Beruflich Dokumente

Kultur Dokumente

Slide Annual Report

Hochgeladen von

Ummu Zubair0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

90 Ansichten10 SeitenFinancial Statement Analysis

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenFinancial Statement Analysis

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

90 Ansichten10 SeitenSlide Annual Report

Hochgeladen von

Ummu ZubairFinancial Statement Analysis

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 10

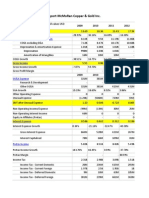

HUP SENG INDUSTRIES BERHAD

Statement of Comprehensive Income of the Group

2011 2010 2009 Inc/Dec

Revenue 112.6% 102.7% 100% 12.6%

Cost of Sales 116.8% 103.3% 100% 16.8%

Gross Profit 104.7% 101.5% 100% 4.7%

Interest Income 269.5% 176.7% 100% 169.5%

Other Income 84.6% 73.1% 100% -15.4%

Administrative expenses 152.2% 121.2% 100% 52.2%

Selling and marketing expenses 116.2% 103.5% 100% 16.2%

Financial cost 35.4% 13.7% 100% -64.6%

Profit before tax 77.1% 65.2% 100% -22.9%

Income tax expenses 100.8% 105.4% 100% 0.8%

Profit net of tax 69.3% 86.8% 100% -30.7%

HUP SENG INDUSTRIES BERHAD

Unit 2011 2010 2009

PROFITABILITY

Net Profit Margin %

7.8% 10.65% 12.60%

Total Assets Turnover

Times per

year

1.18 1.13 1.14

Return on Assets %

9.1% 12.02% 14.32%

Operating Income Margin %

11.5% 14.95% 16.78%

Operating Assets Turnover

Times per

year

3.51 3.19 2.96

Return on Operating Assets %

40.3% 47.75% 49.73%

DuPont Return on Operating Assests %

40.4% 47.69% 49.67%

Sales to Fixed Assets

Times per

year

3.51 3.19 2.96

Return on Investment %

12.0% 15.05% 17.80%

Return on Total Equity %

12.7% 15.93% 18.88%

Return on Common Equity %

31.1% 38.90% 44.80%

Gross Profit Margin %

32.5% 34.61% 35.53%

Unit 2011 2010 2009

INVESTOR ANALYSIS

Degree of Financial Leverage N/A

1 1 1

Diluted earning per share N/A

15.52 19.45 22.4

Earning per share RM

15.52 19.45 22.4

Percentage of Earning Retained %

36.0% 18.00% 61.00%

Dividend Payout %

96.6% 62% 96%

Book Value per shares RM

1.23 1.22 2.37

Operating Cash Flow per share RM

0.27 0.25 0.54

HUP SENG INDUSTRIES BERHAD

VS

HWA TAI INDUSTRIES BERHAD

Unit Hup Seng Hwa Tai

PROFITABILITY

Net Profit Margin %

7.8% -2.45%

Total Assets Turnover Times per year

1.18 1.26

Return on Assets %

9.1% -3.09%

Operating Income Margin %

11.5% 2.52%

Operating Assets Turnover Times per year

3.51 4.11

Return on Operating Assets %

40.3% 10.36%

DuPont Return on Operating Assests %

40.4% 10.36%

Sales to Fixed Assets Times per year

351.0% 4.11

Return on Investment %

12.0% -10.16%

Return on Total Equity %

12.7% -11.60%

Return on Common Equity %

31.1% -4.50%

Gross Profit Margin %

32.5% 26.72%

Unit Hup Seng Hwa Tai

INVESTOR ANALYSIS

Degree of Financial Leverage N/A

1 1

Diluted earning per share N/A

15.52 -4.5

Earning per share RM

15.52 -4.5

Percentage of Earning Retained %

36.0% 100.00%

Dividend Payout %

96.6% -

Book Value per shares RM

1.23 0.39

Operating Cash Flow per share RM

2.74 0.00

In general, by comparing from past 2 years, it

shows that for Hup Seng, its liquidity ratio

fluctuates from year 2009 to 2011. The

company have a large amount of the assets

over its liabilities, the result show the paying

ability of long term debt for Hup Sengs is

considered less risky. In profitability area, there

were a number of declines in 2011. Some of

these declines were material especially in net

profit margin, and operating income margin.

CONCLUSION

The return on assets, return on investment and

return on total equity also decline. It it reflects that

this companys performance may facing a problem

in their profitability. Investor analysis is not

favorable towards Hup Seng especially book value

per share and earning per share. Therefore, Hup

Seng must improve their performance to encourage

investors to invest in their company, so that every

cash given by investor can give a higher investment

returns.

Das könnte Ihnen auch gefallen

- Hipaa ChecklistDokument2 SeitenHipaa Checklistapi-470771218Noch keine Bewertungen

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- 10 Basics For Starting Your Online Business PDFDokument16 Seiten10 Basics For Starting Your Online Business PDFJacob Obbo100% (1)

- Internal Auditing (Online) - Syllabus - ConcourseDokument15 SeitenInternal Auditing (Online) - Syllabus - Concoursebislig water districtNoch keine Bewertungen

- CH 1 Introduction To AccountingDokument53 SeitenCH 1 Introduction To AccountingUmmu ZubairNoch keine Bewertungen

- CH 6 Model 13 Financial Statements Scenario AnalysisDokument12 SeitenCH 6 Model 13 Financial Statements Scenario AnalysisrealitNoch keine Bewertungen

- Cost and Managment Accounting PDFDokument142 SeitenCost and Managment Accounting PDFNaveen NaviNoch keine Bewertungen

- Integrated Digital MarketingDokument14 SeitenIntegrated Digital MarketingsuryaNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- Internal Audit Framework - COSODokument12 SeitenInternal Audit Framework - COSOUmmu ZubairNoch keine Bewertungen

- Pharmacovigilance Systems Master File (PSMF) : Dr. Varun Sharma Senior Project LeaderDokument22 SeitenPharmacovigilance Systems Master File (PSMF) : Dr. Varun Sharma Senior Project LeaderEldaniz Hasanov100% (2)

- Euan Sinclair Option Trading PDFDokument2 SeitenEuan Sinclair Option Trading PDFBeth33% (3)

- Project Absenteeism of EmployeesDokument64 SeitenProject Absenteeism of Employeesruchikunal90% (50)

- Nature of AdvertisingDokument13 SeitenNature of AdvertisingMitzi Gia CuentaNoch keine Bewertungen

- SAP Authorization Management GuidelinesDokument3 SeitenSAP Authorization Management GuidelinesMohiuddin BabanbhaiNoch keine Bewertungen

- FM 2 Real Project 2Dokument12 SeitenFM 2 Real Project 2Shannan Richards100% (1)

- TCS - NSE Valuation FileDokument53 SeitenTCS - NSE Valuation Fileshreyjain75Noch keine Bewertungen

- Balance Sheet of John Limited As OnDokument19 SeitenBalance Sheet of John Limited As OnAravind MaitreyaNoch keine Bewertungen

- Table 4Dokument2 SeitenTable 4Nam NguyễnNoch keine Bewertungen

- Ings BHD RR 3Q FY2012Dokument6 SeitenIngs BHD RR 3Q FY2012Lionel TanNoch keine Bewertungen

- Ratio Analysis Case Study SolutionDokument7 SeitenRatio Analysis Case Study SolutionRanjuNoch keine Bewertungen

- Liquidity and Profitability Ratios of Attock Petroleum 2010-2014Dokument10 SeitenLiquidity and Profitability Ratios of Attock Petroleum 2010-2014Ali AmarNoch keine Bewertungen

- Financial Statement Analysis Individual AssignmentDokument4 SeitenFinancial Statement Analysis Individual AssignmentmmdinarNoch keine Bewertungen

- Case 4 For AnanlysisDokument2 SeitenCase 4 For AnanlysisLaura HNoch keine Bewertungen

- Kbank enDokument356 SeitenKbank enchead_nithiNoch keine Bewertungen

- Tabel Financial PerformanceDokument17 SeitenTabel Financial Performancezanmatto22Noch keine Bewertungen

- Ashok Leyland Result UpdatedDokument13 SeitenAshok Leyland Result UpdatedAngel BrokingNoch keine Bewertungen

- American Vanguard Corporation (Security AnaylisisDokument18 SeitenAmerican Vanguard Corporation (Security AnaylisisMehmet SahinNoch keine Bewertungen

- Analysis 02 As Per SirDokument55 SeitenAnalysis 02 As Per SirSaran RamakrishnanNoch keine Bewertungen

- Group 1-Activity 4Dokument12 SeitenGroup 1-Activity 4Dũng NguyễnNoch keine Bewertungen

- Kawan Food 110301 RNFY10Dokument2 SeitenKawan Food 110301 RNFY10Sam NgNoch keine Bewertungen

- Final Report (Renata Limited) RYA FIN440Dokument51 SeitenFinal Report (Renata Limited) RYA FIN440Prince AhmedNoch keine Bewertungen

- B&I DBBL PRSNDokument42 SeitenB&I DBBL PRSNMahirNoch keine Bewertungen

- Final Project Presentation of Introduction To Financial AccountingDokument35 SeitenFinal Project Presentation of Introduction To Financial AccountingFatima Razzaq100% (1)

- FY 2011-12 Third Quarter Results: Investor PresentationDokument34 SeitenFY 2011-12 Third Quarter Results: Investor PresentationshemalgNoch keine Bewertungen

- Key Business Indicators Q1 2014Dokument1 SeiteKey Business Indicators Q1 2014Hitesh MoreNoch keine Bewertungen

- Copia de FCXDokument16 SeitenCopia de FCXWalter Valencia BarrigaNoch keine Bewertungen

- Adidas AG AR2010 Financial HighlightsDokument1 SeiteAdidas AG AR2010 Financial HighlightsGaurav GoyalNoch keine Bewertungen

- BIMBSec - Hartalega 4QFY12 Results 20120509Dokument3 SeitenBIMBSec - Hartalega 4QFY12 Results 20120509Bimb SecNoch keine Bewertungen

- Performance Highlights: NeutralDokument10 SeitenPerformance Highlights: NeutralAngel BrokingNoch keine Bewertungen

- Epicentre: Corporate UpdateDokument5 SeitenEpicentre: Corporate UpdateTan Wei ShunNoch keine Bewertungen

- Dupont Analysis For 3 Automobile CompaniesDokument6 SeitenDupont Analysis For 3 Automobile Companiesradhika chaudharyNoch keine Bewertungen

- First Resources 4Q12 Results Ahead of ExpectationsDokument7 SeitenFirst Resources 4Q12 Results Ahead of ExpectationsphuawlNoch keine Bewertungen

- Analysis and Interpretation of Financial Ratios and Trends for Nishat MillsDokument12 SeitenAnalysis and Interpretation of Financial Ratios and Trends for Nishat Millssabeen ansariNoch keine Bewertungen

- Tide Water OilDokument24 SeitenTide Water OilAditya Kumar KonathalaNoch keine Bewertungen

- Project Report FAM HULDokument16 SeitenProject Report FAM HULSagar PanchalNoch keine Bewertungen

- Financial Analysis of Lucky Cement LTD For The Year 2013Dokument11 SeitenFinancial Analysis of Lucky Cement LTD For The Year 2013Fightclub ErNoch keine Bewertungen

- Triple-A Office Mart Ratio AnalysisDokument8 SeitenTriple-A Office Mart Ratio Analysissahil karmaliNoch keine Bewertungen

- Profitability Analysis (Sapphire Fibres Limited)Dokument5 SeitenProfitability Analysis (Sapphire Fibres Limited)Aqsa MoizNoch keine Bewertungen

- Financial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismDokument18 SeitenFinancial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismPham Thuy HuyenNoch keine Bewertungen

- Ratio AnalysisDokument27 SeitenRatio AnalysisSwati SharmaNoch keine Bewertungen

- Power Engineering Consulting Firm AnalysisDokument3 SeitenPower Engineering Consulting Firm AnalysishotransangNoch keine Bewertungen

- Quickfix's financial analysisDokument8 SeitenQuickfix's financial analysisCheveem Grace EmnaceNoch keine Bewertungen

- Bulgari Group Q1 2011 Results: May 10th 2011Dokument10 SeitenBulgari Group Q1 2011 Results: May 10th 2011sl7789Noch keine Bewertungen

- Financial Analysis of Indigo Airlines From Lender's PerspectiveDokument12 SeitenFinancial Analysis of Indigo Airlines From Lender's PerspectiveAnil Kumar Reddy100% (1)

- Case 1 - Financial Manager & PolicyDokument16 SeitenCase 1 - Financial Manager & PolicycatatankotakkuningNoch keine Bewertungen

- Wah Seong 4QFY11 20120223Dokument3 SeitenWah Seong 4QFY11 20120223Bimb SecNoch keine Bewertungen

- Siyaram Silk MillsDokument9 SeitenSiyaram Silk MillsAngel BrokingNoch keine Bewertungen

- Financial Analyses On The Various Davao City-Based CompaniesDokument24 SeitenFinancial Analyses On The Various Davao City-Based CompaniesmasterdrewsNoch keine Bewertungen

- Market Outlook 29th July 2011Dokument11 SeitenMarket Outlook 29th July 2011Angel BrokingNoch keine Bewertungen

- Ajanta Pharma LTDDokument4 SeitenAjanta Pharma LTDSatish BagNoch keine Bewertungen

- Annual Performance 2012Dokument3 SeitenAnnual Performance 2012Anil ChandaliaNoch keine Bewertungen

- Inventory Turn Over Ratio Inventory Turnover Is A Showing How Many Times A Company's Inventory Is Sold andDokument23 SeitenInventory Turn Over Ratio Inventory Turnover Is A Showing How Many Times A Company's Inventory Is Sold andrajendranSelviNoch keine Bewertungen

- Rs 203 BUY: Key Take AwayDokument6 SeitenRs 203 BUY: Key Take Awayabhi_003Noch keine Bewertungen

- Alok Industries LTD: Q1FY12 Result UpdateDokument9 SeitenAlok Industries LTD: Q1FY12 Result UpdatejaiswaniNoch keine Bewertungen

- Du Pont AnalysisDokument5 SeitenDu Pont AnalysisSandip PatelNoch keine Bewertungen

- Aomq 3Dokument2 SeitenAomq 3Dinesh SharmaNoch keine Bewertungen

- SpiceJet Result UpdatedDokument9 SeitenSpiceJet Result UpdatedAngel BrokingNoch keine Bewertungen

- A. Liquidity Ratio: Current Assets Include Cash and Bank Balances, Marketable Securities, Debtors andDokument28 SeitenA. Liquidity Ratio: Current Assets Include Cash and Bank Balances, Marketable Securities, Debtors andYugendra Babu KNoch keine Bewertungen

- ACF CaseDokument22 SeitenACF CaseHaris AliNoch keine Bewertungen

- Case 03Dokument9 SeitenCase 03Sajieda FuadNoch keine Bewertungen

- Accounting Conceptual FrameworkDokument4 SeitenAccounting Conceptual FrameworkUmmu ZubairNoch keine Bewertungen

- LabourDokument19 SeitenLabourUmmu ZubairNoch keine Bewertungen

- Public Finance Reform (Edited)Dokument9 SeitenPublic Finance Reform (Edited)Ummu ZubairNoch keine Bewertungen

- Harbins AnalysisDokument1 SeiteHarbins AnalysisUmmu ZubairNoch keine Bewertungen

- Internal Audit Challenges in Malaysian GovernmentsDokument33 SeitenInternal Audit Challenges in Malaysian GovernmentsUmmu ZubairNoch keine Bewertungen

- UnknownDokument8 SeitenUnknownAsiful IslamNoch keine Bewertungen

- MfrsDokument26 SeitenMfrsUmmu ZubairNoch keine Bewertungen

- A Study of Auditors' Responsibility For Fraud Detection in MalaysiaDokument8 SeitenA Study of Auditors' Responsibility For Fraud Detection in MalaysiaUmmu ZubairNoch keine Bewertungen

- Benefiting ISA On Quality Control (A Tool To Assessing Audit Firm)Dokument11 SeitenBenefiting ISA On Quality Control (A Tool To Assessing Audit Firm)Ummu ZubairNoch keine Bewertungen

- Internal Audit Independence and Corporate Governance PDFDokument20 SeitenInternal Audit Independence and Corporate Governance PDFUmmu ZubairNoch keine Bewertungen

- Issues and Challenges Promoting AccountabilityDokument3 SeitenIssues and Challenges Promoting AccountabilityUmmu ZubairNoch keine Bewertungen

- Fraud Survey 2004 by PDRMDokument28 SeitenFraud Survey 2004 by PDRMUmmu ZubairNoch keine Bewertungen

- Ways To Prevent Accting Fraud 1Dokument11 SeitenWays To Prevent Accting Fraud 1Ummu ZubairNoch keine Bewertungen

- Auditing An Ethics Policy Adds Credibility, Avoids Window DressingDokument5 SeitenAuditing An Ethics Policy Adds Credibility, Avoids Window DressingUmmu ZubairNoch keine Bewertungen

- The Accountant Issue Winter 2011Dokument38 SeitenThe Accountant Issue Winter 2011Ummu ZubairNoch keine Bewertungen

- 7 Short Logistic RegressionDokument13 Seiten7 Short Logistic RegressionUmmu ZubairNoch keine Bewertungen

- Tugasan 1Dokument32 SeitenTugasan 1Ummu ZubairNoch keine Bewertungen

- 2 Assignment Partiipant Ver1Dokument1 Seite2 Assignment Partiipant Ver1Ummu ZubairNoch keine Bewertungen

- Shariah and Good GovernanceDokument20 SeitenShariah and Good GovernanceUmmu ZubairNoch keine Bewertungen

- HSE Engineer - Job Description TemplateDokument2 SeitenHSE Engineer - Job Description Templatefazalkhan1111Noch keine Bewertungen

- McdonaldsDokument36 SeitenMcdonaldsnitin100% (1)

- Securities Regulation Code of The Philippines (R.A. 8799) PurposeDokument11 SeitenSecurities Regulation Code of The Philippines (R.A. 8799) PurposeWilmar AbriolNoch keine Bewertungen

- Summer Internship ReportDokument46 SeitenSummer Internship ReportJanvi Singh100% (1)

- Original Syllabus Sem 2Dokument21 SeitenOriginal Syllabus Sem 2Sharad RathoreNoch keine Bewertungen

- Epc PDFDokument8 SeitenEpc PDFmasimaha1379Noch keine Bewertungen

- Tax Invoice for LG Washing MachineDokument1 SeiteTax Invoice for LG Washing MachineAnkit TripathiNoch keine Bewertungen

- Need, Want, Demand: Understanding Consumer BehaviorDokument5 SeitenNeed, Want, Demand: Understanding Consumer Behaviorbim269100% (1)

- Blue Ocean Strategy - Creating Uncontested Market SpaceDokument37 SeitenBlue Ocean Strategy - Creating Uncontested Market SpaceSAYED FARAZ ALI SHAHNoch keine Bewertungen

- Interview Base - Knowledge & PracticalDokument39 SeitenInterview Base - Knowledge & Practicalsonu malikNoch keine Bewertungen

- 8K Miles: Keep Yourself Away 8K Miles'Dokument4 Seiten8K Miles: Keep Yourself Away 8K Miles'Suneel KotteNoch keine Bewertungen

- Guide de ProcessusDokument13 SeitenGuide de Processusnajwa zinaouiNoch keine Bewertungen

- College of Accountancy Final Examination Acctg 207A InstructionsDokument5 SeitenCollege of Accountancy Final Examination Acctg 207A InstructionsCarmela TolinganNoch keine Bewertungen

- Revised Chapter 2Dokument44 SeitenRevised Chapter 2kellydaNoch keine Bewertungen

- SEC approval needed for merger validityDokument2 SeitenSEC approval needed for merger validityGlaiza OtazaNoch keine Bewertungen

- Bandhan Bank Statement.Dokument1 SeiteBandhan Bank Statement.ssbajajbethua22Noch keine Bewertungen

- Performance Management FinalsDokument2 SeitenPerformance Management FinalsHasan Ali BokhariNoch keine Bewertungen

- Chap 7Dokument20 SeitenChap 7Ika ChillayNoch keine Bewertungen

- Week 2 - Recruitment SourcesDokument47 SeitenWeek 2 - Recruitment Sourcesyousuf AhmedNoch keine Bewertungen

- Flash Reports DefinitionDokument8 SeitenFlash Reports Definitionca_rudraNoch keine Bewertungen