Beruflich Dokumente

Kultur Dokumente

Techiniques Oof Project Appraisal

Hochgeladen von

Arij KidwaiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Techiniques Oof Project Appraisal

Hochgeladen von

Arij KidwaiCopyright:

Verfügbare Formate

Techniques of Project

Appraisal

BY -:

Meaning of Project Appraisal: -

Project Appraisal is the analysis of costs and benefits of a proposed project with

a goal of assuring a rational allocation of limited financial resources amongst

alternate Investment opportunities with the objective of achieving specific goals.

The various Factors considered by Financial Institutions while appraising a

project are: -

Technical, Financial, Economic, Commercial, Social and

Managerial Factors.

Objectives & Scope: -

To extract relevant information for determining the success or

failure of a project.

To apply standard yardsticks for determining the rate of success or

failure of a project.

To determine the expected costs and benefits of the project.

To arrive at specific conclusions regarding the project.

Significance: -

It helps in arriving at specific and predicted results.

It evaluates the desirability of the project.

It provides information to determine the success or failure of a

project.

It employs existing norms to predict the rate of success or failure

of the project.

Factors Considered while Appraising a Project : -

Technical Factors

Financial Factors

Economic Factors

Social Factors

Commercial Factors

Managerial Factors

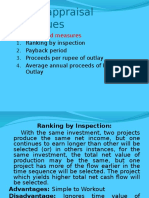

Methods of Project Appraisal

METHODS OF

PROJECT APPRAISAL

DISCOUNTING

CRITERIA

NON -DISCOUNTING

CRITERIA

NET

PRESENT

VALUE

PROFIT-

ABILITY

INDEX

INTERNAL

RATE OF

RETURN

PAYBACK

PERIOD

ACCOUNTING

RATE OF

RETURN

Pay-Back Period Method: -

The Pay-Back Period is the length of time required to recover the initial outlay

on the project Or It is the time required to recover the original investment

through income generated from the project.

Pay-Back Period = Original Cost of Investment____

Annual Cash Inflows or Savings

Pros: - a) It is easy to operate and simple to understand.

b) It is best suited where the project has shorter gestation period and

project cost is also less.

c) It is best suited for high risk category projects. Which are prone to rapid

technological changes.

d) It enables entrepreneur to select an investment which yields quick return

of funds.

Cons: - a) It Emphasizes more on liquidity rather than profitability.

b) It does not cover the earnings beyond the pay back period, which may

result in wrong selection of investment projects.

c) It is suitable for only small projects requiring less investment and time

d) This method ignores the cost of capital which is very important factor

in making sound investment decision.

Decision Rule: - A project which gives the shortest pay-back period, is considered

to be the most ACCEPTABLE

Accounting Rate of Return Method: -

This method is considered better than pay-back period method because it considers

earnings of the project during its full economic life. This method is also known

as Return On Investment (ROI). It is mainly expressed in terms of percentage.

ARR or ROI = Average Annual Earnings After Tax_______ * 100

Average Book Investment After Depreciation

Decision Rule: - In the ARR, A project is to be ACCEPTED when ( If Actual ARR

is higher or greater than the rate of return) otherwise it is Rejected

and In case of alternate projects, One with the highest ARR is to

be selected.

Pros: - a) It is simple to calculate and easy to understand.

b) It considers earning of the project during the entire operative life.

c) It helps in comparing the projects which differ widely.

d) This method considers net earnings after depreciation and taxes.

Cons: - a) It ignores time value of money.

b) It lays more emphasis on profit and less on cash flows.

c) It does not consider re-investment of profit over years.

d) It does not differentiate between the size of investments required for

different projects.

NPV (Net Present Value) Method: -

This method mainly considers the time value of money. It is the sum of the

aggregate present values of all the cash flows positive as well as negative that

are expected to occur over the operating life of the project.

NPV = PV of Net Cash Inflows Initial Outlay (Cash outflows)

Decision Rule: -

If NPV is positive, ACCEPT

If NPV is negative, REJECT

If NPV is 0, then apply Payback Period Method

The standard NPV method is based on the assumption that the intermediate cash

flows are reinvested at a rate of return equal to the cost of capital. When this

assumption is not valid, the investment rates applicable to the intermediate cash

flows need to be defined for calculating the modified NPV.

Pros and Cons of NPV: -

Pros: -

a) This method introduces the element of time value of money and as such is a

scientific method of evaluating the project.

b) It covers the whole project from start to finish and gives more accurate figures

c) It Indicates all future flows in todays value. This makes possible comparisons

between two mutually exclusive projects.

d) It takes into account the objective of maximum profitability

Cons: -

a) It is difficult method to calculate and use.

b) It is biased towards shot run projects.

c) In this method profitability is not linked to capital employed.

d) It does not consider Non-Financial data like the marketability of a product.

For Example: -

Initial Investment 20,000

Estimated Life 5 years

Scrap Value 1000 XYZ Enterprises Capital Project

Year Cash flow Discount factor Present Value

@10%

1 5.000 0.909 4545

2 10,000 0.826 8260

3 10,000 0.751 7510

4 3,000 0.683 2049

5 2,000 0.621 1242

5 1,000 0.621 621

PV of Net Cash Inflows = 24227

NPV = PV of Net Cash Inflows Cash Outflows

= 24227 20,000

NPV = 4227

Here, NPV is Positive (+ ve) The Project is ACCEPTED.

Profitability I ndex Method: -

Profitability Index is the ratio of present value of expected future cash inflows and

Initial cash outflows or cash outlay. It is also used for ranking the projects in order

of their profitability. It is also helpful in selecting projects in a situation of capital

rationing. It is also know as Benefit / Cost Ratio (BCR).

PI = Present value of Future cash Inflows

Initial Cash Outlay

Decision Rule: - In Case of Independent Investments, ACCEPT a Project If a PI is

greater ( > 1 ) and Reject it otherwise.

In Case of Alternative Investments, ACCEPT the project with the

largest PI, provided it is greater than ( > 1 ) and Reject others.

Pros: - a) It is conceptually sound.

b) It considers time value of money.

c) It Facilitates ranking of projects which help in the selection of projects.

Cons: - a) It is vulnerable to different interpretations.

b) Its computation Process is complex.

For Example: - In Case of Above Illustration: -

Here PI = Present Value of Cash Inflows

Present Value of cash Outflows

= 24227

20000

PI = 1.21

Here, The PI is greater than ONE ( > 1 ), so the project is accepted.

I RR (I nternal Rate of Return) Method: -

This method is known by various other names like Yield on Investment or Rate of

Return Method. It is used when the cost of investment and the annual cash inflows

are known and rate of return is to be calculated. It takes into account time value of

Money by discounting inflows and cash flows. This is the Most alternative to NPV.

It is the Discount rate that makes it NPV equal to zero.

In this Method, the IRR can be ascertained by the Trial & Error Yield Method,

Whose the objective is to find out the expected yield from the investment.

= Smaller discount rate + NPV @ Smaller rate

Sum of the absolute values of the

NPV @ smaller and the bigger

Discount rates

Bigger Smaller

X discount discount

rate rate

Decision Rule: - In the Case of an Independent Investment, ACCEPT the project if

Its IRR is greater than the required rate of return and if it is

lower, Then Reject it. In Case of Mutually Exclusive Projects,

ACCEPT the project with the largest IRR, provided it is greater

than the required rate of return & Reject others.

Pros: - a) It considers the profitability of the project for its entire economic life and

hence enables evaluation of true profitability.

b) It recognizes the time value of money and considers cash flows over

entire life of the project.

c) It provides for uniform ranking of various proposals due to the

percentage rate of return.

d) It has a psychological appeal to the user. Since values are expressed in

percentages.

Cons: - a) It is most difficult method of evaluation of investment proposals.

b) It is based upon the assumption that the earnings are reinvested at the

Internal Rate of Return for the remaining life of the project.

c) It may result in Incorrect decisions in comparing the Mutually Exclusive

Projects.

NPV Vs I RR

It is calculated in terms of

currency.

It recognizes the importance of

market rate of interest or cost of

capital.

The PV is determined by

discounting the future cash flows

of a project at a predetermined

rate called cut off rate based on

cost of capital.

In this, intermediate cash flows

are reinvested at a cutoff rate.

Project is accepted, If NPV is + ve

It is expresses in terms of the

percentage return.

It does not consider the market

rate of interest.

The PV of cash flow are

discounted at a suitable rate by hit

& trial method which equates the

present value so calculated the

amount of investment.

In this, intermediate cash inflows

are presumed to be reinvested at

the internal rate of return.

Project is accepted, if r > k.

Das könnte Ihnen auch gefallen

- Project Appraisal TechniquesDokument31 SeitenProject Appraisal TechniquesRajeevAgrawal86% (7)

- Unit 5 - Social Cost Benefit AnalysisDokument24 SeitenUnit 5 - Social Cost Benefit Analysislamao123Noch keine Bewertungen

- Project Appraisal: Meaning and Definition Various Aspects of Project AppraisalDokument9 SeitenProject Appraisal: Meaning and Definition Various Aspects of Project Appraisalynkamat83% (6)

- Social Cost Benefit AnalysisDokument67 SeitenSocial Cost Benefit Analysisitsmeha100% (1)

- Project Identification and SelectionDokument8 SeitenProject Identification and SelectionSathish Jayakumar50% (6)

- Project IdentificationDokument6 SeitenProject Identificationynkamat85% (13)

- Gondar Planning ModuleDokument114 SeitenGondar Planning ModuleMeseret AdisieNoch keine Bewertungen

- Project Identification and SelectionDokument11 SeitenProject Identification and SelectionSivasubramanian JayaramanNoch keine Bewertungen

- Project Appraisal Question and AnswersDokument6 SeitenProject Appraisal Question and AnswersRod Dumala Garcia100% (3)

- Project Identification and FormulationDokument112 SeitenProject Identification and FormulationAnonymous kwi5IqtWJ67% (18)

- Project AppraisalDokument4 SeitenProject AppraisalRajinder Kaur67% (3)

- Project IdentificationDokument17 SeitenProject Identificationmishratrilok100% (1)

- Project AppraisalDokument15 SeitenProject AppraisalTesfanesh Ethiopia100% (1)

- PROJECT MANAGEMENT - Anant Dhuri PDFDokument67 SeitenPROJECT MANAGEMENT - Anant Dhuri PDFAnant Dhuri88% (17)

- Chapter 2 - Project Life Cycle-2Dokument37 SeitenChapter 2 - Project Life Cycle-2Yabe Mohammed100% (1)

- Chapter Four (4) 4. Planning in Practice: Experiences From Ethiopian and Other Countries 4.1Dokument6 SeitenChapter Four (4) 4. Planning in Practice: Experiences From Ethiopian and Other Countries 4.1Mohammed Abdu100% (2)

- Project Technical AnalysisDokument111 SeitenProject Technical AnalysisalemayehuNoch keine Bewertungen

- Approaches To Economic Analysis of ProjectsDokument25 SeitenApproaches To Economic Analysis of ProjectsRodrick WilbroadNoch keine Bewertungen

- Chapter 3 Project Identification and Feasibility-1Dokument82 SeitenChapter 3 Project Identification and Feasibility-1Yabe Mohammed100% (1)

- Pre Requisites For Project ImplementationDokument3 SeitenPre Requisites For Project ImplementationTage NobinNoch keine Bewertungen

- Project Identification and Selection 1Dokument25 SeitenProject Identification and Selection 1Sahilu100% (7)

- Project AppraisalDokument19 SeitenProject AppraisalSagar Parab100% (2)

- Chapter 4 Project Preparation and Analysis - 2Dokument54 SeitenChapter 4 Project Preparation and Analysis - 2Aida Mohammed100% (1)

- Project FormulationDokument28 SeitenProject FormulationSwarnalata DashNoch keine Bewertungen

- CH 7 Project FinancingDokument37 SeitenCH 7 Project Financingyimer0% (1)

- Multiple Choice QuestionsDokument6 SeitenMultiple Choice QuestionsMani Chawla50% (2)

- Unit II-Project Identification, Selection, PlanningDokument76 SeitenUnit II-Project Identification, Selection, PlanningRohit GhulanavarNoch keine Bewertungen

- Social Cost Benefit Analysis - PPT 2009Dokument47 SeitenSocial Cost Benefit Analysis - PPT 2009Rahul Jain100% (2)

- ELPDokument44 SeitenELPRaghupathi Venkata SujathaNoch keine Bewertungen

- Social and Cost Benefit Analysis: Unido and LM ApproachDokument40 SeitenSocial and Cost Benefit Analysis: Unido and LM Approachricha_yaduvanshi100% (14)

- Budgetary Control PracticesDokument53 SeitenBudgetary Control PracticesPhaniraj Lenkalapally100% (5)

- Chapter 2 - Project Life CycleDokument36 SeitenChapter 2 - Project Life Cyclehailegebrael100% (1)

- Appraising A Project by Discounting and Non-Discounting CriteriaDokument55 SeitenAppraising A Project by Discounting and Non-Discounting CriteriaVaidyanathan Ravichandran100% (5)

- Types of AuditDokument11 SeitenTypes of Auditbhaveshjaiin100% (2)

- Question Bank For The Final ExamDokument2 SeitenQuestion Bank For The Final ExamRaktim100% (1)

- Unit 1: What Is The Nature and Scope of Project Management?Dokument24 SeitenUnit 1: What Is The Nature and Scope of Project Management?Rahul kumarNoch keine Bewertungen

- 5 Methods of Project AppraisalDokument7 Seiten5 Methods of Project AppraisalAlyanna Hipe - Esponilla100% (1)

- Development Planning and Project Analysis II: ECON-3212Dokument49 SeitenDevelopment Planning and Project Analysis II: ECON-3212Aytenew AbebeNoch keine Bewertungen

- Project Identification and Feasibility Study-DetailedDokument53 SeitenProject Identification and Feasibility Study-DetailedSarkar GattimNoch keine Bewertungen

- The Effect of Working Capital Management On The Manufacturing Firms' ProfitabilityDokument20 SeitenThe Effect of Working Capital Management On The Manufacturing Firms' ProfitabilityAbdii DhufeeraNoch keine Bewertungen

- Course Title SeminarDokument4 SeitenCourse Title Seminartemedebere100% (1)

- Basic Similarity and Different Between BAUMDokument3 SeitenBasic Similarity and Different Between BAUMSAMUEL DEBEBE100% (9)

- Presentation On Strategy Control and Operational ControlDokument35 SeitenPresentation On Strategy Control and Operational ControlShreya VermaNoch keine Bewertungen

- Project AppraisalDokument16 SeitenProject AppraisalSigei LeonardNoch keine Bewertungen

- Economics Project WorkDokument63 SeitenEconomics Project WorkMehanshNoch keine Bewertungen

- Final Exam Project PlanningDokument4 SeitenFinal Exam Project Planningarchie tNoch keine Bewertungen

- UNIDO Approach Of: Social Cost Benefit AnalysisDokument80 SeitenUNIDO Approach Of: Social Cost Benefit AnalysisRoshni Patro100% (3)

- Financial Feasibility of Your Tourism BusinessDokument11 SeitenFinancial Feasibility of Your Tourism BusinessSimina AvrigeanNoch keine Bewertungen

- Project ReportDokument19 SeitenProject Reportsuperkings23149091% (34)

- Types of Project TerminationDokument17 SeitenTypes of Project TerminationLokam80% (10)

- Financial Management: A Project On Capital BudgetingDokument20 SeitenFinancial Management: A Project On Capital BudgetingHimanshi SethNoch keine Bewertungen

- DCF N Non DCFDokument36 SeitenDCF N Non DCFNikita PorwalNoch keine Bewertungen

- ShaliniDokument27 SeitenShaliniSumit KumarNoch keine Bewertungen

- Capital Budgeting Analysis: CA. Sonali Jagath PrasadDokument63 SeitenCapital Budgeting Analysis: CA. Sonali Jagath PrasadSonali JagathNoch keine Bewertungen

- Capital Budgetting DecisionsDokument22 SeitenCapital Budgetting Decisionshassan mohammedNoch keine Bewertungen

- Capital BudgetingDokument30 SeitenCapital BudgetinganupsuchakNoch keine Bewertungen

- DR - Naushad Alam: Capital BudgetingDokument38 SeitenDR - Naushad Alam: Capital BudgetingUrvashi SinghNoch keine Bewertungen

- Capital Budgeting and Cash FlowsDokument49 SeitenCapital Budgeting and Cash FlowsArun S BharadwajNoch keine Bewertungen

- Capital Budgeting Presentation Part 1Dokument38 SeitenCapital Budgeting Presentation Part 1eiaNoch keine Bewertungen

- Indranil Paul - 092 - Capital BudgetngDokument13 SeitenIndranil Paul - 092 - Capital BudgetngIndranil PaulNoch keine Bewertungen

- Always Keep SmilingDokument1 SeiteAlways Keep SmilingGayatri SharmaNoch keine Bewertungen

- MMDokument16 SeitenMMGayatri SharmaNoch keine Bewertungen

- Use Cases For Example ATM SystemDokument54 SeitenUse Cases For Example ATM SystemGayatri SharmaNoch keine Bewertungen

- Multimedia 1-8-2011Dokument1 SeiteMultimedia 1-8-2011Gayatri SharmaNoch keine Bewertungen

- Techniques For Avoiding Risk ManagementDokument11 SeitenTechniques For Avoiding Risk ManagementGayatri SharmaNoch keine Bewertungen

- Techniques For Avoiding Risk ManagementDokument11 SeitenTechniques For Avoiding Risk ManagementGayatri SharmaNoch keine Bewertungen

- Module 5 Course Matterial Ipcomp Monopolies and Restrictive Trade Practices Act (MRTP)Dokument18 SeitenModule 5 Course Matterial Ipcomp Monopolies and Restrictive Trade Practices Act (MRTP)Ankush JadaunNoch keine Bewertungen

- Sample HSE PolicyDokument1 SeiteSample HSE Policykoo langot67% (3)

- AMFI Questionnaire For Due DiligenceDokument7 SeitenAMFI Questionnaire For Due DiligenceHarish Ruparel100% (2)

- Warsh (2007) 387 Knowledge & Wealth of NationsDokument381 SeitenWarsh (2007) 387 Knowledge & Wealth of NationsFazal RahmanNoch keine Bewertungen

- Tom Brass Unfree Labour As Primitive AcumulationDokument16 SeitenTom Brass Unfree Labour As Primitive AcumulationMauro FazziniNoch keine Bewertungen

- Name: Mrunmayee Mirlekar Roll No: 3812 Div: C Paper: Microeconomics Paper Code: RUAECO501 Topic: Game Theory Analysis of US-China Trade WarDokument17 SeitenName: Mrunmayee Mirlekar Roll No: 3812 Div: C Paper: Microeconomics Paper Code: RUAECO501 Topic: Game Theory Analysis of US-China Trade WarMrunmayee MirlekarNoch keine Bewertungen

- 10 Pitfalls March 2015 PDFDokument1 Seite10 Pitfalls March 2015 PDFShahid AkramNoch keine Bewertungen

- Cameo Sports Agencies Pvt. LTDDokument4 SeitenCameo Sports Agencies Pvt. LTDBhupender TakshakNoch keine Bewertungen

- Labor Cost Per Bell Will Be Rs. 1 Variable Overheads 100% of Labor CostDokument3 SeitenLabor Cost Per Bell Will Be Rs. 1 Variable Overheads 100% of Labor CostanushkaNoch keine Bewertungen

- Standard Costing 1.1Dokument3 SeitenStandard Costing 1.1Lhorene Hope DueñasNoch keine Bewertungen

- CBU2202200910 Customer Relationship ManangementDokument2 SeitenCBU2202200910 Customer Relationship ManangementSimbarashe MaringosiNoch keine Bewertungen

- Investment Analyst CV TemplateDokument3 SeitenInvestment Analyst CV TemplatenisteelroyNoch keine Bewertungen

- Final TOR Medical Consultants-RD CellDokument4 SeitenFinal TOR Medical Consultants-RD Cellrohit gargNoch keine Bewertungen

- Bank MaterialDokument30 SeitenBank Materialgaffar87mcaNoch keine Bewertungen

- HFS HOT Vendors Hfs Hot Vendors Compendium 2018 2021 RS 2106 v1.0FINALDokument211 SeitenHFS HOT Vendors Hfs Hot Vendors Compendium 2018 2021 RS 2106 v1.0FINALVidhya Charan PNoch keine Bewertungen

- Usa Policy y GlobalizationDokument11 SeitenUsa Policy y GlobalizationmayuNoch keine Bewertungen

- Case 03 02 Frito LayDokument16 SeitenCase 03 02 Frito LayGunjan ShethNoch keine Bewertungen

- What Is Talent ManagementDokument8 SeitenWhat Is Talent ManagementarturoceledonNoch keine Bewertungen

- How Construction Technology Is Reshaping The Construction IndustryDokument17 SeitenHow Construction Technology Is Reshaping The Construction IndustryAlex ResearchersNoch keine Bewertungen

- Urban-Transport PDFDokument116 SeitenUrban-Transport PDFM .U.KNoch keine Bewertungen

- Enquiries and Offers Seminar 03Dokument17 SeitenEnquiries and Offers Seminar 03lenkaNoch keine Bewertungen

- Receiptsreceipts 04032011 25203Dokument1 SeiteReceiptsreceipts 04032011 25203Deepak KumarNoch keine Bewertungen

- Development AdministrationDokument3 SeitenDevelopment AdministrationJean Aspiras WongNoch keine Bewertungen

- HRM-Mountain Lodge Case StudyDokument15 SeitenHRM-Mountain Lodge Case StudyMadhur Mehta100% (1)

- Motorcycle To Car Ownership The Role of Road Mobility Accessibility and Income InequalityDokument8 SeitenMotorcycle To Car Ownership The Role of Road Mobility Accessibility and Income Inequalitymèo blinksNoch keine Bewertungen

- Impact of Dividend PolicyDokument12 SeitenImpact of Dividend PolicyGarimaNoch keine Bewertungen

- Who Is An Entrepreneur? Distinguish Between Owner Manager and EntrepreneurDokument7 SeitenWho Is An Entrepreneur? Distinguish Between Owner Manager and EntrepreneurShyme FritsNoch keine Bewertungen

- Jack Guttman Vs Warren Diamond John Delmonaco, Jacob FrydmanDokument129 SeitenJack Guttman Vs Warren Diamond John Delmonaco, Jacob FrydmanJayNoch keine Bewertungen

- ACCG200 SolutionCh 04 PDFDokument32 SeitenACCG200 SolutionCh 04 PDFlethiphuongdanNoch keine Bewertungen

- Topic 2 - Ias 16Dokument46 SeitenTopic 2 - Ias 16jpatrickNoch keine Bewertungen