Beruflich Dokumente

Kultur Dokumente

BEFN Presentation

Hochgeladen von

amritns0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

51 Ansichten11 SeitenApplying Behavioral Finance to Capital Budgeting

Project Terminations

Termination decisions are difficult even when they are wise

The paper explores why managers become entrapped into negative NPV projects and throw good money after bad projects as they attempt to rescue them. The paper first unravels a tendency to become entrapped and resist project terminations.

The second part of the paper describes structures, such as organizational hierarchies and hostile takeovers, that are designed to overcome resistance to project terminations

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenApplying Behavioral Finance to Capital Budgeting

Project Terminations

Termination decisions are difficult even when they are wise

The paper explores why managers become entrapped into negative NPV projects and throw good money after bad projects as they attempt to rescue them. The paper first unravels a tendency to become entrapped and resist project terminations.

The second part of the paper describes structures, such as organizational hierarchies and hostile takeovers, that are designed to overcome resistance to project terminations

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

51 Ansichten11 SeitenBEFN Presentation

Hochgeladen von

amritnsApplying Behavioral Finance to Capital Budgeting

Project Terminations

Termination decisions are difficult even when they are wise

The paper explores why managers become entrapped into negative NPV projects and throw good money after bad projects as they attempt to rescue them. The paper first unravels a tendency to become entrapped and resist project terminations.

The second part of the paper describes structures, such as organizational hierarchies and hostile takeovers, that are designed to overcome resistance to project terminations

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 11

Behavioral Finance Indian School of Business

Applying Behavioral Finance to Capital Budgeting

Project Terminations

- Meir Statman and David Caldwell

Presentation Overview

Behavioral Finance Indian School of Business

1.) Abstract of the paper

2.) How people make decisions: Some basic behavioral insights

3.) Application of Insights- Project Termination Decisions

4.) Some examples and applications from the context of Behavioral Finance

5.) Conclusions

Abstract

Central Rule of capital budgeting prescribes :

Investment projects should be selected, continued or terminated based on NPV

Sunk costs should be ignored

Projects should be terminated when

E(cash flows)

project terminated today

> E(cash flows)

project continued for one additional period

Termination decisions are difficult even when they are wise

The paper explores why managers become entrapped into negative NPV projects and

throw good money after bad projects as they attempt to rescue them. The paper first

unravels a tendency to become entrapped and resist project terminations.

The second part of the paper describes structures, such as organizational hierarchies

and hostile takeovers, that are designed to overcome resistance to project

terminations

Behavioral Finance Indian School of Business

Insights: Behavioral Finance

Prospect Theory: Framing mental accounts and evaluating them

A person is involved in a business venture in which he has already lost $2,000. Now he faces a

choice between a sure gain of $1000 and an even chance to win $2,000 or nothing. What will he

choose?

Economic accounting Vs. Mental Accounting-Ignore Vs. Consider Sunk Cost

Economic accounting-$2,000 sunk cost be ignored and project be abandoned

Mental Accounting-The choice of closing the account with a sure loss of $1,000 is discarded

over the choice of closing the account with a loss of $2,000 or a loss of $0

Kahneman and Tversky argue that people display risk-seeking behavior when faced with a

choice between a sure loss and a gamble

Behavioral Finance Indian School of Business

Aversion to Regret

According to Kahneman, Tversky and Thaler people are reluctant to realize losses because

realization induces regret

Insights: Behavioral Finance

Regret

Availability of

choices

Reluctance to

violate standard

procedure

Reluctance to act

innovatively

Responsibility of

the final outcome

Behavioral Finance Indian School of Business

Behavioral Finance Indian School of Business

Insights: Behavioral Finance

Self Control Problem

Realization of loss Regret

Procrastination

Postpone the pain

Continue negative

NPV project

An intrapersonal agency conflict between a rational

forward looking principal and an emotional myopic agent

Link between personal responsibility for the initial

decision and the reluctance to realize losses in the later

stages

Behavioral Finance: Project Termination Decisions

Why Wasteful Commitment

Behavioral Finance Indian School of Business

Wasteful

Commitment

Temptations to rescue

the project

Sunk Cost: Counter

intuitive

Admire people who

persist

High rewards-success

High penalty-failure

Two faces of commitment

1.) Motivating face-Leads to accomplishing goals that seem impossibly remote

2.) Wasteful face- Leads to throwing good money after bad money

Behavioral Finance Indian School of Business

Project Termination Decisions

What can be done for better project termination decisions in firms

Formulation of projects-Economic Accounting (+ NPV)

Continuation contingent on periodic NPV comparison

Iron clad internal enforced rules to realize losses

Rules

Performed by the finance function

Absence of commitment to the project

Exposing rosy projections made by project champions

Enforcing Pre-commitment milestones

Anti Champions

Not Part of the main decision making process

Consultants-possess the objectivity and are not entrapped

Takeovers- A way to terminate losing strategies

Work out units

(Internal & External)

Incentivize accurate information for periodic audit

Reward people who disclose bad news early

Avoid acute penalties as they entrap project champions

Frame losses as gains (to avoid alienation of the manager)

Rewards & penalties

Concorde effect-British and French governments decision to

continue funding the joint development despite poor sales

Political implications and publicly admitting that all past expenses

on the project prevented either government from abandoning

the project.

Behavioral Finance Indian School of Business

Project Termination Decisions-Some examples

Shugart Company-Leader in disk drives

Started the project in 1980

Project abandoned in 1983 after severe time and cost overruns

Keeping the project going was a way to placate the people by

giving them more time to make it come out right and not admit

defeat-

Lockheed Martin: Started working on Tri-Star L1011

Program Terminated in 1981-Would have bankrupted the

company if not for a federal government bailout

Stock prices increased by 18% on the day of the termination

announcement

Conclusions

Behavioral Finance Indian School of Business

Key Insights

Mental Accounting takes sunk cost into consideration and hence project termination

becomes difficult

Availability of choice, individual responsibility accentuate the feeling of regret

High personal responsibility, high insecurity and high resistance to a decision lead to

increased commitment to previously chosen decisions

Consistent rather than experimental behavior is considered socially desirable

Procrastination: People tend to delay termination because of the fear of loss

realization

Periodic reviews, project audits by finance people, internal rules, pre-commitment,

alignment of rewards and penalties fear of take overs are used as tools for project

termination

Thank You

Behavioral Finance Indian School of Business

Group Members:

Akshun Gulati-61210522

Sidharth Gambhir-61210600

Shruti Singh-61210377

Amrit Singh-61210554

Das könnte Ihnen auch gefallen

- Interview Question - What Are Your Strengths and Weaknesses?Dokument1 SeiteInterview Question - What Are Your Strengths and Weaknesses?MinZartar100% (2)

- Potential Agency ProblemsDokument16 SeitenPotential Agency ProblemslimsterryNoch keine Bewertungen

- Project Finance: Aditya Agarwal Sandeep KaulDokument96 SeitenProject Finance: Aditya Agarwal Sandeep Kaulsguha123Noch keine Bewertungen

- Policy Ccs Implementation Presentations 20230330 enDokument152 SeitenPolicy Ccs Implementation Presentations 20230330 enav1986362Noch keine Bewertungen

- ESG ManagementDokument4 SeitenESG ManagementSarah ShaikhNoch keine Bewertungen

- Week 12 Risk ManagementDokument29 SeitenWeek 12 Risk ManagementRay Mund100% (1)

- Note On Financial Ratio AnalysisDokument9 SeitenNote On Financial Ratio Analysisabhilash831989Noch keine Bewertungen

- Risk Assessment: - By: Dedy Syamsuar, PHDDokument29 SeitenRisk Assessment: - By: Dedy Syamsuar, PHDIstiarso BudiyuwonoNoch keine Bewertungen

- LeadershipDokument60 SeitenLeadershipChhurliana100% (1)

- Gambling on Green: Uncovering the Balance among Revenues, Reputations, and ESG (Environmental, Social, and Governance)Von EverandGambling on Green: Uncovering the Balance among Revenues, Reputations, and ESG (Environmental, Social, and Governance)Noch keine Bewertungen

- Climate and ComplianceDokument12 SeitenClimate and ComplianceMouna messaoudiNoch keine Bewertungen

- Chapter 9 Project Cash FlowsDokument28 SeitenChapter 9 Project Cash FlowsGovinda AgrawalNoch keine Bewertungen

- Presented By:-Pankaj Smit Ojas Sayali Ishaan Dattaji Ashutosh Omkar MaheshDokument11 SeitenPresented By:-Pankaj Smit Ojas Sayali Ishaan Dattaji Ashutosh Omkar MaheshOjas LeoNoch keine Bewertungen

- Free Cash FlowDokument31 SeitenFree Cash FlowKaranvir GuptaNoch keine Bewertungen

- WhitePaper - Universal Competency FrameworkDokument11 SeitenWhitePaper - Universal Competency FrameworkTristia100% (1)

- Management: Stephen P. Robbins Mary CoulterDokument27 SeitenManagement: Stephen P. Robbins Mary CoulterBhunesh KumarNoch keine Bewertungen

- Upside of Irrationality SummaryDokument7 SeitenUpside of Irrationality SummaryluukmuuNoch keine Bewertungen

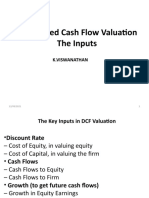

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDokument47 SeitenDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarNoch keine Bewertungen

- Business Economics II: (C) UPESDokument430 SeitenBusiness Economics II: (C) UPESAditya SharmaNoch keine Bewertungen

- Envy TheoryDokument2 SeitenEnvy Theorynorjumawatonshahrudd100% (1)

- CH-3-Financial Reporting & Analysis-8PDBUA060P PDFDokument428 SeitenCH-3-Financial Reporting & Analysis-8PDBUA060P PDFSiravit AriiazNoch keine Bewertungen

- ESG ReportDokument9 SeitenESG ReportSourish BurmanNoch keine Bewertungen

- Adopting PDCA (Plan-Do-Check-Act) Cycle For Energy OptimizationDokument17 SeitenAdopting PDCA (Plan-Do-Check-Act) Cycle For Energy OptimizationMuhammad NaeemNoch keine Bewertungen

- 1 Sustainability ReportingDokument28 Seiten1 Sustainability Reportingmaulikravat3Noch keine Bewertungen

- WRD - Ab - Az.ch26 - SV Capital Investment AnalysisDokument40 SeitenWRD - Ab - Az.ch26 - SV Capital Investment AnalysisDieksa BebaditoNoch keine Bewertungen

- Brij Pal Bajaj SugarDokument88 SeitenBrij Pal Bajaj SugargoswamiphotostatNoch keine Bewertungen

- Risk Analysis in Capital Investment DecisionsDokument57 SeitenRisk Analysis in Capital Investment Decisionsanindya_kundu100% (1)

- Investment Analysis and Lockheed Tri Star ADokument9 SeitenInvestment Analysis and Lockheed Tri Star AEshesh GuptaNoch keine Bewertungen

- Assurance and Validation IcmDokument56 SeitenAssurance and Validation IcmHéctor Walter Salvador JaraNoch keine Bewertungen

- Sustainability Report 2011Dokument110 SeitenSustainability Report 2011Miguee Calderon VargasNoch keine Bewertungen

- Businessstrategyandcorporateculture 111128195955 Phpapp01Dokument52 SeitenBusinessstrategyandcorporateculture 111128195955 Phpapp01richierismyNoch keine Bewertungen

- Melaka Lube Blending Plant TechnicalDokument5 SeitenMelaka Lube Blending Plant TechnicalAdila SaidNoch keine Bewertungen

- The Diamond FrameworkDokument45 SeitenThe Diamond FrameworkMaria Tariq100% (1)

- IIGCC 2021 Oil and Gas - FinalDokument32 SeitenIIGCC 2021 Oil and Gas - FinalAkshansh GuptaNoch keine Bewertungen

- Capital Budgeting: Should We Build This Plant?Dokument51 SeitenCapital Budgeting: Should We Build This Plant?Amit VijayvargiyaNoch keine Bewertungen

- Capital BudgetingDokument31 SeitenCapital Budgetingrimatripathy0% (2)

- Eva Cooking OilDokument22 SeitenEva Cooking OilAlishba YousufNoch keine Bewertungen

- CSR TheoriesDokument26 SeitenCSR TheoriesRajatBansal100% (1)

- Hurwicz Criterion in Decision TheroryDokument11 SeitenHurwicz Criterion in Decision TherorysubinNoch keine Bewertungen

- Module 10 Capital Investment Decisions SolutionDokument19 SeitenModule 10 Capital Investment Decisions SolutionChiran AdhikariNoch keine Bewertungen

- Barrick Gold Corporation - TanzaniaDokument19 SeitenBarrick Gold Corporation - TanzaniaRajesh Kumar PradhanNoch keine Bewertungen

- Waste Manifest Attachment III: P A R TDokument1 SeiteWaste Manifest Attachment III: P A R TSanthoshNoch keine Bewertungen

- Module III. Risk ManagementDokument5 SeitenModule III. Risk ManagementMelanie SamsonaNoch keine Bewertungen

- Analysis of Financial Statements PDFDokument14 SeitenAnalysis of Financial Statements PDFMuhammad Akmal HossainNoch keine Bewertungen

- Krakatau Steel A CaseDokument9 SeitenKrakatau Steel A CaseFarhan SoepraptoNoch keine Bewertungen

- Stakeholder ManagmentDokument21 SeitenStakeholder Managmentsolomon getachewNoch keine Bewertungen

- CSR & Sustainable Development PresentationDokument13 SeitenCSR & Sustainable Development PresentationArnav BothraNoch keine Bewertungen

- Samsung Everland (A)Dokument10 SeitenSamsung Everland (A)ameyparsekarNoch keine Bewertungen

- Calculate Project ROI Using NPV, IRR and Packback PeriodDokument5 SeitenCalculate Project ROI Using NPV, IRR and Packback PeriodsapsrikaanthNoch keine Bewertungen

- IBM Oil - Elevating Enterpise Risk Management For Market SuccessDokument16 SeitenIBM Oil - Elevating Enterpise Risk Management For Market SuccessIBM Chemical and PetroleumNoch keine Bewertungen

- Decision TheoryDokument4 SeitenDecision TheoryDhananjay ShettyNoch keine Bewertungen

- Microsign PresentationDokument27 SeitenMicrosign PresentationMicrosign ProductsNoch keine Bewertungen

- Risk Analysis Applied in E & PDokument7 SeitenRisk Analysis Applied in E & PKivuti NyagahNoch keine Bewertungen

- CIB8942Dokument6 SeitenCIB8942Shepherd NhangaNoch keine Bewertungen

- Financial DistressDokument24 SeitenFinancial DistressdawitNoch keine Bewertungen

- PMN SlidesDokument101 SeitenPMN SlidesPaola VerdiNoch keine Bewertungen

- Measuring Corporate Performance - An EVA Approach: DR Sarbesh MishraDokument20 SeitenMeasuring Corporate Performance - An EVA Approach: DR Sarbesh MishraDr Sarbesh Mishra100% (1)

- Sea Aire Development Stormwater Management Final Report: Executive SummaryDokument62 SeitenSea Aire Development Stormwater Management Final Report: Executive SummarykcresweNoch keine Bewertungen

- Investment Decisions in Petroleum Exploration and ProductionDokument5 SeitenInvestment Decisions in Petroleum Exploration and ProductionIkhwanushafa DjailaniNoch keine Bewertungen

- Chapter 13 ValuationDokument23 SeitenChapter 13 ValuationIndah Dwi RetnoNoch keine Bewertungen

- Operating Manual Dgps 132Dokument6 SeitenOperating Manual Dgps 132budiyana budiNoch keine Bewertungen

- Third Quiz of MGt503 16-12-2011Dokument10 SeitenThird Quiz of MGt503 16-12-2011AliImranNoch keine Bewertungen

- Critical Path Method A Complete Guide - 2020 EditionVon EverandCritical Path Method A Complete Guide - 2020 EditionNoch keine Bewertungen

- Threat And Risk Assessment A Complete Guide - 2020 EditionVon EverandThreat And Risk Assessment A Complete Guide - 2020 EditionNoch keine Bewertungen

- 01 Fin - Introduction To Financial ManagementDokument19 Seiten01 Fin - Introduction To Financial Managementshahin shekhNoch keine Bewertungen

- AN Assignment ON: "Interpersonal Skills"Dokument8 SeitenAN Assignment ON: "Interpersonal Skills"John LoukrakpamNoch keine Bewertungen

- Source, Message, and Channel FactorsDokument31 SeitenSource, Message, and Channel Factorsgttrans111Noch keine Bewertungen

- Goal Setting LessonDokument14 SeitenGoal Setting Lessonapi-262527285Noch keine Bewertungen

- Human Resource ManagementDokument106 SeitenHuman Resource ManagementGangadharNoch keine Bewertungen

- Butler, L. T., & Berry, D. C. (2001) - Implicit Memory, Intention and Awareness Revisited. Trends in Cognitive Sciences, 5 (5), 192-197.Dokument6 SeitenButler, L. T., & Berry, D. C. (2001) - Implicit Memory, Intention and Awareness Revisited. Trends in Cognitive Sciences, 5 (5), 192-197.Iván BravoNoch keine Bewertungen

- CH 4 Discover My Values Plan of AnalysisDokument2 SeitenCH 4 Discover My Values Plan of Analysisapi-277405228Noch keine Bewertungen

- Basic Principles PiesDokument10 SeitenBasic Principles PiesAngela J MurilloNoch keine Bewertungen

- Theories of Motivation: 1) Contribution of Robert OwenDokument13 SeitenTheories of Motivation: 1) Contribution of Robert OwenluminitarusuNoch keine Bewertungen

- Job Satisfaction Among Staffs at Universiti Sultan Zainal Abidin (Unisza)Dokument10 SeitenJob Satisfaction Among Staffs at Universiti Sultan Zainal Abidin (Unisza)abidchannaNoch keine Bewertungen

- Organizational Behaviour: Presentation ON Personality - Jack MaDokument17 SeitenOrganizational Behaviour: Presentation ON Personality - Jack MaShivam GuptaNoch keine Bewertungen

- 5952-MentalHealth - Imp - 5 - 2676 - 12008Dokument76 Seiten5952-MentalHealth - Imp - 5 - 2676 - 12008jotajota10004950Noch keine Bewertungen

- Unit 7 Module 31 Studying and Building Memories PowerpointDokument24 SeitenUnit 7 Module 31 Studying and Building Memories Powerpointapi-300762638Noch keine Bewertungen

- Teresa B. - Cognitivism - Presentation TranscriptDokument3 SeitenTeresa B. - Cognitivism - Presentation TranscriptAini NordinNoch keine Bewertungen

- Reflection On Knowing OneselfDokument2 SeitenReflection On Knowing OneselfDannah100% (2)

- The Relationships Among Social Intelligence Emotional Intelligence and Cultural IntelligenceDokument17 SeitenThe Relationships Among Social Intelligence Emotional Intelligence and Cultural IntelligencehalleyworldNoch keine Bewertungen

- Attitude Formation and ChangeDokument29 SeitenAttitude Formation and ChangeratidwivediNoch keine Bewertungen

- Aspects of Culture: Group 3Dokument11 SeitenAspects of Culture: Group 3The StarboyNoch keine Bewertungen

- Functions of ManagementDokument21 SeitenFunctions of Managementarjinder kaurNoch keine Bewertungen

- What Qualities Does A Successful Leader NeedDokument2 SeitenWhat Qualities Does A Successful Leader NeedSamimNoch keine Bewertungen

- Gradual Release of Responsibility: I Do, We Do, You Do: Mentoring Roles & ResponsibilitiesDokument1 SeiteGradual Release of Responsibility: I Do, We Do, You Do: Mentoring Roles & Responsibilitiesapi-329098711Noch keine Bewertungen

- Preschool AC Report Card Comment Term 3: Class: Kindergarden 1 No. Student's Name CommentDokument2 SeitenPreschool AC Report Card Comment Term 3: Class: Kindergarden 1 No. Student's Name CommentDita WardhanyNoch keine Bewertungen

- High Performance Notes PDFDokument5 SeitenHigh Performance Notes PDFDummy Indian SupportNoch keine Bewertungen

- Human Resource Management in The Hospitality and Tourism SectorDokument37 SeitenHuman Resource Management in The Hospitality and Tourism SectorH ChâuNoch keine Bewertungen

- Iep Meeting ObservationDokument2 SeitenIep Meeting Observationapi-350131256100% (1)