Beruflich Dokumente

Kultur Dokumente

Legal Aspect of New Cement Plant

Hochgeladen von

Rajesh ChandravanshiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Legal Aspect of New Cement Plant

Hochgeladen von

Rajesh ChandravanshiCopyright:

Verfügbare Formate

INCORPORATING A CEMENT

MANUFACTURING UNIT

A LEGAL PERSPECTIVE ACTS, LAWS AND OFFICES

Agenda

Cement Industry

Industry Overview

Incorporation of a Cement Company

Private/Public Entities

Joint Ventures/Subsidiaries

Requests to RoC

Flow-chart view

Industrial Policies

Industrial Licensing, IEMs , Location Policies

Procedures for Approval for E0Us/EPZs/FTZs/SEZs

List of approvals/clearances and departments

Government Involvement(Specific Acts and policies)

List of Applicable Labour Laws in the Sector

Legal Challenges to Cement Industry

Industry overview

Cement industry

Large cement plants

Mini & White cement

plants

Cement plants: 139

Effective capacity: 234.3 mtpa

Cement plants: 365

Effective capacity: 11.1 mtpa

*Source : Ambit capital, Aranca research

2

nd

largest market in the

world , 78 per cent of

global production

Exports to more 30

countries generating

employment for 50,000

people

Annual production of more

than 1 mn tonnes

Per Capita consumption

around 170kg, world

average 430 kg

Incorporation: An overview

COMPANIES ACT 1956

Governs Incorporation of a company in India

Part II of the Act deal with the incorporation of a company and matters related thereto

* A public company is a private company which is a subsidiary of a company which is not a private company.

Private Company Public Company

Minimum Paid-up Capital - 100,000 Minimum Paid-up Capital - 500,000

Minimum number of members: 2 Minimum number of members: 7

Maximum number of members : 50 Maximum number of members : Unlimited

Transerferability of shares :

Complete restriction

Transerferability of shares :

No restriction

Issue of Prospectus : Cannot

issue prospectus

Issue of Prospectus : Can

issue prospectus

Number of Directors : < =2

Number of Directors : >=3

Incorporation of a Cement Company

Getting the appropriate persons to subscribe to the Memorandum(Public company: Min. of 7,

Private company: Min. of 2)

Drawing up the Articles of Association (Indian Stamp Act, 1899)

Drawing up the Memorandum of Association (Indian Stamp Act, 1899)

Obtaining approval for the proposed name of the company from the ROC (Form 1A) (Prevention of

Improper Use, Act-1950)

Incorporation of a Cement Company

Obtain a certificate of commencement of business from ROC in case of a public

company

Receipt of Certificate of incorporation

Payment of registration Fee to the ROC

Starting Operations in India

Starting

operations

in India

As a Indian

company

Joint Ventures

Wholly owned

subsidiaries

As a foreign

company

Liaison Office

Project Office

Branch Office

Taxation

Corporate tax rate for foreign companies is

40%. The net tax rate includes various

deductions and exemptions available under

the tax laws. Tax holidays are available in

Special Economic zones. Infrastructure

Sector Projects enjoy special tax

treatment/holidays. Electronic filing of

customs documents is also there.

Investment Facilitation

Secretariat for Industrial Assistance (SIA) in

Department of Industrial Policy and

Promotion, Government of India provides a

single window service for entrepreneurial

assistance, Investor facilitation and

monitoring implementation of the projects.

Joint Ventures

Wholly owned

subsidiaries

By forging strategic alliances with Indian partners foreign companies get following advantages.

Established distribution/ marketing set up of the Indian partner

Available financial resource of the Indian partners

Established contacts of the Indian partners which help smoothen the process of setting up of operations

100% FDI is allowed in cement industry

Application to be filed to registrar of companies

Department of Company Affairs under Ministry of Finance is the regulatory authority

Liaison Office

Branch Office

Project Office

Foreign Companies planning to execute specific projects in India can set up temporary project/site offices in India with

RBIs permission subject to specified conditions.

No activity other than the activity relating and incidental to execution of the project

Project Offices may remit outside India the surplus of the project on its completion

Not allowed to carry out manufacturing activities on its own ,subcontract these to an Indian manufacturer.

Branch Offices established with the approval of RBI, may remit outside India profit of the branch, net of

applicable Indian taxes and subject to RBI guidelines

A channel of communication between the principal place of business or head office and entities in India

Cannot undertake any commercial activity directly or indirectly and cannot earn any income

Its role is to collect information about market opportunities and providing info about the company and its products to

prospective Indian customers

It can promote export/import from/to India and also facilitate technical/financial collaboration

Industrial Policy

Reforms

Reduced Industrial

Licensing requirements

Removed restrictions on

investment and expansion

Facilitated easy access to

foreign technology and

foreign direct investment

Industrial Policy

Industrial Licensing

All industrial undertakings

are exempt from obtaining

an industrial license to

Manufacture, except for:

1. Industries reserved for the Public Sector

2. Industries retained under compulsory licensing

3. Items of manufacture reserved for the small

scale sector

4. If the proposal attracts location restriction

Industrial Entrepreneurs Memorandum (IEM)

Industrial undertakings exempt

from obtaining an industrial

license are required to file an

IEM

1. In Part A with Secretariat of Industrial Assistance (SIA), DIPP,

GOI, and obtain an acknowledgement

2. After commencement of commercial production, Part B of

the IEM has to be filled

Industrial Policy

Industrial undertakings are

free to select the location of

a project

In the case of cities with population of more than a million (as per

the 1991 census):

The proposed location should be at least 25 KM away from the

Standard Urban Area limits of that city

Located in an area designated as an "industrial area" before the

25

th

July, 1991

The location of industrial units is further regulated by the local zoning, land use regulations &

also the environmental regulations

Policy Relating to Small Scale Undertakings*

Locational Policy

Get registered with the Directorate of Industries/District Industries Centre in the concerned

State Government

Also free from locational restrictions cited above

(An industrial undertaking is defined as a small scale unit if the investment

in fixed assets in plant and machinery does not exceed Rs 10 million)

Industrial Policy

A Notification issued under The Environment Protection Act 1986 has listed 29 projects in

respect of which environmental clearance needs to be obtained from the Ministry of

Environment, GOI: Cement Industry is one of these.

Foreign Direct Investments Policy

Environmental Clearances

The GOI has allowed FDI up to 100% in the cement and gypsum products industry

FDI can be bought through:

Automatic

Route

New

Ventures

Existing

Companies

Government

Approval

RBI has given permission to Indian Cement

companies to accept investment under this Route

without obtaining prior approval from RBI

Government approvals are accorded on the

recommendation of the Foreign Investment Promotion

Board (FIPB), chaired by the Secretary, DIPP (Ministry of

Commerce and Industry) with the Union Finance

Secretary, Commerce Secretary, and

other key Secretaries of the Government as its members.

Industrial Policy

Clearances and Approvals Required

Approvals/Clearances Required Department to be Approached and Consulted

Incorporation of Company Registrar of Companies

Registration/IEM/Industrial license DIC for SSI/SIA for large and medium

industries

Allotment of land State DI/SIDC/Infrastructure Corporation /SSIDC

Permission for land use a. State DI

b. Dept. of Town and Country

Planning

NOC and consent under Water and Air Pollution Control Acts State Pollution Control Board

Approval of construction activity and building plan a. Town and country planning

b. Municipal and local authorities

c. Chief Inspector of Factories

d. Pollution Control Board

Weights and Measures Inspector of Weights and Measures

Quality Marking Certificate Quality Marking Center of the State Government

Industrial Policy

Regulation

Problem:

Cartelizing of cement

firms

The Competition Commission of India says that cement firms met regularly to fix

prices, control market share and hold back supply

The Commission claims that cement companies in India had been organizing

themselves in a cartel for a while now, colluding, during industry body meetings,

to fix production levels as well as the price of a bag of cement in this case

doubling it between 2004 and 2011 so they could make windfall, illegal profits

Consequently, the CCI has slapped a fine totaling Rs 6,307.32 crore on the top-10

cement companies here and the industry body Cement Manufacturers

Association

Competition Commission of India is a body of the Government of

India responsible for enforcing The Competition Act,

2002 throughout India and to prevent activities that have an

adverse effect on competition in India. It was established on 14

October 2003

Cement Control Order, 1967

Cement Cess Rule, 1993

Cement (Quality Control) Order,1995

Cement (Quality Control) Order, 2003

Site and Building Plan approval

Health clearance

Fire service clearance

Environmental clearance from State Pollution Control Board

Registration with Inspector of Factories under Factories Act

Registration under Boilers Act (For Boilers)

Safety Certificate from Chief Electrical Inspector

Rules and Orders, DIPP

NODAL AGENCY

Department of Industrial Policy and Promotion (DIPP), Ministry of Commerce

State Level Statutory Clearance

Government Involvement

Applicable Labour Laws

Promotion of new manpower at skills and improvement/refinement of old

skills

Apprenticeship Advisor

Obligations of employers and apprentice

Offences and punishment

APPRENTICES ACT, 1961

To regulate the employment of contract labor and abolish it in certain cases

Applicability

Revocation and amendment of licenses

Liability of principal employer

CONTRACT LABOUR ACT, 1970

Eligibility

Benefits

Applicability

EMPLOYEES PROVIDENT FUNDS &

MISC. PROVISIONS ACT, 1952

Applicability of the act

Benefits

Penalties

Contribution period

EMPLOYEES STATE INSURANCE ACT

1948

Applicable Labour Laws

Applicability of the Act

Registration & Renewal of Factories

Welfare Measures

Employment of Young Persons

FACTORIES ACT, 1948

Provisions for investigation and settlement of industrial disputes and for certain other purposes.

Power of Labour Court to give appropriate Relief

Period of Operation of Settlements and Awards

Prohibition of Strikes & Lock Outs

INDUSTRIAL DISPUTES ACT, 1947

Applicability of the Act

Matters to be provided

PENALTIES

STANDING ORDERS ACT, 1946

Provide for fixing minimum rates of wages in certain employments

Composition of Committee Penalties

Payment of Minimum Rates of Wages

MINIMUM WAGES ACT, 1948

Applicable Labour Laws

To provide for fixing minimum rates of wages in certain employments

Fixing Hours for normal working

Composition of Committee

Maintenance of registers and records

Claims, Penalties, Offence, Punishment

MINIMUM WAGES ACT,

1948

To provide for the registration of Trade Union & define the law relating to

registered Trade Unions

Minimum Requirement for membership of Trade Union

Registrations and Cancellation of Trade Unions

Penalties, Offence and Punishment

TRADE UNIONS ACT, 1926

To provide for the payment of equal remuneration to men and women

workers and for the prevention of discrimination

Advisory Committee to regulate the process

Power of Government for appropriation

Penalties and Offence

EQUAL REMUNERATION

ACT, 1972

Applicable Labour Laws

To regulate the payment of wages of certain classes of employed persons

Applicability and Coverage

Legal deductions

Offences and Penalties

PAYMENT OF WAGES ACT,

1936

To provide workmen and/or their dependents some relief in case of

accidents, arising out of and in the course of employment and causing

either death or disablement of workmen

Applicability, Coverage and Employers Liability

Amount of Compensation

Report of Incidents and Penalties

WORKMENS

COMPENSATION ACT,

1923

To provide for a scheme for the payment of gratuity to employees

Applicability, Qualification, Nomination

Forfeiture of Gratuity

Protection of gratuity and Penalties

PAYMENT OF GRATUITY

ACT, 1972

Environmental Laws and Acts

Stated in Constitution of

India

Referred by Directive

Principles of State Policy

Guided by Fundamental

Rights structure

The Environment

(Protection) Act -

1986

Hazardous Waste

(Management and

Handling) Rules -

1989

The Public Liability

Insurance Act and

Amendment -1991 &

1992

The National

Environmental

Tribunal Act 1995

The National

Environment

Appellate Authority

Act 1997

The Forest

(Conservation) Act

1981

The Water

(Prevention and

Control of Pollution)

Act 1974

The Water

(Prevention and

Control of Pollution)

Cess Act 1977

The Air (Prevention

and Control of

Pollution) Act 1981

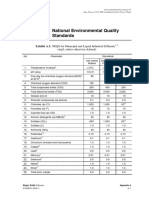

Practice required by law India China United States

Standard work day 9 hours 8 hours 8 hours

Severance pay for redundancy

dismissal of employee with 5 year

tenure

10.7 week salary 21.7 week salary None

Severance pay for redundancy

dismissal of employee with 1 year

tenure

2.1 week salary 4.3 week salary None

Premium pay for overtime 100% 50% 50%

Minimum Wage (US$/month) 29.9 182.5 1242.6

Minimum rest while at work 30 minutes per 5 hour None None

Maximum overtime limit 200 hours per year 1 hour per day None

Government approval required

for 9 person dismissal

Yes No No

Government approval required

for 1 person dismissal

Yes No No

Government approval

for redundancy dismissal granted

Rarely Not applicable Not applicable

Dismissal priority rules regulated Yes Yes No

Dismissal due

to redundancy allowed?

Yes, if approved by government Yes, without approval of government Yes, without approval of government

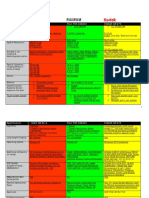

Legal Challenges to Cement Industry

Competition Act 2002 ( Amendment in 2007)

Competition Commission of India

Competition Appellate Tribunal

6300 Crore Rs Penalty on Cement Companies for cartelization

Orders for CMA

Obsolete Labor Laws

World Bank Report on Indian Labor Laws- 2008

Indias labor regulations - among the most restrictive and complex in the world - have constrained the growth of the

formal manufacturing sector where these laws have their widest application. Better designed labor regulations can attract more

labor- intensive investment and create jobs for Indias unemployed millions and those trapped in poor quality jobs. Given the

countrys momentum of growth, the window of opportunity must not be lost for improving the job prospects for the 80 million

new entrants who are expected to join the work force over the next decade..

References

Links

http://www.cmaindia.org/ Cement Manufacturers association

www.mhupa.gov.in - Ministry of Housing and Urban Poverty Alleviation

www.cidc.in Construction Industry Development Council , set up by Planning Commission

www.ncbindia.com National Council for Cement and Building Materials

www.dipp.nic.in Department of Industrial Policy and Promotion under Ministry of Commerce and Industry, Govt of India

http://www.fipbindia.com/ - Foreign Investment Promotion Board

http://www.mca.gov.in/ - Ministry of Corporate Affairs

http://finmin.nic.in/ - Ministry of Financial Affairs

http://moia.gov.in/ - Ministry of Overseas Indian Affairs

http://envfor.nic.in/ - Ministry of Environment and Forests

http://www.investindia.gov.in

Articles, Papers and Reports

FDI Circular for consolidated FDI policy 2012- Department of Industrial Policy and Promotion under Ministry of Commerce and Industry,

Govt of India

The Labour Laws Manual

Indian Cement Industry CII

The Competition (Amendment) Act, 2007 Competition Commission of India

Equal Remuneration Act, 1976

Ninety fifth report on performance of cement industry Parliament Report ( Presented to Rajya Sabha & lok sabha in 2011)

Das könnte Ihnen auch gefallen

- QA/QC Checklist - Installation of MDB Panel BoardsDokument6 SeitenQA/QC Checklist - Installation of MDB Panel Boardsehtesham100% (1)

- MBTI Form M Description PDFDokument1 SeiteMBTI Form M Description PDFRajesh Chandravanshi0% (1)

- Understanding Radiographic Safety Bounda PDFDokument1.227 SeitenUnderstanding Radiographic Safety Bounda PDFkrishimaNoch keine Bewertungen

- 150 18 255 2013 Anlagenoptimierung HomogenisierungDokument26 Seiten150 18 255 2013 Anlagenoptimierung HomogenisierungAnonymous iI88Lt100% (1)

- Rescue Scaffold DrawingDokument1 SeiteRescue Scaffold DrawingIslam ahmedNoch keine Bewertungen

- Cement Production PlantDokument24 SeitenCement Production PlantaazaidiNoch keine Bewertungen

- Walmart, Amazon, EbayDokument2 SeitenWalmart, Amazon, EbayRELAKU GMAILNoch keine Bewertungen

- Project Profile Calcinated GypsumDokument19 SeitenProject Profile Calcinated GypsumMergia100% (1)

- Termination LetterDokument2 SeitenTermination Letterultakam100% (1)

- Ambuja Cement AR 2021Dokument368 SeitenAmbuja Cement AR 2021adoniscalNoch keine Bewertungen

- Energy Savings of Cement Industry Sir Usman SBDokument6 SeitenEnergy Savings of Cement Industry Sir Usman SBMuhammad ImranNoch keine Bewertungen

- HSE Manual 01Dokument16 SeitenHSE Manual 01Arman Ul NasarNoch keine Bewertungen

- Lafarge Ravena Modernization FEISDokument97 SeitenLafarge Ravena Modernization FEISLafargeRavenaFactsNoch keine Bewertungen

- EHS ManagerDokument3 SeitenEHS Managerapi-78943192Noch keine Bewertungen

- SPH4U Assignment - The Wave Nature of LightDokument2 SeitenSPH4U Assignment - The Wave Nature of LightMatthew GreesonNoch keine Bewertungen

- POST TEST 3 and POST 4, in ModuleDokument12 SeitenPOST TEST 3 and POST 4, in ModuleReggie Alis100% (1)

- 09 WA500-3 Shop ManualDokument1.335 Seiten09 WA500-3 Shop ManualCristhian Gutierrez Tamayo93% (14)

- Orica Kurri ANE Appendix-10 GreenhouseDokument45 SeitenOrica Kurri ANE Appendix-10 GreenhouselladopiNoch keine Bewertungen

- Motivation and Reward Motivational Schemes at Rourkela Steel PlantDokument6 SeitenMotivation and Reward Motivational Schemes at Rourkela Steel PlantSAMIR RANJAN DUTTANoch keine Bewertungen

- Sourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDokument58 SeitenSourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyAlaa Al HarbiNoch keine Bewertungen

- Employee Development & RewardDokument4 SeitenEmployee Development & RewardamitwestroNoch keine Bewertungen

- TIS-HSE FRM-26 HSE Award Nomination FormDokument1 SeiteTIS-HSE FRM-26 HSE Award Nomination FormSyed Ahmed manzoor100% (1)

- Work Permit - Working at HeightDokument2 SeitenWork Permit - Working at HeightJaks JaksNoch keine Bewertungen

- Safety Incentive Programs: Safety and Health Resource ManualDokument7 SeitenSafety Incentive Programs: Safety and Health Resource ManualNorthNoch keine Bewertungen

- Ert TeamDokument1 SeiteErt TeamRavi TejaNoch keine Bewertungen

- AETHER Cement - ECRA Barcelona PresentationDokument23 SeitenAETHER Cement - ECRA Barcelona PresentationGilsayan100% (1)

- Package Cement Fugitive EmissionDokument192 SeitenPackage Cement Fugitive EmissionJay KumarNoch keine Bewertungen

- Portland Cement Clinker - LafargeDokument10 SeitenPortland Cement Clinker - Lafargeمهندس فهمي عبدالعزيزNoch keine Bewertungen

- Ambuja CementDokument29 SeitenAmbuja CementAnu SikkaNoch keine Bewertungen

- On Shree Cement Jun 2010Dokument39 SeitenOn Shree Cement Jun 2010Ana JainNoch keine Bewertungen

- Maple Leaf Cement FactoryDokument290 SeitenMaple Leaf Cement FactorySarfraz AliNoch keine Bewertungen

- SCM 310 Logistic and Transportation Section:2 Prepared For: Meshbaul Hasan ChowdhuryDokument24 SeitenSCM 310 Logistic and Transportation Section:2 Prepared For: Meshbaul Hasan ChowdhuryShamima AkterNoch keine Bewertungen

- Attock CementDokument18 SeitenAttock CementDeepak MatlaniNoch keine Bewertungen

- Legislation NEQS PakistanDokument7 SeitenLegislation NEQS PakistanMuhammad UsamaNoch keine Bewertungen

- PSO Ar 2020 PDFDokument365 SeitenPSO Ar 2020 PDFJahangir KhanNoch keine Bewertungen

- Report On JNPT Disaster ManagementDokument44 SeitenReport On JNPT Disaster ManagementAnubhav JainNoch keine Bewertungen

- DG Cement Annual Report 2016 PDFDokument261 SeitenDG Cement Annual Report 2016 PDFSamsam RaufNoch keine Bewertungen

- Lafarge Zambia 2015 Annual ReportDokument60 SeitenLafarge Zambia 2015 Annual Reportimbo9100% (1)

- NEQSDokument119 SeitenNEQSudbarryNoch keine Bewertungen

- D.G. Khan CementDokument11 SeitenD.G. Khan Cementkanwal_bawaNoch keine Bewertungen

- Productivity of Cement Industry of PakistanDokument37 SeitenProductivity of Cement Industry of Pakistansyed usman wazir100% (9)

- Safety Program Quarry As of 2011Dokument45 SeitenSafety Program Quarry As of 2011Arthur OllivierreNoch keine Bewertungen

- Mock Drill Oil Bottling Plant Ban Gal OresDokument34 SeitenMock Drill Oil Bottling Plant Ban Gal OresYogendra KatiyarNoch keine Bewertungen

- Finance Lafargeholcim Fy Annual Report enDokument288 SeitenFinance Lafargeholcim Fy Annual Report enMatteo GetraliNoch keine Bewertungen

- Country Analysis Brief: Malaysia: Last Updated: April 26, 2017Dokument23 SeitenCountry Analysis Brief: Malaysia: Last Updated: April 26, 2017FierDaus MfmmNoch keine Bewertungen

- OGDCl Complete Ann2011Dokument116 SeitenOGDCl Complete Ann2011tawakkalyNoch keine Bewertungen

- Presentation On Ambuja CementDokument47 SeitenPresentation On Ambuja CementParesh BhuriaNoch keine Bewertungen

- To Know About The Convenient Level of Small CarDokument35 SeitenTo Know About The Convenient Level of Small CarPrannoy RajNoch keine Bewertungen

- Cement Industries in PakistanDokument20 SeitenCement Industries in PakistanAli Imran Jalali100% (1)

- EIA Report MBS Isd Peshawar Morr NIIA - CompressedDokument288 SeitenEIA Report MBS Isd Peshawar Morr NIIA - CompressedMuhammad Waqas AhmedNoch keine Bewertungen

- Anhui Conch Cement Company LTD Annual Report 2013Dokument274 SeitenAnhui Conch Cement Company LTD Annual Report 2013hnmdungdqNoch keine Bewertungen

- Risk Assessment - Cleaning of Bucket Elevator BoothDokument2 SeitenRisk Assessment - Cleaning of Bucket Elevator BoothAbasiemekaNoch keine Bewertungen

- PGP QSHSEM Brochure2014Dokument0 SeitenPGP QSHSEM Brochure2014Shreyash NaikNoch keine Bewertungen

- Shree Cement HR ReporTDokument95 SeitenShree Cement HR ReporTRahul SoganiNoch keine Bewertungen

- Module 2 On-Line PTO ApplicationDokument138 SeitenModule 2 On-Line PTO Applicationnylzner100% (1)

- National Fire Service Week or Day Celebration Global EHS 059Dokument16 SeitenNational Fire Service Week or Day Celebration Global EHS 059Global EHSNoch keine Bewertungen

- Ccohs: By. Lussiana M. MaramisDokument21 SeitenCcohs: By. Lussiana M. MaramislussianaNoch keine Bewertungen

- Quarry Dust-Are You in Control?Dokument29 SeitenQuarry Dust-Are You in Control?Fritz LumasagNoch keine Bewertungen

- BEE Cement Plant Code FinalDokument4 SeitenBEE Cement Plant Code FinalHazem DiabNoch keine Bewertungen

- EIA Guidelines For Proposed Desalination Plants: Department of EnvironmentDokument47 SeitenEIA Guidelines For Proposed Desalination Plants: Department of EnvironmentdinaaarlNoch keine Bewertungen

- SafetyNews Special Edition09 PDFDokument16 SeitenSafetyNews Special Edition09 PDFsentra transformaNoch keine Bewertungen

- Paper Darab Cement Kiln SealDokument11 SeitenPaper Darab Cement Kiln Sealomid1302Noch keine Bewertungen

- IEEE 2019 Conference Program - FINAL - For WebDokument44 SeitenIEEE 2019 Conference Program - FINAL - For Webhilander2k2100% (2)

- 1 s2.0 S2211464522000690 MainDokument14 Seiten1 s2.0 S2211464522000690 MainyasminNoch keine Bewertungen

- Dalimia Cements PDFDokument133 SeitenDalimia Cements PDFjsrao1100% (1)

- Industrial & Licensing PolicyDokument7 SeitenIndustrial & Licensing PolicyRobinvarshneyNoch keine Bewertungen

- Industrial Licensing PolicyDokument15 SeitenIndustrial Licensing PolicyrohitbatraNoch keine Bewertungen

- How To Start An Industry in PuducherryDokument5 SeitenHow To Start An Industry in PuducherryKathir RkoNoch keine Bewertungen

- Frequently Asked Questions About MBTI (Myers-Briggs Type Indicator)Dokument3 SeitenFrequently Asked Questions About MBTI (Myers-Briggs Type Indicator)Rajesh ChandravanshiNoch keine Bewertungen

- MBTI Form Q Description PDFDokument1 SeiteMBTI Form Q Description PDFRajesh Chandravanshi100% (1)

- Metal Detector: ComponentsDokument2 SeitenMetal Detector: ComponentsRajesh ChandravanshiNoch keine Bewertungen

- You'Dokument1 SeiteYou'Rajesh ChandravanshiNoch keine Bewertungen

- Expectation Vs Reality: Job Order and Contract of ServiceDokument10 SeitenExpectation Vs Reality: Job Order and Contract of ServiceMikee Louise MirasolNoch keine Bewertungen

- HandloomDokument4 SeitenHandloomRahulNoch keine Bewertungen

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Dokument4 SeitenEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNoch keine Bewertungen

- Agfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Dokument3 SeitenAgfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Youness Ben TibariNoch keine Bewertungen

- PeopleSoft Application Engine Program PDFDokument17 SeitenPeopleSoft Application Engine Program PDFSaurabh MehtaNoch keine Bewertungen

- 90FF1DC58987 PDFDokument9 Seiten90FF1DC58987 PDFfanta tasfayeNoch keine Bewertungen

- SAS SamplingDokument24 SeitenSAS SamplingVaibhav NataNoch keine Bewertungen

- CIR Vs PAL - ConstructionDokument8 SeitenCIR Vs PAL - ConstructionEvan NervezaNoch keine Bewertungen

- BCG - Your Capabilities Need A Strategy - Mar 2019Dokument9 SeitenBCG - Your Capabilities Need A Strategy - Mar 2019Arthur CahuantziNoch keine Bewertungen

- Brochure Ref 670Dokument4 SeitenBrochure Ref 670veerabossNoch keine Bewertungen

- Algorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésDokument298 SeitenAlgorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésSerges KeouNoch keine Bewertungen

- 1 PBDokument14 Seiten1 PBSaepul HayatNoch keine Bewertungen

- Microsoft Word - Claimants Referral (Correct Dates)Dokument15 SeitenMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieNoch keine Bewertungen

- 7 TariffDokument22 Seiten7 TariffParvathy SureshNoch keine Bewertungen

- 06-Apache SparkDokument75 Seiten06-Apache SparkTarike ZewudeNoch keine Bewertungen

- Shahroz Khan CVDokument5 SeitenShahroz Khan CVsid202pkNoch keine Bewertungen

- Oracle Exadata Database Machine X4-2: Features and FactsDokument17 SeitenOracle Exadata Database Machine X4-2: Features and FactsGanesh JNoch keine Bewertungen

- The Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and CountriesDokument13 SeitenThe Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and Countriesluisbmwm6Noch keine Bewertungen

- SM Land Vs BCDADokument68 SeitenSM Land Vs BCDAelobeniaNoch keine Bewertungen

- DC Servo MotorDokument6 SeitenDC Servo MotortaindiNoch keine Bewertungen

- Weekly Learning PlanDokument2 SeitenWeekly Learning PlanJunrick DalaguitNoch keine Bewertungen

- ARUP Project UpdateDokument5 SeitenARUP Project UpdateMark Erwin SalduaNoch keine Bewertungen

- Sterling B2B Integrator - Installing and Uninstalling Standards - V5.2Dokument20 SeitenSterling B2B Integrator - Installing and Uninstalling Standards - V5.2Willy GaoNoch keine Bewertungen