Beruflich Dokumente

Kultur Dokumente

CH 04

Hochgeladen von

SarahmnmOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CH 04

Hochgeladen von

SarahmnmCopyright:

Verfügbare Formate

Chapter

4-1

Chapter

4-2

CHAPTER 4

COMPLETING THE

ACCOUNTING

CYCLE

Accounting Principles, Eighth Edition

Chapter

4-3

A multiple-column form used in preparing

financial statements.

Not a permanent accounting record.

Five step process.

Use of worksheet is optional.

Using A Worksheet

LO 1 Prepare a worksheet.

Worksheet

Chapter

4-4

Steps in Preparing a Worksheet

LO 1 Prepare a worksheet.

Illustration 4-2

Chapter

4-5

P4-1A The trial balance for Undercover Roofing for the month

ended March 31, 2008, is as follows.

Steps in Preparing a Worksheet

Account Titles Dr. Cr.

Cash 2,500 $

Accounts Receivable 1,800

Roofing Supplies 1,100

Equipment 6,000

Accumulated Depreciation 1,200 $

Accounts Payable 1,400

Unearned Revenue 300

I. Spy, Capital 7,000

I. Spy, Drawing 600

Service Revenue 3,000

Salaries Expense 700

Miscellaneous Expense 200

Totals 12,900 $ 12,900 $

Trial Balance Other data:

1. Supplies on hand total $140.

2. Depreciation for March is

$200.

3. Unearned revenue amounted

to $130 on March 31.

4. Accrued salaries are $350.

Instructions

a. Prepare and complete the

worksheet.

LO 1 Prepare a worksheet.

Chapter

4-6

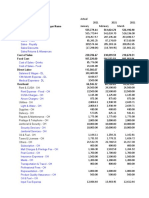

Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash 2,500

Accounts Receivable 1,800

Roofing Supplies 1,100

Equipment 6,000

Accumulated Depreciation 1,200

Accounts Payable 1,400

Unearned Revenue 300

I. Spy, Capital 7,000

I. Spy, Drawing 600

Service Revenue 3,000

Salaries Expense 700

Miscellaneous Expense 200

Totals 12,900 12,900

Balance Sheet

Adjusted Income

Trial Balance Adjustments Trial Balance Statement

Steps in Preparing a Worksheet

1. Prepare a Trial Balance on the Worksheet

Trial balance amounts

come directly from

ledger accounts.

Include all

accounts with

balances.

LO 1 Prepare a worksheet.

Chapter

4-7

Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash 2,500

Accounts Receivable 1,800

Roofing Supplies 1,100 960

Equipment 6,000

Accumulated Depreciation 1,200 200

Accounts Payable 1,400

Unearned Revenue 300 170

I. Spy, Capital 7,000

I. Spy, Drawing 600

Service Revenue 3,000 170

Salaries Expense 700 350

Miscellaneous Expense 200

Totals 12,900 12,900

Supplies Expense 960

Depreciation Expense 200

Salaries Payable 350

Totals 1,680 1,680

Balance Sheet

Adjusted Income

Trial Balance Adjustments Trial Balance Statement

Steps in Preparing a Worksheet

2. Enter the Adjustments in the Adjustments Columns

Enter adjustment

amounts, total

adjustments columns,

and check for equality.

(a)

(a)

(b)

(b)

(d)

(d)

(c)

(c)

LO 1 Prepare a worksheet.

Add additional

accounts as

needed.

Adjustments Key:

(a) Supplies used.

(b) Depreciation expense.

(c) Service revenue earned.

(d) Salaries accrued.

Chapter

4-8

Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash 2,500 2,500

Accounts Receivable 1,800 1,800

Roofing Supplies 1,100 960 140

Equipment 6,000 6,000

Accumulated Depreciation 1,200 200 1,400

Accounts Payable 1,400 1,400

Unearned Revenue 300 170 130

I. Spy, Capital 7,000 7,000

I. Spy, Drawing 600 600

Service Revenue 3,000 170 3,170

Salaries Expense 700 350 1,050

Miscellaneous Expense 200 200

Totals 12,900 12,900

Supplies Expense 960 960

Depreciation Expense 200 200

Salaries Payable 350 350

Totals 1,680 1,680 13,450 13,450

Balance Sheet

Adjusted Income

Trial Balance Adjustments Trial Balance Statement

Steps in Preparing a Worksheet

LO 1 Prepare a worksheet.

3. Complete the Adjusted Trial Balance Columns

Total the adjusted

trial balance columns

and check for equality.

(a)

(a)

(b)

(b)

(d)

(d)

(c)

(c)

Chapter

4-9

Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash 2,500 2,500

Accounts Receivable 1,800 1,800

Roofing Supplies 1,100 960 140

Equipment 6,000 6,000

Accumulated Depreciation 1,200 200 1,400

Accounts Payable 1,400 1,400

Unearned Revenue 300 170 130

I. Spy, Capital 7,000 7,000

I. Spy, Drawing 600 600

Service Revenue 3,000 170 3,170 3,170

Salaries Expense 700 350 1,050 1,050

Miscellaneous Expense 200 200 200

Totals 12,900 12,900

Supplies Expense 960 960 960

Depreciation Expense 200 200 200

Salaries Payable 350 350

Totals 1,680 1,680 13,450 13,450 2,410 3,170

Balance Sheet

Adjusted Income

Trial Balance Adjustments Trial Balance Statement

Steps in Preparing a Worksheet

LO 1 Prepare a worksheet.

4. Extend Amounts to Financial Statement Columns

Extend all revenue and expense

account balances to the income

statement columns.

(a)

(a)

(b)

(b)

(d)

(d)

(c)

(c)

Chapter

4-10

Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash 2,500 2,500 2,500

Accounts Receivable 1,800 1,800 1,800

Roofing Supplies 1,100 960 140 140

Equipment 6,000 6,000 6,000

Accumulated Depreciation 1,200 200 1,400 1,400

Accounts Payable 1,400 1,400 1,400

Unearned Revenue 300 170 130 130

I. Spy, Capital 7,000 7,000 7,000

I. Spy, Drawing 600 600 600

Service Revenue 3,000 170 3,170 3,170

Salaries Expense 700 350 1,050 1,050

Miscellaneous Expense 200 200 200

Totals 12,900 12,900

Supplies Expense 960 960 960

Depreciation Expense 200 200 200

Salaries Payable 350 350 350

Totals 1,680 1,680 13,450 13,450 2,410 3,170 11,040 10,280

Balance Sheet

Adjusted Income

Trial Balance Adjustments Trial Balance Statement

Steps in Preparing a Worksheet

LO 1 Prepare a worksheet.

4. Extend Amounts to Financial Statement Columns

Extend all asset, liability, and

equity account balances to the

balance sheet columns.

(a)

(a)

(b)

(b)

(d)

(d)

(c)

(c)

Chapter

4-11

Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash 2,500 2,500 2,500

Accounts Receivable 1,800 1,800 1,800

Roofing Supplies 1,100 960 140 140

Equipment 6,000 6,000 6,000

Accumulated Depreciation 1,200 200 1,400 1,400

Accounts Payable 1,400 1,400 1,400

Unearned Revenue 300 170 130 130

I. Spy, Capital 7,000 7,000 7,000

I. Spy, Drawing 600 600 600

Service Revenue 3,000 170 3,170 3,170

Salaries Expense 700 350 1,050 1,050

Miscellaneous Expense 200 200 200

Totals 12,900 12,900

Supplies Expense 960 960 960

Depreciation Expense 200 200 200

Salaries Payable 350 350 350

Totals 1,680 1,680 13,450 13,450 2,410 3,170 11,040 10,280

Net Income 760 760

Totals 3,170 3,170 11,040 11,040

Balance Sheet

Adjusted Income

Trial Balance Adjustments Trial Balance Statement

Steps in Preparing a Worksheet

LO 1 Prepare a worksheet.

5. Total Columns, Compute Net Income (Loss)

Compute Net income or Net loss.

(a)

(a)

(b)

(b)

(d)

(d)

(c)

(c)

Chapter

4-12

Net income is shown on a work sheet in the:

a. income statement debit column only.

b. balance sheet debit column only.

c. income statement credit column and balance

sheet debit column.

d. income statement debit column and balance

sheet credit column.

Review Question

Steps in Preparing a Worksheet

LO 1 Prepare a worksheet.

Chapter

4-13

Income statement is prepared from the

income statement columns.

Balance sheet and owners equity statement

are prepared from the balance sheet columns.

Companies journalize and post adjusting entries.

Preparing Financial Statements from a Worksheet

LO 1 Prepare a worksheet.

Worksheet

Chapter

4-14

Preparing Financial Statements from a Worksheet

LO 1 Prepare a worksheet.

Revenues 3,170 $

Service revenues

Expenses

Salaries expense 1,050 $

Supplies expense 960

Depreciation expense 200

Miscellaneous expense 200

Total expenses 2,410

Net income 760 $

Undercover Roofing

Income Statement

For the Month Ended March 31, 2008

b. Prepare an income statement for the month ended

March 31, 2008.

Chapter

4-15

Preparing Financial Statements from a Worksheet

LO 1 Prepare a worksheet.

b. Prepare an owners equity statement for the month

ended March 31, 2008.

I. Spy, Capital, March 1 7,000 $

Add: Net income 760

Less: Drawings (600)

I. Spy, Capital, March 31 7,160 $

Undercover Roofing

Statement of Owner's Equity

For the Month Ended March 31, 2008

Chapter

4-16

Preparing Financial Statements from a Worksheet

LO 1 Prepare a worksheet.

b. Prepare a balance sheet as of March 31, 2008.

Current assets

Cash 2,500 $

Accounts receivable 1,800

Roofing supplies 140

Total current assets 4,440

Property, plant, and equipment

Equipment 6,000

Less: Accumulated depreciation 1,400 4,600

Total assets 9,040 $

Current liabilities

Accounts payable 1,400 $

Salaries payable 350

Unearned revenue 130

Total current liabilities 1,880

Owner's equity

I. Spy, Capital 7,160

Total liabilities and owner's equity 9,040 $

Liabilities and Owner's Equity

Assets

Undercover

Roofing

Balance Sheet

March 31, 2008

Chapter

4-17

The adjusting entries are prepared from the

adjustments columns of the worksheet.

Journalizing and posting of adjusting entries

follows the preparation of financial

statements when a worksheet is used.

Preparing Adjusting Entries from a Worksheet

LO 1 Prepare a worksheet.

Adjusting Entries

Chapter

4-18

Preparing Financial Statements from a Worksheet

LO 1 Prepare a worksheet.

c. Journalize the adjusting entries from the

adjustments columns of the worksheet.

Account Title Ref. Debit Credit

Mar. 31 Supplies expense 960

Roofing supplies 960

Depreciation expense 200

Accumulated depreciation 200

Unearned revenue 170

Service revenue 170

Salaries expense 350

Salaries payable 350

Date

Chapter

4-19

At the end of the accounting period, the company

makes the accounts ready for the next period.

Closing the Books

LO 2 Explain the process of closing the books.

Illustration 4-5

Chapter

4-20

Closing entries formally recognize, in the general

ledger, the transfer of

net income (or net loss) and

owners drawing

to owners capital.

Closing the Books

LO 2 Explain the process of closing the books.

Only at the end of the annual accounting period.

Chapter

4-21

Closing the Books

LO 2 Explain the process of closing the books.

Illustration 4-6

Owners Capital is a

permanent account; all

other accounts are

temporary accounts.

Owners Drawing is closed

directly to Capital and not

to Income Summary

because Owners Drawing

is not an expense.

Note:

Chapter

4-22

Service revenue 3,170

Income summary 3,170

Income summary 2,410

Salary expense 1,050

Supplies expense 960

Depreciation expense 200

Income summary 760

I. Spy, Capital 760

I. Spy, Capital 600

I. Spy, Drawing 600

Miscellaneous expense 200

d. Journalize the closing entries from the financial

statement columns of the worksheet.

Closing the Books

LO 2 Explain the process of closing the books.

Closing

Entries

need

to be

Posted

Chapter

4-23

Purpose is to prove the equality of the permanent

account balances after journalizing and posting of

closing entries.

Preparing a Post-Closing Trial Balance

LO 3 Describe the content and purpose of a post-closing trial balance.

Account Titles Dr. Cr.

Cash 2,500 $

Accounts Receivable 1,800

Roofing Supplies 140

Equipment 6,000

Accumulated Depreciation 1,400 $

Accounts Payable 1,400

Salaries payable 350

Unearned Revenue 130

I. Spy, Capital 7,160

Totals 10,440 $ 10,440 $

Trial Balance

Post-Closing

All temporary accounts

will have zero balances.

Chapter

4-24

Summary of the Accounting Cycle

1. Analyze business transactions

2. Journalize the

transactions

6. Prepare an adjusted trial

balance

7. Prepare financial

statements

8. Journalize and post

closing entries

9. Prepare a post-closing

trial balance

4. Prepare a trial balance

3. Post to ledger accounts

5. Journalize and post

adjusting entries

Illustration 4-12

LO 4 State the required steps in the accounting cycle.

Chapter

4-25

Correcting entries

are unnecessary if the records are error-free.

are made whenever an error is discovered.

must be posted before closing entries.

Instead of preparing a correcting entry, it is possible

to reverse the incorrect entry and then prepare the

correct entry.

Correcting EntriesAn Avoidable Step

LO 5 Explain the approaches to preparing correcting entries.

Chapter

4-26

BE4-9 At Batavia Company, the following errors were

discovered after the transactions had been journalized and

posted. Prepare the correcting entries.

1. A collection on account from a customer was recorded as a

debit to Cash and a credit to Service Revenue for $780.

Correcting EntriesAn Avoidable Step

LO 5 Explain the approaches to preparing correcting entries.

Cash 780 Incorrect

entry

Service revenue 780

Cash 780 Correct

entry

Accounts receivable 780

Service revenue 780

Correcting

entry

Accounts receivable 780

Chapter

4-27

BE4-9 At Batavia Company, the following errors were

discovered after the transactions had been journalized and

posted. Prepare the correcting entries.

2. The purchase of supplies on account for $1,570 was recorded

as a debit to Supplies and a credit to Accounts Payable $1,750.

Correcting EntriesAn Avoidable Step

LO 5 Explain the approaches to preparing correcting entries.

Supplies 1,750 Incorrect

entry

Accounts payable 1,750

Supplies 1,570 Correct

entry

Accounts payable 1,560

Accounts payable 180

Correcting

entry

Supplies 180

Chapter

4-28

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Presents a snapshot at a point in time.

To improve understanding, companies group

similar assets and similar liabilities together.

Assets Liabilities and Owners Equity

Current assets Current liabilities

Long-term investments Long-term liabilities

Property, plant, and equipment Owners (Stockholders) equity

Intangible assets

Illustration 4-17

Standard Classifications

Chapter

4-29

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Assets that a company expects to convert to

cash or use up within one year or the

operating cycle, whichever is longer.

Operating cycle is the average time it takes

from the purchase of inventory to the

collection of cash from customers.

Current Assets

Chapter

4-30

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Companies usually list current asset accounts in the order

they expect to convert them into cash.

Illustration 4-19

Current Assets

Chapter

4-31

Cash, and other resources that are reasonably

expected to be realized in cash or sold or

consumed in the business within one year or the

operating cycle, are called:

a. Current assets.

b. Intangible assets.

c. Long-term investments.

d. Property, plant, and equipment.

Review Question

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Chapter

4-32

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Investments in stocks and bonds of other companies.

Investments in long-term assets such as land or

buildings that a company is not currently using in its

operating activities.

Long-Term Investments

Illustration 4-20

Chapter

4-33

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Long useful lives.

Currently used in operations.

Depreciation - allocating the cost of assets to a

number of years.

Accumulated depreciation - total amount of

depreciation expensed thus far in the assets

life.

Property, Plant, and Equipment

Chapter

4-34

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Illustration 4-21

Property, Plant, and Equipment

Chapter

4-35

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Assets that do not have physical substance.

Intangible Assets

Illustration 4-22

Chapter

4-36

Patents and copyrights are

a. Current assets.

b. Intangible assets.

c. Long-term investments.

d. Property, plant, and equipment.

Review Question

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Chapter

4-37

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Obligations the company is to pay within the

coming year.

Usually list notes payable first, followed by

accounts payable. Other items follow in order

of magnitude.

Liquidity - ability to pay obligations expected

to be due within the next year.

Current Liabilities

Chapter

4-38

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Illustration 4-23

Current Liabilities

Chapter

4-39

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Obligations a company expects to pay after one year.

Long-Term Liabilities

Illustration 4-24

Chapter

4-40

Which of the following is not a long-term

liability?

a. Bonds payable

b. Current maturities of long-term obligations

c. Long-term notes payable

d. Mortgages payable

Review Question

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Chapter

4-41

The Classified Balance Sheet

LO 6 Identify the sections of a classified balance sheet.

Proprietorship - one capital account.

Partnership - capital account for each partner.

Corporation - Capital Stock and Retained Earnings.

Owners Equity

Illustration 4-25

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Excel Solutions To CasesDokument32 SeitenExcel Solutions To Cases박지훈Noch keine Bewertungen

- Project Mangement FullDokument20 SeitenProject Mangement FullggyutuygjNoch keine Bewertungen

- Buying and MerchandisingDokument155 SeitenBuying and MerchandisingMJ100% (2)

- Sample Problems On Relevant CostsDokument9 SeitenSample Problems On Relevant CostsJames Ryan AlzonaNoch keine Bewertungen

- Case Study #4:: Defining Standard Projects at Global Green Books PublishingDokument3 SeitenCase Study #4:: Defining Standard Projects at Global Green Books PublishingHarsha ReddyNoch keine Bewertungen

- Banking Financial Institutions.Dokument18 SeitenBanking Financial Institutions.Jhonrey BragaisNoch keine Bewertungen

- Group Discussions PointsDokument8 SeitenGroup Discussions PointsmrkhandhediaNoch keine Bewertungen

- How The Johnson and Johnson Brand Does Has Positioned Itself in ConsumerDokument4 SeitenHow The Johnson and Johnson Brand Does Has Positioned Itself in ConsumerAreej Choudhry 5348-FMS/BBA/F18Noch keine Bewertungen

- Organisational CultureDokument26 SeitenOrganisational CultureAditi Basnet100% (1)

- Case Bloomsbury Capital NCDokument39 SeitenCase Bloomsbury Capital NCashmangano0% (1)

- Erika Xim Paola Santos BSBA (Marketing) - III BA 170 - 4Dokument4 SeitenErika Xim Paola Santos BSBA (Marketing) - III BA 170 - 4XimPao SaintNoch keine Bewertungen

- E CommerceDokument10 SeitenE CommerceShruti SinghNoch keine Bewertungen

- Strategic Management (MGMT 2301) : The Cost Leadership StrategyDokument8 SeitenStrategic Management (MGMT 2301) : The Cost Leadership StrategyDusmahomedNoch keine Bewertungen

- Entrepreneurship Past Papers Solved MCQsDokument11 SeitenEntrepreneurship Past Papers Solved MCQsShahbaz NoorNoch keine Bewertungen

- Case Study Project Income Statement BudgetingDokument186 SeitenCase Study Project Income Statement BudgetingKate ChuaNoch keine Bewertungen

- Audit Planning NotesDokument30 SeitenAudit Planning NotesTinoManhangaNoch keine Bewertungen

- Business Environment Factors, Incoterms Selection and Export PerformanceDokument16 SeitenBusiness Environment Factors, Incoterms Selection and Export PerformanceMinh LêNoch keine Bewertungen

- Exercises OnDokument5 SeitenExercises OnPrasanth GummaNoch keine Bewertungen

- BP010 Business and Process StrategyDokument13 SeitenBP010 Business and Process StrategyparcanjoNoch keine Bewertungen

- GMI Currenex ManualDokument30 SeitenGMI Currenex ManualsarakalineNoch keine Bewertungen

- MGT 210Dokument19 SeitenMGT 210FAYAZ AHMEDNoch keine Bewertungen

- ECON 1000 Exam Review Q41-61Dokument5 SeitenECON 1000 Exam Review Q41-61Slock TruNoch keine Bewertungen

- 8 Step GemDokument5 Seiten8 Step GemDhananjay YarrowsNoch keine Bewertungen

- Best Practices For Work-At-Home (WAH) Operations: Webinar SeriesDokument24 SeitenBest Practices For Work-At-Home (WAH) Operations: Webinar SeriesHsekum AtpakNoch keine Bewertungen

- Sarthak Gajjar: ObjectiveDokument2 SeitenSarthak Gajjar: ObjectivesarthakNoch keine Bewertungen

- Organizational StructureDokument2 SeitenOrganizational StructureSinthya Chakma RaisaNoch keine Bewertungen

- Reed Supermarkets: A New Wave For CompetitorsDokument46 SeitenReed Supermarkets: A New Wave For CompetitorsAhsan JavedNoch keine Bewertungen

- Just Us! CafeDokument3 SeitenJust Us! CafeAditya WibisanaNoch keine Bewertungen

- Practice Examination in Auditing TheoryDokument28 SeitenPractice Examination in Auditing TheoryGabriel PonceNoch keine Bewertungen

- Simple and Compound InterestDokument22 SeitenSimple and Compound InterestNadeth DayaoNoch keine Bewertungen