Beruflich Dokumente

Kultur Dokumente

A Comment On Raising The Ceilings On Tax-Free 13th Month Bonuses

Hochgeladen von

Office of Senator Sonny AngaraOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A Comment On Raising The Ceilings On Tax-Free 13th Month Bonuses

Hochgeladen von

Office of Senator Sonny AngaraCopyright:

Verfügbare Formate

A Comment on Raising the Ceilings on

Tax-free 13

th

Month Bonuses

SA. Quimbo

22 September 2014

Presented at a Public Hearing

of the Ways and Means Committee

Senate of the Philippines

How do salary and wage earners fare

in terms of horizontal equity?

Horizontal equity: similarly situated taxpayers

should pay similar taxes

Salary and wage earners:

Shoulder 85 percent of all individual income

taxes (excluding capital gains)

Pay more taxes than the self-employed

professional and non-professional, for the same

income decile

Not horizontally equitable

Source: 2013 LFS

-

5,000

10,000

15,000

20,000

25,000

First Decile Second Decile Third Decile Fourth Decile Fifth Decile Sixth Decile Seventh

Decile

Eight Decile Ninth Decile Tenth Decile

Salary and wage earner

Self-employed (non-prof)

Self-employed (prof)

Source of Basic Data: 2012 LFS-2013 FIES

(N=76,405 workers from 40,171 households)

Gains in horizontal

(and intertemporal) equity

Primarily, salary and wage earners gain from the the

proposed increase in ceilings for tax-free 13

th

month

pay from 30,000 pesos to 70,000 pesos

30,000 pesos in 1994 is equivalent to 70,633 pesos

in 2014

The effect of increasing the ceiling to 70,000 pesos is

to reduce taxable income by at most 40,000 pesos (=

70,000 30,000) for workers with monthly pay of at

least 30,000

How many workers gain?

Using data from the 2013 Labor Force

Survey, 1.99% of all salary and wage earners

have a basic monthly pay of at least 30,000

pesos:

22,212,000 S&W earners x 1.99%

~ 442,000 workers

Back-of-the-envelope estimates

(maximum loss)

442,000 workers (earning at least 30,000 per month)

x 40,000 pesos (assume that all workers earn at least 70,000 per month)

x 32% (highest tax rate)

________________________

5.6576 Billion Pesos

Decompose total individual income tax collections as

reported by BIR by bracket

Use income and household characteristics from the merged

2012 FIES-2013 LFS to estimate taxable income and tax

payments due

Assume income underreporting 15% - 25%

Limitation: maximum income is 10M only

Use tax payments reported by BIR for the top 500 tax payers

for individuals with at least 16 M pesos

Tax payments for those with income 10M-16M are treated as

a balancing figure

All relevant tax rules applied to estimate taxes due (for Self-

employed, we used standard deductions, not the 40%

optional standard deductions)

Estimating the Revenue Effects (1)

BASE SCENARIO

Estimating the Revenue Effects (2)

Re-computed taxable income assuming

various ceilings (40,000; 50,000; 60,000;

and 70,000)

Assumed that 68% (1-proportion of

professionals to all workers) of top 500

taxpayers (plus all those with income in

excess of 10 million pesos) have a 13

th

month bonus

Simulations

Can be partially

recovered from VAT

(77% of expenditures

are subject to VAT)

Distribution of Income Tax Payments,

by ceiling amount

17.23% 16.81% 16.64% 16.57% 16.52%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

30K tax-exempt

bonus

40K tax-exempt

bonus

50K tax-exempt

bonus

60K tax-exempt

bonus

70K tax-exempt

bonus

1000 individuals earning at least PhP10M - 16M

(assumed)

From TOP 500 (over 16M)

Prof

Self-employed

Over PhP500K

Over PhP250K but not over PhP500K

Over PhP140K but not over PhP250K

Over PhP70K but not over PhP140K

Over PhP30K but not over PhP70K

Over PhP10K but not over PhP30K

Not over PhP10K

A concern: will firms be strategic?

Strategic behavior

makes sense only for

workers earning 30,000

70,000 pesos per

month:

These are 407,000

workers.

Assume a 20,000 peso

loss in taxable income

per worker.

Estimated total loss

from strategic behavior

= 20,000 x 407,000

workers x 32% =

PhP2.6048 B

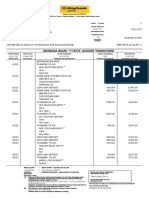

Worker's Annual Basic Compensation 1,200,000

OPTION 1

(straight)

OPTION 2

(strategic)

Monthly Pay 100,000 50,000

Annual Basic Pay 1,200,000 600,000

13th Month Pay 100,000 700,000

TOTAL Annual Compensation 1,300,000 1,300,000

Taxable Income

1.2 M - deductions

+ (100k-70k)

600k deductions

+ (700k - 70K)

Assume: 100k deductions

Estimated Taxable Income 1,130,000 1,130,000

Worker's Annual Basic Compensation 600,000

OPTION 1

(straight)

OPTION 2

(strategic)

Monthly Pay 50,000 20,000

Annual Basic Pay 600,000 240,000

13th Month Pay 50,000 410,000

TOTAL Annual Compensation 650,000 650,000

Taxable Income

600K - deductions

+ 0

240k - deductions

+ (410K - 70K)

Assume: 100k deductions

Estimated Taxable Income 500,000 480,000

Concluding Remarks

I support the proposal on grounds of horizontal equity

Protective of salary and wage workers

Improved equity comes at small price: 1.7 B

Strategic behavior can be curbed with ceilings on the ratio of 13

th

month pay to monthly basic pay or limits on frequency of payments

of the 13

th

month bonus (e.g., at most twice a year)

Estimated loss of 2.6B under the extreme (but unlikely) scenario that all

firms will undertake strategic behavior

Whether back-of-the-envelope estimates or more careful estimates

using population-based surveys and the roster of top taxpayers, the

maximum potential loss ranges from 4.3 B (=1.7+2.6) to 5.6 B

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Healthpro Vs MedbuyDokument3 SeitenHealthpro Vs MedbuyTim RosenbergNoch keine Bewertungen

- Script For Performance Review MeetingDokument2 SeitenScript For Performance Review MeetingJean Rose Aquino100% (1)

- Competition Act: Assignment ONDokument11 SeitenCompetition Act: Assignment ONSahil RanaNoch keine Bewertungen

- Contract Costing 07Dokument16 SeitenContract Costing 07Kamal BhanushaliNoch keine Bewertungen

- Aml Az Compliance TemplateDokument35 SeitenAml Az Compliance TemplateAnonymous CZV5W00Noch keine Bewertungen

- Year 2016Dokument15 SeitenYear 2016fahadullahNoch keine Bewertungen

- S03 - Chapter 5 Job Order Costing Without AnswersDokument2 SeitenS03 - Chapter 5 Job Order Costing Without AnswersRigel Kent MansuetoNoch keine Bewertungen

- Agony of ReformDokument3 SeitenAgony of ReformHarmon SolanteNoch keine Bewertungen

- HQ01 - General Principles of TaxationDokument14 SeitenHQ01 - General Principles of TaxationJimmyChao100% (1)

- PaySlip 05 201911 5552Dokument1 SeitePaySlip 05 201911 5552KumarNoch keine Bewertungen

- Quijano ST., San Juan, San Ildefonso, BulacanDokument2 SeitenQuijano ST., San Juan, San Ildefonso, BulacanJoice Dela CruzNoch keine Bewertungen

- Proposal Tanaman MelonDokument3 SeitenProposal Tanaman Melondr walferNoch keine Bewertungen

- MBBcurrent 564548147990 2022-12-31 PDFDokument10 SeitenMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinNoch keine Bewertungen

- Fabozzi Ch13 BMAS 7thedDokument36 SeitenFabozzi Ch13 BMAS 7thedAvinash KumarNoch keine Bewertungen

- Vtiger Software For CRMDokument14 SeitenVtiger Software For CRMmentolNoch keine Bewertungen

- Brita. SWOTDokument21 SeitenBrita. SWOTNarayan TiwariNoch keine Bewertungen

- CMACGM Service Description ReportDokument58 SeitenCMACGM Service Description ReportMarius MoraruNoch keine Bewertungen

- Guide To Accounting For Income Taxes NewDokument620 SeitenGuide To Accounting For Income Taxes NewRahul Modi100% (1)

- SKS Microfinance CompanyDokument7 SeitenSKS Microfinance CompanyMonisha KMNoch keine Bewertungen

- Ape TermaleDokument64 SeitenApe TermaleTeodora NedelcuNoch keine Bewertungen

- Modified Jominy Test For Determining The Critical Cooling Rate For Intercritically Annealed Dual Phase SteelsDokument18 SeitenModified Jominy Test For Determining The Critical Cooling Rate For Intercritically Annealed Dual Phase Steelsbmcpitt0% (1)

- (Dilg Memorandum Circular No. 2014-81) For The 2nd Quarter of C.Y. 2019 Region: HUC: BarangayDokument3 Seiten(Dilg Memorandum Circular No. 2014-81) For The 2nd Quarter of C.Y. 2019 Region: HUC: BarangayYuri VillanuevaNoch keine Bewertungen

- July 07THDokument16 SeitenJuly 07THYashwanth yashuNoch keine Bewertungen

- Irda CircularDokument1 SeiteIrda CircularKushal AgarwalNoch keine Bewertungen

- Presentation NGODokument6 SeitenPresentation NGODulani PinkyNoch keine Bewertungen

- RBS Internship ReportDokument61 SeitenRBS Internship ReportWaqas javed100% (3)

- KaleeswariDokument14 SeitenKaleeswariRocks KiranNoch keine Bewertungen

- Flex Parts BookDokument16 SeitenFlex Parts BookrodolfoNoch keine Bewertungen

- Manual Goldfinger EA MT4Dokument6 SeitenManual Goldfinger EA MT4Mr. ZaiNoch keine Bewertungen

- EOQ HomeworkDokument4 SeitenEOQ HomeworkCésar Vázquez ArzateNoch keine Bewertungen