Beruflich Dokumente

Kultur Dokumente

Chap 1 - ME

Hochgeladen von

laddooparmarCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chap 1 - ME

Hochgeladen von

laddooparmarCopyright:

Verfügbare Formate

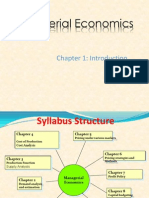

Managerial Economics

Chapter 1: Introduction

Chapter 5

Pricing under various markets

Syllabus Structure

Managerial

Economics

Chapter 3

Production Function

Supply Analysis

Chapter 1

Introduction. The nature

& scope of managerial

economic decision making

Chapter 6

Pricing strategies and

Methods

Chapter 9

Business and Government.

Chapter 8

Capital budgeting

Chapter 2

Demand analysis

and estimation

Chapter 4

Cost of Production

Cost Analysis

Chapter 7

Profit Policy

Introduction

You have Rs. 500 what will you do?

Make choices Dilemma (individual, society &

country)

Use resources to satisfy wants but all wants cant be

satisfied

Why?

Two fundamental facts:

Human being have unlimited wants;

Means of satisfying these wants are relatively scarce

from the subject matter of economics

Economics

Economics is the branch of Knowledge

that deals with how the scarce resources

can be used to produce valuable goods

and services and distribute them

efficiently among different classes of

people in the society.

What is Managerial Economics?

Douglas - Managerial economics is .. the

application of economic principles and

methodologies to the decision-making process

within the firm or organization.

Pappas & Hirschey - Managerial economics

applies economic theory and methods to business

and administrative decision-making.

Salvatore - Managerial economics refers to the

application of economic theory and the tools of

analysis of decision science to examine how an

organisation can achieve its objectives most

effectively.

5

6

What is Managerial Economics?

Howard Davies and Pun-Lee Lam -

It is the application of economic analysis

to business problems; it has its origin in

theoretical microeconomics.

Economics is the study of the

making, buying, and selling of goods

or services.

MANAGERIAL ECONOMICS

Economicscontributestoagreatdealtowardsthe

performanceofmanagerialdutiesandresponsibilities.

Like:BiologyMedicalprofession

Physics-Engineering

Economicscontributestomanagerialprofession.

Managerswithworkingknowledgeofeconomicscan

performtheirfunctionsmoreefficientlythanthose

withoutit.

Theemphasishereisonthemaximizationofthe

objectiveandlimitednessoftheresources.Thetaskof

managementistooptimizetheuseofresources.

Nature

Fundamental Academic Subject

Economic rationale of business administration

Allocation of resources

Theory of firm

Market condition

Profits and Pricing

Basis of Decision Making

Pragmatic Approach

Help of Quantitative Techniques

Socio-Cultural Aspects

Scope of Managerial Economics

Scope

Demand Analysis & Forecasting

Cost & Production Analysis

Pricing Decisions, Policies & Practices

Profit management

Capital Management

Analysis of Business Environment

Allied Disciplines

Subject Extensively used concepts of the subject

Economics Demand function, Cost function, revenue function

etc.

Operations research Model Building, Linear programming, queuing,

transportation, Optimization techniques etc

Mathematics Algebra, Calculus, exponential, vectors etc

Statistics Averages, Measures of dispersion, Correlation ,

regression, time series, interpolation, probability

etc.

Accountancy Provides information relating to costs, revenue,

receivables, payables, profits/losses etc.

Psychology To understand the behavior of individuals in

terms of attitudes, perception, behavioral

implications, motivations etc and its helps in study

the behavior of customers, supplier/seller, investor,

worker or an employee

Organizational Behavior Helps in understanding the group behavior in

organization environment.

Business issues are

Operational or internal

Environment or external

Microeconomics applied to Operational

issues

Operational issues are of internal nature-include

problems which arise within the business

organization and fall within the purview and

control of the management.-

Choice of business and nature of products to

produce, how much to produce (size of the firm),

choosing the factors combination (technology),

how to price, how to decide on new investments,

how to manage profits and capital, how to manage

inventory etc

Micro economic theories

Theory of Demand

Production theory (Theory of firm)

Pricing theory

Profit analysis and Management

Theory of Capital and investment decisions

Macro economic applied

Macro economics issues is generally pertain to factors

in the economic environment in which the business

operates-

Type of economic system,

General trends in production, employment, income, -

prices, savings and investments

Structure & trends of working of the financial

institutions

Magnitude of and trends in foreign trade

Govts economic policies

Social factors

Political environment-govt attitude towards business

Degree of openness of the economy

Basis of

Difference

Micro - Economics Macro-Economics

ORIGIN Individuals, Small groups Large level, Nation

OBJECTIVE Supply Profit Max

Demand - Utility

Employment, economic

growth, stable Price

DRIVING FORCES Price Mechanism Demand &

Supply

National Income Agg

demand & Supply

ASSUMPTIONS Rational behaviour of

Individuals

Agg O/P of economy & its

resources

EQUILIBRIUM

ANALYSIS

Partial Individual, Industry General No of variables,

Interdependence

TIME ELEMENT Static analysis, @ particular

time

Time lags, Rates of change,

value of variables

The role of managerial economics in managerial decision

making

Managerial decision problems

Product price and output

Make or buy

Production technique

Internet strategy

Advertising media and intensity

Investment and financing

Economic concepts

Theory of consumer behaviour

Theory of firm

Theory of market structures and

pricing

Decision making tools

Numerical analysis

Statistical analysis

Forecasting

Game theory

Optimisation

Managerial Economics

Use of economics concepts and

decision making tools to solve

managerial decision problems

Optimal solutions

18

The Use of Economic Models

Positive Economics:-

Derives useful theories with testable propositions

about WHAT IS.

analyze systematically & explain economic

phenomenon as they actually happen

Normative Economics:-

Provides the basis for value judgments on

economic outcomes. WHAT SHOULD BE

concerned with Ideal Economic situation,

not with what actually happens

19

What is the purpose of economic analysis?

Why do we want to apply economic analysis to business

problems?

For the academic economist: to understand, to

make predictions about firms behavior

The positive approach to theory: What is?

For the businessperson: to assist decision-

making, to provide decision-rules which can be

applied

The normative approach to theory: What should

be?

Optimization

Optimization means solving problems in which

one seeks to minimize or maximize areal

function by systematically

Economics relies so heavily on optimization that

some economists define their field as the study of

optimization under constraints or optimization

under scarcity.

Modern optimization theory overlaps with game

theory and the study of (economic) equilibrium, as

well as traditional optimization theory.

THE OPPORTUNITY COST CONCEPT

Opportunity costs are the costs of displaced

alternatives. The opportunity cost of a decision is

meant the sacrifice of alternatives required by the

decision.

If a scarce resource is put to particular use, other uses

of the resources must be given up. The net revenue

that could be produced in the next best use of the

resource is called the opportunity cost of the resource

for the use actually made.

Opportunity cost also called alternative cost is the

expected return from the next best use of the

resource(s) which are foregone due to scarcity of

resources.

Marginal Analysis

Marginal analysis is used to assist people in

allocating their scarce resources to maximize the

benefit of the output produced.

Simply getting the most value for the resources

used.

Marginal analysis: The analysis of the benefits

and costs of the marginal unit of a good or input.

(Marginal = the next unit)

Marginal Analysis

A technique widely used in business decision-

making and ties together much

of economic thought.

In any situation, people want to maximize net

benefits:

Net Benefits = Total Benefits - Total Costs

The Control Variable

To do marginal analysis, we can change a variable,

such as the:

quantity of a good you buy,

the quantity of output you produce, or

the quantity of an input you use.

This variable is called the control variable .

Marginal analysis focuses upon whether the

control variable should be increased by one more

unit or not.

Key Procedure for Using Marginal

Analysis

1. Identify the control variable (cv).

2. Determine what the increase in total

benefits would be if one more unit of the

control variable were added.

This is the marginal benefit of the added

unit.

3. Determine what the increase in total cost

would be if one more unit of the control

variable were added.

This is the marginal cost of the added unit.

Key Procedure for Using Marginal

Analysis

4. If the unit's marginal benefit exceeds (or

equals) its marginal cost, it should be added.

Remember to look only at the changes in total

benefits and total costs.

If a particular cost or benefit does not change,

IGNORE IT !

Why Does This Work?

Because:

Marginal Benefit = Increase in Total Benefits

per unit of control

variable

TR / Q

cv

=

MR

where cv = control variable

Why Does This Work?

Marginal Cost = Increase in Total Costs

per unit of control

variable

TC / Q

cv

=

MC

Why Does This Work?

So:

Change in Net Benefits =

Marginal Benefit - Marginal Cost

When marginal benefits exceed marginal cost, net

benefits go up.

So the marginal unit of the control variable should

be added.

Example: Should a firm produce

more ?

A firm's net benefit of being in business is PROFIT.

The following equation calculates profit:

PROFIT = TOTAL REVENUE - TOTAL COST

Example: Should a firm produce

more ?

Where:

TR = (P

output

X Q

output

)

n

TC = (P

input

i

X Q

input

i

)

i=1

Assume the firm's control variable is the

output it produces.

Problem:

International Widget is producing fifty widgets

at a total cost of $50,000 and is selling them for

$1,200 each for a total revenue of $60,000.

If it produces a fifty-first widget, its total

revenue will be $61,200 and its total cost will

be $51,500.

Should the firm produce the fifty-first widget?

Answer: NO

The fifty-first widget's marginal benefit is

$1,200

($61,200 - $60,000) / 1

This is the change in total revenue from

producing one additional widget and is called

marginal revenue.

Answer:

The firm's marginal cost is $1,500

($51,500 - $50,000) / 1

This is the change in total cost from producing

one additional widget.

This extra widget should NOT be produced

because it does not add to profit:

Answer:

Change in Net Revenue (Benefit) =

Marginal Revenue - Marginal Cost

- $300 = $1,200 - $1,500

Q

cv

Q

widgets

TR TR TC TC

50 60,000 50,000

1 1,200 1,500

51 61,200 51,500

MR = TR / Q

cv

= $1,200 / 1 = $1,200

MC = TC / Q

cv

= $1,500 / 1 = $1,500

A Question:

What is the minimum price consumers would

have to pay to get a 51st Widget produced?

Consumers would have to pay at least $1,500

for the extra widget to get the producer to

increase production.

Summary

Marginal analysis forms the basis of economic

reasoning.

To aid in decision-making, marginal analysis looks

at the effects of a small change in the control

variable.

Each small change produces some good (its

marginal benefit) and some bad (its marginal

cost).

As long as there is more "good" than "bad", the

control variable should be increased (since net

benefits will then be increased).

Economic Model

In economics, a model is a theoretical construct

that represents economic processes by a set of

variables and a set of logical and/or quantitative

relationships between them.

The economic models a simplified framework

designed to illustrate complex processes, often but

not always using mathematical techniques.

economic models functions

Simplification of and abstraction from observed data

Means of selection of data based on a paradigm of

econometric study

Simplification function is helpful in diluting the

complex economic processes. Complexity are due

to

Individual and co-operative decision processes

Resource limitation

Environmental and geographical constraints

Institutional and legal requirements

Purely random fluctuations

Selection is important because the nature of an

economic model will often determine what facts

will be looked at, and how they will be compiled.

Additionally use of economic models include:

Forecasting

Deciding economic policy

Planning & allocation

Management of business

In financial models

Types of Economic Models

Stochastic models: Random process Models (Based on

statistics & Hypothesis Formulation)

Non- Stochastic models: may be purely qualitative (for

example, models involved in some aspect of social

choice theory) or quantitative (involving rationalization of

financial variables, for example, specific forms of functional

relationships between variables).

Qualitative models: Although almost all economic models

involve some form of mathematical or quantitative analysis,

qualitative models are occasionally used. Like

qualitative scenario planning in which possible future events

are played out. Another example is non-numerical decision tree

analysis. Qualitative models often suffer from lack of precision.

Quantitative modeling: At a more practical level, quantitative

modeling is applied to many areas of economics and several

methodologies have evolved more or less independently of each

other.

Accounting model : is based on the premise that for

every credit there is a debit. More symbolically, an accounting model

expresses some principle of conservation in the form

algebraic sum of inflows = sinks sources

Aggregate Models: Macroeconomics needs to deal with aggregate

quantities such as output, the price level, the interest rate and so on.

However, for the most part, these models are computationally much

harder to deal with and harder to use as tools for qualitative analysis.

For this reason, macroeconomic models usually lump together

different variables into a single quantity such as output or price.

Moreover, quantitative relationships between these aggregate

variables are often parts of important macroeconomic theories

Types of Economic Models

In economic static mean the studies focus only on

particular period of time

It is similar to taking a photo when you press the

button for a shot then the photo is just at a

particular point of time.

In Dynamic we focus on the change of time and

how the equilibrium change with time.

It is the same as watching the movie you can see

how the image animate and movement.

Static and Dynamics.

Static and Dynamics.

In static economies, consumption patterns become

rigid, and marketing is typically nothing more

than a supply effort.

In a dynamic economy, consumption patterns

change rapidly. Marketing is constantly faced with

the challenge of detecting and providing for new

levels of consumption, and marketing efforts must

be matched with ever-changing market needs and

wants.

Thank You

Das könnte Ihnen auch gefallen

- Meeting Organization: Mbaisemi PD Lab-OCT 2018Dokument4 SeitenMeeting Organization: Mbaisemi PD Lab-OCT 2018laddooparmarNoch keine Bewertungen

- Chap 1 Historical Perspective W CMDokument39 SeitenChap 1 Historical Perspective W CMladdooparmarNoch keine Bewertungen

- Case 1 - TQMDokument8 SeitenCase 1 - TQMladdooparmarNoch keine Bewertungen

- Chapter 1 - Introduction To OBDokument13 SeitenChapter 1 - Introduction To OBladdooparmarNoch keine Bewertungen

- Service Organizations: Management Control Systems in ADokument29 SeitenService Organizations: Management Control Systems in AladdooparmarNoch keine Bewertungen

- Chap 5 - MEDokument47 SeitenChap 5 - MEladdooparmarNoch keine Bewertungen

- Chap 5 - MRPDokument75 SeitenChap 5 - MRPladdooparmarNoch keine Bewertungen

- Chapter No.1 Research Design and Methodology: The Researcher Had The Following Objectives For The StudyDokument6 SeitenChapter No.1 Research Design and Methodology: The Researcher Had The Following Objectives For The StudyladdooparmarNoch keine Bewertungen

- Financial Management Series Number 8: Performance Measurement & Performance Based Budgeting (PBB)Dokument95 SeitenFinancial Management Series Number 8: Performance Measurement & Performance Based Budgeting (PBB)laddooparmarNoch keine Bewertungen

- 1Dokument2 Seiten1Archit JoshiNoch keine Bewertungen

- International Body LanguageDokument21 SeitenInternational Body LanguageladdooparmarNoch keine Bewertungen

- Chapter 7 - Types of DataDokument31 SeitenChapter 7 - Types of DataladdooparmarNoch keine Bewertungen

- Source: The World FactbookDokument21 SeitenSource: The World FactbookladdooparmarNoch keine Bewertungen

- Method StudyDokument80 SeitenMethod StudyladdooparmarNoch keine Bewertungen

- Chap 1 - MEDokument46 SeitenChap 1 - MEladdooparmarNoch keine Bewertungen

- Chap 5 - MOMDokument27 SeitenChap 5 - MOMladdooparmarNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Rhavif's ResumeDokument1 SeiteRhavif's ResumeRhavif BudiboyNoch keine Bewertungen

- Articles On Philippine Obligation and ContractsDokument114 SeitenArticles On Philippine Obligation and ContractsKriz Batoto100% (1)

- My Cook BookDokument66 SeitenMy Cook BookAkshay KumariNoch keine Bewertungen

- Student's Lab Pack: Preteens 02 11 Weeks CourseDokument30 SeitenStudent's Lab Pack: Preteens 02 11 Weeks CourseMi KaNoch keine Bewertungen

- SQL Interview QuestionsDokument89 SeitenSQL Interview QuestionsVaneet Arora100% (2)

- Au 170Dokument1 SeiteAu 170Ida Bagus Gede PalgunaNoch keine Bewertungen

- Sample Information For Attempted MurderDokument3 SeitenSample Information For Attempted MurderIrin200Noch keine Bewertungen

- 03 Dizon v. COMELECDokument1 Seite03 Dizon v. COMELECChelle BelenzoNoch keine Bewertungen

- India: Labor Market: A Case Study of DelhiDokument4 SeitenIndia: Labor Market: A Case Study of DelhiHasnina SaputriNoch keine Bewertungen

- Fiche 2 ConnexionsDokument2 SeitenFiche 2 ConnexionsMaria Marinela Rusu50% (2)

- ILO Report On Disability and Labour India - 2011wcms - 229259Dokument56 SeitenILO Report On Disability and Labour India - 2011wcms - 229259Vaishnavi JayakumarNoch keine Bewertungen

- Volume 1Dokument17 SeitenVolume 1Anant RamNoch keine Bewertungen

- Developing The Tourism Sector in The Sultanate of OmanDokument18 SeitenDeveloping The Tourism Sector in The Sultanate of OmanSalma Al-NamaniNoch keine Bewertungen

- сестр главы9 PDFDokument333 Seitenсестр главы9 PDFYamikNoch keine Bewertungen

- FABM 1-Answer Sheet-Q1 - Summative TestDokument2 SeitenFABM 1-Answer Sheet-Q1 - Summative TestFlorante De Leon100% (2)

- ROSEN Group - Challenging Pipeline DiagnosticsDokument42 SeitenROSEN Group - Challenging Pipeline DiagnosticsFuad0% (1)

- Bernard New PersDokument12 SeitenBernard New PersChandra SekarNoch keine Bewertungen

- (Promotion Policy of APDCL) by Debasish Choudhury: RecommendationDokument1 Seite(Promotion Policy of APDCL) by Debasish Choudhury: RecommendationDebasish ChoudhuryNoch keine Bewertungen

- Problematic Customers and Turnover Intentions of CustomerDokument10 SeitenProblematic Customers and Turnover Intentions of Customernaqash1111Noch keine Bewertungen

- Alamat NG BatangasDokument2 SeitenAlamat NG BatangasGiennon Arth LimNoch keine Bewertungen

- Practice 3Dokument7 SeitenPractice 3NinhNoch keine Bewertungen

- Kohn v. Hollywood Police, Einhorn, Knapp, Perez, Sheffel, Cantor, BlattnerDokument30 SeitenKohn v. Hollywood Police, Einhorn, Knapp, Perez, Sheffel, Cantor, Blattnerkohn5671Noch keine Bewertungen

- SLS Ginopol L24 151-21-3-MSDS US-GHSDokument8 SeitenSLS Ginopol L24 151-21-3-MSDS US-GHSRG TNoch keine Bewertungen

- Citing Textual EvidenceDokument4 SeitenCiting Textual EvidenceRaymondNoch keine Bewertungen

- 007-012477-001 SAS Token Guide OTP Hardware Token RevEDokument14 Seiten007-012477-001 SAS Token Guide OTP Hardware Token RevEBarons ArismatNoch keine Bewertungen

- Ventures Onsite Market Awards 22062023 64935868dDokument163 SeitenVentures Onsite Market Awards 22062023 64935868dhamzarababa21Noch keine Bewertungen

- Andrea Falcon - Aristotle On How Animals MoveDokument333 SeitenAndrea Falcon - Aristotle On How Animals MoveLigia G. DinizNoch keine Bewertungen

- EDUC307 BEED CurriculumDokument9 SeitenEDUC307 BEED CurriculumPaula Antonette L. CelizNoch keine Bewertungen

- Listening Test Sweeney Todd, Chapter 4: 1 C. Zwyssig-KliemDokument3 SeitenListening Test Sweeney Todd, Chapter 4: 1 C. Zwyssig-KliemCarole Zwyssig-KliemNoch keine Bewertungen

- MBA Advantage LRDokument304 SeitenMBA Advantage LRAdam WittNoch keine Bewertungen