeitenQuestionaire - About Role of Financial Statement On Investment Decision MakingIsmael yareNoch keine Bewertungen

- Airtel FinanceDokument24 SeitenAirtel FinancePrajjwol Bikram KhadkaNoch keine Bewertungen

- Study Cases Share Based PaymentDokument2 SeitenStudy Cases Share Based PaymentAnisya IntaningtyasNoch keine Bewertungen

- SM CH 4 Abh 2017Dokument46 SeitenSM CH 4 Abh 2017Mistere SolomonNoch keine Bewertungen

- Summary of IFRS 3 Business CombinationDokument5 SeitenSummary of IFRS 3 Business CombinationAbdullah Al RaziNoch keine Bewertungen

- Pricing Strategy ReviewerDokument2 SeitenPricing Strategy ReviewerMarissa PatricioNoch keine Bewertungen

- Executive Summary: Procter & Gamble Is A Major American ManufacturerDokument7 SeitenExecutive Summary: Procter & Gamble Is A Major American Manufacturerkavya guptaNoch keine Bewertungen

- Tutorial 5Dokument3 SeitenTutorial 5Shyne SzeNoch keine Bewertungen

- Module 8 - Strategic Analysis of Diversified CompaniesDokument53 SeitenModule 8 - Strategic Analysis of Diversified CompanieshyraldNoch keine Bewertungen

- Chapter SixDokument47 SeitenChapter SixAlmaz Getachew0% (1)

- Total P 1,200,000: Refer PDF Problem 1Dokument2 SeitenTotal P 1,200,000: Refer PDF Problem 1Joanna Rose DeciarNoch keine Bewertungen

- Executive SummaryDokument20 SeitenExecutive SummaryShehzana MujawarNoch keine Bewertungen

- 6 BondDokument18 Seiten6 Bondßïshñü PhüyãlNoch keine Bewertungen

- Q Finman2 Capbudgtng 1920Dokument5 SeitenQ Finman2 Capbudgtng 1920Deniece RonquilloNoch keine Bewertungen

- BCG Susan BistaDokument1 SeiteBCG Susan BistasusanNoch keine Bewertungen

- CMA2011 CatalogDokument5 SeitenCMA2011 CatalogDaryl DizonNoch keine Bewertungen

- Chapter 16 Budgeting Capital Expenditures Research and Development Expenditures and Cash Pert Cost The Flexible BudgetDokument17 SeitenChapter 16 Budgeting Capital Expenditures Research and Development Expenditures and Cash Pert Cost The Flexible BudgetZunaira ButtNoch keine Bewertungen

- Assignment On Financial Statement Ratio Analysis PDFDokument27 SeitenAssignment On Financial Statement Ratio Analysis PDFJosine JonesNoch keine Bewertungen

- Swot Matrix ItcDokument3 SeitenSwot Matrix ItcRiya PandeyNoch keine Bewertungen

- Straight ProblemsDokument1 SeiteStraight ProblemsMaybelle100% (1)

- Which of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Dokument3 SeitenWhich of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Kath LeynesNoch keine Bewertungen

- The Effects of Changes in Foreign Exchange Rates PDFDokument13 SeitenThe Effects of Changes in Foreign Exchange Rates PDFChelsy SantosNoch keine Bewertungen

- International Business: by Charles W.L. HillDokument16 SeitenInternational Business: by Charles W.L. HillNno 367555Noch keine Bewertungen

- THX-1 Case-8 5Dokument5 SeitenTHX-1 Case-8 5BonitoNoch keine Bewertungen

- Defensive StrategiesDokument4 SeitenDefensive StrategiesChrisNoch keine Bewertungen

- Audit Quiz 2Dokument1 SeiteAudit Quiz 2Von Andrei MedinaNoch keine Bewertungen

- Decentralization and Segment ReportingDokument3 SeitenDecentralization and Segment ReportingYousuf SoortyNoch keine Bewertungen

- Basket Wonders' Balance Sheet (Asset Side)Dokument32 SeitenBasket Wonders' Balance Sheet (Asset Side)OSAMA0% (1)

- Entrepreneurial SpectrumDokument13 SeitenEntrepreneurial SpectrumDr. Meghna DangiNoch keine Bewertungen

- Overview of Strategic EvaluationDokument18 SeitenOverview of Strategic Evaluationpopat vishal100% (1)

- Cash BudgetDokument45 SeitenCash BudgetJoy Estela MangayaNoch keine Bewertungen

- F3ch2dilemna Socorro SummaryDokument8 SeitenF3ch2dilemna Socorro SummarySushii Mae60% (5)

- FA - PartnershipDokument109 SeitenFA - PartnershipRafay RashidNoch keine Bewertungen

- 4, Understanding Market OpportunitiesDokument24 Seiten4, Understanding Market OpportunitiesumairNoch keine Bewertungen

- International Capital MarketDokument31 SeitenInternational Capital MarketSmitaNoch keine Bewertungen

- Group-6 Presentation On FIIDokument42 SeitenGroup-6 Presentation On FIIPankaj Kumar Bothra100% (1)

- SYBFM Equity Market II Session I Ver 1.1Dokument80 SeitenSYBFM Equity Market II Session I Ver 1.111SujeetNoch keine Bewertungen

- Different Kinds of ObligationDokument7 SeitenDifferent Kinds of ObligationLimVianesse100% (3)

- Accounting Week 1Dokument4 SeitenAccounting Week 1Muhammad Fikri MaulanaNoch keine Bewertungen

- Essentials of Investments (BKM 5 Ed.) Answers To Selected Problems - Lecture 6Dokument3 SeitenEssentials of Investments (BKM 5 Ed.) Answers To Selected Problems - Lecture 6Kunal KumudNoch keine Bewertungen

- Multinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsDokument20 SeitenMultinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsAbhijit RoyNoch keine Bewertungen

- Selina Investor PresentationDokument63 SeitenSelina Investor PresentationLewisNoch keine Bewertungen

- Barclays - Tesco1Q2324salesreview-strongUKLFLsales (90) - Jun - 16 - 2023Dokument22 SeitenBarclays - Tesco1Q2324salesreview-strongUKLFLsales (90) - Jun - 16 - 2023Edward LaiNoch keine Bewertungen

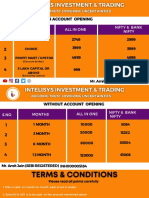

- Intelisys Pricing PlanDokument5 SeitenIntelisys Pricing PlanregsNoch keine Bewertungen

- Chapter 7 Financial Statement Analysis 2011Dokument49 SeitenChapter 7 Financial Statement Analysis 2011Mohd Fathil Pok SuNoch keine Bewertungen

- NASDAQDokument4 SeitenNASDAQNeha KrishnaniNoch keine Bewertungen

- Tutorial On AdjustmentsDokument8 SeitenTutorial On AdjustmentsPushpa ValliNoch keine Bewertungen

- 2013 Product Guide and Calendar FX ProductsDokument135 Seiten2013 Product Guide and Calendar FX ProductsThomas KimNoch keine Bewertungen

- Guidebook For European Investors in IndiaDokument177 SeitenGuidebook For European Investors in IndiaWim KrämerNoch keine Bewertungen

- Freight Forward AgreementsDokument42 SeitenFreight Forward AgreementsMoka Swaroop100% (1)

- Capital Market InstrumentsDokument72 SeitenCapital Market InstrumentsAFNA SHERIN KNoch keine Bewertungen

- As Accounting Incomplete RecordsDokument43 SeitenAs Accounting Incomplete RecordsKasparov T MhangamiNoch keine Bewertungen

- RFBT Drill 2 (Partnership, Corpo, and Nego)Dokument13 SeitenRFBT Drill 2 (Partnership, Corpo, and Nego)ROMAR A. PIGA100% (1)

- Ipo Procedure: An Analysis On The Book Building Method in BangladeshDokument9 SeitenIpo Procedure: An Analysis On The Book Building Method in BangladeshMuhaiminul IslamNoch keine Bewertungen

- Bach Et Al 2015 SwedenDokument57 SeitenBach Et Al 2015 SwedenhoangpvrNoch keine Bewertungen

- Sahoo Committee ReportDokument110 SeitenSahoo Committee ReportNeerajKapoorNoch keine Bewertungen

- G.R. No. 210542. February 24, 2016. Rosalina Carodan, Petitioner, vs. China Banking CORPORATION, RespondentDokument21 SeitenG.R. No. 210542. February 24, 2016. Rosalina Carodan, Petitioner, vs. China Banking CORPORATION, RespondentJoannah SalamatNoch keine Bewertungen

- Dolphin: Return: 25.87 (8Y CAGR) RISK: LOWDokument5 SeitenDolphin: Return: 25.87 (8Y CAGR) RISK: LOWJinesh ShahNoch keine Bewertungen

- A Detailed Study On The Malkapur Bank It's Business Operation and Financial Performance."Dokument5 SeitenA Detailed Study On The Malkapur Bank It's Business Operation and Financial Performance."Swapnil BhagatNoch keine Bewertungen

- California Apostile Info and HelpDokument3 SeitenCalifornia Apostile Info and HelpDiana0% (1)

- Comparison of Mutual Funds With Other Investment OptionsDokument56 SeitenComparison of Mutual Funds With Other Investment OptionsDiiivya86% (14)

- Cease and DesistDokument6 SeitenCease and DesistAllen Kaul100% (6)

- Blades Inc. Case Study: Finance 490 - International FinanceDokument23 SeitenBlades Inc. Case Study: Finance 490 - International Financeareis714Noch keine Bewertungen

- A Projecr Report On Derivatives at India Infoline LiimitedDokument78 SeitenA Projecr Report On Derivatives at India Infoline Liimitedvenu6akhilNoch keine Bewertungen

- Cap3 Problems ContDokument1 SeiteCap3 Problems ContProf. LUIS BENITEZNoch keine Bewertungen