Beruflich Dokumente

Kultur Dokumente

The Basics of Capital Budgeting: Should We Build This Plant?

Hochgeladen von

Riza Joie VersalesOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Basics of Capital Budgeting: Should We Build This Plant?

Hochgeladen von

Riza Joie VersalesCopyright:

Verfügbare Formate

10-1

CHAPTER 10

The Basics of Capital Budgeting

Should we

build this

plant?

10-2

What is capital budgeting?

Analysis of potential additions to

fixed assets.

Long-term decisions; involve large

expenditures.

Very important to firms future.

10-3

Steps to capital budgeting

1. Estimate CFs (inflows & outflows).

2. Assess riskiness of CFs.

3. Determine the appropriate cost of capital.

4. Find NPV and/or IRR.

5. Accept if NPV > 0 and/or IRR > WACC.

10-4

What is the difference between

independent and mutually exclusive

projects?

Independent projects if the cash flows of

one are unaffected by the acceptance of

the other.

Mutually exclusive projects if the cash

flows of one can be adversely impacted by

the acceptance of the other.

10-5

What is the difference between normal

and nonnormal cash flow streams?

Normal cash flow stream Cost (negative

CF) followed by a series of positive cash

inflows. One change of signs.

Nonnormal cash flow stream Two or

more changes of signs. Most common:

Cost (negative CF), then string of positive

CFs, then cost to close project. Nuclear

power plant, strip mine, etc.

10-6

What is the payback period?

The number of years required to

recover a projects cost, or How long

does it take to get our money back?

Calculated by adding projects cash

inflows to its cost until the cumulative

cash flow for the project turns positive.

10-7

Calculating payback

Payback

L

= 2 + / = 2.375 years

CF

t

-100 10 60 100

Cumulative -100 -90 0 50

0 1 2

3

=

2.4

30 80

80

-30

Project L

Payback

S

= 1 + / = 1.6 years

CF

t

-100 70 100 20

Cumulative -100 0 20 40

0 1 2

3

=

1.6

30 50

50

-30

Project S

10-8

Strengths and weaknesses of

payback

Strengths

Provides an indication of a projects risk

and liquidity.

Easy to calculate and understand.

Weaknesses

Ignores the time value of money.

Ignores CFs occurring after the payback

period.

10-9

Discounted payback period

Uses discounted cash flows rather than

raw CFs.

Disc Payback

L

= 2 + / = 2.7 years

CF

t

-100 10 60 80

Cumulative -100 -90.91 18.79

0 1 2

3

=

2.7

60.11

-41.32

PV of CF

t

-100 9.09 49.59

41.32 60.11

10%

10-10

Net Present Value (NPV)

Sum of the PVs of all cash inflows and

outflows of a project:

n

0 t

t

t

) k 1 (

CF

NPV

10-11

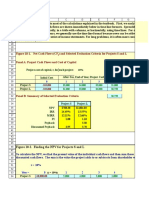

What is Project Ls NPV?

Year CF

t

PV of CF

t

0 -100 -P100

1 10 9.09

2 60 49.59

3 80 60.11

NPV

L

= P18.79

NPV

S

= P19.98

10-12

Solving for NPV:

Financial calculator solution

Enter CFs into the calculators CFLO

register.

CF

0

= -100

CF

1

= 10

CF

2

= 60

CF

3

= 80

Enter I/YR = 10, press NPV button to

get NPV

L

= P18.78.

10-13

Rationale for the NPV method

NPV = PV of inflows Cost

= Net gain in wealth

If projects are independent, accept if the

project NPV > 0.

If projects are mutually exclusive, accept

projects with the highest positive NPV,

those that add the most value.

In this example, would accept S if

mutually exclusive (NPV

s

> NPV

L

), and

would accept both if independent.

10-14

Internal Rate of Return (IRR)

IRR is the discount rate that forces PV of

inflows equal to cost, and the NPV = 0:

Solving for IRR with a financial calculator:

Enter CFs in CFLO register.

Press IRR; IRR

L

= 18.13% and IRR

S

= 23.56%.

n

0 t

t

t

) IRR 1 (

CF

0

10-15

How is a projects IRR similar to a

bonds YTM?

They are the same thing.

Think of a bond as a project. The

YTM on the bond would be the IRR

of the bond project.

EXAMPLE: Suppose a 10-year bond

with a 9% annual coupon sells for

P1,134.20.

Solve for IRR = YTM = 7.08%, the

annual return for this project/bond.

10-16

Rationale for the IRR method

If IRR > WACC, the projects rate of

return is greater than its costs.

There is some return left over to

boost stockholders returns.

10-17

IRR Acceptance Criteria

If IRR > k, accept project.

If IRR < k, reject project.

If projects are independent, accept

both projects, as both IRR > k =

10%.

If projects are mutually exclusive,

accept S, because IRR

s

> IRR

L

.

10-18

NPV Profiles

A graphical representation of project NPVs at

various different costs of capital.

k NPV

L

NPV

S

0 P50 P40

5 33 29

10 19 20

15 7 12

20 (4) 5

10-19

Drawing NPV profiles

-10

0

10

20

30

40

50

60

5 10 15 20 23.6

NPV

(P)

Discount Rate (%)

IRR

L

= 18.1%

IRR

S

= 23.6%

Crossover Point = 8.7%

S

L

.

.

.

.

.

.

.

.

.

.

.

10-20

Comparing the NPV and IRR

methods

If projects are independent, the two

methods always lead to the same

accept/reject decisions.

If projects are mutually exclusive

If k > crossover point, the two methods

lead to the same decision and there is no

conflict.

If k < crossover point, the two methods

lead to different accept/reject decisions.

10-21

Finding the crossover point

1. Find cash flow differences between the

projects for each year.

2. Enter these differences in CFLO register,

then press IRR. Crossover rate = 8.68%,

rounded to 8.7%.

3. Can subtract S from L or vice versa, but

better to have first CF negative.

4. If profiles dont cross, one project

dominates the other.

10-22

Reasons why NPV profiles cross

Size (scale) differences the smaller

project frees up funds at t = 0 for

investment. The higher the opportunity

cost, the more valuable these funds, so

high k favors small projects.

Timing differences the project with faster

payback provides more CF in early years

for reinvestment. If k is high, early CF

especially good, NPV

S

> NPV

L

.

10-23

Reinvestment rate assumptions

NPV method assumes CFs are reinvested

at k, the opportunity cost of capital.

IRR method assumes CFs are reinvested

at IRR.

Assuming CFs are reinvested at the

opportunity cost of capital is more

realistic, so NPV method is the best. NPV

method should be used to choose

between mutually exclusive projects.

Perhaps a hybrid of the IRR that assumes

cost of capital reinvestment is needed.

10-24

Since managers prefer the IRR to the NPV

method, is there a better IRR measure?

Yes, MIRR is the discount rate that

causes the PV of a projects terminal

value (TV) to equal the PV of costs. TV

is found by compounding inflows at

WACC.

MIRR assumes cash flows are

reinvested at the WACC.

10-25

Calculating MIRR

66.0

12.1

10%

10%

-100.0 10.0 60.0 80.0

0 1 2 3

10%

PV outflows

-100.0

P100

MIRR = 16.5%

158.1

TV inflows

MIRR

L

= 16.5%

P158.1

(1 + MIRR

L

)

3

=

10-26

Why use MIRR versus IRR?

MIRR correctly assumes reinvestment

at opportunity cost = WACC. MIRR

also avoids the problem of multiple

IRRs.

Managers like rate of return

comparisons, and MIRR is better for

this than IRR.

10-27

Project P has cash flows (in 000s): CF

0

=

-P800, CF

1

= P5,000, and CF

2

= -P5,000.

Find Project Ps NPV and IRR.

Enter CFs into calculator CFLO register.

Enter I/YR = 10.

NPV = -P386.78.

IRR = ERROR Why?

-800 5,000 -5,000

0 1 2

k = 10%

10-28

Multiple IRRs

NPV Profile

450

-800

0

400 100

IRR

2

= 400%

IRR

1

= 25%

k

NPV

10-29

Why are there multiple IRRs?

At very low discount rates, the PV of CF

2

is

large & negative, so NPV < 0.

At very high discount rates, the PV of both

CF

1

and CF

2

are low, so CF

0

dominates and

again NPV < 0.

In between, the discount rate hits CF

2

harder than CF

1

, so NPV > 0.

Result: 2 IRRs.

10-30

Solving the multiple IRR problem

Using a calculator

Enter CFs as before.

Store a guess for the IRR (try 10%)

10 STO

IRR = 25% (the lower IRR)

Now guess a larger IRR (try 200%)

200 STO

IRR = 400% (the higher IRR)

When there are nonnormal CFs and more than

one IRR, use the MIRR.

10-31

When to use the MIRR instead of

the IRR? Accept Project P?

When there are nonnormal CFs and

more than one IRR, use MIRR.

PV of outflows @ 10% = -P4,932.2314.

TV of inflows @ 10% = P5,500.

MIRR = 5.6%.

Do not accept Project P.

NPV = -P386.78 < 0.

MIRR = 5.6% < k = 10%.

Das könnte Ihnen auch gefallen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument24 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?remus007Noch keine Bewertungen

- High-Q Financial Basics. Skills & Knowlwdge for Today's manVon EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manNoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument31 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?AhsanNoch keine Bewertungen

- Handbook of Capital Recovery (CR) Factors: European EditionVon EverandHandbook of Capital Recovery (CR) Factors: European EditionNoch keine Bewertungen

- Capital Budgeting: Should We Build This Plant? Should We Build This Plant?Dokument24 SeitenCapital Budgeting: Should We Build This Plant? Should We Build This Plant?Ankkit PandeyNoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument30 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?siddis316Noch keine Bewertungen

- The Basics of Capital Budgeting - Financial ManagementDokument31 SeitenThe Basics of Capital Budgeting - Financial ManagementReaderNoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument41 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?Asif Islam SamannoyNoch keine Bewertungen

- Chapter 11: Capital Budgeting: Decision CriteriaDokument56 SeitenChapter 11: Capital Budgeting: Decision CriteriaRajitharaghuNoch keine Bewertungen

- The Basics of Capital Budgeting Evaluating Cash FlowsDokument59 SeitenThe Basics of Capital Budgeting Evaluating Cash FlowsBabasab Patil (Karrisatte)Noch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument41 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?Angga BayuNoch keine Bewertungen

- LC 2Dokument31 SeitenLC 2ghazal khanNoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument28 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?Hadizatul AisyahNoch keine Bewertungen

- Capital BudgetingDokument41 SeitenCapital Budgetingcatharina arnitaNoch keine Bewertungen

- Chapter 11 - Capital BudgetingDokument28 SeitenChapter 11 - Capital BudgetingAn TuanNoch keine Bewertungen

- Ch10 The Basics of Capital BudgetingDokument31 SeitenCh10 The Basics of Capital BudgetingGrace Karmel DjapriNoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument28 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?Jessica Adharana KurniaNoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument26 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?NitishKhadeNoch keine Bewertungen

- Basics of Capital BudgetingDokument28 SeitenBasics of Capital BudgetingEugene NavarroNoch keine Bewertungen

- FM11 CH 10 Capital BudgetingDokument56 SeitenFM11 CH 10 Capital Budgetingm.idrisNoch keine Bewertungen

- 11W-Ch 10&11 Capital Budget Basics & CF Estimation-2011-12-SkraćenoDokument38 Seiten11W-Ch 10&11 Capital Budget Basics & CF Estimation-2011-12-SkraćenoRachel PalosNoch keine Bewertungen

- The Basics of Capital Budgeting: Evaluating Cash FlowsDokument56 SeitenThe Basics of Capital Budgeting: Evaluating Cash FlowsVinit KadamNoch keine Bewertungen

- What Is Capital Budgeting?Dokument43 SeitenWhat Is Capital Budgeting?anjanellaNoch keine Bewertungen

- Session 12 13 Capital BudgetingDokument91 SeitenSession 12 13 Capital BudgetingNANCY BANSALNoch keine Bewertungen

- Week 10 Basics-Of-Capital-BudgetingDokument26 SeitenWeek 10 Basics-Of-Capital-BudgetingQurat SaboorNoch keine Bewertungen

- Chapter 7: The Basics of Capital Budgeting: Evaluating Cash FlowsDokument56 SeitenChapter 7: The Basics of Capital Budgeting: Evaluating Cash FlowsAdil KhanNoch keine Bewertungen

- Capital Budgeting: Decision CriteriaDokument66 SeitenCapital Budgeting: Decision CriteriaBich VietNoch keine Bewertungen

- The Basics of Capital Budgeting: Evaluating Cash Flows: Should We Build This Plant?Dokument27 SeitenThe Basics of Capital Budgeting: Evaluating Cash Flows: Should We Build This Plant?Suvro SisirNoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument30 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?Chandra HimaniNoch keine Bewertungen

- The Basics of Capital BudgetingDokument39 SeitenThe Basics of Capital BudgetingSeethalakshmy NagarajanNoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument70 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?Jithin NairNoch keine Bewertungen

- Chapter 7: The Basics of Capital Budgeting: Evaluating Cash FlowsDokument56 SeitenChapter 7: The Basics of Capital Budgeting: Evaluating Cash FlowsAbdullahRafiqNoch keine Bewertungen

- Basics of Capital Budgeting PDFDokument26 SeitenBasics of Capital Budgeting PDFShikinNorehaNoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument18 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?Mansi PakhiddeyNoch keine Bewertungen

- The Basics of Capital Budgeting Chapter 9 & 10: Should We Build This Plant?Dokument32 SeitenThe Basics of Capital Budgeting Chapter 9 & 10: Should We Build This Plant?世泉Noch keine Bewertungen

- Ch10 Tool KitDokument30 SeitenCh10 Tool KitRimpy Sondh100% (1)

- Ch10 Tool KitDokument18 SeitenCh10 Tool KitElias DEBSNoch keine Bewertungen

- Cash Flow Estimation and Risk AnalysisDokument37 SeitenCash Flow Estimation and Risk AnalysisAhsanNoch keine Bewertungen

- Slides of NPV, Free Cash Flow, Sensitivity Analysis Project DecisionsDokument57 SeitenSlides of NPV, Free Cash Flow, Sensitivity Analysis Project DecisionsSebastian GorhamNoch keine Bewertungen

- Unit III-B PMDokument45 SeitenUnit III-B PMAbdul AleemNoch keine Bewertungen

- Investment DecDokument29 SeitenInvestment DecSajal BasuNoch keine Bewertungen

- NPV and Other Investment CriteriaDokument11 SeitenNPV and Other Investment CriteriaGYANESHWAR MALHOTRANoch keine Bewertungen

- Apital Budgeting: Decision Criteria: Should We Build This Plant?Dokument59 SeitenApital Budgeting: Decision Criteria: Should We Build This Plant?hendraNoch keine Bewertungen

- Ch10 Tool Kit NPV Dan IRRDokument23 SeitenCh10 Tool Kit NPV Dan IRRSyarif Bin DJamalNoch keine Bewertungen

- Chap 11Dokument45 SeitenChap 11SEATQMNoch keine Bewertungen

- Capital BudgetingDokument16 SeitenCapital BudgetingMZK videosNoch keine Bewertungen

- The Basics of Capital BudgetingDokument55 SeitenThe Basics of Capital BudgetingnewaznahianNoch keine Bewertungen

- CH 12 Cash Flow Estimatision and Risk AnalysisDokument39 SeitenCH 12 Cash Flow Estimatision and Risk AnalysisRidhoVerianNoch keine Bewertungen

- ch.3 Capital BudgetingDokument46 Seitench.3 Capital Budgetingj787Noch keine Bewertungen

- Keputusan Investasi-12Dokument19 SeitenKeputusan Investasi-12indaeh0207Noch keine Bewertungen

- The Basics of Capital BudgetingDokument28 SeitenThe Basics of Capital BudgetingMariel BerdigayNoch keine Bewertungen

- Financial ModelingDokument37 SeitenFinancial ModelingSofoniasNoch keine Bewertungen

- Ch. 10 - 13ed Cap Budgeting - MasterDokument80 SeitenCh. 10 - 13ed Cap Budgeting - MasterVillena Divina Victoria100% (1)

- Cap BudgetingDokument80 SeitenCap Budgetingsharon torrefielNoch keine Bewertungen

- Aspek KeuanganDokument25 SeitenAspek KeuanganRevy Diaz FadhilahNoch keine Bewertungen

- Corporate Finance Unit 2 Study Guide StudentsDokument8 SeitenCorporate Finance Unit 2 Study Guide StudentsJust for Silly UseNoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument41 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?MoheuddinMayrajNoch keine Bewertungen

- Chapter 8 - Capital Budgeting Analysis - NPV and Other MethodsDokument71 SeitenChapter 8 - Capital Budgeting Analysis - NPV and Other MethodsMadhav Chowdary TumpatiNoch keine Bewertungen

- Net Cash Flows (CF) and Selected Evaluation Criteria For Projectsa and BDokument23 SeitenNet Cash Flows (CF) and Selected Evaluation Criteria For Projectsa and BNaila FaradilaNoch keine Bewertungen

- Organic Chemistry Board Exam QuestionsDokument10 SeitenOrganic Chemistry Board Exam QuestionsRiza Joie Versales100% (1)

- Cost of CapitalDokument37 SeitenCost of CapitalRiza Joie VersalesNoch keine Bewertungen

- Spectroscopic Applications For Structure Elucidation of Organic CompoundsDokument4 SeitenSpectroscopic Applications For Structure Elucidation of Organic CompoundsRiza Joie VersalesNoch keine Bewertungen

- Physical Chemistry Board Exam QuestionsDokument10 SeitenPhysical Chemistry Board Exam QuestionsRiza Joie Versales50% (2)

- Chap 16Dokument78 SeitenChap 16Riza Joie VersalesNoch keine Bewertungen

- t2 s08sDokument11 Seitent2 s08sRiza Joie VersalesNoch keine Bewertungen

- Decision 1Dokument10 SeitenDecision 1Riza Joie VersalesNoch keine Bewertungen

- Forecasting TechniquesDokument46 SeitenForecasting TechniquesRiza Joie VersalesNoch keine Bewertungen

- Chap 16Dokument78 SeitenChap 16Riza Joie VersalesNoch keine Bewertungen

- Operating and Financial LeverageDokument64 SeitenOperating and Financial Leveragebey_topsNoch keine Bewertungen

- Advanced Accounting Lupisan 3aDokument14 SeitenAdvanced Accounting Lupisan 3aDaniel Tadeja0% (1)

- Advanced Accounting Lupisan 3aDokument14 SeitenAdvanced Accounting Lupisan 3aDaniel Tadeja0% (1)

- Associates and Joint ArrangementsDokument32 SeitenAssociates and Joint ArrangementsRiza Joie VersalesNoch keine Bewertungen

- 4 AmlaDokument133 Seiten4 AmlaDanielle Nicole ValerosNoch keine Bewertungen

- Maura Practice 2Dokument13 SeitenMaura Practice 2Yoga Sangkan PrasetyaNoch keine Bewertungen

- Santa Claus RallyDokument7 SeitenSanta Claus Rallytanner3052Noch keine Bewertungen

- Sample Letter To Activate Dormant AccountDokument9 SeitenSample Letter To Activate Dormant AccountAshis MingalaNoch keine Bewertungen

- Pepsico Inc 2019 Annual ReportDokument1 SeitePepsico Inc 2019 Annual ReportToodley DooNoch keine Bewertungen

- The Asian Crisis and Recent DevelopmentDokument30 SeitenThe Asian Crisis and Recent DevelopmentfabyunaaaNoch keine Bewertungen

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2021Dokument12 SeitenSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2021muhammad osamaNoch keine Bewertungen

- AFSA Cash Flow AnalysisDokument19 SeitenAFSA Cash Flow AnalysisRikhabh DasNoch keine Bewertungen

- Fund Flow Statement: Dr. Varsha RayanadeDokument18 SeitenFund Flow Statement: Dr. Varsha RayanadeNishikant RayanadeNoch keine Bewertungen

- Super Trader Tactics For TRIPLE-DIGIT RETURNSDokument22 SeitenSuper Trader Tactics For TRIPLE-DIGIT RETURNSjdalvaran85% (20)

- Hill CountryDokument8 SeitenHill CountryAtif Raza AkbarNoch keine Bewertungen

- Type RI Contract NB 165895 INVOICE NB 132829 Client NB 388603 PDFDokument3 SeitenType RI Contract NB 165895 INVOICE NB 132829 Client NB 388603 PDFPushpendra NamdeoNoch keine Bewertungen

- Technological Development in Banking SectorDokument5 SeitenTechnological Development in Banking SectorPrabhu89% (9)

- The EXPLOITATION of Security Mispricing inDokument13 SeitenThe EXPLOITATION of Security Mispricing inJorge J MoralesNoch keine Bewertungen

- Crypto Trading Secrets How To Earn Big in The Cryptocurrency MarketDokument25 SeitenCrypto Trading Secrets How To Earn Big in The Cryptocurrency MarketSiddharth KaulNoch keine Bewertungen

- ICICI NEFT Application FormDokument1 SeiteICICI NEFT Application FormAtul Kawale100% (1)

- Assessement Test 6 - Change of PSR - Docx - 1661182024584Dokument2 SeitenAssessement Test 6 - Change of PSR - Docx - 1661182024584Shreya PushkarnaNoch keine Bewertungen

- S.N o Name of Stock Quantit y Purchas e Price Last Traded Price Sale S Pric e Gain Realized/UnrealizedDokument8 SeitenS.N o Name of Stock Quantit y Purchas e Price Last Traded Price Sale S Pric e Gain Realized/UnrealizedShreya ChitrakarNoch keine Bewertungen

- Cruz, Leyra R. Bsba Block 1-9 Readings in Philippine HistoryDokument11 SeitenCruz, Leyra R. Bsba Block 1-9 Readings in Philippine HistoryBLOG BLOGNoch keine Bewertungen

- PoudDokument3 SeitenPoudPrajwal AlvaNoch keine Bewertungen

- Bhavnaben RavalDokument4 SeitenBhavnaben RavalBhavee PrajapatiNoch keine Bewertungen

- Chapter 8 Stock ValuationDokument14 SeitenChapter 8 Stock ValuationLuu Quang TungNoch keine Bewertungen

- Accounting Quick Update - IFRS 16 - Leases and IFRS 15 - RevenueDokument50 SeitenAccounting Quick Update - IFRS 16 - Leases and IFRS 15 - RevenueTAWANDA CHIZARIRANoch keine Bewertungen

- Chapter Seven: Central BankingDokument23 SeitenChapter Seven: Central BankingManuelNoch keine Bewertungen

- National Income: Learning ObjectivesDokument30 SeitenNational Income: Learning Objectivesmuhammedsadiq abdullaNoch keine Bewertungen

- CBP Circular No. 905-82 December 10, 1982Dokument6 SeitenCBP Circular No. 905-82 December 10, 1982Emil BautistaNoch keine Bewertungen

- Typesof ClearingDokument3 SeitenTypesof ClearingteliumarNoch keine Bewertungen

- Trader's Psychology and Key Rules of Forex TradingDokument3 SeitenTrader's Psychology and Key Rules of Forex TradingAkingbemi MorakinyoNoch keine Bewertungen

- Unit 3-Time Value of MoneyDokument12 SeitenUnit 3-Time Value of MoneyGizaw BelayNoch keine Bewertungen

- Asset Classes and Financial InstrumentsDokument33 SeitenAsset Classes and Financial Instrumentskaylakshmi8314Noch keine Bewertungen