Beruflich Dokumente

Kultur Dokumente

Monetary Policy and "Stabilisation Trap" in Selected Asian Countries - Implications For Poverty Reduction

Hochgeladen von

Inri Asridisastra D0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

43 Ansichten47 Seitenmonetary

Originaltitel

Monetary Policy ERG

Copyright

© © All Rights Reserved

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenmonetary

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

43 Ansichten47 SeitenMonetary Policy and "Stabilisation Trap" in Selected Asian Countries - Implications For Poverty Reduction

Hochgeladen von

Inri Asridisastra Dmonetary

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 47

Monetary Policy and Stabilisation

Trap in Selected Asian Countries

Implications for Poverty Reduction

Anis Chowdhury

Professor of Economics

University of Western Sydney, Australia

Introduction

deficit financing can lead to a very

unsustainable economy. Bolivia in the

1980s is an extreme example: its

deficit rose to 28% of GNP leading

to hyperinflation and serious economic

crisis. So, each country should aim at

roughly balancing its budget

(Human Development Report, 1991, p. 42)

Generalisation from extreme cases led

to the policy package of IMF/World

Bank in the 1980s & 1990s

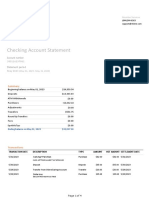

Single digit Inflation and growth stagnation

Sources: World Development Reports, 1991, 2002

Country

Inflation Rate

Growth Rate

1965-80

1980-89

1965-80

1980-89

Bangladesh

14.8

10.6

2.5

3.5

Ethiopia

3.4

2.0

2.7

1.9

Burundi

5.0

3.7

7.1

3.3

Mali

9.0

3.6

4.2

3.8

Niger

7.5

3.4

0.3

-1.6

Rwanda

12.5

4.0

4.9

1.5

Pakistan

10.3

6.7

5.2

6.4

Indonesia

35.5

8.3

7.0

5.3

Cote dIvorie

9.4

3.1

6.8

1.2

Peru

8.1

5.6

4.1

2.1

Congo

6.8

0.3

6.2

3.9

Cameron

9.0

6.6

5.1

3.2

Panama

5.4

2.5

5.5

0.5

Gabon

12.8

-1.0

9.5

1.2

Trinidad & Tobago

14.1

5.8

5.0

-5.5

Sources: World Development Reports, 1991, 2002

Poverty in the 1990s

Sources: World Development Reports, 1991, 2002

Sources: World Development Reports, 1991, 2002

Country

$1 a day

$2 a day

Bangladesh

29.1

77.8

Ethiopia

31.3

76.4

Burundi

Mali

72.8

90.6

Niger

61.4

85.3

Rwanda

35.7

84.6

Pakistan

31.0

84.7

Indonesia

7.7

55.3

Cote dIvorie

12.3

49.4

Peru

15.5

41.4

Congo

Cameron

Panama

10.3

25.1

Gabon

Trinidad & Tobago

Argentina in the 1980s

hyper-inflation the average annual inflation rate

around 391% and average annual economic growth

rate around 1%

1990s

orthodox IMF stabilisation package succeeded;

average annual inflation rate 1.5%, and the economy

grew by an average annual rate of 6.7% during 1991-

1997

However

the continuation of severe restrictive macroeconomic

policies forced the economy into a deflationary spiral

the inflation rate dropped to 0.9% and 1.3% in

2000 and 2001 respectively

economy contracted by 3.4% in 1999 and by 2.1% in

2000

unemployment rate rose from 6.5% in 1991 to 17.5% in

1996

consequently, the poverty rate (head-count ratio) rose

from 21.8% in 1993 to 34.3% in 2002, and the Gini

coefficient from 0.45 to 0.49

Asian Experience

While lower inflationis a positive indicatora near-zero inflation rate

may be symptomatic of demand deficiency leading to capacity

underutilizationTargeting for a too-low inflation ratecan sometimes

result in overkill. .. Yet another problem with pushing inflation too low is

that it will make it difficult to bring about the large relative price changes

that the structural adjustment policies aim at. (Bangladesh Report, p. 38).

The point is not that the authority has to fight inflation at any price and to

only value deflationary policy. Rather, it has to face the tough question of

how far to go with fighting inflation, knowing that with ongoing deflation an

economy might face greater risk of entering into the chain of rising

unemployment, falling demand, and reduction in the level of national

incomeThis restricted policy should not be seen as the only way out,

without flexibility. The inflation ratehas remained low since 1995 But,

the targeted inflation of about 4 per centseems to be low if the aim is to

create employment and economic growth. (Cambodia Report, pp. 48, 60-

61).

In the current context, one of Chinas important challenges appears to lie

in counteracting deflationary pressures and sustaining rapid economic

growth rather than combating inflation...Persistent deflation may have

serious adverse effects on Chinas economic growth and poverty

reduction prospects. (China Report, p. 72).

Policymakers continue to adhere to tight IMF-prescribed fiscal and

monetary targets in order to achieve single-digit inflation

ratesMeanwhile, domestic consumption, not private investment, is

supporting growth. But clearly this is not sustainableHigh interest rates

[needed for a low inflation target] are an impediment to growth in

circumstances such as Indonesias, where the corporate sector is heavily

indebted. (Indonesia Report, pp. 15, 19)

Bank Indonesia highlighted Indonesias monetary policy dilemma:

if the policy is tightly directed at attaining inflation targetit is feared

to disturb the current economic recovery.

If Bank Indonesia is still persistent in achieving the base money

target, extremely high increase in interest rate will be required,

whichcould harm the economic recovery prospects

This sentiment was echoed by the Chairman of the Indonesian Chamber

of Commerce of Industry: Bank Indonesia has been keeping interest

rates high to ease pressure on the rupiah and stall inflation however,

[this] discouraged industries from making new investments that would

otherwise have helped create new jobs

Realisation at Last!

Wolfensohn, if we take a closer look,

we see something else something

alarming. In developing countries,

excluding China, at least 100 million more

people are living in poverty today than a

decade ago. And the gap between rich

and poor yawns wider.

World Bank (2005, p. xiii), there is no

unique universal set of rules [W]e need

to get away from formulae and the search

for elusive best practices.

Easterly (2001) called the 1980s and

1990s the lost decades.

Monetary Policy and Poverty theories

and evidence

The channels through which monetary policy can

affect poverty are:

long-run economic growth

short-run output stabilisation and

income distribution.

Since monetary growth and inflation are positively

linked, moneys role in poverty reduction will be

examined by looking at the:

inflation-growth inflation

short-run trade off between output and price

stabilisation and

inflation-inequality relationship.

We shall also examine the question of central

bank independence.

Money in the Long-run Does Inflation

Harm Economic Growth?

In theory, the answer is both Yes and No.

What is the empirical evidence?

Extensive empirical research indicates that the

negative relationship between inflation and

economic or productivity growth is influenced by

extreme values or outlying countries having an

exceptionally high inflation rates (see Figure 2).

In the words of Bruno and Easterly (1998), the

correlation loses significance with the omission of

single observation Nicaragua, which had hyper-

inflation and negative growth in the 1980s More

generally, significance and sign of the cross-

section correlation depends on the inclusion of the

countries with high inflation crises the above

40% episodes.

They also observed, the significance of the

negative growth during 20-40% inflation vanishes

if a single extreme annual observation is omitted

Iran in 1980.

Easterly (2003) reported similar findings and

regarded inflation rates below 35% as moderate.

Figure 2a: Inflation-Growth (1980-1990)

-10

-5

0

5

10

15

-100 0 100 200 300 400 500

Inflation

G

r

o

w

t

h

Figure 2c: Inflation-Growth (1980-1998)

-10

-5

0

5

10

15

-200 0 200 400 600 800

Inflation

G

r

o

w

t

h

Figure 3: Average GDP Growth & Inflation Rates

(1960-2000)

-1

-0.5

0

0.5

1

1.5

2

2.5

3

3.5

4

Between 0

& 5%

Between 5

& 10%

Between 10

& 15%

Over 15%

Average Inflation Rate

A

v

e

r

a

g

e

G

D

P

G

r

o

w

t

h

R

a

t

e

(

%

)

1960-1979

1980-2000

Source: Islam, 2003

Figure 3 plots average inflation and growth rates

over four decades (1960-2000) for 141

countries. Two interesting features emerge.

The inflation-growth relationship was negative

in the period 1960-1979. But it seems to have

become non-linear first positive and then

negative in the later period of 1980-2000. This

confirms the uncertain nature of the inflation-

growth relationship.

The variation in growth rate between the two

time periods is much larger at both low and

high inflation. That is, both high and low

inflation rates can be destabilising, and hence

harmful for the poor.

Thus, one may conclude that while policy makers should

guard against high inflation, a country may need

moderate inflation to sustain economic growth. This

understanding is essential when there is excess capacity

and persistent high unemployment or underemployment.

The over-fixation with a single digit inflation target cannot

be justified based on the fear of inflation going out of

control once it is allowed to go beyond, say 10% level.

Dornbusch and Fischer (1993) found that inflation rate in

the moderate range of 15-30% does not usually

accelerate to extreme levels.

Bruno and Easterly (1998) found that the threshold

inflation rate of 40% at which the probability of inflation

rate accelerating rises significantly.

Furthermore, only in a handful of cases inflation rate did

accelerate and output stagnated or declined in the past,

and these cases could be attributed to unusual

circumstances (e.g Iran or Nicaragua in the 1980s

following dramatic fall of the regimes).

Cross-country scatter diagram (Figure 5) shows, the claim

of the orthodox school that inflation harms the poor breaks

down when one considers inflation rate in the range of 5-

20%. Consistent with the aggregate inflation-growth

relationship, the negative relationship between inflation

and the income of the poor is based on few cases of

extreme inflation.

Therefore, contrary to the orthodox view, poverty-

reduction strategy requires moderately expansionary

monetary policy, and fear of excesses cannot be a basis

for sound public policy.

Money in the Short-run: Is there any

Output Stabilisation Role?

Demand Shock: Monetary policys role in

stabilizing output depends on two questions:

To what extent a country is prone to demand

shocks

To what extent prices (product prices,

exchange rate & interest rate) and wages

flexible

The components of aggregate demand are less

stable in developing countries due to:

Narrow export base

Poverty and the role of current income

Liquidity constraint for both households & small

firms

Among key prices

Exchange rate is quasi fixed

Wages are sluggish downwards mainly

because real wage is already too low.

Therefore, regardless of whether the

adjustment happens through output or

prices, falling aggregate demand will have

serious implications for the poor.

If the adjustment happens through cuts in

output and employment, the first to lose

job is unskilled and unorganised labour.

If the adjustment happens through

declines in wages, again the unorganised

and unskilled workers would be forced to

accept lower wages.

S

Po

P1

Do

D1

Y2 Y1 Yo

Figure 6: Adjustments to Demand Shocks

Thus, the poor unorganised workers are

forced to choose between jobs and lower

real wages. In either case, the average

income of the poor is likely to drop when

nominal GDP growth drops from its trend.

Cross- country (Figure 7) evidence shows

that average income of the poor is

negatively related to aggregate demand

variability.

This negative relationship does not

breakdown even when the outliers are

omitted.

Therefore, from the point of view of

protecting the poor, monetary policy needs

to stabilise output in the face of adverse

demand shocks.

Supply Shock: It is generally accepted that

the developing countries are more prone

to supply shocks than demand shocks.

This is due to their heavy dependence on

agriculture and imported raw materials,

and energy (oil).

While alternating floods and drought are

almost regular phenomena affecting

agriculture, declining terms of trade due to

rising prices of imported raw materials and

energy adversely affects the industrial

sector.

The choice between output and price

stabilisation becomes starker in the case

of a supply shock. This can be shown

diagrammatically:

Figure 8: Adjustment to Supply Shocks

D1 S1 S1

Do So Do So

D1

P2

P1 P1

Po Po

Y1 Yo Y2 Y1 Yo

In panel A, the response to an adverse

supply shock is an expansionary

monetary policy to stabilise output at

Q0.

In panel B, the response is a

contractionary monetary policy to

stabilise the price level at P0.

When the response is an

expansionary policy, the price level

rises further to P2, causing higher

inflation.

When the objective is price

stabilisation with a contractionary

monetary policy, output declines

further to Q2.

Inflation and Income Distribution

Inflation can disproportionately hurt the poor through

two channels:

Wage rise lags behind price rises

Poor mostly save in money and inflation reduces

the value of their savings.

Counter arguments:

If real wage declines due to inflation then

employment should rise. Therefore, the employment

effect of inflation can outweigh the real wage effect

on poverty.

The gain from expansionary monetary policy will not

be temporary if the inflation rate remains

moderate. This is evident from the positive

relationship between moderate inflation and

economic growth as demonstrated earlier.

The poor are largely net financial debtors. Thus,

inflation can benefit the poor by reducing the real

value of their net debt. On the other hand, lower

inflation not only increases the real value of financial

debt, the high interest rate policy aimed at bringing

inflation down increases the debt servicing cost of

indebted poor. This makes them, doubly

disadvantaged.

Evidence

Studies have found that income distribution

narrows during the expansionary phase and

widens during the contractionary phase of a

business cycle.

Figure 9 presents the scatter plots of average

inflation and inequality (measured by Gini

coefficient). Once again, we find that the claim

of adverse distributional effect of inflation is

based on extreme inflationary cases.

There seems to be no relation between

inequality and inflation when the inflation rate

ranges between 5 and 15%. On the other hand,

inequality rises with the variability of nominal

GDP growth (Figure 10).

The evidence presented in Figures 9 & 10

vindicates the need for output stabilising

monetary policy that allows for moderate

inflation.

Central Bank Independence and Inflation-

targeting

The empirical evidence on the performance of

independent central banks is still mixed.

The conditions required for the success of an

inflation-targeting approach include

the lack of fiscal dominance and

the absence of any other objectives.

None of these conditions appears to hold in

most developing countries.

The revenue base of these countries is very low

and their capital market is underdeveloped. This

forces most developing countries to borrow from

the central bank.

These countries also have some sort of quasi-fixed

exchange rate systems needed to prevent

imported inflation and to attract short-term portfolio

foreign capital.

Thus money supply responds to developments in

government finance and the balance of payments.

Leaving aside the technical argument, there is a

broader issue of democratic governance and

technocratic insulation of institutions.

It is pertinent at this juncture to quote Milton

Friedman who is on record for voicing the

concern ' money is too important to be left

to the central bankers'. His concerns are

elaborated in the following quote:

The political objections are perhaps more

obvious than the economic ones. Is it really

tolerable in a democracy to have so much

power concentrated in a body free from any

direct political control? One economic

defect of an independent central bank is

that it almost invariably involves dispersal of

responsibility Another defect is the

extent to which policy is made highly

dependent on personalities A third

technical defect is that an independent

central bank will almost invariably give undue

emphasis to the point of view of bankers

The defects I have outlined constitute a

strong technical argument against an

independent central bank.

Stern and Stiglitz (1996) have made the

point more succinctly:

The degree of independence of the

central bank is an issue of the balance of

power in a democratic society. The

variables controlled by the central bank

are of great importance and thus require

democratic accountability. At the same

time the central bank can act as a check

on government irresponsibility. The most

successful economies have developed

institutional arrangements that afford the

central bank considerable autonomy; but

in which there is a check provided by

public oversight, an oversight that ensures

the broader national interest is taken into

account in the final decisions.

In this respect, it is worth highlighting the distinction

between "goal independence" and "instrument

independence".

The former refers to central bank's ability to set the

inflation target independently of the government.

The later is its independence in the choice of

instruments and hence relates to central bank's

day to operations.

No central bank can be entirely independent of a

democratic government while it can be entirely

free in choosing its instruments.

Most developing countries are new democracies.

In such a situation, a central bank with both goal

and instrument independence may choose a very

low inflation target which can undermine a nascent

democracy by delaying economic recovery.

Furthermore, the very argument that an elected

government cannot be trusted with the

responsibility of managing the economy goes

against the very principle of representative

democracy.

The above issues have become more prominent in

Indonesia as the new central bank law (enacted in

1999) grants the Bank Indonesia (BI) both goal and

instrument independence.

This has been responsible for open disputes between

the BI and parliament in a number of occasions on the

appropriateness of monetary policy stance.

The national planning agency (BAPPENAS) has also

expressed concerns about the mismatch between the

monetary policy stance of the BI and fiscal policy.

The Indonesia country report (p. 19) observes:

It is difficult to ease monetary policy and achieve

some consistency between fiscal and monetary

policies when the Bank of Indonesia (BI) remains

relatively autonomous and wedded to tight

monetary policies. While BI should have autonomy in

determining its policy instruments, its objectives

should be subject to public discussion and oversight.

By setting low inflation as its overriding objective, BI

can compromise the achievement of other objectives,

such as growth of income and employment

generation, which most people value highly, in

addition to price stability.

It is rather strange that under the provision

of the current legislation of BI

independence, neither the president nor

the parliament can remove the governor of

BI before the expiry of his/her tenure.

This led to the much publicised stand-off

when President Wahid wanted to remove

the Governor after he was indicted in a

corruption case.

The Governor refused to resign even

when he was convicted following a guilty

verdict.

In sum, inflation targeting and central bank

independence are not merely technical

matters, as the orthodoxy tends to believe.

It is pertinent at this juncture to point to the

observation made by a central bank

insider, Guy Debelle (1996: 1).

An increase in the inflation aversion of

the central bank, while always reducing

inflation rate, may reduce welfare because

of its adverse effects on output and

government spending. The net welfare

effect is shown to depend on the weights

in the welfare functions of the fiscal

authority and society. Thus, increasing the

central bank's inflation aversion is not

necessarily a free lunch.

Thus, the essence of inflation targeting is

embedded in the so-called social welfare

function that includes both inflation and

economic growth.

High unemployment that is required to bring

inflation rate to a single digit level or to keep

inflation rate in the range of 3-5% has

significant and systematically regressive effects

on the distribution of income.

The poor fare worse when unemployment rises

and persists, especially when there is no

adequate safety-net or social security system.

At the same time the real value of their net debt

rises with falling inflation.

Hence the poor have reasons to be more

averse to unemployment and less averse to

inflation than the elite in society.

As the poor lack voice and representation, the

choice of weights for inflation and

unemployment in the social welfare function

raises an important issue of conflicts and

political economy of public policy.

Policy Recommendations

Recognise both price and output stabilisation

roles. That is, avoid both too conservative

and too expansionary monetary policy.

Inflation in the range of 10-20% can be

regarded as safe both from the point of view

of avoiding a stabilisation trap and harmful

affects of expansionary monetary policy.

Achieve consistency with the fiscal policy

stance. Safe expansionary monetary policy

within the above guideline will allow

governments to borrow from the central bank

to finance employment-intensive public

investment programs in infrastructure. This

can create and stabilise employment without

pressure on interest rate. Thus private

investment is unlikely to be crowded out;

rather both domestic and foreign investment

will be encouraged by demand growth and

externality benefits from improved physical

infrastructure.

Develop directed credit programs to

employment-intensive small and medium

enterprises, agriculture and rural industries.

This is essential because they are more

dependent on bank credits than larger

enterprises that have better access to capital

markets. Therefore, even when over-all credit

growth needs to be restrained, directed credit

to SMEs and rural-agricultural sectors must be

maintained to avoid asymmetric adverse impact

on employment. This will protect the income of

the poor and offset likely adverse impacts of

cyclical downturn on inequality.

Central banks should be given autonomy to

choose and implement the instruments of

monetary policy within the over-all economic

objectives dictated by the poverty reduction

strategy of the government. This means a

participatory policy making process so that the

trade-off parameter between inflation and

unemployment reflects the concerns of the

poor, and not of the elite or multilateral

agencies.

Given that there is no evidence of a

trade-off between employment

creation and moderate inflation, the

conflict between goals and

instruments is not as stark.

Yet for two targets the monetary

authorities can have two

instruments:

Traditional instrument of interest rate

(or such instruments as reserve

requirements) assigned to keep

inflation at a moderate level.

Specialised credit regulation directed

to employment creation.

The central banks can consider a

number of options in designing

specialised credit programs:

Follow the Indian example, where all banks

(public and private) are required to lend at

least 40 per cent of their net credit to the

priority sector. If banks fail to meet this

requirement, they are required to lend

money to specific government agencies at

a very low interest as a penalty.

Alternatively, use some carrot and stick

measures by combining the penalty

system with incentive based measures

such as asset based reserve requirements,

support for pooling and underwriting small

loans, utilising the discount window in

support of employment generating

investments

Asset based reserve requirements are an

effective tool for creating incentives for

banks to invest in socially productive

assets. For example:

Based on well-research findings of employment

elasticities, the central banks would list a set of

employment generating investment, and a lower

reserve requirement would apply for the deposits

invested in these activities than the deposits invested

in speculation or Treasury Bills.

The central banks can also take steps to create

liquidity and risk sharing institutions for loans to

small businesses which have promise to generate

employment, but do not have adequate access to the

credit market. For example, the central banks can

provide financial and administrative support for asset

backed securities which would take loans to small

businesses and other employment intensive activities,

bundle these investments and sell them as securities

on the open market.

Finally, the central banks can open a special discount

window facility to offer credit, guarantee or discount

facilities to institutions that are on-lending to firms

and co-operatives engaged in employment intensive

activities.

To achieve the RER target, the

central banks should intervene in

the exchange market.

That is; the nominal exchange rate

should move to hold RER at a

stable and competitive level for

an extended period of time.

There are basically three options:

1. interest rate manipulation

2. sterilised intervention

3. capital controls.

To support the developmental role of

exchange rate, monetary policy must

maintain stable and low real interest

rates. By boosting exports this will

complement the employment target

of monetary policy.

Will low interest rates set off

inflationary nominal depreciation

(under speculative exchange rate

dynamics)?

Targeting RER can help central banks

avoid this problem.

Finally central banks need to have

some controls on capital flows.

This will give central banks

controls over monetary

aggregates and hence monetary

policy independence to keep real

interest rates low, stabilise

employment and keep inflation at

a moderate level, while the

exchange rate policy aims to

maintain international

competitiveness.

There are, of course, many critics of

capital controls. However, they must

accept that the Mundell-Fleming

model conceived of capital flows as

largely money-market flows or at

most money and bond markets

flows.

An important development in the

world economy in the late 1990s was

the shift of international capital flows

from the fixed income market both

money and bond flows to the

equity market both portfolio equity

flows and FDI.

A decline in policy interest rates can

raise expected corporate earnings. This

can lead equity prices to rise and attract

foreign investors with extrapolative

expectations to buy more equities.

Therefore, equity effect of lower interest

rates can be larger than the money-bond

market effects to overturn standard

Mundell-Flemming results.

Thus, capital account openness should

not be viewed as an all-or-nothing

proposition. The increased importance of

equity flows has increased the effective

scope of a capital account policy of semi-

openness. A capital account can be open

to equity flows both portfolio and FDI,

but closed to money and bond flows.

Das könnte Ihnen auch gefallen

- Public Expenditure PFM handbook-WB-2008 PDFDokument354 SeitenPublic Expenditure PFM handbook-WB-2008 PDFThơm TrùnNoch keine Bewertungen

- Pub Rethinking Development GeographiesDokument286 SeitenPub Rethinking Development Geographiesxochilt mendozaNoch keine Bewertungen

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Dokument17 SeitenGuide To Original Issue Discount (OID) Instruments: Publication 1212Theplaymaker508Noch keine Bewertungen

- The Making of A Smart City - Best Practices Across EuropeDokument256 SeitenThe Making of A Smart City - Best Practices Across Europefionarml4419Noch keine Bewertungen

- Monetary Policy of The PhilippinesDokument37 SeitenMonetary Policy of The PhilippinesNiala-Gibbson Niala100% (1)

- COA Resolution Number 2015-031Dokument3 SeitenCOA Resolution Number 2015-031gutierrez.dorie100% (7)

- Dr. Mohamed A. El-Erian's The Only Game in Town Central Banks, Instability, and Avoiding the Next Collapse | SummaryVon EverandDr. Mohamed A. El-Erian's The Only Game in Town Central Banks, Instability, and Avoiding the Next Collapse | SummaryBewertung: 4 von 5 Sternen4/5 (1)

- The Great Depression of the 2020s: Its Causes and Who to BlameVon EverandThe Great Depression of the 2020s: Its Causes and Who to BlameNoch keine Bewertungen

- Kotler - MarketingDokument25 SeitenKotler - Marketingermal880% (1)

- Macroeconomics AssignmentDokument16 SeitenMacroeconomics AssignmentHarkishen Singh0% (2)

- Globalization and Global DisinflationDokument36 SeitenGlobalization and Global DisinflationOkechukwu MeniruNoch keine Bewertungen

- Monetary Policy, Inflation, and Distributional Impact: South Africa's CaseDokument24 SeitenMonetary Policy, Inflation, and Distributional Impact: South Africa's CaseGrace MutoreNoch keine Bewertungen

- Topic 1 Concepts and Problems in Macroeconomics - JBNDokument21 SeitenTopic 1 Concepts and Problems in Macroeconomics - JBNleimarNoch keine Bewertungen

- Kenyatta University.: Curbing Inflation For Economic Growth: The Causes of Persistently High Inflation Rates in KenyaDokument12 SeitenKenyatta University.: Curbing Inflation For Economic Growth: The Causes of Persistently High Inflation Rates in KenyaMainSq19Noch keine Bewertungen

- Svensson, L. (2003) - Escaping From A Liquidity Trap and DeflationDokument26 SeitenSvensson, L. (2003) - Escaping From A Liquidity Trap and DeflationAnonymous WFjMFHQNoch keine Bewertungen

- Financial Structure and Financial Crisis: International Review of Finance, 2:1/2, 2001: Pp. 1 19Dokument19 SeitenFinancial Structure and Financial Crisis: International Review of Finance, 2:1/2, 2001: Pp. 1 19ginaNoch keine Bewertungen

- Macroeconomic Policies and Poverty ReductionDokument14 SeitenMacroeconomic Policies and Poverty ReductionAmjad ThasleemNoch keine Bewertungen

- Research ProposalDokument37 SeitenResearch ProposalFadhil ChiwangaNoch keine Bewertungen

- Inflation Chapter 1Dokument87 SeitenInflation Chapter 1Ling DylNoch keine Bewertungen

- IT Impact Policy AlternativesDokument30 SeitenIT Impact Policy AlternativesThi GiaiNoch keine Bewertungen

- 14.06 Lecture Notes Intermediate Macroeconomics: George-Marios Angeletos MIT Department of Economics Spring 2004Dokument15 Seiten14.06 Lecture Notes Intermediate Macroeconomics: George-Marios Angeletos MIT Department of Economics Spring 2004pareekNoch keine Bewertungen

- Angeletos - Macro Intermedia MIT 2013 Geletos - Macro Intermedia MIT 2013-01-02 Introd Solow ModelDokument93 SeitenAngeletos - Macro Intermedia MIT 2013 Geletos - Macro Intermedia MIT 2013-01-02 Introd Solow Modelrhroca2762Noch keine Bewertungen

- Introduction and Growth FactsDokument14 SeitenIntroduction and Growth FactsSehrish KayaniNoch keine Bewertungen

- Macroeconomic Stability: The More The Better?Dokument27 SeitenMacroeconomic Stability: The More The Better?Roselyn Mahinay QuilongquilongNoch keine Bewertungen

- Ethiopia Growth Inflation DilemmaDokument22 SeitenEthiopia Growth Inflation DilemmaTatekia DanielNoch keine Bewertungen

- AMLO - A Contract With MexicoDokument36 SeitenAMLO - A Contract With MexicodespiertmexNoch keine Bewertungen

- In Ation and Growth in Developing Countries: The Nigerian ExperienceDokument16 SeitenIn Ation and Growth in Developing Countries: The Nigerian ExperienceArshita PattanaikNoch keine Bewertungen

- #Business Economics Session MacroeconomicsDokument52 Seiten#Business Economics Session MacroeconomicsNADExOoGGYNoch keine Bewertungen

- 024 Article A001 enDokument47 Seiten024 Article A001 enDianaNoch keine Bewertungen

- Pakistan's Economy and Monetary PolicyDokument17 SeitenPakistan's Economy and Monetary Policysaad aliNoch keine Bewertungen

- Rao and Singh (PEB)Dokument21 SeitenRao and Singh (PEB)Anonymous 9dEMgo0Noch keine Bewertungen

- SAP 4 TanzaniaDokument11 SeitenSAP 4 TanzaniasdaakiNoch keine Bewertungen

- Imf's Main FaultsDokument48 SeitenImf's Main FaultsAnkur BansalNoch keine Bewertungen

- Impact of Inflation On A Developing EconomyDokument35 SeitenImpact of Inflation On A Developing Economynuttynehal17Noch keine Bewertungen

- MPL T6 (Group 5)Dokument19 SeitenMPL T6 (Group 5)resourcesficNoch keine Bewertungen

- Inflation Targets in LA (Di Gregorio) - UNIDAD 2Dokument16 SeitenInflation Targets in LA (Di Gregorio) - UNIDAD 2Vicky BlancoNoch keine Bewertungen

- Temitope Chapter 1-5Dokument50 SeitenTemitope Chapter 1-5Adeniyi Oluwaseyi IsaacNoch keine Bewertungen

- What Works When Infl Ation Hits?: May 2021 Time To Read: 8 MinutesDokument8 SeitenWhat Works When Infl Ation Hits?: May 2021 Time To Read: 8 MinutesgdsfgdfaNoch keine Bewertungen

- Theme I II - Overview of Macroeconomics and System of National AccountsDokument52 SeitenTheme I II - Overview of Macroeconomics and System of National Accountsajoselyn61Noch keine Bewertungen

- Fluctuations in Global Macro VolatilityDokument54 SeitenFluctuations in Global Macro Volatilityvineet.khattarNoch keine Bewertungen

- Monitary Policy, Output & Inflation in The Short RUNDokument38 SeitenMonitary Policy, Output & Inflation in The Short RUNDina MarbidaNoch keine Bewertungen

- Indonesian Economic Slowdown 1.1Dokument15 SeitenIndonesian Economic Slowdown 1.1Havidz IbrahimNoch keine Bewertungen

- Capital Controls and Monetary Policy in Developing CountriesDokument33 SeitenCapital Controls and Monetary Policy in Developing CountriesCenter for Economic and Policy ResearchNoch keine Bewertungen

- The International Monetary and Financial Environment Learning ObjectivesDokument4 SeitenThe International Monetary and Financial Environment Learning ObjectivesAna KatulićNoch keine Bewertungen

- Lacy Hunt - Hoisington - Quartely Review Q1 2015Dokument5 SeitenLacy Hunt - Hoisington - Quartely Review Q1 2015TREND_7425Noch keine Bewertungen

- 03 Demographics and Real Interest RatesDokument19 Seiten03 Demographics and Real Interest RatesFlolol HahahaNoch keine Bewertungen

- Historical U.S. Money Growth, Inflation, and Inflation CredibilityDokument12 SeitenHistorical U.S. Money Growth, Inflation, and Inflation CredibilityTabletop237Noch keine Bewertungen

- Ben S Bernanke, 2005 - Inflation in Latin AmericaDokument7 SeitenBen S Bernanke, 2005 - Inflation in Latin AmericaRaspeLNoch keine Bewertungen

- New Zealand Trend Analysis FinalDokument9 SeitenNew Zealand Trend Analysis Finalkfaryal576Noch keine Bewertungen

- RCC at Harvard Executive Program: Views On The Economy & The World: Holes in The RoofDokument61 SeitenRCC at Harvard Executive Program: Views On The Economy & The World: Holes in The RoofAminNoch keine Bewertungen

- The Fiscal and Monetary History of Latin America 1960 2014 - The C - CompressedDokument38 SeitenThe Fiscal and Monetary History of Latin America 1960 2014 - The C - CompressedmarielamasottoNoch keine Bewertungen

- Economic Enironment For Business ReportDokument47 SeitenEconomic Enironment For Business Reportutpala123456Noch keine Bewertungen

- Chile's Economic GrowthDokument45 SeitenChile's Economic GrowthBasilio MaliwangaNoch keine Bewertungen

- Answer To ECON19033+T1+AssessmentDokument10 SeitenAnswer To ECON19033+T1+AssessmentjenadenebNoch keine Bewertungen

- 1ADEGBITE - Financial Sector ReformsDokument31 Seiten1ADEGBITE - Financial Sector ReformsYogesh KumarNoch keine Bewertungen

- Inflation Inertia in Egypt and Its PolicyDokument27 SeitenInflation Inertia in Egypt and Its PolicyTio KumowalNoch keine Bewertungen

- Japanese Economy HistoryDokument12 SeitenJapanese Economy Historydebarka100% (1)

- AfterNeoliberalism Empire, SocialDemocracy, OrSocialism MindiLi Monthly ReviewDokument7 SeitenAfterNeoliberalism Empire, SocialDemocracy, OrSocialism MindiLi Monthly ReviewkapateNoch keine Bewertungen

- Economics Term PaperDokument8 SeitenEconomics Term PaperJawad QureshiNoch keine Bewertungen

- Macro IntroductionDokument31 SeitenMacro IntroductionamritNoch keine Bewertungen

- Role of Oil inDokument6 SeitenRole of Oil inAntelopeNoch keine Bewertungen

- D R H D P ? N E L, L - M M - I G: O Emittances URT Omestic Rices EW Vidence From OW Ower Iddle and Iddle Ncome RoupsDokument20 SeitenD R H D P ? N E L, L - M M - I G: O Emittances URT Omestic Rices EW Vidence From OW Ower Iddle and Iddle Ncome RoupsBurim GashiNoch keine Bewertungen

- Deficits and Inflation 11Dokument17 SeitenDeficits and Inflation 11Sulei123Noch keine Bewertungen

- The Effect of The Global Financial Crisis and On Emerging and Developing EconomiesDokument16 SeitenThe Effect of The Global Financial Crisis and On Emerging and Developing EconomiesIPPRNoch keine Bewertungen

- Session 1 Introduction To MacroeconomicsDokument7 SeitenSession 1 Introduction To MacroeconomicsdboterNoch keine Bewertungen

- Global InflationDokument7 SeitenGlobal InflationJeremiah AnjorinNoch keine Bewertungen

- Secure QualityDokument15 SeitenSecure QualityAnonymous e2wolbeFsNoch keine Bewertungen

- Analysis of Monetary Policy of IndiaDokument18 SeitenAnalysis of Monetary Policy of IndiaShashwat TiwariNoch keine Bewertungen

- Rethinking Social Protection Paradigm-1Dokument22 SeitenRethinking Social Protection Paradigm-1herryansharyNoch keine Bewertungen

- Institutional Investor - 07 JUL 2009Dokument72 SeitenInstitutional Investor - 07 JUL 2009jumanleeNoch keine Bewertungen

- Closure of 26% of PH Businesses Alarms DTI - Manila BulletinDokument7 SeitenClosure of 26% of PH Businesses Alarms DTI - Manila BulletinLara Melissa DanaoNoch keine Bewertungen

- Some of The Most Important Theories of Business CyDokument24 SeitenSome of The Most Important Theories of Business CyAqib ArshadNoch keine Bewertungen

- 9Dokument7 Seiten9jeelorNoch keine Bewertungen

- Antwerp Dimamond CaseDokument5 SeitenAntwerp Dimamond Casechiranjeeb mitra100% (1)

- Hhse - JSJ Ozark Bank GarnishmentDokument38 SeitenHhse - JSJ Ozark Bank GarnishmentYTOLeaderNoch keine Bewertungen

- Etoro Aus Capital Pty LTD Product Disclosure Statement: Issue Date: 31 July 2018Dokument26 SeitenEtoro Aus Capital Pty LTD Product Disclosure Statement: Issue Date: 31 July 2018robert barbersNoch keine Bewertungen

- Traffic and Highway Engineering 5th Edition Garber Solutions ManualDokument27 SeitenTraffic and Highway Engineering 5th Edition Garber Solutions Manualsorrancemaneuverpmvll100% (32)

- Wedding BlissDokument16 SeitenWedding BlissThe Myanmar TimesNoch keine Bewertungen

- Chapter 6 - An Introduction To The Tourism Geography of EuroDokument12 SeitenChapter 6 - An Introduction To The Tourism Geography of EuroAnonymous 1ClGHbiT0JNoch keine Bewertungen

- An Iot Based Dam Water Management System For AgricultureDokument21 SeitenAn Iot Based Dam Water Management System For AgriculturemathewsNoch keine Bewertungen

- Ibm 530Dokument6 SeitenIbm 530Muhamad NasirNoch keine Bewertungen

- DARBHANGA MapDokument1 SeiteDARBHANGA MapRISHIKESH ANANDNoch keine Bewertungen

- Advantages and Disadvantages of Shares and DebentureDokument9 SeitenAdvantages and Disadvantages of Shares and Debenturekomal komal100% (1)

- Od124222428139339000 4Dokument2 SeitenOd124222428139339000 4biren shahNoch keine Bewertungen

- Effect of Vishal Mega Mart On Traditional RetailingDokument7 SeitenEffect of Vishal Mega Mart On Traditional RetailingAnuradha KathaitNoch keine Bewertungen

- Cir v. Citytrust InvestmentDokument12 SeitenCir v. Citytrust InvestmentJor LonzagaNoch keine Bewertungen

- Extracted Pages From May-2023Dokument4 SeitenExtracted Pages From May-2023Muhammad UsmanNoch keine Bewertungen

- RECEIPTSDokument6 SeitenRECEIPTSLyka DanniellaNoch keine Bewertungen

- Perkembangan Kebun Teh Danau Kembar Dari Tahun 2000 - 2017.Dokument12 SeitenPerkembangan Kebun Teh Danau Kembar Dari Tahun 2000 - 2017.niaputriNoch keine Bewertungen

- Wec12 01 Que 20240120Dokument32 SeitenWec12 01 Que 20240120Hatim RampurwalaNoch keine Bewertungen