Beruflich Dokumente

Kultur Dokumente

Extended Erp (Bi) - Final Project Presentation

Hochgeladen von

ajjukuce19810 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

51 Ansichten32 SeitenThis document discusses the implementation of an InsFocus business intelligence (BI) system by Shlomo Insurance. It provides an overview of Shlomo Insurance and the insurance industry, outlines the needs and requirements for an extended enterprise resource planning (ERP) system, describes the InsFocus BI solution and its functional modules, and discusses the implementation strategy including phased rollout, training approach, and sample management information system, decision support system, and executive information system reports.

Originalbeschreibung:

ERP Project NMIMS.

Buisness Intelligence

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document discusses the implementation of an InsFocus business intelligence (BI) system by Shlomo Insurance. It provides an overview of Shlomo Insurance and the insurance industry, outlines the needs and requirements for an extended enterprise resource planning (ERP) system, describes the InsFocus BI solution and its functional modules, and discusses the implementation strategy including phased rollout, training approach, and sample management information system, decision support system, and executive information system reports.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

51 Ansichten32 SeitenExtended Erp (Bi) - Final Project Presentation

Hochgeladen von

ajjukuce1981This document discusses the implementation of an InsFocus business intelligence (BI) system by Shlomo Insurance. It provides an overview of Shlomo Insurance and the insurance industry, outlines the needs and requirements for an extended enterprise resource planning (ERP) system, describes the InsFocus BI solution and its functional modules, and discusses the implementation strategy including phased rollout, training approach, and sample management information system, decision support system, and executive information system reports.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 32

Extended ERP (BI) Project

InsFocus- BI Product for Insurance

Group Members

Ajay Kumar (Roll No. 05)

Ganpathy V (Roll No. 16)

Subramanian Iyer (Roll No. 51)

Saurab Salian (Roll No. 45)

Bankim Thakkar (Roll No. 09)

Aug 28, 2013

NMIMS PT MBA 2

nd

year

Agenda

InsFocus- Design and Process Flow

Impact Of Extended ERP (BI)

Industry & Company - Overview

Extended ERP BI - Introduction

Requirements Analysis- As Is To Be

Shlomo- Need for Extended ERP (BI)

Business Solution (IT Solution)

Implementation Strategy and

planning

Conclusion

Shlomo Future Scope

Extended ERP BI Introduction

Business Intelligence (BI)

Business Analytics (BA)

The ability of an organization to collect, maintain, and organize knowledge. This

produces large amounts of information that can help develop new opportunities.

Identifying these opportunities, and implementing an effective strategy, can provide a

competitive market advantage and long-term stability.

83% Demand for BI/BA

Common functions of business intelligence technologies are:-

Reporting, online analytical processing, analytics, data mining, process mining,

complex event processing, business performance management, benchmarking, text

mining, predictive analytics and prescriptive analytics.

Organisations using Business Intelligence Shlomo insurance, Middlesea

Insurance plc & Bituach Haklai Insurance company.

Industry and Company Overview

Company Overview - Shlomo Insurance

Began operations in January 2008.

It is a subsidiary of Shlomo Group, one of the top 10 service companies in

Israel

The group set up its own captive insurer to avoid the costs of

insuring its fleet with insurance companies

Also provide insurance to individuals and students.

Business Activities

Operating the countrys largest motor leasing fleet.

Insurance Industry Overview

Insurance in Israel is $ 22 billion industry. India about $ 50 billion.

25 domestic insurers and 4 foreign insurers. Annual growth rate of 12 %

BI/BA used heavily in Insurance sector

All insurance companies use one or the other BI products.

BI product vendors are Oracle, Sap, Microsoft, IBM etc.

Shlomo Need for Extended ERP (BI)

Need for Extended ERP (BI)

The company required a reliable BI system with all the relevant domain

content to control its marketing, underwriting and claims operations within a

few months of beginning operations.

This is a new in-house insurance company, setup to insure its motor fleets

so they need a new BI insurance solution

Need to replace a Legacy policy and claims administration system

implemented by an external software company with no data structure

documentation

Replace the system build on IBM AS/400 with latest technology

Requirements Analysis: As Is To Be

As Is System

Called as Legacy Policy Administration System

This was just to keep records of insurance policies that the company took

for its fleet from third party insurance companies.

Build on out-dated technologies like IBM/AS400

No data structure documentation from vendor software firm.

Not much data available for integration.

No Interface with other Business Functions.

As Is System

LPAS

Front-End

AS400

Back-End

File System

DB

Batch

Reporting

Requirements Analysis: As Is To Be

To Be System

Full IT infrastructure and support that is normally created by insurance

companies over years

Interface with all Business Functions.

Should have a generalized insurance data model.

Should have all the functional modules of an insurance product as

outlined in the next slide

Provide all insurance KPIs.

InsFocus BI Functional Modules

Caters to any insurance

business users

requirements

Sales &

Marketing

Shlomo

Insurance

Claims

Reinsurance

Finance &

Accounting

Actuarial

Underwriting

Requirements Analysis: As Is To Be

Requirements Analysis: As Is To Be

To Be System Some more basic featured outlined in

Requirements

Dynamic calculation of earned premiums and unearned premium reserves

Calculation of insurance exposures

Profitability calculations of agents portfolios

Claim experience per risk parameters used for pricing calculations

Monitoring ultimate claims cost in comparison to reserves

Policy renewal control and renewal lists

Integration to company CRM system

Claims accounting with group companies

Policy riders analysis

Agent product portfolio analysis

The Solution for Insurance InsFocus (Extended ERP BI)

Shlomo selected InsFocus as a sure and quick route to implementing a BI

solution providing all insurance KPIs.

InsFocus is one of the leading business intelligence companies in the

insurance industry.

InsFocus brings advanced analytics to every part of the insurance

business, including marketing, underwriting, reinsurance, actuarial, and

accounting domains.

InsFocus is structured around a generalized insurance data model

The underlying integration project was initiated using InsFocus Data

Integration Module.

Business Solution (IT Solution)

Business Solution (IT Solution)

IT Infrastructure

InsFocus- Description

* For small & mid Size companies

* Complete solution for insurance

* Provides DW & BI

* Replaces traditional ETL/DW/BI

* Multiple languages

* Microsoft Integrated BI platform

SSIS, SSAS, SSRS

* Agile development method

Communicate securely,

protect data, and extend

InsFocus BI using robust

SOA - REST platform

InsFocus- Architecture

InsFocus BI Design & Process flow

InsFocus BI

Product Modules

InsFocus BI

Product Modules

Open Code

Calculation

templates

Data-level, role-level,

and restriction-based

permissions

Central System

Administration

Report

scheduler

Secure SOA with

REST services

Pre-

aggregation

mechanism

Data

Warehouse

centric

ETL

User

Interface

Module

InsFocus BI Design & Process flow

Central System

Administration

flow

Individual

submit

application

System receive

application and

check for

eligibility

X

Eligible for

enrolment

[No]

[Yes]

System Sends Notice

that Individual is Not

Eligible for Enrolment

Individual Receives

Notice (not eligible for

Enrolment)

Individual

select

plan

Transactional

database

[No]

Make

Payment

[Yes]

Enrolment

&Plan

transaction

Rejection

transaction

Receives

enrolment

confirmation

Not Eligible

transaction

Data Warehouse

(Data Model)

Start

Event

End

Event

End

Event

X

Individual

Plan

Premium

Rejection

Individual get

Notice of

Rejection

End

Event

InsFocus BI Design & Process flow

Implementation Strategy & Planning

As requested by Shlomo that they want to replace the existing legacy system with

InsFocus and that too in a very short span.

So InsFocus Adopted 4 pronged approach to implement

Learn

Design Implement Deliver

Approach to Solution Implementation

Phased Implementation

Sales, Reinsurance

Claims, Finance & Accts

Actuarial, Underwriting

Learn Companys

Business

Systems

Processes

Profitability Driver

Data Model

High level Design

Low level Design

Data map

DW

ETL

Business Logic scripts

Validation rules

Data Validation

Adapt Reports library

Users from all Dept.

Management Provide Requirements

Budget

SME Need to understand the system functionality

Data Model

Available reports

Technical Architecture

Train users to use the system

Employees

Attend training and demo sessions

Use the system to the fullest

Roles and Responsibilities of stakeholders

Implementation Strategy & Planning

Jan 2008 deadline - The date when all the fleets Physical Damage and Obligatory

insurance policies needed to be renewed.

Full IT Infrastructure & Support Normally created by insurance companies over

the years.

New Insurance company with no historical standards to rely on.

Management was occupied in launching new operations.

Train the employees at minimum cost.

Build IT team which can handle first-level support and create additional content

based on user requirements.

Challenges for Management & People

Implementation Strategy & Planning

Knowledge transfer and training involves:

End-user training: End-user training takes the form of comprehensive workshops

with business users or the companys appointed BI specialists, ensuring they are up

to speed with systems functionality, data model, and available reports.

Technical training: This training ensures that IT personnel and system

administrators have the ability to handle first-level support and create additional

content based on user requirements.

Training Method used

Integration testing

Validity tests

Data adaptation scripts

UAT

Implementation Strategy & Planning

InsFocus BI - Reports (MIS, DSS & EIS)

Reports Library: - InsFocus reports library addresses business issues concerning

executive management, sales and marketing, underwriting, claims, reinsurance,

actuarial analysis, internal auditing and accounting. These are the report created

from InsFocus BI system.

InsFocus BI - Reports (MIS, DSS & EIS)

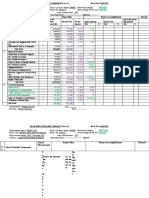

MIS - It shows the number of private clients in different insurance premium bands.

This information can be used by the insurance advisors of the company to make

decisions.

InsFocus BI - Reports (MIS, DSS & EIS)

MIS - This report is used by the Sales managers to gets the sales comparison by

product group for an Agent.

InsFocus BI - Reports (MIS, DSS & EIS)

DSS - This report is used by the Sales managers to compare, predict and analyse

the sales over a time period.

InsFocus BI - Reports (MIS, DSS & EIS)

EIS - This profitability report is used by senior executives to analyse the profitability

of the company. It shows the profit/loss in different years selected.

Improved business performance: Information-based decision-making

facilitates business decision-making including underwriting control, risk selection,

claims reserving and distribution channel reporting.

Easy creation of operational reports: Customizable operational reports and

bordereaux can easily be created by users to serve various functions in the

organization such as claims, reinsurance, supplier accounts and more.

Short Implementation: Structured implementation methodology ensures a quick

and predictable project.

Risk management: Self-service BI enables insurance professionals such as risk

officers and actuaries to analyze risks and exposures by providing sophisticated

data management capabilities.

InsFocus BI - Advantages & Business Benefits

Functionality: InsFocus is built for insurance companies providing out-of-the-

box insurance-specific calculations and information analysis solutions.

Data Model: The systems prebuilt, tested, and optimized insurance data model,

is the foundation for its insurance data management.

Insurance Content: The InsFocus definitions library consists of hundreds of

insurance measurements, dimensions, risk factors and sample reports.

Infrastructure: Based on a robust database infrastructure, the system provides

information security, data access control, complete system administration, SOA

connectivity and multilingual capabilities.

Self-Service: A user-friendly self-service interface enables business users to

create sophisticated analysis and reports.

Comprehensive Solution: InsFocus manages the full DW/BI lifecycle, without

the need for additional software tools.

InsFocus BI - Advantages & Business Benefits

SWOT Analysis (Extended ERP BI)

Strength

The company is able to closely monitor all its KPIs and operate profitably

in a very competitive insurance market.

The implementation project was very smooth, with very little input required

from companys executives.

A new insurance company deployed InsFocus to get a full functionality BI

solution up in record time.

Weakness

The company needed to deploy on day one the full IT infrastructure and

support that is normally created by insurance companies over years.

Not integrated with Mobiles, Tabs & I pad

Impact of Extended ERP (BI)

SWOT Analysis (Extended ERP BI)

Opportunity

For InsFocus it was a big opportunity to provide the End-to-End Insurance

solution to a new company which is part of a big group.

For Shlomo it was a new business opportunity. So it was necessary to go

for the right product.

InsFocus is a complete insurance BI product with a built in general data

integration module

Threat

The biggest threat is the data theft. When such huge DB is created then

there is risk of loosing the confidential and personal data.

Very less timeframe to build the complete IT infrastructure.

Impact of Extended ERP (BI)

Shlomo Future Scope

Introduction of Dynamic Parameters

Dynamic parameters is a mechanism that allows

exposing some of a reports parameters right above the

report itself, allowing all users the ability to change those

parameters. This is very helpful for:

Reports with popular parameters

Limited users

Universal access

Web Client Responsive Layout

Under todays various standard resolutions (and devices), it is

important for application to appear optimally in any scenario like

on mobiles, I-pad, Laptops etc.

Responsive Layout

Strives to make applications optimal for every resolution

Elements of Alteration

Alters the sizes and amounts of details it shows to adapt itself to

the screen size

1366 x 768 - Full application size

1280 x 1024 - Announcements and search boxes on right

become smaller

1024 x 768 - Report thumbnails become smaller, only six are

shown

Shlomo Future Scope

Conclusion

TAKE AWAYs

BI & InsFocus leads to -

Time Reduction

Cost reduction

Customer Satisfaction

Leading to customer Acquisition

End- End process Mapping

Thank You

Group Members

Ajay Kumar (Roll No. 05)

Ganpathy V (Roll No. 16)

Subramanian Iyer (Roll No. 51)

Saurab Salian (Roll No. 45)

Bankim Thakkar (Roll No. 09)

References

http://en.wikipedia.org/wiki/Business_intelligence

http://www.shlomo.co.il/shlomogroup/Insurance.asp

http://www.shlomo-bit.co.il

http://www.insfocus.com/

http://www2.microstrategy.com/download/files/whitepapers/open/Bus

iness-Intelligence-and-Insurance.pdf

References

Das könnte Ihnen auch gefallen

- Siebel Incentive Compensation Management ( ICM ) GuideVon EverandSiebel Incentive Compensation Management ( ICM ) GuideNoch keine Bewertungen

- Business Intelligence Software at SYSCODokument2 SeitenBusiness Intelligence Software at SYSCOSwati SwatuNoch keine Bewertungen

- Itis403 Erp Ch6Dokument26 SeitenItis403 Erp Ch6noor222.202Noch keine Bewertungen

- Castrol Bike Zone Case StudyDokument7 SeitenCastrol Bike Zone Case Studymartial20Noch keine Bewertungen

- IBM Insurance IAA Warehouse GIMv85Dokument23 SeitenIBM Insurance IAA Warehouse GIMv85Matthew ReachNoch keine Bewertungen

- IAA Poster 2006Dokument1 SeiteIAA Poster 2006Krishna_IndiaNoch keine Bewertungen

- 04.an Evaluation of The Use of Application Software As A Mechanism For Effective Business Processing in Carson Cumberbatch PLC - (D1)Dokument10 Seiten04.an Evaluation of The Use of Application Software As A Mechanism For Effective Business Processing in Carson Cumberbatch PLC - (D1)Navoda pramudiniNoch keine Bewertungen

- Business Intelligence Tools ReviewsDokument33 SeitenBusiness Intelligence Tools ReviewsDario Cardona SosaNoch keine Bewertungen

- ERP Basics: Report UsageDokument12 SeitenERP Basics: Report UsagearslsaadNoch keine Bewertungen

- Preetam Kumar Sahu: ObjectiveDokument5 SeitenPreetam Kumar Sahu: ObjectiveNasir NaseemNoch keine Bewertungen

- GaneshK - Sap FicoDokument4 SeitenGaneshK - Sap Ficonidhi.ratnaNoch keine Bewertungen

- Business Analytics - Level 1 Quiz (25 - 25)Dokument9 SeitenBusiness Analytics - Level 1 Quiz (25 - 25)Zarazno100% (4)

- Business IntelligenceDokument15 SeitenBusiness IntelligenceSandeep SinghNoch keine Bewertungen

- BI AssignmentDokument6 SeitenBI Assignmentssj_renukaNoch keine Bewertungen

- Business Intelligence: A Managerial Perspective On AnalyticsDokument18 SeitenBusiness Intelligence: A Managerial Perspective On Analyticsmeme_qana100% (2)

- Business IntelligenceDokument18 SeitenBusiness IntelligenceDunil RiviruNoch keine Bewertungen

- Business Intelligence (BI) Refers ToDokument8 SeitenBusiness Intelligence (BI) Refers Tosangee_itNoch keine Bewertungen

- Business Intelligence & AnlyticsDokument3 SeitenBusiness Intelligence & AnlyticsVidya GoreNoch keine Bewertungen

- Whitepaper: Insurance Business AnalyticsDokument7 SeitenWhitepaper: Insurance Business AnalyticsSanjay GuptaNoch keine Bewertungen

- 03-Case Study 2 - Simply Investment Group Business Intelligence Implementation Project 1Dokument6 Seiten03-Case Study 2 - Simply Investment Group Business Intelligence Implementation Project 1Adrian NowowiejskiNoch keine Bewertungen

- What Are Intelligent SystemsDokument15 SeitenWhat Are Intelligent SystemsLOOPY GAMINGNoch keine Bewertungen

- HardDokument9 SeitenHardSourav DeyNoch keine Bewertungen

- Unit 1 Introduction To Business Intelligence (BI) Systems: StructureDokument24 SeitenUnit 1 Introduction To Business Intelligence (BI) Systems: StructuregaardiNoch keine Bewertungen

- Enterprise Resource Planning (Unit-1) Alish Patel: Overview of ERP Software SolutionsDokument9 SeitenEnterprise Resource Planning (Unit-1) Alish Patel: Overview of ERP Software SolutionsKrishna KantNoch keine Bewertungen

- Itappb23z Co1 - Functional and Enterprise SysDokument5 SeitenItappb23z Co1 - Functional and Enterprise SysJenniveve OcenaNoch keine Bewertungen

- Assignment 2 ErpDokument10 SeitenAssignment 2 ErpAreeb Shahid100% (1)

- Gaya ErpDokument12 SeitenGaya ErpGayathri VNoch keine Bewertungen

- Business Intelligence OverviewDokument10 SeitenBusiness Intelligence OverviewBhavdeepsinh JadejaNoch keine Bewertungen

- Module 1Dokument61 SeitenModule 1Harish135Noch keine Bewertungen

- Software and Information Technology Glossary of TermsDokument19 SeitenSoftware and Information Technology Glossary of TermsBusiness Software Education CenterNoch keine Bewertungen

- Business Process ManagementDokument34 SeitenBusiness Process ManagementThan PhyoNoch keine Bewertungen

- Migrating To Cloud Based ERP SolutionDokument4 SeitenMigrating To Cloud Based ERP SolutionVenkat KadajariNoch keine Bewertungen

- SAP SD Configuration GuideDokument363 SeitenSAP SD Configuration GuideAdnanNoch keine Bewertungen

- TB 2 - ERP - KELOMPOK 5 - ENG - TeoryDokument8 SeitenTB 2 - ERP - KELOMPOK 5 - ENG - TeoryristonoNoch keine Bewertungen

- Week 1 Tutorial Exercise Introduction To Business Intelligence Task 1 Answer To Discussion QuestionDokument7 SeitenWeek 1 Tutorial Exercise Introduction To Business Intelligence Task 1 Answer To Discussion QuestionSyed ZaidiNoch keine Bewertungen

- Case Study 2Dokument15 SeitenCase Study 2Abdullah ghauriNoch keine Bewertungen

- MARUTI AutomobileCompany DMSDokument4 SeitenMARUTI AutomobileCompany DMSbuccas1367% (3)

- FB Upload Fundamentals of Corporate Performance ManagementDokument3 SeitenFB Upload Fundamentals of Corporate Performance ManagementbpmcapitalpartnersNoch keine Bewertungen

- BEA NotesDokument76 SeitenBEA NotesPukhrajNoch keine Bewertungen

- Executive Support SystemDokument9 SeitenExecutive Support SystemHemavathi Hema100% (1)

- Determining BI FlowchartDokument7 SeitenDetermining BI FlowchartHishamAlruainiNoch keine Bewertungen

- Accounting vs. Enterprise Resource Planning Software: Iqra SaeedDokument9 SeitenAccounting vs. Enterprise Resource Planning Software: Iqra Saeedkhurram_ahmedNoch keine Bewertungen

- A Project Report On Business Intelligence and It's Use in Decision Making" at TARANG SOFTWARE TECHNOLOGY LTD, BangaloreDokument65 SeitenA Project Report On Business Intelligence and It's Use in Decision Making" at TARANG SOFTWARE TECHNOLOGY LTD, BangaloreBabasab Patil (Karrisatte)100% (1)

- Evaluation of Business Performance (CIS412) : Lecture NotesDokument5 SeitenEvaluation of Business Performance (CIS412) : Lecture NotesRodney Jack SandovalNoch keine Bewertungen

- The Business Value of Business IntelligenceDokument28 SeitenThe Business Value of Business IntelligenceSilver StoneNoch keine Bewertungen

- Chapter I and Chapter IiDokument32 SeitenChapter I and Chapter IiDhanya vijeeshNoch keine Bewertungen

- Economic and Business IntelligenceDokument10 SeitenEconomic and Business IntelligenceSiva SrinivasanNoch keine Bewertungen

- Second LectureDokument44 SeitenSecond LectureMahad RizwanNoch keine Bewertungen

- Bits Ms Software Systems DissertationDokument6 SeitenBits Ms Software Systems DissertationHelpWithWritingPaperCanada100% (1)

- Applications of BI in HRDokument19 SeitenApplications of BI in HRVikramadithya TandraNoch keine Bewertungen

- Enterprise SolutionsDokument11 SeitenEnterprise Solutionsmundal minatiNoch keine Bewertungen

- Iam Tool v2 0 E1Dokument59 SeitenIam Tool v2 0 E1Joanna CrabtreeNoch keine Bewertungen

- 1.-Sap ErpDokument14 Seiten1.-Sap ErpEdgardo Ascanio RegueiraNoch keine Bewertungen

- SapsdmaterialDokument367 SeitenSapsdmaterialNaresh BitlaNoch keine Bewertungen

- Data Archving Project: ME Diagnostic PageDokument2 SeitenData Archving Project: ME Diagnostic PageRohit SharmaNoch keine Bewertungen

- Project Charter - FICODokument10 SeitenProject Charter - FICOkoti kebeleNoch keine Bewertungen

- Benefits of Enterprise SystemsDokument10 SeitenBenefits of Enterprise SystemsAziella RebiNoch keine Bewertungen

- ADDM New Customer PresentationDokument17 SeitenADDM New Customer PresentationkkuppachiNoch keine Bewertungen

- Auditing Information Systems: Enhancing Performance of the EnterpriseVon EverandAuditing Information Systems: Enhancing Performance of the EnterpriseNoch keine Bewertungen

- Basic Operation Electrical - Total - Eng - Prot PDFDokument439 SeitenBasic Operation Electrical - Total - Eng - Prot PDFdidik setiawan100% (2)

- Unit 9 Organic Law On Provincial and Local-Level Government (OLPLLG) - SlidesDokument29 SeitenUnit 9 Organic Law On Provincial and Local-Level Government (OLPLLG) - SlidesMark DemNoch keine Bewertungen

- Manual Chiller Parafuso DaikinDokument76 SeitenManual Chiller Parafuso Daiking3qwsf100% (1)

- BlackCat ManualDokument14 SeitenBlackCat ManualNestor Marquez-DiazNoch keine Bewertungen

- Userguide SW-MC V2 2015-W45 EN S034308Dokument131 SeitenUserguide SW-MC V2 2015-W45 EN S034308ReneNoch keine Bewertungen

- Rediscovering Alginate Wound DressingsDokument4 SeitenRediscovering Alginate Wound DressingstanveerhusseinNoch keine Bewertungen

- Installation Manual (DH84309201) - 07Dokument24 SeitenInstallation Manual (DH84309201) - 07mquaiottiNoch keine Bewertungen

- Microbial Communities From Arid Environments On A Global Scale. A Systematic ReviewDokument12 SeitenMicrobial Communities From Arid Environments On A Global Scale. A Systematic ReviewAnnaNoch keine Bewertungen

- Cough PDFDokument3 SeitenCough PDFKASIA SyNoch keine Bewertungen

- RCM Design and ImplementationDokument34 SeitenRCM Design and ImplementationRozi YudaNoch keine Bewertungen

- To 33B-1-1 01jan2013Dokument856 SeitenTo 33B-1-1 01jan2013izmitlimonNoch keine Bewertungen

- W2 - Fundementals of SepDokument36 SeitenW2 - Fundementals of Sephairen jegerNoch keine Bewertungen

- MSDS Lubriplate 105Dokument2 SeitenMSDS Lubriplate 105mackyyo0% (1)

- Preservation and Collection of Biological EvidenceDokument4 SeitenPreservation and Collection of Biological EvidenceanastasiaNoch keine Bewertungen

- Full Bridge Phase Shift ConverterDokument21 SeitenFull Bridge Phase Shift ConverterMukul ChoudhuryNoch keine Bewertungen

- Quarterly Progress Report FormatDokument7 SeitenQuarterly Progress Report FormatDegnesh AssefaNoch keine Bewertungen

- Optical Fiber Communication Unit 3 NotesDokument33 SeitenOptical Fiber Communication Unit 3 NotesEr SarbeshNoch keine Bewertungen

- Soal 2-3ADokument5 SeitenSoal 2-3Atrinanda ajiNoch keine Bewertungen

- PowderCoatingResins ProductGuide 0Dokument20 SeitenPowderCoatingResins ProductGuide 0zizitroNoch keine Bewertungen

- Course Syllabus Manufacturing Processes (1) Metal CuttingDokument4 SeitenCourse Syllabus Manufacturing Processes (1) Metal CuttingG. Dancer GhNoch keine Bewertungen

- Athletes Who Made Amazing Comebacks After Career-Threatening InjuriesDokument11 SeitenAthletes Who Made Amazing Comebacks After Career-Threatening InjuriesანაNoch keine Bewertungen

- SRV SLB222 en - 05062020Dokument2 SeitenSRV SLB222 en - 05062020Nguyen ThuongNoch keine Bewertungen

- Social Connectedness and Role of HopelessnessDokument8 SeitenSocial Connectedness and Role of HopelessnessEmman CabiilanNoch keine Bewertungen

- Cooling Tower (Genius)Dokument7 SeitenCooling Tower (Genius)JeghiNoch keine Bewertungen

- Community Medicine DissertationDokument7 SeitenCommunity Medicine DissertationCollegePaperGhostWriterSterlingHeights100% (1)

- DIAC Experienced Associate HealthcareDokument3 SeitenDIAC Experienced Associate HealthcarecompangelNoch keine Bewertungen

- Coalition TacticsDokument2 SeitenCoalition Tacticsakumar4u100% (1)

- Kenwood Report FinalDokument43 SeitenKenwood Report Finaltooba siddiquiNoch keine Bewertungen

- Erich FrommDokument2 SeitenErich FrommTina NavarroNoch keine Bewertungen

- Ammonium Chloride: Product InformationDokument2 SeitenAmmonium Chloride: Product InformationusamaNoch keine Bewertungen