Beruflich Dokumente

Kultur Dokumente

Sap CIN Overview

Hochgeladen von

Albet Straus0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

608 Ansichten103 SeitenSap Cin Overview Training

Copyright

© © All Rights Reserved

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenSap Cin Overview Training

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

608 Ansichten103 SeitenSap CIN Overview

Hochgeladen von

Albet StrausSap Cin Overview Training

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 103

1

Country India Version (CIN)

Overview

Presented By

K V Ramesh Babu

2

India Localization

1. India Legal Requirements Overview

2. Logistics Process Overview ( Procurement & Sales )

3. Utilization

4. Extended Withholding Tax

Contents

3

India Localization Requirements -

Overview

CENVAT (Excise)

VAT / LST / CST

Service Tax

Cenvat Credit

4

India Localization Requirements -

Overview

Central Value Added Tax (Excise)

VAT (LST) / Central Sales Tax

Service Tax

Cenvat Credit

5

Central Value Added Tax (Excise)

What is Cenvat?

Tax on manufacturing or production of goods in India

Goods having 4M Characteristics are covered under this

- Movable (No duty on Immovable Goods)

- Marketable (Bought and Sold)

- Manufactured (Come up out of a process)

- Mentioned (Central Excise Tariff)

Every legal entity that manufactures or produces excisable goods

shall pay the duty leviable on such goods

Materials are classified under various tariff headings (Chapter Ids).

This will be subject to change in every financial budget.

Goods consumed in-house also liable for payment of duty

6

Central Value Added Tax (Excise)

What is the basis of charge?

Tax Rates Provided by GOI and are subject to change after each

year based on the budget

Exemption to pay duty on intermediate products in the

following cases

- used for manufacturing capital goods

- used for manufacturing final goods which are eligible for

Cenvat credit

Duty shall be paid when the goods are removed from the

place of production or place of storage

Excise duty not payable on goods manufactured for

exports or deemed exports

Goods manufactured in factory for use within the factory

for repairs of machinery installed within the factory are exempt from

excise.

7

Central Value Added Tax

(Excise)

Types of Excise Duty

Basic Excise Duty (BED)

Additional Excise Duty (AED)

Special Excise Duty (SED)

Education Cess on Excise

Secondary and Higher education Cess

8

Central Value Added Tax

(Excise)

Duty Calculation

Specific duty It is calculated on the basis of certain unit,

length, weight etc. Eg. cigarette

Ad valorem duty It is based on the value of the goods

Duty based on tariff value The Govt. may fix tariff value from

time to time. The duty will be calculated as percentage of tariff

value fixed by the Govt. and not on assessable value

9

Central Value Added Tax (Excise)

Duty Calculation Considerations

Transaction value is the price actually paid or payable for the

goods and includes any other amount that the buyer is liable

to pay in connection with such sale

Any additional consideration flowing directly or indirectly to

the seller from the buyer should be added to the transaction

value.

Cost of production is not relevant for the purpose of

determining assessable value.

Assessable value may be lower than the cost price of the

goods.

Goods should be assessed in the form in which they are

removed.

10

Excise Payment Overview

Vendor Plant Customer

Pays Excise Duty Pays Excise Duty for all

outbound goods movement

Claims Cenvat

Pays Excise component to

the Vendor

11

Central Value Added Tax

(Excise)

CENVAT PAYMENT

Duty to be paid by 5

th

of the following month

Duty deposited in bank using TR 6 challan and credited to PLA

Duty is paid by debiting PLA

12

Central Value Added Tax

(Excise)

Excise Registers

Statutory Excise Reporting

Excise Registers

(RG23A & C Part I & Part II,RG1, PLA, RG23D)

Excise Monthly Returns

Bond Registers

License Registers

Running Bond Registers

13

India Localization

Requirements - Overview

CENVAT (Excise)

VAT / LST / CST

Service Tax

Cenvat Credit

14

VAT / Central Sales Tax

How is Sales tax treated in India ?

This is a tax on sale

VAT / LST is charged on sales within the state

Central Sales Tax (CST) is charged on inter-state sales

Any sale would be charged to either VAT or CST but only to one

of them

Every person carrying on any business is required to charge

VAT / CST, on all sales made by him, and pay it to the

Government

VAT / CST shall be charged at the rate in force as on the date

of sale

15

VAT / Central Sales Tax

Tax Impact under VAT System

Rs.

STAGES

I Manufacturer II Wholesaler III Retailer

Selling price

(excl. tax)

100.00 Cost price 100.00 Cost price 120.00

VAT @ 12.5% 12.50 Overheads & profit

@ 20%

20.00 Overheads &

profit @ 20%

24.00

Sale price 112.50 Sale price

(excl. tax)

120.00 Sale price

(excl. tax)

144.00

Tax paid 12.50 VAT @ 12.5% 15.00 VAT @ 12.5% 18.00

Sale price

(incl. Tax)

135.00 Sale price

(incl. Tax)

162.00

Tax paid

(15-12.50)

2.50 Tax paid

(18-15)

3.00

16

CENVAT vs. VAT

Cenvat VAT

Central Value Added Tax State Value Added Tax

Revenue to Central Government Revenue to State Government

Tax on Manufactured Goods Tax on Sale of goods

Single point tax - paid at the first point of goods movement Multi Point Tax payable at each stage of value chain

Credit can be availed Credit can be availed except in case of LST

General CENVAT rate @ 16% with exceptions General VAT rate @ 4% or 12.5% with exceptions

Centrally administered Cenvat Chain cannot be broken on

interstate boundaries

State administered Chain broken on interstate transactions

Cenvat credit can be availed on Services Cenvat credit cannot be availed on Services

17

India Localization Requirements -

Overview

CENVAT (Excise)

VAT (LST) / Central Sales Tax

Service Tax

Cenvat Credit

18

Service Tax

Tax on services rendered

Applicable only on those services which have been notified

by the Government

Tax is payable @ 12 % plus education cess & Higher and

Secondary education cess

Exemptions to persons rendering taxable service below

400,000 INR

Tax to be paid by 5

th

of the next month

Service tax is payable on advances

19

Service Tax

Service Tax Considerations

Service tax is payable on value of services

Value of service is the gross amount charged by the service

provider for the taxable service provided

Any discount/rebate given to customer before accepting the

payment would be deducted from the gross amount

In most of the cases person providing the taxable service is

liable to pay tax

Reimbursement of expenses incurred on behalf of customer

is not taxable

No tax on services which are exported or used for providing

services which are being exported

20

Service Tax

Export of Service

Should be at least partly performed outside India

It is delivered outside India and used outside India

Payment for such services is received in foreign exchange

No tax on services which are exported

21

Service Tax

Import of Service

Should be provided from outside India to a person in India

Service provider does not have a place of business in India

Person receiving such service has a place of business in India

Person receiving such services is liable to pay service tax

Cenvat credit can be utilized for tax payment

Tax paid can be used for availing credit

22

Service Tax

CENVAT Credit on Input Services

Service provider is entitled to take credit of service tax paid on input

services

Credit can be taken only when full payment has been made for the

service

Credit may be taken for service tax and also for education Cess ,

Secondary and Higher Education Cess paid

In case the service provider is engaged in exporting services, he shall

be granted refund of CENVAT on input services

In many cases, various input services will be consumed in the

headquarters/administrative offices of manufacturers and OSPs. In

such cases, the invoices indicating the payment of service tax will be in

the name of such headquarters/ administrative offices. Provision can be

made for availing credit of such service tax, in the premises where

manufacturing activity is undertaken or the premises where the output

services are rendered.

23

Service Tax

Reporting

Half yearly return in form ST-3 to be filed within 25 days from

the end of the half year

Return needs to be accompanied by TR -6 challan evidencing

duty payment

24

India Localization Requirements -

Overview

CENVAT (Excise)

VAT / LST / CST

Service Tax

Cenvat Credit

25

CENVAT Credit

A manufacturer or producer of the final product or provider

of taxable services is entitled to take credit of

Cenvat (Excise)

Education Cess

Secondary and Higher Education Cess

Secondary and Higher Education Cess

Service tax paid on input services

Countervailing Duty

26

CENVAT Credit

What items can be considered for taking Credit?

A manufacturer or producer of the final product or provider of

taxable services is entitled to take credit of CENVAT paid on the

INPUTS used in the manufacturing process

INPUTS include inputs in capital goods manufacture which would

be used further in manufacturing process

Inputs need not be contained in the final product. It should have

been used in the process

27

CENVAT Credit

What items can be considered for taking Credit?

CENVAT paid on the CAPITAL GOODS used in the

manufacturing process

Capital goods should be used in manufacturing process and

not in any office

Service tax and education cess paid on any input service used

in relation to manufacturing process

When capital or inputs are removed as such (i.e. without

using), only the credit availed originally needs to be paid

Inputs are eligible for Cenvat credit even if the intermediate

products are exempt

28

CENVAT Credit

When the Credit may be taken?

Cenvat credit in respect of inputs may be taken immediately on

receipt of the inputs

Input includes all goods, except diesel and petrol / gasoline,

used in relation to the manufacturing whether directly or

indirectly and whether contained in the final product or not

Credit in respect of inputs shall be available whether such

inputs are lying in stock or used in the manufacturing process

29

CENVAT Credit

When the Credit may be taken?

Cenvat credit in respect of capital goods may be taken for an

amount not exceeding 50 % of the duty paid on such capital

goods in the year in which such goods are received and balance

in any subsequent financial year

Cenvat credit in respect of the capital goods shall be allowed

even if such goods have been acquired on lease, hire purchase

or loan agreement

No Cenvat credit shall be allowed on any input or capital good

which is used in the manufacture of exempted goods or in

providing exempted services

30

CENVAT Credit

When the Credit may be taken?

No time limit for availing CENVAT credit

Unutilized Cenvat credit at the year end should be shown

under Loans & Advances in Balance Sheet

Cenvat credit balance should be reviewed at the year end

and any non-utilizable portion should be added to purchase

cost

SSI units ( turnover below 10 million INR) cannot avail

Cenvat credit on inputs but can avail Cenvat credit on Capital

goods. But this credit can be utilized only when SSI unit

becomes liable to pay excise.

31

CENVAT Credit

How the CENVAT credit may be Utilized?

Cenvat credit may be utilized towards payment of

Excise duty on any final product

An amount equal to Cenvat credit taken on inputs if such

inputs are removed as such

An amount equal to Cenvat credit taken on capital goods if

such capital goods are removed as such

Service tax on any output service

32

CENVAT Credit

How the CENVAT credit may be Utilized?

Towards payment of Education cess on excisable goods or on

taxable services

Where any input or input service is used in final product which

is cleared for export, the Cenvat credit in respect of input or input

service so used shall be utilized towards payment of excise duty

on domestic consumption or towards payment of service tax on

output service

Where the adjustment mentioned above is not possible, the

manufacturer shall be allowed a refund of such an amount

33

CENVAT Availment &

Utilization Overview

CENVAT on hold

for Cap Goods

CENVAT Account

VENDOR EXCISE

INVOICE PROCESS

GOODS

RECEIPT

DESPATCH

SALES EXCISE

INVOICE PROCESS

Excise Duty

Payable A/C

PLA A/C

DEPOSIT

FUNDS

IN PLA

ACCOUNT

Debit

PLA Account

SELECT

REGISTER

Excise duty

Utilization

Transaction

ON-LINE TRANSACTIONS

MONTHLY TRANSACTIONS

Debit ED Payable A/c

(Consolidated Entry)

Credit ED Payable A/c

Credit PLA A/c

Credit CENVAT A/c

Debit CENVAT A/c

Debit CENVAT

on-hold A/c

34

India Localization

1. India Legal Requirements Overview

2. Logistics Process Overview ( Procurement & Sales )

3. Utilization

4. Extended Withholding Tax

Contents

35

Logistics Process Overview

Overseas

Customer

Domestic Vendor

Import Vendor

Domestic Vendor

Domestic Customer

Subcontractor

Plant X Plant Y

Depot A Depot B

36

Excise Procurement

Scenarios

Domestic Procurement Process

Subcontracting Process

Stock Transport Process

Imports Purchase

Service Procurement Process

37

Typical Procurement Cycle

Invoice Verification

Payment Processing Requirement Determination

Goods Receipt

Purchase Order Monitoring

Order Processing

Vendor Selection

38

Excise Procurement Scenarios

Domestic Procurement Process

Subcontracting Process

Stock Transport Process

Imports Purchase

Service Procurement Process

39

Domestic Procurement of

Raw Materials

Vendor liable to pay

excise to Govt.

Vendor Excise Invoice

accompanies Goods

GR at Factory Gate

Excise Invoice

Capture

Excise Invoice Post

(Optional)

Excise Stock Part I

Register entry

Excise Invoice Post

CENVAT Part II

Register entry

Vendor Delivery Goods Receipt Excise Invoice

Liability to Vendor

- Price

- Excise

- Other Taxes

- Other Costs

Vendor Invoice

40

Domestic Procurement of

Raw Materials

Accounting Entries

GR Posting

Inventory Account Dr.

GR/IR Clearing Account Cr.

Excise Invoice Posting

Excise Duty A/C Dr.

CENVAT Clearing Account Cr.

CENVAT Onhold A/C ( For Capital Goods) Dr.

Vendor Invoice Posting

CENVAT Clearing A/C Dr.

GR/IR Clearing A/C Dr.

Accounts Payable Cr.

41

Procurement: Cancellation of

CENVAT Credit

It is possible to cancel the CENVAT credit after it has been

availed.

In the first step, the material document has to be cancelled.

This is followed by canceling the CENVAT credit.

42

Procurement: Vendor Returns

Vendor returns possible by creating an excise invoice for Other

movements

Avail the credit for the materials/goods that are received.

Create an excise invoice for the materials/goods returned to the

vendor and pay excise duty by posting this invoice.

43

Procurement: Additional Adjustments

A supplementary excise invoice for extra excise duty sent by a

vendor can be captured and credit availed

CENVAT credit for Materials destroyed, lost, etc. can be written

off

Surrender of credit for the excisable materials which are used

for non-productive purposes

All these are taken care by Excise JV Transaction

44

Procurement: Adjustments & Reversals

Highlights

Flexibility for 100% Compliance

Management of CENVAT Credit for Capital Goods

CENVAT Reversals and Adjustments

One-Step Reversal of Excise Invoice

Scrap

Non-production use

Additional Excise Paid by Vendor

Deposit into PLA through TR6

Cancel Excise Invoice

With Reference to External Document

CENVAT Adjustment

45

Excise Procurement

Scenarios

Domestic Procurement Process

Subcontracting Process

Stock Transport Process

Imports Purchase

Service Procurement Process

46

Subcontracting Process

Input

Output

Challan

FACTORY

Sub contractor

47

Subcontracting Process

A. With out Payment of Duty: Removal of Materials from Factory

Note: Print Immediate

Option to be used

Subcon

Order

Transfer

Posting

Subcon

Challan

Challan

Printing

48

Subcontracting Process

A. With out Payment of Duty : Receipt of materials from subcontractor

Note: Challans on which quantities are

not completely returned have the status

assigned

Goods Receipt

Subcon challan

Reconciliation

Complete

Challan

49

Subcontracting Process

A. With out Payment of Duty : Reversals

Note: Listing Transaction gives list of

Challans due for Reversal

Run Listing

Transaction

Get Material Qty not

returned on Challan

Reverse Credit

availed on Input

Material

50

Subcontracting Process

A. With out Payment of Duty : Recredit

Note: Listing Transaction gives list of

Challans due for Recredit

Run Listing

Transaction

Get Material Qty

subsequently

returned on Challan

Recredit

Reversed Credit

51

Subcontracting Process

B. Under Full Payment of Duty : Transfer Posting of Input Material to Subcon

Note: Excise Invoice

created and Posted

under other Movements

Subcon

Order

Transfer

Posting

Excise

Invoice

Creation

Excise

Invoice

Posting

52

Subcontracting Process

B. Under Full Payment of Duty : Receipt of Material from Subcon

Goods Receipt

Excise

Invoice

Capture

Excise

Invoice

Post

Invoice

Verification

53

Excise Procurement

Scenarios

Domestic Procurement Process

Subcontracting Process

Stock Transport Process

Imports Purchase

Service Procurement Process

54

Stock Transport Process

Plant liable to pay

excise to Govt.

Excise Invoice

accompanies Goods

GR at Plant Gate

Excise Invoice

Capture

Excise Invoice Post

(Optional)

Excise Stock Part I

Register entry

Excise Invoice Post

CENVAT Part II

Register entry

Supplying Plant

Delivery

Goods Receipt

Receiving Plant

Excise Invoice

55

Stock Transport Process

FEATURES

Applicable for Plants in different registration Ids

Assessable value in excise master used for duty computation

EI capture in receiving plant w.r.t

- STO

- GR

Excise Values copied from supplying plant invoice during EI capture

No Inter Plant Billing

Delivery through MM

Stock Transfer

Excise Invoice

Other Movements

56

Excise Procurement

Scenarios

Domestic Procurement Process

Subcontracting Process

Stock Transport Process

Imports Purchase

Service Procurement Process

57

Imports Purchase

Vendor Outside India

Duties to be paid to

Customs

Credit can be claimed

on CVD

Liability to Customs in

India

CD & CVD

GR at Factory Gate

Excise Invoice

Capture

Excise Invoice Post

Excise Stock Part I

Register entry

CENVAT Part 2

Register

Vendor Invoicing

- Price

- Other Costs

Imports PO Commercial Invoice

Goods Receipt &

Excise Invoicing

Invoice Verification

58

Imports Purchase

Accounting Entries

Commercial Invoice Posting

Customs Clearing Dr.

Customs Payable (Commissioner) Cr.

GR Posting

Inventory Account Dr.

GR/IR Clearing Account Cr.

Excise Invoice Posting

Excise Duty A/C Dr.

Customs Clearing Account Cr.

Vendor Invoice Posting

GR/IR Clearing A/C Dr.

Accounts Payable (Vendor) Cr.

59

Excise Procurement

Scenarios

Domestic Procurement Process

Subcontracting Process

Stock Transport Process

Imports Purchase

Service Procurement Process

60

Service Procurement

Service PO

Service Entry &

Acceptance

Invoice Verification

PO for Services

Service Tax, Ecess

and SECESS

Service Provider liable

to Pay ST to Govt.

Additional Detailing of

Individual Services

Performed

Additional Control of

acceptance

Vendor Invoicing

Inclusive of Service

Tax

61

Service Procurement

Vendor Payment FI - JV Utilization

Payment Inclusive of

Service Tax

Transfer to Service

Tax availed accounts

Credit Taken on

availed accounts

Utilization Service Tax

availed against

Service Tax Payable

62

Service Procurement

Accounting Entries

Accounting Entry after Vendor Invoice Verification

Accounts Payable (Vendor) Cr.

GR/IR Clearing Account Dr.

Service Tax Receivable Account Dr.

Education Cess on Service Tax Receivable Account Dr.

Sec.Education Cess on Service Tax Receivable Account Dr.

FI-JV after Vendor Payment to avail Service Tax Credit

Service Tax Availed Account Dr.

Education Cess on Service Tax Availed Account Dr.

Sec.Education Cess on Service Tax Availed Account Dr.

Service Tax Receivable Account Cr.

Education Cess on Service Tax Receivable Account Cr.

Sec.Education Cess on Service Tax Receivable Account Cr

63

Excise Sales Overview

Full Compliance across the

Distribution Process

Removal of Goods

From Factory From Depot

Sale Transfer to Factory

Return to Vendor Transfer to Depot

Return to Customer Transfer to Subcontractor

Sale Transfer to Factory

Return to Vendor Transfer to Depot

Return to Customer Transfer to Subcontractor

64

Excise Sales Scenarios

Sale from Factory

Transfers to Depot

Sale from Depot

Export Sale

65

Excise Sales Scenarios

Sale from Factory

Transfers to Depot

Sale from Depot

Export Sale

66

Sale from Factory

Supplying Plant

Price: 1000

Qty : 10 PC

Duty 16%

+ 160

Excise Invoice

Dispatch

Fortnightly utilization

CENVAT/Part II Register

PLA Register

Debit:

Rs. 160

Excise

Duty

Payable

A/C

67

Sale from Factory

Delivery

Goods Issue

Excise Invoice

No CIN related updates

Update Registers and batch utilization

ED Payable

Utilization

68

Sale from Factory

Posting to Excise duty payable account

Posting to CENVAT accounts for Utilization

Separate Commercial and Excise Invoice

Sales Order Delivery

Proforma

Invoice

Excise

Invoice

Printing

Excise

Invoice

Commercia

l

Invoice

69

Sale from Factory

Single Commercial and Excise Invoice

Sales Order Delivery

Commercia

l

Invoice

Excise

Invoice

Printing

Excise

Invoice

Posting to Excise duty payable account

Posting to CENVAT accounts for Utilization

70

Sale from Factory

Excise Document Flow

Sales Order

Sold to : 2300

Material: 400

Quantity: 5

Delivery

Ship to:

2300

Material:

400

Quantity: 5

Billing

Bill to: 2300

Material:

400

Quantity: 5

Excise

Invoice

Sold to :

2300

Material:

400

Quantity: 5

71

Sale from Factory

Excise Invoice Features

Excise invoice created automatically in background during

creation of billing document

Feature made optional and triggered based on customization

settings

Excise group and Series group automatically determined

based on customization

Provision to print excise invoice immediately after automatic

creation of excise invoice

72

Sale from Factory

Utilization Due List

Listing of all billing documents due for utilization provided

Also includes ability to view,

- Account balances

- Total duty amount needed to utilize the displayed billing

documents

- Deficit, if any

73

Sale from Factory

Batch Utilization

Excise Invoices can be created in Batches

Provision of additional fields in selection screen like,

- Billing Date

- SD Document Category

- Billing Document Category

74

Excise Sales Scenarios

Sale from Factory

Transfers to Depot

Sale from Depot

Export Sale

75

Transfers to Depot

Stock

Transfer

Order

Replishme

nt

Delivery

Proforma

Invoice

Excise

Invoice

Printing

Excise

Invoice

76

Transfers to Depot

Depot Excise Requirements

Distribution of Excisable goods at depot involves maintenance

of RG23D registers.

Incoming Excise Invoice reference is required to be mentioned

on depot Sales Invoice

At the Factory gate, Excise is paid on the declared value of the

goods to be sold at depot.

Depot should charge from the customer the same Excise duty

from that was paid at factory/source.

In case of price escalations at depot the difference needs to be

paid at the factory.

77

Transfers to Depot

Depot Receipts for Stock Transfer

GR made against the delivery note / stock transfer

Excise invoice details directly copied from factory invoice

Loss in transit taken care of

Ship-from can be captured at Excise Invoice for depot.

Multiple P.O.s can be combined in one receipt

Folio number generation can be switched on through

customization

Item details are proposed for stock returns

78

Transfers to Depot

Depot Receipts for Direct Purchases

GR made against the PO

Individual excise invoice details copied from PO item or can

be entered at item level

For imports CVD can be marked

Ship-from can be captured at Excise Invoice for depot.

Multiple P.O.s can be combined in one receipt

Folio number generated based on customization

79

Excise Sales Scenarios

Sale from Factory

Transfers to Depot

Sale from Depot

Export Sale

80

Sale from Depot

Sales Order

Delivery &

PGI

Excise

Invoice

Capture

Commercia

l

Invoice

Selling Price 1000 , Quantity 10, ED @ 16% = 160

RG23D Reduce quantity by 10, Debit 160

81

Sale from Depot

Depot Sales

Separate steps for Excise Invoice create and verification

Option for Single step creation and verification through

customization

Option to cancel excise invoice before verification

Provision to create depot invoice before post goods issue based on

delivery document

Option to restrict incoming excise invoice selection from the same

source of supply

User-exits for unit conversion and Excise / Series group

determination

82

Sale from Depot

Depot Sales: A-Certificate Selection

Pick up the A-certificates relevant for the current removal

A-certificate can be selected along with the corresponding excise

invoice

Multiple A-certificates can be picked up

Splitting of the A-certificate amount across removals not allowed

Separate RG23D entries in the same folio for better tracking

Value gets added up and cumulative excise proposed during

Billing

83

RG23D Register

Material

Receipt in

Depot

Movement /

sale from

depot

Text

Text

Text

Receipt update the quantity and the value in RG23D

The reference / mother invoice details in terms of batches etc captured

Reference to the mother invoice is made

Update goods issue quantity

Excise amount cannot differ from that paid at the first point of goods

movement

84

Depot Operations

Comprehensive solution for Depot functionality

RG23D Maintenance and Printing functionality is available

Provision to receive Internal as well as External Excise

Invoice at Depot.

Close integration with MM and SD processes

85

Excise Sales Scenarios

Sale from Factory

Transfers to Depot

Sale from Depot

Export Sale

86

Export Sale

Supplying

Plant Excise

Invoice

If Exported

under bond

If not exported

under bond

Price 1000, Quantity 10, Duty@ 16% = 160

Update Registers

Debit ED payable a/c 160

Update Cenvat Part II register and PLA register

Fortnightly utilization

87

Export Sale

Excise Bonding Document Flow

Sales Order

Sold to : 2300

Material: 400

Quantity: 5

Delivery

Ship to:

2300

Material:

400

Quantity: 5

Billing

Bill to: 2300

Material:

400

Quantity: 5

Excise

Invoice

Sold to :

2300

Material:

400

Quantity: 5

Bond

Register

Sold to :

2300

Material:

400

Quantity: 5

Capture

Licence

Sold to :

2300

Material:

400

Quantity: 5

Bonds / LOUT / Licence as applicable in the Business process

88

Export Sale

Deemed Export Sales

Sale is marked as Deemed

Excise status of customer gives complete concession

No amount utilization

Use of local excise invoice range based on series group

89

India Localization

1. India Legal Requirements Overview

2. Logistics Process Overview ( Procurement & Sales )

3. Utilization

4. Extended Withholding Tax

Contents

90

Utilization

Monthly Utilization

Facilitates payment of duty accumulated for each month

Features include

Display of pending invoices

Option for Posting date

Posting to a Business area

Selection based on a range of dates

Optionally, Selection based on a range of invoices

Utilization strategy based on customization settings

Posting of TR6 Challan entry to PLA account

91

Utilization

Utilization Due List

Feature to view list of all billing documents due for utilization

Other features include ability to view

- Account balances

- Total duty amount needed to utilize the displayed billing

documents

- Deficit, if any

92

TR6 Challan Posting with PLA Register

Updation

House Bank Own

Create Excise JV - PLA updation

TR6 Challan (J1IH )

PLA Register for Value

Post Accounting document in FI

to post the payment

Excise PLA hold A/c Dr

House Bank A/c Cr

Prepare Cheque & TR 6 Chllan

Enter the Accounting Doct. or

TR6 Challan No., FY,

Plant, Excise Group, etc.,

Allocate the TR6 Challan Amount

as per TR6C i.e. BED / AED / SED

Banker Transfer the

funds toExcise

Authorities and

Acknowledge the

TR 6 Chllan

Update the PLA Register &

Accounting Document Posted

EXCISE PLA A/c Dr

Excise PLA hold A/c Cr

93

Utilization of CENVAT

Total Available

Balances RG23A

Input

Debit Balance

Credit Balance

Is the Balance

Sufficient

NO Yes

Output

RG23A & C Part II

PLA Register

TR6 Challan Payment

Input Credit from Vendor

Material Purchase

Input Credit from Vendor

Capital Purchase (50%)

RG23C

PLA Balance

Perform the Excise

Utilization

Total Excise duty

payable

Excise duty payable on

Customer Invoice

Apportion the payable amount

between the

Registers

RG23A, RG23C & PLA

Post the Utilization

Accounting document generated

& Registers updated

based on Amount apportionment

94

CENVAT Availment & Utilization

Overview

CENVAT on hold

for Cap Goods

CENVAT Account

VENDOR EXCISE

INVOICE PROCESS

GOODS

RECEIPT

DESPATCH

SALES EXCISE

INVOICE PROCESS

Excise Duty

Payable A/C

PLA A/C

DEPOSIT

FUNDS

IN PLA

ACCOUNT

Debit

PLA Account

SELECT

REGISTER

Excise duty

Utilization

Transaction

ON-LINE TRANSACTIONS

MONTHLY TRANSACTIONS

Debit ED Payable A/c

(Consolidated Entry)

Credit ED Payable A/c

Credit PLA A/c

Credit CENVAT A/c

Debit CENVAT A/c

Debit CENVAT

on-hold A/c

95

India Localization

1. India Legal Requirements Overview

2. Logistics Process Overview ( Procurement & Sales )

3. Utilization

4. Extended Withholding Tax

Contents

96

EWT: TDS Overview

Pay Tax to

Government

Issue

Certificates

Deduct Tax

from Vendor

Vendor Vendor

Income tax office

Bank

97

EWT: TDS (Tax Deducted at Source)

Tax is deducted at source from all payments/provisions which

are hit by the TDS provisions of the Act

Some of the above payments/provisions pertain to services

that come within the scope of Tax Deducted at Source

(TDS) under the Indian Income-tax Act, 1961 (Act).

Tax is not deducted from payment for goods

TDS is required to be deducted at the time of payment or

invoice posting whichever is earlier.

The taxes which are so deducted, will then have to be

deposited to the credit of the Indian Government on or before

7

th

of next every month.

The company will have to issue TDS certificates to the

vendors for the tax deducted and also file with the tax office,

Quarterly & Annual Return of the total taxes deducted during

the year under the various sections of the Act.

98

EWT: Vendor TDS

ABC Ltd

Mumbai plant

Vendor

Advance

Invoice

Services

Payment/Challan

Certificate

Vendor

Payment

BANK

Income Tax

Office

Quarterly Returns

99

EWT: Vendor Transactions

Down

Payment

Reverse

Invoice

Invoice

Credit

Memo

Clear DP

Challan

Update

TDS JV

Bank

Challan

Reprint

Certificate

Certificate

Cancel

Certificate

Quarterly

Returns

Cash Journal

Postings

Logistics

Invoice

100

EWT: Customer Interest TDS

ABC Ltd

Mumbai plant

BANK

Income Tax

Office

Certificate

Advance

Interest Payment

Payment/Challan

Customer

Quarterly Returns

101

EWT: Provisions and Adjustments

TDS computed on entries in provisional liability accounts

(GR/IR and SR/IR Accounts)

TDS is computed at each period end on uncleared entries

remaining in the GR/IR and SR/IR accounts

GR/IR and SR/IR accounts relevant for computing TDS on

provisions identified separately

GL accounts to which the provisional TDS is posted identified

and document Type used for provisional TDS postings is

separately identified

JV facility available for carrying out changes to TDS relevant

postings

Accounts to which losses (non-recoverable TDS) is to be

posted and the document type to be used for TDS adjustment

postings is identified separately

102

EWT Activities

Posting

Invoice, Credit

Memo, Down

Payment, etc

Challan

Update

On payment

due date

TDS

Certificate

Printing,

Reprinting and

Cancellation

on appropriate

due dates

Quarterly

Return

Tax

Adjustment

JV

Where required

Periodic Activities Daily Activities

TDS on

Provisions

Posting

Where required

103

Thank you!

Questions??

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- ERPLO DeemedExport 200614 0653 1304Dokument4 SeitenERPLO DeemedExport 200614 0653 1304SivaprasadVasireddyNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- ERP SAP Rel471Dokument46 SeitenERP SAP Rel471Albet StrausNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- SAP Shortcut Keys PDFDokument5 SeitenSAP Shortcut Keys PDFHarish KumarNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Material MM User ManualDokument314 SeitenMaterial MM User ManualPushparaj PatelNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Updating The Details in Table... : Sudharsanan SDokument2 SeitenUpdating The Details in Table... : Sudharsanan SAlbet StrausNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Kee Engine LogDokument41 SeitenKee Engine LogAlbet StrausNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Rfq-Sap MMDokument12 SeitenRfq-Sap MMashish sawantNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Export/Import Process: Dipak MukherjeeDokument1 SeiteExport/Import Process: Dipak MukherjeeAlbet StrausNoch keine Bewertungen

- Rfq-Sap MMDokument12 SeitenRfq-Sap MMashish sawantNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- W Bs DictionaryDokument321 SeitenW Bs DictionaryAlbet StrausNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Mysap Healthcare Focus AreassDokument19 SeitenMysap Healthcare Focus AreassAlbet StrausNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- EY-Indirect Tax 2014Dokument100 SeitenEY-Indirect Tax 2014manNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- How To Check If SAP Note Is Already AppliedDokument2 SeitenHow To Check If SAP Note Is Already AppliedAlbet StrausNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- SAP Is H HealthCareDokument8 SeitenSAP Is H HealthCareAlbet StrausNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- SAP Patient Management: The Patient-Centric SolutionDokument24 SeitenSAP Patient Management: The Patient-Centric SolutionAlbet StrausNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Holiday List - 2015: Holiday Date Day DescriptionDokument1 SeiteHoliday List - 2015: Holiday Date Day DescriptionAlbet StrausNoch keine Bewertungen

- SAP S Solution Portfolio For The Healthcare CommunityDokument41 SeitenSAP S Solution Portfolio For The Healthcare CommunityAlbet StrausNoch keine Bewertungen

- TRDokument3 SeitenTRAlbet StrausNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- A1 UpdationDokument2 SeitenA1 UpdationAlbet StrausNoch keine Bewertungen

- NCERT Class 12 Accountancy Part 2Dokument329 SeitenNCERT Class 12 Accountancy Part 2KishorVedpathak100% (2)

- SM G7102Dokument129 SeitenSM G7102Albet StrausNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- WBS StructureDokument10 SeitenWBS StructureAlbet StrausNoch keine Bewertungen

- Std11 Acct EMDokument159 SeitenStd11 Acct EMniaz1788100% (1)

- NCERT Class 11 Accountancy Part 2Dokument296 SeitenNCERT Class 11 Accountancy Part 2AnoojxNoch keine Bewertungen

- India Localization With Respect To SD: T.MuthyalappaDokument77 SeitenIndia Localization With Respect To SD: T.MuthyalappadavinkuNoch keine Bewertungen

- Find Out T-Code in Different Ways in SPRODokument9 SeitenFind Out T-Code in Different Ways in SPROAlbet StrausNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

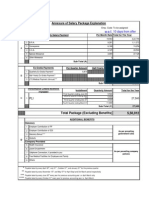

- Annexure of Salary Package Explanation: Emp. Code To Be AssignedDokument1 SeiteAnnexure of Salary Package Explanation: Emp. Code To Be AssignedAlbet StrausNoch keine Bewertungen

- CBSC Class XI - Accounting For BusinessDokument228 SeitenCBSC Class XI - Accounting For BusinessSachin KheveriaNoch keine Bewertungen

- Std11 Acct EMDokument159 SeitenStd11 Acct EMniaz1788100% (1)

- Provisional Selct List Neet-Ug 2021 Round-2Dokument88 SeitenProvisional Selct List Neet-Ug 2021 Round-2Debopriya BhattacharjeeNoch keine Bewertungen

- CarfaxDokument7 SeitenCarfaxAnonymous wvAFftNGNSNoch keine Bewertungen

- Cambridge International AS & A Level: SOCIOLOGY 9699/41Dokument4 SeitenCambridge International AS & A Level: SOCIOLOGY 9699/41maharanaanauyaNoch keine Bewertungen

- Gardner DenverDokument25 SeitenGardner DenverConstantin WellsNoch keine Bewertungen

- 559 Big Landlord Tenant OutlineDokument89 Seiten559 Big Landlord Tenant Outlinemoury227100% (1)

- DetailsDokument28 SeitenDetailsNeerajNoch keine Bewertungen

- Iso-Iec 19770-1Dokument2 SeitenIso-Iec 19770-1Ajai Srivastava50% (2)

- Capitalism Vs SocialismDokument14 SeitenCapitalism Vs Socialismrajesh_scribd1984100% (1)

- VM PresentationDokument29 SeitenVM Presentationoshin charuNoch keine Bewertungen

- Cai Wu v. Atty Gen USA, 3rd Cir. (2010)Dokument5 SeitenCai Wu v. Atty Gen USA, 3rd Cir. (2010)Scribd Government DocsNoch keine Bewertungen

- GC University, Faisalabad: Controller of Examinations Affiliated Institutions Semester ExaminationsDokument1 SeiteGC University, Faisalabad: Controller of Examinations Affiliated Institutions Semester ExaminationsIrfan Mohammad IrfanNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Order Granting Motion For Entry of DefaultDokument8 SeitenOrder Granting Motion For Entry of DefaultJames Alan Bush100% (2)

- Memo Writing WorkshopDokument17 SeitenMemo Writing Workshopkcope412Noch keine Bewertungen

- National Human Rights CommissionDokument15 SeitenNational Human Rights CommissionVDNoch keine Bewertungen

- Lifetime License ApplicationDokument2 SeitenLifetime License ApplicationBibhaas ojhaNoch keine Bewertungen

- Text of CorrectionDokument3 SeitenText of CorrectionKim Chung Trần Thị0% (1)

- Solution To Ch14 P13 Build A ModelDokument6 SeitenSolution To Ch14 P13 Build A ModelALI HAIDERNoch keine Bewertungen

- Spark Notes - Julius Caesar - Themes, Motifs & SymbolsDokument3 SeitenSpark Notes - Julius Caesar - Themes, Motifs & SymbolsLeonis MyrtilNoch keine Bewertungen

- Filipinas Synthetic Fiber Corporation vs. CA, Cta, and CirDokument1 SeiteFilipinas Synthetic Fiber Corporation vs. CA, Cta, and CirmwaikeNoch keine Bewertungen

- Evidence Case DigestDokument4 SeitenEvidence Case DigestBrenda de la GenteNoch keine Bewertungen

- Contreras V MacaraigDokument4 SeitenContreras V MacaraigDanilo Dela ReaNoch keine Bewertungen

- Program From Ncip MaeDokument3 SeitenProgram From Ncip Maeset netNoch keine Bewertungen

- Napolcom ReviewerDokument23 SeitenNapolcom ReviewerEmsNoch keine Bewertungen

- Plextol R 4152Dokument1 SeitePlextol R 4152Phạm Việt DũngNoch keine Bewertungen

- First Amended Complaint Stardock v. Paul Reiche and Fred FordDokument98 SeitenFirst Amended Complaint Stardock v. Paul Reiche and Fred FordPolygondotcomNoch keine Bewertungen

- Adjusting EntryDokument38 SeitenAdjusting EntryNicaela Margareth YusoresNoch keine Bewertungen

- DUTY of Counsel - ClientDokument30 SeitenDUTY of Counsel - ClientKhairul Iman78% (9)

- Loan SyndicationDokument57 SeitenLoan SyndicationSandya Gundeti100% (1)

- II Bauböck 2006Dokument129 SeitenII Bauböck 2006OmarNoch keine Bewertungen

- My Phillips Family 000-010Dokument138 SeitenMy Phillips Family 000-010Joni Coombs-HaynesNoch keine Bewertungen

- Arizona, Utah & New Mexico: A Guide to the State & National ParksVon EverandArizona, Utah & New Mexico: A Guide to the State & National ParksBewertung: 4 von 5 Sternen4/5 (1)

- The Bahamas a Taste of the Islands ExcerptVon EverandThe Bahamas a Taste of the Islands ExcerptBewertung: 4 von 5 Sternen4/5 (1)