Beruflich Dokumente

Kultur Dokumente

Management Accounting

Hochgeladen von

jazzmahbubOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Management Accounting

Hochgeladen von

jazzmahbubCopyright:

Verfügbare Formate

1

MBA_508

Management

Accounting

2

Cost accounting systems:

Job-Order System

3

3

Manufacturing Firms & Service Firms

Manufacturing involves joining together direct

materials, direct labour, and overhead to produce a

new product. The product is tangible and can be

inventoried.

A service is intangible. It cannot be separated from

the customer and cannot be inventoried.

Managers must be able to track the costs of services

rendered just as precisely as they must track the

costs of goods manufactured.

4

Features of service firms

5

Unique versus Standardized Products and

Services

Firms that produce unique products in small batches that

incur different product costs must track the costs of each

product or batch separately. This is called a job-order

costing system.

Examples: Cabinet makers, home builders, dental and

medical services

6

Unique versus Standardized Products

and Services

Some firms produce identical units of the same product.

The costs of each unit are also the same. This is called a

process-costing costing system.

Examples: Food, cement, petroleum and chemicals

7

The three functions of a cost accounting system

Relationship of Cost Accumulation, Cost Measure- ment,

and Cost Assignment

The cost accounting system must

satisfy the needs for cost

accumulation, cost measurement and

cost assignment.

8

The three functions of a cost accounting system

Cost accumulation refers to the recognition and

recording of costs. Source documents can be

designed to supply information that can be used for

multiple purposes.

Cost measurement refers to classifying the costs

and determining the dollar amounts for direct

materials, direct labor and overhead.

Cost measurement methods:

Actual costing

Normal costing

9

The three functions of a cost accounting system

Cost assignment occurs after costs have been

accumulated and measured. Total product costs

associated with the units is divided by the number of

units produced to determine unit cost.

Unit costs in manufacturing firms are used for:

Valuing inventory

Determining income

Decision making

Unit costs in non-manufacturing firms are used for:

Determining profitability

Determining feasibility of new services

10

Components of unit cost (normal costing)

Unit cost is made up of

direct materials

direct labour

overhead

Overhead is applied using a predetermined rate based on

budgeted overhead costs and budgeted amount of driver.

Commonly used drivers include:

1. Units produced

2. Direct labour hours

3. Direct labour dollars

4. Machine hours

5. Direct materials dollars or cost

traced directly to units

11

Overview of the Job-Order Costing System

Job-order industries produce a wide variety of products

or jobs that are distinct.

Costs are accumulated by job in a job-order costing

system. Each job is documented on a job-order cost

sheet.

Total manufacturing costs for the job are divided by the

number of units produced to determine unit cost.

The work-in-process inventory is the collection of all

job-order cost sheets.

12

The Job-Order Cost Sheet

13

Materials Requisition Form

14

Time Ticket

15

Assignment of overhead

Overhead is assigned to jobs using a

predetermined overhead rate. The actual amount

of the driver used as a base must be collected and

recorded.

16

Summary of Direct Materials Cost Flows

+

=

17

Summary of Direct Labor Cost Flows

+

=

18

Summary of Overhead Cost Flows

+

=

19

Completed Job-Order Cost Sheet

20

Summary of Finished Goods Cost Flows

21

Statement of Cost of Goods Manufactured

22

Job-Order Costing:

Specific Cost Flow

Description

Statement of Cost of Goods Manufactured

23

Job-Order Costing:

Specific Cost Flow

Description

Statement of Cost of Goods Manufactured

24

Job-Order Costing:

Specific Cost Flow

Description

Statement of Cost of Goods Manufactured

25

Statement of Cost of Goods Manufactured

26

Statement of Cost of Goods Sold

27

All Signs Company Summary of Manufacturing Cost Flows

28

Income Statement

29

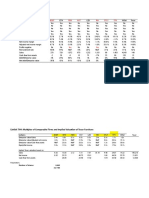

Departmental Overhead Costs and Activity

=

Plantwide

overhead rate

$240,000

20,000

= $12 per direct labor hour

Department A

overhead rate

=

$60,000

15,000

= $4 per direct labor hour

Department B

overhead rate

=

$180,000

15,000

= $12 per machine hour

30

Production Data for Jobs 23 and 24

Job 23 overhead: $4 500 DLH = $2,000

Job 24 overhead: $12 500 M/H = $6,000

31

Department A Department B

Overhead cost $60,000 $180,000

Cost driver 15,000 DLH 15,000 MHr

Department overhead rate $4/DLH $12/MHr

Overhead applied to Job 23 $2,000

Overhead applied to Job 24 $6,000

Overhead assigned using multiple

overhead rates

32

Compare to overhead assigned using a single overhead rate:

Job 23 overhead: $12 500 DLH = $6,000

Job 24 overhead: $12 1 DLH = $12

Department A Department B

Overhead cost $60,000 $180,000

Cost driver 15,000 DLH 15,000 MHr

Department overhead rate $4/DLH $12/MHr

Overhead applied to Job 23 $2,000

Overhead applied to Job 24 $6,000

Overhead assigned using multiple

overhead rates

33

Recap Module 3

The production process and the cost

accounting system

Job order costing Vs Process costing

The three functions of a cost acct system:

Cost accumulation

Cost measurement

Cost assignment

Job order costing procedures

Single Vs multiple overhead rates

Das könnte Ihnen auch gefallen

- Cost-Chapter 4 NewDokument18 SeitenCost-Chapter 4 NewYonas AyeleNoch keine Bewertungen

- Job Costing Problems For Practice - CMADokument22 SeitenJob Costing Problems For Practice - CMAShreyansh Priyam75% (4)

- Cost of Equity Risk Free Rate of Return + Beta × (Market Rate of Return - Risk Free Rate of Return)Dokument7 SeitenCost of Equity Risk Free Rate of Return + Beta × (Market Rate of Return - Risk Free Rate of Return)chatterjee rikNoch keine Bewertungen

- Bandy How To Build Trading SysDokument113 SeitenBandy How To Build Trading SysJack ParrNoch keine Bewertungen

- Job OrdercostingDokument31 SeitenJob OrdercostingGunawan Setio PurnomoNoch keine Bewertungen

- Job Order and Process CostingDokument47 SeitenJob Order and Process CostingdarunNoch keine Bewertungen

- Systems Design: Job-Order CostingDokument46 SeitenSystems Design: Job-Order CostingRafay Salman MazharNoch keine Bewertungen

- Module 4 - Multiple Job Order Cost SystemDokument24 SeitenModule 4 - Multiple Job Order Cost SystemSonali Jagath100% (1)

- Ac102 ch2Dokument21 SeitenAc102 ch2Fisseha GebruNoch keine Bewertungen

- Introduction To Cost Accounting: MeaningDokument11 SeitenIntroduction To Cost Accounting: MeaningTejas YeoleNoch keine Bewertungen

- Q.9. Differentiate Direct Cost and Direct Costing?Dokument10 SeitenQ.9. Differentiate Direct Cost and Direct Costing?Hami KhaNNoch keine Bewertungen

- Cost 1 Chapt-3 - 1Dokument38 SeitenCost 1 Chapt-3 - 1Tesfaye Megiso BegajoNoch keine Bewertungen

- Asiment SolutionDokument4 SeitenAsiment Solutionmansoor1307100% (1)

- Cost 1 Chapt-3Dokument43 SeitenCost 1 Chapt-3Tesfaye Megiso BegajoNoch keine Bewertungen

- Accounting and Finance-1Dokument36 SeitenAccounting and Finance-1Rao Zaheer100% (1)

- Job Order CostingDokument6 SeitenJob Order CostingJomar Teneza100% (1)

- Managerial Accounting: Chapter 2: Job Order Costing - Calculating Unit Product CostsDokument5 SeitenManagerial Accounting: Chapter 2: Job Order Costing - Calculating Unit Product CostsBogdan MorosanNoch keine Bewertungen

- Lesson 10 Costing SystemsDokument8 SeitenLesson 10 Costing SystemsSuhanna DavisNoch keine Bewertungen

- Slide of Chapter 2Dokument19 SeitenSlide of Chapter 2Uyen ThuNoch keine Bewertungen

- MANAC Session-4Dokument29 SeitenMANAC Session-4Aastha SharmaNoch keine Bewertungen

- ACCY121FinalExamInstrManualchs9!11!13 16 AppendixDokument115 SeitenACCY121FinalExamInstrManualchs9!11!13 16 AppendixArun MozhiNoch keine Bewertungen

- CH 4Dokument72 SeitenCH 4Chang Chan ChongNoch keine Bewertungen

- CH.3 COMM 305 Managerial AccountingDokument19 SeitenCH.3 COMM 305 Managerial Accountingryry1616Noch keine Bewertungen

- CH 9 Factory Overhead - 2Dokument43 SeitenCH 9 Factory Overhead - 2Rana Umair67% (3)

- Activity Based CostingDokument35 SeitenActivity Based Costingpiyush_ckNoch keine Bewertungen

- Job Batch CostingDokument21 SeitenJob Batch CostingsamiNoch keine Bewertungen

- Activity-Based Costing SystemDokument35 SeitenActivity-Based Costing SystemAhmad Tariq Bhatti100% (1)

- Factory Overhead - RFDDokument32 SeitenFactory Overhead - RFDSamantha DionisioNoch keine Bewertungen

- Module For Managerial Accounting-Job Order CostingDokument17 SeitenModule For Managerial Accounting-Job Order CostingMary De JesusNoch keine Bewertungen

- Cost Accounting Normal Job Costing: Presented By: Umut Korkuter & Sina BakhshalianDokument35 SeitenCost Accounting Normal Job Costing: Presented By: Umut Korkuter & Sina BakhshalianBurakhan YanıkNoch keine Bewertungen

- Chapter 10Dokument11 SeitenChapter 10clarice razonNoch keine Bewertungen

- Mowen Chapter 4Dokument49 SeitenMowen Chapter 4Dhani SardonoNoch keine Bewertungen

- Activity-Based CostingDokument49 SeitenActivity-Based CostingKartika Wulandari IINoch keine Bewertungen

- Principles of Accounting Chapter 17Dokument42 SeitenPrinciples of Accounting Chapter 17myrentistoodamnhighNoch keine Bewertungen

- Ac102 Rev01-03Dokument24 SeitenAc102 Rev01-03Aaron DownsNoch keine Bewertungen

- CVP PrintDokument32 SeitenCVP Printstef van der veerNoch keine Bewertungen

- Steps in Job CostingDokument8 SeitenSteps in Job CostingBhagaban DasNoch keine Bewertungen

- Lecture 3 - Cost & Management Accounting - March 3, 2019 - 3pm To 6pmDokument3 SeitenLecture 3 - Cost & Management Accounting - March 3, 2019 - 3pm To 6pmBhunesh KumarNoch keine Bewertungen

- TB ch02 5e MADokument8 SeitenTB ch02 5e MAعبدالله ماجد المطارنهNoch keine Bewertungen

- Cost I Chapter 4 Bproviding End To End Reliable Communication Is The Function of The TransportDokument19 SeitenCost I Chapter 4 Bproviding End To End Reliable Communication Is The Function of The TransportTahir DestaNoch keine Bewertungen

- Utilisation of Product Costing Systems in The Manufacturing IndustryDokument15 SeitenUtilisation of Product Costing Systems in The Manufacturing Industryrina00Noch keine Bewertungen

- Mrac211 Midterm Concepts For ReviewDokument3 SeitenMrac211 Midterm Concepts For Reviewlunamae evangelistaNoch keine Bewertungen

- اسئلهIMA الهامهDokument31 SeitenاسئلهIMA الهامهhmza_6Noch keine Bewertungen

- JOB, BATCH AND SERVICE COSTING-lesson 11Dokument22 SeitenJOB, BATCH AND SERVICE COSTING-lesson 11Kj NayeeNoch keine Bewertungen

- 401Dokument7 Seiten401Justine Louise Bravo FerrerNoch keine Bewertungen

- C.A-I Chapter-3Dokument38 SeitenC.A-I Chapter-3Tariku KolchaNoch keine Bewertungen

- ABC CostingDokument2 SeitenABC CostingChrissa Marie VienteNoch keine Bewertungen

- CH4 - Job Order Costing and Overheads ApplicationDokument51 SeitenCH4 - Job Order Costing and Overheads ApplicationYMNoch keine Bewertungen

- Chapter 3 Cost IDokument64 SeitenChapter 3 Cost IBikila MalasaNoch keine Bewertungen

- Job Order Costing SystemDokument4 SeitenJob Order Costing Systemgosaye desalegnNoch keine Bewertungen

- 4672 4986 - Rajasekaran Cost Accounting Supplements Important FormulaeDokument16 Seiten4672 4986 - Rajasekaran Cost Accounting Supplements Important FormulaeKunal SharmaNoch keine Bewertungen

- Cost Sheet PDFDokument17 SeitenCost Sheet PDFRajuSharmiNoch keine Bewertungen

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageVon EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageBewertung: 5 von 5 Sternen5/5 (1)

- Cost Management: A Case for Business Process Re-engineeringVon EverandCost Management: A Case for Business Process Re-engineeringNoch keine Bewertungen

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesVon EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNoch keine Bewertungen

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesVon EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Cost & Managerial Accounting II EssentialsVon EverandCost & Managerial Accounting II EssentialsBewertung: 4 von 5 Sternen4/5 (1)

- Controllership: The Work of the Managerial AccountantVon EverandControllership: The Work of the Managerial AccountantNoch keine Bewertungen

- Please Read CarefullyDokument6 SeitenPlease Read CarefullyjazzmahbubNoch keine Bewertungen

- East West University: MBA Program Integrated Marketing Communication (IMC)Dokument1 SeiteEast West University: MBA Program Integrated Marketing Communication (IMC)jazzmahbubNoch keine Bewertungen

- Mymensingh DealerDokument2 SeitenMymensingh DealerjazzmahbubNoch keine Bewertungen

- Lecture1 Economy Summer2014Dokument8 SeitenLecture1 Economy Summer2014jazzmahbubNoch keine Bewertungen

- Submitted ToDokument1 SeiteSubmitted TojazzmahbubNoch keine Bewertungen

- Teuer B DataDokument41 SeitenTeuer B DataAishwary Gupta100% (1)

- Teens and Credit Card Debt Passage and WKSHTDokument2 SeitenTeens and Credit Card Debt Passage and WKSHTmillboarNoch keine Bewertungen

- Exercises1 BFNDC002 Time Value of Money - Simon, JusthineDokument13 SeitenExercises1 BFNDC002 Time Value of Money - Simon, JusthineJohn Dexter SimonNoch keine Bewertungen

- Smart ConsensusDokument1 SeiteSmart ConsensusKarthikKrishnanNoch keine Bewertungen

- Master Thesis Maarten VD WaterDokument92 SeitenMaster Thesis Maarten VD WaterkennemerNoch keine Bewertungen

- Travel Hunt Mail - 01 Night 02 Days Yercaud Tour Package - Travel HuntDokument2 SeitenTravel Hunt Mail - 01 Night 02 Days Yercaud Tour Package - Travel HuntsalesNoch keine Bewertungen

- PFR - 5 MW Solar of Milisaty Vinimay Pvt. LTDDokument11 SeitenPFR - 5 MW Solar of Milisaty Vinimay Pvt. LTDpvpavanNoch keine Bewertungen

- TA DA RulesDokument54 SeitenTA DA RulesSheikh InayatNoch keine Bewertungen

- Quiz 9Dokument3 SeitenQuiz 9朱潇妤100% (1)

- Project On Indian Financial MarketDokument44 SeitenProject On Indian Financial MarketParag More85% (13)

- Greetings From ICICI BankDokument3 SeitenGreetings From ICICI BankNitin MathurNoch keine Bewertungen

- IDBI Bank: This Article Has Multiple Issues. Please HelpDokument15 SeitenIDBI Bank: This Article Has Multiple Issues. Please HelpmayurivinothNoch keine Bewertungen

- KCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Dokument24 SeitenKCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Avani Raju Baai0% (1)

- Dvs Minutes - September 19 2013Dokument3 SeitenDvs Minutes - September 19 2013api-124277777Noch keine Bewertungen

- A Study On Technical Analysis As An Indicator For Investment Decision-MakingDokument69 SeitenA Study On Technical Analysis As An Indicator For Investment Decision-MakingHarshil Sanghavi100% (1)

- De Beers Insight Report 2014 PDFDokument90 SeitenDe Beers Insight Report 2014 PDFAntonia Maria100% (1)

- CRSP Stock Indices Data DescriptionsDokument148 SeitenCRSP Stock Indices Data DescriptionsnejisouNoch keine Bewertungen

- Tqs Finals Operations-AuditDokument46 SeitenTqs Finals Operations-AuditCristel TannaganNoch keine Bewertungen

- Page 1 of 8Dokument8 SeitenPage 1 of 8Calvince OumaNoch keine Bewertungen

- Life Insurance Advertising in India Analysis of Recen 337186587Dokument12 SeitenLife Insurance Advertising in India Analysis of Recen 337186587Raghav DudejaNoch keine Bewertungen

- Module 1-The Concept and Development of MoneyDokument20 SeitenModule 1-The Concept and Development of MoneyRoliane LJ RugaNoch keine Bewertungen

- Property Law II - ContentsDokument12 SeitenProperty Law II - Contentsdanyal860Noch keine Bewertungen

- GM Coogan - Money Creators Who Creates Money Who Should Create It 1935Dokument176 SeitenGM Coogan - Money Creators Who Creates Money Who Should Create It 1935mrpoisson100% (1)

- Final-Fall-2009 Mock SolutionDokument16 SeitenFinal-Fall-2009 Mock SolutionmehdiNoch keine Bewertungen

- Franchising: Introduction ToDokument30 SeitenFranchising: Introduction Tohemant mohiteNoch keine Bewertungen

- Real Estate Marketing Agent Registration Form: Important InstructionsDokument7 SeitenReal Estate Marketing Agent Registration Form: Important InstructionsAshok KumarNoch keine Bewertungen

- Final Exam Review 2 - LSM 1003 - HCT - ..Dokument12 SeitenFinal Exam Review 2 - LSM 1003 - HCT - ..Roqaia AlwanNoch keine Bewertungen

- Franchise ConsignmentDokument2 SeitenFranchise ConsignmentClarissa Atillano FababairNoch keine Bewertungen