Beruflich Dokumente

Kultur Dokumente

Business Administration: Ing. Pavla Řehořová, PH.D

Hochgeladen von

Paula Bandola-Mohamed0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

15 Ansichten28 Seitendescription for business add

Originaltitel

1_Legal_Forms (1)

Copyright

© © All Rights Reserved

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldendescription for business add

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

15 Ansichten28 SeitenBusiness Administration: Ing. Pavla Řehořová, PH.D

Hochgeladen von

Paula Bandola-Mohameddescription for business add

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 28

Business Administration

Ing. Pavla ehoov, Ph.D.

Phone: +420 48 535 2353

E-mail: pavla.rehorova@tul.cz

Rules of BUSINESS

ADMINISTRATION COURSE

1) All students:

Attendance of seminars (x ? absences)

=> active work at seminars

Rules of BUSINESS

ADMINISTRATION COURSE

2) All students:

2 students = 1 semestral project

Firm Establishment (and its presentation)

(i. e. foundation documents, strategic plan,

SWOT analysis, balance sheet,

depreciations, production and sale plan )

Rules of BUSINESS

ADMINISTRATION COURSE

3) NISA students:

Exam: written test minimum 60 %

Syllabus:

25. 10. 07 Legal forms of business

01. 11. 07 my absence (selfstudy, home preparation)

Marketing activities

08. 11. 07 Organisation structure

15. 11. 07 Capital and property structure

22. 11. 07 Cost and Benefits, Cash Flow

29. 11. 07 Revision lesson

06. 12. 07 Financing of the enterprise, Future Value of Money

13. 12. 07 Investment activities

20. 12. 07 Human resource management, Taxes

03. 01. 07 Presentation of projects

10. 01. 08 1st term of exam

Classification of Business

Enterprises

Typology of enterprises

Legal forms

Size of enterprise

Type of production

Sectors and branch of economy

Size clasification

a) Microenterprise: number of employees < 10,

assets < 180 mil. CZK or

net turnover < 250 mil. CZK

b) Small enterprise: number of employees < 50,

assets < 180 mil. CZK or

net turnover < 250 mil. CZK

c) Medium enterprise: number of employees < 250,

assets< 980 mil. CZK or

net turnover < 1 450 mil. CZK

d) Great enterprise

Size clasification - EU

a) Microenterprise: number of employees < 10,

assets < 2 mil. EUR or

net turnover < 2 mil. EUR

b) Small enterprise: number of employees < 50,

assets < 10 mil. EUR (in 1996 5 mil. EUR) or

net turnover < 10 mil. EUR (in 1996 7 mil. EUR)

c) Medium enterprise: number of employees < 250,

assets< 43 mil. EUR (in 1996 27 mil.) or

net turnover < 50 mil. EUR (in 1996 40 mil. EUR)

d) Great enterprise

Enterprise share according to

the number of employees

Number of employees % of enterprises

1 - 9 96,0

10 - 49 3,1

50 - 249 0,7

250 and more 0,2

Type of production

Enterprises with production:

a) Single-part production small amount of the same

products

b) Batch (line) production production of the same type of

product repeating in batches;

Size of batch:

b1) small

b2) medium

b3) great

c) Continual production production of great amount of

small type of products

Sectors

1. Primary sector (primary production, basic

industry, e.g. agriculture, forestry, mining industry)

2. Secondary sector (manufacturing industry,

e.g. manufacturing, food, textile)

3. Terciary sector (non-productive enterprises,

e.g. trade, transport, banks)

Legal forms

1. Natural person (tradesman, enterpreneur)

2. Corporations

3. Cooperative

4. State enterprises, state organisations

5. Budgetary organisation

6. Contributory organisation

7. Foundation

8. Association

9. Not-for-profit organisation

10. Others

Legal forms

Choice of legal form depends on these factors:

1. liability

2. competence to the management

3. number of founders

4. claims to the initiatory capital

5. administrative costingness

6. share in profit/loss

7. financial possibilities

8. tax burden

9. duties of publication

Organisational Structure

of Czech Economy

Legal form %

Total subjects 100

State enterprises 1,65

Corporations 13,84

- joint stock companies 1,80

Cooperation 1,74

Sole enterpreneur 75,93

Individual farmers 6,84

Types of business organisations

a) personal established by 2 and more people,

partners participate on business,

collective company liability

- co-partnership

- limited partnership

b) capital capital participation of partners on business,

they do not participate personally on

business,

- limited company Ltd.,

- joint-stock company

(public limited company Plc.)

Sequence of establishment

of companies

1) Signing of partnership contract

2) Deposit the capital in the bank

3) Application in the licence authority

4) Registration in the Companies register

Natural Person (Sole trader)

Simpliest legal form of business organization

Proprietor sole owner of business enterprise

and is able to exercise complete control over its

operations

Sole trader is liable for the debts of business to

the full extent of his personal assets

Sole traders are taxed on the individuals

personal income tax return at a progressive rate

from 15%

Natural Person (Sole trader)

Natural person can be only a person who:

- is older than 18,

- is unblemished,

- is eligible (competent) to the legal acts,

- does not have any tax back-payment.

= we distinguish three types of Natural Person

= according to these types people need a special

licence and different number of working

experience years

Ltd

Liability of owners

together into amount of

outstanding deposit

Minimum of capital

min. 200 000 CZK

each partner min. 20 000 CZK

Minimum of partners (founders) min. 1, max. 50

Institutions

General meeting highest

institution

Executives corporate inst.

Advisory board - voluntary

Profit/loss sharing

according of share of business

share

Limited liability company

(Spolenost s ruenm omezenm)

Joint stock company

Akciov spolenost (Corporation USA)

Legal entity is separate and distinct from the

people who are its owners

It has legal distinction between the corporation

and its stockholders

There is a separation of roles stockholders are

owners, president and other executives manage

the corporation (company)

Company in which each owner has unlimited

liability. Joint stock company combines features

of a corporation and a partnership

Joint stock company

The process of becoming a corporation, call

incorporation, gives the company separate

legal standing from its owners and protects

those owners from being personally liable

in the event when the company is losing

(a condition known as limited liability).

Incorporation also provides companies with

a more flexible way to manage their

ownership structure.

Joint stock company

Share capital must be at least CZK 2 million.

The company must put at least 20 % of the

capital into a reserve fund, which is founded by

after-tax profits.

The accounts must be audited annually.

There must be at least three members on the

board of directors, and each member must be a

Czech citizen or resident.

Joint stock company

Liability of stock holders none

Minimum of capital

min. 2 000 000 CZK without tender of

stocks

min. 20 000 000 CZK with tender of

stocks

Minimum of partners

(founders)

min. 2 natural person or 1 corporate

bodies (legal entities)

Institutions

Shareholders meeting

Board of directors

Advisory board min. 3 members

Profit/loss sharing

according of share of nominal value of

stock to all stocks

Limited partnership

(Komanditn spolenost)

Liability of owners

Complementar Sole trader, liable

for the debts of business to the full

extent of his personal assets

Commanditist amount of

outstanding deposit

Minimum of capital Commanditist minimum 5 000 CZK

Minimum of partners

(founders)

1 + 1

Profit/loss sharing

profit 1 : 1,

complementars - the same amount,

commanditist - among their deposits

loss complementars the same

amount (equal share)

Co - partnership

(Veejn obchodn spolenost)

Liability of owners

together liability for the debts of

business to the full extent of

personal assets

Minimum of capital is not defined

Minimum of partners (founders)

2 natural person or 2 corporate

bodies (legal entities)

Profit/loss sharing equal share

Cooperative

(Drustvo)

Liability of owners no liability

Minimum of capital min. 50 000 CZK

Minimum of partners (founders)

min. 5 partners or 2 corporate

bodies (legal entities)

Institutions

Member meeting

Board of directors corporate

inst.

Control commission 3

members

Profit share

according to level of member

deposit

Seminar

Groups 3-4 people

(German + Polish + Czech)

Legal forms of enterprises in Germany and

Poland

Comparison of these forms with Czech

system

Capital and personal companies

Das könnte Ihnen auch gefallen

- Business Administration: Ing. Pavla Řehořová, PH.DDokument28 SeitenBusiness Administration: Ing. Pavla Řehořová, PH.DVenkat GVNoch keine Bewertungen

- Business Administration: Ing. Pavla Řehořová, PH.DDokument28 SeitenBusiness Administration: Ing. Pavla Řehořová, PH.DYashwant MisaleNoch keine Bewertungen

- Corporate Law: 1-Choice of A Company FormDokument6 SeitenCorporate Law: 1-Choice of A Company FormMei XinNoch keine Bewertungen

- Guide: How To Set Up A Company in Italy Portugal Denmark Germany and The Czech RepublicDokument24 SeitenGuide: How To Set Up A Company in Italy Portugal Denmark Germany and The Czech RepublicRui BaptistaNoch keine Bewertungen

- Doing Business in SlovakiaDokument4 SeitenDoing Business in SlovakiaPixo Van UhričíkNoch keine Bewertungen

- 04 EnterpriseDokument4 Seiten04 EnterpriseJasmína PolaneckáNoch keine Bewertungen

- 2017 Company Formation SlovakiaDokument13 Seiten2017 Company Formation SlovakiaAccaceNoch keine Bewertungen

- Las Empresas: Presentado Por: Julieth Martinez Lic: Julio Hincapie GRADO: 10 I.E San Isidro Chichimene Acacias-MetaDokument40 SeitenLas Empresas: Presentado Por: Julieth Martinez Lic: Julio Hincapie GRADO: 10 I.E San Isidro Chichimene Acacias-MetaAnonymous 9ffDkwauINoch keine Bewertungen

- Individual Assignments For EconomicsDokument17 SeitenIndividual Assignments For EconomicsGetachew ZelekeNoch keine Bewertungen

- Strategic Plan Investment SocietyDokument4 SeitenStrategic Plan Investment SocietyEdwin van PuttenNoch keine Bewertungen

- Accounting, Controlling, Tax (Part1 Introduction)Dokument34 SeitenAccounting, Controlling, Tax (Part1 Introduction)Baljinnyam TsevegjavNoch keine Bewertungen

- Course 2Dokument68 SeitenCourse 2Anto DNoch keine Bewertungen

- Establishing and Managing A Company.: 5.1 Corporate StructuresDokument9 SeitenEstablishing and Managing A Company.: 5.1 Corporate StructuresRule Amethyst OportoNoch keine Bewertungen

- PPP Unit 1Dokument37 SeitenPPP Unit 1nandaamaharajhNoch keine Bewertungen

- 1 Doing Business in France Legal Framework and Practical Advice EngDokument18 Seiten1 Doing Business in France Legal Framework and Practical Advice EngAhmad Mujtaba PhambraNoch keine Bewertungen

- Define Accounting According To FRSCDokument3 SeitenDefine Accounting According To FRSCChariz AudreyNoch keine Bewertungen

- FM 101 SG 2Dokument5 SeitenFM 101 SG 2Kezia GwynethNoch keine Bewertungen

- Business Management: Chapter 2Dokument33 SeitenBusiness Management: Chapter 2Javier BallesterosNoch keine Bewertungen

- Spain: Doing Business inDokument23 SeitenSpain: Doing Business inSusil GuptaNoch keine Bewertungen

- Small Business Development Program in HNC 2011-2015Dokument34 SeitenSmall Business Development Program in HNC 2011-2015cajgerNoch keine Bewertungen

- Seminar 03Dokument5 SeitenSeminar 03Lenuța PapucNoch keine Bewertungen

- Lektsia 1Dokument12 SeitenLektsia 1Lolita IsakhanyanNoch keine Bewertungen

- Slovakia: Annex 1. PDokument16 SeitenSlovakia: Annex 1. PSabina Alexandra ChituNoch keine Bewertungen

- Business Studies Notes: Unit 1Dokument11 SeitenBusiness Studies Notes: Unit 1Matt RobsonNoch keine Bewertungen

- How Do I Register A Business in Ukraine?Dokument4 SeitenHow Do I Register A Business in Ukraine?serikiiNoch keine Bewertungen

- GuideEuroregion AnglaisDokument25 SeitenGuideEuroregion AnglaisGeorgiana CălvunNoch keine Bewertungen

- CompaniesDokument16 SeitenCompaniesEmy LeNoch keine Bewertungen

- AssignmentDokument5 SeitenAssignmentkashishfatima152Noch keine Bewertungen

- Venture Capital Fund Terms and Conditions. Termsheets Sample - A Fund For SME CaseDokument8 SeitenVenture Capital Fund Terms and Conditions. Termsheets Sample - A Fund For SME CaseManuel Lacarte67% (3)

- Engineering Economics: ACADEMIC YEAR: 2021/2022Dokument5 SeitenEngineering Economics: ACADEMIC YEAR: 2021/2022Thomas DejoieNoch keine Bewertungen

- Accounting 2022 - L01-03Dokument9 SeitenAccounting 2022 - L01-03Rátky Éva ViktóriaNoch keine Bewertungen

- Business Studies NotesDokument8 SeitenBusiness Studies NotesMuskaan SuriNoch keine Bewertungen

- Denmark en LAWDokument14 SeitenDenmark en LAWAutumnNoch keine Bewertungen

- Course Title - Financial Accounting - 2Dokument14 SeitenCourse Title - Financial Accounting - 2IK storeNoch keine Bewertungen

- MPRA Paper 31159Dokument8 SeitenMPRA Paper 31159Marandici IonNoch keine Bewertungen

- Topic 1 - Nature of BusinessDokument8 SeitenTopic 1 - Nature of BusinessLeila FonuaNoch keine Bewertungen

- Unit 1.2 Types of Organizations2021Dokument41 SeitenUnit 1.2 Types of Organizations2021Ziyu YangNoch keine Bewertungen

- Jamille Cummins, Transworld Group - Isle of Man For BusinessDokument53 SeitenJamille Cummins, Transworld Group - Isle of Man For BusinessSteve Cummins, Transworld GroupNoch keine Bewertungen

- DocxDokument108 SeitenDocxPhebieon MukwenhaNoch keine Bewertungen

- Lecture K59CLCDokument113 SeitenLecture K59CLCNhật Tân Lê TrầnNoch keine Bewertungen

- Business Wiki ENDokument18 SeitenBusiness Wiki ENvadiNoch keine Bewertungen

- Unit: Business and The Business Environment (Level 4) Week 1Dokument23 SeitenUnit: Business and The Business Environment (Level 4) Week 1Edufluent ResearchNoch keine Bewertungen

- دراسات تجارية بلغة انجليزيةDokument215 Seitenدراسات تجارية بلغة انجليزيةahmedNoch keine Bewertungen

- Formalizing A Small Business in PeruDokument64 SeitenFormalizing A Small Business in PeruoficinadeturismomdmNoch keine Bewertungen

- Polish CompaniesDokument3 SeitenPolish CompanieskalinovskayaNoch keine Bewertungen

- UNIT 18 Company LawDokument14 SeitenUNIT 18 Company LawRaven471Noch keine Bewertungen

- Spanish Company LAWDokument19 SeitenSpanish Company LAWmichaelfoy1Noch keine Bewertungen

- Financial Accounting - Quick Revision Notes Introduction To Business Organisation Legal Structures of A BusinessDokument26 SeitenFinancial Accounting - Quick Revision Notes Introduction To Business Organisation Legal Structures of A Businessjohn_841Noch keine Bewertungen

- Establishing A Business in PortugalDokument30 SeitenEstablishing A Business in Portugaldaniel francoNoch keine Bewertungen

- Establishing A Business in SwitzerlandDokument30 SeitenEstablishing A Business in Switzerlanddaniel francoNoch keine Bewertungen

- 2019 09 02 Pres Int'l Tax Law For MNEs - 1920 - Class 1Dokument26 Seiten2019 09 02 Pres Int'l Tax Law For MNEs - 1920 - Class 1DanielaNoch keine Bewertungen

- Doing Business in Vietnam - Lee & AssociatesDokument7 SeitenDoing Business in Vietnam - Lee & AssociatesNhung LeNoch keine Bewertungen

- Outline Exam U.S. Business LawDokument54 SeitenOutline Exam U.S. Business LawNina HakeNoch keine Bewertungen

- Financial Market Environment: Chapter 2 - Principles of Managerial Finance (Gitman)Dokument16 SeitenFinancial Market Environment: Chapter 2 - Principles of Managerial Finance (Gitman)NerissaNoch keine Bewertungen

- Lecture 1: The Goal of Financial Management: 1. Sole Proprietorship: Business Owned by One IndividualDokument5 SeitenLecture 1: The Goal of Financial Management: 1. Sole Proprietorship: Business Owned by One IndividualDenka DrábováNoch keine Bewertungen

- Taxation A2Dokument6 SeitenTaxation A2Thanh VânNoch keine Bewertungen

- Topic 1: Overview of Business FinanceDokument45 SeitenTopic 1: Overview of Business FinancealfonsoalexavierNoch keine Bewertungen

- 9 - Companies ActDokument58 Seiten9 - Companies Actbisma irfanNoch keine Bewertungen

- Accounting: The Language of BusinessDokument30 SeitenAccounting: The Language of BusinessMuhammad AzamNoch keine Bewertungen

- Taxation for Australian Businesses: Understanding Australian Business Taxation ConcessionsVon EverandTaxation for Australian Businesses: Understanding Australian Business Taxation ConcessionsNoch keine Bewertungen

- NuMeths - Final Oral ExaminationsDokument4 SeitenNuMeths - Final Oral Examinationskathrin_jazz26Noch keine Bewertungen

- Unicorn Floral BannerDokument1 SeiteUnicorn Floral BannerPaula Bandola-MohamedNoch keine Bewertungen

- NuMeths - Final Oral ExaminationsDokument4 SeitenNuMeths - Final Oral Examinationskathrin_jazz26Noch keine Bewertungen

- Album of Verbs & Nouns: SubmittedDokument4 SeitenAlbum of Verbs & Nouns: SubmittedPaula Bandola-MohamedNoch keine Bewertungen

- Despicable MeDokument95 SeitenDespicable Meade prasetyoNoch keine Bewertungen

- 10 Commandments of GodDokument2 Seiten10 Commandments of GodPaula Bandola-MohamedNoch keine Bewertungen

- For UploadDokument1 SeiteFor UploadPaula Bandola-MohamedNoch keine Bewertungen

- Welcome BackDokument1 SeiteWelcome BackPaula Bandola-MohamedNoch keine Bewertungen

- Manual and Automatic TransmissionDokument2 SeitenManual and Automatic TransmissionPaula Bandola-MohamedNoch keine Bewertungen

- Lesson 1Dokument39 SeitenLesson 1Paula Bandola-MohamedNoch keine Bewertungen

- Nokia 310 UG en INDokument111 SeitenNokia 310 UG en INPaula Bandola-MohamedNoch keine Bewertungen

- Tik Tok LyricsDokument3 SeitenTik Tok LyricsPaula Bandola-MohamedNoch keine Bewertungen

- Routing Table InterpretationDokument5 SeitenRouting Table InterpretationDeco1983Noch keine Bewertungen

- Write The FractionDokument1 SeiteWrite The FractionPaula Bandola-MohamedNoch keine Bewertungen

- Expl RTR Chapter 08 Routing TableDokument34 SeitenExpl RTR Chapter 08 Routing TablePaula Bandola-MohamedNoch keine Bewertungen

- Mor (Interview&Observation) 1Dokument18 SeitenMor (Interview&Observation) 1Paula Bandola-MohamedNoch keine Bewertungen

- Ccna 2 Chapter 8 AnswersDokument9 SeitenCcna 2 Chapter 8 AnswersPaula Bandola-MohamedNoch keine Bewertungen

- Ccna 2 Chapter 8 AnswersDokument9 SeitenCcna 2 Chapter 8 AnswersPaula Bandola-MohamedNoch keine Bewertungen

- Darlington Business Venture Balance Sheet BasicsDokument10 SeitenDarlington Business Venture Balance Sheet BasicsVipul DesaiNoch keine Bewertungen

- Indian Institute of Management, SambalpurDokument86 SeitenIndian Institute of Management, SambalpurCommerce StudentNoch keine Bewertungen

- Basics of Share and DebentureDokument14 SeitenBasics of Share and DebentureChaman SinghNoch keine Bewertungen

- 2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvoDokument3 Seiten2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvonathalie velasquezNoch keine Bewertungen

- Corporate Profile HLTMTDokument12 SeitenCorporate Profile HLTMTAzihan AripinNoch keine Bewertungen

- E-Commerce Start-Up Business PlanDokument45 SeitenE-Commerce Start-Up Business PlanHassan Mohamed100% (1)

- Project MadhuDokument132 SeitenProject MadhushirleyNoch keine Bewertungen

- The Economy and Securities Analysis - Business FinanceDokument45 SeitenThe Economy and Securities Analysis - Business FinanceMark Angelo R. Arceo100% (1)

- Exit Strategy Analysis With CAN SLIM StocksDokument58 SeitenExit Strategy Analysis With CAN SLIM StocksKapil Nandwana100% (1)

- Jamba Juice Company AnalysisDokument24 SeitenJamba Juice Company AnalysisMary Kim100% (6)

- Assignment No 02Dokument2 SeitenAssignment No 02FaiXan Ahmad KhiljiNoch keine Bewertungen

- GST 311 Past Question 2016 BashDokument4 SeitenGST 311 Past Question 2016 BashYahaya Suleiman AliyuNoch keine Bewertungen

- Biotechnology Positioning and What Matters in 2014Dokument196 SeitenBiotechnology Positioning and What Matters in 2014dickygNoch keine Bewertungen

- Final Assignment ValuationDokument5 SeitenFinal Assignment ValuationSamin ChowdhuryNoch keine Bewertungen

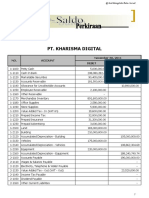

- Kunci Jawaban Pt. Kharisma DigitalDokument91 SeitenKunci Jawaban Pt. Kharisma DigitalSanti Mulya100% (3)

- Feasibility Study Plan: LabadabangoDokument38 SeitenFeasibility Study Plan: LabadabangoCocoy Llamas HernandezNoch keine Bewertungen

- Answering Machine. The Company's Income Statement For The Most Recent Year Is Given BelowDokument10 SeitenAnswering Machine. The Company's Income Statement For The Most Recent Year Is Given BelowmeseleNoch keine Bewertungen

- SC Rules Voluntary Retirement Schemes Only Have 'Take It or Leave It' Option For Employees, Read JudgementDokument16 SeitenSC Rules Voluntary Retirement Schemes Only Have 'Take It or Leave It' Option For Employees, Read JudgementLatest Laws TeamNoch keine Bewertungen

- Financial Management Assignment NotesDokument3 SeitenFinancial Management Assignment NotesDaniyal AliNoch keine Bewertungen

- Final Exam 5Dokument3 SeitenFinal Exam 5HealthyYOUNoch keine Bewertungen

- Report 29Dokument9 SeitenReport 29Pran piya100% (1)

- August 2013 SolutionDokument66 SeitenAugust 2013 SolutionZiaul HuqNoch keine Bewertungen

- Reporting and Analyzing ReceivablesDokument72 SeitenReporting and Analyzing ReceivablesRishabh JainNoch keine Bewertungen

- SSRN Id2607730Dokument84 SeitenSSRN Id2607730superbuddyNoch keine Bewertungen

- Chapter 5 New11 - Block Hirt BookDokument14 SeitenChapter 5 New11 - Block Hirt BookRamishaNoch keine Bewertungen

- Acdoca FieldsDokument4 SeitenAcdoca FieldsAnkitSoman0% (1)

- The Evolution of Accounting TheoryDokument4 SeitenThe Evolution of Accounting TheoryOwl100% (1)

- Landau Company Draft1Dokument4 SeitenLandau Company Draft1cedric sevilla100% (2)

- An Overview of The Different Types of Companies - : in The UK in The Usa DescriptionDokument9 SeitenAn Overview of The Different Types of Companies - : in The UK in The Usa DescriptionSolange Toloza InostrozaNoch keine Bewertungen

- Exp Fia-Ffm NotesDokument51 SeitenExp Fia-Ffm Notesati19100% (1)