Beruflich Dokumente

Kultur Dokumente

Chap 003

Hochgeladen von

MichaelFraserCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chap 003

Hochgeladen von

MichaelFraserCopyright:

Verfügbare Formate

Financial Statements Analysis and Long-Term

Planning

Chapter 3

Copyright 2010 by the McGraw-Hill Companies, I nc. All rights reserved.

McGraw-Hill/I rwin

3-1

Key Concepts and Skills

Know how to standardize financial statements

for comparison purposes

Know how to compute and interpret important

financial ratios

Be able to develop a financial plan using the

percentage of sales approach

Understand how capital structure and dividend

policies affect a firms ability to grow

3-2

Chapter Outline

3.1 Financial Statements Analysis

3.2 Ratio Analysis

3.3 The Du Pont Identity

3.4 Financial Models

3.5 External Financing and Growth

3.6 Some Caveats Regarding Financial Planning

Models

3-3

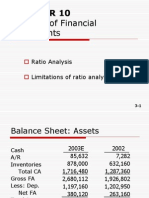

3.1 Financial Statements Analysis

Common-Size Balance Sheets

Compute all accounts as a percent of total assets

Common-Size Income Statements

Compute all line items as a percent of sales

Standardized statements make it easier to compare

financial information, particularly as the company

grows.

They are also useful for comparing companies of

different sizes, particularly within the same industry.

3-4

3.2 Ratio Analysis

Ratios also allow for better comparison

through time or between companies.

As we look at each ratio, ask yourself:

How is the ratio computed?

What is the ratio trying to measure and why?

What is the unit of measurement?

What does the value indicate?

How can we improve the companys ratio?

3-5

Categories of Financial Ratios

Short-term solvency or liquidity ratios

Long-term solvency or financial leverage

ratios

Asset management or turnover ratios

Profitability ratios

Market value ratios

3-6

Computing Liquidity Ratios

Current Ratio = CA / CL

708 / 540 = 1.31 times

Quick Ratio = (CA Inventory) / CL

(708 - 422) / 540 = .53 times

Cash Ratio = Cash / CL

98 / 540 = .18 times

3-7

Computing Leverage Ratios

Total Debt Ratio = (TA TE) / TA

(3588 - 2591) / 3588 = 28%

Debt/Equity = TD / TE

(3588 2591) / 2591 = 38.5%

Equity Multiplier = TA / TE = 1 + D/E

1 + .385 = 1.385

3-8

Computing Coverage Ratios

Times Interest Earned = EBIT / Interest

691 / 141 = 4.9 times

Cash Coverage = (EBIT + Depreciation +

Amortization) / Interest

(691 + 276) / 141 = 6.9 times

3-9

Computing Inventory Ratios

Inventory Turnover = Cost of Goods Sold /

Inventory

1344 / 422 = 3.2 times

Days Sales in Inventory = 365 / Inventory

Turnover

365 / 3.2 = 114 days

3-10

Computing Receivables Ratios

Receivables Turnover = Sales / Accounts

Receivable

2311 / 188 = 12.3 times

Days Sales in Receivables = 365 /

Receivables Turnover

365 / 12.3 = 30 days

3-11

Computing Total Asset Turnover

Total Asset Turnover = Sales / Total Assets

2311 / 3588 = .64 times

It is not unusual for TAT < 1, especially if a firm

has a large amount of fixed assets.

3-12

Computing Profitability Measures

Profit Margin = Net Income / Sales

363 / 2311 = 15.7%

Return on Assets (ROA) = Net Income / Total Assets

363 / 3588 = 10.1%

Return on Equity (ROE) = Net Income / Total Equity

363 / 2591 = 14.0%

EBITDA Margin = EBITDA / Sales

967 / 2311 = 41.8%

3-13

Computing Market Value Measures

Market Capitalization = $88 per share x 33 million shares =

2904 million

PE Ratio = Price per share / Earnings per share

88 / 11 = 8 times

Market-to-book ratio = market value per share / book value per

share

88 / (2591 / 33) = 1.12 times

Enterprise Value (EV) = Market capitalization + Market value

of interest bearing debt cash

2904 + (196 + 457) 98 = 3465

EV Multiple = EV / EBITDA

3465 / 967 = 3.6 times

3-14

Using Financial Statements

Ratios are not very helpful by themselves: they

need to be compared to something

Time-Trend Analysis

Used to see how the firms performance is

changing through time

Peer Group Analysis

Compare to similar companies or within industries

SIC and NAICS codes

3-15

3.3 The Du Pont Identity

ROE = NI / TE

Multiply by 1 and then rearrange:

ROE = (NI / TE) (TA / TA)

ROE = (NI / TA) (TA / TE) = ROA * EM

Multiply by 1 again and then rearrange:

ROE = (NI / TA) (TA / TE) (Sales / Sales)

ROE = (NI / Sales) (Sales / TA) (TA / TE)

ROE = PM * TAT * EM

3-16

Using the Du Pont Identity

ROE = PM * TAT * EM

Profit margin is a measure of the firms operating

efficiency how well it controls costs.

Total asset turnover is a measure of the firms

asset use efficiency how well it manages its

assets.

Equity multiplier is a measure of the firms

financial leverage.

3-17

Calculating the Du Pont Identity

ROA = 10.1% and EM = 1.39

ROE = 10.1% * 1.385 = 14.0%

PM = 15.7% and TAT = 0.64

ROE = 15.7% * 0.64 * 1.385 = 14.0%

3-18

Potential Problems

There is no underlying theory, so there is no way to

know which ratios are most relevant.

Benchmarking is difficult for diversified firms.

Globalization and international competition makes

comparison more difficult because of differences in

accounting regulations.

Firms use varying accounting procedures.

Firms have different fiscal years.

Extraordinary, or one-time, events

3-24

3.5 External Financing and Growth

At low growth levels, internal financing

(retained earnings) may exceed the required

investment in assets.

As the growth rate increases, the internal

financing will not be enough, and the firm will

have to go to the capital markets for financing.

Examining the relationship between growth

and external financing required is a useful tool

in financial planning.

3-25

The Internal Growth Rate

The internal growth rate tells us how much the

firm can grow assets using retained earnings

as the only source of financing.

Using the information from the Hoffman Co.

ROA = 66 / 500 = .132

b = 44/ 66 = .667

% 65 . 9

0965 .

667 . 132 . 1

667 . 132 .

b ROA - 1

b ROA

Rate Growth Internal

3-26

The Sustainable Growth Rate

The sustainable growth rate tells us how much

the firm can grow by using internally

generated funds and issuing debt to maintain a

constant debt ratio.

Using the Hoffman Co.

ROE = 66 / 250 = .264

b = .667

% 4 . 21

214 .

667 . 264 . 1

667 . 264 .

b ROE - 1

b ROE

Rate Growth e Sustainabl

3-27

Determinants of Growth

Profit margin operating efficiency

Total asset turnover asset use efficiency

Financial leverage choice of optimal debt

ratio

Dividend policy choice of how much to pay

to shareholders versus reinvesting in the firm

3-28

3.6 Some Caveats

Financial planning models do not indicate

which financial polices are the best.

Models are simplifications of reality, and the

world can change in unexpected ways.

Without some sort of plan, the firm may find

itself adrift in a sea of change without a rudder

for guidance.

3-29

Quick Quiz

How do you standardize balance sheets and

income statements?

Why is standardization useful?

What are the major categories of financial ratios?

How do you compute the ratios within each

category?

What are some of the problems associated with

financial statement analysis?

3-30

Quick Quiz

What is the purpose of financial planning?

What are the major decision areas involved in

developing a plan?

What is the percentage of sales approach?

What is the internal growth rate?

What is the sustainable growth rate?

What are the major determinants of growth?

3-31

Review

1. A firm has sales of $1,200, net income of

$200, net fixed assets of $500, and current

assets of $300. The firm has $100 in

inventory. What is the common-size statement

value of inventory?

A. 8.3%

B. 12.5%

C. 20.0%

D. 33.3%

E. 50.0%

3-32

2. Jessica's Boutique has cash of $50,

accounts receivable of $60, accounts payable

of $200, and inventory of $150. What is the

value of the quick ratio?

A. .30

B. .55

C. .77

D. 1.30

E. 1.82

3-33

3. A firm has a debt-equity ratio of .40. What

is the total debt ratio?

A. .29

B. .33

C. .67

D. 1.40

E. 1.50

The debt-equity ratio is .40. Thus, if total debt

is $40, total equity is $100 and total assets are

$140. Total debt ratio = $40 $140 = .29

3-34

4. Syed's Industries has accounts receivable of

$700, inventory of $1,200, sales of $4,200,

and cost of goods sold of $3,400. How long

does it take Syed's to both sell its inventory

and then collect the payment on the sale?

A. 128 days

B. 146 days

C. 163 days

D. 190 days

E. 211 days

3-35

5. A firm has net working capital of $400, net

fixed assets of $2,400, sales of $6,000, and

current liabilities of $800. How many dollars

worth of sales are generated from every $1 in

total assets?

A. $1.33

B. $1.67

C. $1.88

D. $2.33

E. $2.50

3-36

6. Lee Sun's has sales of $3,000, total assets

of $2,500, and a profit margin of 5%. The

firm has a total debt ratio of 40%. What is the

return on equity?

A. 6%

B. 8%

C. 10%

D. 12%

E. 15%

3-37

7. Patti's has net income of $1,800, a price-

earnings ratio of 12, and earnings per share of

$1.20. How many shares of stock are

outstanding?

A. 1,200

B. 1,400

C. 1,500

D. 1,600

E. 1,800

3-38

8. Samuelson's has a debt-equity ratio of 40%,

sales of $8,000, net income of $600, and total

debt of $2,400. What is the return on equity?

A. 6.25%

B. 7.50%

C. 9.75%

D. 10.00%

E. 11.25%

3-39

9. A firm has a return on equity of 15%. The

debt-equity ratio is 50%. The total asset

turnover is 1.25 and the profit margin is 8%.

The total equity is $3,200. What is the amount

of the net income?

A. $480

B. $500

C. $540

D. $600

E. $620

3-40

10. Neal's Nails has an 11% return on assets

and a 30% dividend payout ratio. What is the

internal growth rate?

A. 7.11%

B. 7.70%

C. 8.34%

D. 8.46%

E. 11.99%

3-41

11. The Green Giant has a 5% profit margin

and a 40% dividend payout ratio. The total

asset turnover is 1.40 and the equity multiplier

is 1.50. What is the sustainable rate of

growth?

A. 6.30%

B. 6.53%

C. 6.72%

D. 6.80%

E. 6.83%

3-42

12. A firm has a market capitalization of $2

million, market value of interest bearing debt

of $1 million, book value of interest bearing

debt of $500,000 and cash of $100,000. What

is the enterprise value?

A. $2.5 million

B. $2.9 million

C. $3.0 million

D. $3.5 million

E. $3.6 million

Das könnte Ihnen auch gefallen

- Financial Statements Analysis and Long-Term Planning: Mcgraw-Hill/IrwinDokument58 SeitenFinancial Statements Analysis and Long-Term Planning: Mcgraw-Hill/IrwinNguyễn Văn NguyênNoch keine Bewertungen

- Financial Statements Analysis and Long-Term PlanningDokument31 SeitenFinancial Statements Analysis and Long-Term PlanningArviandi AntariksaNoch keine Bewertungen

- Financial Statements Analysis and Long-Term Planning: Mcgraw-Hill/IrwinDokument31 SeitenFinancial Statements Analysis and Long-Term Planning: Mcgraw-Hill/Irwindaisuke_kazukiNoch keine Bewertungen

- Financial Statements Analysis and Financial Models: Mcgraw-Hill/IrwinDokument31 SeitenFinancial Statements Analysis and Financial Models: Mcgraw-Hill/IrwinPháp NguyễnNoch keine Bewertungen

- Chap 003Dokument31 SeitenChap 003NazifahNoch keine Bewertungen

- 03 Financial AnalysisDokument55 Seiten03 Financial Analysisselcen sarıkayaNoch keine Bewertungen

- Working With Financial Statements: Mcgraw-Hill/IrwinDokument33 SeitenWorking With Financial Statements: Mcgraw-Hill/IrwinKamarulnizam ZainalNoch keine Bewertungen

- Chapter 4 - Analysis of Financial StatementsDokument50 SeitenChapter 4 - Analysis of Financial Statementsnoor_maalik100% (1)

- 03 CH03Dokument41 Seiten03 CH03Walid Mohamed AnwarNoch keine Bewertungen

- Lecture 3Dokument27 SeitenLecture 3Antonio AguiarNoch keine Bewertungen

- Chap 03 - Financial Statements Analysis and Financial ModelsDokument36 SeitenChap 03 - Financial Statements Analysis and Financial ModelsFaika Nawar NoorNoch keine Bewertungen

- Analyzing Financial Ratios of a CompanyDokument35 SeitenAnalyzing Financial Ratios of a Companyfrasatiqbal100% (1)

- Financial Statement Analysis and Ratio CalculationsDokument33 SeitenFinancial Statement Analysis and Ratio CalculationsKamrul HasanNoch keine Bewertungen

- Analysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDokument9 SeitenAnalysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDebasish PahiNoch keine Bewertungen

- Mini Case CH 3 SolutionsDokument14 SeitenMini Case CH 3 SolutionsTimeka CarterNoch keine Bewertungen

- Fi 410 Chapter 3Dokument50 SeitenFi 410 Chapter 3Austin Hazelrig100% (1)

- CH 3 f3716sDokument40 SeitenCH 3 f3716salbabtainbaderNoch keine Bewertungen

- Chap 3 SolutionsDokument70 SeitenChap 3 SolutionsHoàng Huy80% (10)

- Triple-A Office Mart Ratio AnalysisDokument8 SeitenTriple-A Office Mart Ratio Analysissahil karmaliNoch keine Bewertungen

- Financial Statement Analysis (ch-6)Dokument38 SeitenFinancial Statement Analysis (ch-6)Wares KhanNoch keine Bewertungen

- Dmp3e Ch05 Solutions 02.28.10 FinalDokument37 SeitenDmp3e Ch05 Solutions 02.28.10 Finalmichaelkwok1Noch keine Bewertungen

- FinMan Report On FS Analysis RATIODokument31 SeitenFinMan Report On FS Analysis RATIOMara LacsamanaNoch keine Bewertungen

- Working With Financial StatementsDokument27 SeitenWorking With Financial StatementsYannah HidalgoNoch keine Bewertungen

- 5ffb Ims03Dokument32 Seiten5ffb Ims03Azadeh AkbariNoch keine Bewertungen

- Analysis of Financial StatementsDokument37 SeitenAnalysis of Financial StatementsChajar Matari Fath MalaNoch keine Bewertungen

- Chapter 19: Financial Statement AnalysisDokument11 SeitenChapter 19: Financial Statement AnalysisSilviu TrebuianNoch keine Bewertungen

- Financial Leverage Du Pont Analysis &growth RateDokument34 SeitenFinancial Leverage Du Pont Analysis &growth Rateahmad jamalNoch keine Bewertungen

- Solution 2Dokument75 SeitenSolution 2Asiful MowlaNoch keine Bewertungen

- FM 6 Financial Statements Analysis MBADokument50 SeitenFM 6 Financial Statements Analysis MBAMisganaw GishenNoch keine Bewertungen

- Financial Statement Analysis and ModelingDokument51 SeitenFinancial Statement Analysis and ModelingLAMOUCHI RIMNoch keine Bewertungen

- ch3 RatioDokument18 Seitench3 RatioEman Samir100% (1)

- Ratio Analysis: Ratio Analysis Is The Process of Establishing and Interpreting Various RatiosDokument26 SeitenRatio Analysis: Ratio Analysis Is The Process of Establishing and Interpreting Various RatiosTarpan Mannan100% (2)

- Financial Statements & AnalysisDokument36 SeitenFinancial Statements & AnalysisMahiNoch keine Bewertungen

- Analysis of Financial Statements: Answers To End-Of-Chapter QuestionsDokument25 SeitenAnalysis of Financial Statements: Answers To End-Of-Chapter QuestionsCOLONEL ZIKRIANoch keine Bewertungen

- Financial Statement Analysis and Ratio GuideDokument37 SeitenFinancial Statement Analysis and Ratio Guidesiauw0283Noch keine Bewertungen

- RWJ Chapter 3 Financial Statements Analysis and Financial ModelsDokument34 SeitenRWJ Chapter 3 Financial Statements Analysis and Financial ModelsAshekin MahadiNoch keine Bewertungen

- Working With Financial StatementsDokument39 SeitenWorking With Financial StatementsRe xunNoch keine Bewertungen

- FIN 310 - Chapter 3 Questions With AnswersDokument8 SeitenFIN 310 - Chapter 3 Questions With AnswersKelby BahrNoch keine Bewertungen

- Analyzing Financial Ratios to Evaluate a CompanyDokument38 SeitenAnalyzing Financial Ratios to Evaluate a Companymuzaire solomon100% (1)

- Analysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDokument9 SeitenAnalysis of Financial Statements: Answers To Selected End-Of-Chapter Questionsfeitheart_rukaNoch keine Bewertungen

- Working With Financial Statements: Mcgraw-Hill/IrwinDokument32 SeitenWorking With Financial Statements: Mcgraw-Hill/Irwinwahid_040Noch keine Bewertungen

- wk2 SophiaDokument7 Seitenwk2 SophiaJong ChaNoch keine Bewertungen

- PRESENTATION ON Finincial Statement FinalDokument28 SeitenPRESENTATION ON Finincial Statement FinalNollecy Takudzwa Bere100% (2)

- FM - Chapter 4Dokument19 SeitenFM - Chapter 4Maxine SantosNoch keine Bewertungen

- Example Assignment 7003Dokument14 SeitenExample Assignment 7003Javeriah Arif75% (4)

- Lecture 2 - Answer Part 2Dokument6 SeitenLecture 2 - Answer Part 2Thắng ThôngNoch keine Bewertungen

- Financial Statement Analysis and Cash FlowDokument10 SeitenFinancial Statement Analysis and Cash FlowHằngg ĐỗNoch keine Bewertungen

- Corporate Financial Analysis NotesDokument19 SeitenCorporate Financial Analysis NotesWinston WongNoch keine Bewertungen

- Explanation For This Change Is:: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Dokument3 SeitenExplanation For This Change Is:: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Makan TidorNoch keine Bewertungen

- Lecture 7 - Ratio AnalysisDokument39 SeitenLecture 7 - Ratio AnalysisMihai Stoica100% (1)

- Financial Analysis of A CompanyDokument10 SeitenFinancial Analysis of A CompanyRupesh PuriNoch keine Bewertungen

- Unknown Parameter ValueDokument59 SeitenUnknown Parameter ValueTauqeerNoch keine Bewertungen

- Chapter 3 - OutlineDokument7 SeitenChapter 3 - OutlineBen YungNoch keine Bewertungen

- Topic 1Dokument18 SeitenTopic 1Nivaashene SaravananNoch keine Bewertungen

- Solutions To Chapter 12Dokument8 SeitenSolutions To Chapter 12Luzz LandichoNoch keine Bewertungen

- PP For Chapter 6 - Financial Statement Analysis - FinalDokument67 SeitenPP For Chapter 6 - Financial Statement Analysis - FinalSozia TanNoch keine Bewertungen

- Business Metrics and Tools; Reference for Professionals and StudentsVon EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNoch keine Bewertungen

- Financial Statement Analysis: Business Strategy & Competitive AdvantageVon EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageBewertung: 5 von 5 Sternen5/5 (1)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Von EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Noch keine Bewertungen

- Hindalco Ratio AanysisDokument23 SeitenHindalco Ratio AanysisTathagataNoch keine Bewertungen

- Kasetsart Journal of Social Sciences: Attasuda LerskullawatDokument12 SeitenKasetsart Journal of Social Sciences: Attasuda LerskullawatCorolla SedanNoch keine Bewertungen

- What Is A PipDokument6 SeitenWhat Is A PipJuma BasilioNoch keine Bewertungen

- True / False Questions: Credit Risk: Individual Loan RiskDokument31 SeitenTrue / False Questions: Credit Risk: Individual Loan Risklatifa hnNoch keine Bewertungen

- "Financial Statement Analysis of Bank of Maharashtra": A Project Report OnDokument65 Seiten"Financial Statement Analysis of Bank of Maharashtra": A Project Report OnShashi RanjanNoch keine Bewertungen

- Lease Financing: RWJ CHP 21Dokument17 SeitenLease Financing: RWJ CHP 21Khawaja Nabeel AneesNoch keine Bewertungen

- Tourism ManagementDokument13 SeitenTourism ManagementFolasayo OlalereNoch keine Bewertungen

- Return On Average Tangible Common Shareholders Equity (ROTCE)Dokument4 SeitenReturn On Average Tangible Common Shareholders Equity (ROTCE)leaortiz1403Noch keine Bewertungen

- Full Report On Capital Structure of Nepal SBIDokument12 SeitenFull Report On Capital Structure of Nepal SBINisha BhujelNoch keine Bewertungen

- CH 3Dokument63 SeitenCH 3fahdmohammed707Noch keine Bewertungen

- Forex Trading in 15 MinDokument29 SeitenForex Trading in 15 Mintim100% (6)

- Asset Rotation Strategy With PythonDokument6 SeitenAsset Rotation Strategy With PythonPeter SamualNoch keine Bewertungen

- Assignment 2/0/2018: Financial StrategyDokument13 SeitenAssignment 2/0/2018: Financial StrategydevashneeNoch keine Bewertungen

- PadgettDokument15 SeitenPadgettDonna RespondekNoch keine Bewertungen

- ACCT MANAGERS KEY 2012-13Dokument2 SeitenACCT MANAGERS KEY 2012-13chsureshkumar1985100% (3)

- 2552 1 2 3 4 5 6 7 8 9Dokument220 Seiten2552 1 2 3 4 5 6 7 8 9Frank GoodwinNoch keine Bewertungen

- Global Economic Crisis causes and impactDokument14 SeitenGlobal Economic Crisis causes and impactSridip AdhikaryNoch keine Bewertungen

- Abera Dessie Article ReiewDokument5 SeitenAbera Dessie Article Reiewewunetu birhunieNoch keine Bewertungen

- chapter-03-working-with-financial-statements-test-bank-đã chuyển đổiDokument60 Seitenchapter-03-working-with-financial-statements-test-bank-đã chuyển đổiThùy Linh PhanNoch keine Bewertungen

- LEVERAGESDokument4 SeitenLEVERAGESdonadisamanta9Noch keine Bewertungen

- Islamic Bank Capital Structure Hoque2021Dokument18 SeitenIslamic Bank Capital Structure Hoque2021Dedi SupiyadiNoch keine Bewertungen

- Examining Financial Performance of Agricultural Cooperatives in USA 2019 12p SKDokument12 SeitenExamining Financial Performance of Agricultural Cooperatives in USA 2019 12p SKdainesecowboyNoch keine Bewertungen

- ReSA Financial Statement Analysis GuideDokument11 SeitenReSA Financial Statement Analysis GuideStefanie FerminNoch keine Bewertungen

- Economic Crisis 2008Dokument31 SeitenEconomic Crisis 2008Enio E. DokaNoch keine Bewertungen

- Bank Performance ScorecardDokument9 SeitenBank Performance ScorecardzindalonerNoch keine Bewertungen

- Gul AhmedDokument44 SeitenGul AhmedMalik ShahzebNoch keine Bewertungen

- Chapter 10 Testbank Key Finance ConceptsDokument8 SeitenChapter 10 Testbank Key Finance ConceptsTu NgNoch keine Bewertungen

- M001 - Level 1 - Accounting Principles and Procedures.Dokument3 SeitenM001 - Level 1 - Accounting Principles and Procedures.nishantdon007Noch keine Bewertungen

- Jana Partners LetterDokument12 SeitenJana Partners LetterSimone Sebastian100% (2)

- Siib c1Dokument38 SeitenSiib c1Santanu Das100% (1)