Beruflich Dokumente

Kultur Dokumente

Islamic Banking of Principle

Hochgeladen von

Md Rasheduzzaman Al-Amin0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten30 SeitenIt describes the principle of islamic banking.

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenIt describes the principle of islamic banking.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten30 SeitenIslamic Banking of Principle

Hochgeladen von

Md Rasheduzzaman Al-AminIt describes the principle of islamic banking.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 30

Introduction to islamic banking

Islamic banking refers to a system of banking or

banking activity that is consistent with the principles

of Islamic law (Sharia) . Sharia prohibits, (Riba, usury)

i.e, interest free business.

Islamic banks are seen to involve themselves as

financial intermediaries and investment oriented

institutions in bringing about wellbeing of the

community, society and the economy in the light of

Shariah

Basic Difference between Islamic and

Conventional Modes of Banking

Conventional

8/29/2014 Nizam Yaquby - Bahrain 2

Bank Client

money

money + money (interest)

Basic Difference between Islamic and

Conventional Modes of Banking

Islamic

8/29/2014 Nizam Yaquby - Bahrain 3

Bank Client Goods &

Services

money

Islamic Banking?

Banking encompassing Islamic injunctions

To avoid:

Riba Earning returns from loans and debts or

Selling debt contracts at discount

Gharar Absolute Risk or Excessive uncertainty in

contracts, Gambling and chance-based games

(Qimar)

General Prohibitions

unethical practices

Shariah Compliance & Prudent Banking

4

5

Islamic Banking

Myths & Realities

Islamic Banking IS NOT

a RELIGIOUS system;

a simple Interest-Free system;

a discriminatory system restricted to Muslim People

Islamic Banking IS:

a SYSTEM based on religious ETHICAL principles;

an Open system and a real alternative to conventional

finance.

Islamic Banking The Concept

Concept principles no deception and no riba (interest)

It is not new 7

th

Century

Money is a medium of exchange

Interest can lead to injustice/exploitation in society Zulm

No real 'lending' as all 'lenders' obtain interests

To earn $ for banks, they must obtain an equity / ownership

Requires banks to participate, share risk profit varies

Profit share is distributed instead of interest earned

Leads to more ethical society (Unlike West you must pay interest)

This concept encourages better resource management

Principles of Islamic Banking

Justice, equality and solidarity

Forbidden objects and creatures.

Acquisition of property rights.

Property (wealth) should be used in a rational but fair

Way.

No gain without either effort or liability

Rules of Islamic Banking

Any predetermined payment over and above the actual

amount of principal is prohibited.

The lender must share in the profits or losses arising

out of the enterprise for which the money was lent.

Making money from money is not Islamically

acceptable Gharar (Uncertainty, Risk or Speculation) is

also prohibited.

Investments should only support practices or products

that are not forbidden -or even discouraged- by Islam.

Primary Characteristics of Islamic

Banks

Prohibition of Interest

Low Consumer Lending Profit and Loss Sharing High

Real Sector Investing

To help Muslims, execute their financial dealings in

social values of the Shariah

To Serve all Muslim communities in mobilizing and

utilizing the financial resources.

To serve the Islamic communities strengthening the

economic ability

Main Objective Of Islamic Banking:

Banking Without Riba

The main objective of an Islamic Bank is to prohibit

Muslims from dealing with interest or usury (Riba)

which has been strictly prohibited by Allah, and to

protect them from one of the biggest sins.

Dubai Islamic Bank Statement

8/29/2014 Nizam Yaquby - Bahrain 10

Islamic Banking Principles

The Shariah prohibits the payment of charges for the

renting of money (riba, which in the definition of Islamic

scholars covers any excess in financial dealings, usury or

interest) for specific terms, as well as investing in

businesses that provide goods or services considered

contrary to its principles (Haram, forbidden)

"While a basic tenant of Islamic banking - the outlawing of

riba, a term that encompasses not only the concept of

usury, but also that of interest - has seldom been

recognized as applicable beyond the Islamic world, many

of its guiding principles have. The majority of these

principles are based on simple morality and common

sense, which form the bases of many religions, including

Islam

Basis of Islamic Banking

In order to be Islamic, the banking system has to avoid

interest

Another Islamic principle is that there should be no

reward without risk-bearing. This principle is

applicable to both labour and capital

Theoretical Basis for Islamic

Banking

A popular belief persists that Islamic banking is simply an

interest-free financial structure. But, in fact, Islamic

economics is a complete system of social and economic

justice. It deals with property rights, the incentive system,

the allocation of resources, economic freedom and

decision-making and the proper role of government

Western bankers have said that savings and investments

would soon dry up if interest were not paid. But this is due

to identifying "rate of interest" and "rate of return". The

Qur'an says: "God has permitted trade, but forbidden riba

(interest) (2:275). Therefore it is only the fixed, or

predetermined, return on savings or transactions that is

forbidden, not an uncertain rate of return, such as the

making of profit

Prohitbition of Interest

Riba as interest (differences among Muslims)

Interest in all forms prohibited

All interest-based transactions should be avoided

Interest-based transactions are seen as unjust

risk on the borrower Basic Framework

Prohibition of Riba

Quran Guides on Definition of Riba

Financial Liability:

Qard (Loan) : to give anything in ownership of other by

way of virtue - same or similar amount of that thing

would be paid back on demand or at the settled time.

Dayn (Debt) : Incurred by way of trade or rent or any

other credit transaction - ought to be returned at the

settled time without any profit.

Verse 2: 279 guides that whatever is over and above the

principal of loans or debts is Riba.

15

Riba?

All increases in wealth or benefits accruing

to a person without any labour, risk, or

expertise.

One who wishes to earn profit on his

monetary investment must bear the loss or

damage accruing to the business where his

money capital is to be used.

Nature of transaction important.

Trading- Bai- Risk taking, value addition

Leasing Ijarah - Risk taking, value addition

Exchange transaction Monetary transactions

Lending a virtuous act; not a business

Hand to hand exchange of currencies

16

17

Riba - Unanimity

Banu Thaqif of Taif, not to forego interest on

their receivables; Banu Amr ibnal Moghirah

refused to pay interest; Referred to the H

Prophet, the Revalation came:

O you who believe. Fear Allah, and give up the Riba

that remains outstanding if you are (in truth)

believer. (11:278).

Riba - Unanimity (Contd)

If you do not do so, then be sure of being at

war with Allah and his Messenger. But, if you

repent, then you have your principal. (11:279)

18

And fear the day when you shall be brought back to

Allah.

19

Then shall every soul be paid what it earned

and none shall be dealt with unjustly.

Challenges for Islamic banks

Establishing appropriate risk and liquidity

management techniques

Achieving consistent Shariah supervision

Managing the talent pool

Addressing legal and tax restrictions

REASON AND NEED OF ISLAMIC

BANKING

Islamic banks can give inclusive growth along with

control over inflation.

Equity finance is extended by lower cost of credit. It

provides equitable share of profit.

It provides small amount of loans

Integrity in Islamic Banking

Islamic banks need to give special care to their

integrity and credibility

Islamic banks come in all shapes and forms: banks and

non-banks, large and small, specialized and

diversified, traditional and innovative, national and

multi-national, successful and unsuccessful, prudent

and reckless, strictly regulated and free-wheeling,

Non-sharing Islamic modes such as murabaha, salam,

istisna'a and ijarah also provide a link between

financial transactions and real economic activities,

Innovation and Research

An important area is development of products for meeting

statutory liquidity requirements

The lack of involvement of Islamic finance in government

financing is due to lack of research and development (R&D)

and differences in Shari'ah-compliance criteria between

different countries

R & D should therefore be attended to by Shari'ah experts

under the guidance of the Organization of Islamic

Conferences (OIC) Fiqh Academy (Islamic jurisprudence)

and AAOIFI (Accounting and Auditing Organizations of

Islamic Financial Institutions)

Data of some islamic

banks

Trade Real

estate

SSI Mfg. Agricult

ure

Name

Of the

Bank

32.79 25.67 1.00 39.79 0.53 Jordan

Islamic

Bank

90.34 9.35 - - - Qatar

Islamic

Bank

73.01 - - 26.10 0.83 Islamic

Bank

Banglad

esh

Islamic Banking in practice(1)

International Banks with Islamic Windows:

Citigroup

HSBC

Deutsche Bank

UBS

ABN AMRO

Standard Chartered Bank

Islamic Banking in practice(2)

1. Jordan Islamic Bank (1979)

2. Faisal Islamic Bank, Egypt (1977)

3. Islamic Bank for Western Sudan (1981)

4. Tadamon Islamic Bank, Sudan (1981)

5. Qatar Islamic Bank (1983)

6. Islamic Bank International Denmark (1983)

7. Islamic Bank, Bangladesh (1983)

8. Sudanese Islamic Bank, Sudan (1983)

PRESENT SCENE

Islamic Banks in the Government Sector

Pakistan, Sudan, Iran

Islamic Banks in the Mixed Sector

- Malaysia

Islamic Banks in the Private Sector

Gulf

Non Banking Financial Institutions

Al Ameen [ Bangalore, India]

Islamic Financing by standard Commercial Banks in the Domestic Sector

Saudi British, NCB, Saudi American, Misr Bank

Islamic financing by Commercial banks in the foreign sector.

Islamic Banks established by multinational Banks

Citibank, HSBC Amanah Bank,

Its prospect

Now a days islamic banking principle are used in

different countries throughout the world.

Some are illustrated here:

CONCLUSION

The Islamic banking can be implemented only by

adopting the Islamic principles of social justice and

introducing laws, practices, procedures and

instruments which help in the maintenance and

dispensation of justice, equity and fairness.

( Muazzam Ali directory of islamic Institutions).

Althogh the western media frequently suggest that Islamic

banking in its present form is a recent phenomenon, in

fact, the basic practices and principles date back to the

early part of the seventh century." (Islamic Finance: A

Euromoney Publication, 1997)

Thank You

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- FourierDokument2 SeitenFourierMd Rasheduzzaman Al-AminNoch keine Bewertungen

- DC GeneratorDokument31 SeitenDC GeneratorMd Rasheduzzaman Al-AminNoch keine Bewertungen

- Maxwell Eqn ReviewDokument9 SeitenMaxwell Eqn ReviewRoss CortezNoch keine Bewertungen

- Strategies For Deploying UltraScale RFSoCDokument11 SeitenStrategies For Deploying UltraScale RFSoCMd Rasheduzzaman Al-AminNoch keine Bewertungen

- Class 16 Optical ModulationDokument11 SeitenClass 16 Optical ModulationMd Rasheduzzaman Al-AminNoch keine Bewertungen

- CST Whitepaper Modeling Simulation Metamaterial Based Devices Industrial ApplicationsDokument6 SeitenCST Whitepaper Modeling Simulation Metamaterial Based Devices Industrial ApplicationsMd Rasheduzzaman Al-AminNoch keine Bewertungen

- Impedance MatchingDokument53 SeitenImpedance MatchingEnricoLiaNoch keine Bewertungen

- Advkin Solution10Dokument8 SeitenAdvkin Solution10Md Rasheduzzaman Al-AminNoch keine Bewertungen

- Iman Sobar AgeDokument60 SeitenIman Sobar AgeMd Rasheduzzaman Al-AminNoch keine Bewertungen

- Turkey ConfDokument8 SeitenTurkey ConfMd Rasheduzzaman Al-AminNoch keine Bewertungen

- Material FullDokument95 SeitenMaterial FullMd Rasheduzzaman Al-AminNoch keine Bewertungen

- Junctions - Carrier InjectionDokument21 SeitenJunctions - Carrier InjectionMd Rasheduzzaman Al-AminNoch keine Bewertungen

- Expt 01Dokument2 SeitenExpt 01Md Rasheduzzaman Al-AminNoch keine Bewertungen

- ECE4762015 Lect1 ForPostingDokument31 SeitenECE4762015 Lect1 ForPostingMd Rasheduzzaman Al-AminNoch keine Bewertungen

- ECE 53: Fundamentals of Electrical EngineeringDokument8 SeitenECE 53: Fundamentals of Electrical EngineeringMd Rasheduzzaman Al-AminNoch keine Bewertungen

- Dastan 4Dokument257 SeitenDastan 4Md Rasheduzzaman Al-AminNoch keine Bewertungen

- Course Outline Spring-15 - EEE 207Dokument2 SeitenCourse Outline Spring-15 - EEE 207Md Rasheduzzaman Al-AminNoch keine Bewertungen

- Getting Started With HFSS:: Floquet PortsDokument44 SeitenGetting Started With HFSS:: Floquet PortsMd Rasheduzzaman Al-AminNoch keine Bewertungen

- 6/14/02 Chapter 10: Short Circuit Fault Calculations 1/10Dokument10 Seiten6/14/02 Chapter 10: Short Circuit Fault Calculations 1/10Balan DanielNoch keine Bewertungen

- Power System Stability Improvement Using FACTS DevicesDokument7 SeitenPower System Stability Improvement Using FACTS DevicesEr. Amar KumarNoch keine Bewertungen

- Tutorial For Ansoft Designer SV - English VersionDokument61 SeitenTutorial For Ansoft Designer SV - English Versionkurts010Noch keine Bewertungen

- Islamic University of Technology: Experiment 1: Measurement of Source FrequencyDokument3 SeitenIslamic University of Technology: Experiment 1: Measurement of Source FrequencyMd Rasheduzzaman Al-AminNoch keine Bewertungen

- L2 f05Dokument26 SeitenL2 f05Md Rasheduzzaman Al-AminNoch keine Bewertungen

- Memory Design PDFDokument38 SeitenMemory Design PDFarammartNoch keine Bewertungen

- Dipole AntennaDokument8 SeitenDipole AntennaMd Rasheduzzaman Al-AminNoch keine Bewertungen

- 2-Lecture Notes Lesson3 7Dokument7 Seiten2-Lecture Notes Lesson3 7kstu1112Noch keine Bewertungen

- Ee2201 Mi 1Dokument9 SeitenEe2201 Mi 1Md Rasheduzzaman Al-AminNoch keine Bewertungen

- 6993 MotDoc NewDokument8 Seiten6993 MotDoc NewMd Rasheduzzaman Al-AminNoch keine Bewertungen

- Security in The LTE-SAE NetworkDokument38 SeitenSecurity in The LTE-SAE NetworkcrosleyjNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Terms and Conditions Governing Internet Banking Service of DCBDokument6 SeitenTerms and Conditions Governing Internet Banking Service of DCBChalsy BansalNoch keine Bewertungen

- Rules Media CristalDokument7 SeitenRules Media CristalkorsikoNoch keine Bewertungen

- Sale of Scrap in SD ModuleDokument20 SeitenSale of Scrap in SD ModuleSrinath VasamNoch keine Bewertungen

- Puzzles SetDokument87 SeitenPuzzles SetShubham ShuklaNoch keine Bewertungen

- Chap 3 InterestDokument19 SeitenChap 3 InterestjilianneoctavianoNoch keine Bewertungen

- SSS Death BenefitsDokument5 SeitenSSS Death BenefitsCPMMNoch keine Bewertungen

- Silver Producers A Call To ActionDokument5 SeitenSilver Producers A Call To Actionrichardck61Noch keine Bewertungen

- RiskMinds USADokument13 SeitenRiskMinds USAUpendra Choudhary100% (1)

- ST OutlineDokument103 SeitenST Outlineam3ze100% (4)

- ANZ QR Indonesia Policy 19092019Dokument4 SeitenANZ QR Indonesia Policy 19092019Handy HarisNoch keine Bewertungen

- SRPM Economy Analysis - Group-7Dokument58 SeitenSRPM Economy Analysis - Group-7hiitsds12bNoch keine Bewertungen

- Chetna AdhiyaDokument8 SeitenChetna AdhiyaVikash MauryaNoch keine Bewertungen

- Your Personal Bank Chequing Account Statement: Toronto, ON M5W 1L5Dokument2 SeitenYour Personal Bank Chequing Account Statement: Toronto, ON M5W 1L5John BarrNoch keine Bewertungen

- DBS Bank FullDokument374 SeitenDBS Bank FullFarhan FachroziNoch keine Bewertungen

- Global SAP Implementation Case Study For PDFDokument28 SeitenGlobal SAP Implementation Case Study For PDFSid MehtaNoch keine Bewertungen

- FDH Bank Prospectus Digital PDFDokument152 SeitenFDH Bank Prospectus Digital PDFhope mfungwe100% (1)

- Research Methodology: Introduction To Credit AppraisalDokument123 SeitenResearch Methodology: Introduction To Credit AppraisalAstute ReportNoch keine Bewertungen

- FAQDokument58 SeitenFAQvivekluvinNoch keine Bewertungen

- Minister of Finance, Indonesia: Sri Mulyani IndrawatiDokument2 SeitenMinister of Finance, Indonesia: Sri Mulyani Indrawatiajeng kartikaNoch keine Bewertungen

- Statement of Account: State Bank of IndiaDokument10 SeitenStatement of Account: State Bank of IndiaKalpa RNoch keine Bewertungen

- What Is FinanceDokument3 SeitenWhat Is FinanceBelle IbarraNoch keine Bewertungen

- Ghid Program PTRDokument42 SeitenGhid Program PTRapi-3772404Noch keine Bewertungen

- Laporan Bank Harian Pt. Bintang Laju Samudra Periode April 2018Dokument8 SeitenLaporan Bank Harian Pt. Bintang Laju Samudra Periode April 2018Budi YantoNoch keine Bewertungen

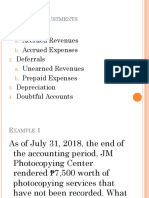

- 13 Accounting Cycle of A Service Business 2Dokument28 Seiten13 Accounting Cycle of A Service Business 2Ashley Judd Mallonga Beran60% (5)

- Financial Statement of Bank Asia Limited and AB BankDokument20 SeitenFinancial Statement of Bank Asia Limited and AB BankNazia AhmedNoch keine Bewertungen

- Dokumen - Tips - The Curious Loan Approval Case AnalysisDokument2 SeitenDokumen - Tips - The Curious Loan Approval Case AnalysisAyren Dela CruzNoch keine Bewertungen

- Bankers Confidential ReportDokument1 SeiteBankers Confidential ReportBappa ChakrabortyNoch keine Bewertungen

- Senior Officers: Executive Vice PresidentsDokument3 SeitenSenior Officers: Executive Vice PresidentsShingieNoch keine Bewertungen

- Gambling Inside StoryDokument18 SeitenGambling Inside StoryDaryl TanNoch keine Bewertungen

- Mutual Fund ProjectDokument35 SeitenMutual Fund ProjectKripal SinghNoch keine Bewertungen