Beruflich Dokumente

Kultur Dokumente

IFM8e ch02

Hochgeladen von

akhil107043Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IFM8e ch02

Hochgeladen von

akhil107043Copyright:

Verfügbare Formate

International Flow of Funds

2

Chapter

South-Western/Thomson Learning 2006

2 - 2

Chapter Objectives

To explain the key components of the

balance of payments; and

To explain how the international flow of

funds is influenced by economic factors

and other factors.

2 - 3

Balance of Payments

The balance of payments is a summary of

transactions between domestic and

foreign residents for a specific country

over a specified period of time.

Inflows of funds generate credits for the

countrys balance, while outflows of funds

generate debits.

2 - 4

Current Account

The current account summarizes the flow

of funds between one specified country

and all other countries due to purchases

of goods or services, or the provision of

income on financial assets.

Key components of the current account

include the balance of trade, factor

income, and transfer payments.

2 - 5

The U.S. Current Account in 2003

(1) U.S. exports of goods + $712

+ (2) U.S. exports of services + 292

+ (3) U.S. income receipts + 275

= (4) Total U.S. exports & income receipts = $1,279

(in billions of $)

(5) U.S. imports of goods $1,263

+ (6) U.S. imports of services 246

+ (7) U.S. income payments 259

= (8) Total U.S. imports & income payments = $1,768

(9) Net transfers by the U.S. $68

(10) Current account balance = (4) (8) (9) $557

2 - 6

The capital account summarizes the flow

of funds resulting from the sale of assets

between one specified country and all

other countries.

The key components of the capital

account are direct foreign investment,

portfolio investment, and other capital

investment.

Capital Account

2 - 7

Some countries are more dependent on

trade than others.

The trade volume of a European country is

typically between 30 40% of its GDP,

while the trade volume of U.S. (and Japan)

is typically between 10 20% of its GDP.

Nevertheless, the volume of trade has

grown over time for most countries.

International Trade Flows

2 - 8

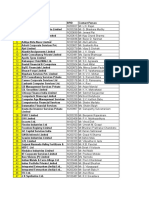

Distribution of U.S. Exports across Countries

(in billions of $)

2 - 9

Distribution of

U.S. Exports

and Imports

2 - 10

U.S.

Balance

of Trade

Over Time

2 - 11

Trade Agreements

Many agreements have been made to

reduce trade restrictions:

1988 U.S. and Canada free trade pact

North American Free Trade Agreement

(NAFTA)

General Agreement on Tariffs and Trade

(GATT)

Single European Act and the European

Union

2 - 12

Trade Disagreements

However, even without tariffs and quotas,

governments seem always able to find

strategies that can give their local firms an

edge in exporting:

different environmental, labor laws

bribes, government subsidies (dumping)

tax breaks for specific industries

exchange rate manipulations

2 - 13

Trade Disagreements

Other trade-related issues include:

the outsourcing of services

the use of trade policies for political

reasons

disagreements within the European Union

2 - 14

Factors Affecting

International Trade Flows

Impact of Inflation

A relative increase in a countrys inflation

rate will decrease its current account, as

imports increase and exports decrease.

Impact of National Income

A relative increase in a countrys income

level will decrease its current account, as

imports increase.

2 - 15

Impact of Government Restrictions

A government may reduce its countrys

imports by imposing a tariff on imported

goods, or by enforcing a quota.

Some trade restrictions may be imposed

on certain products for health and safety

reasons.

Factors Affecting

International Trade Flows

2 - 16

Impact of Exchange Rates

If a countrys currency begins to rise in

value, its current account balance will

decrease as imports increase and exports

decrease.

The factors interact, such that their

simultaneous influence on the balance of

trade is complex.

Factors Affecting

International Trade Flows

2 - 17

Correcting

A Balance of Trade Deficit

By reconsidering the factors that affect

the balance of trade, some common

correction methods can be developed.

A floating exchange rate system may

correct a trade imbalance automatically

since the trade imbalance will affect the

demand and supply of the currencies

involved.

2 - 18

Why a Weak Home Currency Is Not

a Perfect Solution

Counterpricing by competitors

Impact of other weak currencies

Stability of intracompany trade

Many firms purchase products that are

produced by their subsidiaries.

Prearranged international transactions

The lag time between a weaker U.S.$ and

increased foreign demand has been

estimated to be 18 months or longer.

2 - 19

The J-Curve Effect

U

.

S

.

T

r

a

d

e

B

a

l

a

n

c

e

0 Time

Deterioration due to

dollar depreciation

Change in purchasing

power caused by

weaker dollar

J Curve

2 - 20

International Capital Flows

2 - 21

Distribution of DFI

For 2003, in millions of dollars

Source: U.S. Bureau of Economic Analysis

All countries 151,884 100.0% 29,772 100.0%

America 26,997 17.8% 12,641 42.5%

Canada 13,826 9.1% 9,116 30.6%

Mexico 5,667 3.7% 1,944 6.5%

Europe 99,191 65.3% 6,572 22.1%

Germany 8,676 5.7% 407 1.4%

Netherlands 14,968 9.9% -614 -2.1%

Switzerland 14,444 9.5% -6,993 -23.5%

United Kingdom 39,548 26.0% -2,288 -7.7%

Africa 2,211 1.5% -50 -0.2%

Middle East 2,093 1.4% 522 1.8%

Asia & Pacific 21,392 14.1% 10,086 33.9%

Japan 5,800 3.8% 6,495 21.8%

U.S. DFI DFI in the U.S.

2 - 22

Factors Affecting DFI

Changes in Restrictions

New opportunities may arise from the

removal of government barriers.

Privatization

DFI has also been stimulated by the selling

of government operations.

Potential Economic Growth

Countries that have higher potential for

economic growth are more attractive.

2 - 23

Tax Rates

Countries that impose relatively low tax

rates on corporate earnings are more likely

to attract DFI.

Exchange Rates

Firms typically prefer to invest in countries

where the local currency is expected to

strengthen against their own.

Factors Affecting DFI

2 - 24

Factors Affecting

International Portfolio Investment

Tax Rates on Interest or Dividends

Investors will normally prefer countries

where the tax rates are relatively low.

Interest Rates

Money tends to flow to countries with high

interest rates.

Exchange Rates

Foreign investors may be attracted if the

local currency is expected to strengthen.

2 - 25

International Monetary Fund (IMF)

The IMF encourages internationalization of

businesses through surveillance, and

financial and technical assistance.

Its compensatory financing facility attempts

to reduce the impact of export instability on

country economies.

The IM F adopts a quota system, and its

financing is measured in special drawing

rights (SDRs).

Agencies that Facilitate

International Flows

2 - 26

World Bank

This International Bank for Reconstruction

and Development makes loans to countries

to enhance their economic development.

In particular, its Structural Adjustment Loans

(SALs) are intended to enhance a countrys

long-term economic growth.

Funds are spread through cofinancing

agreements with official aid agencies, export

credit agencies, and commercial banks.

Agencies that Facilitate

International Flows

2 - 27

Multilateral Investment Guarantee Agency

Established by the World Bank, the MIGA

helps develop international trade and

investment by offering various forms of

political risk insurance.

International Development Association

The IDA extends loans at low interest rates

to poor nations that cannot qualify for loans

from the World Bank.

Agencies that Facilitate

International Flows

2 - 28

World Trade Organization

The WTO was established to provide a

forum for multilateral trade negotiations

and to settle trade disputes related to the

GATT accord.

International Financial Corporation

The IFC promotes private enterprise within

countries through loan provisions and

stock purchases.

Agencies that Facilitate

International Flows

2 - 29

Bank for International Settlements

The BIS is the central banks central bank

and lender of last resort.

Regional development agencies

Inter-American Development Bank

Asian Development Bank

African Development Bank

European Bank for Reconstruction and

Development.

Agencies that Facilitate

International Flows

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Cfa - Technical Analysis ExplainedDokument32 SeitenCfa - Technical Analysis Explainedshare757592% (13)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Strategic Planning For The Oil and Gas IDokument17 SeitenStrategic Planning For The Oil and Gas ISR Rao50% (2)

- Deductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDokument12 SeitenDeductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersMichael Reyes75% (4)

- Ship Breaking Report Dec 2010Dokument105 SeitenShip Breaking Report Dec 2010rezababakhaniNoch keine Bewertungen

- Introduction - IEC Standards and Their Application V1 PDFDokument11 SeitenIntroduction - IEC Standards and Their Application V1 PDFdavidjovisNoch keine Bewertungen

- Create A Specimen of A Corporate Web Page. Design Home Page Including About Us, Logo Image, History, Site-Map, Sub-BranchesDokument22 SeitenCreate A Specimen of A Corporate Web Page. Design Home Page Including About Us, Logo Image, History, Site-Map, Sub-Branchesakhil107043Noch keine Bewertungen

- Q'aire SolutionDokument22 SeitenQ'aire Solutionakhil107043Noch keine Bewertungen

- Cover PDFDokument1 SeiteCover PDFakhil107043Noch keine Bewertungen

- Training Session On Questionnaire MakingDokument17 SeitenTraining Session On Questionnaire Makingakhil107043Noch keine Bewertungen

- Demand Estimation & Market Sizing: Study To Understand M-Commerce Market in IndiaDokument37 SeitenDemand Estimation & Market Sizing: Study To Understand M-Commerce Market in Indiaakhil107043Noch keine Bewertungen

- 2Dokument2 Seiten2akhil107043Noch keine Bewertungen

- International Financial Markets: South-Western/Thomson Learning © 2006Dokument30 SeitenInternational Financial Markets: South-Western/Thomson Learning © 2006akhil107043Noch keine Bewertungen

- India Ports and Terminals: S.L.GanapathiDokument19 SeitenIndia Ports and Terminals: S.L.Ganapathiakhil107043Noch keine Bewertungen

- Cluster Analysis BRM Session 14Dokument25 SeitenCluster Analysis BRM Session 14akhil107043Noch keine Bewertungen

- BNI Mobile Banking: Histori TransaksiDokument1 SeiteBNI Mobile Banking: Histori TransaksiWebi SuprayogiNoch keine Bewertungen

- Microsoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDokument8 SeitenMicrosoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDuy Trần TấnNoch keine Bewertungen

- Manufactures Near byDokument28 SeitenManufactures Near bykomal LPS0% (1)

- Module 2Dokument7 SeitenModule 2Joris YapNoch keine Bewertungen

- P1 Ii2005Dokument3 SeitenP1 Ii2005Boris YanguezNoch keine Bewertungen

- Regional Policy in EU - 2007Dokument65 SeitenRegional Policy in EU - 2007sebascianNoch keine Bewertungen

- Monsoon 2023 Registration NoticeDokument2 SeitenMonsoon 2023 Registration NoticeAbhinav AbhiNoch keine Bewertungen

- Levacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesDokument14 SeitenLevacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesAlvaro MedinaNoch keine Bewertungen

- Voltas Case StudyDokument27 SeitenVoltas Case Studyvasistakiran100% (3)

- Business Plan SampleDokument14 SeitenBusiness Plan SampleGwyneth MuegaNoch keine Bewertungen

- Dhiratara Pradipta Narendra (1506790210)Dokument4 SeitenDhiratara Pradipta Narendra (1506790210)Pradipta NarendraNoch keine Bewertungen

- QQy 5 N OKBej DP 2 U 8 MDokument4 SeitenQQy 5 N OKBej DP 2 U 8 MAaditi yadavNoch keine Bewertungen

- Billing Summary Customer Details: Total Amount Due (PKR) : 2,831Dokument1 SeiteBilling Summary Customer Details: Total Amount Due (PKR) : 2,831Shazil ShahNoch keine Bewertungen

- Contact Details of RTAsDokument18 SeitenContact Details of RTAsmugdha janiNoch keine Bewertungen

- Basice Micro - AssignmentDokument2 SeitenBasice Micro - AssignmentRamiah Colene JaimeNoch keine Bewertungen

- CBN Rule Book Volume 5Dokument687 SeitenCBN Rule Book Volume 5Justus OhakanuNoch keine Bewertungen

- PDC Yanque FinalDokument106 SeitenPDC Yanque FinalNilo Cruz Cuentas100% (3)

- Alcor's Impending Npo FailureDokument11 SeitenAlcor's Impending Npo FailureadvancedatheistNoch keine Bewertungen

- Dak Tronic SDokument25 SeitenDak Tronic SBreejum Portulum BrascusNoch keine Bewertungen

- Paul Romer: Ideas, Nonrivalry, and Endogenous GrowthDokument4 SeitenPaul Romer: Ideas, Nonrivalry, and Endogenous GrowthJuan Pablo ÁlvarezNoch keine Bewertungen

- Democracy Perception Index 2021 - Topline ResultsDokument62 SeitenDemocracy Perception Index 2021 - Topline ResultsMatias CarpignanoNoch keine Bewertungen

- Clerks 2013Dokument12 SeitenClerks 2013Kumar KumarNoch keine Bewertungen

- Aus Tin 20105575Dokument120 SeitenAus Tin 20105575beawinkNoch keine Bewertungen

- Daily ChecklistDokument1 SeiteDaily ChecklistPatel AspNoch keine Bewertungen

- Forex Fluctuations On Imports and ExportsDokument33 SeitenForex Fluctuations On Imports and Exportskushaal subramonyNoch keine Bewertungen