Beruflich Dokumente

Kultur Dokumente

Session 7 Cash Flow Statements

Hochgeladen von

Sonali JagathOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Session 7 Cash Flow Statements

Hochgeladen von

Sonali JagathCopyright:

Verfügbare Formate

The McGraw-Hill Companies, I nc.

, 2005

McGraw-Hill/I rwin

Reporting and Analyzing

Cash Flows

12-1

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-2

How does a

company obtain its

cash?

Where does a

company spend its

cash?

What explains the

change in the cash

balance?

Purpose of the Statement of Cash Flows

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-3

How did the

business fund its

operations?

Did the business

borrow any funds or

repay any loans?

Does the business

have sufficient cash

to pay its debts as

they mature?

Did the business

make any dividend

payments?

Importance of Cash Flows

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-4

Cash

Currency

Cash

Equivalents

Short-term, highly liquid investments.

Readily convertible into cash.

So near maturity that market value is unaffected by

interest rate changes.

Measurement of Cash Flows

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-5

The Statement of Cash Flows includes the

following three sections:

Operating Activities

Investing Activities

Financing Activities

Classifying Cash Flows

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-6

Outflows

Salaries and wages.

Payments to suppliers.

Taxes and fines.

Interest paid to lenders.

Other.

Inflows

Receipts from customers.

Cash dividends received.

Interest from borrowers.

Other.

Operating Activities

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-7

Outflows

Purchasing long-term

productive assets.

Purchasing equity

investments.

Purchasing debt investments.

Other.

Inflows

Selling long-term productive

assets.

Selling equity investments.

Collecting principal on loans.

Other.

Investing Activities

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-8

Outflows

Pay dividends.

Purchasing treasury stock

Repaying cash loans.

Paying owners withdrawals.

Inflows

Issuing its own equity

securities.

Issuing bonds and notes.

Issuing short- and long-term

liabilities.

Financing Activities

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-9

Items requiring separate disclosure

include:

Retirement of debt by issuing equity

securities.

Conversion of preferred stock to

common stock.

Leasing of assets in a capital lease

transaction.

Noncash Investing and Financing

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-10

Cash flows from operating activities:

[List of individual inflows and outflows]

Net cash provided (used) by operating activites $ #####

Cash flows from investing activities:

[List of individual inflows and outflows]

Net cash provided (used) by investing activites #####

Cash flows from financing activities:

[List of individual inflows and outflows]

Net cash provided (used) by financing activites #####

Net increase (decrease) in cash $ #####

Cash (and equivalents) balance at beginning of period #####

Cash (and equivalents) balance at end of period $ #####

Company Name

Statement of Cash Flows

For Period Ended Date

Format of the Statement of Cash Flows

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-11

Cash flows from operating activities:

[List of individual inflows and outflows]

Net cash provided (used) by operating activites $ #####

Cash flows from investing activities:

[List of individual inflows and outflows]

Net cash provided (used) by investing activites #####

Cash flows from financing activities:

[List of individual inflows and outflows]

Net cash provided (used) by financing activites #####

Net increase (decrease) in cash $ #####

Cash (and equivalents) balance at beginning of period #####

Cash (and equivalents) balance at end of period $ #####

Company Name

Statement of Cash Flows

For Period Ended Date

There are two acceptable methods to determine Cash

Flows from Operating Activities:

Direct Method

Indirect Method

Format of the Statement of Cash Flows

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-12

Lets look at the

Direct Method

for preparing

the Cash Flows

from Operating

Activities

section.

Preparing the Statement of Cash Flows

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-13

Analyzing the Cash Account

Balance, Jan. 1, 2005 22,000 Payments for merchandise 150,000

Receipts from customers 466,000 Payments for wages 145,000

Receipts from sale of land 25,000 Payments for interest 10,000

Receipts from stock issuance 35,000 Payments for taxes 20,000

Payments for equipment 70,000

Payments for bond retirement 50,000

Payments for dividends 40,000

Balance, Dec. 31, 2005 63,000

Cash

Lets use this Cash account to prepare

B&G Companys Statement of Cash Flows

under the Direct Method.

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-14

Cash flows from operating activities

Cash received from customers 466,000 $

Cash paid for merchandise (150,000)

Cash paid for wages (145,000)

Cash paid for interest (10,000)

Cash paid for taxes (20,000)

Net cash provided by operating activities 141,000

Cash flows from investing activities

Proceeds from sale of land 25,000

Purchase of equipment (70,000)

Net cash used by investing activities (45,000)

Cash flows from financing activities

Proceeds from issuance of common stock 35,000

Redemption of bonds (50,000)

Payment of dividends (40,000)

Net cash used by financing activities (55,000)

Net increase in cash 41,000

Cash, January 1, 2005 22,000

Cash, December 31, 2005 63,000 $

B&G Company

Statement of Cash Flows

For the Year Ended December 31, 2005

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-15

Lets look at the

Indirect Method

for preparing

the Cash Flows

from Operating

Activities

section.

Preparing the Statement of Cash Flows

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-16

Net

Income

Cash Flows

from Operating

Activities

97.5% of all companies use the indirect method.

Changes in current assets

and current liabilities.

+ Losses and

- Gains

+ Noncash

expenses such as

depreciation and

amortization.

Indirect Method

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-17

Use this table when adjusting Net Income

to Operating Cash Flows.

Change in Account Balance During Year

Increase Decrease

Current Subtract from net Add to net income.

Assets income.

Current Add to net income. Subtract from net

Liabilities income.

Indirect Method

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-18

East, Inc. reports $125,000 net income for

the year ended December 31, 2005.

Accounts Receivable increased by $7,500

during the year and Accounts Payable

increased by $10,000.

During 2005, East reported $12,500 of

Depreciation Expense.

What is East, Inc.s Operating

Cash Flow for 2005?

Indirect Method Example

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-19

Net income 125,000 $

Deduct: Increase in accounts

receivable

Cash provided by operating

activities

Net income 125,000 $

Deduct: Increase in accounts

receivable

Cash provided by operating

activities

For the indirect

method, start with

net income.

Indirect Method Example

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-20

Net income 125,000 $

Add: Depreciation expense 12,500

Deduct: Increase in accounts

receivable

Cash provided by operating

activities

Net income 125,000 $

Add: Depreciation expense 12,500

Deduct: Increase in accounts

receivable

Cash provided by operating

activities

Add noncash

expenses such as

depreciation,

depletion,

amortization, or bad

debt expense.

Indirect Method Example

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-21

Net income 125,000 $

Add: Depreciation expense 12,500

Deduct: Increase in accounts

receivable (7,500)

Cash provided by operating

activities

Net income 125,000 $

Add: Depreciation expense 12,500

Deduct: Increase in accounts

receivable (7,500)

Cash provided by operating

activities

Change in Account Balance During Year

Increase Decrease

Current Subtract from net Add to net income.

Assets income.

Current Add to net income. Subtract from net

Liabilities income.

Indirect Method Example

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-22

Net income 125,000 $

Add: Depreciation expense 12,500

Deduct: Increase in accounts

receivable (7,500)

Add: Increase in accounts payable 10,000

Cash provided by operating

activities

Net income 125,000 $

Add: Depreciation expense 12,500

Deduct: Increase in accounts

receivable (7,500)

Add: Increase in accounts payable 10,000

Cash provided by operating

activities

Change in Account Balance During Year

Increase Decrease

Current Subtract from net Add to net income.

Assets income.

Current Add to net income. Subtract from net

Liabilities income.

Indirect Method Example

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-23

Net income 125,000 $

Add: Depreciation expense 12,500

Deduct: Increase in accounts

receivable (7,500)

Add: Increase in accounts payable 10,000

Cash provided by operating

activities 140,000 $

Net income 125,000 $

Add: Depreciation expense 12,500

Deduct: Increase in accounts

receivable (7,500)

Add: Increase in accounts payable 10,000

Cash provided by operating

activities 140,000 $

If we used the Direct Method, we would get the same

$140,000 for Cash Provided by Operating Activities.

Indirect Method Example

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-24

Lets prepare a

Statement of Cash

Flows for B&G

Company using

the Indirect

Method.

Indirect Method

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-25

2005 2004

Increase

or

(Decrease)

Cash 63,000 $ 22,000 $ 41,000 $

Accounts receivable 85,000 76,000 9,000

Inventories 170,000 189,000 (19,000)

Land 75,000 100,000 (25,000)

Equipment 270,000 200,000 70,000

Accumulated depreciation-equipment (66,000) (32,000) (34,000)

Total Assets 597,000 $ 555,000 $ 42,000 $

Liabilities and Stockholders' Equity

Accounts payable 39,000 $ 47,000 $ (8,000)

Bonds payable 150,000 200,000 (50,000)

Common stock, $1 par 209,000 174,000 35,000

Retained earnings 199,000 134,000 65,000

Total Liabilities and Stockholders' Equity 597,000 $ 555,000 $ 42,000 $

B&G Company

Comparative Balance Sheets

December 31

Assets

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-26

Additional Information for 2005:

Net income was $105,000.

Cash dividends declared and paid were

$40,000.

Bonds payable of $50,000 were

redeemed for $50,000 cash.

Common stock was issued for $35,000

cash.

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-27

Cash flows from operating activities

Net income 105,000 $

Adjustments to accrual-basis net income:

B&G Company

Statement of Cash Flows

For the Year Ended December 31, 2005

Add noncash expenses

and losses.

Subtract noncash

revenues and gains.

Start with

accrual-basis

net income.

Then, analyze the

changes in current

assets and current

liabilities.

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-28

Cash flows from operating activities

Net income 105,000 $

Adjustments to accrual-basis net income:

Depreciation expense 34,000 $

Increase in accounts receivable (9,000)

Decrease in inventory 19,000

Decrease in accounts payable (8,000)

Total adjustments 36,000

Net cash provided by operating activities 141,000

Cash flows from investing activities

B&G Company

Statement of Cash Flows

For the Year Ended December 31, 2005

Change in Account Balance During Year

Increase Decrease

Current Subtract from net Add to net income.

Assets income.

Current Add to net income. Subtract from net

Liabilities income.

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-29

Cash flows from operating activities

Net income 105,000 $

Adjustments to accrual-basis net income:

Depreciation expense 34,000 $

Increase in accounts receivable (9,000)

Decrease in inventory 19,000

Decrease in accounts payable (8,000)

Total adjustments 36,000

Net cash provided by operating activities 141,000

Cash flows from investing activities

B&G Company

Statement of Cash Flows

For the Year Ended December 31, 2005

Now, lets complete

the investing

section.

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-30

Cash flows from operating activities

Net income 105,000 $

Adjustments to accrual-basis net income:

Depreciation expense 34,000 $

Increase in accounts receivable (9,000)

Decrease in inventory 19,000

Decrease in accounts payable (8,000)

Total adjustments 36,000

Net cash provided by operating activities 141,000

Cash flows from investing activities

Proceeds from sale of land 25,000

Purchase of equipment (70,000)

Net cash used by investing activities (45,000)

Cash flows from financing activities

B&G Company

Statement of Cash Flows

For the Year Ended December 31, 2005

Now, lets complete

the financing section.

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-31

Cash flows from operating activities

Net income 105,000 $

Adjustments to accrual-basis net income:

Depreciation expense 34,000 $

Increase in accounts receivable (9,000)

Decrease in inventory 19,000

Decrease in accounts payable (8,000)

Total adjustments 36,000

Net cash provided by operating activities 141,000

Cash flows from investing activities

Proceeds from sale of land 25,000

Purchase of equipment (70,000)

Net cash used by investing activities (45,000)

Cash flows from financing activities

Proceeds from issuance of common stock 35,000

Redemption of bonds (50,000)

Payment of dividends (40,000)

Net cash used by financing activities (55,000)

Net increase in cash 41,000

Cash, January 1, 2005 22,000

Cash, December 31, 2005 63,000 $

B&G Company

Statement of Cash Flows

For the Year Ended December 31, 2005

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-32

Analyzing Cash Sources and Uses

BMX ATV Trex

90,000 $ 40,000 $ (24,000) $

26,000

(48,000) (25,000)

13,000

(27,000)

15,000 $ 15,000 $ 15,000 $

Cash Flows of Competing Companies

all numbers in thousands

Cash provided (used) by operating

activities

Cash provided (used) by investing

activities:

Repayment of debt

Net increase (decrease) in cash

Proceeds from sale of operating

assets

Purchase of operating assets

Cash provided (used) by financing

activities:

Proceeds from issuance of debt

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-33

Used, along with income-based ratios, to

assess company performance.

Cash flow on

total assets

=

Operating cash flows

Average total assets

Cash Flow on Total Assets

The McGraw-Hill Companies, I nc., 2005

McGraw-Hill/I rwin

12-34

End of Chapter 12

Das könnte Ihnen auch gefallen

- Reporting The Statement of Cash FlowsDokument38 SeitenReporting The Statement of Cash FlowsElsa OngkowijoyoNoch keine Bewertungen

- Chapter 13Dokument59 SeitenChapter 13Asad AbbasNoch keine Bewertungen

- Financial Accounting Chapter 13Dokument59 SeitenFinancial Accounting Chapter 13Waqas MazharNoch keine Bewertungen

- Chapter 15Dokument56 SeitenChapter 15Vhinz Teneza100% (1)

- Appendix BDokument49 SeitenAppendix Bfahdmohammed707Noch keine Bewertungen

- Chap 013Dokument16 SeitenChap 013Jessica GonzalezNoch keine Bewertungen

- Chapter 5: Cash Flow StatementDokument41 SeitenChapter 5: Cash Flow StatementCharlie HoangNoch keine Bewertungen

- Acct 100 Chapter 5 S22Dokument23 SeitenAcct 100 Chapter 5 S22Cyntia ArellanoNoch keine Bewertungen

- Chapter FourDokument37 SeitenChapter FourbiyaNoch keine Bewertungen

- Cash Flow AnalysisDokument32 SeitenCash Flow AnalysisKok Wai YapNoch keine Bewertungen

- Topic 6 Cash Flow AnalysisDokument32 SeitenTopic 6 Cash Flow AnalysisLoges WarryNoch keine Bewertungen

- Financial Statement Analysis: K R Subramanyam John J WildDokument35 SeitenFinancial Statement Analysis: K R Subramanyam John J Wildchristina dwi setiaNoch keine Bewertungen

- Statement of Cash Flows: Powerpoint Authors: Brandy Mackintosh Lindsay HeiserDokument76 SeitenStatement of Cash Flows: Powerpoint Authors: Brandy Mackintosh Lindsay HeiserjohnnyezepNoch keine Bewertungen

- Principles of Accounting Chapter 13Dokument43 SeitenPrinciples of Accounting Chapter 13myrentistoodamnhigh100% (1)

- Financial Statement Analysis: K R Subramanyam John J WildDokument34 SeitenFinancial Statement Analysis: K R Subramanyam John J Wild'Pooe' Putri Kumala DewiNoch keine Bewertungen

- Cash FlowsDokument26 SeitenCash Flowsvickyprimus100% (1)

- Chapter07 - Cash Flow AnalysisDokument34 SeitenChapter07 - Cash Flow AnalysisKashaf Segar100% (1)

- Financial Statement Analysis: K R Subramanyam John J WildDokument34 SeitenFinancial Statement Analysis: K R Subramanyam John J WildAgus Tina100% (1)

- Power Notes: Statement of Cash FlowsDokument63 SeitenPower Notes: Statement of Cash FlowsRon ManNoch keine Bewertungen

- Lecture 5 - Cash Flow StatementDokument60 SeitenLecture 5 - Cash Flow StatementMutesa Chris100% (1)

- Dersnot 1372 1677580751Dokument34 SeitenDersnot 1372 1677580751Murat SiyahkayaNoch keine Bewertungen

- Statement of Cash Flows: Financial Accounting, Fifth EditionDokument45 SeitenStatement of Cash Flows: Financial Accounting, Fifth EditionPankaj KaliaNoch keine Bewertungen

- Statement of Cash Flows: Mcgraw-Hill/IrwinDokument64 SeitenStatement of Cash Flows: Mcgraw-Hill/IrwinUmm-e MughalNoch keine Bewertungen

- ACC101-Chapter12new 000 PDFDokument26 SeitenACC101-Chapter12new 000 PDFShibasundar Behera100% (1)

- Acc 255 Final Exam Review Packet (New Material)Dokument6 SeitenAcc 255 Final Exam Review Packet (New Material)Tajalli FatimaNoch keine Bewertungen

- Chapter 13 PowerPointDokument89 SeitenChapter 13 PowerPointcheuleee100% (1)

- Chapter 5 - Cash Flows - HandoutDokument53 SeitenChapter 5 - Cash Flows - HandoutĐứcAnhLêVũ100% (1)

- Unit 3Dokument73 SeitenUnit 3api-3698864100% (1)

- Cash Flow Statement-2015Dokument43 SeitenCash Flow Statement-2015Sudipta Chatterjee100% (1)

- The Statement of Cash Flows Chapter 12Dokument33 SeitenThe Statement of Cash Flows Chapter 12Rupesh PolNoch keine Bewertungen

- Cash Flow Statement Direct MethodDokument20 SeitenCash Flow Statement Direct MethodMidsy De la Cruz100% (1)

- Lesson 5:: Cash Flow Statement (CFS)Dokument17 SeitenLesson 5:: Cash Flow Statement (CFS)Franz BatulanNoch keine Bewertungen

- Statement of Cash FlowsDokument32 SeitenStatement of Cash FlowsMaryrose Ann CorpenNoch keine Bewertungen

- Cash Flow Accounts Final Project (2Dokument21 SeitenCash Flow Accounts Final Project (2KandaroliNoch keine Bewertungen

- Chapter 6 - Cash Flow Analysis LMSDokument40 SeitenChapter 6 - Cash Flow Analysis LMSamanthi gunarathna95Noch keine Bewertungen

- 3 CFSDokument65 Seiten3 CFSRocky Bassig100% (1)

- Chapters 4 B: Statement of Cash FlowsDokument81 SeitenChapters 4 B: Statement of Cash FlowsKrupaliNoch keine Bewertungen

- ACC501 - Lecture 22Dokument45 SeitenACC501 - Lecture 22Shivati Singh Kahlon100% (1)

- Wlof Hsac Gnitarepo Gncinfina: Jumble LettersDokument23 SeitenWlof Hsac Gnitarepo Gncinfina: Jumble LettersAce Soleil RiegoNoch keine Bewertungen

- CH 10Dokument29 SeitenCH 10Ratalos HunterzNoch keine Bewertungen

- ACC201 Financial AccountingDokument47 SeitenACC201 Financial AccountingG JhaNoch keine Bewertungen

- Chap 007Dokument33 SeitenChap 007Loser NeetNoch keine Bewertungen

- Statement of Cash Flow - Simple ExampleDokument5 SeitenStatement of Cash Flow - Simple ExampleVinnie VermaNoch keine Bewertungen

- $RGX46M0Dokument39 Seiten$RGX46M0Ngọc Tâm Anh đang học bài T.TNoch keine Bewertungen

- Chapter 12 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Dokument67 SeitenChapter 12 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais AzeemiNoch keine Bewertungen

- Subramanyam Chapter07Dokument34 SeitenSubramanyam Chapter07Saras Ina Pramesti100% (2)

- Chapter 12Dokument60 SeitenChapter 12Avreile Rabena100% (1)

- Financial Statement Analysis: K.R. SubramanyamDokument34 SeitenFinancial Statement Analysis: K.R. SubramanyamFitri SafiraNoch keine Bewertungen

- Statement of Changes in Financial Position: Cash Flow StatementDokument25 SeitenStatement of Changes in Financial Position: Cash Flow StatementCharu Arora100% (1)

- ABM 12 (Cash Flow Statement) CFSDokument6 SeitenABM 12 (Cash Flow Statement) CFSBianca DalipeNoch keine Bewertungen

- Chapter 13Dokument38 SeitenChapter 13Awrangzeb AwrangNoch keine Bewertungen

- 04 - Chapter 4 Cash Flow Financial PlanningDokument68 Seiten04 - Chapter 4 Cash Flow Financial Planninghunkie71% (7)

- Alwadi International School Accounting Grade 12 Notes: Statement of Cash FlowsDokument14 SeitenAlwadi International School Accounting Grade 12 Notes: Statement of Cash FlowsFarrukhsgNoch keine Bewertungen

- 4cash Flow StatementDokument8 Seiten4cash Flow StatementMarilyn Nelmida TamayoNoch keine Bewertungen

- FABM 2 Lesson 6 CFSDokument28 SeitenFABM 2 Lesson 6 CFSKia MorenoNoch keine Bewertungen

- Cash Flow Statments Lesson 16Dokument46 SeitenCash Flow Statments Lesson 16Charos Aslonovna100% (1)

- Statement of Cash Flows: Preparation, Presentation, and UseVon EverandStatement of Cash Flows: Preparation, Presentation, and UseNoch keine Bewertungen

- Summary of Richard A. Lambert's Financial Literacy for ManagersVon EverandSummary of Richard A. Lambert's Financial Literacy for ManagersNoch keine Bewertungen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Module I - TMDokument18 SeitenModule I - TMSonali JagathNoch keine Bewertungen

- UAE Financial System - Detail AnswerDokument9 SeitenUAE Financial System - Detail AnswerSonali JagathNoch keine Bewertungen

- Elements of Cost SheetDokument41 SeitenElements of Cost Sheetapi-2701408994% (18)

- Economic Crisis - Is Islamic Banking Really ImmuneDokument39 SeitenEconomic Crisis - Is Islamic Banking Really ImmuneSonali JagathNoch keine Bewertungen

- Finanical MathDokument41 SeitenFinanical MathSonali JagathNoch keine Bewertungen

- Financing StructureDokument25 SeitenFinancing StructureSonali JagathNoch keine Bewertungen

- Introduction To Cost Accounting - Module 1Dokument49 SeitenIntroduction To Cost Accounting - Module 1Sonali Jagath0% (1)

- Module 6 - NBFCDokument31 SeitenModule 6 - NBFCSonali JagathNoch keine Bewertungen

- Office Records ManagementDokument17 SeitenOffice Records ManagementSonali JagathNoch keine Bewertungen

- Capital Budgeting Analysis: CA. Sonali Jagath PrasadDokument63 SeitenCapital Budgeting Analysis: CA. Sonali Jagath PrasadSonali JagathNoch keine Bewertungen

- Business Ethics: Introduction To Human Value EthicsDokument13 SeitenBusiness Ethics: Introduction To Human Value EthicsSonali JagathNoch keine Bewertungen

- Resident - Benefits AllowableDokument10 SeitenResident - Benefits AllowableSonali JagathNoch keine Bewertungen

- 2015 11 SP Accountancy Solved 01Dokument4 Seiten2015 11 SP Accountancy Solved 01Siddharth JainNoch keine Bewertungen

- Module 1 - Overview of Financial System - UAEDokument44 SeitenModule 1 - Overview of Financial System - UAESonali Jagath100% (1)

- Module 1 - PerformanceofcontractDokument22 SeitenModule 1 - PerformanceofcontractSonali JagathNoch keine Bewertungen

- Role of Insurance in Economic DevelopmentDokument9 SeitenRole of Insurance in Economic Developmentm_dattaias81% (16)

- Employee Performance Review - Interview Questionnaire - Module 4Dokument5 SeitenEmployee Performance Review - Interview Questionnaire - Module 4Sonali JagathNoch keine Bewertungen

- Insurance MGMT - MODULE 1Dokument41 SeitenInsurance MGMT - MODULE 1Sonali Jagath100% (1)

- Role of Insurance in Economic DevelopmentDokument9 SeitenRole of Insurance in Economic Developmentm_dattaias81% (16)

- Accounting - Question PaperDokument8 SeitenAccounting - Question PaperSonali JagathNoch keine Bewertungen

- Module 4 - Multiple Job Order Cost SystemDokument24 SeitenModule 4 - Multiple Job Order Cost SystemSonali Jagath100% (1)

- Cost Sheet FormatDokument1 SeiteCost Sheet FormatSonali JagathNoch keine Bewertungen

- Module 4 - Multiple Job Order Cost SystemDokument24 SeitenModule 4 - Multiple Job Order Cost SystemSonali Jagath100% (1)

- Finanical MathDokument41 SeitenFinanical MathSonali JagathNoch keine Bewertungen

- Accounting - Question PaperDokument8 SeitenAccounting - Question PaperSonali JagathNoch keine Bewertungen

- Rapp 2011 TEREOS GBDokument58 SeitenRapp 2011 TEREOS GBNeda PazaninNoch keine Bewertungen

- OsciloscopioDokument103 SeitenOsciloscopioFredy Alberto Gómez AlcázarNoch keine Bewertungen

- Review of LiteratureDokument3 SeitenReview of LiteratureAbhimanyu Narayan RaiNoch keine Bewertungen

- Ticket: Fare DetailDokument1 SeiteTicket: Fare DetailSajal NahaNoch keine Bewertungen

- What Is The PCB Shelf Life Extending The Life of PCBsDokument9 SeitenWhat Is The PCB Shelf Life Extending The Life of PCBsjackNoch keine Bewertungen

- Managing Errors and ExceptionDokument12 SeitenManaging Errors and ExceptionShanmuka Sreenivas100% (1)

- Our Story Needs No Filter by Nagarkar SudeepDokument153 SeitenOur Story Needs No Filter by Nagarkar SudeepKavya SunderNoch keine Bewertungen

- Bagian AwalDokument17 SeitenBagian AwalCitra Monalisa LaoliNoch keine Bewertungen

- National Insurance Mediclaim Claim FormDokument4 SeitenNational Insurance Mediclaim Claim FormIhjaz VarikkodanNoch keine Bewertungen

- ABHA Coil ProportionsDokument5 SeitenABHA Coil ProportionsOctav OctavianNoch keine Bewertungen

- GrenTech Express Communication System Introduction 1.0Dokument30 SeitenGrenTech Express Communication System Introduction 1.0Son NguyenNoch keine Bewertungen

- HR Practices in Public Sector Organisations: (A Study On APDDCF LTD.)Dokument28 SeitenHR Practices in Public Sector Organisations: (A Study On APDDCF LTD.)praffulNoch keine Bewertungen

- MegaMacho Drums BT READ MEDokument14 SeitenMegaMacho Drums BT READ MEMirkoSashaGoggoNoch keine Bewertungen

- Agrinome For Breeding - Glossary List For Mutual Understandings v0.3 - 040319Dokument7 SeitenAgrinome For Breeding - Glossary List For Mutual Understandings v0.3 - 040319mustakim mohamadNoch keine Bewertungen

- 95-03097 Ballvlv300350 WCB PDFDokument26 Seiten95-03097 Ballvlv300350 WCB PDFasitdeyNoch keine Bewertungen

- Institutions and StrategyDokument28 SeitenInstitutions and StrategyFatin Fatin Atiqah100% (1)

- Coke Drum Repair Welch Aquilex WSI DCU Calgary 2009Dokument37 SeitenCoke Drum Repair Welch Aquilex WSI DCU Calgary 2009Oscar DorantesNoch keine Bewertungen

- Actron Vismin ReportDokument19 SeitenActron Vismin ReportSirhc OyagNoch keine Bewertungen

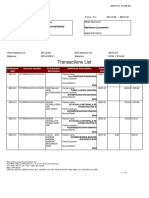

- Transactions List: Marilena Constantin RO75BRDE445SV93146784450 RON Marilena ConstantinDokument12 SeitenTransactions List: Marilena Constantin RO75BRDE445SV93146784450 RON Marilena ConstantinConstantin MarilenaNoch keine Bewertungen

- Previews 1633186 PreDokument11 SeitenPreviews 1633186 PreDavid MorenoNoch keine Bewertungen

- Ppap - 2556 PDFDokument7 SeitenPpap - 2556 PDFMohamed ElmakkyNoch keine Bewertungen

- BSNL BillDokument3 SeitenBSNL BillKaushik GurunathanNoch keine Bewertungen

- Employee of The Month.Dokument2 SeitenEmployee of The Month.munyekiNoch keine Bewertungen

- Leather PuppetryDokument8 SeitenLeather PuppetryAnushree BhattacharyaNoch keine Bewertungen

- 01 - TechDocs, Acft Gen, ATAs-05to12,20 - E190 - 202pgDokument202 Seiten01 - TechDocs, Acft Gen, ATAs-05to12,20 - E190 - 202pgေအာင္ ရွင္း သန္ ့Noch keine Bewertungen

- Ferobide Applications Brochure English v1 22Dokument8 SeitenFerobide Applications Brochure English v1 22Thiago FurtadoNoch keine Bewertungen

- Equilibrium of A Rigid BodyDokument30 SeitenEquilibrium of A Rigid BodyChristine Torrepenida RasimoNoch keine Bewertungen

- SPFL Monitoring ToolDokument3 SeitenSPFL Monitoring ToolAnalyn EnriquezNoch keine Bewertungen

- Punches and Kicks Are Tools To Kill The Ego.Dokument1 SeitePunches and Kicks Are Tools To Kill The Ego.arunpandey1686Noch keine Bewertungen

- Present Tenses ExercisesDokument4 SeitenPresent Tenses Exercisesmonkeynotes100% (1)