Beruflich Dokumente

Kultur Dokumente

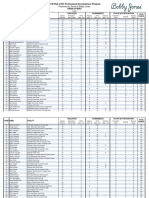

PGA of BC Benefits Plan

Hochgeladen von

PGA of BCCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PGA of BC Benefits Plan

Hochgeladen von

PGA of BCCopyright:

Verfügbare Formate

PGA of BC

Benefit Plan

Presented by:

Axis Life Insurance Agency

Inc.

Existing Benefit Plan - PGA of

Canada

Life Insurance

Accidental Death and Dismemberment

(AD&D)

Long Term Disability

Optional Critical Illness

Click in here to listen in

Existing Benefit Plan Life

Insurance

Income supplement

Family planning

$15,000 Life Insurance coverage

No dependant coverage

Existing Benefit Plan -

Accidental Death and

Dismemberment (AD&D)

In correlation with Life Insurance, AD&D is

used to protect against tragic loss of life or

limbs

365 day window to make a claim from time of

accident

Amount payable depending on the severity

of the accident.

100% of the amount payable examples: Loss

of life, both hands, feet, arms, legs, or eyes.

Refer to Item 7, Schedule of Benefits,

Declarations in benefit booklet for all accidents

covered.

Existing Benefits Plan - Long

Term Disability Coverage

PGA of Canada plan is designed to "stack

on" to any existing coverage that a

member may have in place. It is not

intended to replace another policy.

Coverage is available to age 70

Disability can be resulting from both

accident and sickness.

Coverage to a maximum of $1,000 per

month after 120 days of disability.

Existing Benefits Plan - Long

Term Disability Coverage

(continued)

If you are unable to perform your OWN

job, benefits will continue to pay for the

first two years.

After the first two years, if you are unable

to perform ANY job, benefits will continue

to pay to age 70.

If you are disabled after age 65, benefits

will be payable for up to 24 months.

Existing Benefits Plan Critical

Illness (Optional)

Not inclusive to core plan, would have to be

purchased in addition

Available to members up to age 70

No medical required

Coverage up to $250,000 available

Two types of coverage:

Option A Baseline coverage for illness that

occur more frequently

Option B More comprehensive program that

covers 20 conditions.

Existing Benefits Plan Critical

Illness (continued)

Lump sum tax free benefit, paid after

attracting an illness stated in option

selected.

Survival of 30 days after diagnosis as per

the terms of policy

Option A:

Life Threatening Cancer

Heart Attack and

Stroke/Cerebral Vascular Incident

Axis Life Benefit Plan

This plan will work in unison with existing

PGA of Canada plan

Great coverage at a great price

Coverage for additional: Life, AD&D and

Long Term Disability

Extends to coverage not offered by PGA

of Canada: Health and Dental

Axis Life Benefit Plan: Life

Insurance and AD&D

$50,000 Death Benefit

Coverage for Dependents up to $10,000

per person

No medical required

Matches Life Benefit in the event of a

tragic accident

Provides the same coverage as indicated

on the existing plans schedule

Axis Life Benefit Plan: Long

Term Disability

Benefit payments will provide $2,000 per month

120 days waiting period

No medical requirement

If you are unable to perform your OWN job,

benefits will continue to pay for the first two years.

After the first two years, if you are unable to

perform ANY job, benefits will continue to pay to

age 70.

Optional Disability policy for Playing Pros that will

provide high limits coverage

Axis Life Benefit Plan: Health

Care

Works parallel with Provincial Medical Services

Plan

No deductible

Provides 80% coverage on prescription

medication

Easy to use drug card provided

Vision care included in package

Paramedical coverage: massage therapy,

chiropractor, physiotherapy, psychologist,

naturopath, podiatrist, speech therapist or

acupuncture.

Axis Life Benefit Plan: Dental

No deductible

Provides 80% coverage on basic services

and 50% on major services

$1,500 maximum per year combined with

major services

2 check ups a year

50% Coverage on orthodontics for

dependent children

Axis Contacts

John Pham

604-638-5979

jpham@axisinsurance.ca

Jennifer Adams

604-697-1831

jadams@axisinsurance.ca

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- William R. Miller, Alyssa A. Forcehimes, Allen Zweben, A. Thomas McLellan - Treating Addiction - A Guide For Professionals-The Guilford Press (2011)Dokument481 SeitenWilliam R. Miller, Alyssa A. Forcehimes, Allen Zweben, A. Thomas McLellan - Treating Addiction - A Guide For Professionals-The Guilford Press (2011)MERIDA NEISUNoch keine Bewertungen

- 2020 PGA of BC Professional Development Program Order of MeritDokument6 Seiten2020 PGA of BC Professional Development Program Order of MeritPGA of BCNoch keine Bewertungen

- 2020 Pga of BC PDP - April 22, 2020Dokument11 Seiten2020 Pga of BC PDP - April 22, 2020PGA of BCNoch keine Bewertungen

- 2018 PGA of BC PDPDokument8 Seiten2018 PGA of BC PDPPGA of BCNoch keine Bewertungen

- PGA of Canada Branding GuidelinesDokument25 SeitenPGA of Canada Branding GuidelinesPGA of BCNoch keine Bewertungen

- 2019 PGA of BC Order of MeritDokument8 Seiten2019 PGA of BC Order of MeritPGA of BCNoch keine Bewertungen

- 2016 PGA of BC PDP ResultsDokument7 Seiten2016 PGA of BC PDP ResultsPGA of BCNoch keine Bewertungen

- 2018Dokument7 Seiten2018PGA of BCNoch keine Bewertungen

- 2020 PGA of BC PDP - March 16, 2020Dokument4 Seiten2020 PGA of BC PDP - March 16, 2020PGA of BCNoch keine Bewertungen

- 2019 PGA of BC Professional Development Program Order of MeritDokument7 Seiten2019 PGA of BC Professional Development Program Order of MeritPGA of BCNoch keine Bewertungen

- 2018 Order of MeritDokument2 Seiten2018 Order of MeritPGA of BCNoch keine Bewertungen

- 2017 PGA of BC PDPDokument7 Seiten2017 PGA of BC PDPPGA of BCNoch keine Bewertungen

- 2017 Order of MeritDokument7 Seiten2017 Order of MeritPGA of BCNoch keine Bewertungen

- 2017 PGA of BC Tournament ManualDokument10 Seiten2017 PGA of BC Tournament ManualPGA of BCNoch keine Bewertungen

- 2016 Order of MeritDokument7 Seiten2016 Order of MeritPGA of BCNoch keine Bewertungen

- Srixon Fixtures 16Dokument1 SeiteSrixon Fixtures 16PGA of BCNoch keine Bewertungen

- Vancouver Island Pro Tour 2016Dokument1 SeiteVancouver Island Pro Tour 2016PGA of BCNoch keine Bewertungen

- 2015 PGA of BC PDP FinalDokument8 Seiten2015 PGA of BC PDP FinalPGA of BCNoch keine Bewertungen

- 2016 Kootenay Pro TourDokument1 Seite2016 Kootenay Pro TourPGA of BCNoch keine Bewertungen

- 2015 PGA of BC - Updated November 3, 2015Dokument8 Seiten2015 PGA of BC - Updated November 3, 2015PGA of BCNoch keine Bewertungen

- 2015 Forestar Golf Community Leadership BursaryDokument2 Seiten2015 Forestar Golf Community Leadership BursaryPGA of BCNoch keine Bewertungen

- Member Benefits ProgramDokument11 SeitenMember Benefits ProgramPGA of BCNoch keine Bewertungen

- 2015 Jim Gibson ScholarshipDokument2 Seiten2015 Jim Gibson ScholarshipPGA of BCNoch keine Bewertungen

- PGA of BC Hard CardDokument1 SeitePGA of BC Hard CardPGA of BCNoch keine Bewertungen

- Fuggles and Warlock FlatSheet PDFDokument1 SeiteFuggles and Warlock FlatSheet PDFPGA of BCNoch keine Bewertungen

- Iridia Offer - PGA of BCDokument1 SeiteIridia Offer - PGA of BCPGA of BCNoch keine Bewertungen

- 2015 PGA of BC Tournament ManualDokument10 Seiten2015 PGA of BC Tournament ManualPGA of BCNoch keine Bewertungen

- PGA of BC Championship - Full Field ScoresDokument2 SeitenPGA of BC Championship - Full Field ScoresPGA of BCNoch keine Bewertungen

- 2015 Order of MeritDokument4 Seiten2015 Order of MeritPGA of BCNoch keine Bewertungen

- Srixon PGA of BC Tour: 2015 Fixture ListDokument1 SeiteSrixon PGA of BC Tour: 2015 Fixture ListPGA of BCNoch keine Bewertungen

- Presidential Decree No 1926 & 1363Dokument3 SeitenPresidential Decree No 1926 & 1363Raymond Godfrey DagwasiNoch keine Bewertungen

- History and Physical ExaminationDokument18 SeitenHistory and Physical ExaminationadesamboraNoch keine Bewertungen

- Pharmacy Intravena Admixture Services (Pivas) : IV - Admixture Handling CytotoxicDokument32 SeitenPharmacy Intravena Admixture Services (Pivas) : IV - Admixture Handling CytotoxicintanNoch keine Bewertungen

- Nihms579455 PDFDokument78 SeitenNihms579455 PDFMASIEL AMELIA BARRANTES ARCENoch keine Bewertungen

- Philhealth List of Assigned Members in Lala Rural Health UnitDokument299 SeitenPhilhealth List of Assigned Members in Lala Rural Health UnitJhonrie PakiwagNoch keine Bewertungen

- Summary of Product Characteristics: 4.1 Therapeutic IndicationsDokument3 SeitenSummary of Product Characteristics: 4.1 Therapeutic IndicationsasdwasdNoch keine Bewertungen

- Information Desk ModuleDokument7 SeitenInformation Desk Moduleyokes waranNoch keine Bewertungen

- Allison Bouwman: AccomplishmentsDokument1 SeiteAllison Bouwman: Accomplishmentsapi-245529211Noch keine Bewertungen

- Exclusions first two years health insurance planDokument2 SeitenExclusions first two years health insurance planBaby SivaNoch keine Bewertungen

- Standards For Good Pharmacy Practice - A Comparative AnalysisDokument6 SeitenStandards For Good Pharmacy Practice - A Comparative AnalysisClaudia NovăceanNoch keine Bewertungen

- Strength W Rating W-Score Column1Dokument3 SeitenStrength W Rating W-Score Column1Zuka KazalikashviliNoch keine Bewertungen

- Comprehensive Development Plan for the City of San Fernando, PampangaDokument153 SeitenComprehensive Development Plan for the City of San Fernando, PampangaPopoy CanlapanNoch keine Bewertungen

- Quality Assurance in Nursing SeminarDokument29 SeitenQuality Assurance in Nursing Seminarmerin sunilNoch keine Bewertungen

- ZZZZZZZDokument34 SeitenZZZZZZZmikeNoch keine Bewertungen

- Communicable Diseases: InfectiousDokument4 SeitenCommunicable Diseases: InfectiousRichmond Catchillar BonusNoch keine Bewertungen

- Continuous Quality Improvement Cqi Project ProposalDokument6 SeitenContinuous Quality Improvement Cqi Project Proposalapi-581690140Noch keine Bewertungen

- Margret Diston Final ResumejlDokument3 SeitenMargret Diston Final Resumejlapi-287491727Noch keine Bewertungen

- Lesson Plan - ProstaglandinsDokument5 SeitenLesson Plan - ProstaglandinsDelphy VargheseNoch keine Bewertungen

- Review Loads PampangaDokument4 SeitenReview Loads PampangaYaj CruzadaNoch keine Bewertungen

- (Smtebooks - Com) Clinical Trials in Neurology - Design, Conduct, Analysis 1st Edition PDFDokument385 Seiten(Smtebooks - Com) Clinical Trials in Neurology - Design, Conduct, Analysis 1st Edition PDFnarasimhahanNoch keine Bewertungen

- Pa Tas Database (Conso)Dokument40 SeitenPa Tas Database (Conso)AlbeldaArnaldoNoch keine Bewertungen

- The State of The Worlds Children 2009Dokument168 SeitenThe State of The Worlds Children 2009UNICEF SverigeNoch keine Bewertungen

- Decision Trees and Markov Chains List of Suggested Problems To DoDokument5 SeitenDecision Trees and Markov Chains List of Suggested Problems To Dosolo docs0% (1)

- Bedside To Boardroom PDFDokument7 SeitenBedside To Boardroom PDFDayanaNoch keine Bewertungen

- Standard Treatment: Guidelines 2022Dokument10 SeitenStandard Treatment: Guidelines 2022LijoeliyasNoch keine Bewertungen

- Moot Proposition Purc LudhianaDokument4 SeitenMoot Proposition Purc LudhianaRaj RawlNoch keine Bewertungen

- Guide Services Children ASDDokument52 SeitenGuide Services Children ASDCornelia AdeolaNoch keine Bewertungen

- Grief and Loss Practice TestDokument6 SeitenGrief and Loss Practice TestMaybelyn JoradoNoch keine Bewertungen

- Vocabulary (In The Hospital)Dokument3 SeitenVocabulary (In The Hospital)Nurvivi Fitri Arianty PermanaNoch keine Bewertungen