Beruflich Dokumente

Kultur Dokumente

Fdi in Retail

Hochgeladen von

anilpkumar3Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fdi in Retail

Hochgeladen von

anilpkumar3Copyright:

Verfügbare Formate

FDI IN RETAIL

Amit Agrawal

Monichandra allamneni

STRUCTURE OFINDIAN RETAILSECTOR

The High Court of Delhi defined the term retail' as a sale for final

consumption in contrast to a sale for further sale or processing (i.e.

wholesale).i.e A sale to the ultimate consumer.

Retailing is the last link that connects the individual consumer with the

manufacturing and distribution chain.

Retailer is involved in the act of selling goods to the individual consumer at

a margin of profit.

The retail industry in India is mainly divided into:

1) Organized :

Organized retailing refers to trading activities undertaken by licensed retailers,

that is, those who are registered for sales tax, income tax, etc. These include

the corporate-backed hypermarkets and retail chains, and also the privately

owned large retail businesses.

2) Unorganized Retailing:

Unorganized retailing, refers to the traditional formats of low-cost retailing, for

example, the local kirana shops, owner manned general stores,paan/beedi

shops, convenience stores, hand cart and pavement vendors, etc.

Retailing contributes about 15% of India 's gross domestic

product (GDP) and 8%ofemployment (Patibandla 2012).

The size of India's retail sector is currently estimated at around

$450 billion and organised retail accounts for around 5% of

the total market share.

PRESENT FDI POLICYFOR RETAILSECTOR

IN INDIA

The Ministry of Commerce and Industry, Government of India

is the nodal agency for motoring and reviewing the FDI policy

on continued basis and changes in sect oral policy/ sect oral

equity cap.

The FDI policy is notified through Press Notes by the

Secretariat for Industrial Assistance (SIA), Department of

Industrial Policy and Promotion (DIPP).The foreign investors

are free to invest in India, except few sectors/activities, where

prior approval from the RBI or Foreign Investment Promotion

Board (=FIPB') would be required.

1. India will allow FDI of up to 51% in .multi-brand. sector.

2.Single brand retailers such as Apple and Ikea, can own 100% of their Indian

stores, up from previous cap of 51%.

3. FDI up to 100% for cash and carry wholesale trading and export trading

allowed under the automatic route.

4.The retailers (both single and multi-brand) will have to source at least 30% of

their goods from small and medium sized Indian suppliers.

5.. All retail stores can open up their operations in population having over

1million.Out of approximately 7935 towns and cities in India, 55 suffice such

criteria.

6..Multi-brand retailers must bring minimum investment of US$ 100 million. Half

of this must be invested in back-end infrastructure facilities such as cold

chains, refrigeration, transportation, packaging etc. to reduce post-harvest

losses and provide remunerative prices to farmers.

7. The opening of retail competition (policy) will be within parameters of state

laws and regulations.

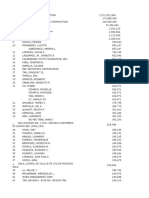

GLOBALRETAILSCENERAIO :

LIMITATIONS IN INDIAN RETAILTRADE

1.Infrastructure: Lack of adequate storage facilities cause

heavy losses to farmers in terms of wastage in quality and

quantity of produce in general.

2. Intermediaries dominate the value chain : Indian farmers

realize only 1/3rd of the total price paid by the final

consumer, as against 2/3rd by farmers in nations with a

higher share of organized retail.

POSITIVE ASPECTS OFFDI IN RETAIL

1.More investments in the end to end supply chain and world

class cold storage facilities.

2.Low spillage and wastage of farm produce during the

transportation.

3.Better options and offers to the consumer

4.Increase in economic growth by dealing in various

international products

5.According to the UPA Government 1 million (10 lakh)

employment will be created in next three years

6.Billion dollars will be invested in Indian retail market

7.Agriculture related people will get good price for their

goods

NEGATIVE ASPECTS OF FDI IN RETAIL

1.Will affect 50 million small merchants in India

2.Profit distribution and investment ratios are not fixed

3.An economically backward class person may suffer from

price raise in future.

4.Retailer faces heavy loss of employment and profit

5.Workers safety and policies are not mentioned clearly

6.Inflation may be increased

7.Small farmers will not benefit by FDI policy

8.The rural India will remain deprived of the services of

foreign players.

CONCLUSION

1.Small retailers will not be crowded out, but would strengthen their market

positions by modernizing their working

2.Growing economy and increasing purchasing power would compensate the

loss of market share of the

unorganized sector retailers.

3.There will be initial and desirable displacement of middlemen involved in

the supply chain of farm produce, but they would be absorbed by increase

in the food processing sector induced by organized retailing.

4.Innovative government measures could mitigate adverse effects on small

retailers

5.Farmers will get an opportunity of direct marketing and hence get better

price for their produce..

6.Consumers would certainly gain from enhanced competition, better quality,

variety of branded goods and attractive discount offers.

7.The state revenues will rise on account of larger business as well as

recorded sales.

8.The Competition Commission of India would need to play a proactive role to

avoid unfair competition in retail industry

Das könnte Ihnen auch gefallen

- Foreign Direct InvestmentDokument5 SeitenForeign Direct InvestmentBhavya GandhiNoch keine Bewertungen

- FDI in Retail A Necessary Evil October 2012.Dokument4 SeitenFDI in Retail A Necessary Evil October 2012.Praveen Kumar ThotaNoch keine Bewertungen

- Introduction To FDIDokument22 SeitenIntroduction To FDIPRATIKNoch keine Bewertungen

- Fdi in Retail IndustryDokument8 SeitenFdi in Retail IndustryJacky ShamdasaniNoch keine Bewertungen

- Raw Data On FDI Retail PolicyDokument16 SeitenRaw Data On FDI Retail PolicySuresh ParajuliNoch keine Bewertungen

- C CC YcDokument8 SeitenC CC YcAmitabh KumarNoch keine Bewertungen

- FDI IN RETAIL: A PerspectiveDokument5 SeitenFDI IN RETAIL: A PerspectiverakeshNoch keine Bewertungen

- Retail Sector in India PDFDokument12 SeitenRetail Sector in India PDFjayNoch keine Bewertungen

- FDI in Multi Brand - Gain or Pain For Traditional Retailers?Dokument2 SeitenFDI in Multi Brand - Gain or Pain For Traditional Retailers?royston2304Noch keine Bewertungen

- All ChaptersDokument8 SeitenAll ChaptersDrShailly SinghNoch keine Bewertungen

- Multi Brand Retailing in IndiaDokument30 SeitenMulti Brand Retailing in IndiasupriyaNoch keine Bewertungen

- FDI in IndiaDokument100 SeitenFDI in IndiaAlok Prakash0% (1)

- Advantages of Allowing FDI in RetailDokument6 SeitenAdvantages of Allowing FDI in RetailAbaddon Bipul PurkaitNoch keine Bewertungen

- FDI in Retail Sector in India - A Global PerspectiveDokument19 SeitenFDI in Retail Sector in India - A Global PerspectiveHoney VashishthaNoch keine Bewertungen

- Impact of Fdi On India Retail TradeDokument18 SeitenImpact of Fdi On India Retail TradeRaja SekharNoch keine Bewertungen

- Synopsis: FDI in Retail Is A Boon For IndiaDokument6 SeitenSynopsis: FDI in Retail Is A Boon For Indiaamit.18.singh2466Noch keine Bewertungen

- FDI in RetailDokument12 SeitenFDI in RetailVignesh Arun S KNoch keine Bewertungen

- Fdi DataaDokument3 SeitenFdi DataaSagar SatujaNoch keine Bewertungen

- Reliance DigitalDokument70 SeitenReliance Digitaldingaringring75% (4)

- Foreign Direct Investment in IndiaDokument5 SeitenForeign Direct Investment in IndiaDisha JaniNoch keine Bewertungen

- Project OnDokument15 SeitenProject OnRahul BhansaliNoch keine Bewertungen

- Government Clears 51% FDI in Retail, 49% in Aviation: Email This Article Print This Article Share On RedittDokument5 SeitenGovernment Clears 51% FDI in Retail, 49% in Aviation: Email This Article Print This Article Share On RedittPrabhat Kumar SinghNoch keine Bewertungen

- Implications of FDI in Indian RetailDokument8 SeitenImplications of FDI in Indian RetailAvishkarzNoch keine Bewertungen

- Advantages of FDI in Retail Sector in IndiaDokument16 SeitenAdvantages of FDI in Retail Sector in IndiaAmolnanavareNoch keine Bewertungen

- Fdi PPPDokument7 SeitenFdi PPPDebamalya BhattacharyaNoch keine Bewertungen

- Swot Analysison Fdi in Retail sector02PPTDokument10 SeitenSwot Analysison Fdi in Retail sector02PPTsaurabhpandey30Noch keine Bewertungen

- FDI in Retailing: Divisions of Retail SectorDokument6 SeitenFDI in Retailing: Divisions of Retail Sectorrangamanisriraghav07Noch keine Bewertungen

- Retail Marketing in IndiaDokument32 SeitenRetail Marketing in IndiaJai GuptaNoch keine Bewertungen

- Impact of Foreign Direct Investment On Retail Shops: Dr. Prasanna KumarDokument7 SeitenImpact of Foreign Direct Investment On Retail Shops: Dr. Prasanna KumarShyamSunderNoch keine Bewertungen

- Final ThesisDokument314 SeitenFinal ThesisDatta PravalNoch keine Bewertungen

- Objectives:: Foreign Direct InvestmentDokument5 SeitenObjectives:: Foreign Direct InvestmentTroy DavisNoch keine Bewertungen

- Reliance DigitalDokument42 SeitenReliance Digitalmgajen100% (3)

- Legal Obligations of Retail IndustryDokument14 SeitenLegal Obligations of Retail IndustryArzit PaulNoch keine Bewertungen

- Critical Appraisal of FDI On Retail MarketDokument11 SeitenCritical Appraisal of FDI On Retail MarketJayesh MahajanNoch keine Bewertungen

- Foreign Direct Investment in Indian Retail Sector - A SWOT AnalysisDokument2 SeitenForeign Direct Investment in Indian Retail Sector - A SWOT Analysissandesh2429Noch keine Bewertungen

- Prepared By: Vikram SolankiDokument8 SeitenPrepared By: Vikram SolankiHarsh SoniNoch keine Bewertungen

- Write Up 2Dokument3 SeitenWrite Up 2Raviraj PrajapatNoch keine Bewertungen

- FDI in Retail: Misplaced Expectations and Half-Truths by Sukhpal SinghDokument7 SeitenFDI in Retail: Misplaced Expectations and Half-Truths by Sukhpal SinghShihabudeenkunjuNoch keine Bewertungen

- Union Cabinet Approves 51% FDI in Multi-Brand RetailDokument17 SeitenUnion Cabinet Approves 51% FDI in Multi-Brand RetailDeepak NairNoch keine Bewertungen

- Reliance DigitalDokument70 SeitenReliance Digitalmastionline121Noch keine Bewertungen

- Topic 6 - Organized Vs Unorganized Retailing in IndiaDokument17 SeitenTopic 6 - Organized Vs Unorganized Retailing in IndiaAnuvind SRNoch keine Bewertungen

- Reliance DigitalDokument71 SeitenReliance Digitalmastionline121Noch keine Bewertungen

- Foreign Direct Investment: The Big Bang in Indian Retail: VSRD-IJBMR, Vol. 2 (7), 2012, 327-337Dokument11 SeitenForeign Direct Investment: The Big Bang in Indian Retail: VSRD-IJBMR, Vol. 2 (7), 2012, 327-337pawan_019Noch keine Bewertungen

- Indian Retail Sector: Presented By: Suraj Patil, Shakti Dash, Vidwaita SachanDokument26 SeitenIndian Retail Sector: Presented By: Suraj Patil, Shakti Dash, Vidwaita SachanShakti DashNoch keine Bewertungen

- Civil Services Mentor October 2011 WWW - UpscportalDokument100 SeitenCivil Services Mentor October 2011 WWW - UpscportalNSRajasekarNoch keine Bewertungen

- A Swot Analysis of Fdi in Indian Retail SectorDokument7 SeitenA Swot Analysis of Fdi in Indian Retail SectorMALLIKARJUNNoch keine Bewertungen

- Iimt PaperDokument9 SeitenIimt PaperuttkarshNoch keine Bewertungen

- Reliance DigitalDokument70 SeitenReliance Digitalram86.san89Noch keine Bewertungen

- MonginisDokument68 SeitenMonginisrabi_kungleNoch keine Bewertungen

- Reliance DigitalDokument27 SeitenReliance DigitalvaibhavNoch keine Bewertungen

- The Retail Industry IndiaDokument2 SeitenThe Retail Industry IndiaRajvindRathiNoch keine Bewertungen

- Foreign Direct Investment in Indian Retail Sector: Strategic Issues and ImplicationsDokument26 SeitenForeign Direct Investment in Indian Retail Sector: Strategic Issues and ImplicationsBV3SNoch keine Bewertungen

- Retailing in IndiaDokument17 SeitenRetailing in IndiabashaprabhuNoch keine Bewertungen

- Presented By: Ayushi Kumari Bba 2 Year (Group 1) Integral UniversityDokument22 SeitenPresented By: Ayushi Kumari Bba 2 Year (Group 1) Integral UniversityRaj VermaNoch keine Bewertungen

- Fdi in Multi - Brand Retail: Is It The Need of The HOUR??: ZenithDokument39 SeitenFdi in Multi - Brand Retail: Is It The Need of The HOUR??: ZenithKapil DharmaniNoch keine Bewertungen

- Retail Trends and Its Role in India: Mr. Syed Khaja Faculty in Management GFGC Humanabad Dist: BidarDokument21 SeitenRetail Trends and Its Role in India: Mr. Syed Khaja Faculty in Management GFGC Humanabad Dist: BidarSyedNoch keine Bewertungen

- Main Doc EM Grocery Business UpdateDokument16 SeitenMain Doc EM Grocery Business UpdateEmaad KarariNoch keine Bewertungen

- What Is Foreign Direct InvestmentDokument2 SeitenWhat Is Foreign Direct InvestmentpplahaneNoch keine Bewertungen

- A Practical Approach to the Study of Indian Capital MarketsVon EverandA Practical Approach to the Study of Indian Capital MarketsNoch keine Bewertungen

- FFM Group 3 PresentationDokument5 SeitenFFM Group 3 Presentationlohithagowda122001Noch keine Bewertungen

- WNG Capital LLC Case AnalysisDokument8 SeitenWNG Capital LLC Case AnalysisMMNoch keine Bewertungen

- Alternate Revenue Sources For The Bank, Idbi Bank - MarketingDokument36 SeitenAlternate Revenue Sources For The Bank, Idbi Bank - Marketingwelcome2jungle100% (2)

- Corporate Finance - GBV PDFDokument12 SeitenCorporate Finance - GBV PDFHesty SaniaNoch keine Bewertungen

- Public Borrowing and Debt ManagementDokument53 SeitenPublic Borrowing and Debt Managementaige mascod100% (1)

- Dr. Shakuntala Misra National Rehabilitation University LucknowDokument6 SeitenDr. Shakuntala Misra National Rehabilitation University LucknowashwaniNoch keine Bewertungen

- Revision Questions 2020 Part IVDokument31 SeitenRevision Questions 2020 Part IVJeffrey KamNoch keine Bewertungen

- 1BUSN603 CGRM Assessment 2 Case Study Semester 1 2017Dokument6 Seiten1BUSN603 CGRM Assessment 2 Case Study Semester 1 2017Ṁysterious ṀarufNoch keine Bewertungen

- GE - McKinsey Matrix - ADKDokument3 SeitenGE - McKinsey Matrix - ADKViz PrezNoch keine Bewertungen

- Business Plan: "The Tooth Fairy"Dokument34 SeitenBusiness Plan: "The Tooth Fairy"Nepotu Tina100% (1)

- ATC/Xcel Joint ApplicationDokument148 SeitenATC/Xcel Joint ApplicationErik LorenzsonnNoch keine Bewertungen

- Principles and Practices of BankingDokument63 SeitenPrinciples and Practices of BankingPaavni SharmaNoch keine Bewertungen

- G-U2Dokument19 SeitenG-U2Belay Mekonen100% (1)

- Brown, Walter W. or Annabelle P. BrownDokument20 SeitenBrown, Walter W. or Annabelle P. BrownJan Ellard CruzNoch keine Bewertungen

- FEMADokument51 SeitenFEMAChinmay Shirsat50% (2)

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDokument105 SeitenIntroduction To Corporate Finance: Mcgraw-Hill/IrwinVKrishna Kilaru100% (2)

- Business Plan Template InteractiveDokument18 SeitenBusiness Plan Template InteractiveAlex GranderNoch keine Bewertungen

- 3.sesbreno Vs CaDokument2 Seiten3.sesbreno Vs CaJesa FormaranNoch keine Bewertungen

- Tax 1 CorpDokument16 SeitenTax 1 CorpRen A Eleponio0% (1)

- ISE 2014 Chapter 2 - Cost Concepts: Fixed/Variable Costs - If Costs Change Appreciably WithDokument15 SeitenISE 2014 Chapter 2 - Cost Concepts: Fixed/Variable Costs - If Costs Change Appreciably WithTesfuNoch keine Bewertungen

- Application of Information Technology in Insurance SectorDokument2 SeitenApplication of Information Technology in Insurance Sectorjauharansari3Noch keine Bewertungen

- Class 1Dokument24 SeitenClass 1Kat GuptaNoch keine Bewertungen

- Additional Income Tax QuizzerDokument3 SeitenAdditional Income Tax QuizzerJolina Mancera0% (1)

- Provisions and ReservesDokument9 SeitenProvisions and Reservessujan BhandariNoch keine Bewertungen

- Bangladesh Economy Prospects and ChallengesDokument27 SeitenBangladesh Economy Prospects and ChallengesMahbubul Islam KoushickNoch keine Bewertungen

- Annual-Report Eng 2010Dokument48 SeitenAnnual-Report Eng 2010AlezNgNoch keine Bewertungen

- 457 (1) - HR Outsourcing in IndiaDokument86 Seiten457 (1) - HR Outsourcing in IndiaNitu Saini100% (1)

- DTAA Between India and MauritiusDokument16 SeitenDTAA Between India and MauritiusAdv Aastha MakkarNoch keine Bewertungen

- Asian Paints Limited Dividend Distribution PolicyDokument3 SeitenAsian Paints Limited Dividend Distribution PolicyJaiNoch keine Bewertungen

- Ac557 W3 HW HBDokument2 SeitenAc557 W3 HW HBHasan Barakat100% (2)