Beruflich Dokumente

Kultur Dokumente

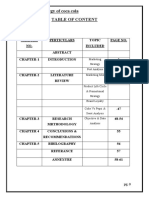

Financial Risk Management: Course Syllabus

Hochgeladen von

Raj ParekhOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Risk Management: Course Syllabus

Hochgeladen von

Raj ParekhCopyright:

Verfügbare Formate

Financial Risk Management

Course Syllabus

Personal Information

Instructor Name: Ming-Yuan Leon Li

Instructor Tel: Ext 53421

E-mail: lmyleon@mail.ncku.edu.tw

Office Hours:

Wednesday: 10:00-12:00 AM

Office Number: 63315

Course Descriptions/Objectives

Help students to better understand the topic

relating to financial risk management by

textbook studying and extra handouts.

The goals of this course are the following

Provide quick access to the whys and how of risk

management

Provide easy-to-understand information, including

equations and examples that can be quickly applied

to most risk management problems.

Provide information about how risk measurement is

used in the management of risk and profitability

Course Descriptions/Objectives

After studying the course , you should be

able to answer the following four questions

How much could we lose

Can we absorb a significant loss without

going bankrupt

Is the return high enough for us to take risk

How can we reduce the risk without

significantly reducing the return

Grading

1st Exam (25%): held in the 7th week

2nd Exam (25%): held in the 13th week

3rd Exam (30%): held in the 18th week

Class participation (20%)

Grading

Class participation

Homework

Writing report and/or oral report

Quick Quiz

In the ending of each chapter, I will

provide a quick quiz including several

simple questions to review today's

content

Your performance will be evaluated into

your score

Textbook

Chris Marrison, Fundamental of Risk

Measurement

Book store:

Mr. , 0936-968488

TEL: 02-2381-9277

Course Calendar/Schedule

Before 1st Exam:

The Basic of Risk Management (Ch 1 to Ch 2)

Market Risk Management (Ch 5 to Ch 8)

Between 1st and 2nd Exam:

Market Risk Management (Ch 9 to Ch 11)

Asset Liability Risk Management (Ch 12 to Ch 13)

After 2nd Exam:

Asset Liability Risk Management (Ch 13 to Ch 15)

Credit Risk Management (Ch 15 to Ch 19)

Course Policies

The purpose of this class is to identify the hidden

agenda in this subject

I will follow the textbook to present the important

topics of risk management, especially for banks

It is expected that every student attend all

classes and take all examinations when

scheduled

In order to maximize your learning and to

receive credit for your classes, you must attend

at least 80% of classes

Slides

The slides in PowerPoint file

How to find them

My personal web-site

http://140.116.51.3/chinese/faculty/mingyuan/

myweb11/index.htm

Some suggestions

Download them and study them before the

class

Certain Important Perspectives

Review

What is the risk?

A potential loss in the future

How to measure the risk

Use the historical data to simulate the distribution of

return rate of your portfolio

For example, 2-year data to picture the distribution

curve

Assume the return rate in the next trading day will be

drawn from the same distribution

How to picture the distribution?

Mean and Standard errors

Correlation coefficients

Some Important Perspectives

Review

Two Examples

The daily return rates of U.S. S&P 500 stock

index

The daily return rates of Taiwan company:

Acer 2353

Distribution of Return Rate for U.S. Market

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

-4 -3 -2 -1 0 1 2 3 4

Use 2-yea data (near 500

daily return rates data) to

simulate the underlying

distribution of return rates

of our portfolio

R

t

, for t=1 to 500

Assume the return

rate in the next

trading day is drawn

from the same

distribution

Rt, for t=501,502,

Standard

error,

Standard

error,

If we assume the return

rate follows the normal

distribution, then the

potential loss can be

presented by standard

error

Distribution of Return Rate for U.S. Market

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

-4 -3 -2 -1 0 1 2 3 4

Standard

error,

(0.94%)

Standard

error,

(1)If we assume the return rate follows the normal distribution, then the potential

loss can be presented by standard error

(2) The P[ return rate<-2.33X]=1%

The P[ return rate<-1.96X]=2.5%

The P[ return rate<-1.645X]=5%

(3) If we assume the initial investment money is 100,000, the loss

of >100,000X 2.33X in the next day will have 1% probability of occurrences

Homework (1)

Please pick up one company

Figure the distributions of their daily stock price

returns

One-year daily data at least

Estimate its mean and standard error

Assume the initial investment is 1 million dollars

(1,000,000)

Calculate the potential 1% loss in the next day

Homework (1)

Does the distribution follow a normal

distribution?

Normalize the returns: (returns-mean)/SD

The 1% critical value of the distribution vs.

2.33

More Discussions

One asset versus Portfolio?

Variance and covariance/correlation

Risk contribution?

stock: 100 units, bond: 50 units;

Q: a portfolio=stock + bond: 150 units?

Normal distribution?

Other types of risk?

Structure of Financial Risk

Management

Define the risk

Market risk

ALM risk

ALM interest rate risk

ALM liquidity risk

Credit risk

Measure the risk

Use the historical data to picture the

distribution of the loss

Structure of Financial Risk

Management

Manage the risk

Reduce the risk

Hedge

Diversification

Capital preparation

Risk allocation

Which unit takes the risk?

Performance evaluation

Risk-adjusted performance

Market Risk

Credit Risk

Floating rate vs. Fixed rate:

interest rate risk

Long-term vs. short-term: Liquidity Risk

Das könnte Ihnen auch gefallen

- Business Valuation and Analysis Using Financial StatementsDokument20 SeitenBusiness Valuation and Analysis Using Financial Statementsrovvy85Noch keine Bewertungen

- BA 190 Course Outline 0120Dokument9 SeitenBA 190 Course Outline 0120Sophia TayagNoch keine Bewertungen

- Understanding Risk and Risk ManagementDokument30 SeitenUnderstanding Risk and Risk ManagementSemargarengpetrukbagNoch keine Bewertungen

- Data Analytics PPT 1Dokument7 SeitenData Analytics PPT 1Vicky100% (1)

- Data Analytics - Intro To Key ConceptsDokument17 SeitenData Analytics - Intro To Key ConceptsVickyNoch keine Bewertungen

- BEPP 305 805 Lecture 1Dokument57 SeitenBEPP 305 805 Lecture 1Brandon WalkerNoch keine Bewertungen

- Risk AnalysisDokument13 SeitenRisk AnalysisSamar PratapNoch keine Bewertungen

- UC Berkeley Econ 136 Financial EconomicsDokument8 SeitenUC Berkeley Econ 136 Financial EconomicsateiskaNoch keine Bewertungen

- EFB334 Lecture01, IntroductionDokument31 SeitenEFB334 Lecture01, IntroductionTibet LoveNoch keine Bewertungen

- ICT110 Task 2 2017pdf 6910Dokument6 SeitenICT110 Task 2 2017pdf 6910Anupam KumarNoch keine Bewertungen

- FRM Unit-2Dokument31 SeitenFRM Unit-2prasanthi CNoch keine Bewertungen

- Data Analysis: - Describing Data and DatasetsDokument15 SeitenData Analysis: - Describing Data and DatasetsTarig GibreelNoch keine Bewertungen

- Syllabus 5161 MasterDokument13 SeitenSyllabus 5161 Masterhsnpdr365Noch keine Bewertungen

- Hydro OneDokument28 SeitenHydro Onefruitnuts67% (3)

- Strategic - Risk MGMTDokument23 SeitenStrategic - Risk MGMTNiraj AcharyaNoch keine Bewertungen

- Week 11 RevisionDokument26 SeitenWeek 11 RevisionCJ NzeNoch keine Bewertungen

- Quantitative and Qualitative Factors in Managerial Decision MakingDokument12 SeitenQuantitative and Qualitative Factors in Managerial Decision MakingPriya Ranjan KumarNoch keine Bewertungen

- Week 3 External Risk ManagementDokument20 SeitenWeek 3 External Risk ManagementHristo DimitrovNoch keine Bewertungen

- Information Technology Project Management: by Jack T. MarchewkaDokument44 SeitenInformation Technology Project Management: by Jack T. Marchewkadeeps0705Noch keine Bewertungen

- Lecture Three RiskDokument98 SeitenLecture Three RiskEyoel AsmeromNoch keine Bewertungen

- Lesson I, Engineering EconomyDokument79 SeitenLesson I, Engineering EconomytheoristanNoch keine Bewertungen

- IntroductionDokument26 SeitenIntroductionjk_rentzkeNoch keine Bewertungen

- Lazer - Syllabus FSA - OY - 2023 - RUNIDokument5 SeitenLazer - Syllabus FSA - OY - 2023 - RUNIכפיר בר לבNoch keine Bewertungen

- Policy, Strategy, Tactics and BCPDokument36 SeitenPolicy, Strategy, Tactics and BCPKaruna ShresthaNoch keine Bewertungen

- Applied StatisticsDokument46 SeitenApplied Statisticscreation portalNoch keine Bewertungen

- Deck1 - IntroductionDokument15 SeitenDeck1 - Introductionjjwright3Noch keine Bewertungen

- Cyber Security ManagementDokument33 SeitenCyber Security ManagementMahesh KashyapNoch keine Bewertungen

- Lecture 3 - ARM 2022-23-1Dokument51 SeitenLecture 3 - ARM 2022-23-1Francisca PereiraNoch keine Bewertungen

- Osd Pa&E Osd Pa&EDokument15 SeitenOsd Pa&E Osd Pa&EAgnes GamboaNoch keine Bewertungen

- Managerial Decision Modeling With SpreadsheetsDokument11 SeitenManagerial Decision Modeling With SpreadsheetsDevan BhallaNoch keine Bewertungen

- CRODokument38 SeitenCROminaevilNoch keine Bewertungen

- Accounting 101 IntroductionDokument35 SeitenAccounting 101 IntroductionBob McCawlhNoch keine Bewertungen

- Instructor: Dr. Nancy Ruff Email: Phone: 770-781-2264 Ext: 100213 Room: 213Dokument3 SeitenInstructor: Dr. Nancy Ruff Email: Phone: 770-781-2264 Ext: 100213 Room: 213Kishori RaoNoch keine Bewertungen

- MBA15.402 Syllabus 2Dokument8 SeitenMBA15.402 Syllabus 2Mimo ZizoNoch keine Bewertungen

- Lecture 1Dokument39 SeitenLecture 1TusharNoch keine Bewertungen

- Case Study AnalysisDokument32 SeitenCase Study Analysisferroal93% (29)

- Impact of RiskDokument16 SeitenImpact of RiskRakha Alzena zayyanNoch keine Bewertungen

- Crisis Management: How Would You Cope'?Dokument32 SeitenCrisis Management: How Would You Cope'?KawaduhokiNoch keine Bewertungen

- Week 2-Credit Risk Analysis1Dokument41 SeitenWeek 2-Credit Risk Analysis1Senuri Almeida0% (1)

- Business Analytics for ManagersDokument7 SeitenBusiness Analytics for ManagersRajeshNoch keine Bewertungen

- Econ2209 Week 1Dokument28 SeitenEcon2209 Week 1jinglebelliezNoch keine Bewertungen

- Miller Syllabus 204-004 FA18-2Dokument6 SeitenMiller Syllabus 204-004 FA18-2Hotdogie5684Noch keine Bewertungen

- FIN3102 01 IntroductionDokument88 SeitenFIN3102 01 IntroductioncoffeedanceNoch keine Bewertungen

- Case Study AnalysisDokument32 SeitenCase Study AnalysisMichelle GoNoch keine Bewertungen

- 14.750x Syllabus 2019Dokument8 Seiten14.750x Syllabus 2019carlos merlanoNoch keine Bewertungen

- Corporate Finance SyllabusDokument15 SeitenCorporate Finance SyllabusgosangNoch keine Bewertungen

- VMBE2014 Managerial Economics Unit Guide Sept2019Dokument12 SeitenVMBE2014 Managerial Economics Unit Guide Sept2019Prateek GehlotNoch keine Bewertungen

- Intermediate Financial ModellingDokument95 SeitenIntermediate Financial ModellingWilliam WilliamsonNoch keine Bewertungen

- MGMT 223: Business Strategy Syllabus - Fall 2021: Instructor Saerom (Ronnie) LeeDokument18 SeitenMGMT 223: Business Strategy Syllabus - Fall 2021: Instructor Saerom (Ronnie) LeeSanketNoch keine Bewertungen

- Prasad KodaliDokument9 SeitenPrasad KodalijtnylsonNoch keine Bewertungen

- Wealth Management PlanDokument18 SeitenWealth Management PlanVinod PandeyNoch keine Bewertungen

- IS-344 Week 3 Agenda and Course OverviewDokument110 SeitenIS-344 Week 3 Agenda and Course OverviewFaded RianbowNoch keine Bewertungen

- Eng 111 Syllabus PDFDokument3 SeitenEng 111 Syllabus PDFnadimNoch keine Bewertungen

- IB RiskMgmt FinalDokument33 SeitenIB RiskMgmt FinalMelzer CreadoNoch keine Bewertungen

- Mayer Fund: Class of 2009 Recruiting PresentationDokument15 SeitenMayer Fund: Class of 2009 Recruiting PresentationgudunNoch keine Bewertungen

- AcF 304-22-23 Revision SessionDokument39 SeitenAcF 304-22-23 Revision Session郭晶Noch keine Bewertungen

- Risk and Risk ManagementDokument32 SeitenRisk and Risk ManagementAnandNoch keine Bewertungen

- 10 Fall MGT 6090Dokument4 Seiten10 Fall MGT 6090viveklumbaNoch keine Bewertungen

- INSTITUTIONAL RISK ANALYSISDokument24 SeitenINSTITUTIONAL RISK ANALYSISAbebe TilahunNoch keine Bewertungen

- Mikes Bikes Lessons LearnedDokument8 SeitenMikes Bikes Lessons LearnedJagadish SambandanNoch keine Bewertungen

- Mikes Bikes Lessons LearnedDokument8 SeitenMikes Bikes Lessons LearnedJagadish SambandanNoch keine Bewertungen

- ,case Study Icici BankDokument40 Seiten,case Study Icici BankRuchika Garg67% (3)

- Which Australian Companies Are Thriving in ThailandDokument56 SeitenWhich Australian Companies Are Thriving in ThailandRaj ParekhNoch keine Bewertungen

- Advanced Lean Delivering Value To Customers in The Shortest Turn Around Time - Toyota ModelDokument101 SeitenAdvanced Lean Delivering Value To Customers in The Shortest Turn Around Time - Toyota ModelRaj ParekhNoch keine Bewertungen

- Companies Act, 1956Dokument82 SeitenCompanies Act, 1956Raj Parekh100% (1)

- Ratio Analysis PDFDokument7 SeitenRatio Analysis PDFRaj ParekhNoch keine Bewertungen

- Roger's ChocolateDokument6 SeitenRoger's ChocolateCatalina Tapia100% (1)

- Procter and Gamble CBDDokument10 SeitenProcter and Gamble CBDalina_rauleaNoch keine Bewertungen

- Key Concepts in Marketing: Maureen Castillo Dyna Enad Carelle Trisha Espital Ethel SilvaDokument35 SeitenKey Concepts in Marketing: Maureen Castillo Dyna Enad Carelle Trisha Espital Ethel Silvasosoheart90Noch keine Bewertungen

- Costing Accounting ProblemsDokument3 SeitenCosting Accounting Problemstrixie maeNoch keine Bewertungen

- Assignment of Advertisement and PromotionDokument16 SeitenAssignment of Advertisement and PromotionMoin UddinNoch keine Bewertungen

- Basic Framework of Management Accounting: Prof. Mark Jing D. Tayactac, CPA, MBA, MDMDokument10 SeitenBasic Framework of Management Accounting: Prof. Mark Jing D. Tayactac, CPA, MBA, MDMMaria Christina CandelarioNoch keine Bewertungen

- Swot-Tows Workshop: Strategic Audit FrameworkDokument24 SeitenSwot-Tows Workshop: Strategic Audit FrameworkGiang Nguyễn HươngNoch keine Bewertungen

- Nissan Cogent Case Study of Supply Chain ManagementDokument10 SeitenNissan Cogent Case Study of Supply Chain ManagementZeeshan Majeed Butt100% (2)

- TG Customer Relationship WORDDokument2 SeitenTG Customer Relationship WORDLouiseNoch keine Bewertungen

- Adjusting Journal EntriesDokument11 SeitenAdjusting Journal EntriesKatrina RomasantaNoch keine Bewertungen

- DRHP - JSW Infrastructure Limited - 09!05!2023 - 20230510205626Dokument525 SeitenDRHP - JSW Infrastructure Limited - 09!05!2023 - 20230510205626raghulNoch keine Bewertungen

- Cost Accounting - Chapter 10Dokument14 SeitenCost Accounting - Chapter 10xxxxxxxxx67% (6)

- ICAZ Guidance On Code of Ethics and Other Professional Conduct RequiremeDokument6 SeitenICAZ Guidance On Code of Ethics and Other Professional Conduct RequiremePrimrose NgoshiNoch keine Bewertungen

- Unit 3 Production and Cost AnalysisDokument6 SeitenUnit 3 Production and Cost Analysismanjunatha TK100% (1)

- Principles of Marketing 1 16Dokument138 SeitenPrinciples of Marketing 1 16Tran Thanh Thao (K16 DN)Noch keine Bewertungen

- 7 Int Parity RelationshipDokument40 Seiten7 Int Parity RelationshipumangNoch keine Bewertungen

- YCMOU Dec 2019 M.Com exam timetableDokument1 SeiteYCMOU Dec 2019 M.Com exam timetableamol nimaseNoch keine Bewertungen

- Ukpr19 Disney Emea BriefDokument2 SeitenUkpr19 Disney Emea Briefapi-457838992Noch keine Bewertungen

- Gym Business Plan 2023Dokument36 SeitenGym Business Plan 2023cobbymarkNoch keine Bewertungen

- CEMA Brochure PDFDokument2 SeitenCEMA Brochure PDFKumar RajputNoch keine Bewertungen

- Detect Financial Fraud and ErrorsDokument11 SeitenDetect Financial Fraud and ErrorsIvan LandaosNoch keine Bewertungen

- Chapter 4 MNGT 8Dokument26 SeitenChapter 4 MNGT 8Angel MaghuyopNoch keine Bewertungen

- Chandni Pie Coca-Cola ProjectDokument61 SeitenChandni Pie Coca-Cola ProjectRaghunath AgarwallaNoch keine Bewertungen

- Strategic AllianceDokument12 SeitenStrategic AllianceMadhura GiraseNoch keine Bewertungen

- Presented by Minal Neswankar Jivika Thakur Preeti WaghmodeDokument21 SeitenPresented by Minal Neswankar Jivika Thakur Preeti WaghmodeJivika ThakurNoch keine Bewertungen

- Porter's 5 Forces Step by StepDokument6 SeitenPorter's 5 Forces Step by StepDanielle Williams100% (2)

- Vertical Integration in Apparel IndustryDokument15 SeitenVertical Integration in Apparel IndustryAyushi ShuklaNoch keine Bewertungen

- Accounting For Management: Total No. of Questions 17Dokument2 SeitenAccounting For Management: Total No. of Questions 17vikramvsuNoch keine Bewertungen

- Table - 23-7: Schedule 1g: Ending Inventories Budget, First Quarter, 20XXDokument4 SeitenTable - 23-7: Schedule 1g: Ending Inventories Budget, First Quarter, 20XXeahpotNoch keine Bewertungen

- PetMeds Analysis 2Dokument10 SeitenPetMeds Analysis 2Марго КоваленкоNoch keine Bewertungen