Beruflich Dokumente

Kultur Dokumente

GST & International Trade 1.0

Hochgeladen von

Nikhil Dubey0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

270 Ansichten22 SeitenGST and International Trade PPT

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenGST and International Trade PPT

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

270 Ansichten22 SeitenGST & International Trade 1.0

Hochgeladen von

Nikhil DubeyGST and International Trade PPT

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 22

MOVING TO GOODS AND SERVICES TAX IN INDIA:

IMPACT ON INDIAS GROWTH AND INTERNATIONAL

TRADE

Submitted By

Anupam Yadav (101)

Gajendra Mohan Jha (117)

Ashok Chakravarthy K (122)

Nikhil Dubey (130)

Satyajit Bagchi (145)

Venkani Alnoor (157)

Chaitanya P (166)

INTRODUCTION

GST - tax on goods and services with comprehensive and continuous

chain of set-off benefits from the producer's point and service

provider's point up to the retailer's level.

Essentially a tax only on value addition at each stage

Advantages

boost up economic unification of India

better conformity and revenue resilience

evade the cascading effect in Indirect tax regime

reduce the tax burden for consumers

simple, transparent and easy tax structure

uniformity in tax rates

increased tax collections due to wide coverage

cost competitiveness of goods and services in Global market

reduce transaction costs for taxpayers

Problems in implementing GST

Computerization and trained personnel to audit revenues from

GST

Carefully choose the most suitable tax rate

Impact on general price level

Adequately informing the general public

Proper system to keep accounting records

The broad objective of this study refers to analyzing the impact of

introducing comprehensive goods and services tax (GST) on

economic growth and international trade.

HISTORY OF TAX REFORMS 1/4

References both in Manu Smriti and Arthasastra to a variety of tax

measures

King taxed traders and artisans, agriculturists and others on a

differential basis

Akbar of the Mughal dynasty constructed an efficient and fair Tax

regime

decentralised system of annual assessment

It was replaced by a system called the Dahsala

This system was credited to Raja Todar Mal

Other local methods of assessment

British Tax System

Salt Tax, Irrigation Tax, Indigo Tax, Cotton Tax or the Railroad Tax

HISTORY OF TAX REFORMS 2/4

IT department was set up in 1922

In 1924, Central Board of Revenue Act constituted the Board as a statutory body with functional

responsibilities for the administration of the Income-tax Act

In 1940 - Directorate of Inspection was created

In 1941, the Appellate Tribunal came into existence

Central Board of Revenue Act, 1963 was passed

Central Board of Direct Taxes was constituted, under this Act

In 1965, the Voluntary Disclosure Scheme was brought in followed by the 1975 Disclosure Scheme

Settlement Commission was created

The recovery of arrears of tax which till 1970 was the function of State authorities was passed on to

the departmental officers

Tax Recovery Officers

Tax Recovery Commissioners

HISTORY OF TAX REFORMS 3/4

Post independence

strong Import Substitution policy

Economic Liberalization

Tax reform in India resembles the best practice approach of

broadening the base,

reducing the rates,

reducing rate differentiation and

keeping the system simple

Need for Change

In corporate tax, excise, customs and sales taxes - almost 40 per cent of revenue comes

from diesel and petrol.

Personal income tax continues to be narrow based

Recent reforms - improve revenue productivity and horizontal equity

HISTORY OF TAX REFORMS 4/4

Indian government announces

GST roll out in April 2011

to create an efficient and

harmonized consumption tax

system in the country

The first step towards

introducing GST is to

progressively converge the

service tax rate and the CENVAT

rate

The GST is proposed to be a

comprehensive indirect tax levy

on manufacture, sale and

consumption of goods as well as

services at a national level

End the long standing distortions

of differential treatments of

manufacturing and service

sector

Impact: lead to the abolition of

taxes such as

octroi,

Central sales tax,

State level sales tax,

entry tax,

stamp duty,

telecom licence fees,

turnover tax,

tax on consumption or sale of

electricity,

taxes on transportation of

goods and services

GST will facilitate seamless

credit across the entire supply

chain and across all states under

a common tax base

CURRENT TAX STRUCTURE

Traditionally, Indias tax regime relied heavily on indirect taxes

including customs and excise

Tax structure is a three-tier federal structure, comprising the Union

Government, the State Governments and the Urban/Rural Local

Bodies

The power to levy taxes and duties is distributed in accordance with

the provisions of the government

The main taxes/duties that the Union Government is empowered to

levy are Income Tax, Customs duties, Central Excise and Sales Tax

and Service Tax

The principal taxes levied by the State Governments are Sales Tax,

Stamp Duty, Land Revenue, State Excise

The Local Bodies are empowered to levy tax on properties, Tax on

Markets and Tax/User Charges for utilities like water supply,

drainage, etc.

INEFFICIENCIES IN THE CURRENT SYSTEM

Taxation at Manufacturing Level:

The CENVAT is levied on goods manufactured or produced in

India

gives rise to definitional issues as to what constitutes

manufacturing, and valuation issues for determining the value on

which the tax is to be levied

virtually all countries have abandoned this form of taxation and

replaced it by multi-point taxation system

Exclusion of Service

States are precluded from taxing services

This limitation is unsatisfactory from two perspectives

the advancements in information technology and digitization

have blurred the distinction between goods and services

negative impact on the buoyancy of State tax revenues

CONTD.

Tax Cascading:

the most serious flaw of the current system

occurs under both Centre and State taxes, most significant

contributing factor is the partial coverage Central and State

taxes

increases the cost of production and puts Indian suppliers at

a competitive disadvantage in the international markets

Complexity

The most significant cause of complexity is policy related and

is due to the existence of exemptions and multiple rates, and

the irrational structure of the levies

complexities under the State VAT relate primarily to

classification of goods to different tax rate schedules

starting base for the CENVAT is narrow, and is being further

eroded by a variety of area-specific, and conditional and

unconditional exemptions

LITERATURE REVIEW

Krueger, Anne O. (2008): The Role of Trade and International

Policy in Indian Economic Performance, Asian Economic Policy

Review, (3), Japan Center for Economic Research.

Should Indian economic policies continue in about their present form, it is likely

that growth might decelerate to a 56% rate.

A political system and democracy with gradual reform and consensus, the

demo-graphic dividend as the percentage of population in the labor force will

rise, etc., as demonstrated by achievements in IT so far.

Bird, Richard M., Jack M. Mintz and Thomas A. Wilson (2006):

Coordinating Federal andProvincial Sales Taxes Lessons from Canadian

Experience, National Tax Journal, (59),809-25

Impact of VAT in Canada and its relevance to USA

Operated both as a federal value-added tax (the GST) and two variants of

provincial VATs

Canadian case suggests that the introduction of a federal VAT in the US would not

create any great technical problems for either the states or business.

CONTD..

Poirson Helene (2006): The Tax System in India: Could reform spur

growth?, IMF Working Paper.

Assesses the effects of Indias tax system on growth, through the level

and productivity of private investment.

Indian tax system is characterized by

a high dependence on indirect taxes

low average effective tax rates and tax productivity

high marginal effective tax rates and large tax-induced distortions on investment and

financing decisions

GST would improve tax productivity and lower the marginal tax burden

and tax-induced distortions.

Devarajan et al (1991): A Value-Added Tax (VAT) in Thailand:

Who Wins and Who Loses?, TDRI Quarterly Review, 6(1).

the impact of introducing 10 per cent VAT in Thailand using a general

equilibrium model

identify gainers and losers and the effect on output, prices and incomes.

does not bring out sectoral changes therein

CONTD..

Meagher, G.A. and Brian R. Parmenter (1993): Some Short-Run

Implications of Fight back: A General Equilibrium Analysis, General Paper

No. G-101, CPSIP, Monash University.

Analyse short-run implications of Australias tax reforms of 1992 proposed as

Fightback

Use a general equilibrium model for their analysis

The GST does not discriminate between imports and domestic commodities and

affects exports only in a minor indirect way

impact on cost-sensitive industries exposed to international competition is smaller

than the impacts of other taxes

Summers, H. Lawrence H(1989): "Tax Policy and International

Competitiveness," NBER Working Papers 2007, National Bureau of

Economic Research

Examines the interactions between tax policy, international capital mobility, and

international competitiveness

effects of tax policies depend critically on the extent of the international capital flows

which they generate.

while tax policies could generate large capital flows, governments pursue policies

which tend to inhibit capital flows following tax changes

CURRENT SYSTEM: PRINCIPAL DEFICIENCIES

Taxation at

manufacturing

level (CENVAT)

Exclusion of

Services (for

states)

Tax Cascading

Complexity

BALANCING GAME?

Vertical

Equity

Horizontal

Equity

TAX REFORM: OBJ ETIVO PRINCIPAL

Addressing Deficiencies

Economic

ally

Efficient

Neutral in

application

Distributiona

lly attractive

Simple to administer

Tax Design

Infrastructure

for tax design

Degree of

Harmonization

MODEL TO DETERMINE TOTAL OUTPUT OF VARIOUS

SECTORS OF ECONOMY

Structural input coefficients aij

Flows from sector i to sector j

of inputs required to produce one

rupees worth of output in the

current year

In standard input-output flow

matrix inputs required for capital

formation are included in the final

demand vector

B matrix (bij) represents capital

requirements of 60 sectors of the

economy

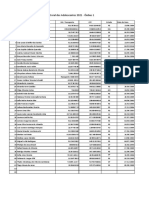

REGRESSION MODEL

RESULTS AND IMPLICATIONS

THANK YOU

Das könnte Ihnen auch gefallen

- How to Handle Goods and Service Tax (GST)Von EverandHow to Handle Goods and Service Tax (GST)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- Acharya ThirtyYearsTax 2005Dokument10 SeitenAcharya ThirtyYearsTax 2005Meenakshi PandeyNoch keine Bewertungen

- Acharya ThirtyYearsTax 2005Dokument10 SeitenAcharya ThirtyYearsTax 2005lourdesynotesNoch keine Bewertungen

- A Project Report On "Goods and Services Tax in India"Dokument38 SeitenA Project Report On "Goods and Services Tax in India"Simran KaurNoch keine Bewertungen

- Tax Reforms in India.Dokument10 SeitenTax Reforms in India.shubh1612Noch keine Bewertungen

- Project Report GST PDFDokument36 SeitenProject Report GST PDFhaz008100% (1)

- Project Report GSTDokument36 SeitenProject Report GSTshilpi_suresh70% (50)

- 223 JayakumarDokument33 Seiten223 JayakumarUniq ManjuNoch keine Bewertungen

- Project Report GSTDokument36 SeitenProject Report GSThaz002Noch keine Bewertungen

- Major Issues Reference Notes EnglishDokument202 SeitenMajor Issues Reference Notes EnglishLeslie WrightNoch keine Bewertungen

- VAT by Nishita GuptaDokument8 SeitenVAT by Nishita GuptaVineet KhandelwalNoch keine Bewertungen

- GST & Single National Market PDFDokument39 SeitenGST & Single National Market PDFVishal YadavNoch keine Bewertungen

- Thirty Years of Tax Reform in India: Pecial ArticlesDokument9 SeitenThirty Years of Tax Reform in India: Pecial ArticlesAayushi BhattacharyaNoch keine Bewertungen

- GST Sem 2 Parth Final Assignment 1Dokument15 SeitenGST Sem 2 Parth Final Assignment 1ParthNoch keine Bewertungen

- GST VS VatDokument62 SeitenGST VS VatMohit AgarwalNoch keine Bewertungen

- Effect of Vat and Tax On Economy: An Analysis in The Context of BangladeshDokument8 SeitenEffect of Vat and Tax On Economy: An Analysis in The Context of BangladeshshakilNoch keine Bewertungen

- Goods and Services TaxDokument19 SeitenGoods and Services TaxAnushka SinghNoch keine Bewertungen

- Wa0007.Dokument39 SeitenWa0007.Ankit Joshi100% (1)

- A Study On Impact of Value Added Tax (Vat) Implementation in IndiaDokument35 SeitenA Study On Impact of Value Added Tax (Vat) Implementation in IndiaHappy KumarNoch keine Bewertungen

- Present State of Goods and Services Tax (GST) Reform in IndiaDokument24 SeitenPresent State of Goods and Services Tax (GST) Reform in IndiaResuf AhmedNoch keine Bewertungen

- Taxation Law Assignment by Sushali Shruti 18FLICDDN01144Dokument10 SeitenTaxation Law Assignment by Sushali Shruti 18FLICDDN01144Shreya VermaNoch keine Bewertungen

- GST - It's Meaning and ScopeDokument11 SeitenGST - It's Meaning and ScopeRohit NagarNoch keine Bewertungen

- Income TaxDokument3 SeitenIncome Taxrahulsthakur22Noch keine Bewertungen

- GST Data CollectedDokument11 SeitenGST Data CollectedtpplantNoch keine Bewertungen

- Aryan and Krunal Consumer Affairs Report....................Dokument17 SeitenAryan and Krunal Consumer Affairs Report....................ME16 Krunal DeshmukhNoch keine Bewertungen

- 10 Benefits of Goods and Service Tax GSTDokument4 Seiten10 Benefits of Goods and Service Tax GSTckmNoch keine Bewertungen

- Impact of Direct Tax Reforms On Tax Revenue in IndiaDokument10 SeitenImpact of Direct Tax Reforms On Tax Revenue in Indiadhruvisagar44Noch keine Bewertungen

- Implementation of Goods and Services Tax (GST)Dokument11 SeitenImplementation of Goods and Services Tax (GST)NATIONAL ATTENDENCENoch keine Bewertungen

- M. Govinda Rao Director, National Institute of Public Finance and PolicyDokument12 SeitenM. Govinda Rao Director, National Institute of Public Finance and PolicySantosh SinghNoch keine Bewertungen

- Foreword: 14/11/17, 2N15 PM Page 1 of 20Dokument20 SeitenForeword: 14/11/17, 2N15 PM Page 1 of 20Anonymous XVUefVN4S8Noch keine Bewertungen

- GST in IndiaDokument6 SeitenGST in IndiaNaveen SihareNoch keine Bewertungen

- GST Main PDFDokument13 SeitenGST Main PDFSHASHANK SHEKHARNoch keine Bewertungen

- Taxation in Sri LankaDokument11 SeitenTaxation in Sri LankaThiluneluNoch keine Bewertungen

- Tyranny of The Status Quo - The Challenges of Reforming The Indian Tax SystemDokument56 SeitenTyranny of The Status Quo - The Challenges of Reforming The Indian Tax SystemAditya SeethaNoch keine Bewertungen

- 201902-Govinda Rao - GSTDokument39 Seiten201902-Govinda Rao - GSTbest videosNoch keine Bewertungen

- Finance Compiled FinalDokument21 SeitenFinance Compiled Finaljadyn nicholasNoch keine Bewertungen

- Utkarsh PandeyDokument6 SeitenUtkarsh Pandeyjitendra kumarNoch keine Bewertungen

- Goods and Services Tax: Sandeep Kumar Singh Roll No: 23 ITM ChennaiDokument10 SeitenGoods and Services Tax: Sandeep Kumar Singh Roll No: 23 ITM ChennaiSandeep SinghNoch keine Bewertungen

- GST and Its ImpactDokument33 SeitenGST and Its Impactbiplav2u100% (1)

- GST PDFDokument5 SeitenGST PDFOMPRAKASH SM EE021Noch keine Bewertungen

- A Study of GST and Its Impact On EconomyDokument8 SeitenA Study of GST and Its Impact On EconomySingh LKNoch keine Bewertungen

- ASSIGNMENTDokument5 SeitenASSIGNMENTmariyaNoch keine Bewertungen

- GST (Goods & Service Tax: Submitted by Nikita Sawant 44 Aditya Kadam 22Dokument19 SeitenGST (Goods & Service Tax: Submitted by Nikita Sawant 44 Aditya Kadam 22Balkrushna ShingareNoch keine Bewertungen

- Investor's Awareness About The New PracticesDokument13 SeitenInvestor's Awareness About The New PracticesPratik MittalNoch keine Bewertungen

- D - R M L N L U, L: Indian Tax Structure and Tax Reforms With GSTDokument17 SeitenD - R M L N L U, L: Indian Tax Structure and Tax Reforms With GSThardik anandNoch keine Bewertungen

- GST in IndiaDokument6 SeitenGST in IndiaAbhishek ChatterjeeNoch keine Bewertungen

- Tax AssignmentDokument11 SeitenTax AssignmentmanalNoch keine Bewertungen

- Critical Analysis of GSTDokument7 SeitenCritical Analysis of GSTPooja BhagatNoch keine Bewertungen

- Economics RP Kartik Goel BBA - LLBDokument21 SeitenEconomics RP Kartik Goel BBA - LLBKartikNoch keine Bewertungen

- Goods and Services Tax: Make India A Common Market: Dr. Anoop Kumar Vyas Irfan Yasin Allie AbstractDokument5 SeitenGoods and Services Tax: Make India A Common Market: Dr. Anoop Kumar Vyas Irfan Yasin Allie AbstractViral StationNoch keine Bewertungen

- Laws of TaxationDokument15 SeitenLaws of TaxationAstha DehariyaNoch keine Bewertungen

- Indirect Taxes: Assignment-2Dokument27 SeitenIndirect Taxes: Assignment-2Arpita ArtaniNoch keine Bewertungen

- SynopsisDokument15 SeitenSynopsisBADDAM PARICHAYA REDDYNoch keine Bewertungen

- Tax Law IIDokument18 SeitenTax Law IIZene QamarNoch keine Bewertungen

- GST by Mukul AsherDokument42 SeitenGST by Mukul AsherPoulasta ChakrabortyNoch keine Bewertungen

- Public Finance Goods & Services Tax (GST)Dokument15 SeitenPublic Finance Goods & Services Tax (GST)Preethi RajanNoch keine Bewertungen

- GST Group 1aDokument14 SeitenGST Group 1aaarti_mallyaNoch keine Bewertungen

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesVon EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNoch keine Bewertungen

- Business Economics: Business Strategy & Competitive AdvantageVon EverandBusiness Economics: Business Strategy & Competitive AdvantageNoch keine Bewertungen

- Binder PI T4 Weber July 2017Dokument63 SeitenBinder PI T4 Weber July 2017Nilesh GaikwadNoch keine Bewertungen

- Reflective EssayDokument5 SeitenReflective EssayBrandy MorganNoch keine Bewertungen

- Supplier Claim Flow ChecklistDokument1 SeiteSupplier Claim Flow ChecklistChris GloverNoch keine Bewertungen

- Implications - CSR Practices in Food and Beverage Companies During PandemicDokument9 SeitenImplications - CSR Practices in Food and Beverage Companies During PandemicMy TranNoch keine Bewertungen

- From "Politics, Governance and The Philippine Constitution" of Rivas and NaelDokument2 SeitenFrom "Politics, Governance and The Philippine Constitution" of Rivas and NaelKESHNoch keine Bewertungen

- Coral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascDokument1 SeiteCoral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascGabriel Kuhs da RosaNoch keine Bewertungen

- 8299 PDF EngDokument45 Seiten8299 PDF Engandrea carolina suarez munevarNoch keine Bewertungen

- Procure To Pay (p2p) R12 - ErpSchoolsDokument20 SeitenProcure To Pay (p2p) R12 - ErpSchoolsMadhusudhan Reddy VangaNoch keine Bewertungen

- 304 1 ET V1 S1 - File1Dokument10 Seiten304 1 ET V1 S1 - File1Frances Gallano Guzman AplanNoch keine Bewertungen

- Pip Assessment GuideDokument155 SeitenPip Assessment Guideb0bsp4mNoch keine Bewertungen

- Allstate Car Application - Sign & ReturnDokument6 SeitenAllstate Car Application - Sign & Return廖承钰Noch keine Bewertungen

- Folio BiologiDokument5 SeitenFolio BiologiPrincipessa FarhanaNoch keine Bewertungen

- Work Place CommitmentDokument24 SeitenWork Place CommitmentAnzar MohamedNoch keine Bewertungen

- Show Catalogue: India's Leading Trade Fair For Organic ProductsDokument58 SeitenShow Catalogue: India's Leading Trade Fair For Organic Productsudiptya_papai2007Noch keine Bewertungen

- Why Some Platforms Thrive and Others Don'tDokument11 SeitenWhy Some Platforms Thrive and Others Don'tmahipal singhNoch keine Bewertungen

- Persuasive Writing Exam - Muhamad Saiful Azhar Bin SabriDokument3 SeitenPersuasive Writing Exam - Muhamad Saiful Azhar Bin SabriSaiful AzharNoch keine Bewertungen

- Employee Shift ScheduleDokument32 SeitenEmployee Shift ScheduleRishane RajapakseNoch keine Bewertungen

- Test Present Simple TenseDokument2 SeitenTest Present Simple TenseSuchadaNoch keine Bewertungen

- Odysseus JourneyDokument8 SeitenOdysseus JourneyDrey MartinezNoch keine Bewertungen

- MOP Annual Report Eng 2021-22Dokument240 SeitenMOP Annual Report Eng 2021-22Vishal RastogiNoch keine Bewertungen

- E 10Dokument7 SeitenE 10AsadNoch keine Bewertungen

- Superstore PROJECT 1Dokument3 SeitenSuperstore PROJECT 1Tosin GeorgeNoch keine Bewertungen

- The Importance of Connecting The First/Last Mile To Public TransporDokument14 SeitenThe Importance of Connecting The First/Last Mile To Public TransporLouise Anthony AlparaqueNoch keine Bewertungen

- Ost BSMDokument15 SeitenOst BSMTata Putri CandraNoch keine Bewertungen

- Cultural Materialism and Behavior Analysis: An Introduction To HarrisDokument11 SeitenCultural Materialism and Behavior Analysis: An Introduction To HarrisgabiripeNoch keine Bewertungen

- Chinua Achebe: Dead Men's PathDokument2 SeitenChinua Achebe: Dead Men's PathSalve PetilunaNoch keine Bewertungen

- IJHSS - A Penetrating Evaluation of Jibanananda Das' Sensibilities A Calm Anguished Vision - 3Dokument10 SeitenIJHSS - A Penetrating Evaluation of Jibanananda Das' Sensibilities A Calm Anguished Vision - 3iaset123Noch keine Bewertungen

- Priyanshu Mts Answer KeyDokument34 SeitenPriyanshu Mts Answer KeyAnima BalNoch keine Bewertungen

- Technical AnalysisDokument4 SeitenTechnical AnalysisShaira Ellyxa Mae VergaraNoch keine Bewertungen

- VoterListweb2016-2017 81Dokument1 SeiteVoterListweb2016-2017 81ShahzadNoch keine Bewertungen