Beruflich Dokumente

Kultur Dokumente

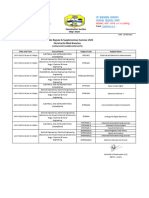

Chapter 6 - Contingencies

Hochgeladen von

Nagaeshwary Murugan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

52 Ansichten40 SeitenProvision is a liability of uncertain timing or amount. Companies accrue an expense and related liability for a provision only if the following three conditions are met. IFRS: Amount recognized should be the best estimate of the expenditure required to settle the present obligation.

Originalbeschreibung:

Copyright

© © All Rights Reserved

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenProvision is a liability of uncertain timing or amount. Companies accrue an expense and related liability for a provision only if the following three conditions are met. IFRS: Amount recognized should be the best estimate of the expenditure required to settle the present obligation.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

52 Ansichten40 SeitenChapter 6 - Contingencies

Hochgeladen von

Nagaeshwary MuruganProvision is a liability of uncertain timing or amount. Companies accrue an expense and related liability for a provision only if the following three conditions are met. IFRS: Amount recognized should be the best estimate of the expenditure required to settle the present obligation.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 40

Provision is a liability of uncertain timing or amount.

Reported either as current or non-current liability.

Common types are

Obligations related to litigation.

Warrantees or product guarantees.

Business restructurings.

Environmental damage.

Provisions

Uncertainty about

the timing or

amount of the

future expenditure

required to settle

the obligation.

Companies accrue an expense and related liability for a provision

only if the following three conditions are met:

1. Warrantees or product guarantees.

2. Probable that an outflow of resources will be required to

settle the obligation; and

3. A reliable estimate can be made.

Recognition of a Provision

A reliable estimate of the amount of the obligation can be determined.

Recognition of a Provision

LO 4

Recognition Examples

Recognize the provision

Illustration 13-4

Constructive obligation is an obligation that derives from a

companys actions where:

1. By an established pattern of past practice, published policies,

or a sufficiently specific current statement, the company has

indicated to other parties that it will accept certain

responsibilities; and

2. As a result, the company has created a valid expectation on

the part of those other parties that it will discharge those

responsibilities.

Recognition of a Provision

Recognition Examples

A reliable estimate of the amount of the obligation can be determined.

Recognition of a Provision

LO 4

Recognition Examples

A provision is recognizes for the best estimate of the cost of refunds

Illustration 13-5

A reliable estimate of the amount of the obligation can be determined.

Recognition of a Provision

LO 4

Recognition Examples

Illustration 13-6

Morisson does not need to record a provision if , on the other hand Morisson s lawyer determined that it is

Probable that company will lost the lawsuit, then Morisson should recognize a provision at December 31 2011

How does a company determine the amount to report

for a provision?

IFRS:

Amount recognized should be the best estimate of the

expenditure required to settle the present obligation.

Best estimate represents the amount that a company would

pay to settle the obligation at the statement of financial

position date.

Measurement of Provisions

Management must use judgment, based on

past or similar transactions, discussions with

experts, and any other pertinent information.

Measurement of the liability should consider

the time value of money. Future events that

may have an impact on the measurement of

the costs should be considered.

Measurement of Provisions

Common Types:

Common Types of Provisions

1. Lawsuits

2. Warranties

3. Premiums

4. Environmental

5. Onerous contracts

6. Restructuring

Litigation Provisions

Common Types of Provisions

Companies must consider the following in determining whether

to record a liability with respect to pending or threatened

litigation and actual or possible claims and assessments.

1. Time period in which the underlying cause of action

occurred.

2. Probability of an unfavorable outcome.

3. Ability to make a reasonable estimate of the amount of

loss.

Litigation Provisions

Common Types of Provisions

With respect to unfiled suits and unasserted claims and

assessments, a company must determine

1. the degree of probability that a suit may be filed or a claim

or assessment may be asserted, and

2. the probability of an unfavorable outcome.

If both are probable, if the loss is reasonably estimable, and if the

cause for action is dated on or before the date of the financial

statements, then the company should accrue the liability.

BE13-10: Scorcese Inc. is involved in a lawsuit at December 31,

2010. (a) Prepare the December 31 entry assuming it is probable

that Scorcese will be liable for $900,000 as a result of this suit. (b)

Prepare the December 31 entry, if any, assuming it is not probable

that Scorcese will be liable for any payment as a result of this suit.

(a) Lawsuit loss 900,000

Lawsuit liability 900,000

(b) No entry is necessary. The loss is not accrued because it

is not probable that a liability has been incurred at

12/31/10.

Common Types of Provisions

Warranty Provisions

Common Types of Provisions

Promise made by a seller to a buyer to make good on a deficiency

of quantity, quality, or performance in a product.

If it is probable that customers will make warranty claims and a

company can reasonably estimate the costs involved, the

company must record an expense.

Two basic methods of accounting for warranty costs:

Cash-Basis method

Expense warranty costs as incurred, because

1. it is not probable that a liability has been

incurred, or

2. it cannot reasonably estimate the amount of

the liability.

Warranty Provisions

Common Types of Provisions

Two basic methods of accounting for warranty costs:

Accrual-Basis method

Charge warranty costs to operating expense in the

year of sale.

Method is the generally accepted method.

Referred to as the expense warranty approach.

Common Types of Provisions

Warranty Provisions

Common Types of Provisions

BE13-13: Streep Factory provides a 2-year warranty with one of its

products which was first sold in 2010. In that year, Streep spent

$70,000 servicing warranty claims. At year-end, Streep estimates that

an additional $400,000 will be spent in the future to service warranty

claims related to 2010 sales. Prepare Streeps journal entry to record

the $70,000 expenditure, and the December 31 adjusting entry.

2010 Warranty expense 70,000

Cash 70,000

12/31/10 Warranty expense 400,000

Warranty liability 400,000

Common Types of Provisions

Companies should charge the costs of premiums and coupons

to expense in the period of the sale that benefits from the plan.

Accounting:

Estimate the number of outstanding premium offers that

customers will present for redemption.

Charge cost of premium offers to Premium Expense and

credits Premium Liability.

Premiums and Coupons

Common Types of Provisions

Illustration: Fluffy Cakemix Company offered its customers a large

non-breakable mixing bowl in exchange for 25 cents and 10 boxtops.

The mixing bowl costs Fluffy Cakemix Company 75 cents, and the

company estimates that customers will redeem 60 percent of the

boxtops. The premium offer began in June 2011 and resulted in the

transactions journalized below. Fluffy Cakemix Company records

purchase of 20,000 mixing bowls as follows.

Inventory of Premium Mixing Bowls 15,000

Cash 15,000

$20,000 x .75 = $15,000

Common Types of Provisions

Illustration: The entry to record sales of 300,000 boxes of cake mix

would be:

Cash 240,000

Sales 240,000

300,000 x .80 = $240,000

Fluffy records the actual redemption of 60,000 boxtops, the receipt

of 25 cents per 10 boxtops, and the delivery of the mixing bowls as

follows.

Cash [(60,000 / 10) x $0.25] 1,500

Premium Expense 3,000

Inventory of Premium Mixing Bowls 4,500

Computation: (60,000 / 10) x $0.75 = $4,500

Common Types of Provisions

Illustration: Finally, Fluffy makes an end-of-period adjusting entry

for estimated liability for outstanding premium offers (boxtops) as

follows.

Premium Expense 6,000

Premium Liability 6,000

LO 4

Common Types of Provisions

A company must recognize an environmental liability

when it has an existing legal obligation associated with the

retirement of a long-lived asset and when it can reasonably

estimate the amount of the liability.

Environmental Provisions

Common Types of Provisions

Obligating Events. Examples of existing legal obligations, which

require recognition of a liability include, but are not limited to:

Decommissioning nuclear facilities,

Dismantling, restoring, and reclamation of oil and gas

properties,

Certain closure, reclamation, and removal costs of mining

facilities,

Closure and post-closure costs of landfills.

Environmental Provisions

Common Types of Provisions

Measurement. A company initially measures an environmental

liability at the best estimate of its future costs.

Environmental Provisions

Recognition and Allocation. To record an environmental liability

a company includes

the cost associated with the environmental liability in the

carrying amount of the related long-lived asset, and

records a liability for the same amount.

Common Types of Provisions

Illustration: On January 1, 2010, Wildcat Oil Company erected an

oil platform in the Gulf of Mexico. Wildcat is legally required to

dismantle and remove the platform at the end of its useful life,

estimated to be five years. Wildcat estimates that dismantling and

removal will cost $1,000,000. Based on a 10 percent discount rate,

the fair value of the environmental liability is estimated to be

$620,920 ($1,000,000 x .62092). Wildcat records this liability on Jan.

1, 2011 as follows.

Drilling platform 620,920

Environmental liability 620,920

Common Types of Provisions

Illustration: During the life of the asset, Wildcat allocates the asset

retirement cost to expense. Using the straight-line method, Wildcat

makes the following entries to record this expense.

Depreciation expense ($620,920 / 5) 124,184

Accumulated depreciation 124,184

December 31, 2011, 2012, 2013, 2014, 2015

Common Types of Provisions

Illustration: In addition, Wildcat must accrue interest expense each

period. Wildcat records interest expense and the related increase in

the environmental liability on December 31, 2011, as follows.

Interest expense ($620,092 x 10%) 62,092

Environmental liability 62,092

December 31, 2011

Common Types of Provisions

Illustration: On January 10, 2016, Wildcat contracts with Rig

Reclaimers, Inc. to dismantle the platform at a contract price of

$995,000. Wildcat makes the following journal entry to

record settlement of the liability.

Environmental liability 1,000,000

Gain on settlement of liability 5,000

Cash 995,000

January 10, 2016

Common Types of Provisions

The unavoidable costs of meeting the obligations exceed the

economic benefits expected to be received.

The expected costs should reflect the least net cost of exiting from

the contract, which is the lower of

1. the cost of fulfilling the contract, or

2. the compensation or penalties arising from failure to fulfill the

contract.

Onerous Contract Provisions

Common Types of Provisions

Onerous Contract Provisions

Illustration: Sumart Sports operates profitably in a factory that it

has leased and on which it pays monthly rentals. Sumart decides to

relocate its operations to another facility. However, the lease on the

old facility continues for the next three years. Unfortunately, Sumart

cannot cancel the lease nor will it be able to sublet the factory to

another party. The expected costs to satisfy this onerous contract

are 200,000. In this case, Sumart makes the following entry.

Loss on lease contract 200,000

Lease contract liability 200,000

Common Types of Provisions

Onerous Contract Provisions

Assume the same facts as above for the Sumart example and the

expected costs to fulfill the contract are 200,000. However,

Sumart can cancel the lease by paying a penalty of 175,000. In

this case, Sumart should record the liability as follows.

Loss on lease contract 175,000

Lease contract liability 175,000

Common Types of Provisions

Restructuring Provisions

Restructurings are defined as a program that is planned and

controlled by management and materially changes either

1. the scope of a business undertaken by the company; or

2. the manner in which that business is conducted.

Companies are required to have a detailed formal plan for the restructuring

and to have raised a valid expectation to those affected by implementation

or announcement of the plan.

Common Types of Provisions

Restructuring Provisions

IFRS provides specific guidance related to certain costs and losses

that should be excluded from the restructuring provision.

Illustration 13-9

Common Types of Provisions

LO 4

Illustration 13-10

A provision is recognized at december 31,2011,for the best estimate of

Closing the division ,in this case,500,000

Restructuring Provisions

Disclosures Related To Provisions

A company must provide a reconciliation of its beginning to

ending balance for each major class of provisions, identifying

what caused the change during the period.

In addition,

Provision must be described and the expected timing of

any outflows disclosed.

Disclosure about uncertainties related to expected

outflows as well as expected reimbursements should be

provided.

Contingent Liabilities

Contingent liabilities (MFRS 137) are not recognized in the

financial statements because they are

1. A possible obligation (not yet confirmed),

2. A present obligation for which it is not probable that

payment will be made, or

3. A present obligation for which a reliable estimate of the

obligation cannot be made.

Contingent Liabilities

Illustration 13-12

Contingent Liabilities Guidelines

Contingent Assets

A contingent asset is a possible asset that arises from past

events and whose existence will be confirmed by the occurrence

or non-occurrence of uncertain future events not wholly within the

control of the company. Typical contingent assets are:

1. Possible receipts of monies from gifts, donations, bonuses.

2. Possible refunds from the government in tax disputes.

3. Pending court cases with a probable favorable outcome.

Contingent assets are not recognized on the statement of financial position.

Contingent Assets

Illustration 13-14

Contingent Asset Guidelines

Contingent assets are disclosed when an inflow of economic

benefits is considered more likely than not to occur (greater than 50

percent).

Presentation of Current Liabilities

Presentation of Current Liabilities

Usually reported at their full maturity value.

Difference between present value and the maturity

value is considered immaterial.

Presentation of Current Liabilities

Illustration 13-15

Das könnte Ihnen auch gefallen

- Finacc RevDokument2 SeitenFinacc RevAcoOh Sii MHarian SagumNoch keine Bewertungen

- 08 Audit of InvestmentsDokument10 Seiten08 Audit of InvestmentsAryando Mocali TampubolonNoch keine Bewertungen

- Aaca Receivables and Sales ReviewerDokument13 SeitenAaca Receivables and Sales ReviewerLiberty NovaNoch keine Bewertungen

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDokument12 SeitenACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNoch keine Bewertungen

- Unit 6. Audit of Property, Plant and Equipment - Handout - T21920 (Final)Dokument8 SeitenUnit 6. Audit of Property, Plant and Equipment - Handout - T21920 (Final)Alyna JNoch keine Bewertungen

- Applied Auditing Audit of Investment: Problem No. 1Dokument3 SeitenApplied Auditing Audit of Investment: Problem No. 1JessicaNoch keine Bewertungen

- Hakdog PDFDokument18 SeitenHakdog PDFJay Mark AbellarNoch keine Bewertungen

- Preweek Practical Accounting 1Dokument24 SeitenPreweek Practical Accounting 1alellieNoch keine Bewertungen

- Toa - 2011Dokument7 SeitenToa - 2011EugeneDumalagNoch keine Bewertungen

- CHAPTER 10 - Pre-Board ExaminationsDokument34 SeitenCHAPTER 10 - Pre-Board Examinationsmjc24Noch keine Bewertungen

- Audit of PPEDokument6 SeitenAudit of PPEJuvy DimaanoNoch keine Bewertungen

- Chapter06 - Answer PDFDokument6 SeitenChapter06 - Answer PDFAvon Jade RamosNoch keine Bewertungen

- Ppe Depreciation and DepletionDokument21 SeitenPpe Depreciation and DepletionEarl Lalaine EscolNoch keine Bewertungen

- Cost Accounting Activity - Answer KeyDokument3 SeitenCost Accounting Activity - Answer KeyJanen Redondo TumangdayNoch keine Bewertungen

- AT Quizzer 2 - Profl Practice of Acctg - Summer 2020 PDFDokument12 SeitenAT Quizzer 2 - Profl Practice of Acctg - Summer 2020 PDFJohn Carlo CruzNoch keine Bewertungen

- POST-TEST 1 - Auditing and The Audit Process - AUDITING AND ASSURANCE PRINCIPLES - CONCEPTS AND APPLICATIONSDokument6 SeitenPOST-TEST 1 - Auditing and The Audit Process - AUDITING AND ASSURANCE PRINCIPLES - CONCEPTS AND APPLICATIONSDonise Ronadel SantosNoch keine Bewertungen

- Quiz - IntangiblesDokument1 SeiteQuiz - IntangiblesAna Mae HernandezNoch keine Bewertungen

- Which of The Following Would Indicate That A Note Receivable or Other Loan Is ImpairedDokument1 SeiteWhich of The Following Would Indicate That A Note Receivable or Other Loan Is ImpairedJAHNHANNALEI MARTICIONoch keine Bewertungen

- TOA Quizzer 1 - Intro To PFRSDokument6 SeitenTOA Quizzer 1 - Intro To PFRSmarkNoch keine Bewertungen

- Practice Final PB AuditingDokument14 SeitenPractice Final PB AuditingBenedict BoacNoch keine Bewertungen

- Afar Income Recognition Installment Sales Franchise Long Term Construction PDFDokument10 SeitenAfar Income Recognition Installment Sales Franchise Long Term Construction PDFKim Nicole ReyesNoch keine Bewertungen

- Draft RR Registration EOPT - For Public ConsultationDokument18 SeitenDraft RR Registration EOPT - For Public ConsultationGennelyn OdulioNoch keine Bewertungen

- AT Quizzer 2 - Profl Practice of AcctgDokument12 SeitenAT Quizzer 2 - Profl Practice of AcctgJimmyChaoNoch keine Bewertungen

- Act 20-Ap 04 PpeDokument7 SeitenAct 20-Ap 04 PpeJomar VillenaNoch keine Bewertungen

- Substantive Test of LiabilitiesDokument4 SeitenSubstantive Test of LiabilitiesJohn Francis IdananNoch keine Bewertungen

- Ap04-01 Audit of SheDokument7 SeitenAp04-01 Audit of Shenicole bancoroNoch keine Bewertungen

- 01 - Audit of Cash & Cash EquivalentsDokument4 Seiten01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNoch keine Bewertungen

- Cash and Accrual BasisDokument2 SeitenCash and Accrual Basisviji9999Noch keine Bewertungen

- 89 07 Gross IncomeDokument9 Seiten89 07 Gross IncomeNah HamzaNoch keine Bewertungen

- Audit of ReceivablesDokument2 SeitenAudit of ReceivablesCarmelaNoch keine Bewertungen

- Final Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursDokument84 SeitenFinal Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursJatin PanchiNoch keine Bewertungen

- Nfjpia Nmbe Far 2017 AnsDokument9 SeitenNfjpia Nmbe Far 2017 AnsSamieeNoch keine Bewertungen

- Far Compre DraftDokument27 SeitenFar Compre DraftMika MolinaNoch keine Bewertungen

- Review of Accounting Cycle - w97Dokument17 SeitenReview of Accounting Cycle - w97Ding CostaNoch keine Bewertungen

- Advanced Financial Accounting 1Dokument12 SeitenAdvanced Financial Accounting 1Gemine Ailna Panganiban NuevoNoch keine Bewertungen

- Chapter 14Dokument32 SeitenChapter 14faye anneNoch keine Bewertungen

- Seatwork 3-Liabilities 22Aug2019JMDokument3 SeitenSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaNoch keine Bewertungen

- Chapt 23 Current LiabilitiesDokument47 SeitenChapt 23 Current LiabilitiesMikaela SamonteNoch keine Bewertungen

- Unit Vi - Audit of Leases - Final - T11415 PDFDokument4 SeitenUnit Vi - Audit of Leases - Final - T11415 PDFSed ReyesNoch keine Bewertungen

- Unit V - Audit of Employee Benefits - Final - T31415 PDFDokument5 SeitenUnit V - Audit of Employee Benefits - Final - T31415 PDFSed ReyesNoch keine Bewertungen

- Investment in Securities (Notes)Dokument5 SeitenInvestment in Securities (Notes)Karla BordonesNoch keine Bewertungen

- Philippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Dokument13 SeitenPhilippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Thalia UyNoch keine Bewertungen

- Practice Examination in Auditing TheoryDokument28 SeitenPractice Examination in Auditing TheoryGabriel PonceNoch keine Bewertungen

- Cash To Inventory Reviewer 1Dokument15 SeitenCash To Inventory Reviewer 1Patricia Camille AustriaNoch keine Bewertungen

- 7th Pylon Cup Final Round SGVDokument11 Seiten7th Pylon Cup Final Round SGVrcaa04Noch keine Bewertungen

- Financial Accounting Problems: Problem I (Current Assets)Dokument21 SeitenFinancial Accounting Problems: Problem I (Current Assets)Fery AnnNoch keine Bewertungen

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Dokument14 SeitenNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Tricia Jen TobiasNoch keine Bewertungen

- LG 03A Overview of Auditing and The Audit Process 2018 PDFDokument4 SeitenLG 03A Overview of Auditing and The Audit Process 2018 PDFNash JuaqueraNoch keine Bewertungen

- Review of Accounting ProcessDokument2 SeitenReview of Accounting ProcessSeanNoch keine Bewertungen

- Theory of Accounts On Business CombinationDokument2 SeitenTheory of Accounts On Business CombinationheyNoch keine Bewertungen

- Quiz Audit of LiabilitiesDokument3 SeitenQuiz Audit of LiabilitiesCattleyaNoch keine Bewertungen

- MSQ-09 Working Capital FinanceDokument19 SeitenMSQ-09 Working Capital FinanceElin SaldañaNoch keine Bewertungen

- TB16 Income Taxes - TAX 2Dokument21 SeitenTB16 Income Taxes - TAX 2scrapped princeNoch keine Bewertungen

- Elimination RoundDokument11 SeitenElimination RoundDeeNoch keine Bewertungen

- Common Types of ProvisionsDokument7 SeitenCommon Types of ProvisionsiyexrahmanNoch keine Bewertungen

- PROVISIONDokument18 SeitenPROVISIONKirena XavieryNoch keine Bewertungen

- Chapter 11 Provision and Contingent Liabilities - ZasDokument39 SeitenChapter 11 Provision and Contingent Liabilities - Zasying huiNoch keine Bewertungen

- IAS 37 Provisions, Contingent Liabilities and Contingent AssetsDokument33 SeitenIAS 37 Provisions, Contingent Liabilities and Contingent AssetsTsegay ArayaNoch keine Bewertungen

- Provision, With Solved Tutorial Question and Briefly ConceptDokument17 SeitenProvision, With Solved Tutorial Question and Briefly ConceptSamson KilatuNoch keine Bewertungen

- Current Liabilities, Provisions and Contingencies LO2 Accounting For ProvisionsDokument40 SeitenCurrent Liabilities, Provisions and Contingencies LO2 Accounting For Provisionsammad uddinNoch keine Bewertungen

- Assignment: Advanced Financial Management 2014 Islamic Bond (Sukuk)Dokument1 SeiteAssignment: Advanced Financial Management 2014 Islamic Bond (Sukuk)Nagaeshwary MuruganNoch keine Bewertungen

- Legal Implication of IncorporationDokument1 SeiteLegal Implication of IncorporationNagaeshwary MuruganNoch keine Bewertungen

- Aurora - Directors ReportDokument4 SeitenAurora - Directors ReportNagaeshwary MuruganNoch keine Bewertungen

- Consolidation Subsequent To The Date of AcquisitionDokument68 SeitenConsolidation Subsequent To The Date of AcquisitionShahrul IzwanNoch keine Bewertungen

- SQQS AssgnmtDokument11 SeitenSQQS AssgnmtNagaeshwary MuruganNoch keine Bewertungen

- 6 Cash Flows in Capital Budgeting Slides - (FB) PDFDokument13 Seiten6 Cash Flows in Capital Budgeting Slides - (FB) PDFNagaeshwary Murugan100% (1)

- Introduction To Information System Analysis & DesignDokument37 SeitenIntroduction To Information System Analysis & DesignNagaeshwary MuruganNoch keine Bewertungen

- Far 1 Notes Chapter 4Dokument66 SeitenFar 1 Notes Chapter 4Nagaeshwary MuruganNoch keine Bewertungen

- Chapter 5 - Time Value of Money Multiple Choice QuestionsDokument35 SeitenChapter 5 - Time Value of Money Multiple Choice QuestionsNagaeshwary Murugan100% (2)

- MDOF (Multi Degre of FreedomDokument173 SeitenMDOF (Multi Degre of FreedomRicky Ariyanto100% (1)

- The Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageDokument5 SeitenThe Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageHenny ZahranyNoch keine Bewertungen

- Methodical Pointing For Work of Students On Practical EmploymentDokument32 SeitenMethodical Pointing For Work of Students On Practical EmploymentVidhu YadavNoch keine Bewertungen

- Elastic Modulus SFRCDokument9 SeitenElastic Modulus SFRCRatul ChopraNoch keine Bewertungen

- ACIS - Auditing Computer Information SystemDokument10 SeitenACIS - Auditing Computer Information SystemErwin Labayog MedinaNoch keine Bewertungen

- Brand Positioning of PepsiCoDokument9 SeitenBrand Positioning of PepsiCoAbhishek DhawanNoch keine Bewertungen

- Research Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNADokument10 SeitenResearch Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNAAnonymous cgcKzFtXNoch keine Bewertungen

- Sourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDokument58 SeitenSourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyAlaa Al HarbiNoch keine Bewertungen

- CV Ovais MushtaqDokument4 SeitenCV Ovais MushtaqiftiniaziNoch keine Bewertungen

- Hager Pricelist May 2014Dokument64 SeitenHager Pricelist May 2014rajinipre-1Noch keine Bewertungen

- Shubham RBSEDokument13 SeitenShubham RBSEShubham Singh RathoreNoch keine Bewertungen

- 4th Sem Electrical AliiedDokument1 Seite4th Sem Electrical AliiedSam ChavanNoch keine Bewertungen

- How Yaffs WorksDokument25 SeitenHow Yaffs WorkseemkutayNoch keine Bewertungen

- 5 Deming Principles That Help Healthcare Process ImprovementDokument8 Seiten5 Deming Principles That Help Healthcare Process Improvementdewi estariNoch keine Bewertungen

- Information Security Chapter 1Dokument44 SeitenInformation Security Chapter 1bscitsemvNoch keine Bewertungen

- HealthInsuranceCertificate-Group CPGDHAB303500662021Dokument2 SeitenHealthInsuranceCertificate-Group CPGDHAB303500662021Ruban JebaduraiNoch keine Bewertungen

- Hayashi Q Econometica 82Dokument16 SeitenHayashi Q Econometica 82Franco VenesiaNoch keine Bewertungen

- Portrait of An INTJDokument2 SeitenPortrait of An INTJDelia VlasceanuNoch keine Bewertungen

- Oracle FND User APIsDokument4 SeitenOracle FND User APIsBick KyyNoch keine Bewertungen

- 1.1. Evolution of Cloud ComputingDokument31 Seiten1.1. Evolution of Cloud Computing19epci022 Prem Kumaar RNoch keine Bewertungen

- Underwater Wellhead Casing Patch: Instruction Manual 6480Dokument8 SeitenUnderwater Wellhead Casing Patch: Instruction Manual 6480Ragui StephanosNoch keine Bewertungen

- Prachi AgarwalDokument1 SeitePrachi AgarwalAnees ReddyNoch keine Bewertungen

- TAS5431-Q1EVM User's GuideDokument23 SeitenTAS5431-Q1EVM User's GuideAlissonNoch keine Bewertungen

- 48 Volt Battery ChargerDokument5 Seiten48 Volt Battery ChargerpradeeepgargNoch keine Bewertungen

- Epidemiologi DialipidemiaDokument5 SeitenEpidemiologi DialipidemianurfitrizuhurhurNoch keine Bewertungen

- ATPDraw 5 User Manual UpdatesDokument51 SeitenATPDraw 5 User Manual UpdatesdoniluzNoch keine Bewertungen

- Gardner Denver PZ-11revF3Dokument66 SeitenGardner Denver PZ-11revF3Luciano GarridoNoch keine Bewertungen

- KSU OGE 23-24 AffidavitDokument1 SeiteKSU OGE 23-24 Affidavitsourav rorNoch keine Bewertungen

- United Nations Economic and Social CouncilDokument3 SeitenUnited Nations Economic and Social CouncilLuke SmithNoch keine Bewertungen

- On CatiaDokument42 SeitenOn Catiahimanshuvermac3053100% (1)