Beruflich Dokumente

Kultur Dokumente

Strategy Analysis & Choice: Strategic Management: Concepts & Cases 12 Edition Fred David Nov: 2009

Hochgeladen von

Talha Khan SherwaniOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Strategy Analysis & Choice: Strategic Management: Concepts & Cases 12 Edition Fred David Nov: 2009

Hochgeladen von

Talha Khan SherwaniCopyright:

Verfügbare Formate

Ch 6 -1

Chapter 6

Strategy Analysis & Choice

Strategic Management:

Concepts & Cases

12

th

Edition

Fred David

Nov: 2009

Perform

External

Audit

Chapter 3

Perform

Internal

Audit

Chapter 4

Establish

Long-Term

Objectives

Chapter 5

Generate,

Evaluate,

Select

Strategies

Chapter 6

Implement

Strategies:

Mgmt Issues

Chapter 7

Implement

Strategies:

Marketing,

Fin/Acct,

R&D, CIS

Chapter 8

Measure &

Evaluate

Performance

Chapter 9

Vision

&

Mission

Chapter 2

Types of Strategies

Strategy

Formulation

Strategy

Implementation

Strategy

Evaluation

The Process of Generating, Evaluating

and Selecting Strategies

What course of action (strategy) to pursue

to achieve mission, goals and objectives

Current strategies + Mission goals, objects +

External environment basis for generating

and evaluating strategies.

Looking at the present position desired position

Ch 6 -3

The Process of Generating, Evaluating

and Selecting Strategies

Find all flexible alternatives

Involve as many different managers &

employees

Give every one all internal & external audit

information

Creativity is the key

All alternatives should be discussed

List proposed strategies

Prioritize &rank them (1 least implementable4 Most

likely)

Ch 6 -4

Ch 6 -5

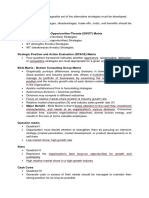

Comprehensive Strategy-Formulation

Framework

Stage 1:

The Input Stage

Stage 2:

The Matching Stage

Stage 3:

The Decision Stage

Ch 6 -6

Stage 1: The Input Stage

Basic input information for the matching &

decision stage

Requires strategists to quantify subjectivity

early in the process w.r.t:

External and Internal Analysis

Good intuitive judgment always needed

Cite information from EFE, CPM and IFE

The Strategy-Formulation Analytical

Framework

STAGE 1: THE INPUT STAGE

EFE MATRIX CPM IFE

STAGE 2: THE MATCHING STAGE

SWOT

MATRIX

SPACE

MATRIX

BCG

MATRIX

Internal-External

(IE) Matrix

Grand Strategy

Matrix

STAGE 3: THE DECISION STAGE

Quantitative Strategic Planning Matrix

(QSPM)

Ch 6 -7

Ch 6 -8

Strategy-Formulation Analytical

Framework

SWOT Matrix

SPACE Matrix

BCG Matrix

IE Matrix

Grand Strategy Matrix

Stage 2:

The Matching Stage

Ch 6 -9

SWOT Matrix

Strengths-Opportunities (SO)

Weaknesses-Opportunities (WO)

Strengths-Threats (ST)

Weaknesses-Threats (WT)

Four Types of Strategies

Be Quantitative

Use Notions (S1-O3, W3-O2, W2-T5)

Here just generate alternatives, dont select

them

Not all strategies generated in SWOT Matrix will be

considered for implementation

Ch 6 -10

SWOT Matrix

Leave Blank

Strengths S

List Strengths

S1

S2

S3

S4

Weaknesses W

List Weaknesses

W1

W2

W3

W4

Opportunities O

List Opportunities

O1

O2

O3

O4

SO Strategies

Use strengths to take

advantage of

opportunities

WO Strategies

Overcoming weaknesses

to exploit opportunities

Threats T

List Threats

T1

T2

T3

T4

ST Strategies

Use strengths to avoid

threats

WT Strategies

Minimize weaknesses and

avoid threats

Very precarious position

(Defensive tactics)

Matching Key External and Internal Factors to formulate

Alternative Strategies

Key Internal Factors Key External Factors Resultant Strategy

Excess working capital

(Strg)

20% annual growth in

Cell phone industry (OP)

Acquire Company XYZ

Insufficient capacity (WK) Exit of two major foreign

companies (OP)

Pursue horizontal

integration by buying

competitors facilities

Strong R & D (Strg) Number of young

adults(TH)

NPD for older adults

Poor employees morale

(WK)

Strong Union activity (TH) Develop new

employee benefit

Package (overcome

Wk-Avoid TH)

Ch 6 -11

Ch 6 -12

Strategy-Formulation Analytical

Framework

SWOT Matrix

SPACE Matrix

BCG Matrix

IE Matrix

Grand Strategy Matrix

Stage 2:

The Matching Stage

Ch 6 -13

SPACE Matrix

Strategic Position & Action Evaluation Matrix

Four Quadrants:

Aggressive

Conservative

Defensive

Competitive

Two Internal Dimensions

Financial Strength (FS)

Competitive Advantage (CA)

Two External Dimensions

Environmental Stability (ES)

Industry Strength (IS)

Ch 6 -14

SPACE Factors

Environmental Stability (ES)

Technological changes

Rate of inflation

Demand variability

Price range of competing products

Barriers to entry

Competitive pressure

Ease of exit from market

Price elasticity of demand

Risk involved in business

Financial Strength (FS)

Return on investment

Leverage

Liquidity

Working capital

Cash flow from Operations

Inventory Turnover

Price Earnings Ratio

External Strategic Position Internal Strategic Position

Ch 6 -15

SPACE Factors

Industry Strength (IS)

Growth potential

Profit potential

Financial stability

Technological know how

Resource utilization

Ease of entry into market

Productivity

Competitive Advantage CA

Market share

Product quality

Product life cycle

Customer loyalty

Competitions capacity utilization

Technological know-how

Control over suppliers & distributors

External Strategic Position Internal Strategic Position

SPACE Matrix

FS

+6

+1

+5

+4

+3

+2

-6

-5

-4

-3

-2

-1

-6 -5 -4 -3 -2 -1 +1 +2 +3 +4 +5 +6

ES

CA IS

(+ 6) FS = BEST

(+ 6) IS = BEST

(+1) FS = WORST

(+ 1) IS = WORST

(-1) CA= BEST

(-6) ES= WORST

(-6) CA= WORST

(-1) ES= BEST

Assign numerical rating:

For FS and IS

+6 = Best

+1 = Worst

For ES and CA

-1 = Best

-6 = Worst

Compute an Average Score

INTERNAL STRATEGIC POSITION EXTERNAL STRATEGIC POSITION

A

X

I

S

X

Competitive (CA) Industry (IS)

(-6 Worst, -1 best)

-1 Product Quality

-1 Market Share

-3 Brand & image

-2 Product life Cycle

Average: -1.75

(+1 Worst, +6 Best)

+6 Barriers to entry

+4 Growth potential

+4 Access to financing

+5 Consolidation

Average: +4.75

A

X

I

S

Y

Financial Strength (FS) Environmental (ES)

(+1 Worst, +6 Best)

+5 ROA

+4 Leverage

+6 Liquidity

+5 Cash Flow

Average: +5.00

(-6 Worst, -1 best)

-2 Inflation

-1 Technology

-2 Demand elasticity

-4 Taxation

Average: -2.25

Compute an Average Score

INTERNAL STRATEGIC POSITION EXTERNAL STRATEGIC POSITION

A

X

I

S

X

Competitive (CA) Industry (IS)

(-6 Worst, -1 best)

-1 Product Quality

-1 Market Share

-3 Brand & image

-2 Product life Cycle

Average: -1.75

(+1 Worst, +6 Best)

+6 Barriers to entry

+4 Growth potential

+4 Access to financing

+5 Consolidation

Average: +4.75

A

X

I

S

Y

Financial Strength (FS) Environmental (ES)

(+1 Worst, +6 Best)

+5 ROA

+4 Leverage

+6 Liquidity

+5 Cash Flow

Average: +5.00

(-6 Worst, -1 best)

-2 Inflation

-1 Technology

-2 Demand elasticity

-4 Taxation

Average: -2.25

Total Axis X Score: CA+IS = +4.75 + (-1.25)

=3.00

Total Axis Y Score: FS + ES = +5.00 + (-2.25)

= 2.75

SPACE Matrix

FS

+6

+1

+5

+4

+3

+2

-6

-5

-4

-3

-2

-1

-6 -5 -4 -3 -2 -1 +1 +2 +3 +4 +5 +6

ES

CA IS

Total Axis X Score:

3.00

Total Axis Y Score:

2.75

Suggested

Strategy type

Conservative Aggressive

Defensive Competitive

Ch 6 -20

SPACE Matrix

FS

+6

+1

+5

+4

+3

+2

-6

-5

-4

-3

-2

-1

-6 -5 -4 -3 -2 -1 +1 +2 +3 +4 +5 +6

ES

CA IS

Conservative Aggressive

Defensive Competitive

Market Penetration

Market Development

Product Development

Related Diversification

Backward, forward, horizontal

integration

Market Penetration

Market Development

Product Development

Diversification (Related or Unrelated)

Retrenchment

Divestiture

Liquidation

Backward, forward, horizontal

integration

Market Penetration

Market Development

Product Development

Ch 6 -21

Strategy-Formulation Analytical

Framework

SWOT Matrix

SPACE Matrix

BCG Matrix

IE Matrix

Grand Strategy Matrix

Stage 2:

The Matching Stage

Ch 6 -22

BCG Matrix

Boston Consulting Group Matrix

Autonomous divisions = business portfolio (Profit

centers)

Divisions may compete in different industries

Focus is on relative market-share position & industry

growth rate

X Axis: Relative Market Share Position

Y Axis: Industry Sales Growth Rate

Ch 6 -23

BCG Matrix

Relative Market Share Position

High

1.0

Medium

.50

Low

0.0

I

n

d

u

s

t

r

y

S

a

l

e

s

G

r

o

w

t

h

R

a

t

e

High

+20

Low

-20

Medium

0

Question Marks

I

Stars

II

Cash Cows

III

Dogs

IV

31

20

8

39

2

X Axis: Relative Market Share Position

Y Axis: Industry Sales Growth Rate

Ch 6 -24

BCG Matrix

Relative Market Share Position

High

1.0

Medium

.50

Low

0.0

I

n

d

u

s

t

r

y

S

a

l

e

s

G

r

o

w

t

h

R

a

t

e

High

+20

Low

-20

Medium

0

Question Marks

Stars

Cash Cows Dogs

Backward, forward, horizontal

integration

Market Penetration

Market Development

Product Development

Market Penetration

Market Development

Product Development

Divesture

Product Development

Diversification

Retrenchment

Divestiture

Retrenchment

Divestiture

Liquidation

Ch 6 -25

Strategy-Formulation Analytical

Framework

SWOT Matrix

SPACE Matrix

BCG Matrix

IE Matrix

Grand Strategy Matrix

Stage 2:

The Matching Stage

The Internal-External (IE) Matrix

9 Cell Display

Also a portfolio matrix

The Size of the Circles represents the percentage

of sales contribution of each division

The slice of the pie reveals the percentage profit

contribution of each division

Generates input from IFE and EFE Scores

Ch 6 -26

Ch 6 -27

I

II III

IV

V

VI

IX VIII VII

1.0 3.0 2.0 4.0

1.0

3.0

2.0

The IFE Total Weighted Scores

Strong

3.0-4.0

Average

2.0-2.99

Weak

1.0-1.99

High

3.0-4.0

Medium

2.0-2.99

Low

1.0-1.99

The

EFE

Total

Weighted

Scores

Hold and Maintain

Market Penetration

Product Development

Harvest or Divest

Retrenchment

Divesture

Forward, Backward, horizontal

integration

Market Penetration

Market Development

Product Development

Grow and Build

Ch 6 -28

Strategy-Formulation Analytical

Framework

SWOT Matrix

SPACE Matrix

BCG Matrix

IE Matrix

Grand Strategy Matrix

Stage 2:

The Matching Stage

Ch 6 -29

Grand Strategy Matrix

Tool for formulating alternative strategies

Based on two dimensions

Competitive position

Market (Industry) growth > 5% Rapid

Ch 6 -30

Quadrant IV

1. Concentric diversification

2. Horizontal diversification

3. Conglomerate

diversification

4. Joint ventures

Quadrant III

1. Retrenchment

2. Concentric diversification

3. Horizontal diversification

4. Conglomerate

diversification

5. Liquidation

Quadrant I

1. Market development

2. Market penetration

3. Product development

4. Forward integration

5. Backward integration

6. Horizontal integration

7. Concentric diversification

Quadrant II

1. Market development

2. Market penetration

3. Product development

4. Horizontal integration

5. Divestiture

6. Liquidation

RAPID MARKET GROWTH

SLOW MARKET GROWTH

WEAK

COMPETITIVE

POSITION

STRONG

COMPETITIVE

POSITION

Ch 6 -31

Quadrant I

RAPID MARKET GROWTH

SLOW MARKET GROWTH

WEAK

COMPETITIVE

POSITION

STRONG

COMPETITIVE

POSITION

Excellent strategic position

Take advantage of Ext-Envt

Take risks aggressively when

necessary

Concentration on current

markets/products

1. Market development

2. Market penetration

3. Product development

4. Forward integration

5. Backward integration

6. Horizontal integration

7. Concentric diversification

Adopt these if you have

surplus resources

Use this if the organization is

concentrating on single

product Diversify into more

related businesses

Ch 6 -32

Quadrant II

RAPID MARKET GROWTH

SLOW MARKET GROWTH

WEAK

COMPETITIVE

POSITION

STRONG

COMPETITIVE

POSITION

Industry is growing but weak

competitive position

Evaluate present position

How to improve competitiveness

1. Market development

2. Market penetration

3. Product development

4. Horizontal integration

5. Divestiture

6. Liquidation

Option I:

Intensive Growth

Option II:

Horizontal Integration

Last Option:

Defensive

Ch 6 -33

Quadrant III

RAPID MARKET GROWTH

SLOW MARKET GROWTH

WEAK

COMPETITIVE

POSITION

STRONG

COMPETITIVE

POSITION

1. Retrenchment

2. Concentric diversification

3. Unrelated diversification

4. Divesture

5. Liquidation

Compete in slow-growth industries

Weak competitive position

Drastic changes are required

quickly

Cost & asset reduction

Shift Resources away from current

Business to different areas

Sell off

Ch 6 -34

Quadrant IV

RAPID MARKET GROWTH

SLOW MARKET GROWTH

WEAK

COMPETITIVE

POSITION

STRONG

COMPETITIVE

POSITION

Strong competitive position

Slow-growth industry

Diversification to more

promising growth areas

1. Concentric diversification

2. Conglomerate diversification

3. Joint ventures

Strong competitive position Is used

by moving in other markets

Or Pursue

Ch 6 -35

Strategy-Formulation Analytical

Framework

Stage 3:

The Decision Stage

Quantitative Strategic

Planning Matrix

(QSPM)

QSPM: Quantitative Strategic

Planning Matrix

Determines relative attractiveness of feasible

alternative actions

Which alternative strategies are best

Tool to evaluate alternatives strategies objectively

Use good intuitive judgment in selecting strategies

Determines the relative attractiveness of different

strategies

Ch 6 -36

Important

Any number of set of alternative strategies

can be included

Any number of strategies can make up a

given set, BUT only strategies within a given

set are evaluated relative to each other e.g.

one set of strategies may include diversification.

another set may include issuing stock & selling a

division to raise needed capital.

These two sets of strategies are totally different

and the QSPM evaluates strategies only within a

given set.

Ch 6 -37

Outcomes of Techniques in Matching Stage

Alternative Strategies SWOT SPACE BCG IE GRAND TOTAL

X X 2

X X 2

X 1

X X X X 4

X X X X 4

X 1

0

0

X X X X 4

X X X X 4

X X 2

Ch 6 -38

6 steps to QSPM

1. Make a list of the firms key external

opportunities/threats and Internal Strengths/

weaknesses in the left Column.

10 minimum for each

2. Assign weights to each key external and

internal factor

same as EFE and IFE

3. Examine the stage 2 (matching) matrices and

identify alternative strategies that the

organization should consider implementing

Group them into mutually exclusive sets

Open Turkish Airlines Document

Ch 6 -39

6 steps to QSPM

4. Determine the Attractiveness scores (AS)

Ask does this factor affect the choice of strategies benign

made? If yes assign scores:

1 = Not attractive

2= Somewhat attractive

3 = Reasonably attractive

4 = Highly attractive

All strategies should be assigned a weight. If one factor does

not effect the 2

nd

or 3

rd

alternative, it will not be included and

a dash will be applied to all three alternatives 1, 2, 3, even if

it were effecting the 1

st

alternative.

Important: Never rate duplicate scores( 1s, 2s, 3s

or 4s) in a row

Only work row by row.

Rates assigned and their difference should have a rationale

to do so.

Ch 6 -40

5. Compute the total attractiveness scores (TAS)

Multiply the weights by the attractiveness

These will indicate the relative attractiveness of each

alternative strategy

6. Compute the Sum Total Attractiveness Scores.

Add TAS in each strategy column .

The Sum Total Attractiveness Scores (STAS) reveals which

strategy is most attractive

Magnitude of STAS amongst strategies will give desirability

of one strategy over another.

Table 6-6

Ch 6 -41

Ch 6 -42

QSPM

Key Internal Factors

Management

Marketing

Finance/Accounting

Production/Operations

Research and Development

Computer Information

Systems

Strategy 3 Strategy 2 Strategy 1 Weight Key External Factors

Economy

Political/Legal/Governmental

Social/Cultural/Demographic/

Environmental

Technological

Competitive

Strategic Alternatives

Copyright 2005 Prentice Hall

Ch 6 -43

QSPM (for a Retail Computer Store)

Key External Factors

Buy New Land and

Build New Larger Store

Fully Renovate

Existing Store

Opportunities Weight AS TAS AS TAS

1. Population of City Growing 10% 0.10 4 0.40 2 0.2

2. Rival Computer Store opening one mile away 0.10 2 0.20 4 0.40

3. Vehicle Traffic passing store up 12% 0.08 1 0.80 4 0.32

4. Vendors average six new products per year 0.05 --- --- --- ---

5. Senior citizen use of computers up 8% 0.05 --- --- --- ---

6. Small business growth I area up 10% 0.10 --- --- --- ---

7. Desire for Websites up 18% by Realtors 0.06 --- --- --- ---

8. Desire for Websites up 18% by Small Firms 0.06 --- --- --- ---

1

Contd

Threats

1.Best Buy opening new store nearby in 1 year 0.15 4 0.60 3 0.45

2. Local University offers computer repair 0.08 --- --- --- ---

3. New bypass for HWY 34 in 1 year will divert traffic 0.12 4 --- 1 ---

4. New Mall being built nearby 0.08 2 --- 4 ---

5. Gas prices up by 14% 0.04 --- --- --- ---

6. Vendors raising prices by 8% 0.03 --- --- --- ---

1.00

Key Internal Factors

Buy New Land and

Build New Larger Store

Fully Renovate

Existing Store

Strengths Weight AS TAS AS TAS

1. Inventory turnover increased from 5.8 to 6.7 0.05 --- --- --- ---

2. Average customer purchase increased from $97 to $128 0.07 2 0.14 4 0.28

3. Employee morale is excellent 0.10 --- --- --- ---

4. In-store promotions resulted in 20% increase in sales 0.05 --- --- --- ---

5. Revenues from repair/service segment of store up 16% 0.15 4 0.60 3 0.45

6. In-store technical support personnel have MIS college degree 0.05 --- --- --- ---

7. Stores debt-to-total assets ratio declined to 34% 0.03 4 0.12 2 0.06

3

Weaknesses

1. Revenue from Software segment of store down 12% 0.10 --- --- --- ---

2. Location of store negatively impacted by new Highway 34 0.15 4 0.60 1 0.15

3. Carpet and paint in store somewhat in disrepair 0.02 1 0.02 4 0.08

4. Bathroom in store needs refurbishing 0.02 1 0.02 4 0.08

5. Revenues from businesses down 8% 0.04 3 0.12 4 0.16

6. Store has no website 0.05 --- --- --- ---

7. Often customers have to wait to check-Out 0.05 2 0.10 4 0.20

TOTAL 1.00 3.72 2.83

Das könnte Ihnen auch gefallen

- Self-Service Data Analytics and Governance for ManagersVon EverandSelf-Service Data Analytics and Governance for ManagersNoch keine Bewertungen

- Analysis of StrategyDokument50 SeitenAnalysis of StrategyVignesh KumarNoch keine Bewertungen

- Chapter 6Dokument34 SeitenChapter 6Azam MacchiatoNoch keine Bewertungen

- Space & QSPMDokument41 SeitenSpace & QSPMRadhik Kalra50% (2)

- cdf58sm Mod 3.1Dokument68 Seitencdf58sm Mod 3.1vibhuti goelNoch keine Bewertungen

- Strategy Analysis and SelectingDokument26 SeitenStrategy Analysis and SelectingNyadroh Clement MchammondsNoch keine Bewertungen

- Lecture 6 Strategic Analysis and Choice ImportantDokument34 SeitenLecture 6 Strategic Analysis and Choice ImportantSarsal6067Noch keine Bewertungen

- Strategy Formulation. Strategy Analysis & Choice (8-10M)Dokument45 SeitenStrategy Formulation. Strategy Analysis & Choice (8-10M)Muhammad FaisalNoch keine Bewertungen

- Strategy Analysis and ChoiceDokument32 SeitenStrategy Analysis and ChoicerajendrakumarNoch keine Bewertungen

- Chapter 3 - Strategy Analysis and Management Decision - SVDokument76 SeitenChapter 3 - Strategy Analysis and Management Decision - SV8.Nguyễn Việt HoàngNoch keine Bewertungen

- Strategic Analysis ToolsDokument30 SeitenStrategic Analysis Toolsmostafa elshehabyNoch keine Bewertungen

- Askri Final 1Dokument10 SeitenAskri Final 1fahadsiddiqNoch keine Bewertungen

- Lesson 6-StramaaDokument61 SeitenLesson 6-Stramaaishinoya keishiNoch keine Bewertungen

- WK 8Dokument55 SeitenWK 8Muhammad AmryNoch keine Bewertungen

- The Strategic Position and Action EvaluationDokument6 SeitenThe Strategic Position and Action Evaluationraju_su143Noch keine Bewertungen

- Space and BCG MatrrixDokument16 SeitenSpace and BCG Matrrixnewa944Noch keine Bewertungen

- Strategic ChoiceDokument31 SeitenStrategic ChoiceRajesh TandonNoch keine Bewertungen

- 3 Aquino Ronquillo Tapia Mondia Parada Origen Guadalupe Geronimo Arcay NarizDokument53 Seiten3 Aquino Ronquillo Tapia Mondia Parada Origen Guadalupe Geronimo Arcay NarizrcdcaviteNoch keine Bewertungen

- Triarko Nurlambang: PT Daya Makara UIDokument30 SeitenTriarko Nurlambang: PT Daya Makara UIAnonymous B6yEOYINoch keine Bewertungen

- Chapter 8 - Strategy Generation and Selection 2Dokument74 SeitenChapter 8 - Strategy Generation and Selection 2safira dindaNoch keine Bewertungen

- MGT603 - Strategic Management Solved MCQ and Subjective Lecture Wise For Final Term Exam PreparationDokument76 SeitenMGT603 - Strategic Management Solved MCQ and Subjective Lecture Wise For Final Term Exam Preparationmuhammad shahbazNoch keine Bewertungen

- Strategic Management - Chapter 6Dokument56 SeitenStrategic Management - Chapter 6juan faustian siregarNoch keine Bewertungen

- Topic 5 Strategy Formulation 3 (Strategy Generation Selection)Dokument49 SeitenTopic 5 Strategy Formulation 3 (Strategy Generation Selection)黄洁宣Noch keine Bewertungen

- Strategy Analysis & Choice: Strategic Management: Concepts & Cases 11 Edition Fred DavidDokument50 SeitenStrategy Analysis & Choice: Strategic Management: Concepts & Cases 11 Edition Fred Davidliza shahNoch keine Bewertungen

- Chapter 5Dokument54 SeitenChapter 5JulianNoch keine Bewertungen

- EFE MatrixDokument9 SeitenEFE MatrixMuhammad Asad Bin FaruqNoch keine Bewertungen

- David 6 Rev 1Dokument73 SeitenDavid 6 Rev 1Alvin DimasacatNoch keine Bewertungen

- Valuing Growth Managing RiskDokument35 SeitenValuing Growth Managing RiskJohn Aldridge Chew67% (3)

- SPACE Matrix Strategic Management MethodDokument15 SeitenSPACE Matrix Strategic Management MethodAloja ValienteNoch keine Bewertungen

- Chapter2 (2 1 1)Dokument50 SeitenChapter2 (2 1 1)Xander MaxNoch keine Bewertungen

- Strategy Analysis and ChoiceDokument32 SeitenStrategy Analysis and ChoiceManjari MundanadNoch keine Bewertungen

- Chapter 5 - HandoutDokument21 SeitenChapter 5 - HandoutNhật HoàngNoch keine Bewertungen

- 2 Strategy Module 2 2012Dokument12 Seiten2 Strategy Module 2 2012anashussainNoch keine Bewertungen

- Matching StageDokument3 SeitenMatching StageSittie Islah Hadji FaisalNoch keine Bewertungen

- Chapter 5 HandoutDokument21 SeitenChapter 5 HandoutDuc Trieu MinhNoch keine Bewertungen

- The Input Tools Require Strategists To Quantify Subjectivity During Early Stages of The Strategy-Formulation ProcessDokument24 SeitenThe Input Tools Require Strategists To Quantify Subjectivity During Early Stages of The Strategy-Formulation ProcessHannah Ruth M. GarpaNoch keine Bewertungen

- Chapter 4 Strategy Analysis and ChoiceDokument13 SeitenChapter 4 Strategy Analysis and Choicemelvin cunananNoch keine Bewertungen

- SPACE StarbucksDokument3 SeitenSPACE StarbucksAzfar NoordinNoch keine Bewertungen

- Chapter 5 - HandoutDokument21 SeitenChapter 5 - HandoutNinh NguyễnNoch keine Bewertungen

- Strategic Managment TotalDokument49 SeitenStrategic Managment TotalkailashdhirwaniNoch keine Bewertungen

- Strategy Generation and Selection: Chapter EightDokument53 SeitenStrategy Generation and Selection: Chapter EightAwesomely FairNoch keine Bewertungen

- MGT603 FinalTerm 2008 S01Dokument57 SeitenMGT603 FinalTerm 2008 S01NadirAbidiNoch keine Bewertungen

- Chapter 6 Strategy Analysis and Choice Summary 17132120-002Dokument6 SeitenChapter 6 Strategy Analysis and Choice Summary 17132120-002NOORI KhanaNoch keine Bewertungen

- Space MTRXDokument4 SeitenSpace MTRXakkuliNoch keine Bewertungen

- 06 - Strategy Generation and Selection (For Sharing)Dokument30 Seiten06 - Strategy Generation and Selection (For Sharing)Andrew AndersonNoch keine Bewertungen

- CH 6. Strategy Analysis and ChoiceDokument45 SeitenCH 6. Strategy Analysis and ChoiceMaham GillaniNoch keine Bewertungen

- Space Matrix BMWDokument4 SeitenSpace Matrix BMWmadalus123Noch keine Bewertungen

- Sixteenth Edition: Strategy Analysis and ChoiceDokument56 SeitenSixteenth Edition: Strategy Analysis and ChoiceMinh Trang NguyễnNoch keine Bewertungen

- AssignmentDokument10 SeitenAssignmentWaqar AliNoch keine Bewertungen

- StrategiesDokument17 SeitenStrategiesLiaqat AliNoch keine Bewertungen

- Chapter 6 - Strategy Analysis & ChoiceDokument10 SeitenChapter 6 - Strategy Analysis & ChoiceHimangee Gupta0% (1)

- MGT603 Final Term Solved Papers 08 Papers SolvedDokument83 SeitenMGT603 Final Term Solved Papers 08 Papers SolvedMurad Khan100% (1)

- Strat Reviewer Chapter 6Dokument20 SeitenStrat Reviewer Chapter 6Ross John JimenezNoch keine Bewertungen

- David PPT Exp Ch06Dokument64 SeitenDavid PPT Exp Ch06Gracia PrimaNoch keine Bewertungen

- What Is The SPACE Matrix Strategic Management Method?Dokument4 SeitenWhat Is The SPACE Matrix Strategic Management Method?Subhadeep PaulNoch keine Bewertungen

- Nhóm 5 Nguyễn Quốc Huy SWOT AND SPACE MATRIX 1Dokument6 SeitenNhóm 5 Nguyễn Quốc Huy SWOT AND SPACE MATRIX 1Gamer và Âm nhạcNoch keine Bewertungen

- Strategic ManagementDokument16 SeitenStrategic ManagementM. E. C.Noch keine Bewertungen

- Hamill Bassue Owen Hendershot Goran NagradicDokument47 SeitenHamill Bassue Owen Hendershot Goran NagradicIrfan SaleemNoch keine Bewertungen

- Strama Mod 6Dokument13 SeitenStrama Mod 6Jaysah BaniagaNoch keine Bewertungen

- Chargezoom Achieves PCI-DSS ComplianceDokument2 SeitenChargezoom Achieves PCI-DSS CompliancePR.comNoch keine Bewertungen

- The Newton-Leibniz Book Research - Gate - 06!12!2023Dokument17 SeitenThe Newton-Leibniz Book Research - Gate - 06!12!2023Constantine KirichesNoch keine Bewertungen

- Simple Linear Equations A Through HDokument20 SeitenSimple Linear Equations A Through HFresgNoch keine Bewertungen

- Department of Education Division of Cebu ProvinceDokument5 SeitenDepartment of Education Division of Cebu ProvinceNelsie FernanNoch keine Bewertungen

- Course Hand Out Comm. Skill BSC AgDokument2 SeitenCourse Hand Out Comm. Skill BSC Agfarid khanNoch keine Bewertungen

- MK Slide PDFDokument26 SeitenMK Slide PDFPrabakaran NrdNoch keine Bewertungen

- National Formulary of Unani Medicine Part Ia-O PDFDokument336 SeitenNational Formulary of Unani Medicine Part Ia-O PDFMuhammad Sharif Janjua0% (1)

- Contoh Pidato Bahasa Inggris Dan Terjemahannya Untuk SMPDokument15 SeitenContoh Pidato Bahasa Inggris Dan Terjemahannya Untuk SMPAli Husein SiregarNoch keine Bewertungen

- Pemphigus Subtypes Clinical Features Diagnosis andDokument23 SeitenPemphigus Subtypes Clinical Features Diagnosis andAnonymous bdFllrgorzNoch keine Bewertungen

- 39 - Riyadhah Wasyamsi Waduhaha RevDokument13 Seiten39 - Riyadhah Wasyamsi Waduhaha RevZulkarnain Agung100% (18)

- Cambridge IGCSE: BIOLOGY 0610/31Dokument20 SeitenCambridge IGCSE: BIOLOGY 0610/31Balachandran PalaniandyNoch keine Bewertungen

- Ms Cell Theory TestDokument6 SeitenMs Cell Theory Testapi-375761980Noch keine Bewertungen

- Gian Lorenzo BerniniDokument12 SeitenGian Lorenzo BerniniGiulia Galli LavigneNoch keine Bewertungen

- Weekly Learning Plan: Department of EducationDokument2 SeitenWeekly Learning Plan: Department of EducationJim SulitNoch keine Bewertungen

- What Does The Scripture Say - ' - Studies in The Function of Scripture in Early Judaism and Christianity, Volume 1 - The Synoptic GospelsDokument149 SeitenWhat Does The Scripture Say - ' - Studies in The Function of Scripture in Early Judaism and Christianity, Volume 1 - The Synoptic GospelsCometa Halley100% (1)

- Baccarat StrategyDokument7 SeitenBaccarat StrategyRenz Mervin Rivera100% (3)

- LabDokument11 SeitenLableonora KrasniqiNoch keine Bewertungen

- Lesson Plan Earth and Life Science: Exogenic ProcessesDokument2 SeitenLesson Plan Earth and Life Science: Exogenic ProcessesNuevalyn Quijano FernandoNoch keine Bewertungen

- Group Process in The Philippine SettingDokument3 SeitenGroup Process in The Philippine Settingthelark50% (2)

- Massage Format..Dokument2 SeitenMassage Format..Anahita Malhan100% (2)

- Simple Linear Regression Analysis: Mcgraw-Hill/IrwinDokument16 SeitenSimple Linear Regression Analysis: Mcgraw-Hill/IrwinNaeem AyazNoch keine Bewertungen

- Basic Catholic Prayer 1Dokument88 SeitenBasic Catholic Prayer 1Josephine PerezNoch keine Bewertungen

- Read Chapter 4 Minicase: Fondren Publishing, Inc. From The Sales Force Management Textbook by Mark W. Johnston & Greg W. MarshallDokument1 SeiteRead Chapter 4 Minicase: Fondren Publishing, Inc. From The Sales Force Management Textbook by Mark W. Johnston & Greg W. MarshallKJRNoch keine Bewertungen

- Virtual Verde Release Plan Emails: Email 1Dokument4 SeitenVirtual Verde Release Plan Emails: Email 1Violet StarNoch keine Bewertungen

- Neuromarketing EssayDokument3 SeitenNeuromarketing Essayjorge jmzNoch keine Bewertungen

- Michael Parenti - The Demonization of Slobodan MilosevicDokument9 SeitenMichael Parenti - The Demonization of Slobodan MilosevicRicardo Castro Camba100% (1)

- Mod B - HSC EssayDokument11 SeitenMod B - HSC EssayAryan GuptaNoch keine Bewertungen

- CRM Project (Oyo)Dokument16 SeitenCRM Project (Oyo)Meenakshi AgrawalNoch keine Bewertungen

- Secant Method - Derivation: A. Bracketing MethodsDokument5 SeitenSecant Method - Derivation: A. Bracketing MethodsStephen Dela CruzNoch keine Bewertungen