Beruflich Dokumente

Kultur Dokumente

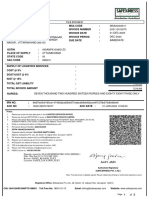

Fiscal Policy

Hochgeladen von

Aditya0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

366 Ansichten21 SeitenFiscal POLICY is the policy related to revenue, expenditure $ debt of the government. Govt. Collects large funds from public by way of taxes, these taxes are broadly classed as direct taxes $ indirect taxes. On increase in public (govt.) expenditure there is increase in aggregate demand.

Originalbeschreibung:

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenFiscal POLICY is the policy related to revenue, expenditure $ debt of the government. Govt. Collects large funds from public by way of taxes, these taxes are broadly classed as direct taxes $ indirect taxes. On increase in public (govt.) expenditure there is increase in aggregate demand.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

366 Ansichten21 SeitenFiscal Policy

Hochgeladen von

AdityaFiscal POLICY is the policy related to revenue, expenditure $ debt of the government. Govt. Collects large funds from public by way of taxes, these taxes are broadly classed as direct taxes $ indirect taxes. On increase in public (govt.) expenditure there is increase in aggregate demand.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 21

WHAT IS FISCAL POLICY?

Fiscal policy is the policy

related to revenue,

expenditure $ debt of the

government for achieving a

set of definite objectives.

DEFINITION

“fiscal policy is defined as the

discretionary action by the

government to change (i) the level of

government expenditure on goods $

services and transfer payments and

(ii) the yield of taxation at any given

level of output.”

-D.C. ROWAN

OBJECTIVES OF FISCAL POLICY

1. Full employment

2. Price stability

3. Reduction in economic

inequality

4. Economic development

METHODS OR TOOLS OF FISCAL

POLICY

THERE ARE FOUR MAIN INSTRUMENTS OF

FISCAL POLICY SUCH AS:

(1)TAXATION POLICY: Govt. collects large

funds from public by way of taxes, these

taxes are broadly classify as direct taxes $

indirect taxes .As a result of taxes, real

income of people is diminished $ so also

their aggregate demand. Also change in

taxation has an inverse effect on national

income, fall in taxation increases national

income $ rise in taxation decreases national

income.

(2)GOVERNMENT EXPENDITURE PLOICY:

Aggregate demand is influenced by govt.

expenditure. On increase in public (govt.)

expenditure there is increase in aggregate

demand and vice versa. Public expenditure

can be of two types (i) expenditure

incurred to buy goods $ services. it has

direct effect on aggregate demand. (ii)

public expenditure can also be incurred

without buying goods $ services e.g.

expenditure Made on pensions, medical

facilities, education by govt., it has indirect

effect on aggregate demand.

(3) PUBLIC DEBT POLICY: Aggregate

demand is also influenced by public

debt policy.public debt is of two kinds

(i) internal debt (ii) external debt.

effect of public debt on aggregate

demand depends on many factors.if

due to public debt;demand of private

sector doesn’t fall then by spending

the amount collected through public

debt,govt. can increase aggregate

demand.

(4)DEFICIT FINANCING: It refers to

financing to financing of the deficit of

government’s budget. when govt.

meets its budgetary deficit by

borrowing from the central bank, it is

called deficit financing. As a result of

deficit financing, income of the people

goes up and alongwith it aggregate

demand also goes up.

FISCAL POLICY AND

STABILISATION

Economic stability refers to minimum

possible changes in the internal price-

level and foreign exchange rate.

FISCAL POLICY can help in achieving

economic stabilisation in the following

ways:

1.Fiscal policy and inflation.

2.Fiscal policy and deflation.

3.Exchange stability and fiscal policy.

1.FISCAL POLICY AND

INFLATION

Keynes emphasised the following

fiscal measures to check inflation:

(i) Decrease in public expenditure.

(ii) Increase in public debts.

(iii) Delay in the payment of old debts.

(iv) Increase in taxes.

(v) Over-valuation of money.

(vi) Surplus budget policy.

2.FISCAL POLICY AND

DEFLATION

Following measures are suggested to

check deflation:

(i) Increase in government expenditure.

(ii) Decrease in taxes.

(iii) Increase in social welfare expenditure.

(iv) Pump priming.

(v) Price support policy.

(vi) Deficit financing.

3. EXCHANGE STABILITY AND

FISCAL POLICY

Exchange stability means that fluctuations

in the foreign exchange rate should be

minimised.

To achieve exchange stability It is

necessary that BOP should be in

equilibrium.

To stabilize the exchange rate, it is

necessary that adverse BOP be corrected

by promoting exports and restricting

imports.

LIMITATIONS OF FISCAL

POLICY IN UNDERDEVELOPED

COUNTRIES

SOME OF THE MAIN LIMITATIONS

ARE:

(1)Lack of elasticity

(2)Non-monetized sector

(3)Inadequate statistics

(4)Illiteracy

(5)Limited scope

METHODS OF FISCAL POLICY IN

UNDERDEVELOPED COUNTRIES

(1)TAXATION POLICY: govt. should pursue

such a taxation policy as may (i) promote

capital formation. (ii) curb consumption

expenditure to boost saving. (iii) mobilize

economic surplus (it means difference

between the current production $ current

consumption).

SPECIAL MEASURES BE TAKEN TO CHECK

TAX EVASION, AS IT LEADS TO THE

GENERATION OF BLACK MONEY AND

INFLATION.

(2)PUBLIC EXPENDITURE

POLICY

Economic development requires large

availability of capital which can’t be

expected from private sector alone, it is

necessary to increase public sector

expenditure for this purpose.

Public expenditure can be made in following

ways: (i) development of public

enterprises. (ii) encouragement to private

sector. (iii) provision of infrastructure i.e.

development of railways, roads, bridges

etc.

(3)PUBLIC DEBT POLICY

Public debt can be:

(i) INTERNAL DEBT

(ii) EXTERNAL DEBT

It is of great significance to economic

development in more than one way. (a) it

encourages propensity to save. (b) it helps in

capital formation for economic development.

(c) it helps to control inflation. (d) it can be

repaid out of the increased national income.

(4) DEFICIT FINANCING

It refers to financing of the deficit of

government’s budget. when govt.

meets its budgetary deficit by

borrowing from the central bank, it

is called deficit financing. Central

bank gives this loan by printing

new currency notes.

(5) FISCAL DEFICIT

Fiscal deficit is estimated, accounting for both

the capital as well as revenue receipts and

expenditures of the govt.

FD=BE-BR other than borrowings

HERE,

FD= fiscal deficit

BE= budget or total expenditure

BR= budget or total receipts

FISCAL DEFICIT IS INFACT EQUAL TO THE

TOAL BORROWINGS AND OTHER LIABILITIES

OF THE GOVT.

LIMITATIONS OR EVALUATION

OF FISCAL POLICY

Lack of accurate forecasting

Delay of decisions

Conflicting trends in public $ private sectors

Limitations of fiscal policy relating to full

employment

Conflict between social $ other economic

objectives

Increase in public debt

Problems of deficit financing

Das könnte Ihnen auch gefallen

- Factory Act 1948Dokument13 SeitenFactory Act 1948reetesh88% (8)

- Inventory ManagementDokument29 SeitenInventory ManagementAditya80% (5)

- Cash Concentration StrategiesDokument11 SeitenCash Concentration StrategiesAditya100% (1)

- Fiscal PolicyDokument14 SeitenFiscal Policykzakiya17Noch keine Bewertungen

- List of Foreign Venture Capital Investors Registered With SEBISDokument19 SeitenList of Foreign Venture Capital Investors Registered With SEBISDisha NagraniNoch keine Bewertungen

- The Influence of Consumer Behavior, Competitive Advantages On The Performance of MSMEs During Covid-19Dokument5 SeitenThe Influence of Consumer Behavior, Competitive Advantages On The Performance of MSMEs During Covid-19International Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Payment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalDokument23 SeitenPayment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalAdityaNoch keine Bewertungen

- Fiscal PolicyDokument34 SeitenFiscal PolicyReymar Lorente Uy100% (1)

- Hedging Cash Balance UncertaintiesDokument11 SeitenHedging Cash Balance UncertaintiesAditya100% (1)

- Producer and Consumer SurplusDokument28 SeitenProducer and Consumer SurplusSyedNoch keine Bewertungen

- Public Fin CH-1Dokument49 SeitenPublic Fin CH-1Wonde Biru100% (1)

- IE Singapore MRA GrantDokument4 SeitenIE Singapore MRA GrantAlfizanNoch keine Bewertungen

- Risk Management in BanksDokument16 SeitenRisk Management in BanksAdityaNoch keine Bewertungen

- CKB Bonded Logistics Center Presentation Kit - Rev - 2017Dokument31 SeitenCKB Bonded Logistics Center Presentation Kit - Rev - 2017Yôgáà C Erlànggà100% (2)

- Emissions TradingDokument22 SeitenEmissions Tradingasofos100% (1)

- 3rd Chapter Public Expenduture PolicyDokument65 Seiten3rd Chapter Public Expenduture PolicyTipu HashmiNoch keine Bewertungen

- ECONOMIC GROWTH DETERMINANTS AND BENEFITSDokument24 SeitenECONOMIC GROWTH DETERMINANTS AND BENEFITSDora NasikeNoch keine Bewertungen

- Law of Diminishing Marginal Returns PDFDokument3 SeitenLaw of Diminishing Marginal Returns PDFRaj KomolNoch keine Bewertungen

- 16 Budgeting - Capital Expenditures, Research & Development Expenditures, and Cash - PERT-CostDokument16 Seiten16 Budgeting - Capital Expenditures, Research & Development Expenditures, and Cash - PERT-CostMarizMatampaleNoch keine Bewertungen

- 3.indicators and Measurement of Economic DevelopmentDokument17 Seiten3.indicators and Measurement of Economic Developmentramkumar100% (1)

- Sustainable DevelopmentDokument2 SeitenSustainable DevelopmentSaadNoch keine Bewertungen

- Effects of Public ExpenditureDokument4 SeitenEffects of Public ExpenditureRafiuddin BiplabNoch keine Bewertungen

- 3.term PaperDokument14 Seiten3.term Paperrohitpatil999100% (4)

- IFM11 Solution To Ch09 P11 Build A ModelDokument18 SeitenIFM11 Solution To Ch09 P11 Build A ModelDiana SorianoNoch keine Bewertungen

- Government Budget Objectives and ImpactDokument21 SeitenGovernment Budget Objectives and ImpactSireen IqbalNoch keine Bewertungen

- Workshop: Basic EconomicsDokument120 SeitenWorkshop: Basic EconomicsAbrar HussainNoch keine Bewertungen

- Economics Questions and Answers To First Chapter - : Wealth Set Aside To Produce Further WealthDokument7 SeitenEconomics Questions and Answers To First Chapter - : Wealth Set Aside To Produce Further WealthHarry Sedgwick100% (2)

- Inflation in Cambodia-Causes and Effects On The PoorDokument3 SeitenInflation in Cambodia-Causes and Effects On The PoorVutha Ros100% (1)

- Chapter 09. Solution For CH 09-10 Build A Model: AssetsDokument4 SeitenChapter 09. Solution For CH 09-10 Build A Model: AssetsDiana SorianoNoch keine Bewertungen

- Capital Structure TheoriesDokument31 SeitenCapital Structure Theoriestannu2114Noch keine Bewertungen

- Paper Chapter 12 Group 1Dokument17 SeitenPaper Chapter 12 Group 1Nadiani Nana100% (1)

- Chapter-2 NATIONAL INCOMEDokument42 SeitenChapter-2 NATIONAL INCOMEDr-Abu Hasan Sonai SheikhNoch keine Bewertungen

- Difference Between Balance of Trade (BOT) & Balance of Payment (BOP)Dokument2 SeitenDifference Between Balance of Trade (BOT) & Balance of Payment (BOP)Bhaskar KabadwalNoch keine Bewertungen

- Taxation in PakistanDokument22 SeitenTaxation in PakistanAdnan AkramNoch keine Bewertungen

- Crowding out explainedDokument3 SeitenCrowding out explainedsattysattuNoch keine Bewertungen

- Measurement of Economic DevelopmentDokument10 SeitenMeasurement of Economic DevelopmentFaisal ShafiqueNoch keine Bewertungen

- PL32XX Rural Development and Sustainable Goals (38 charactersDokument2 SeitenPL32XX Rural Development and Sustainable Goals (38 charactersAdinda AngelicaNoch keine Bewertungen

- Parkinmacro4 1300Dokument16 SeitenParkinmacro4 1300Mr. JahirNoch keine Bewertungen

- Definition of Fiscal PolicyDokument27 SeitenDefinition of Fiscal PolicySana IsmailNoch keine Bewertungen

- Should Monetary Policy Be Made Rule or DiscretionDokument14 SeitenShould Monetary Policy Be Made Rule or DiscretionKrishna PatelNoch keine Bewertungen

- Effect of Population Growth Rate On Economic DevelopmentDokument10 SeitenEffect of Population Growth Rate On Economic DevelopmentyashbhardwajNoch keine Bewertungen

- Function and Role of Financial System (Chapter-1)Dokument44 SeitenFunction and Role of Financial System (Chapter-1)Kishor Mahmud83% (6)

- Economic DevelopmentDokument8 SeitenEconomic DevelopmentYogesh KatnaNoch keine Bewertungen

- IFM11 Solution To Ch10 P18 Build A Model-2Dokument3 SeitenIFM11 Solution To Ch10 P18 Build A Model-2Diana SorianoNoch keine Bewertungen

- An Evaluation of The Trade Relations of Bangladesh With ASEANDokument11 SeitenAn Evaluation of The Trade Relations of Bangladesh With ASEANAlexander DeckerNoch keine Bewertungen

- 5f461726 7d5c 42411c 96d2 75d219e1d8aaDokument15 Seiten5f461726 7d5c 42411c 96d2 75d219e1d8aaMuhammed EmbabyNoch keine Bewertungen

- Education and Health in Economic DevelopmentDokument21 SeitenEducation and Health in Economic DevelopmentAshib Uddin Emo100% (1)

- Burden of Public DebtDokument4 SeitenBurden of Public DebtAmrit KaurNoch keine Bewertungen

- 2 Non-Tax Sources of RevenueDokument15 Seiten2 Non-Tax Sources of RevenueTushar PatilNoch keine Bewertungen

- Fiscal Policy - The Basics: A) IntroductionDokument7 SeitenFiscal Policy - The Basics: A) IntroductionmalcewanNoch keine Bewertungen

- Parkinmacro15 1300Dokument17 SeitenParkinmacro15 1300Avijit Pratap RoyNoch keine Bewertungen

- Expansionary and Contractionary Monetary PolicyDokument2 SeitenExpansionary and Contractionary Monetary PolicyTinotenda DubeNoch keine Bewertungen

- Assessing The Economic Policies of President Lula Da Silva in BrazilDokument26 SeitenAssessing The Economic Policies of President Lula Da Silva in BrazilcabamaroNoch keine Bewertungen

- Endogenous Growth ModelDokument17 SeitenEndogenous Growth ModelAsadul Hoque100% (3)

- BFC5935 - Tutorial 1 Solutions PDFDokument7 SeitenBFC5935 - Tutorial 1 Solutions PDFXue Xu100% (1)

- Public Finance and Economic Management Reforms in MalawiDokument15 SeitenPublic Finance and Economic Management Reforms in MalawiInternational Consortium on Governmental Financial ManagementNoch keine Bewertungen

- Principles of Economics - The Classical Long Run ModelDokument53 SeitenPrinciples of Economics - The Classical Long Run ModelMIchael Jay GuintoNoch keine Bewertungen

- Big Push TheoryDokument21 SeitenBig Push TheoryAdarsh Ramesh100% (1)

- Chapter 1: The Ricardian Model of International Trade: Learning ObjectivesDokument9 SeitenChapter 1: The Ricardian Model of International Trade: Learning ObjectivesTze Wei GohNoch keine Bewertungen

- Money - Important in All Economies Because It Is A MeansDokument76 SeitenMoney - Important in All Economies Because It Is A MeansDiamondNoch keine Bewertungen

- AUD Southampton PLCDokument3 SeitenAUD Southampton PLCAivie Pangilinan0% (1)

- DemandDokument22 SeitenDemandSerenity KerrNoch keine Bewertungen

- Eco Exam 22 OctDokument42 SeitenEco Exam 22 OctTauseef AhmedNoch keine Bewertungen

- Public Finance: Faculty of Business & EconomicsDokument12 SeitenPublic Finance: Faculty of Business & Economicsjohn3dNoch keine Bewertungen

- Devlopment and DependencyDokument7 SeitenDevlopment and Dependencygangadhar119Noch keine Bewertungen

- M02 Toda3929 12E IM C02Dokument15 SeitenM02 Toda3929 12E IM C02jam linganNoch keine Bewertungen

- MidtermDokument13 SeitenMidtermnimbus1208Noch keine Bewertungen

- Fiscal PolicyDokument25 SeitenFiscal PolicyJivanjot SinghNoch keine Bewertungen

- BEE (2019-20) Handout 08 (Fiscal Policy)Dokument4 SeitenBEE (2019-20) Handout 08 (Fiscal Policy)Saurabh SinghNoch keine Bewertungen

- Fiscal Policy MeaningDokument27 SeitenFiscal Policy MeaningVikash SinghNoch keine Bewertungen

- Forecasting Cash FlowsDokument4 SeitenForecasting Cash FlowsAdityaNoch keine Bewertungen

- Forecasting Cash FlowsDokument4 SeitenForecasting Cash FlowsAdityaNoch keine Bewertungen

- Disbursement SystemsDokument12 SeitenDisbursement SystemsAdityaNoch keine Bewertungen

- Disbursement SystemsDokument12 SeitenDisbursement SystemsAdityaNoch keine Bewertungen

- DerivativesDokument5 SeitenDerivativesAdityaNoch keine Bewertungen

- Disbursement SystemsDokument12 SeitenDisbursement SystemsAdityaNoch keine Bewertungen

- Capital Adequacy & Capital PlanningDokument21 SeitenCapital Adequacy & Capital PlanningAdityaNoch keine Bewertungen

- Financial. Institution & IFCIDokument18 SeitenFinancial. Institution & IFCIAditya100% (1)

- Financial ForcesDokument25 SeitenFinancial ForcesAdityaNoch keine Bewertungen

- Gratuity Act (Vikram)Dokument23 SeitenGratuity Act (Vikram)AdityaNoch keine Bewertungen

- Currency OptionDokument15 SeitenCurrency OptionAdityaNoch keine Bewertungen

- Global Marketing, R&D StrategiesDokument31 SeitenGlobal Marketing, R&D StrategiesVijay MalikNoch keine Bewertungen

- Currency Option (FINAL)Dokument12 SeitenCurrency Option (FINAL)AdityaNoch keine Bewertungen

- The Payment of Gratuity Act 1972Dokument12 SeitenThe Payment of Gratuity Act 1972AdityaNoch keine Bewertungen

- The Payment of Bonus ACT, 1965Dokument20 SeitenThe Payment of Bonus ACT, 1965anandi_meenaNoch keine Bewertungen

- Int. Product Policy and Marketing MixDokument17 SeitenInt. Product Policy and Marketing MixsujeetleopardNoch keine Bewertungen

- Aggregate PlanningDokument3 SeitenAggregate PlanningAdityaNoch keine Bewertungen

- The Employees' State Insurance Act, 1948Dokument20 SeitenThe Employees' State Insurance Act, 1948AdityaNoch keine Bewertungen

- Workmen Compensation ActDokument17 SeitenWorkmen Compensation ActAdityaNoch keine Bewertungen

- CapmDokument26 SeitenCapmapi-3814557100% (1)

- Lecture 15Dokument17 SeitenLecture 15AdityaNoch keine Bewertungen

- Inventory ControlDokument24 SeitenInventory ControlAdityaNoch keine Bewertungen

- Industrial MarketingDokument9 SeitenIndustrial MarketingAditya0% (1)

- The Indian Retail SectorDokument17 SeitenThe Indian Retail SectorAdityaNoch keine Bewertungen

- Credit 243112012575 12 2023Dokument2 SeitenCredit 243112012575 12 2023bhawesh joshiNoch keine Bewertungen

- Geoweb Channel OverviewDokument8 SeitenGeoweb Channel OverviewJonathan CanturinNoch keine Bewertungen

- Prager History of IP 1545-1787 JPOS 1944Dokument36 SeitenPrager History of IP 1545-1787 JPOS 1944Vent RodNoch keine Bewertungen

- OCI DiscussionDokument6 SeitenOCI DiscussionMichelle VinoyaNoch keine Bewertungen

- Tata Motors Suv Segment ProjectDokument57 SeitenTata Motors Suv Segment ProjectmonikaNoch keine Bewertungen

- Interest Change Prepayment Repayment Schedule: Input Details Details 14396Dokument22 SeitenInterest Change Prepayment Repayment Schedule: Input Details Details 14396bidyut_roy_1Noch keine Bewertungen

- Manufacturing Resources PlanningDokument5 SeitenManufacturing Resources PlanningSachin SalvanikarNoch keine Bewertungen

- Weekly business quiz roundup from 2011Dokument8 SeitenWeekly business quiz roundup from 2011Muthu KumarNoch keine Bewertungen

- Chad Humphrey ResumeDokument2 SeitenChad Humphrey ResumeSeattleChadNoch keine Bewertungen

- Enactus ProposalDokument5 SeitenEnactus Proposalhana alkurdi0% (1)

- PPDA User Guide for Procurement and Disposal PlanningDokument21 SeitenPPDA User Guide for Procurement and Disposal PlanningThoboloMaunNoch keine Bewertungen

- Informative FinalDokument7 SeitenInformative FinalJefry GhazalehNoch keine Bewertungen

- 9731ch04Dokument44 Seiten9731ch04Yuki TakenoNoch keine Bewertungen

- HANDLING | BE DESCHI PROFILEDokument37 SeitenHANDLING | BE DESCHI PROFILECarlos ContrerasNoch keine Bewertungen

- MTNL Mumbai PlansDokument3 SeitenMTNL Mumbai PlansTravel HelpdeskNoch keine Bewertungen

- 6 ACCT 2A&B C. OperationDokument10 Seiten6 ACCT 2A&B C. OperationShannon Mojica100% (1)

- GMG AirlineDokument15 SeitenGMG AirlineabusufiansNoch keine Bewertungen

- Civpro Cases FinalsDokument4 SeitenCivpro Cases FinalsMc DalayapNoch keine Bewertungen

- DR Winston McCalla, Lessons From The Caribbean Region Experience, Presentation, 2-2012Dokument21 SeitenDR Winston McCalla, Lessons From The Caribbean Region Experience, Presentation, 2-2012Detlef LoyNoch keine Bewertungen

- Biblioteca Ingenieria Petrolera 2015Dokument54 SeitenBiblioteca Ingenieria Petrolera 2015margaritaNoch keine Bewertungen

- SIP Project Presentation Brand Promotion of Moolchand Medcity Through Value Added Service (VAS) Program and Medical Camp Nitin SharmaDokument17 SeitenSIP Project Presentation Brand Promotion of Moolchand Medcity Through Value Added Service (VAS) Program and Medical Camp Nitin SharmaNitin SharmaNoch keine Bewertungen

- BELENDokument22 SeitenBELENLuzbe BelenNoch keine Bewertungen

- Company Scrip Code: 533033Dokument17 SeitenCompany Scrip Code: 533033Lazy SoldierNoch keine Bewertungen

- Apcs ProceduresDokument97 SeitenApcs Proceduresmoh_essamoNoch keine Bewertungen

- Companies From Deal CurryDokument5 SeitenCompanies From Deal CurryHemantNoch keine Bewertungen

- ISO 14001 Certification Woodward ControlsDokument3 SeitenISO 14001 Certification Woodward ControlsErick MoraNoch keine Bewertungen