Beruflich Dokumente

Kultur Dokumente

Chapter 03

Hochgeladen von

Saurabh MehtaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 03

Hochgeladen von

Saurabh MehtaCopyright:

Verfügbare Formate

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T.

Lumpkin

3-1

McGraw-Hill/Irwin Copyright 2004 by The McGraw-Hill Companies, Inc. All rights reserved.

Assessing the

Internal

Environment

of the Firm

Chapter 3

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-3

After studying this chapter, you should have

a good understanding of:

The primary and support activities of a firm's value

chain.

How value-chain analysis can help managers create

value by investigating internal and external

relationships among activities

The different types of tangible and intangible

resources, as well as organizational capabilities

The four criteria that a firm's resources must possess

to maintain a sustainable advantage

How to make meaningful comparisons of

performance across firms

The value of recognizing how the interests of a

variety of stakeholders can be interrelated

Learning

Objectives

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-4

Firms and Resources

Why are some firms so successful, and

other less so, within very similar

environments?

Why are firms so different from each

other?

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-5

The Value Chain:

Primary and Support Activities

The Value Chain

General administration

Human resource management

Technology development

Procurement

Inbound

logistics

Operations

Outbound

logistics

Marketing

and sales

Service

Primary Activities

Source: Adapted with the permission of The Free Press, a division of Simon & Schuster, Inc., from Competitive Advantage: Creating and Sustaining

Superior Performance by Michael E. Porter. Copyright 1998 by Michael E. Porter.

Exhibit 3.1

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-6

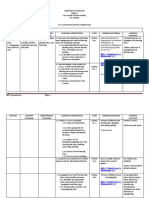

The Value Chain: Some Factors to Consider

in Assessing a Firms Primary Activities

Source:

Adapted with

permission of

The Free Press,

a division of

Simon &

Schuster, from

Competitive

Advantage:

Creating and

Sustaining

Superior

Performance

by Michael E.

Porter.

Copyright

1985, 1998 by

Michael E.

Porter.

Location of

distribution

facilities to

minimize

shipping

times

Excellent

material and

inventory

control

systems

Efficient

plant

operations

Appropriate

level of

automation

Quality

production

control

systems to

reduce costs

and enhance

quality

Efficient

plant layout

and workflow

design

Effective

shipping

processes to

provide

quick

delivery

Efficient

finished

goods

ware-

housing

processes

Shipping of

goods in

large lot

sizes to

minimize

transport-

ation costs

Highly

motivated,

competent

sales force

Innovative

approaches

to promotion

and

advertising

Selection of

appropriate

distribution

channels

Customer

segments

and needs

identified

Effective

pricing

Effective use

of procedures

to solicit

customer

feedback and

to act on

information

Quick

response to

customer

needs and

emergencies

Ability to

furnish

replacement

parts as

required

I nbound

Logistics

Operations Outbound

Logistics

Marketing

and Sales

Service

Exhibit 3.2

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-7

Value Chain: Support Activities (1)

General

Administration

Effective planning

Excellent relationships

with diverse

stakeholders

Ability to integrate

and coordinate value

chain activities

Effective culture and

reputation

Human Resource

Management

Effective recruiting,

training, and retention

Union relationships

Effective reward and

incentive programs

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-8

Value Chain: Support Activities (2)

Technology

Development

Effective R&D

Relationships between

R&D and other depts.

Creative and

innovation in culture

Personnel

qualifications

Procurement

Win-win relationships

with suppliers

Processes and

procedures optimize

quality, price, service,

speed

Proper lease versus

buy decisions

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-9

The Sustainability of Resources and

Capabilities: Four Criteria

Physically unique

Path dependency

Causal ambiguity

Social complexity`

No equivalent strategic resources

or capabilities

Difficult to imitate

Difficult to substitute

Not many firms possess Rare

Neutralize threats and exploit

opportunities

Valuable

Implications Is the resource or capability

Exhibit 3.6

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-10

Criteria for Sustainable Competitive

Advantage and Strategic Implications

Is a Resource

Source: Adapted from Barney 1991. Firm Resources a Sustained Competitive Advantage. Journal of Management, 17:99-120.

Valuable

Rare

Difficult

to Imitate

Without

Substitutes

Implications

for Competitiveness

No No No No Competitive disadvantage

Yes No No No Competitive parity

Yes Yes No No Temporary competitive advantage

Yes Yes Yes Yes Sustainable competitive advantage

Exhibit 3.7

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-11

Tangible Resources

Financial

Firms cash account and cash equivalents

Firms capacity to raise equity

Firms borrowing capacity

Physical

Modern plant and facilities

Favorable manufacturing locations

State-of-the-art machinery and equipment

Technological

Trade secrets

Innovative production processes

Patents, copyrights, trademarks

Organizational

Effective strategic planning processes

Excellent evaluation and control systems

Source: Adapted

from J.B. Barney,

1991, Firm

resources and

sustained

competitive

advantage, Journal

of Management,

17: 101; R.M.

Grant, 1991,

Contemporary

Strategy Analysis

(Cambridge, U.K.:

Blackwell

Business), 100-

102. Hitt, M.A.,

Ireland, R.D. &

Hoskisson, R.E.

2001. Strategic

Management:

Competitivenesss

and Globalization.

Fourth Edition.

South-Western

College Publishing:

Cincinnati, Ohio.

Exhibit 3.4

(adapted)

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-12

Intangible Resources

Human

Experience and capabilities of employees

Trust

Managerial skills

Firm-specific practices and procedures

Innovation

& creativity

Technical and scientific skills

Innovation capacities

Reputation

Brand name

Reputation with customers for quality and

reliability

Reputation with suppliers for fairness

Exhibit 3.4

(adapted)

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-13

Organizational Capabilities

Competencies or skills employed to

transfer inputs to outputs

The capacity to combine tangible and

intangible resources, using organizational

processes to attain a desired end

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-14

Examples of Organizational Capabilities

Outstanding customer service

Excellent product development capabilities

Innovativeness of products and services

The ability to hire, motivate, and retain

human capital

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-15

Marks & Spencer: How Resources and

Capabilities Lead to Advantages

Lower costs and higher

quality of goods sold

Fewer layers of

hierarchy

Capabilities

Customer recognition with

minimal advertising

No promotional sales

Lower labor turnover

8.7% labor costs versus

10%-20% industry

average

Intangible

1% of revenues allocated

to occupancy costs

(versus 3% to 9%

industry average)

Tangible

Competitive Advantages in

Great Britain

Resource

Ownership (vs. leasing)

of property

Brand reputation

Employee loyalty

Supplier chain

Managerial judgment

Source: Adapted

from Collins, D. &

Montgomery, C.

1995. Competing

on resources:

Strategy in the

1990s. Harvard

Business Review,

73(4): 123.

Exhibit 3.5

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-16

Firm Performance: Financial Ratios

Liquidity

Long-term solvency

Asset management

Profitability

Market value

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-17

Performance: Bases for Comparison

Historical comparisons

Industry norms

Key competitors or strategic group

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-18

Historical Trends: ROS for a

Hypothetical Company

20%

10%

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

Year

Exhibit 3.8

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-19

How Financial Ratios Differ

Across Industries

Financial Ratio

Semi-

conductors

Grocery

Stores

Skilled

nursing

facilities

Quick ratio (times)

1.5

0.5

1.1

Current ratio (times) 3.2 1.6 1.9

Total liabilities to net worth (%) 34.8 114.0 93.0

Collection period (days) 54.8 2.9 40.2

Assets to sales (%) 98.1 21.2 108.7

Return on sales (%) 3.1 0.9 2.0

Source: Dun & Bradstreet, Industry Norms and Key Business Ratios, 1999-2000. Desktop Edition. SIC # 0100-8999.

Exhibit 3.9

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-20

Comparison of Procter & Gambles Sales

and R&D Budget to its Key Competitors

COMPANY (OR DIVISION)

SALES*

(billions)

R&D BUDGET

(billions)

P&G DRUG DIVISION $0.8 $0.38

BRISTOL-MYERS SQUIBB $20.2 $1.8

PFIZER $27.4 $4.0

MERCK

$32.7 $2.1

* Most recently completed fiscal year. Data: Lehman Brother Procter & Gamble Co.

Exhibit 3.10

Source: Berner, R. 2000. Procter & Gamble: Just say no to drugs. Business Week: October 9:128.

CHAPTER 3 STRATEGIC MANAGEMENT Gregory G. Dess and G. T. Lumpkin

3-21

ECIs Balanced Business Scorecard

Exhibit 3.11

Financial Perspective

GOALS MEASURES

Survive Cash Flow

Succeed Quarterly sales growth and

operating income by division

Prosper Increased market share and ROE

Customer Perspective

GOALS MEASURES

New products Percent of sales from new

products

Responsive supply On-time delivery (defined by

customer)

Customer

partnership

Number of cooperative

engineering efforts

Source:

Adapted from

Kaplan, R.S.

& Norton,

D.P. 1992.

The balanced

scorecard:

Measures that

drive

performance.

Harvard

Business

Review,

69(1): 71-79.

Internal Business Perspective

GOALS MEASURES

Manufacturing excellence Cycle time

Unit cost

Yield

Design productivity Silicon efficiency

Engineering efficiency

New product introduction Actual introduction schedule

versus plan

Innovation and Learning Perspective

GOALS MEASURES

Technology leadership Time to develop next

generation

Manufacturing learning Process time to maturity

Product focus Percent of products that equal

80% sales

Time to market New product introduction

versus competition

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Wells Fargo Strategic PlanDokument34 SeitenWells Fargo Strategic Plansunuds99990% (10)

- Quiz - Inventories CostingDokument1 SeiteQuiz - Inventories CostingAna Mae Hernandez67% (3)

- AXE Shower Gel Case StudyDokument4 SeitenAXE Shower Gel Case Studyvicious1st100% (1)

- Online Shopping Vs Offline Shopping: A Comparative StudyDokument8 SeitenOnline Shopping Vs Offline Shopping: A Comparative StudyRaja Sarkar67% (3)

- IT Industry in India Comprised of Following: GrowthDokument1 SeiteIT Industry in India Comprised of Following: GrowthSaurabh MehtaNoch keine Bewertungen

- Two Ways in Which Psychology Is Changing Economics: Libertarian Paternalism and The Experimental Method ©Dokument28 SeitenTwo Ways in Which Psychology Is Changing Economics: Libertarian Paternalism and The Experimental Method ©Saurabh MehtaNoch keine Bewertungen

- MarketsDokument12 SeitenMarketsSaurabh MehtaNoch keine Bewertungen

- FLL Microfinance Group24Dokument2 SeitenFLL Microfinance Group24Saurabh MehtaNoch keine Bewertungen

- OpenPages - The High Cost of Non-Compliance - Reaping The Rewards of An Effective Compliance ProgramDokument8 SeitenOpenPages - The High Cost of Non-Compliance - Reaping The Rewards of An Effective Compliance ProgramSaurabh MehtaNoch keine Bewertungen

- Capstone IntroductionDokument22 SeitenCapstone IntroductionSaurabh MehtaNoch keine Bewertungen

- Customer Relationship Management A Databased Approach: V. Kumar Werner J. ReinartzDokument15 SeitenCustomer Relationship Management A Databased Approach: V. Kumar Werner J. ReinartzSaurabh MehtaNoch keine Bewertungen

- Overview of Time and Labor: Peoplesoft HRMS 8.9Dokument5 SeitenOverview of Time and Labor: Peoplesoft HRMS 8.9Saurabh MehtaNoch keine Bewertungen

- PeopleSoft Application Engine Program PDFDokument17 SeitenPeopleSoft Application Engine Program PDFSaurabh MehtaNoch keine Bewertungen

- Supply Chain Executive SummaryDokument6 SeitenSupply Chain Executive SummarySaurabh MehtaNoch keine Bewertungen

- Overview of Time and Labor: Peoplesoft HRMS 8.9Dokument5 SeitenOverview of Time and Labor: Peoplesoft HRMS 8.9Saurabh MehtaNoch keine Bewertungen

- Count Your Chickens Before They HatchDokument9 SeitenCount Your Chickens Before They HatchSaurabh MehtaNoch keine Bewertungen

- 5 M of AdvertisimentDokument10 Seiten5 M of AdvertisimentAbhishek Singh UjjwalNoch keine Bewertungen

- Marketing Analytics: Nanodegree Program SyllabusDokument12 SeitenMarketing Analytics: Nanodegree Program SyllabusJames DanielsNoch keine Bewertungen

- Strategies Applied by Unilever in BrazilDokument7 SeitenStrategies Applied by Unilever in Brazildestiny_of_ariesNoch keine Bewertungen

- Operations StrategyDokument73 SeitenOperations StrategyKiran MittalNoch keine Bewertungen

- Learningreflections Danobrlen r1Dokument5 SeitenLearningreflections Danobrlen r1api-324079029Noch keine Bewertungen

- So Stac Application To Online Business Start Ups 3Dokument9 SeitenSo Stac Application To Online Business Start Ups 3surkannanNoch keine Bewertungen

- CH 02Dokument22 SeitenCH 02Imam Awaluddin0% (1)

- Impact of Customers (Retailers) Towards E-Commerce''Dokument15 SeitenImpact of Customers (Retailers) Towards E-Commerce''salmanNoch keine Bewertungen

- Halal GroceryDokument12 SeitenHalal GroceryDimas Ndaru PrasojoNoch keine Bewertungen

- The Relationships Between Web Design, Reliability, Privacy, Service Quality, and Purchase Intention of Customers at E-Commerce Business An Empirical StudyDokument20 SeitenThe Relationships Between Web Design, Reliability, Privacy, Service Quality, and Purchase Intention of Customers at E-Commerce Business An Empirical StudyJohnathan AUNoch keine Bewertungen

- Group A13 - IR-V - Business Plan ReportDokument36 SeitenGroup A13 - IR-V - Business Plan ReportKeshav KhandelwalNoch keine Bewertungen

- Rose Hansen ResumeDokument2 SeitenRose Hansen ResumepennebakerNoch keine Bewertungen

- Focused Hospitality Company Profile Rev8Dokument15 SeitenFocused Hospitality Company Profile Rev8Komang PriambadaNoch keine Bewertungen

- The Marketing Research ProcessDokument40 SeitenThe Marketing Research ProcessRahul TailorNoch keine Bewertungen

- Airline Industry Microeconomics - EditedDokument10 SeitenAirline Industry Microeconomics - Editeddyn keriNoch keine Bewertungen

- Burton - 2000 - Ethnicity, Identity and Marketing - A Critical ReviewDokument27 SeitenBurton - 2000 - Ethnicity, Identity and Marketing - A Critical ReviewEstudanteSaxNoch keine Bewertungen

- Toefco CompanyDokument6 SeitenToefco CompanyEvans MainaNoch keine Bewertungen

- What You Need To Know About Real Estate InvestingDokument2 SeitenWhat You Need To Know About Real Estate InvestingcarloswhitneyNoch keine Bewertungen

- Retail Supply Chain Creating and Sustaining High Performance PDFDokument4 SeitenRetail Supply Chain Creating and Sustaining High Performance PDFpragyamalik7421Noch keine Bewertungen

- Case#1 CincinnatiZoo 1Dokument8 SeitenCase#1 CincinnatiZoo 1Louraine PoNoch keine Bewertungen

- Curriculum GuideDokument6 SeitenCurriculum GuideEdwin LapatNoch keine Bewertungen

- 1) Case Study - Four VignettesDokument2 Seiten1) Case Study - Four VignettesAdarsh UnnyNoch keine Bewertungen

- Marketing Strategies For Fast-Food Restaurants: A Customer ViewDokument7 SeitenMarketing Strategies For Fast-Food Restaurants: A Customer ViewabhishekmonNoch keine Bewertungen

- Aditya Chhatrala PDFDokument4 SeitenAditya Chhatrala PDFfazela shaukatNoch keine Bewertungen

- Parag DairyDokument11 SeitenParag DairyApurvaSingh100% (1)

- Digital Marketing MM-20192Dokument34 SeitenDigital Marketing MM-20192Christian AriwibowoNoch keine Bewertungen