Beruflich Dokumente

Kultur Dokumente

SN - Interest Rates - Theories

Hochgeladen von

xvzxvzOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SN - Interest Rates - Theories

Hochgeladen von

xvzxvzCopyright:

Verfügbare Formate

Copyright 2014 by Diane Scott Docking

1

Interest Rates Theories

. . . Wasnt it Ben Franklin who said

that????

A fool and his

Money are soon

Partying!!!!

Copyright 2014 by Diane Scott Docking

2

Learning Objectives

Know how inflation, expectations, and risk

combine to determine interest rates

The distinction between real and nominal

interest rates

The Fisher Effect

Copyright 2014 by Diane Scott Docking

3

Interest Rates Defined

Interest rates - are a measure of the

price paid by a borrower (or

debtor) to a lender (or creditor)

for the use of resources during some

time interval.

Copyright 2014 by Diane Scott Docking

4

Distinction Between Real

and Nominal Interest Rates

Inflation and Real Rates Versus

Nominal Rates

Inflation: measures how the purchasing

power of a given amount of currency

declines due to growing prices

Nominal interest rates: indicates the rate

at which your money will grow if invested

for a certain period (the stated rate)

Real interest rate: the rate of growth of

your purchasing power, after adjusting for

inflation

Copyright 2014 by Diane Scott Docking 5

Distinction Between Real

and Nominal Interest Rates - Simplified

Real interest rate

1. Interest rate that is adjusted for expected

changes in the price level

i

r

i

e

2. Real interest rate more accurately reflects true

cost of borrowing

3. When the real rate is low, there are greater

incentives to borrow and less to lend

n r

Copyright 2014 by Diane Scott Docking 6

Example: Distinction Between Real

and Nominal Interest Rates - Simplified

If i = 5% and

e

= 0% then

i

r

5%0% 5%

i

r

10%20% 10%

If i = 10% and

e

= 20% then

Copyright 2014 by Diane Scott Docking

3-7

Copyright 2014 by Diane Scott Docking 8

Fisher Effect

The exact Fisher equation is:

inflation. of rate annual expected the

interest, of rate real the

interest, of rate nominal observed the

where

1 1 1

e

r

i

i

e

i

r

i

Copyright 2014 by Diane Scott Docking 9

Fisher Effect, cont.

From the Fisher equation, we derive the nominal

(contract) rate:

We see that a lender gets compensated for:

rental of purchasing power

anticipated loss of purchasing power on the principal

anticipated loss of purchasing power on the interest

e

i

r

e

i

r

i

Copyright 2014 by Diane Scott Docking

10

Fisher Effect: Example

1-year $1000 loan

Parties agree on 3% rental rate for money and

5% expected rate of inflation.

Items to pay Calculation Amount

Principal $1,000.00

Rent on money $1,000 x 3% 30.00

PP loss on principal $1,000 x 5% 50.00

PP loss on interest $1,000 x 3% x 5% 1.50

Total Compensation $1,081.50

i = .03+.05+(.03x.05) = .08+.0015=.0815=8.15%

P+i$=$1,000x(1.0815)=$1,081.50

Copyright 2014 by Diane Scott Docking 11

Simplified Fisher Equation

The third term in the Fisher equation is

negligible, so it is commonly dropped.

The resulting equation is

e

i

r

i

Copyright 2014 by Diane Scott Docking 12

Example:

Calculating the Real Interest Rate

In the year 2000, short-term U.S. government

bond rates were about 5.8% and the rate of

inflation was about 3.4%. In 2003, interest

rates were about 1% and inflation was about

1.9%. What was the real interest rate in 2000

and 2003?

Copyright 2014 by Diane Scott Docking 13

Example:

Calculating the Real Interest Rate

Solution:

Thus, the real interest rate in 2000 was:

nominal rate inflation rate

real rate

1 inflation rate

(5.8% 3.4%) / (1.034) 2.32%

In 2003, the real interest rate was:

(1% 1.9%) / (1.019) 0.88%.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 004 - NRI - Main Application Form - FillableDokument6 Seiten004 - NRI - Main Application Form - FillableAnkur MishRraNoch keine Bewertungen

- Branch Less BankingDokument48 SeitenBranch Less Bankingsyedasiftanveer100% (2)

- Lee V Court of Appeals G.R. NO. 117913. February 1, 2002Dokument12 SeitenLee V Court of Appeals G.R. NO. 117913. February 1, 2002Zarah JeanineNoch keine Bewertungen

- Cash: Bank Reconciliations: What Is A Bank Reconciliation?Dokument5 SeitenCash: Bank Reconciliations: What Is A Bank Reconciliation?Jireh RiveraNoch keine Bewertungen

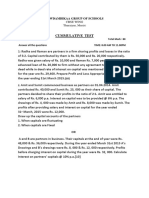

- Cummulative Test: Sowdambikaa Group of SchoolsDokument3 SeitenCummulative Test: Sowdambikaa Group of SchoolsDharmaNoch keine Bewertungen

- Particulars of Claim FinalDokument58 SeitenParticulars of Claim FinalCensored News NowNoch keine Bewertungen

- Invoice: Ace Global Service Co.,Ltd. 2-12-15-312 Fujimi-Cho, Tachikawa-Shi Tokyo 190-0013 Tel/Fax: +81-42-5221814Dokument2 SeitenInvoice: Ace Global Service Co.,Ltd. 2-12-15-312 Fujimi-Cho, Tachikawa-Shi Tokyo 190-0013 Tel/Fax: +81-42-5221814Hendra Widjaja - Golden Nusa Travel ServicesNoch keine Bewertungen

- Household Finance Handbook Chapter 2018 07 23Dokument115 SeitenHousehold Finance Handbook Chapter 2018 07 23Verónica Isabel Armas AyarzaNoch keine Bewertungen

- Kotak ProposalDokument5 SeitenKotak ProposalAmit SinghNoch keine Bewertungen

- FMI7e ch09Dokument44 SeitenFMI7e ch09lehoangthuchien100% (1)

- Order No. 11909520: Thank You For Your OrderDokument2 SeitenOrder No. 11909520: Thank You For Your Orderexu4g.comNoch keine Bewertungen

- UNIT 1 E Payment SystemDokument76 SeitenUNIT 1 E Payment SystemRahul DesuNoch keine Bewertungen

- Seminar Risk ManagementDokument9 SeitenSeminar Risk ManagementDương Nguyễn TùngNoch keine Bewertungen

- Project On Various Credit Schemes of SBI Back PDFDokument46 SeitenProject On Various Credit Schemes of SBI Back PDFAbhinaw KumarNoch keine Bewertungen

- Negotiable Instruments Course OutlineDokument13 SeitenNegotiable Instruments Course OutlinePJDNoch keine Bewertungen

- Brach of Confidence and MOUDokument1 SeiteBrach of Confidence and MOUAkd DeshmukhNoch keine Bewertungen

- Deposit Function PDFDokument75 SeitenDeposit Function PDFrojon pharmacyNoch keine Bewertungen

- Generic ATM Interface User Guide PDFDokument90 SeitenGeneric ATM Interface User Guide PDFBIDC Email100% (1)

- New BankDokument13 SeitenNew BankVelayudhan SunkaraNoch keine Bewertungen

- U03 - Additional Practise QuestionsDokument8 SeitenU03 - Additional Practise QuestionsnemeNoch keine Bewertungen

- ACTIVITY1Dokument1 SeiteACTIVITY1Emman NonatoNoch keine Bewertungen

- The Nigerian Financial Services Market 23-06-2023 15 - 09 - 01 - 674Dokument119 SeitenThe Nigerian Financial Services Market 23-06-2023 15 - 09 - 01 - 674CynthiaNoch keine Bewertungen

- Enter The DateDokument27 SeitenEnter The Dated-fbuser-65596417Noch keine Bewertungen

- Fee Structure 2021Dokument5 SeitenFee Structure 2021lethabozitha41Noch keine Bewertungen

- Internal/External Communication Analysis of Apna BankDokument14 SeitenInternal/External Communication Analysis of Apna Bankanon_350499717Noch keine Bewertungen

- Reviewer in NegoDokument9 SeitenReviewer in NegoMhayBinuyaJuanzonNoch keine Bewertungen

- Quizzer 2 Pdic SBD Ub Week 14 Set BDokument7 SeitenQuizzer 2 Pdic SBD Ub Week 14 Set Bmariesteinsher0Noch keine Bewertungen

- My ESAS - Workflow - RequestDokument1 SeiteMy ESAS - Workflow - RequestIlove music096Noch keine Bewertungen

- Account Statement 271222 260623Dokument20 SeitenAccount Statement 271222 260623Jivan SahariyaNoch keine Bewertungen

- Financial Markets - Products-1Dokument470 SeitenFinancial Markets - Products-1Heet Gandhi100% (1)