Beruflich Dokumente

Kultur Dokumente

Chad Cameroon Pipeline

Hochgeladen von

Umang ThakerCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chad Cameroon Pipeline

Hochgeladen von

Umang ThakerCopyright:

Verfügbare Formate

Corp Fin ( Exxon

single owner)

high risk projects has

high positive NPVs

Although In

unfavourable

condition the distress

costs can be

significant and could

jeopardize the firm as

a whole

Corp Fin( 3 owners)

(Exxon 40%)

corporate finance, the

risk of the project and

the risk of the firm are

intertwined

the risk of

expropriation by the

host government

Corp Fin for Field

system and Proj ect

Finance for Export

system

With project finance

since the funds are

raised from

independent third

parties ( IBRD, EIB,

IFC, ECAs), most of

the risk is transferred

the costs of

bankruptcy are lower

with project finance

Project Finance for

both

generally easier to

monitor the cash

flows associated with

a project relative to

the sponsoring firms

cash flows

Project preparation

costs were only $15

million project

finance is associated

with high transactions

costs and makes sense

only if the deal is a

large

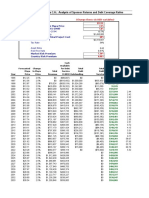

Financing

Field System

Investment (million $)

Export System

Investment (million $)

Total Investment(

million $)

Corp Fin ( Exxon single

owner)

1521 2203 3723

Corp Fin( 3 openers)

(Exxon 40%)

0.4*1521= 608 0.4*2203=881 1489

Corp Fin for Field

system and Project

Finance for Export

system

0.4*1521=608

0.4*123+04*608=

321

929

Project Finance for both 0.16*1521=243 0.16*2203=352 596

Instances of political instability hampered chads

economic development in the past

Political Risk

Ground water contamination from oil leak ( greatest

damage to Atlantic Forest zone Cameroon)

Environmental

Risk

Resettlement of local residents going to be affected

from the project(Chad & Cameroon)

Human rights

Issues

High civil unrest, Cameroon corruption index of 99 (All

stakeholders)

Sovereign Risk

High country credit, therefore chances of default

Financial Risk

Assessment of Returns

Returns were driven by price and volume

Actual reserves could vary from 595 millions to 1038 millions

barrel

Brent crude prices ranged from $9 to $42 with an average of

$20.43 per barrel

With discount of 10% to 20% due to corrosive nature of the oil,

projects development and finding cost was only $5.20 per

barrel

Overall, significant return for all stakeholders

Project provides an important opportunity for Chad to reduce poverty, though

contingent on Govt commitment

Receive up to $125M per year from the project, increasing Govt revenues by more

than 50%

Chad has few other alternatives if any for development

Potential employment opportunities created for local people in operations

Another positive externality may be WBs capacity building efforts to establish the

sufficient infrastructure for a well-functioning petroleum industry and investment

climate

Benefits

The realization of the opportunity for economic development strictly dependent on

Governments commitment in implementation of RMP

Environmental and social risks remain

Some adverse impacts are either irreversible or extremely hard to fix

Despite contingency plans, there may be leakages in the pipeline that would go

unnoticed for long time, due to limitations of even the most advanced technologies

Forest regions, home to 11,000 Bakola people (pygmies) will be affected

Risks

Fair distribution of risk & return although most of the environmental risk is borne

by both countries

Benefits

The presence of World Bank and Internal Finance Corporation along with participation

on governments in equity financing significantly reduced political risk exposure

Low construction risks (sponsors expertise and reputation in the industry)

Low operating risks (positive NPV under most scenarios in Exhibit 5 with different price and

reserve levels)

Low financial risks, considering high debt service coverage ratio(as high as 2:1) and low

and development costs compared to price

Risks

Any social or political instability in either Chad or Cameroon would adversely effect the

export of oil through the pipelines across the two countries

Chad and Cameroon both are high on country credit rank, therefore increasing

chances of default

Private sponsors bear most of the oil reserve risk although they get the largest

portion of the projected return among all the parties involved

The world Banks involvement was essential for the beginning of the project

Commercial lenders were unwilling to lend to the project without the

involvement of the World Bank

The humanitarian nature of the funding: The funding of World bank would ensure

that the projects revenues were used for human development through the

revenue management program

Other countries were ready to fund the project; However the revenues in this

case would have been used to promote arms dealing with the dictator of Chad

IFC provided with a loan of $100 million; $300 million syndicated loan to COTCO

and TOTCO

IFC influenced the raising of finances up to $900m from the export credit

agencies

Helped raise $400m from international capital markets

Objective:

If not utilized properly oil revenue will go into wrong hands, Chad will be

devoid of economic development.

RMP ensured benefits accrue to all the citizens of Chad

Positives:

RMP was designed with inputs from Chads government thus by establishing

trust factor

Chad will receive around $1.78 billion over the next years

Discretion in the hand of government on how to spend revenue They wont

feel that their hands are tied

Oversight committee consisting of 9 members to monitor and approve

annual expenditure program

Governments RMP performance linked to the future world bank lending

added incentive

External audit to review annual operations

Risks :

7 members from government in 9 member committee Overrepresentation

could lead to higher bargaining power.

Prone to colluding or bribery.

Assumptions

Average Price per barrel is assumed to be constant across the years

Extracted oil volume is 96% of reserve quantity ( based on base case

scenario)

Distribution of cash flows is calculated for all 9 scenarios according to base

case scenario

Operating costs and other costs are assumed to be same as of base case

scenario

Reinvestment rate is assumed to be 8% for MIRR calculation

MIRR

Price Chad Cameron Private Sponsors

Reserve = 595 mm

bbl

12 12.31% 10.80% 4.20%

15.25 16.63% 14.56% 6.78%

18.5 19.37% 16.91% 8.54%

Reserve = 917 mm

bbl

12 19.37% 16.91% 8.54%

15.25 21.45% 19.31% 10.49%

18.5 22.86% 20.69% 11.90%

Reserve = 1038 mm

bbl

12 20.53% 18.31% 8.54%

15.25 22.37% 20.21% 11.40%

18.5 23.69% 21.51% 12.76%

World Banks

investments

(in $ million)

Investment Rate of return Assumptions

IFC-A Loan 100 15% IFC Lending rates ( Lending rates for Chad and

cameroon is not given on the website; hence the

lending rates for countries like Afghanistan, Nigeria

and Haiti is taken as reference)

IFC-B Loan 300 15%

IBRD 33 8.216%

IBRD lending rates = LIBOR + 1.35%; now for the

calculations we have taken a 12-month LIBOR.

IBRD 44 8.216%

Using the above conditions, the revenues for the World Bank is

projected for the 32-year period and the Net present value is

calculated.

The investments are assumed to be equally spread over the first

4 years from 2000-03. The revenues are materialized from 2004-

32.

Taking this into account the NPV is found to be $73.69 million.

As a result of this, the board members would be expected to

go ahead with the project.

Whether board members of the World Bank

should approve of the project?- YES

Das könnte Ihnen auch gefallen

- Gemi Chad CameronDokument13 SeitenGemi Chad CameronavijeetboparaiNoch keine Bewertungen

- Chad CameroonDokument17 SeitenChad CameroonAshish BhartiNoch keine Bewertungen

- Chad Cameroon Petroleum Development andDokument24 SeitenChad Cameroon Petroleum Development andYourick Evans Pouga MbockNoch keine Bewertungen

- The Chad-Cameroon Petroleum Development and Pipeline ProjectDokument22 SeitenThe Chad-Cameroon Petroleum Development and Pipeline ProjectAjay GuptaNoch keine Bewertungen

- Chad Cameroon Case FinalDokument28 SeitenChad Cameroon Case FinalAbhi Krishna ShresthaNoch keine Bewertungen

- Project Finance CaseDokument15 SeitenProject Finance CaseDennies SebastianNoch keine Bewertungen

- BP Amoco - A Case Study On Project FinanceDokument11 SeitenBP Amoco - A Case Study On Project Financevinay5209100% (2)

- Chad Cameroon Pipeline - Project Finance v2Dokument27 SeitenChad Cameroon Pipeline - Project Finance v2Ajay GuptaNoch keine Bewertungen

- Petrozuata Case StudyDokument20 SeitenPetrozuata Case StudyBasit Ali Chaudhry100% (1)

- Chad-Cameroon Pipeline Project - PAF Project Group 1Dokument14 SeitenChad-Cameroon Pipeline Project - PAF Project Group 1kundanNoch keine Bewertungen

- Petrolera Zuata: A Project Finance Case StudyDokument15 SeitenPetrolera Zuata: A Project Finance Case StudySaathwik ChandanNoch keine Bewertungen

- Financing The Mozal Projec1Dokument6 SeitenFinancing The Mozal Projec1Kapil Arora100% (1)

- Petrolera Zuata, Petrozuata CaseDokument8 SeitenPetrolera Zuata, Petrozuata CaseAndy Vibgyor50% (2)

- PF Group 11 AquasureDokument13 SeitenPF Group 11 Aquasuresiby13172Noch keine Bewertungen

- Mozal FinancingDokument18 SeitenMozal FinancingSourabh Dhawan100% (1)

- Group - 3 - FM Case StudyDokument18 SeitenGroup - 3 - FM Case StudyBiswa Mohan PatiNoch keine Bewertungen

- This Study Resource Was: Chad-Cameroon Project 1Dokument8 SeitenThis Study Resource Was: Chad-Cameroon Project 1Ashutosh TulsyanNoch keine Bewertungen

- Project Finance Petrolera Zuata, Petrozuata C.A: BackgorundDokument3 SeitenProject Finance Petrolera Zuata, Petrozuata C.A: BackgorundPearly ShopNoch keine Bewertungen

- Case Analysis - Petrolera ZuataDokument8 SeitenCase Analysis - Petrolera ZuataAnupam Sharma0% (1)

- BP Amoco (Case Study)Dokument25 SeitenBP Amoco (Case Study)Abhik Tushar Das67% (3)

- Chad Cameroon PipelineDokument12 SeitenChad Cameroon PipelineskhhmlNoch keine Bewertungen

- AJCDokument42 SeitenAJCShashank Kanodia100% (1)

- BP Amoco (A)Dokument8 SeitenBP Amoco (A)BhartiMahawarNoch keine Bewertungen

- AJC CaseDokument46 SeitenAJC CaseHemachandar Vaida100% (1)

- Petrozuata and Articles Handout 2020Dokument12 SeitenPetrozuata and Articles Handout 2020Darshan Gosalia0% (1)

- AJC CaseDokument18 SeitenAJC CaseAbhinava Chanda100% (1)

- Group 6 Financing Mozal Project ReportDokument4 SeitenGroup 6 Financing Mozal Project ReportManan Sanghi100% (1)

- Risks Petrolera Zuata Petrozuata CaDokument9 SeitenRisks Petrolera Zuata Petrozuata CahdvdfhiaNoch keine Bewertungen

- Petrozuata Questions - SPR - 2015Dokument1 SeitePetrozuata Questions - SPR - 2015daweizhang100% (1)

- Chasecase PaperDokument10 SeitenChasecase PaperadtyshkhrNoch keine Bewertungen

- Petrozuata Analysis WriteupDokument5 SeitenPetrozuata Analysis Writeupgkfernandes0% (1)

- AJC Case Analysis.Dokument4 SeitenAJC Case Analysis.sunny rahulNoch keine Bewertungen

- The Costs and Benefits of A $3 Billion Factory:: Should Development Aid Be Used To Expand The MOZAL Mega-Project?Dokument19 SeitenThe Costs and Benefits of A $3 Billion Factory:: Should Development Aid Be Used To Expand The MOZAL Mega-Project?jvoth5186Noch keine Bewertungen

- BP Amoco (B)Dokument32 SeitenBP Amoco (B)Arnab RoyNoch keine Bewertungen

- Restructuring Bulong Debt - 3Dokument7 SeitenRestructuring Bulong Debt - 3Kumar Abhishek100% (1)

- Petroleraa ZuataDokument9 SeitenPetroleraa ZuataArka MitraNoch keine Bewertungen

- Petrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Dokument1 SeitePetrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Shrikant KrNoch keine Bewertungen

- Petrolera Zueta, Petrozuata CDokument6 SeitenPetrolera Zueta, Petrozuata CAnkur SinhaNoch keine Bewertungen

- Chad-Cameroon Case AnalysisDokument15 SeitenChad-Cameroon Case AnalysisPooja TyagiNoch keine Bewertungen

- PetrozuataDokument13 SeitenPetrozuataMikhail TitkovNoch keine Bewertungen

- Petrolera Zuata, Petrozuata C. A. Case AnalysisDokument10 SeitenPetrolera Zuata, Petrozuata C. A. Case Analysisshivam saraffNoch keine Bewertungen

- Guide Questions Liability Management at General MotorsDokument1 SeiteGuide Questions Liability Management at General MotorsZtreat Nohanih0% (1)

- Financing The Mozal Project - Total - 1Dokument22 SeitenFinancing The Mozal Project - Total - 1Shubhra SanghiNoch keine Bewertungen

- BP Amoco PDFDokument35 SeitenBP Amoco PDFPankhil Shikha100% (2)

- Stone Container Corporation: Strategic Financial ManagementDokument3 SeitenStone Container Corporation: Strategic Financial ManagementMalika BajpaiNoch keine Bewertungen

- Dharavi 2Dokument24 SeitenDharavi 2Kayzad Madan0% (1)

- Cast Study - GM MotorsDokument9 SeitenCast Study - GM MotorsAbdullahIsmailNoch keine Bewertungen

- Mozal ProjectDokument7 SeitenMozal Projectprajeshgupta100% (1)

- Financing The Mozal Project Case Analysis: BY-Vivek KumarDokument25 SeitenFinancing The Mozal Project Case Analysis: BY-Vivek Kumarvarun7659Noch keine Bewertungen

- Case: Calpine Corporation: The Evolution From Project To Corporate FinanceDokument7 SeitenCase: Calpine Corporation: The Evolution From Project To Corporate FinanceKshitishNoch keine Bewertungen

- Petrozuata Case AnalysisDokument8 SeitenPetrozuata Case AnalysisVishal VishyNoch keine Bewertungen

- Poland MotorwayDokument16 SeitenPoland MotorwayPrateek Agarwal100% (2)

- Project FinanceDokument9 SeitenProject FinanceAditi AggarwalNoch keine Bewertungen

- Financing Mozal ProjectDokument19 SeitenFinancing Mozal ProjectSimran MalhotraNoch keine Bewertungen

- Chad-Cameron Pipeline Project Case Study Managing Credit Risk Assessment 2Dokument19 SeitenChad-Cameron Pipeline Project Case Study Managing Credit Risk Assessment 2FESTUS EFOSA EFOSA100% (1)

- Mozal Project: Group: 1 Team: 5Dokument13 SeitenMozal Project: Group: 1 Team: 5GNoch keine Bewertungen

- PZ Financial AnalysisDokument2 SeitenPZ Financial AnalysisdewanibipinNoch keine Bewertungen

- Mozal ProjectDokument12 SeitenMozal ProjectKumar PrashantNoch keine Bewertungen

- Infra Finance Case PPT - Group 7 (Final)Dokument19 SeitenInfra Finance Case PPT - Group 7 (Final)manindra1konda100% (3)

- The Chad-Cameroon Petroleum Development and Pipeline ProjectDokument13 SeitenThe Chad-Cameroon Petroleum Development and Pipeline ProjectAshutosh TulsyanNoch keine Bewertungen

- Sony AiboDokument17 SeitenSony AiboUmang Thaker100% (1)

- Case - Yamuna ExpresswayDokument17 SeitenCase - Yamuna ExpresswayUmang Thaker100% (2)

- Hide SignDokument7 SeitenHide SignUmang ThakerNoch keine Bewertungen

- TATA JLR DealDokument8 SeitenTATA JLR DealUmang ThakerNoch keine Bewertungen

- SnappleDokument13 SeitenSnappleUmang ThakerNoch keine Bewertungen

- The Contemporary WorldDokument7 SeitenThe Contemporary WorldRental System100% (1)

- Dhmi Annual Report 2009Dokument58 SeitenDhmi Annual Report 2009mtktsNoch keine Bewertungen

- BMW: Currency Hedging 2007: IES204 2-207-002 Rev. 9/08Dokument20 SeitenBMW: Currency Hedging 2007: IES204 2-207-002 Rev. 9/08Zahra AfrozNoch keine Bewertungen

- Respuestas de Paridad InternacionalDokument15 SeitenRespuestas de Paridad InternacionalDavid BoteroNoch keine Bewertungen

- BKM CH 03 Answers W CFADokument8 SeitenBKM CH 03 Answers W CFAAmyra KamisNoch keine Bewertungen

- AUG 03 Danske EMEADailyDokument3 SeitenAUG 03 Danske EMEADailyMiir ViirNoch keine Bewertungen

- Best Forex Indicators For Scalping: What Is A Scalping Strategy?Dokument9 SeitenBest Forex Indicators For Scalping: What Is A Scalping Strategy?jpvjpvNoch keine Bewertungen

- Moody's Investor DayDokument44 SeitenMoody's Investor Daymaxbg91Noch keine Bewertungen

- CH 11Dokument12 SeitenCH 11ShelviDyanPrastiwiNoch keine Bewertungen

- Exercise Chap 5Dokument4 SeitenExercise Chap 5Lê Hồng ThuỷNoch keine Bewertungen

- Financial Management Chapter 02 IM 10th EdDokument21 SeitenFinancial Management Chapter 02 IM 10th EdDr Rushen SinghNoch keine Bewertungen

- Ejercicios de Buenas Practicas en Materias de G.corporativosDokument41 SeitenEjercicios de Buenas Practicas en Materias de G.corporativosmargarethNoch keine Bewertungen

- Final Report: Submitted By: TAIMOOR RIAZ 13044954-030 Submitted ToDokument65 SeitenFinal Report: Submitted By: TAIMOOR RIAZ 13044954-030 Submitted ToSherryMirzaNoch keine Bewertungen

- Reading 15 Currency Exchange RatesDokument28 SeitenReading 15 Currency Exchange RatesNeerajNoch keine Bewertungen

- The Asset Approach To Exchange Rates and The Foreign Exchange Market!Dokument46 SeitenThe Asset Approach To Exchange Rates and The Foreign Exchange Market!Brian LiuNoch keine Bewertungen

- Marketing BMW: Emanuel Paul MüllerDokument19 SeitenMarketing BMW: Emanuel Paul Mülleremanuel MüllerNoch keine Bewertungen

- 101 Globalisation and Culture 1225869777273912 9Dokument35 Seiten101 Globalisation and Culture 1225869777273912 9Gilm AutismeNoch keine Bewertungen

- Delay Tactics: by Stephen Devaux, November 16, 2006 - SHAREDokument4 SeitenDelay Tactics: by Stephen Devaux, November 16, 2006 - SHARETanveerAhmed NiaziNoch keine Bewertungen

- Petróleo en Cómodas CuotasDokument9 SeitenPetróleo en Cómodas CuotasArmandoInfoNoch keine Bewertungen

- 12 NTi Fan AcDokument823 Seiten12 NTi Fan AcIvanPetrovicNoch keine Bewertungen

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDokument5 SeitenMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNoch keine Bewertungen

- 2023 Tennis Europe Junior Tour Regulations 23.06.2023Dokument135 Seiten2023 Tennis Europe Junior Tour Regulations 23.06.2023ANDREEANoch keine Bewertungen

- Payment Information: Mannheim Full-Time MBA Class of 2021Dokument1 SeitePayment Information: Mannheim Full-Time MBA Class of 2021nishantraj94Noch keine Bewertungen

- Sugar Quarterly Q1 2020Dokument18 SeitenSugar Quarterly Q1 2020Ahmed OuhniniNoch keine Bewertungen

- Philippine Derivative Market, A StudyDokument15 SeitenPhilippine Derivative Market, A Studybookworm_1550% (6)

- Speculating On Anticipated Exchange RateDokument9 SeitenSpeculating On Anticipated Exchange RatefaisalharaNoch keine Bewertungen

- Central Banks in The Age of EuroDokument475 SeitenCentral Banks in The Age of EuroAdam GellenNoch keine Bewertungen

- Berri Case StudyDokument22 SeitenBerri Case StudyNeha SinghNoch keine Bewertungen

- The Economist UK Edition - May 29 2021Dokument88 SeitenThe Economist UK Edition - May 29 2021linh myNoch keine Bewertungen

- Global Economics NotesDokument51 SeitenGlobal Economics NotesVibhav Upadhyay75% (4)