Beruflich Dokumente

Kultur Dokumente

Corporate Governance India

Hochgeladen von

Himanshu KumarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Corporate Governance India

Hochgeladen von

Himanshu KumarCopyright:

Verfügbare Formate

Corporate Governance -

Liability of Management

By

Harry Chawla

Senior Partner

Key Considerations

Board and Management Structure and Responsibility

Emphasis on Investor Protection

Inclusive CSR Agenda

Board Management

Structure and Responsibility

Section 2 (53) Manager

an individual who has the management of the whole or substantially

the whole of the affairs of the company,

includes a director or any other person occupying the position of a

manager (by whatever name called),

whether under a contract of service or not,

subject to the superintendence, control and direction of the Board of

Directors.

Board and Management

Structure and Responsibility

Company

Parameters

1 Director

Resident in

India 182

days

1 Woman

Director

1/3

rd

Independent

Directors

Audit

Committee

Nomination

and

Remuneration

Committee

Stakeholders

Relationship

Committee

Listed

Unlisted (All)

Public Cos.

with (i) Share

Capital INR

10 cr; or

(ii) Turnover

INR 100 cr; or

(iii) Loans /

Debentures /

Deposits INR

50 cr

Public Cos.

with Share

Capital INR

100 cr or

Turnover INR

300 cr

Security /

Debenture

Holders 1000

Board and Management Structure

and Responsibility (contd.)

Enhanced responsibility for Board and its committees

Board to have maximum of 15 directors (minimum directors public

companies: 3; private companies: 2)

Companies to have one resident director

Specified unlisted companies to have independent directors

Code of professional conduct imposing stringent responsibility and

accountability on independent directors

Mandatory woman directors for certain companies

Majority of Audit Committee members including Chairperson to have the

ability to read and understand financial statements

Mandatory Key Managerial Personnel CEO / MD / WTD, CFO and CS

(every listed company and every other public company having a paid up share

capital INR 100 mn; Whole time CS for every company having a paid up

share capital INR 50 mn)

A listed company to have one director elected by small shareholders

Codified duties of directors

Significant penalties for directors for defaults in discharge of duties

Board and Management Structure

and Responsibility Liability of

Managers / Directors (contd.)

Liability of Non Executive / Independent Directors

Liable only in respect of acts of omission or commission which occurred with

their knowledge, attributable through Board processes, and with his consent

or connivance or where he had not acted diligently

Liability as Officers

For compliances / actions / omissions under various sections of the

Companies Act, 2013

Liability as Officer in Default

Liable under all sections where specific penalty is provided for each officer in

default

Where no specific penalty is provided, liable under Section 450

Board and Management Structure

and Responsibility Liability of

Managers / Directors (contd.)

Liability for Fraud

Fraud in relation to affairs of a company

Imprisonment for a term which shall not be less than 6 months but which may

extend to 10 years, and pecuniary liability of not less than the amount

involved in the fraud, but which may extend to 3 times the amount involved

Personal Liability of Directors

Where directors enter into contracts in their own name

Where they enter into contracts on behalf of the company but fail to use the

word Limited or Private Limited

Where directors exceed their powers

Director not to enter into contracts without Boards authorizations

Civil liability for misstatement in prospectus

Damages for fraud

Liability for fraudulent conduct of business

Emphasis on Investor Protection

Related Party Transactions:

[Section 2(76), read with Rule 3 of Companies (Specification of definitions details) Rules, 2014]

Individuals:

Director or his relative

Key Managerial Personnel or his Relative

Any person on whose advice, directions or instructions a director or manager is

accustomed to act

A director or key managerial personnel of the holding company or his relative

Other than individuals:

A firm, in which a director, manager or his relative is a partner

A private company in which a director or manager is a member or director

A public company in which a director or manager is a director or holds along

with his relatives, more than 2% of its paid up share capital

Any body corporate whose Board of Directors, managing director or manager is

accustomed to act in accordance with the advice, directions or instructions of a

director or manager

A holding, subsidiary or an associate company

A subsidiary of a holding company to which it is also a subsidiary

Transactions in ordinary course of business on arms length basis

permissible. Central Govt approval no longer required.

Board approval necessary where transactions are not in ordinary

course of business / not at arms length basis.

Special resolution, where no related party can vote, required for non

arms length transactions or transactions not in ordinary course of

business where:

Share capital > INR 100 mn; or

Sale, purchase or supply of any goods or material > 25% of annual turnover

Selling or otherwise disposing of, or buying, property of any kind > 10% of

networth

Leasing of property of any kind > 10% of networth

Availing or rendering of any services > 10% of networth

Appointment to any office or place of profit in any company, subsidiary or

associate @ monthly remuneration > INR 250,000

Remuneration for underwriting subscription of any securities or derivaties 1%

of networth

Emphasis on Investor Protection

(contd.)

Emphasis on Investor Protection

(contd.)

Insider Trading

Director / KMP to refrain from forward dealing / buy options in shares or

debentures of company / holding company/ subsidiary / associate

No company person (including Director / KMP) with access to non-

public price sensitive information to indulge in any form of insider

trading / counseling

Fraud Risk Mitigation

Fraud defined / referred to under various sections and includes acts,

omissions, concealment of facts, abuse of position.

Considered fraud irrespective of any wrongful gain or loss

Serious Fraud Investigation Officer (SFIO) made statutory body with

significant powers

Mandatory establishment of vigil mechanism for directors / employees

to report concerns

Inclusive CSR Agenda

Obligation, Trigger and Calculation

Covers all companies in India meeting any one or more of the following

conditions:

Turnover INR 10 bn

Networth INR 5 bn

Net profits INR 50 mn

CSR contribution to be 2% of average net profit before tax for last three financial

years

Contributions to be made towards causes set forth in Schedule VII. Entries of

Schedule VII to be interpreted liberally.

Administration and Reporting

Board to appoint 3 member CSR Committee including 1 independent director

(except for private companies requiring not more than 2 directors)

CSR Committee to formulate CSR policy, recommend CSR activities and

monitor CSR expenditure

Mandatory reporting on CSR under Section 135

In case of failure to spend, reasons to be disclosed. Non disclosure entails

penal consequences

The End

Das könnte Ihnen auch gefallen

- DirectorsDokument32 SeitenDirectorsNarendra WadhwaNoch keine Bewertungen

- Unit 2 Company Law - Part IIDokument25 SeitenUnit 2 Company Law - Part IIDeborahNoch keine Bewertungen

- On DirectorsDokument18 SeitenOn DirectorsSarthak SinghNoch keine Bewertungen

- Auditing and Corporate Governance AssignmentDokument32 SeitenAuditing and Corporate Governance AssignmentSiddhi GargNoch keine Bewertungen

- taxguru.in-Clause 49 -Corporate Governance and Company Law ProvisionsDokument9 Seitentaxguru.in-Clause 49 -Corporate Governance and Company Law Provisionsasmitamittal1998Noch keine Bewertungen

- Corporate Governance Code History IndiaDokument26 SeitenCorporate Governance Code History IndiaTapu PandaNoch keine Bewertungen

- Corporate Governance ConceptsDokument30 SeitenCorporate Governance ConceptsChandni SheikhNoch keine Bewertungen

- Corporate Governance: "Satyam Vada Dharmam Chara"Dokument23 SeitenCorporate Governance: "Satyam Vada Dharmam Chara"Akshay MalhotraNoch keine Bewertungen

- Independent DirectorDokument6 SeitenIndependent Directorankita1802sharmaNoch keine Bewertungen

- Role and Responsibilities of Independent DirectorsDokument20 SeitenRole and Responsibilities of Independent DirectorsMurli Manohar PurohitNoch keine Bewertungen

- Role Players: by Prangya ParamitaDokument55 SeitenRole Players: by Prangya ParamitaPrangya ParamitaNoch keine Bewertungen

- Board of Directors_ Roles, Responsibilities, and Governance- taxguru.inDokument9 SeitenBoard of Directors_ Roles, Responsibilities, and Governance- taxguru.inArya SenNoch keine Bewertungen

- Directors, Duties & LiabilitiesDokument36 SeitenDirectors, Duties & LiabilitiesSuryaNoch keine Bewertungen

- Corporate GovernanceDokument49 SeitenCorporate Governanceppinku0003Noch keine Bewertungen

- Corporate Governance: "Satyam Vada Dharmam Chara"Dokument26 SeitenCorporate Governance: "Satyam Vada Dharmam Chara"Durga Prasad DashNoch keine Bewertungen

- Corporate governance boards and directorsDokument92 SeitenCorporate governance boards and directorsHussain NazNoch keine Bewertungen

- Governance in Corporate WorldDokument6 SeitenGovernance in Corporate WorldPragati DixitNoch keine Bewertungen

- Chapter - 3 Management Ppt.pptxDokument60 SeitenChapter - 3 Management Ppt.pptxsanskriti04805Noch keine Bewertungen

- Independent DirectorDokument28 SeitenIndependent DirectorVasvi Aren100% (1)

- Corporate GovernanceDokument17 SeitenCorporate GovernanceAshhish GangulyNoch keine Bewertungen

- Management-Of-CompanyDokument23 SeitenManagement-Of-Companynidhisaxena83Noch keine Bewertungen

- 12Dokument15 Seiten12David JohnNoch keine Bewertungen

- CG PPT-03 Corportae GovernanceDokument26 SeitenCG PPT-03 Corportae GovernanceSri V N Prakash Sharma, Asst. Professor, Management & Commerce, SSSIHLNoch keine Bewertungen

- Presented by Group 3Dokument23 SeitenPresented by Group 3Aishwarya ShettyNoch keine Bewertungen

- Shri. N.R.Narayana Murthy CommitteeDokument41 SeitenShri. N.R.Narayana Murthy CommitteegbsshravanthyNoch keine Bewertungen

- Clause - 49Dokument18 SeitenClause - 49Manish AroraNoch keine Bewertungen

- KM Birla ReportDokument3 SeitenKM Birla ReportKaRan KatariaNoch keine Bewertungen

- Agency Theory and Its Implication On Corporate GovernanceDokument18 SeitenAgency Theory and Its Implication On Corporate GovernanceSatish BidgarNoch keine Bewertungen

- Internal and External Institutions and Influences of Corporate GovernanceDokument39 SeitenInternal and External Institutions and Influences of Corporate GovernanceLovely PasatiempoNoch keine Bewertungen

- Code of Corporate GovernanceDokument5 SeitenCode of Corporate GovernanceSyed Mujtaba HassanNoch keine Bewertungen

- TM 2 - Fiduciary and Decision Roles and Duties of BOD, Board Committees, Board Models, Board CharacteristicDokument23 SeitenTM 2 - Fiduciary and Decision Roles and Duties of BOD, Board Committees, Board Models, Board CharacteristicMuh Rizky HendrawanNoch keine Bewertungen

- Board and Its PowersDokument43 SeitenBoard and Its PowersKALYAN SREEPADANoch keine Bewertungen

- Corporate Management and Functions of Board CommitteesDokument170 SeitenCorporate Management and Functions of Board CommitteesVijeth PatavardhanNoch keine Bewertungen

- Whoisa Director: For Determining and Implementing The Company's PolicyDokument25 SeitenWhoisa Director: For Determining and Implementing The Company's PolicySWATI SINGHNoch keine Bewertungen

- Corporate Governance: Umar HassanDokument26 SeitenCorporate Governance: Umar HassanUmar HassanNoch keine Bewertungen

- Unit 1 - Role of Director in A Company & Types of DirectorsDokument18 SeitenUnit 1 - Role of Director in A Company & Types of DirectorsAthi VenkateshNoch keine Bewertungen

- Directors, Meetings, Winding Up, Statutory Bodies, CSR, ReconstructionDokument42 SeitenDirectors, Meetings, Winding Up, Statutory Bodies, CSR, ReconstructionHELI SHAHNoch keine Bewertungen

- CL Unit-3 NotesDokument24 SeitenCL Unit-3 NotesRahul Mohan100% (1)

- Board Committees and Its Roles and Responsibilities: Presented by Rahul S IPEDokument20 SeitenBoard Committees and Its Roles and Responsibilities: Presented by Rahul S IPESmriti ShahNoch keine Bewertungen

- Chapter 2 - Corporate GovernanceDokument34 SeitenChapter 2 - Corporate GovernancebkamithNoch keine Bewertungen

- Role of AuditorsDokument41 SeitenRole of AuditorsSai PhaniNoch keine Bewertungen

- DirectorsDokument38 SeitenDirectorsSatyam PathakNoch keine Bewertungen

- Audit committees and independent directors key focus of revised Clause 49Dokument3 SeitenAudit committees and independent directors key focus of revised Clause 49Anwar KhanNoch keine Bewertungen

- Company ManagementDokument68 SeitenCompany ManagementLatha Dona VenkatesanNoch keine Bewertungen

- Corporate Governance: 2015-2016 Lecture 12 &13Dokument37 SeitenCorporate Governance: 2015-2016 Lecture 12 &13Amartya SenNoch keine Bewertungen

- Provisions Relating To Corporate GovernanceDokument16 SeitenProvisions Relating To Corporate GovernanceNiharika ManchalNoch keine Bewertungen

- Director Types of DirectorsDokument28 SeitenDirector Types of Directorssarah lalrohlui hnialumNoch keine Bewertungen

- Auditors & Board of DirectorsDokument18 SeitenAuditors & Board of Directorsvrushali06Noch keine Bewertungen

- Corporate Governance in India: History, Principles and GuidelinesDokument23 SeitenCorporate Governance in India: History, Principles and GuidelinesKrystle DseuzaNoch keine Bewertungen

- The Powers of BoardDokument28 SeitenThe Powers of BoardMuhammad AbdullahNoch keine Bewertungen

- Corporate GovernanceDokument37 SeitenCorporate GovernanceMike OscarNoch keine Bewertungen

- Indep Directors FinalDokument22 SeitenIndep Directors FinalAbdur RahmanNoch keine Bewertungen

- Board of Directors - A Powerful Instrument in GovernanceDokument27 SeitenBoard of Directors - A Powerful Instrument in GovernancesweetrozzNoch keine Bewertungen

- Corporate Law Module 3.1Dokument28 SeitenCorporate Law Module 3.1Nani MadhavNoch keine Bewertungen

- Certificate Course For Women DirectorsDokument36 SeitenCertificate Course For Women DirectorsJhilik PradhanNoch keine Bewertungen

- Faria Hossain Oishe, ID 183080001 (LLB 9)Dokument17 SeitenFaria Hossain Oishe, ID 183080001 (LLB 9)faria hossainNoch keine Bewertungen

- Corporate Finance: A Beginner's Guide: Investment series, #1Von EverandCorporate Finance: A Beginner's Guide: Investment series, #1Noch keine Bewertungen

- International SIA PrinciplesDokument9 SeitenInternational SIA PrinciplesHimanshu KumarNoch keine Bewertungen

- Trends in Patterns of Urbanization in The Next 5 Years and Its Impact On Vehicle Usage and Experience 1) Study 16 Countries Including IndiaDokument2 SeitenTrends in Patterns of Urbanization in The Next 5 Years and Its Impact On Vehicle Usage and Experience 1) Study 16 Countries Including IndiaHimanshu KumarNoch keine Bewertungen

- Gibbon Dey Article On SROI and SAA - 141211Dokument11 SeitenGibbon Dey Article On SROI and SAA - 141211Himanshu KumarNoch keine Bewertungen

- Chambers y Conway-1991Dokument33 SeitenChambers y Conway-1991Santiago DominiNoch keine Bewertungen

- FSA Project GuidelinesDokument1 SeiteFSA Project GuidelinesHimanshu KumarNoch keine Bewertungen

- Smart Know NetDokument36 SeitenSmart Know NetsapnamathurNoch keine Bewertungen

- Economy of Happiness Course PPTeDokument286 SeitenEconomy of Happiness Course PPTeHimanshu KumarNoch keine Bewertungen

- Institutions and Envl SustainabilityDokument10 SeitenInstitutions and Envl SustainabilityHimanshu KumarNoch keine Bewertungen

- Essentials QuizzesDokument45 SeitenEssentials QuizzesHimanshu KumarNoch keine Bewertungen

- My Caf - Strasbourg Center - CafDokument2 SeitenMy Caf - Strasbourg Center - CafHimanshu KumarNoch keine Bewertungen

- Flight TicketsDokument4 SeitenFlight TicketsHimanshu Kumar100% (6)

- Trends in Patterns of Urbanization in The Next 5 Years and Its Impact On Vehicle Usage and Experience 1) Study 16 Countries Including IndiaDokument2 SeitenTrends in Patterns of Urbanization in The Next 5 Years and Its Impact On Vehicle Usage and Experience 1) Study 16 Countries Including IndiaHimanshu KumarNoch keine Bewertungen

- Airtel Payment ReceiptDokument1 SeiteAirtel Payment ReceiptHimanshu KumarNoch keine Bewertungen

- My Caf - Strasbourg Center - CafDokument2 SeitenMy Caf - Strasbourg Center - CafHimanshu KumarNoch keine Bewertungen

- SUAPSDokument2 SeitenSUAPSHimanshu KumarNoch keine Bewertungen

- Sealed AirDokument10 SeitenSealed AirHimanshu KumarNoch keine Bewertungen

- ANOVADokument8 SeitenANOVAHimanshu KumarNoch keine Bewertungen

- Term 4 ExpensesDokument5 SeitenTerm 4 ExpensesHimanshu KumarNoch keine Bewertungen

- Bloomberg User GuideDokument37 SeitenBloomberg User GuideHimanshu KumarNoch keine Bewertungen

- Inflation Targeting As PolicyDokument5 SeitenInflation Targeting As PolicyAshwani RanaNoch keine Bewertungen

- France Visa - The Rules, The Procedure, The DocumentsDokument1 SeiteFrance Visa - The Rules, The Procedure, The DocumentsHimanshu KumarNoch keine Bewertungen

- Delhi Flight TicketDokument1 SeiteDelhi Flight TicketHimanshu KumarNoch keine Bewertungen

- How To Complete Your CF FormDokument39 SeitenHow To Complete Your CF FormHimanshu KumarNoch keine Bewertungen

- Financial Strains in The "New" China: Shanxi Haixin Iron and Steel Group, Defaulted On Loans From Minsheng BankDokument3 SeitenFinancial Strains in The "New" China: Shanxi Haixin Iron and Steel Group, Defaulted On Loans From Minsheng BankHimanshu KumarNoch keine Bewertungen

- Airtel Payment ReceiptDokument1 SeiteAirtel Payment ReceiptHimanshu KumarNoch keine Bewertungen

- Flight TicketsDokument4 SeitenFlight TicketsHimanshu Kumar100% (6)

- Course Outline FSA PGP Term IV 2015Dokument6 SeitenCourse Outline FSA PGP Term IV 2015Himanshu KumarNoch keine Bewertungen

- IBM Cash Flow StatementDokument1 SeiteIBM Cash Flow StatementHimanshu KumarNoch keine Bewertungen

- Solution Example 1Dokument2 SeitenSolution Example 1Himanshu KumarNoch keine Bewertungen

- MT Examination FSA 2014Dokument4 SeitenMT Examination FSA 2014Himanshu KumarNoch keine Bewertungen

- Catering Liability Proposal FormDokument4 SeitenCatering Liability Proposal FormmxtimsNoch keine Bewertungen

- Sale of Goods Act 1930 Partnership Act 1932Dokument6 SeitenSale of Goods Act 1930 Partnership Act 1932Manan LodhaNoch keine Bewertungen

- Tuition Reimbursement AgreementDokument3 SeitenTuition Reimbursement AgreementAzmyNoch keine Bewertungen

- Contract of Sale vs. Contract To SellDokument3 SeitenContract of Sale vs. Contract To SellChristian LugtuNoch keine Bewertungen

- 2016 Bravery Tips - Commercial Law PDFDokument16 Seiten2016 Bravery Tips - Commercial Law PDFKristal LeeNoch keine Bewertungen

- التلقي والاسلوب الصحفي - دراسة في جدلية العلاقة بين القاريء والنص PDFDokument378 Seitenالتلقي والاسلوب الصحفي - دراسة في جدلية العلاقة بين القاريء والنص PDFصادق الوسيمNoch keine Bewertungen

- Sole Traders, Partnerships, Social EnterpriseDokument4 SeitenSole Traders, Partnerships, Social EnterpriseKazi Rafsan NoorNoch keine Bewertungen

- Chap 22 Futures & ForwardsDokument134 SeitenChap 22 Futures & ForwardsAfnanNoch keine Bewertungen

- Kampil-Katipunan V TrajanoDokument2 SeitenKampil-Katipunan V TrajanoCindee Yu100% (1)

- A Silver Lining for Strangers Dealing with the CompanyDokument15 SeitenA Silver Lining for Strangers Dealing with the CompanyDevanshi GarodiaNoch keine Bewertungen

- 2021 Altima PaperworkDokument24 Seiten2021 Altima Paperworkqqvhc2x2prNoch keine Bewertungen

- Root Declarations Page 20210916Dokument4 SeitenRoot Declarations Page 20210916SMART CHOICE AUTO GROUPNoch keine Bewertungen

- Additional Remedies: Concentrate Questions and Answers Contract Law: Law Q&A Revision and Study Guide (2nd Edn)Dokument15 SeitenAdditional Remedies: Concentrate Questions and Answers Contract Law: Law Q&A Revision and Study Guide (2nd Edn)Mahdi Bin MamunNoch keine Bewertungen

- Uncitral Model Law On International Commerical Arbitration AlongDokument15 SeitenUncitral Model Law On International Commerical Arbitration AlongRanjeet Mathew JacobNoch keine Bewertungen

- Regulatory Framework for Business TransactionsDokument36 SeitenRegulatory Framework for Business TransactionsHybe RetweetsNoch keine Bewertungen

- Labour Law Recognition NotesDokument13 SeitenLabour Law Recognition NotesBrishti MondalNoch keine Bewertungen

- IAS 24 Related Party Disclosures (ICAP C6 S07) : Page 1 of 3Dokument3 SeitenIAS 24 Related Party Disclosures (ICAP C6 S07) : Page 1 of 3amitsinghslideshareNoch keine Bewertungen

- CBA Guide: Key Issues and AnswersDokument13 SeitenCBA Guide: Key Issues and AnswersJomar TenezaNoch keine Bewertungen

- Transes RFBTDokument4 SeitenTranses RFBTdave excelleNoch keine Bewertungen

- Debt Settlement AgreementDokument2 SeitenDebt Settlement AgreementStewart Paul Torre80% (5)

- Contract of Lease GatorsDokument7 SeitenContract of Lease GatorsJig-Etten SaxorNoch keine Bewertungen

- Nature and Evolution of Corporate GovernanceDokument19 SeitenNature and Evolution of Corporate GovernanceRashmi SinghNoch keine Bewertungen

- CM Sales Distribution Policy SummaryDokument37 SeitenCM Sales Distribution Policy SummaryjosephkjamesNoch keine Bewertungen

- Sales Associate AgreementDokument6 SeitenSales Associate Agreementjerry TNoch keine Bewertungen

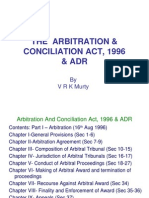

- The Arbitration & Conciliation Act - DDokument46 SeitenThe Arbitration & Conciliation Act - DArchana Ramani0% (1)

- Execution of Public Instrument. - Placing of Titles of Ownership in TheDokument10 SeitenExecution of Public Instrument. - Placing of Titles of Ownership in TheWagun Lobbangon BasungitNoch keine Bewertungen

- Dataimage - DB - Innovanata Sturua Sadoqtoro Nashromi PDFDokument201 SeitenDataimage - DB - Innovanata Sturua Sadoqtoro Nashromi PDFtazoNoch keine Bewertungen

- Testing Concrete Cores Compression BS EN 12504-1Dokument12 SeitenTesting Concrete Cores Compression BS EN 12504-1Arisan IqmaNoch keine Bewertungen

- Relationship of Agent & PrincipalDokument25 SeitenRelationship of Agent & PrincipalSaadiahMansur100% (2)

- SKF 10X14X3 HM4 R SpecificationDokument3 SeitenSKF 10X14X3 HM4 R SpecificationJanos HallaNoch keine Bewertungen