Beruflich Dokumente

Kultur Dokumente

Bahan Kuliah Accounting Theory Presentation

Hochgeladen von

Vilgia DelarhozaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bahan Kuliah Accounting Theory Presentation

Hochgeladen von

Vilgia DelarhozaCopyright:

Verfügbare Formate

Eddy R.

Rasyid

Andalas University

The Future of Financial Reporting:

From the Early Nineteenth Century to

the Recent Global Crisis

Prof. Eddy R.Rasyid

Drs. Akt [UGM], MCom-Hons [Uwoll], PhD [Uwoll]

Universitas Andalas

Eddy R.Rasyid

Andalas University

Resume

Birth: Bukittinggi

1979-1984: Drs.Akt [UGM]

1990-1996: MCom(Hons) & PhD[Uni of Wollongong, Australia

1996-1997: Director, Centre for Accounting Development (PPA) FE

Unand

1997-2002: Head Dept. of Accounting

2000-2004: Executive Director QUE Program, Accounting Dept.

2002-2006: Director of MM FE Unand

2006-2010: Head of IAI KAPd Educational Development

2008-2010: Head of IAI KAPd Organisational Development

Audit Committee PT Semen Padang

Member of Higher Education Board (DPT) Dikti

Eddy R.Rasyid

Andalas University

Outline

During the 19

th

Century accounting

Early Twentieth Century: Accounting by

Norms

1929 Crash: Norms Challenged

1998 and then the Recent Global Crises:

Swing Back?

Finally: Issues in the Future

Eddy R.Rasyid

Andalas University

Introduction

Eddy R.Rasyid

Andalas University

Introduction

The recent accounting and auditing

failures have received much attention.

Institutional or individual failures? Or both?

Attempting to look briefly at the changes

happened from the early nineteenth

century to the recent era and what

responds made.

Eddy R.Rasyid

Andalas University

The Era of 19

th

Century

Eddy R.Rasyid

Andalas University

Accounting Practices Emerged

Reports of accounts including profit and loss

records have been in practices since 1600.

However, the evolution of accounting from book-

keeping was there in the era of 19

th

century.

In this era, profit was conceptualised as the

growth assets, while the concepts of costs and

income were yet not there.

The emergence of joint ventures in UK where

investors put their money lead to the significance

of periodical reports.

Eddy R.Rasyid

Andalas University

Separation of Income with Capital

The separation of capital with income started as the emergence of

corporation.

According to Scott (2006)*, it is in this era a long transition period

started: from accounting as a controlling system with which

businessman could control their business, to accounting as a

system providing information for investors who have not involved in

the management of the corporation.

A common interest between investors and the company lead to a

need of trustworthy information.

This circumstances encouraged the emergence of auditing practices

and a need to regulate accounting.

WR Scott, Financial Accounting Theory, fourth edition, Pearson, 2006, h. 2.

Eddy R.Rasyid

Andalas University

UK Companies Act 1844

The UK Companies Act 1844 requires that

balance sheet for investors to be audited.

Consequently, accounting practices had to

consider the Act. For example, devidend has to

be taken from profit and accounts have to be

audited by independent persons.

However, at that time any person could perform

auditing.

Companies Act 1844 together with other

regulation together with Industrial Revolution

have lead to a need of accounting professional

standards.

Eddy R.Rasyid

Andalas University

Industrial Revolution: USA

At the end of 19

th

Century, Industrial Revolution reached USA.

It is followed by the move of accounting development.

The introduction of corporate income tax in 1909 in US encouraged

such an awareness on the importance of income measurement.

Managers then started to reduce amortisation from income.

However, prior to the 1929 stock market crash followed by a great

depression, accounting had just minimally regulated (unregulated)

Following the 1934 Securities Exchange Act , there was a formation

of the Securities and Exchange Commission (SEC) with the prime

focus is to protect the interests of investors by issuing regulation that

is based on disclosures.

SEC is accountable to ensure that all investors will have relevant

information on companies issuing and trading their stocks.

Eddy R.Rasyid

Andalas University

Early Twentieth Century:

Accounting by Norms

Early Twentieth Century:

Accounting by Norms

Eddy R.Rasyid

Andalas University

In The Earlier

As mentioned before, in the early 20

th

century accounting has not

yet much regulated.

Instead, accounting practices were predominantly lead by norms.

Accounting practices are very normative.

In April 1909, American Association of Public Accountants

established a Special Committee on Accounting Terminology.

However, the Committee is just:

to collate and arrange accounting words and phrases and show

in connection with each the varying usages to which they are

put. This committee will not attempt to determine the correct

or even the preferable usage where more than one is in

existence (Zeff 1971, p. 112).

Shyam Sunder, Minding our manners: Accounting as social norms,

The British Accounting Review, 37 (December 2005) 367-387.

Eddy R.Rasyid

Andalas University

Nature of Norms

Norms of a group are shared (common knowledge)

expectations of its members about the behavior of others

Etiquette, dress, table manners, grammar, language, customary

law, private associations

Objective of norms is observable behavior, not

unobservable beliefs

Must be a consensus, not just majority support

A new entry of norms becomes respectable by attracting

a following, not by enforced authority

Eddy R.Rasyid

Andalas University

The Memorandum

A memorandum on auditing procedures was prepared by

the American Institute of Accountants, in 1918.

The memorandum approved by the Federal Trade

Commission (FTC), and originally published in the

Federal Reserve Bulletin, labeled A Tentative Proposal

Submitted by the Federal Reserve Board for the

Consideration of Banks, Bankers, and Banking

Associations; Merchants, Manufacturers, and

Associations of Manufacturers; Auditors, Accountants,

and Associations of Accountants.

The intent was to coordinate the evolution of norms, and

not to impose and enforce a standard.

Eddy R.Rasyid

Andalas University

Evolution of Norms

In 1918, the American Institute of Accountants appointed a Special

Committee on Interest in Relation to Cost to address a lively

controversy on imputed interest as part of the cost of production

The Committees recommendation against inclusion of imputed

interest in cost of production, approved at the annual meeting of the

Institute, does not become accepted as an accounting norm

The Institute appoints a special committee on the standardization of

accounting procedure to consider all questions of procedure

brought before it, and to make recommendations from time to time

on vexed questions in the hope that ultimately there may be

established something approaching uniformity of procedure

throughout the country

The charge suggests facilitation to form norms, not legislation of

standards. During its eleven-year tenure (1918-1929), the

Committee produced six reports, and none was submitted for an

official stamp of approval of the Institutes membership

Eddy R.Rasyid

Andalas University

Mechanism to Identify the Norms

The absence of authoritative standards of accounting did not mean

that the world of accounting had less order.

Active mechanisms the accountants used to identify the norms of

their profession

Journal of Accountancy and the CPA Journal served as forums for

active, even feisty debates on accounting and auditing.

During 1920-29, the Librarian of the Institute issued 33 special

bulletins on topics referred to them, without the authority of the

Institute.

In 1931, the Institute published a 126-page book Accounting

Terminology, a compilation of accounting terms and their definitions as

a matter of advice, not authority.

Throughout the 1920s and into 1930s, a committee of the Institute

worked in close cooperation with a committee of Robert Morris

Associates, an organization of bank loan officers, to respond to inquiries

submitted to them.

Eddy R.Rasyid

Andalas University

1929 Crash:

Norms Challenged

Eddy R.Rasyid

Andalas University

Loss of Credibility

The stock market crash of 1929

Severe economic depression that followed, precipitated

another crash

Loss of credibility of norms of accounting, and the formal

or informal mechanisms by which these norms evolved

and were sustained

Too many had lost wealth, livelihoods, even lives

Financial reporting wrong doing were very deep, people

lost trust in the social contract

Shyam Sunder, Social Norms Versus Standards of Accounting, in M. Dobija and Susan Martin, eds., General

Accounting Theory: Towards Balanced Development, pp. 157-177. Cracow, Poland: Cracow University of

Economics, 2005.

Eddy R.Rasyid

Andalas University

Moving [or Swing .?]

Since the enactment of the securities laws in the

early 1930s, the U.S. has seen a steady shift in

financial reporting

From business and professional norms towards

legislated written standards enforced by threats of

explicit punishment for violators

This shift altered virtually all aspects of

accounting (including accounting education)

The recent events can be seen as a

consequence of the policy decisions of the past

seven decades (Sunders 2006).

Eddy R.Rasyid

Andalas University

The Norms Does Not Work

Politicians responded the only way they could

and introduced federal securities laws and

regulations (to override the states)

In the following seven decades, accounting and

audit failures have been interpreted as evidence

that norms do not work;

Norms were gradually shifted to the back burner,

and accounting standards gradually rose to

dominate corporate financial reporting

Eddy R.Rasyid

Andalas University

Norms Not Well Defined

Social conventions and norms are rarely well defined,

vary in time and space, require an extended socialization

process to learn and understand.

They carry a penumbra of uncertainty about them.

Substantial but incomplete overlap among the beliefs of

the individual members of a group about its norms.

Norms evolve in small, almost imperceptible steps, by

processes that are not well understood.

This evolution is decentralized, difficult to predict the

future direction.

Eddy R.Rasyid

Andalas University

Pressure to Write Standards

While the evolutionary process is not solid, the

lack of definition and our poor understanding of

how norms evolve make them less transparent

During periods of crises, political or bureaucratic

decision makers feel pressured to write new

standards rather than continue to rely on

existing (recently discredited) norms and

business practices

Eddy R.Rasyid

Andalas University

Working with Regulation

In 1933-34, U.S. Congress give SEC the legal authority to regulate

financial reporting

The first three decades: mostly codified the existing practices

Gradually, these efforts shifted from identification of conventions or

social norms to promulgation of standards with increasing power of

enforcement

Increasingly assertive nomenclature of the three private sector

organizations to write accounting rules

The Committee on Accounting Procedures Accounting

Research Bulletins (1948-59)

The Accounting Principles Boards Opinions (1959-73)

The FASBs Financial Accounting Standards (1973 to present).

(IASBs International Financial Reporting Standards being the latest addition to this trend)

Eddy R.Rasyid

Andalas University

Standardisation Going On

Accountants shifted their allegiance from norms to

authoritative promulgation.

Profession now views standardisation as a measure of

progress (the thicker the book the better).

There has been little research and debate on merits and

consequences of standardization in accounting.

By 2000, the social norms have few advocates left, most

favor legislated standards (with legal enforcement)

model for financial reporting.

Eddy R.Rasyid

Andalas University

The Goodness of Formal Standards

Written standards: concrete, salient, published, easily

disseminated, easy to find, specified formally with some

precision, can be analyzed and discussed line and verse.

They come into existence at a specific time, through a known

and understood institutional process that may allow the

participation of the constituents.

When the environment changes, a systematic process is

available to formulate changes and submit them to a well-

specified process for possible promulgation.

Democratic appeal of a transparent institutional mechanism

for setting standards.

Formal written standards appeal to our sense of good

housekeeping

Specified processes for enforcement of violations

Eddy R.Rasyid

Andalas University

Limits of Written Standards

Following accidents and scandals, the rules

were not clear is a popular defense.

Recent evidence suggest that formal standards

do any better than social norms of financial

reporting remains elusive

The case for the efficacy of enforced standards

remains to be made

Eddy R.Rasyid

Andalas University

Consequences

More competition in the market for audit services has

progressively replaced judgment by mechanical

processes.

The competition has driven up the demand for both

accounting as well as auditing standards.

FASB/IASB are busy writing reams of standards

Standards have replaced the sense of personal

responsibility. (the result is Enron, WorldCom)

But the investment bankers and lawyers are busy

designing new transactions to get around the accounting

treatments of today

Eddy R.Rasyid

Andalas University

And Then..

Standards relieve mature accountant of the responsibility for

making intellectually sound decisions

Standards prevent thoughtful analysis by auditor because

they are used in legal proceedings (cannot oppose standards)

Auditors thought standards will help defend what they do, but

they do not

No other profession with claim to respect allows itself to be so

driven by standards as accountants have (under the false

impression that it is better for them)

That they think that standardization of accounting and auditing

will solve the problem, when it might actually be the major

source of the problem

Eddy R.Rasyid

Andalas University

1998 and then the Recent Global Crises:

Swing Back?

Eddy R.Rasyid

Andalas University

Global Crises: Shaking

After almost 50 years working with standards

Asian Crisis 1998

Enron

DotCom Crisis 2002

2008 Global Crisis: Started by Red September

Taking over of Fannie Mae and Freddie Mac by the Federal

Government

Merrill Lynch sold to Bank of America

Lehman Brothers files for bankruptcy

The crisis crossing over the continent and passing

Indonesia

US and other governments bail out

Eddy R.Rasyid

Andalas University

Estimated cost of the recent crisis

Country Period Estimated Cost as

Percent of

GDP

United States 1980s 2.5%

Japan 1990s 20.0%

Norway 1987-89 4.0%

..

..

Korea 1997- 60.0%

Indonesia 1997- 80.0%

..

USA 2007-2010 $700 billion=5.0%

$1600 billion=11.4%

$3200 billion= 22.8%

Source: Howell E. J ackson Harvard Law School, October 2008

Eddy R.Rasyid

Andalas University

What was Going On?

Increasingly complex and opaque financial

products

Unsound risk management practice

Inadequate structural reform

Eddy R.Rasyid

Andalas University

Then ..

Financial engineering to get around the

rules (Enrons SPVs)

Reasonable body of rule might be devised

to deal with a given set of transactions

No rules can be devised when

transactions are continually redesigned to

get around a slowly adapting body of rules

Eddy R.Rasyid

Andalas University

.. And Then

Clients actively played audit firms against one

another to lower their audit fees

The amount and quality of the work done by the

auditors was not observable to the clients

Competition for audit services would not sustain a

price to make auditing self-supporting

Auditors responded by a new business model to

survive in this cut rate environment

Eddy R.Rasyid

Andalas University

Revised Business Model

Aggressive pricing of audit services

Cut labor-intensive substantive testing, and replace it by

cheaper analytical reviews

Use audit service as foot in the clients door to sell

consulting services

Share consulting revenue with audit partners

Use consulting revenue to pay for any additional audit

liability coverage arising from reduced substantive

testing

Reduce the pay for fresh graduates

Eddy R.Rasyid

Andalas University

The Impacts: Post Crisis

Business and corporate environment has

significantly changed

Regulatory Change

Strengthening Financial Reporting Governance

Revisiting Risk and Control Reporting

Globalisation of war against frauds and

misconduct.

Eddy R.Rasyid

Andalas University

Finally ..

Enron and Worldcom, 2 of the 20 largest companies in the US,

declared bankruptcy as a result of frauds. Not just in the US!

CEOs and CFOs disclaiming responsibility for fraud.

Arthur Andersen no longer in business.

Part of the decline in US stock market since 2001 has been

blamed on overstated earnings and a lack of confidence in the

financial reporting process.

Accounting self-regulation process determined to be deficient.

Perception that accounting rules are there for gaming.

Eddy R.Rasyid

Andalas University

Then . Life Changing

Sarbanes-Oxley Act 2002 (hot issue until

recently)

Moving from historical cost principle to fair

value.

Financial statement emphasises on

Balance Sheet (instead of Income

Statement) SWINGING BACK?

Moving from rules based standards to

principles based on principles

Eddy R.Rasyid

Andalas University

Sarbanes-Oxley (SOX)

Sarbanes-Oxley was passed to help ensure the accuracy of financial reporting

by public traded corporations. Sarbanes-Oxley seeks to improve the

accuracy of financial reporting of public traded corporations. The Act:

Mandates corporate governance reforms. Requires corporations to establish

audit committees, precludes publicly audited clients from engaging an accounting

firm that audits financial statements for non-audit services, and requires

corporations to disclose all material off-balance sheet transactions.

Enhances the role and independence of audit committees. The Act requires

that audit committees pre-approve all audit and non-audit services, receive

regular reports from the auditor on accounting treatments, be responsible for

oversight of the auditor, and be independent of the company who registers and

sells securities.

Creates public accounting firm restrictions. The Act creates a new

Accounting Oversight Board to set standards and supervise accounting firms,

requires all audit or review working papers to be retained for 7 years that support

conclusions in audit reports, requires the rotation of audit partners every 5 years,

and requires audit team members to wait a year before accepting employment

with a client in key financial positions.

Eddy R.Rasyid

Andalas University

Samples of the Parts

Section 302 Required the CEO and CFO to personally sign off on the

appropriateness of the firm's financial statement. Sentences for perjury increased

dramatically.

Section 407 At least one member of the audit committee be a "financial expert"

caused many firms to scramble to find new directors at the same time that they

were facing a crisis in the market for directors insurance. Note: Enron AC Chair

was a financial expert!

Section 404 of the Act has two parts:

Section 404(a) describes managements responsibility for establishing and

maintaining an adequate internal control structure and procedures for

financial reporting. It also outlines managements responsibility for assessing

the effectiveness of internal control over financial reporting.

Section 404(b) describes the independent auditors responsibility for

attesting to and reporting on managements internal control assessment.

Section 409 - REAL-TIME ISSUER DISCLOSURES Each issuer reporting

under section 13(a) or 15(d) shall disclose to the public on a rapid and current

basis such additional information concerning material changes in the financial

condition or operations of the issuer, in plain English, which may include trend

and qualitative information and graphic presentations, as the Commission

determines, by rule, is necessary or useful for the protection of investors and in

the public interest.

Eddy R.Rasyid

Andalas University

Post-Enron Regulatory Change:

Focus on Financial Reporting and Internal Control

Eddy R.Rasyid

Andalas University

Paradigm shift of control and risks

The new approach to controlling business risks may be characterized by the new rules of prevent

and monitor and build in quality as opposed to the old rules of detect and correct and

inspect in quality.

Old Paradigm New Paradigm

Only AUDITORS and TREASURY

are concerned about risks and

controls

EVERYONE, including operations, is

concerned about managing business

risks

FRAGMENTATION Every function

and department does its own thing

(SILO MANAGEMENT)

Business risk assessment and control

are FOCUSED and COORDINATED

with senior level OVERSIGHT

NO BUSINESS RISK CONTROL

POLICY

FORMAL BUSINESS RISK CONTROL

POLICY approved by management and

the board

INSPECT for and DETECT business

risk and REACT to it

ANTICIPATE and PREVENT business

risk at the source and MONITOR

business risk controls continuously

Ineffective PEOPLE are the primary

source of business risk

Ineffective PROCESSES are the

primary source of business risk

Eddy R.Rasyid

Andalas University

Governance over financial reporting:

parties involves in the organization

Eddy R.Rasyid

Andalas University

SAS 112

Reinforces the responsibility of management for internal control systems.

The auditors cannot be a part of the internal control process for preparing

the financial statements during the audit.

44

The management

provides reasonable assurance about

the entitys objectives with regard to

reliability of financial reporting,

effectiveness and efficiency of

operations, and compliance with

applicable laws and regulations.

responsible for making decisions

concerning costs to be incurred (and

related benefits) in relation to the

existence of significant deficiencies or

material weaknesses .

The auditors

must evaluate internal control

must evaluate identified control

deficiencies and determine whether they

are significant deficiencies or material

weaknesses.

If significant deficiencies or material

weaknesses are identified, they must be

reported in writing to management and

those charged with governance (Audit

Committee).

Opine on Consolidated Financial

Statements on 2008.

Eddy R.Rasyid

Andalas University

Deficiency

A control deficiency exists when the design or operation of a

control does not allow management or employees, in the normal

course of performing their assigned functions, to prevent or detect

misstatements on a timely basis.

A significant deficiency is a control deficiency(ies) that adversely

affects the entitys ability to initiate, authorize, record, process or

report financial data reliably such that there is a remote likelihood

that a misstatement of the entitys financial statements will not be

prevented from being detected.

A material weakness is a significant deficiency(ies) that results in

more than a remote likelihood that a material misstatement of the

financial statements will not be prevented or detected.

Eddy R.Rasyid

Andalas University

CEO/CFO Certifications under BAPEPAM Regulation

46

CEO/CFO certification is intended to explicitly

reinforce that certifying officers (CEO/CFO and other

Principal Officers) are DIRECTLY responsible for:

Preparation and disclosure of financial report

Adequacy, accuracy of the financial report

Internal control system in the corporation

Eddy R.Rasyid

Andalas University

Global Convergence on Accounting Standard: IFRS

EQUIVALENCE

PRINCIPLES RULES CONVERGENCE

ISOLATION

Source : Internal Control Reporting Compliance: The UK and European Regulatory Scene, by Robert Hodgkinson, Executive Director-Technical of

The Institute of Chartered Accountants in England and Wales, CPE Conference on SOX 404, Dorchester, UK, 10 May 2007

Eddy R.Rasyid

Andalas University

Moving from Rules Based

towards Principles Based Standards

(SWINGING BACK?)

to general definitions of economics-based

concepts on the other end.

Continuum ranging from highly rigid standards

on one end

Eddy R.Rasyid

Andalas University

Example: Goodwill

Previous practice:

Goodwill is to be amortized over a 40 life until it is fully

amortized.

New IAS rule:

Goodwill is not amortized.

Any recorded goodwill is to be tested for impairment and written down to

its current fair value on an annual basis.

Eddy R.Rasyid

Andalas University

Example: Fixed Asset

Two choices of accounting policy:

cost model), or

revaluation model

Applied on all fixed assets within a same

group

Eddy R.Rasyid

Andalas University

Cost Model

Cost model: After recognition as an asset,

an item of property, plant and equipment

shall be carried at its cost less any

accumulated depreciation and any

accumulated impairment losses.

Eddy R.Rasyid

Andalas University

Revaluation Model

After recognition as an asset, an item of

property, plant and equipment whose fair value

can be measured reliably shall be carried at a

revalued amount, being its fair value at the date

of the revaluation less any subsequent

accumulated depreciation and subsequent

accumulated impairment losses. Revaluations

shall be made with sufficient regularity to ensure

that the carrying amount does not differ

materially from that which would be determined

using fair value at the balance sheet date.

Eddy R.Rasyid

Andalas University

Finally:

Issues in the Future

Eddy R.Rasyid

Andalas University

Issues in the Future

Several of them:

Principles versus Comparability Contradict?

Accounting standards help investors in making better

decision! Really?

Fair value!? Really applicable? Just a rhetorical

device?

Fair value!? Damaging companies?? [especially in

Indonesia]

Economists will be really happy?

Independence of [Indonesia] standard setting body.

Eddy R.Rasyid

Andalas University

Adopted IAS/IFRS 2008

1. IAS 2 Inventories PSAK 14

2. IAS 10 Events after B/S date PSAK 8

3. IAS 11 Construction contracts PSAK 34

4. IAS 16 Property, plant & equipment PSAK 16

5. IAS 17 Leases PSAK 30

6. IAS 18 Revenues PSAK 23

7. IAS 19 Employee benefits PSAK 24

8. IAS 23 Borrowing costs PSAK 26

9. IAS 32 Financial instrument presentation PSAK 50

10. IAS 39 Financial instrument recognition and measurement PSAK

55

11. IAS 40 Investment property PSAK 13

Eddy R.Rasyid

Andalas University

Pernyataan Pencabutan SAK

PSAK 32 Akuntansi Kehutanan

PSAK 35: Akuntansi Pendapatan Jasa

Telekomunikasi

PSAK 37: Akuntansi Penyelenggaraan

Jalan Tol

Eddy R.Rasyid

Andalas University

Program Kerja DSAK 2009

Adopsi:

IAS 1 PSAK 1

IAS 27 Consolidated and separate F/S PSAK 4

IFRS 8 Segment reporting PSAK 5

IAS 21 The effects of changes in foreign exchange rates PSAK 10 & 11

IAS 31 Interests in joint ventures PSAK 12

IAS 26 Accounting and reporting by retirement benefits plans PSAK 18

IAS 38 Intangible assets PSAK 19

IFRS 3 Business combination PSAK 22

IAS 8 Acconting policies, changes in accounting estimates and errors PSAK 25

IFRS 4 Insurance contracts PSAK 28 & 36

IFRS 6 Exploration for and evaluation of mineral resources PSAK 29 & 34

IAS 12 Income taxes PSAK 46

IAS 36 Impairment of assets PSAK 48

Eddy R.Rasyid

Andalas University

THANK YOU!!!

AND

SEE YOU AGAIN

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Presidential CaseDokument9 SeitenPresidential CaseVilgia Delarhoza0% (1)

- E-Commerce AIR ASIADokument22 SeitenE-Commerce AIR ASIAVilgia DelarhozaNoch keine Bewertungen

- Foreign Exchange MarketDokument18 SeitenForeign Exchange MarketVilgia DelarhozaNoch keine Bewertungen

- The Pursuit of Conceptual FrameworkDokument1 SeiteThe Pursuit of Conceptual FrameworkVilgia DelarhozaNoch keine Bewertungen

- Income and RevenueDokument14 SeitenIncome and RevenueVilgia DelarhozaNoch keine Bewertungen

- Financial Statements I, Vilgia Dan HannaDokument18 SeitenFinancial Statements I, Vilgia Dan HannaVilgia DelarhozaNoch keine Bewertungen

- Regular Contact With The CompanyDokument5 SeitenRegular Contact With The CompanyVilgia DelarhozaNoch keine Bewertungen

- External RelationDokument6 SeitenExternal RelationVilgia DelarhozaNoch keine Bewertungen

- Is ABC Suitable For Your CompanyDokument23 SeitenIs ABC Suitable For Your CompanyVilgia Delarhoza0% (1)

- How To Sell Our Product LCC 1Dokument21 SeitenHow To Sell Our Product LCC 1Vilgia DelarhozaNoch keine Bewertungen

- Ford SWOT Analysis 2013Dokument3 SeitenFord SWOT Analysis 2013Vilgia DelarhozaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Transfer Pricing ThesisDokument72 SeitenTransfer Pricing Thesisfahadsiddiqui100% (1)

- Audit 2 - Concept Map For InvestmentsDokument4 SeitenAudit 2 - Concept Map For InvestmentsPrecious Recede100% (1)

- COSTING - With AnswersDokument6 SeitenCOSTING - With AnswersAndrea Nicole MASANGKAYNoch keine Bewertungen

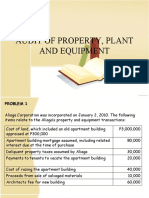

- Audit of Property, Plant and EquipmentDokument26 SeitenAudit of Property, Plant and EquipmentJoseph SalidoNoch keine Bewertungen

- Securities On The BlockchainDokument26 SeitenSecurities On The BlockchainDai Dong Dao PhapNoch keine Bewertungen

- 446A1Dokument4 Seiten446A1San LiNoch keine Bewertungen

- Special Purpose VehiclesDokument2 SeitenSpecial Purpose VehiclesSanthoshNoch keine Bewertungen

- Unofficial: Institute of Business Management (Iobm) Fall 2012 ScheduleDokument52 SeitenUnofficial: Institute of Business Management (Iobm) Fall 2012 ScheduleAryan SmartyNoch keine Bewertungen

- (Leland Yeager) The Fluttering VeilDokument465 Seiten(Leland Yeager) The Fluttering Veilvkozaeva100% (1)

- Audit of Receivables Lecture NotesDokument10 SeitenAudit of Receivables Lecture NotesDebs Fanoga100% (1)

- Investment Analysis and Portfolio Management Assignment - I: Submitted ToDokument14 SeitenInvestment Analysis and Portfolio Management Assignment - I: Submitted ToAmit BatraNoch keine Bewertungen

- Merrill Lynch Case Study - PrajDokument19 SeitenMerrill Lynch Case Study - PrajAmit Shrivastava100% (3)

- Presentation On Certificate of Deposits: Treasury ManagementDokument23 SeitenPresentation On Certificate of Deposits: Treasury ManagementShankeyNoch keine Bewertungen

- Assurance Services (14th Ed.) - Boston, MA: Pearson Learning SolutionsDokument4 SeitenAssurance Services (14th Ed.) - Boston, MA: Pearson Learning SolutionsBrandy Craig100% (2)

- PayPal NoticeDokument7 SeitenPayPal Noticemichaelkan1Noch keine Bewertungen

- Yatin PDFDokument2 SeitenYatin PDFMONU100% (1)

- Cash Credit: OverviewsDokument1 SeiteCash Credit: OverviewsViswa KeerthiNoch keine Bewertungen

- Chapter 01: Multinational Financial Management: An Overview: Page 1Dokument23 SeitenChapter 01: Multinational Financial Management: An Overview: Page 1Dang ThanhNoch keine Bewertungen

- Current Liabilities and Contingencies: True-FalseDokument8 SeitenCurrent Liabilities and Contingencies: True-FalseCarlo ParasNoch keine Bewertungen

- Cyanoacrylate AdhesiveDokument4 SeitenCyanoacrylate AdhesivePathan Sameer KhanNoch keine Bewertungen

- 2010 MBL3 Research Report Mezgebe Mihretu WoldegebrielDokument154 Seiten2010 MBL3 Research Report Mezgebe Mihretu WoldegebrielSally YoussefNoch keine Bewertungen

- Creating and Measuring Shareholder WealthDokument4 SeitenCreating and Measuring Shareholder WealthMANSINoch keine Bewertungen

- Education Loans From Public Sector Banks: Project ReportDokument62 SeitenEducation Loans From Public Sector Banks: Project ReportSomesh YadaNoch keine Bewertungen

- Bölümlere Göre Ki̇tap Li̇stesi̇Dokument94 SeitenBölümlere Göre Ki̇tap Li̇stesi̇NanaNanaNoch keine Bewertungen

- Laporan Keuangan Tengah Tahunan 30 Jun 2019 - INTP - 300719 PDFDokument126 SeitenLaporan Keuangan Tengah Tahunan 30 Jun 2019 - INTP - 300719 PDFAhmad RafifNoch keine Bewertungen

- NWP Second Term Test 2018Dokument15 SeitenNWP Second Term Test 2018Ashley GazeNoch keine Bewertungen

- Practice Problems Far Chap 1-5Dokument13 SeitenPractice Problems Far Chap 1-5Micah Danielle S. TORMONNoch keine Bewertungen

- Answers For Chapter 4Dokument3 SeitenAnswers For Chapter 4Wan MP WilliamNoch keine Bewertungen

- Internship Report On Zarai Taraqiati Bank LTD (ZTBL)Dokument48 SeitenInternship Report On Zarai Taraqiati Bank LTD (ZTBL)bbaahmad8986% (7)

- 1588756021-1693-Allegis Servicses Final PrintDokument9 Seiten1588756021-1693-Allegis Servicses Final PrintDehradun MootNoch keine Bewertungen