Beruflich Dokumente

Kultur Dokumente

Presentation For IT in INDIA by SABITAVO DAS

Hochgeladen von

Sabitavo DasOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Presentation For IT in INDIA by SABITAVO DAS

Hochgeladen von

Sabitavo DasCopyright:

Verfügbare Formate

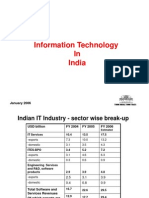

IT/ITES SECTOR IN

INDIA

PRESENTED BY: SABITAVO DAS

TABLE OF CONTAINT

01 SECTOR OVERVIEW

02 REVENUE BREAKUP

03 EMPLOYMENT STATISTICS

04 GOVERNMENT INITIATIVES

05 STRENGTH & WEAKNESS

06 CONCLUSION

Global scenario of IT & ITES.

The worldwide

information technology

industry, comprising

hardware, software,

information technology

(IT)services and BPO, is

estimated to have

clocked aggregate

revenues of $1,800

billion in 2012, an

increase of 5.0 per cent

over the previous year.

IT & ITeS account for a

major chunk of IT

revenues close to 45

percent, followed by

hardware and software,

which contribute

around 38 percent and

18 per cent,

respectively.

In the next 3-4 years, total

spending on IT is

expected to grow at a

CAGR of 5.5 per cent

globally.

At 8.2 per cent, IT-ITeS

spend is likely to grow

faster as compared to

other segments

Source: National Association of Software and Services Companies (Nasscom )data base

Indian IT sectors overview .

9%

3.1

mn

55% 38%

$2.4

bn

99 45% >60

Sectors

share in

GDP

Largest private

sector

employer

Share in global

offshoring

market

Largest share in

total services

exports

IT-BPM share:

47% Highest

attractor of

PE/VC

investments5

Cross border

M&A, 28%

share in total

M&As

Offsets

nearly half

of Indias oil

imports bill

Operational

IT-SEZs; 30%

in Tier II/III

cities35

Source :Nasscom

Evolution of Indian IT & ITES industry

The software

industry was

literally

nonexistent in

India until 1960.

Despite the

government initiatives,

the software exports

were not picking up

because of two reasons

mainly:

The exports of

software, was heavily

dependent on the

imports of hardware,

which was costly as

well as the procedure

for obtaining the same

was very cumbersome.

Secondly, there was a

lack of infrastructural

facilities for software

development.

By early 90s, US-

based companies

began to outsource

work on low-cost and

skilled talent pool in

India.

IT industry started to

mature.

Increased investment

in R&D and

infrastructure started

India increasingly

seen as a product

development

destination

Firms in India became

multinational

companies with

delivery centers across

the globe (580

center's in 75

countries, as of 2012).

Firms in India make

global acquisitions.

The IT sector is

expected to employ

about 3.0 million

people directly and

around 9.5 million

indirectly, as of FY13.

Indias IT sector is at

an inflection point,

moving from

enterprise servicing to

enterprise solutions.

Prior to

1980

1980-1990

1990-2000

2000-

onwards

Localization of IT industry..

Indias first it hub.

Good infrastructure

The idea of SEZ. Karnataka was among the first

to setup tax free SEZ to support technology

companies. This further encouraged IT

companies to set shop in Bangalore.

Bangalore

After Bangalore, Hyderabad has been

dubbed as the Silicon Valley of India, mainly

in light of the fact that more and more firms

have set up their operations there.

Hyderabads IT exports exceeded $1

billion in 2004

Hyderabad

Global leader for business process

outsourcing.(BPO)

Tamil Nadu was one of the first states in the

Indian Union to formulate an IT policy

Third largest it exporter from India

Tamil nadu

Maharashtra has reached the number two

spot in IT exports in the country and Pune

region is the leading source of IT exports

The total software exports out of

Maharashtra amount to Rs 51,760 crore,

second only to Karnataka (Rs 80,000 crore).

Maharashtra

Beginning to be recognized as a

fastest growing it destination

West Bengal

One the fastest growing it export hub.

Export it software 2000crore,its tenth

largest exporter .

Orissa

Source : The hindu,Livemint.

Indian IT sector broadly classified

into four segment

IT

IT services

Business

process

management

Software

products and

engineering

services

Hardware

Market Size: USD56.3 billion during FY13

Over 78 per cent of revenue comes from the export

market

BFSI continued as the major vertical of the IT sector

Market size: USD20.9 billion during FY13

Around 85 per cent of revenue comes from the export

market

Market size: USD17.9 billion during FY13

Over 79 per cent of revenue comes from exports

Market size: USD13.3 billion during FY12

The domestic market is experiencing growth as the

penetration of personal computers is rising in India

The sector has recorded a CAGR of 12% since 2010 to reach

USD118 billion in FY14, primarily driven by exports and IT

services segment

IT

54%

BPM

20%

SOFTWARE

SERVICES

15%

HARDWARE

11%

REVENUE BY SEGMENT

FININANCE YEAR(14E)

IT BPM SOFTWARE SERVICES HARDWARE

50.1

59.4

69.2

76.5

86.4

24.1

29

31.7

32.7

31.6

0

50

100

150

FY10 FY11 FY12 FY13 FY14

REVENUE BY YEARS

EXPORTS DOMESTIC

Export revenue grew by 13% year on year to USD 86.4 billion in14E,highest in five year.

Domestic revenue declined by 1.3% in year FY 14 from FY 13 due economic uncertainties, currency

fluctuation, slow down in GDP and near election 2014 ,all these are main reason for decline.

Among revenue segments, it was highest 54 % contributor, its growth is driven by IT consulting, soft

ware testing.

Domestic revenue break up

0% 10% 20% 30% 40%

Manufacturing

Govermnt

Consumer

Health care

Retail

Domestic revenue by

verticals (FY14)

0

200

400

600

800

1000

1200

1400

IT BPM S/W PRODUCTS

IT BPM REVENUE IN (IRN BILLON)

FY2012 FY2013E

Domestic: Y-o-Y growth 14.1 per cent, fastest

growing IT market in the world

Segments: IT services fastest growth 14.5 per

cent, BPM grew at 12.7 per cent

Services: Managed services, unified

communications, collaborative applications,

integration of core enterprise applications

IT services, export account for 75 %of Indian it services industry, IT services exports

have grown from $17.1 billion in FY 2007 to around $39.8 billion in FY 2012, a CAGR

for 18.5% and in FY13 it grew at $43.9$....

2

8

1

3

1

1

7

3

2

2

3

1

1

4

1

2

8

4

2

2

3

5

1

5

1

4

9

4

2

2

EXPORT REVENUE

GROWTH VERTICAL(USD

BILLION)

FY12 FY13 FY14

Growth in BFSI sector from year FY13 to FY14 is

increasing by12.9%,USD35billion ,growth in

manufacturing sector ,retail, and t&m (telecom

media) also increased by

16.6%,7.142%,7.142%.Growth in retail, healthcare,

travel was led by demand for mobility ,analytics,

government mandated and green technology

and digitalization .

Source:nasscom, Note: t&m- Telecom media,

c&u:construction and utilities

0

50

100

FY2008 FY2009 FY2010 FY2011 FY2012 FY2013 FY2014

IT -BPM -EXPORT REVENUE

IT SERVICE BPM S/W PRODUCTS AND ENGINNIERING

IT services revenue was increasing from FY2008 to FY 2014

by USD 29.7 billion. IF closely looking at the graph it clearly

understand that IT service growth at ~10 per cent; BPM

growth faster at 12.2 per cent from FY 2012TO FY 2013.

Business Drivers for the year-

New verticals and geographies

SMAC based services

Transformation and innovation

Restructured business mod

Growth Service lines: RIM, software testing, knowledge

services and F&A services

Export revenue by Geography.

The US accounted for nearly two-thirds of Indias total IT exports, while UK

experienced the highest growth in revenues

0

10

20

30

40

50

60

US UK CONTINENTIAL

EUROPE

APAC ROW

GEOGRAPHIC BREAKUO OF EXPORT REVENUE

(USD BILLION)

FY12 FY13 FY14

63%

18%

11%

6%

2%

61% 17%

12%

8%

2%

US

UK

CONTINENTIAL

EUROPE

APAC

ROW

TheUS,witha61%shareoftotalITexports,continuestobetheleadingcontributortoITsectorrevenues.ITexportstoU

Sincreased13%YoYinFY14.

TheUKandEuropearewitnessingincreaseddemand,asobservedfromthehigherYoYgrowth.TheAPACmarketis

relativelyunder-penetrated while Row is an emerging market with growing IT adoption.

SOURCE:NASSCOM

IT services revenue recorded a CAGAR

of9.5% during FY-12-14 led by exports

1

2

.

1

7

1

2

.

1

8

1

2

.

0

8

4

1

.

1

4

4

5

.

4

2

5

1

.

9

2

FY12 FY13 FY14

IT SERVICES REVENUE

DOMESTIC EXPORT

48%

17%

3%

7%

25%

EXPORTS REVENUE MIX

CUSTOM APPLICATION IT outsourcing ITCONSULTING SOFTWARE OTHER

TotalITservicesrevenuesincreasedataCAGRof9.5%toreachUSD64billioninFY14.DomesticITservicesmarketde

clinedataCAGRof0.5%.

ITservicesexportrevenuesgrewat14%YoYfromUSD45.4billionto~USD51.9billioninFY14.Thegrowthcanbeascr

ibedtorevivalindemandfromtheUSandEurope.

BPM revenues registered a CAGR of 10.5% during FY1214 with exports

having a 85% share (USD20 billion); CIS was the largest contributor to

export revenues

3% 3.22 3.24

16% 17.88 19.92

FY12 FY13 FY14

BPM REVENUES

DOMESTIC EXPORT

40%

19%

23%

14%

2% 1% 1%

Export revenue mix

customer

interaction

services

knodledge

services

finance &

accounting

verical specific

BPM services

TotalBPMrevenuesgrewataCAGRof10.5%totaling~USD23billioninFY14;theBPMdomesticrevenuesincrease

dataCAGRof2.8%.

BPM export revenues rose at~11%YoY over FY13 to reach~USD20 billion inFY14,accounting for nearly

one-fourth of total IT exports. The revenue growth was driven by knowledge services(data analytics

,legal services)and vertical-specific BPM Services.

SOURCE: Nasscom

Software product and ER&D revenues

3

.

7

3

.

8

3

.

7

1

1

.

7

1

2

.

8

1

4

.

1

FY12 FY13 FY14

DOMESTIC EXPORT

0% 10% 20% 30% 40%

1

SOFTWARE-USD1.7BILLION

RETAIL EDUCATION

MANUFACTURING PHARMA HEALTH CARE

BFSI TECHNOLOGY

OTHER

0% 5% 10% 15% 20% 25% 30% 35%

OTHER

TELECOME

SEMICONDUCTOR

AUTO

AERO

ENERGY

CONSUMER ELECTRONICS

MEDICAL DEVICES

ER&D-USD12.4BILLION

Software products &ER&D revenues grew steadily at a CAGR of 7.5% to reach~USD18billion FY14.

Software product revenues were driven by increased proliferation of mobile devices, advanced

technologies, cloud computing, greater uptake of software product by small and medium

businesses(SMBs)and enterprises ER&D revenues were driven by engineering

solutions(accountingfor55%ofrevenues) and embedded systems(accountingfor45%ofrevenues).

STARTUPS ARE INCREASING IN THE FIELD OF CLOUD,BIG DATA,DATA

ANALYSIS ,SOCIAL MEDIA, ECOMMERCE, seeing significant vc and angel

investor

162

335

400

450

500

2005 2009 2011 2012 2013

NUMBER OF START UPS

43

7

48

32

VC I NVESTOR ANGEL I NVESTOR

NUMBER OF ACTIVE

INVESTOR

2006 2012

43

13

180

80

VC I NVESTOR ANGEL I NVESTOR

NUMBER OF DEALS

2007 2012

32%

29%

21%

18%

18%

18%

14%

14%

14%

11%

11%

0% 5% 10% 15% 20% 25% 30% 35%

CLOUD /BIGDATA

MOBILE

BUSINESS

ECOMMERCE

WEBSITE& ONLINE

DEVICE/HARDWARE

DOMAIN FOCUS BY STARTUP

CLOUD/BIGDATA is

growing faster

than other domain

,account 32% in

the segment

followed by

mobile(29%),ecom

merce(14%).

Number of startups

are increased

by162 to 500 from

2005 to 2013.

Source :

NASSCOM,LIVEMINT

It-BPM service dominated by large players but majority of It-

BPM firms are small which contribute to18% of total

employment and 10% to the revenue

Company size Number of players %of total export

revenue

% of total

employees

Work focus

Large 11 47-50% 35-38% Full range of service

proving.

Presence over 60

countries.

Large scale of

operation and

infrastructure .

Mid size 85-100 32-35% 28-30% Mid size players offering

services in multiple

verticals

Near shore and off

shore presence in>30-

35 countries.

Emerging 450-600 9-10% 15-20% Players offering niche it-

bpm services

Small >40000 9-10% 15-18% Small players focusing

on specific services in

niche segment

Top players in IT-BPM services

Top players in IT SERVICES TOP PLAYERS IN ITES SERVICES TOP IT SECTOR EMPLOYERS

Tata Consultancy Services Ltd

Genpact India Pvt. Ltd. Tata Consultancy Services Ltd.

Infosys Ltd. Tata Consultancy Services Ltd Infosys Ltd

Wipro Ltd.

Serco Global Services

Cognizant Technology Solutions India Pvt. Ltd.

HCL Technologies Ltd. Aegis Ltd. Wipro Ltd.

iGATE

Wipro BPO

HCL Technologies Ltd.

Mphasis Ltd. Infosys BPO Tech Mahindra Ltd.

L&T Infotech Ltd.

Firstsource Solutions Ltd.

Genpact

Syntel Ltd. WNS Global Services (P) Ltd.

Serco Global Services

CSC, India

Aditya Birla Minacs Worldwide Ltd.

Cap Gemini India Pvt. Ltd.

Genpact India Pvt.Ltd.

EXL

Mphasis Ltd

Robert BOSCH Engineering and

Business Solutions Ltd.

Hinduja Global Solutions Ltd.

Aegis Ltd.

KPIT Technologies Ltd. HCL Technologies Ltd. -Business Services iGATE Global Solutions Ltd

Polaris Financial Technology Ltd. Tech Mahindra Limited CSC India

SOURCE :NASSCOM

EMPLOYEEMENT REVIEW

1296

879

601

1407

917

640

I T EXPORTS BPM EXPORTS I T- BPM EXPORTS

DIRECT EMPLYOEES(OOO)

2012 2013E

Industry employs ~3 million professionals directly, and ~9.5 million indirectly Employee growth

supplemented by non linear model. Over > 100,000 foreign nationals employed by the industry

~30 per cent (800,000+) women employees. Worlds largest talent pool: ~ 4.7 million graduates

and post graduates...

SOURCE :NASSCOM

FUTURE PROSPECT IN IT-ITES

Cloud Computing

Market is expected to reach USD650- 700 billion globally and USD1518 billion in India by

2020.

Cloud penetration in hardware is expected to show a major shift from 810% in 2012 to 22

24% in 2016.

Big Data/Analytics

The global market is estimated to grow 45% annually to reach USD25billionby2015.

Indian Big Data industry is expected to grow

from USD 200 million in 2012 to USD 1billionin 2015,aCAGR of over 83%.

Emergence of niche start-up s and technological developments would foster growth.

Social Media Analytics

An explosive growth opportunity for Enterprise Social Software with the global market exceeding USD6.4 billion

by 2016.

According to v Forrester Research ,spending on social business software is expected to grow at a CAGR of 61%

during 201316.

Enterprise Mobility (EM)

Global revenues are estimated to reach around

USD140billion by 2020, a CAGR of~15%.

North America is expected to remain the largest

market while APAC is expected to grow the fastest

at~21%.

Existing spend of less than 5% on EM is expected to

grow to 10-12% by 2020.

SMBs

SMBs are emerging as key stake holders for Indias IT sector.

Despite being large (47millionunits) and highly unorganized, this segment is witnessing rapid IT

adoption.

The key to exploiting the SMB opportunity is to offer cloud models(SaaS ,PaaS,IaaS),bundled end-

to-end offerings, bundled pricing, and intuitive solutions.

Source : NASSCOM

IT-ITES INDUSTRY OVERVIEW FOR NEAR FUTURE

India has the potential to build a US$ 100 billion software product industry by 2025, according to Indian

Software Product Industry Roundtable (iSPIRT).

The software products market in India, which includes accounting software and cloud computing-

based telephony services, is expected to grow at 14 per cent in 2014.

The IT services sector accounted for the largest share of the IT and ITeS industry, with a total market size

of US$ 56.3 billion during FY13, followed by BPM sector (US$ 20.9 billion), and software products and

engineering services (US$ 17.9 billion); the market size for hardware was US$ 13.3 billion during FY12.

The Indian IT-BPM industry is expected to add revenues of US$ 1314 billion to the existing revenues by

FY15, according to National Association of Software and Services Companies (NASSCOM).

Total exports from the IT-BPM sector (excluding hardware) were estimated at US$ 76 billion during FY13,

Export of IT services has been the major contributor, accounting for 57.9 per cent of total IT exports

(excluding hardware) in FY13.

The IT outsourcing sector is expected to see exports growing by 1315 per cent during FY15.

GOVERNMENT INITIATIVES FOR IT INDUSTRY

20 km

free Wi-

Fi zone

in Patna

US$ 6.4

billion

ESDM

PROJECT

SET UP IN

BANGAL

ORE

An

investmen

t of Rs 500

crore (US$

83.24

million)

Central

Government and

the respective State

Governments are

expected to

collectively spend

on it product

&services in 2014,an

increase over 4.3%

in 2013.

The longest across

the planet, making

a strong impression

on the world's

InfoTech map.

The ESDM project will

come up on a 1.16 acre

of land at an investment

of approximately Rs 85

crore (US$ 14.16 million)

More than 20 small

and medium

enterprises (SMEs) in

the IT sector have

recently received

land allotment letters

from the Government

of Punjab to set up

their units.

SOURCE : NASSCOM,GARTNER,

SEZ FOR IT /ITES IN INDIA

3

0

3

5

3

2

5

8

9

2008 2010 2012

IT SEZ UNIT GROWTH

SEZs have grown at a CAGR of ~18% during 2008-12 totaling 589 units in 2012.

Around30%ofalloperationalITSEZsarepresentinTierII/ III cities.

Tier II/III cities offer advantages such as low attrition, affordable real-estate, local government support,

and access to untapped SMB market that are rapidly adopting technology.

SOURCE: NASSCOM

The strengths of the Indian IT sector:

Highly skilled human resource;

Low wage structure;

Quality of work;

Initiatives taken by the Government

English-speaking professionals;

Cost competitiveness;

Quality telecommunications infrastructure.

The weaknesses of the IT sector

Absence of practical knowledge

Dearth of suitable candidates

Less Research and Development;

Contribution of IT sector to Indias GDP is still rather small

IT development concentrated in a few cities

Road Ahead For Indian IT Sector

Most preferred

location for

engineering

offshoring by

poll conducted

by Booz and Co.

Companies are

now offshoring

complete

product

responsibility

and increased

focus on R&D.

Indias IT

sector is

gradually

moving from

linear models

(rising

headcount to

increase

revenue) to

non-linear

ones.

IT companies

in the country

are focusing

on new

models such

as platform-

based BPM

services and

creation of

intellectual

property.

Tier II & III cities

are

increasingly

gaining

attraction

among IT

companies.

Cheap labor,

affordable real

estate,

favorable

government

regulations, tax

breaks and

special

economic zone

(SEZ) schemes

are facilitating

their emergence

as new IT

destinations.

Indian insurance

companies also

plan to spend Rs

12,100 crore

(US$ 2.01 billion)

on IT products

and services in

2014, according

to Gartner.

CONCLUSION :

Hence, IT sector is attracting considerable

interest not only as a vast market but also as

potential production base by international

companies.

Also, it is one of the fastest growing segments of

the Indian industry both in terms of production

and exports.

Das könnte Ihnen auch gefallen

- IT Industry AnalysisDokument7 SeitenIT Industry AnalysisriteshbhuNoch keine Bewertungen

- It Ites March 220313Dokument34 SeitenIt Ites March 220313Doshi KevalNoch keine Bewertungen

- Final Project WorkDokument100 SeitenFinal Project WorkRaja SekharNoch keine Bewertungen

- It Sector in India PDFDokument77 SeitenIt Sector in India PDFAnish NairNoch keine Bewertungen

- Information TechnologyDokument6 SeitenInformation TechnologyFayazuddin EtebarNoch keine Bewertungen

- A Snap Shot of Indian IT IndustryDokument10 SeitenA Snap Shot of Indian IT IndustryGanesh JanakiramanNoch keine Bewertungen

- Industry AnalysisDokument9 SeitenIndustry AnalysisNitesh Kr SinghNoch keine Bewertungen

- Summer Project - HarshitaDokument19 SeitenSummer Project - Harshitasailesh60Noch keine Bewertungen

- IT Industry in India: Indian Education SystemDokument9 SeitenIT Industry in India: Indian Education SystemPradeep BommitiNoch keine Bewertungen

- Studiu de Caz IndiaDokument17 SeitenStudiu de Caz IndiaAngela IriciucNoch keine Bewertungen

- MMMMDokument28 SeitenMMMMJayanth KumarNoch keine Bewertungen

- FM AssignmentDokument30 SeitenFM AssignmentHemendra GuptaNoch keine Bewertungen

- Name: Chintada - Pradeep 1226113112 Information Technology Outsourcing SummaryDokument7 SeitenName: Chintada - Pradeep 1226113112 Information Technology Outsourcing SummaryPradeep ChintadaNoch keine Bewertungen

- Indian Information Technology Industry: Presented By: Govind Singh KushwahaDokument14 SeitenIndian Information Technology Industry: Presented By: Govind Singh KushwahadrgovindsinghNoch keine Bewertungen

- Marketing of Services - 1Dokument7 SeitenMarketing of Services - 1kirtiraj sahooNoch keine Bewertungen

- Submitted in Partial Fulfillment of The Requirements For The Award of DegreeDokument46 SeitenSubmitted in Partial Fulfillment of The Requirements For The Award of DegreeShilpa SharmaNoch keine Bewertungen

- It Sector: BY Harmeet SehgalDokument9 SeitenIt Sector: BY Harmeet SehgalMonisha MalhotraNoch keine Bewertungen

- Financial Ratio Comparison IT Sector Infosys VS WiproDokument28 SeitenFinancial Ratio Comparison IT Sector Infosys VS WiproLOVESH GUPTANoch keine Bewertungen

- IT Sector Contribution To GDPDokument18 SeitenIT Sector Contribution To GDPShiran KhanNoch keine Bewertungen

- It in IndiaDokument27 SeitenIt in Indiashashank0803Noch keine Bewertungen

- Industry Analysis of ItDokument6 SeitenIndustry Analysis of ItDurgesh KumarNoch keine Bewertungen

- Industry & Services Information Technology and Information Technology Enabled Services (Ites)Dokument9 SeitenIndustry & Services Information Technology and Information Technology Enabled Services (Ites)rohityadavalldNoch keine Bewertungen

- Chapter - V Summary, Conclusion & Suggestions Summary:: Page - 144Dokument11 SeitenChapter - V Summary, Conclusion & Suggestions Summary:: Page - 144vSravanakumarNoch keine Bewertungen

- Information Technology Sector of IndiaDokument20 SeitenInformation Technology Sector of IndiaFaizan MukaddamNoch keine Bewertungen

- Information Technology OutsourcingDokument7 SeitenInformation Technology OutsourcingPradeep ChintadaNoch keine Bewertungen

- Global Sourcing TrendsDokument5 SeitenGlobal Sourcing Trendsraghavendra38Noch keine Bewertungen

- IT & ITeS - 2020Dokument27 SeitenIT & ITeS - 2020Ashutosh PatidarNoch keine Bewertungen

- IT and ITeS Industry in India PDFDokument7 SeitenIT and ITeS Industry in India PDFMujahid RezaNoch keine Bewertungen

- Software Sector Analysis ReportDokument8 SeitenSoftware Sector Analysis ReportpintuNoch keine Bewertungen

- Information Technology': GPTAIE Presentation OnDokument54 SeitenInformation Technology': GPTAIE Presentation OnKaran AhujaNoch keine Bewertungen

- Financial Meltdown: Threats & Opportunities For Indian I T SectorDokument2 SeitenFinancial Meltdown: Threats & Opportunities For Indian I T SectorNitesh NigamNoch keine Bewertungen

- Indian BPO IndustryDokument4 SeitenIndian BPO Industrysanjanasingh29Noch keine Bewertungen

- Strategic Review 2011Dokument1 SeiteStrategic Review 2011Rucha_123Noch keine Bewertungen

- It & Ites: Presented By: Harpreet Singh Meghna Peethambaran Vijay Subramanian Giridhar KrishnaDokument26 SeitenIt & Ites: Presented By: Harpreet Singh Meghna Peethambaran Vijay Subramanian Giridhar KrishnaKavitha PeethambaranNoch keine Bewertungen

- Sector Report: It & Ites Industry: by Finance Club, JbimsDokument19 SeitenSector Report: It & Ites Industry: by Finance Club, JbimsRajendra BhoirNoch keine Bewertungen

- IT Industry in IndiaDokument22 SeitenIT Industry in IndiakrisNoch keine Bewertungen

- Nasscom Strategic ReviewDokument25 SeitenNasscom Strategic Reviewpappu.subscriptionNoch keine Bewertungen

- IT Sector BriefOverviewDokument11 SeitenIT Sector BriefOverviewanshuldceNoch keine Bewertungen

- Indian Information Technology IndustryDokument14 SeitenIndian Information Technology IndustrydrgovindsinghNoch keine Bewertungen

- Relative Valuation RepoDokument4 SeitenRelative Valuation RepoPrasanth TalluriNoch keine Bewertungen

- Information Technology in India: January 2006Dokument18 SeitenInformation Technology in India: January 2006richdev009_106456088100% (1)

- Information Technology, Fdi and Economic Growth: An India Case StudyDokument18 SeitenInformation Technology, Fdi and Economic Growth: An India Case StudyAjayPatilNoch keine Bewertungen

- IT-ITes - Beacon Sector Special 2021Dokument32 SeitenIT-ITes - Beacon Sector Special 2021Mammen Vergis PunchamannilNoch keine Bewertungen

- It NWWWDokument4 SeitenIt NWWWHisham AliNoch keine Bewertungen

- Yy Yy Yy Yy Yy Yy: C C Y Yyyy Yy Yyyyy YDokument5 SeitenYy Yy Yy Yy Yy Yy: C C Y Yyyy Yy Yyyyy Ysajna25Noch keine Bewertungen

- Report On Indian IT IndustryDokument7 SeitenReport On Indian IT IndustryMandar KulkarniNoch keine Bewertungen

- Contribution of It Sector in Indian EconomyDokument11 SeitenContribution of It Sector in Indian Economybishnu8974Noch keine Bewertungen

- New Product DevelopmentDokument80 SeitenNew Product DevelopmentPrathapReddyNoch keine Bewertungen

- It & Ites: November 2010Dokument42 SeitenIt & Ites: November 2010pastrana2Noch keine Bewertungen

- Information Technology: Review of The Ninth PlanDokument16 SeitenInformation Technology: Review of The Ninth PlanAyush TripathiNoch keine Bewertungen

- Information Technology LadderDokument2 SeitenInformation Technology LadderAnkan GhoshalNoch keine Bewertungen

- Information TechnologyDokument4 SeitenInformation TechnologySheetal IyerNoch keine Bewertungen

- IT Industry Factsheet-Mar 2009Dokument5 SeitenIT Industry Factsheet-Mar 2009Maruthi Krishna TuragaNoch keine Bewertungen

- Industry Report On IT SectorDokument16 SeitenIndustry Report On IT SectorSailesh Kumar Patel100% (2)

- Development of It Sector in IndiaDokument8 SeitenDevelopment of It Sector in IndiaSuresh BoiniNoch keine Bewertungen

- Working Capital Management of Birlasoft Ltd.Dokument43 SeitenWorking Capital Management of Birlasoft Ltd.riyaNoch keine Bewertungen

- Panaroma - ICT - 2014Dokument4 SeitenPanaroma - ICT - 2014Shubham AroraNoch keine Bewertungen

- Competitive Environment in India: Impact of It Sector On Indian EconomyDokument3 SeitenCompetitive Environment in India: Impact of It Sector On Indian EconomyAkhil DeshwalNoch keine Bewertungen

- Moving up the Value Chain: The Road Ahead for Indian It ExportersVon EverandMoving up the Value Chain: The Road Ahead for Indian It ExportersNoch keine Bewertungen

- Computer Related Services Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandComputer Related Services Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Kirloskar Institute of Advanced Management Studies (KIAMS) : Sabitavo DasDokument1 SeiteKirloskar Institute of Advanced Management Studies (KIAMS) : Sabitavo DasSabitavo DasNoch keine Bewertungen

- Operation Companies Calling ListDokument42 SeitenOperation Companies Calling ListSabitavo DasNoch keine Bewertungen

- What Is SCOR?: Is The Product ofDokument10 SeitenWhat Is SCOR?: Is The Product ofSabitavo DasNoch keine Bewertungen

- List of 430 Companies With HR HeadDokument42 SeitenList of 430 Companies With HR HeadJacob Pruitt46% (13)

- Companies Contact Details Amp HR Name 1Dokument153 SeitenCompanies Contact Details Amp HR Name 1Sabitavo DasNoch keine Bewertungen

- 2.1 Components and General Features of Financial Statements (3114AFE)Dokument19 Seiten2.1 Components and General Features of Financial Statements (3114AFE)WilsonNoch keine Bewertungen

- Ikea AnalysisDokument33 SeitenIkea AnalysisVinod BridglalsinghNoch keine Bewertungen

- Dry Canyon Artillery RangeDokument133 SeitenDry Canyon Artillery RangeCAP History LibraryNoch keine Bewertungen

- Allan ToddDokument28 SeitenAllan ToddBilly SorianoNoch keine Bewertungen

- TAB Procedures From An Engineering FirmDokument18 SeitenTAB Procedures From An Engineering Firmtestuser180Noch keine Bewertungen

- Exp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.Dokument7 SeitenExp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.AbhishEk SinghNoch keine Bewertungen

- Evaluating Project Scheduling and Due Assignment Procedures An Experimental AnalysisDokument19 SeitenEvaluating Project Scheduling and Due Assignment Procedures An Experimental AnalysisJunior Adan Enriquez CabezudoNoch keine Bewertungen

- Interruptions - 02.03.2023Dokument2 SeitenInterruptions - 02.03.2023Jeff JeffNoch keine Bewertungen

- My CoursesDokument108 SeitenMy Coursesgyaniprasad49Noch keine Bewertungen

- ESG NotesDokument16 SeitenESG Notesdhairya.h22Noch keine Bewertungen

- 1 PBDokument14 Seiten1 PBSaepul HayatNoch keine Bewertungen

- Office Storage GuideDokument7 SeitenOffice Storage Guidebob bobNoch keine Bewertungen

- Web Technology PDFDokument3 SeitenWeb Technology PDFRahul Sachdeva100% (1)

- DesalinationDokument4 SeitenDesalinationsivasu1980aNoch keine Bewertungen

- 1.1. Evolution of Cloud ComputingDokument31 Seiten1.1. Evolution of Cloud Computing19epci022 Prem Kumaar RNoch keine Bewertungen

- 1400 Service Manual2Dokument40 Seiten1400 Service Manual2Gabriel Catanescu100% (1)

- Hayashi Q Econometica 82Dokument16 SeitenHayashi Q Econometica 82Franco VenesiaNoch keine Bewertungen

- MSDS - Tuff-Krete HD - Part DDokument6 SeitenMSDS - Tuff-Krete HD - Part DAl GuinitaranNoch keine Bewertungen

- Pindyck TestBank 7eDokument17 SeitenPindyck TestBank 7eVictor Firmana100% (5)

- Reflections On Free MarketDokument394 SeitenReflections On Free MarketGRK MurtyNoch keine Bewertungen

- Elastic Modulus SFRCDokument9 SeitenElastic Modulus SFRCRatul ChopraNoch keine Bewertungen

- Using Boss Tone Studio For Me-25Dokument4 SeitenUsing Boss Tone Studio For Me-25Oskar WojciechowskiNoch keine Bewertungen

- Missouri Courts Appellate PracticeDokument27 SeitenMissouri Courts Appellate PracticeGeneNoch keine Bewertungen

- Wendi C. Lassiter, Raleigh NC ResumeDokument2 SeitenWendi C. Lassiter, Raleigh NC ResumewendilassiterNoch keine Bewertungen

- 06-Apache SparkDokument75 Seiten06-Apache SparkTarike ZewudeNoch keine Bewertungen

- Everlube 620 CTDSDokument2 SeitenEverlube 620 CTDSchristianNoch keine Bewertungen

- 004-PA-16 Technosheet ICP2 LRDokument2 Seiten004-PA-16 Technosheet ICP2 LRHossam Mostafa100% (1)

- Zelio Control RM35UA13MWDokument3 SeitenZelio Control RM35UA13MWSerban NicolaeNoch keine Bewertungen

- Engine Diesel PerfomanceDokument32 SeitenEngine Diesel PerfomancerizalNoch keine Bewertungen

- 1SXP210003C0201Dokument122 Seiten1SXP210003C0201Ferenc SzabóNoch keine Bewertungen