Beruflich Dokumente

Kultur Dokumente

Breakeven

Hochgeladen von

subhaniaqheelCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Breakeven

Hochgeladen von

subhaniaqheelCopyright:

Verfügbare Formate

http://www.bized.co.

uk

Copyright 2006 Biz/ed

Costs and Budgeting

http://www.bized.co.uk

Copyright 2006 Biz/ed

Costs and Budgeting

http://www.bized.co.uk

Copyright 2006 Biz/ed

Costs

http://www.bized.co.uk

Copyright 2006 Biz/ed

Costs

Anything incurred during the production

of the good or service to get the output

into the hands of the customer

The customer could be the public (the

final consumer) or another business

Controlling costs is essential to business

success

Not always easy to pin down

where costs are arising!

http://www.bized.co.uk

Copyright 2006 Biz/ed

Cost Centres

http://www.bized.co.uk

Copyright 2006 Biz/ed

Cost Centres

Parts of the business to which particular

costs can be attributed

In large businesses this can be

a particular location, section

of the business, capital asset

or human resource/s

Enable a business to identify where

costs are arising and to manage those

costs more effectively

http://www.bized.co.uk

Copyright 2006 Biz/ed

Full Costing

A method of allocating indirect costs to

a range of products produced by the

firm.

e.g. if a firm produces three products - a,

b, and c - and has indirect costs of 1

million, assume proportion of direct costs of

20% for a, 55% for b and 25% for c

Indirect costs allocated as 20% of 1 million

to a, 55% of 1 million to b and 25% of 1

million to c

http://www.bized.co.uk

Copyright 2006 Biz/ed

Absorption Costing

All costs incurred are allocated

to particular cost centres direct

costs, indirect costs, semi variable

costs and selling costs

Allocates indirect costs more

accurately to the point where

the cost occurred

http://www.bized.co.uk

Copyright 2006 Biz/ed

Marginal Costing

The cost of producing one extra

unit of output (the variable costs)

Selling price MC = Contribution

Contribution is the amount which

can contribute to the overheads

(fixed costs)

http://www.bized.co.uk

Copyright 2006 Biz/ed

Standard Costing

The expected level of costs

associated with the production

of a good/service

Actual costs Standard costs =

Variance

Monitoring variances can help

the business to identify

where inefficiencies or efficiencies

might lie

http://www.bized.co.uk

Copyright 2006 Biz/ed

Total Revenue

http://www.bized.co.uk

Copyright 2006 Biz/ed

Total Revenue

Total Revenue = Price x Quantity Sold

Price can be raised or lowered

to change revenue price elasticity

of demand important here

Different pricing strategies can be used

penetration, psychological, etc.

Quantity Sold can be influenced

by amending the elements

of the marketing mix 7 Ps

http://www.bized.co.uk

Copyright 2006 Biz/ed

Break Even

http://www.bized.co.uk

Copyright 2006 Biz/ed

Break Even Analysis

Costs/Revenue

Output/Sales

Initially a firm

will incur fixed

costs, these

do not depend

on output or

sales.

FC

As output is

generated, the

firm will incur

variable costs

these vary

directly with the

amount

produced.

VC

The total costs

therefore

(assuming

accurate

forecasts!) is the

sum of FC+VC

TC

Total revenue is

determined by

the price charged

and the quantity

sold again this

will be

determined by

expected

forecast sales

initially.

TR The lower the

price, the less

steep the total

revenue curve.

TR

Q1

The break even

point occurs where

total revenue

equals total costs

the firm, in this

example, would

have to sell Q1 to

generate sufficient

revenue to cover its

costs.

http://www.bized.co.uk

Copyright 2006 Biz/ed

Break Even Analysis

Costs/Revenue

Output/Sales

FC

VC

TC

TR (p = 2)

Q1

If the firm

chose to set

price higher

than 2 (say

3) the TR

curve would

be steeper

they would not

have to sell as

many units to

break even

TR (p = 3)

Q2

http://www.bized.co.uk

Copyright 2006 Biz/ed

Break Even Analysis

Costs/Revenue

Output/Sales

FC

VC

TC

TR (p = 2)

Q1

If the firm

chose to set

prices lower

(say 1) it

would need to

sell more units

before

covering its

costs.

TR (p = 1)

Q3

http://www.bized.co.uk

Copyright 2006 Biz/ed

Break Even Analysis

Costs/Revenue

Output/Sales

FC

VC

TC

TR (p = 2)

Q1

Loss

Profit

http://www.bized.co.uk

Copyright 2006 Biz/ed

Break Even Analysis

Costs/Revenue

Output/Sales

FC

VC

TC

TR (p = 2)

Q1 Q2

Assume

current sales

at Q2.

Margin of Safety

Margin of

safety shows

how far sales

can fall before

losses made. If

Q1 = 1000 and

Q2 = 1800,

sales could fall

by 800 units

before a loss

would be

made.

TR (p = 3)

Q3

A higher price

would lower the

break even

point and the

margin of safety

would widen.

http://www.bized.co.uk

Copyright 2006 Biz/ed

Costs/Revenue

Output/Sales

FC

VC

TR

Eurotunnels problem

High initial FC.

Interest on debt

rises each year FC

rise therefore.

FC 1

Losses get bigger!

http://www.bized.co.uk

Copyright 2006 Biz/ed

Break Even Analysis

Remember:

A higher price or lower price does not

mean that break even will never be

reached!

The break even point depends on the

number of sales needed to generate

revenue to cover costs the break even

chart is NOT time related!

http://www.bized.co.uk

Copyright 2006 Biz/ed

Break Even Analysis

Importance of Price Elasticity

of Demand:

Higher prices might mean fewer sales

to break even but those sales may take

a longer time to achieve

Lower prices might encourage more

customers but higher volume needed

before sufficient revenue generated

to break even

http://www.bized.co.uk

Copyright 2006 Biz/ed

Break Even Analysis

Links of break even to pricing

strategies and elasticity

Penetration pricing high volume,

low price more sales to break even

Market Skimming high price low

volumes fewer sales to break even

Elasticity what is likely to happen

to sales when prices are increased

or decreased?

http://www.bized.co.uk

Copyright 2006 Biz/ed

Budgets

http://www.bized.co.uk

Copyright 2006 Biz/ed

Budgets

Estimates of the income and

expenditure of a business or a part

of a business over a time period

Used extensively in planning

Helps establish efficient use

of resources

Help monitor cash flow and identify

departures from plans

Maintains a focus and discipline

for those involved

http://www.bized.co.uk

Copyright 2006 Biz/ed

Budgets

Flexible Budgets budgets that take

account of changing business conditions

Operating Budgets based on

the daily operations of a business

Objectives Based Budgets - Budgets

driven by objectives set by the firm

Capital Budgets Plans of the

relationship between capital spending

and liquidity (cash) in the business

http://www.bized.co.uk

Copyright 2006 Biz/ed

Budgets

Variance the difference between

planned values and actual values

Positive variance actual figures

less than planned

Negative variance actual figures

above planned

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Kareen Leon, Cpa Page No: - 1 - General JournalDokument4 SeitenKareen Leon, Cpa Page No: - 1 - General JournalTayaban Van Gih100% (2)

- VETASSESS ChecklistDokument2 SeitenVETASSESS ChecklistsubhaniaqheelNoch keine Bewertungen

- Marginal CostingDokument17 SeitenMarginal CostingsubhaniaqheelNoch keine Bewertungen

- Accounting For ReceivablesDokument4 SeitenAccounting For ReceivablesMega Pop Locker50% (2)

- Toa Consolidated Sample QuestionsDokument60 SeitenToa Consolidated Sample QuestionsBabi Dimaano NavarezNoch keine Bewertungen

- The Logical Trader Applying A Method To The Madness PDFDokument137 SeitenThe Logical Trader Applying A Method To The Madness PDFJose GuzmanNoch keine Bewertungen

- Flow ChartDokument3 SeitenFlow Chartnitin235Noch keine Bewertungen

- Invoice for USB HeadphonesDokument2 SeitenInvoice for USB Headphonessubhaniaqheel100% (1)

- Program or Project AdministratorDokument1 SeiteProgram or Project AdministratorsubhaniaqheelNoch keine Bewertungen

- Employment History 1: Name: E-Mail ID: Mobile No: Current Residence AddressDokument3 SeitenEmployment History 1: Name: E-Mail ID: Mobile No: Current Residence AddresssubhaniaqheelNoch keine Bewertungen

- IELTS WritingDokument2 SeitenIELTS WritingsubhaniaqheelNoch keine Bewertungen

- Flow ChartDokument3 SeitenFlow Chartnitin235Noch keine Bewertungen

- Listening Sample Task - Form CompletionDokument4 SeitenListening Sample Task - Form CompletionTrần Đăng Khoa100% (1)

- Click To Edit Master Title StyleDokument4 SeitenClick To Edit Master Title StylesubhaniaqheelNoch keine Bewertungen

- Presentation IELTSDokument5 SeitenPresentation IELTSsubhaniaqheelNoch keine Bewertungen

- IELTS WritingDokument2 SeitenIELTS WritingsubhaniaqheelNoch keine Bewertungen

- PHD Brochure Part TimeDokument2 SeitenPHD Brochure Part TimesubhaniaqheelNoch keine Bewertungen

- Maintenance Planning Chapters 5& 6Dokument39 SeitenMaintenance Planning Chapters 5& 6Pawan Kumar Singh100% (1)

- Boc RequirementsDokument2 SeitenBoc RequirementssubhaniaqheelNoch keine Bewertungen

- JobDokument1 SeiteJobsubhaniaqheelNoch keine Bewertungen

- Covering LetterDokument1 SeiteCovering LettersubhaniaqheelNoch keine Bewertungen

- Upsc 1Dokument1 SeiteUpsc 1subhaniaqheelNoch keine Bewertungen

- Natural Gas ProcessingDokument7 SeitenNatural Gas ProcessingEl Ehsan Abinya FatihNoch keine Bewertungen

- Natural Gas ProcessingDokument7 SeitenNatural Gas ProcessingEl Ehsan Abinya FatihNoch keine Bewertungen

- BaDokument5 SeitenBasaikrishnacafeNoch keine Bewertungen

- Major Assignment #3Dokument17 SeitenMajor Assignment #3Elijah GeniesseNoch keine Bewertungen

- Cashback Redemption FormDokument1 SeiteCashback Redemption FormPapuKaliyaNoch keine Bewertungen

- Square To Launch Baby Diapers To Meet Growing DemandDokument2 SeitenSquare To Launch Baby Diapers To Meet Growing DemandSa'ad Abd Ar RafieNoch keine Bewertungen

- Palais Royal Vol-4 PDFDokument100 SeitenPalais Royal Vol-4 PDFrahul kakapuriNoch keine Bewertungen

- GST India IntroductionDokument274 SeitenGST India IntroductionChandana RajasriNoch keine Bewertungen

- 2 Comm. Management DOC FH 2019 1 PDFDokument5 Seiten2 Comm. Management DOC FH 2019 1 PDFSaudNoch keine Bewertungen

- DeudaPublica BalanzaPagosDokument21 SeitenDeudaPublica BalanzaPagosMartin VallejosNoch keine Bewertungen

- Thesis Writing FinalDokument34 SeitenThesis Writing FinalFriends Law ChamberNoch keine Bewertungen

- Analyze datesDokument31 SeitenAnalyze datesHussain AminNoch keine Bewertungen

- Understanding Credit Agreement Basics: Deals & FacilitiesDokument36 SeitenUnderstanding Credit Agreement Basics: Deals & FacilitiesJonathan RandallNoch keine Bewertungen

- Finance ProblemsDokument5 SeitenFinance Problemsstannis69420Noch keine Bewertungen

- SS 2 SlidesDokument31 SeitenSS 2 SlidesDart BaneNoch keine Bewertungen

- National Open University of Nigeria: Prepared byDokument17 SeitenNational Open University of Nigeria: Prepared byMAVERICK MONROENoch keine Bewertungen

- Comparison of Equity Mutual FundsDokument29 SeitenComparison of Equity Mutual Fundsabhishekbehal5012Noch keine Bewertungen

- Project Report Goods and Service Tax in IndiaDokument6 SeitenProject Report Goods and Service Tax in IndiaAmit AgiwalNoch keine Bewertungen

- Reauthorization of The National Flood Insurance ProgramDokument137 SeitenReauthorization of The National Flood Insurance ProgramScribd Government DocsNoch keine Bewertungen

- Aavas FinanciersDokument8 SeitenAavas FinanciersSirish GopalanNoch keine Bewertungen

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper2Dokument5 SeitenAlagappa University DDE BBM First Year Financial Accounting Exam - Paper2mansoorbariNoch keine Bewertungen

- Global Transition of HR Practices During COVID-19Dokument5 SeitenGlobal Transition of HR Practices During COVID-19Md. Saifullah TariqueNoch keine Bewertungen

- International Finance "Report On The Case Study of Prul"Dokument7 SeitenInternational Finance "Report On The Case Study of Prul"Saima Kausar100% (1)

- Taurian Curriculum Framework Grade 11 BSTDokument6 SeitenTaurian Curriculum Framework Grade 11 BSTDeepak SharmaNoch keine Bewertungen

- Strategic Plan of Indian Tobacco Company (ItcDokument27 SeitenStrategic Plan of Indian Tobacco Company (ItcJennifer Smith100% (1)

- Spring 2006Dokument40 SeitenSpring 2006ed bookerNoch keine Bewertungen

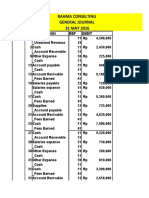

- Rahma ConsutingDokument6 SeitenRahma ConsutingEko Firdausta TariganNoch keine Bewertungen

- Maximizing Advantages of China JV for HCFDokument10 SeitenMaximizing Advantages of China JV for HCFLing PeNnyNoch keine Bewertungen

- Vip No.8 - MeslDokument4 SeitenVip No.8 - Meslkj gandaNoch keine Bewertungen