Beruflich Dokumente

Kultur Dokumente

Lic Pension Policy - Retire & Enjoy Presentation

Hochgeladen von

K.N. BabujeeCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lic Pension Policy - Retire & Enjoy Presentation

Hochgeladen von

K.N. BabujeeCopyright:

Verfügbare Formate

Retire

&

Enjoy

Package

Living

too

Short

is

Risky

The Answer is

Living

toooooooooooooooo

Long

is also

Risky

The Answer is

Planning

for

O OLD AGE CHALLENGES

New Disease & New Treatment

Lack of Adequate Social Security

Unavoidable Commitments

Lack of Financial Discipline

Retirement Needs

Day-To-day Expense

Medical Expense

Social Expense

Dependent

54

Dead

36

Still Working

5

Independent

4

Wealthy 1

100 Youngsters at the Age 25yrs

When Reach 65yrs

Mutual Funds / Direct

Market

Real Estate / Gold

Bank / Post Office

Pension

Medi-claim

Life

Insurance

Any

Time

You

Can

Invest

&

ANY

TIME

You

Can

SPEND

ONLY

IN

YOUNGER

AGE

&

ONLY

FOR

YOUR

USE

Options - 1

Post Office

Monthly Income Scheme

Interest 8%

Guaranteed up to 6 yrs Only

Income Taxable

Options - 2

Govt of India

New Pension Scheme

Interest Not Guaranteed

Income Taxable

Options - 3

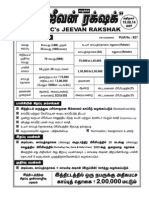

L.I.Cs

Jeevan Akshay Plan-189

Interest 6.9-7.4 %

Guaranteed for LIFE

Income Taxable

Options - 4

L.I.Cs

Jeevan Nidhi & Suraksha

Interest Based on Market

Not Guaranteed

Income Taxable

Which

is

The

Best!

No

One !

Yard-Sticks

to

Choose

Yard-Stick.1

Safety

Yard-Stick.2

Guarantee

Yard-Stick.3

Return On Investment

Yard-Stick.4

Tax-Free

Yard-Stick.5

Extras

When Should

I

Start

Retirement Planning?

Earlier

The

Better

Monthly Savings: 2500/- Pension Age: 55 yrs

Assumed Rate of Interest 6% p.a

Monthly Savings: 2500/- Pension Age: 55 yrs

Assumed Rate of Interest 6% p.a

Pension Age: 55 yrs Capital Required = 16,87,764

Assumed Rate of Interest 6% p.a

What is Retire & Enjoy Package ?

Combination of LIC Plans

Maturity in Successive Years

Any Plan & Any Number of Plans

With or Without Whole Life Cover

14,48,88,90,91,102,103,133,149,

One Policy for 12,00,000 S.A

Sum Assured 1200000

Bonus 1200 x 48 x 21 1209600

Final Adl Bonus 1200 x 100 120000

Total Maturity Amount 2529600

12 Policies for 100000 S.A

14/21 100000 100800 10000 210800

14/22 100000 105600 15000 220600

14/23 100000 110400 25000 235400

14/24 100000 115200 35000 250200

14/25 100000 120000 45000 265000

14/26 100000 124800 55000 279800

14/27 100000 129600 67000 296600

14/28 100000 134400 79000 313400

14/29 100000 139200 91000 330200

14/30 100000 144000 110000 354000

14/31 100000 148800 130000 378800

14/32 100000 153600 155000 408600

TOTAL 12,00,000 15,26,400 8,17,000 35,43,400

What Big Difference

ONE POLICY MATURITY - 25,29,600

12 POLICIES MATURITY - 35,43,400

DIFFERENCE - 10,13,800

Liquidity of R & E Package !

Medical Emergency Fund

Loan

1 day

Interest 9% p.a. Payable Half Yearly

Repayment at Any Time or Pay Only Interest

Sec 10(10)(d) of Income Tax Act 1961

Benefits Received

From

Life Insurance

100%

Tax Free

Direct Tax Code (D.T.C)

From 1

st

April 2012?

Tax Reforms

Tax on Maturity

EEE

Vs

EET

PREMIUM

BONUS

MATURITY

T = TAXABLE

E = EXEMPTED

L.I.C Bonus Rules

Declared Every Year

Based on Term

Less than 11yrs,

11 to 15 yrs,

16 to 20 yrs

More than 21yrs

28 28

34 34

44 44

52

58

62

64

66

67 67 67 67

69 69

71

74

76

78 78

71

64

57

50

46

48 48 48 48

1

9

8

0

1

9

8

1

1

9

8

2

1

9

8

3

1

9

8

4

1

9

8

5

1

9

8

6

1

9

8

7

1

9

8

8

1

9

8

9

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

Endowment Plan Bonus Rates

per Rs.1000/- Sum Assured

L.I.C Final Additional (FAB)Bonus Rules

Payable One Time (on Maturity & Death)

Based on Term

15,16,17,18,1940 & Above yrs

Based on Sum Assured

Up to 25000, 25001 to 50000,

50001 to 199999, 200000 & Above.

Term Up to

25,000

25,001 to

50,000

50,001 to

1,99,999

2,00,000

& Above

15 0 0 10 20

16 0 0 15 25

17 0 10 20 30

18 10 15 25 35

19 15 20 30 50

20 20 25 40 70

21 25 30 50 100

22 30 50 80 150

23 35 100 150 250

25 170 250 330 450

30 670 750 900 1100

35 1400 1500 1850 2300

40 < 2150 2500 3000 3550

Final Additional Bonus per Rs.1000/- Sum Assured 31.03.2010

Why So Long Term Plan ?

Lower Premium

Risk Cover

Higher Bonus

Higher FAB

Longer Pension

LONG TERM INVESTMENT OPTIONS

Taxable Vs Tax-Free Returns

Others Life Insurance

Maturity Rs.100 Rs.80

Tax Payable Rs. 30 0

Net Maturity Rs. 70 Rs.80

( Scope of Tax-Free Long Term Investment Options are Limited,

When compared to Short Term Investment Options )

How L.I.C differ from Private Cos ?

SURPLUS sharing 90 10 Vs 95 5

Past Performance Good Bonus Record

Lower Expenses Lowest Expense Ratio

Claim Settlement Highest Claim

Settlement Ratio

Service Networks 8-Z.O, 109-D.O, 2048+

B.O, 1000+ S.O, . . .

What is Sovereign Guarantee ?

L.I.C OF INDIA Formed & Regulated by

Under LIC OF INDIA ACT 1956

Sum Assured

&

Declared Bonuses

Guaranteed by Govt of India.

Even if LIC in Financial Crisis, Govt will Settle Policy Holders Claim.

Premium Payment is

EASY

GO FOR

E.C.S

Insurance is the

Only Product

Which You Have to Buy

When It is Not Required.

You Cant Buy Insurance

When It is Required.

Because..

Life is Always Uncertain

&

Insecurity is The Biggest Threat in Life

Factors Affecting Confidence Level

Knowledge

Experience

Personality

Position

Power

Influence

Character

Dressing

Ego

Support

Gender

Environment

Performance

Skill

Language

Stress

Spirituality

Insurance

Cash

Confidence

Rule

36,5

TIME IS MONEY

Target Upto June 2011

Rs.5000/-

ECS Monthly

12 Packages

Create a Income of Rs.11,52,000/-

For

Next

25 years

Prepared By

K.N. Babujee B.com M.C.A,

Insurance Advisor &

Wealth Consultant

City Branch VI

Chennai 600 002.

Call: 9884635430

Mail: babujee007@gmail.com

Visit:www.scribd.com/babujee

Das könnte Ihnen auch gefallen

- Form 16 ADokument1 SeiteForm 16 AJigar GutkaNoch keine Bewertungen

- FORM16Dokument5 SeitenFORM16sunnyjain19900% (1)

- Consolidated StatementDokument1 SeiteConsolidated StatementParameswararao BillaNoch keine Bewertungen

- Offer Letter - Sathish Basham - Officer - 12-Sep-2023Dokument3 SeitenOffer Letter - Sathish Basham - Officer - 12-Sep-2023Manikanth ChowdaryNoch keine Bewertungen

- Telephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaDokument3 SeitenTelephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaRamnish MishraNoch keine Bewertungen

- Sudeep Mazumdar Ashok Leyland - ConfirmationDokument2 SeitenSudeep Mazumdar Ashok Leyland - ConfirmationSudeep MazumdarNoch keine Bewertungen

- 556salary Slip Template AADokument5 Seiten556salary Slip Template AARameshNoch keine Bewertungen

- PaySlip July 2022Dokument1 SeitePaySlip July 2022Kaushal YadavNoch keine Bewertungen

- Offer Letter SampleDokument2 SeitenOffer Letter Sampleyevadimata vinakuNoch keine Bewertungen

- POLICY SERVICING REQUEST 2 - With StandardDokument3 SeitenPOLICY SERVICING REQUEST 2 - With Standardsarwar shamsNoch keine Bewertungen

- VishalDokument0 SeitenVishalVishal AggawalNoch keine Bewertungen

- Job Description: Company: ZomatoDokument2 SeitenJob Description: Company: ZomatoGaurav SinghalNoch keine Bewertungen

- OneCode OfferletterDokument1 SeiteOneCode OfferletterAadarshNoch keine Bewertungen

- AccentureDokument1 SeiteAccenturesdrfNoch keine Bewertungen

- Udaan Evf L2Dokument12 SeitenUdaan Evf L2mayank.dce123Noch keine Bewertungen

- Manas PDFDokument3 SeitenManas PDFSantosh Kumar RautNoch keine Bewertungen

- Excel Salary Slip Format DownloadDokument2 SeitenExcel Salary Slip Format DownloadNandgulabDeshmukhNoch keine Bewertungen

- 1 1000 Form16Dokument5 Seiten1 1000 Form16Rakshit SharmaNoch keine Bewertungen

- Abcd Shweta Final PDFDokument76 SeitenAbcd Shweta Final PDFriyaNoch keine Bewertungen

- My Approvaland ConsentDokument97 SeitenMy Approvaland Consentonline order ravi & beenu shrivastavNoch keine Bewertungen

- IGNOU Online Counselor Empanelment Counselor PortalDokument2 SeitenIGNOU Online Counselor Empanelment Counselor Portalsonal vaishnavNoch keine Bewertungen

- 2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMDokument1 Seite2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMMohammad MAAZNoch keine Bewertungen

- Ankit MishraDokument7 SeitenAnkit MishraRähûl Prätäp SïnghNoch keine Bewertungen

- Nov 2015 Payslip PDFDokument1 SeiteNov 2015 Payslip PDFkarthikaNoch keine Bewertungen

- Preview PDFDokument1 SeitePreview PDFVivek KhairnarNoch keine Bewertungen

- Pay SlipDokument1 SeitePay SlipKumar AshuNoch keine Bewertungen

- (A Government of India Enterprise) : Investment Details Details of Pending TY AdvancesDokument1 Seite(A Government of India Enterprise) : Investment Details Details of Pending TY AdvancesindianroadromeoNoch keine Bewertungen

- Screenshot 2023-12-14 at 1.02.56 PMDokument1 SeiteScreenshot 2023-12-14 at 1.02.56 PMshashikumarsk0711Noch keine Bewertungen

- Swati Thapa S-907 Nehru Nagar, Kotra Sultanabad Bhopal (M.P.)Dokument1 SeiteSwati Thapa S-907 Nehru Nagar, Kotra Sultanabad Bhopal (M.P.)anil007rajuNoch keine Bewertungen

- Application Form IPTVDokument4 SeitenApplication Form IPTVInformation everythingNoch keine Bewertungen

- 019 Tender Notice For Erp Upgrades For Cbs 1701776853753146Dokument10 Seiten019 Tender Notice For Erp Upgrades For Cbs 1701776853753146Bilal MughalNoch keine Bewertungen

- (Appraisal Letter) (1) - 1Dokument1 Seite(Appraisal Letter) (1) - 1rishuNoch keine Bewertungen

- Aeries Technology Group Private Limited: Full and Final Settlement - December 2018Dokument3 SeitenAeries Technology Group Private Limited: Full and Final Settlement - December 2018तेजस्विनी रंजनNoch keine Bewertungen

- Airasia Online Print Tax InvoiceDokument15 SeitenAirasia Online Print Tax InvoiceDarshan DarshanNoch keine Bewertungen

- Computation 22-23Dokument2 SeitenComputation 22-23Ruloans VaishaliNoch keine Bewertungen

- AC Bajaj Finance - 2Dokument2 SeitenAC Bajaj Finance - 2prsnjt11Noch keine Bewertungen

- TDS ChallanDokument1 SeiteTDS ChallanJayNoch keine Bewertungen

- Payslip For 16831Dokument1 SeitePayslip For 16831omkassNoch keine Bewertungen

- CRISIL Upgrades Muthoot Finance Long Term Debt Rating From AA-/stable To AA/stable (Company Update)Dokument2 SeitenCRISIL Upgrades Muthoot Finance Long Term Debt Rating From AA-/stable To AA/stable (Company Update)Shyam SunderNoch keine Bewertungen

- Rajan Barot Mumbai Offer LetterDokument6 SeitenRajan Barot Mumbai Offer LetterRajan BarotNoch keine Bewertungen

- Certificate of InsuranceDokument4 SeitenCertificate of Insurancekurundwadesandy007Noch keine Bewertungen

- Deposit Confirmation/Renewal AdviceDokument1 SeiteDeposit Confirmation/Renewal Adviceekta rajoriaNoch keine Bewertungen

- Insurance Smart Sampoorna RakshaDokument10 SeitenInsurance Smart Sampoorna RakshaArpit ShahNoch keine Bewertungen

- Tharun J - AmDokument7 SeitenTharun J - AmTharun RickyNoch keine Bewertungen

- HDFC Life Click 2 Protect SuperDokument3 SeitenHDFC Life Click 2 Protect SuperABISHKAR SARKARNoch keine Bewertungen

- Location - You Will Report To Us in Bangalore or Any Other Location India Depending Upon Your FinalDokument9 SeitenLocation - You Will Report To Us in Bangalore or Any Other Location India Depending Upon Your FinalvanitabNoch keine Bewertungen

- Relieving LetterDokument1 SeiteRelieving LetterKushal SenNoch keine Bewertungen

- Itr 1 FormatDokument3 SeitenItr 1 FormatPawanNoch keine Bewertungen

- SL 11058885651 2018 03 05 08 39 43 51562Dokument2 SeitenSL 11058885651 2018 03 05 08 39 43 51562VikashSinghNoch keine Bewertungen

- 1194 Sneha Babu-Teleperformance (CSE) 2019-2020Dokument3 Seiten1194 Sneha Babu-Teleperformance (CSE) 2019-2020Popi BhowmikNoch keine Bewertungen

- Deduction Under Section 80GDokument2 SeitenDeduction Under Section 80GsadathnooriNoch keine Bewertungen

- 2 - 1988712 - Salary - Annexure - 7 - 27 - 2021 5 - 26 - 41 PMDokument1 Seite2 - 1988712 - Salary - Annexure - 7 - 27 - 2021 5 - 26 - 41 PMVi NodNoch keine Bewertungen

- Offer Letter - Komal SharmaDokument6 SeitenOffer Letter - Komal SharmaHIMANI RANANoch keine Bewertungen

- Offer LetterDokument1 SeiteOffer LetterRajesh PaniNoch keine Bewertungen

- Teamlease Services LimitedDokument1 SeiteTeamlease Services LimitedMimin khsNoch keine Bewertungen

- Page 1 of 9Dokument9 SeitenPage 1 of 9Anirban MazumdarNoch keine Bewertungen

- Ajay Offer LetterDokument3 SeitenAjay Offer LetterTarunkumar LadNoch keine Bewertungen

- Offer LetterDokument12 SeitenOffer LetterFarhan KhanNoch keine Bewertungen

- Have A Look at Its Amazing Benefits: Mr. XyzDokument3 SeitenHave A Look at Its Amazing Benefits: Mr. XyzHarish ChandNoch keine Bewertungen

- ETLife Cashflow ProtectionDokument10 SeitenETLife Cashflow Protectionnadhiya2007Noch keine Bewertungen

- Gated Community, Approved Land For Sale at Padapai, On GST Road at Chengalpattu - MamandurDokument2 SeitenGated Community, Approved Land For Sale at Padapai, On GST Road at Chengalpattu - MamandurK.N. BabujeeNoch keine Bewertungen

- Yoga Class Call 9884635430Dokument2 SeitenYoga Class Call 9884635430K.N. BabujeeNoch keine Bewertungen

- Food Supplements: Code Product Description MRPDokument4 SeitenFood Supplements: Code Product Description MRPTienshealthcare4uNoch keine Bewertungen

- SBI Life - New Child Plan - 9884635430Dokument3 SeitenSBI Life - New Child Plan - 9884635430K.N. BabujeeNoch keine Bewertungen

- Know Ur FutureDokument1 SeiteKnow Ur FutureK.N. BabujeeNoch keine Bewertungen

- Know Ur FutureDokument1 SeiteKnow Ur FutureK.N. BabujeeNoch keine Bewertungen

- Porur House Sale Call 8124248679Dokument1 SeitePorur House Sale Call 8124248679K.N. BabujeeNoch keine Bewertungen

- LIC Jeevan Shagun Policy - Premium Chart - Call 9884635430Dokument1 SeiteLIC Jeevan Shagun Policy - Premium Chart - Call 9884635430K.N. BabujeeNoch keine Bewertungen

- LIC's NEW MONEY BACK PLAN - 20% of The Sum Assured Paid Every 5 Years.Dokument1 SeiteLIC's NEW MONEY BACK PLAN - 20% of The Sum Assured Paid Every 5 Years.K.N. BabujeeNoch keine Bewertungen

- Visit Temple - Daily (Amazing Information)Dokument3 SeitenVisit Temple - Daily (Amazing Information)K.N. BabujeeNoch keine Bewertungen

- Valarpuram Land For SaleDokument1 SeiteValarpuram Land For SaleK.N. BabujeeNoch keine Bewertungen

- Land Sale Below GOVERNMENT GUIDELINE VALUE at Mosur Railway Station Call Babujee 8124248679Dokument1 SeiteLand Sale Below GOVERNMENT GUIDELINE VALUE at Mosur Railway Station Call Babujee 8124248679Babujee K.NNoch keine Bewertungen

- LIC's SUPER PLAN - JEEVAN SHAGUN (Single Premium - Fixed Deposit) Plan Closes On 30-11-2014 Call BABUJEE 8124248679.Dokument1 SeiteLIC's SUPER PLAN - JEEVAN SHAGUN (Single Premium - Fixed Deposit) Plan Closes On 30-11-2014 Call BABUJEE 8124248679.K.N. BabujeeNoch keine Bewertungen

- LIC New Pension Plan by BJP Government For Senior Citizen Only - Varista Pension, Monthly Pension 9% & Yearly Pension 9.38% Gurantee Pension.Dokument1 SeiteLIC New Pension Plan by BJP Government For Senior Citizen Only - Varista Pension, Monthly Pension 9% & Yearly Pension 9.38% Gurantee Pension.K.N. BabujeeNoch keine Bewertungen

- Research On Gayatri Mantra-AmazingDokument1 SeiteResearch On Gayatri Mantra-AmazingK.N. BabujeeNoch keine Bewertungen

- LIC New Plan Jeevan Rakshak (Non Medical Plan) - EnglishDokument1 SeiteLIC New Plan Jeevan Rakshak (Non Medical Plan) - EnglishK.N. BabujeeNoch keine Bewertungen

- Lic Jeevan Shagun Policy Helpline 9884635430Dokument4 SeitenLic Jeevan Shagun Policy Helpline 9884635430K.N. BabujeeNoch keine Bewertungen

- LIC New Plan - Ready Reckoner of Jeevan Rakshak Plan No. 827Dokument26 SeitenLIC New Plan - Ready Reckoner of Jeevan Rakshak Plan No. 827K.N. BabujeeNoch keine Bewertungen

- LIC New Plan Jeevan Rakshak - TAMILDokument1 SeiteLIC New Plan Jeevan Rakshak - TAMILK.N. BabujeeNoch keine Bewertungen

- LIC's NEW ENDOWMENT PLAN - Higher Risk Cover For Low PremiumDokument1 SeiteLIC's NEW ENDOWMENT PLAN - Higher Risk Cover For Low PremiumK.N. BabujeeNoch keine Bewertungen

- LIC's NEW MONEY BACK PLAN - 20% of The Sum Assured Paid Every 5 Years.Dokument1 SeiteLIC's NEW MONEY BACK PLAN - 20% of The Sum Assured Paid Every 5 Years.K.N. BabujeeNoch keine Bewertungen

- LIC New Pension Plan by BJP Government For Senior Citizen Only - Varista Pension, Monthly Pension 9% & Yearly Pension 9.38% Gurantee Pension.Dokument1 SeiteLIC New Pension Plan by BJP Government For Senior Citizen Only - Varista Pension, Monthly Pension 9% & Yearly Pension 9.38% Gurantee Pension.K.N. BabujeeNoch keine Bewertungen

- LIC Single Premium Endowment Plan - Fixed Deposit PLANDokument1 SeiteLIC Single Premium Endowment Plan - Fixed Deposit PLANK.N. BabujeeNoch keine Bewertungen

- Comparison Between Mediclaim and Jeevan Arogya - 9884635430 - LICDokument1 SeiteComparison Between Mediclaim and Jeevan Arogya - 9884635430 - LICBabujee K.N100% (1)

- Investment Land Sale at Sriperumbudur Valapuram 8124248679Dokument2 SeitenInvestment Land Sale at Sriperumbudur Valapuram 8124248679Babujee K.NNoch keine Bewertungen

- LIC's NEW JEEVAN ANAND PLAN - Zindagi Ke Sath Bhi! Zindagi Ke Bath Bhi!!Dokument1 SeiteLIC's NEW JEEVAN ANAND PLAN - Zindagi Ke Sath Bhi! Zindagi Ke Bath Bhi!!K.N. BabujeeNoch keine Bewertungen

- LIC's NEW BIMA BACHAT - A Single Premium Money Back Plan For 9,12 & 15 YearsDokument1 SeiteLIC's NEW BIMA BACHAT - A Single Premium Money Back Plan For 9,12 & 15 YearsK.N. BabujeeNoch keine Bewertungen

- Biggest Lic Policy - 100 Crores S.A - Term InsuranceDokument1 SeiteBiggest Lic Policy - 100 Crores S.A - Term InsuranceK.N. BabujeeNoch keine Bewertungen

- PANCARD Doorstep Service Call 8124248679Dokument3 SeitenPANCARD Doorstep Service Call 8124248679K.N. BabujeeNoch keine Bewertungen

- Kenyan Banks - Could Equity Be A Victim of Its Own SuccessDokument22 SeitenKenyan Banks - Could Equity Be A Victim of Its Own SuccessMukarangaNoch keine Bewertungen

- Obligations Contracts Review Notes QuizzerDokument75 SeitenObligations Contracts Review Notes QuizzerArah Opalec100% (3)

- Assignment 1 Question FIN7210 Fall 2017 DSDokument2 SeitenAssignment 1 Question FIN7210 Fall 2017 DSAmjad khanNoch keine Bewertungen

- Economics Nov 2009 Eng MemoDokument30 SeitenEconomics Nov 2009 Eng Memokubayik7402Noch keine Bewertungen

- Topic 1 Introduction To Malaysian Financial System (S)Dokument36 SeitenTopic 1 Introduction To Malaysian Financial System (S)pedoqpopNoch keine Bewertungen

- Proforma For Calculation of Income Tax For Tax DeductionDokument1 SeiteProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Securities (Lastman) - 2012-13Dokument69 SeitenSecurities (Lastman) - 2012-13scottshear1Noch keine Bewertungen

- Marquez vs. AlindogDokument18 SeitenMarquez vs. AlindogBoyTibsNoch keine Bewertungen

- Nexo WhitepaperDokument44 SeitenNexo Whitepapercheppy montela100% (1)

- 43 - Insurance - Arce v. Capital Insurance and Surety Co.Dokument1 Seite43 - Insurance - Arce v. Capital Insurance and Surety Co.perlitainocencioNoch keine Bewertungen

- Chapter 9 EmpleoDokument4 SeitenChapter 9 Empleoaldric taclanNoch keine Bewertungen

- INDIABULLS CoppanyDokument101 SeitenINDIABULLS CoppanyJasmandeep brarNoch keine Bewertungen

- Module 8 SolDokument10 SeitenModule 8 SolMae Ann GonzalesNoch keine Bewertungen

- Banking Law SyllabusDokument5 SeitenBanking Law SyllabusVicky DNoch keine Bewertungen

- Solution Manuals DownloadDokument5 SeitenSolution Manuals DownloadPutu DenyNoch keine Bewertungen

- Chiripal Poly R 08092017Dokument7 SeitenChiripal Poly R 08092017Saurabh JainNoch keine Bewertungen

- Bus 101 NotesDokument3 SeitenBus 101 NotesNina YunNoch keine Bewertungen

- Falaknaz PresidencyDokument12 SeitenFalaknaz PresidencyAdnan AfzalNoch keine Bewertungen

- Financial Management Strategy Nov 2007Dokument4 SeitenFinancial Management Strategy Nov 2007samuel_dwumfourNoch keine Bewertungen

- FMF L1 4S PDFDokument62 SeitenFMF L1 4S PDFQuynh Trang DinhNoch keine Bewertungen

- NHA - Application Form GEHP RevisedDokument2 SeitenNHA - Application Form GEHP RevisedStephanie Anne Jocson100% (2)

- Group Assignment MChangeDokument28 SeitenGroup Assignment MChangemilashairi0% (1)

- Pretest - Lesson 2 Fabm 1Dokument1 SeitePretest - Lesson 2 Fabm 1robelyn veranoNoch keine Bewertungen

- DocumentationDokument36 SeitenDocumentationRamesh BethaNoch keine Bewertungen

- Order Against Infinity Realcon LimitedDokument18 SeitenOrder Against Infinity Realcon LimitedShyam SunderNoch keine Bewertungen

- Public Bank AnalysisDokument25 SeitenPublic Bank Analysisbennyvun80% (5)

- Case Study On Subhiksha Retail ChainDokument18 SeitenCase Study On Subhiksha Retail ChainSrinivas R. Khode0% (1)

- Chapter 6. Rescissible ContractsDokument37 SeitenChapter 6. Rescissible ContractsNate AlfaroNoch keine Bewertungen

- Mitchell Regional Habitat For Humanity-Mitchell Habitat Audit Report 06-30-2020Dokument17 SeitenMitchell Regional Habitat For Humanity-Mitchell Habitat Audit Report 06-30-2020api-308302326Noch keine Bewertungen

- United States v. Glennis L. Bolden, United States of America v. Clifford E. Bolden, 325 F.3d 471, 4th Cir. (2003)Dokument41 SeitenUnited States v. Glennis L. Bolden, United States of America v. Clifford E. Bolden, 325 F.3d 471, 4th Cir. (2003)Scribd Government DocsNoch keine Bewertungen