Beruflich Dokumente

Kultur Dokumente

Dow Jones Industrial Average US-30: Presented by Muhammad Suleman Usama Khan

Hochgeladen von

Muhammad SulemanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Dow Jones Industrial Average US-30: Presented by Muhammad Suleman Usama Khan

Hochgeladen von

Muhammad SulemanCopyright:

Verfügbare Formate

DOW JONES INDUSTRIAL

AVERAGE

US-30

Presented by Muhammad Suleman

Usama Khan

Introduction

TheDow Jones Industrial Averageis also called

theIndustrial Average, theDow 30, or simply

theDow market, is astock market index. The

industrial average was first calculated on May 26,

1896. Currently owned byS&P Dow Jones Indices,

which is majority owned byMcGraw-Hill Financial,

it is the most notable of the Dow Averages, of

which the first (non-industrial) was first published

on February 16, 1885. It is an index that shows

how 30 large publicly owned companies based in

the United States have traded during a standard

trading session in thestock market.

6-july-2015

On 6-july-2015 the trend in the US-30 or

Dow Jones industrial was bearish which

shows that markets closing was at low

than its opening (i.e. open at 17,728.08

and close at 17,683.58). During the day

the stock traded at highest price of

17,734.36 and the lowest price was about

17,564.36

News

News released on 6-july-2015 was about one of the

listed company in the US-30, the main heading of the

news was Goldman Expands Activism Defense

Group after Anderson Departure. The news was

about Goldman Sachs Group Inc. is turning its

activism defense team into a broader advisory group

after the teams leader, William Anderson, left for

Even core Partners Inc. Banks have built up practices

in recent years that advice companies on how to deter

and respond to activists, as the investors garner more

money and institutional backing. Goldman Sachs is

seeking to provide advice to companies on potential

reactions and pressure from other shareholders.

Pivot point= (H + L + Adjustment) / 3

= 17734.36+17564.36+17683.58/3

= 17660.77

R1 = 2*17660.77 - 17564.36

= 17757.18

R2 = 17660.77 + (17757.18

17564.36)

= 17853.59

S1 = 2*17660.77 - 17734.36

= 17587.18

S2= 17660.77 (17757.18 - 17587.18)

=17490.77

7-july-2015

Explanation:

On 7-july-2015 the trend in the US-30 or

Dow Jones industrial was bullish which

shows that markets closing was at high

than its opening (i.e. open at 17,684.92

and close at 17,776.91). During the day

the stock traded at highest price of

17,793.45 and the lowest price was about

17,465.68

News

On 7-july-2015 news was released about

the economy of japan, the main heading

of the news were Japan's Nikkei falls

below 20,000, hits 7-week low. Japan's

Nikkei share average fell below the

psychologically important 20,000 mark

on Wednesday to a seven-week low on

concerns about a meltdown in Chinese

shares and Greece's debt crisis.

Pivot point= (H + L + Adjustment) / 3

= 17793.45 + 17465.68 + 17776.91 / 3

= 17678.68

R1 = 2 * 17678.68 - 17465.68

=17891.68

R2 = 17678.68 + (17891.68 - 17563.91)

=18006.45

S1 = 2 * 17678.68 - 17793.45

= 17563.91

S2= 17678.68 (17891.68-17563.91)

= 17350.91

8-july-2015

Explanation:

On 8-july-2015 the trend in the US-30 or

Dow Jones industrial was bearish which

shows that markets closing was at low

than its opening (i.e. open at 17,759.01

and close at 17,515.42). During the day

the stock traded at highest price of

17,759.01 and the lowest price was about

17,496.22

News

On 8-july-2015 a news was released

under the main heading Muni Yields

Driven Lower by Greece as Puerto Rico

Woes Ignored. Yields on U.S. tax-exempt

debt are the lowest since May, joining a

broad fixed-income rally amid Greece's

standoff with creditors even after Puerto

Rico declared its $72 billion of debt unpayable.

Pivot point= (H + L + Adjustment) / 3

= 17,759.01 + 17,496.22 + 17515.42 / 3

=17590.21

R1 = 2* 17590.21 - 17496.22

= 17684.20

R2 = 17590.21 + (17684.20 17421.41)

= 17853.00

S1= 2* 17590.21 - 17759.01

= 17421.41

S2= 17590.21 (17684.20 - 17421.41)

= 17327.42

9-july-2015

Explanation

On 9-july-2015 the trend in the US-30 or

Dow Jones industrial was bullish which

shows that markets closing was at high

than its opening (i.e. open at 17,530.38

and close at 17,548.62). During the day

the stock traded at highest price of

17,764.85 and the lowest price was about

17,530.38

News

On 9-july-2015 a news was released under the main

heading of U.S. Stocks Advance after China Rebounds;

Greek Deadline Looms The overall bullish trend at US30 was because of, as U.S. stocks advanced with global

markets as Chinese equities rebounded the most since

2009, easing concern over economic growth. Shares

pared an early rally as Greece approached a deadline

for securing a bailout. Citigroup Inc. and Bank of

America Corp. increased more than 1.4 percent as

banks recovered from Wednesdays drop. Walgreens

Boots Alliance Inc. gained 4.2 percent after quarterly

profits topped analysts projections. Apple Inc. slid 2

percent to lead technology shares lower, while

semiconductors retreated for a fourth day.

Pivot point= (H + L + Adjustment) / 3

= (17764.85 + 17530.38 + 17548.62) / 3

= 17614.62

R1 = 2 * 17614.62 - 17530.38

= 17698.86

R2= 17614.62 + (17698.86 17464.39)

= 17849.09

S1= 2*17614.62 - 17764.85

= 17464.39

S2= 17614.62 (17698.86 - 17464.39)

= 17380.15

10-july-2015

Explanation:

On 10-july-2015 the trend in the US-30 or

Dow Jones industrial was bullish which

shows that markets closing was at high

than its opening (i.e. open at 17,561.12

and close at 17,760.41). During the day

the stock traded at highest price of

17,797.49 and the lowest price was about

17,561.12

News

On 9-july-2015 news was released under the main

heading of U.S. Stocks Rise Amid Optimism on Greece

Proposals, China Shares. U.S. stocks joined a global

rally, with the Nasdaq Composite Index posting its best

advance since January, amid optimism that proposals

Greece submitted to its creditors will pave the way for

a bailout. Apple Inc. climbed 2.7 percent to halt a fivesession slide and pace gains among technology shares.

Semiconductors rebounded as Avago Technologies Ltd.

and Broadcom Corp. rose more than 2.7 percent.

American Airlines Group Inc. jumped 3.9 percent after

the carriertrimmed domestic growth plans this year.

Citigroup Inc. and JPMorgan Chase & Co. increased at

least 1.4 percent as banks gained for a second day.

Pivot point= (H + L + Adjustment) / 3

= (17797.49 + 17561.12 + 17760.41) / 3

= 17706.34

R1= 2 * 17706.34 - 17561.12

= 17851.56

R2 = 17706.34 + (17851.56 17615.19)

= 17942.71

S1= 2 * 17706.34 - 17797.49

= 17615.19

S2 = 17706.34 (17851.56 - 17615.19)

= 17469.97

Forecasting

As we had seen that initially The DOW

JONES market index fell during the start of

the week, but later on we found that enough

support at the 17,500 level to turn things

back around and form a hammer. The

hammer is a bullish sign, so we can say that

the market will move in a upward

momentum, and I hope so that the market

then go to the price of 18,200 or may be

higher than that, which means that the

market will be bullish in the upcoming week.

Das könnte Ihnen auch gefallen

- The Challenge of Global Capitalism: The World Economy in the 21st CenturyVon EverandThe Challenge of Global Capitalism: The World Economy in the 21st CenturyBewertung: 3 von 5 Sternen3/5 (9)

- Quiz 1Dokument4 SeitenQuiz 1gautam_hariharan0% (2)

- (Wyckoff Richard) Stock Market Technique No.1 PDFDokument120 Seiten(Wyckoff Richard) Stock Market Technique No.1 PDFDerek Fong100% (6)

- Early Morning ReidDokument2 SeitenEarly Morning ReidCrodole0% (1)

- Practice Technicals 4Dokument20 SeitenPractice Technicals 4tigerNoch keine Bewertungen

- First Trust WESBURY July 2014Dokument2 SeitenFirst Trust WESBURY July 2014viejudaNoch keine Bewertungen

- Weekly Report Dec 24th 28thDokument2 SeitenWeekly Report Dec 24th 28thFEPFinanceClubNoch keine Bewertungen

- Economy Results With Srinivas Vadde's Positive Confidence & Positive Influence+Dokument1.724 SeitenEconomy Results With Srinivas Vadde's Positive Confidence & Positive Influence+svvpassNoch keine Bewertungen

- Too Early & Still Too HighDokument7 SeitenToo Early & Still Too HighAndrés MárquezNoch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Dow JonesDokument5 SeitenDow JonesRohan FernandezNoch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Global Economics Weekly - Goldman Sachs 02.10.13Dokument13 SeitenGlobal Economics Weekly - Goldman Sachs 02.10.13Martin Tsankov100% (1)

- E IBD100908Dokument24 SeitenE IBD100908cphanhuyNoch keine Bewertungen

- After The Selloff, Investors Eye Cyclicals Switch: Jenny Cosgrave @jenny - CosgraveDokument2 SeitenAfter The Selloff, Investors Eye Cyclicals Switch: Jenny Cosgrave @jenny - CosgraveTheng RogerNoch keine Bewertungen

- Financial Forecast September 2020Dokument22 SeitenFinancial Forecast September 2020Nazerrul Hazwan KamarudinNoch keine Bewertungen

- Viewpoint:: Short Covering - Sellers Remorse Expected To Drive Stocks HigherDokument4 SeitenViewpoint:: Short Covering - Sellers Remorse Expected To Drive Stocks HigherGauriGanNoch keine Bewertungen

- Energy Shares Lead Broad Rebound On Wall Street: .Dji .SPX .IxicDokument2 SeitenEnergy Shares Lead Broad Rebound On Wall Street: .Dji .SPX .IxicJudyann LadaranNoch keine Bewertungen

- Yardeni Stock Market CycleDokument36 SeitenYardeni Stock Market CycleOmSilence2651100% (1)

- EconomyWatch - Sept 30, 2008 - India Economy-Effects of The US Financial Crisis in IndiaDokument2 SeitenEconomyWatch - Sept 30, 2008 - India Economy-Effects of The US Financial Crisis in IndiaJagannadhamNoch keine Bewertungen

- September 8, 2010 PostsDokument431 SeitenSeptember 8, 2010 PostsAlbert L. PeiaNoch keine Bewertungen

- Weekly Economic UpdateDokument3 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Weekly Market Update For The Week of October 21Dokument2 SeitenWeekly Market Update For The Week of October 21mike1473Noch keine Bewertungen

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- March 4 Weekly Economic UpdateDokument2 SeitenMarch 4 Weekly Economic UpdateDoug PotashNoch keine Bewertungen

- Da Vinci Code Final ReportDokument16 SeitenDa Vinci Code Final Reportthu2langaydautuanNoch keine Bewertungen

- Stocks Look Cheap But They Could Get CheaperDokument3 SeitenStocks Look Cheap But They Could Get CheaperGerrit HartinkNoch keine Bewertungen

- Equities Forecast: Q2 2020: Peter Hanks, Analyst Paul Robinson, StrategistDokument10 SeitenEquities Forecast: Q2 2020: Peter Hanks, Analyst Paul Robinson, StrategistBob BlythNoch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument2 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Factiva 20180604 1444Dokument131 SeitenFactiva 20180604 1444Lucas GodeiroNoch keine Bewertungen

- UT Daily Market Update 280911Dokument5 SeitenUT Daily Market Update 280911jemliang_85Noch keine Bewertungen

- March 152010 PostsDokument11 SeitenMarch 152010 PostsAlbert L. PeiaNoch keine Bewertungen

- US Stocks Fall 12%Dokument4 SeitenUS Stocks Fall 12%perete69Noch keine Bewertungen

- Global Stock Sell-Off Eases After Worst Wall Street Rout Since 1987 - Financial TimesDokument5 SeitenGlobal Stock Sell-Off Eases After Worst Wall Street Rout Since 1987 - Financial TimesPhạm An ViênNoch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument3 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- Daily 03.06.2013Dokument1 SeiteDaily 03.06.2013FEPFinanceClubNoch keine Bewertungen

- Yardeni Stock Market Cycle - 2001 PDFDokument36 SeitenYardeni Stock Market Cycle - 2001 PDFscribbugNoch keine Bewertungen

- Blog Coverage - India Economy - Effects of The US Financial Crisis in IndiaDokument2 SeitenBlog Coverage - India Economy - Effects of The US Financial Crisis in IndiaJagannadhamNoch keine Bewertungen

- Weekly Trends March 10, 2016Dokument5 SeitenWeekly Trends March 10, 2016dpbasicNoch keine Bewertungen

- U S Stock Index PDFDokument4 SeitenU S Stock Index PDFhjkl22Noch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument3 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- Us Debt Ceiling Crisis 1Dokument5 SeitenUs Debt Ceiling Crisis 1Prakriti GuptaNoch keine Bewertungen

- Markets Lose Early Bullish Momentum: Midnight Trader 4:17 PM, Jul 6, 2010 - Here's Where MarketsDokument48 SeitenMarkets Lose Early Bullish Momentum: Midnight Trader 4:17 PM, Jul 6, 2010 - Here's Where MarketsAlbert L. PeiaNoch keine Bewertungen

- Ranges (Up Till 11.13am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.13am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Recession: This Article Is About A General Slowdown in Economic Activity. For Other Uses, SeeDokument7 SeitenRecession: This Article Is About A General Slowdown in Economic Activity. For Other Uses, Seesajimathew1104Noch keine Bewertungen

- BNP Paribas Studied 100 Years of Market Crashes - Here's What It Says Is ComingDokument6 SeitenBNP Paribas Studied 100 Years of Market Crashes - Here's What It Says Is Comingd1234dNoch keine Bewertungen

- Stock Market CrashDokument7 SeitenStock Market CrashDorjee TseringNoch keine Bewertungen

- He After: ECONOMIC DATA With ImpactDokument5 SeitenHe After: ECONOMIC DATA With Impactfred607Noch keine Bewertungen

- Capitalbuilderdaily PDFDokument5 SeitenCapitalbuilderdaily PDFCapital Buildr Financial ServicesNoch keine Bewertungen

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- June 12 The Small Cap BeatDokument7 SeitenJune 12 The Small Cap BeatStéphane SolisNoch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Philippine Markets Shut As Waist-High Storm Waters Flood CapitalDokument2 SeitenPhilippine Markets Shut As Waist-High Storm Waters Flood CapitalRaiza SarteNoch keine Bewertungen

- US Trading Note August 09 2016Dokument3 SeitenUS Trading Note August 09 2016robertoklNoch keine Bewertungen

- Daily 23.01.2014Dokument1 SeiteDaily 23.01.2014FEPFinanceClubNoch keine Bewertungen

- Weekly Trends: Should We Fear The Dow Theory Non-Confirmation?Dokument4 SeitenWeekly Trends: Should We Fear The Dow Theory Non-Confirmation?dpbasicNoch keine Bewertungen

- Daily 09.12.2013Dokument1 SeiteDaily 09.12.2013FEPFinanceClubNoch keine Bewertungen

- Weekly Market Update For The Week of October 28Dokument3 SeitenWeekly Market Update For The Week of October 28mike1473Noch keine Bewertungen

- Weekly Market Update Forthe Week of September 16Dokument3 SeitenWeekly Market Update Forthe Week of September 16mike1473Noch keine Bewertungen

- Investor Letter 2013 Q3 PDFDokument4 SeitenInvestor Letter 2013 Q3 PDFdpbasicNoch keine Bewertungen

- Seasonal Stock Market Trends: The Definitive Guide to Calendar-Based Stock Market TradingVon EverandSeasonal Stock Market Trends: The Definitive Guide to Calendar-Based Stock Market TradingNoch keine Bewertungen

- Trading ProjectDokument13 SeitenTrading ProjectMuhammad SulemanNoch keine Bewertungen

- Mod 3Dokument3 SeitenMod 3Muhammad SulemanNoch keine Bewertungen

- Dow Jones Industrial Average US-30: Presented by Muhammad Suleman Usama KhanDokument28 SeitenDow Jones Industrial Average US-30: Presented by Muhammad Suleman Usama KhanMuhammad SulemanNoch keine Bewertungen

- GlobalizationDokument4 SeitenGlobalizationMuhammad SulemanNoch keine Bewertungen

- Crude Oil AnalysisDokument8 SeitenCrude Oil AnalysisMuhammad SulemanNoch keine Bewertungen

- Operations Management ProjectDokument10 SeitenOperations Management ProjectMuhammad SulemanNoch keine Bewertungen

- Case 1 AnswersDokument3 SeitenCase 1 AnswersMuhammad SulemanNoch keine Bewertungen

- Trading ProjectDokument13 SeitenTrading ProjectMuhammad SulemanNoch keine Bewertungen

- Case 1 AnswersDokument3 SeitenCase 1 AnswersMuhammad SulemanNoch keine Bewertungen

- Customers Switching in Pakistani Mobile SectorDokument11 SeitenCustomers Switching in Pakistani Mobile SectorMuhammad SulemanNoch keine Bewertungen

- Dividend Yield MohsinDokument122 SeitenDividend Yield MohsinSuhail MominNoch keine Bewertungen

- A Study On The Performance of Large Cap Equity Mutual Funds in IndiaDokument16 SeitenA Study On The Performance of Large Cap Equity Mutual Funds in IndiaAbhinav AgrawalNoch keine Bewertungen

- Black BookDokument2 SeitenBlack BookChirag KotwalNoch keine Bewertungen

- Mutual FundDokument9 SeitenMutual FundYash MarfatiaNoch keine Bewertungen

- Problems and Prospects of Bangladesh Capital Market (SHARE)Dokument45 SeitenProblems and Prospects of Bangladesh Capital Market (SHARE)Ferdous MostofaNoch keine Bewertungen

- Accounting For Corporations: Mcgraw-Hill/Irwin1 © The Mcgraw-Hill Companies, Inc., 2006Dokument67 SeitenAccounting For Corporations: Mcgraw-Hill/Irwin1 © The Mcgraw-Hill Companies, Inc., 2006Analou LopezNoch keine Bewertungen

- ACCT 101 Pre-Quiz Number Five - F - 2017Dokument8 SeitenACCT 101 Pre-Quiz Number Five - F - 2017Rics GabrielNoch keine Bewertungen

- 5.fin17 Derivatives9 - 10 Done AskDokument33 Seiten5.fin17 Derivatives9 - 10 Done AskPratik GuptaNoch keine Bewertungen

- Ey Buy Back of SharesDokument4 SeitenEy Buy Back of SharesManan ChhabraNoch keine Bewertungen

- IDX Fact Book 2014 PDFDokument232 SeitenIDX Fact Book 2014 PDFdavidwijaya1986100% (3)

- Capital Market Regulatory Insight - P.S.rao & AssociatesDokument43 SeitenCapital Market Regulatory Insight - P.S.rao & AssociatesSharath Srinivas Budugunte100% (1)

- Chapter 7 - Q&ADokument16 SeitenChapter 7 - Q&APro TenNoch keine Bewertungen

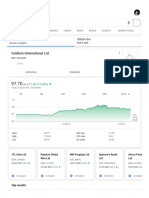

- Goldiam Share - Google SearchDokument5 SeitenGoldiam Share - Google SearchDudheshwar SinghNoch keine Bewertungen

- A Study On OTCEIDokument35 SeitenA Study On OTCEIShibinThomas100% (15)

- Lista de Acoes Mundiais e OutrosDokument86 SeitenLista de Acoes Mundiais e Outrosamjr1001Noch keine Bewertungen

- Engineering EconomyDokument4 SeitenEngineering EconomyRicardo VelozNoch keine Bewertungen

- 03rec3 ExerciseDokument2 Seiten03rec3 Exercisejunaid1626Noch keine Bewertungen

- BEI Rule II-ADokument25 SeitenBEI Rule II-AtravelerontherunNoch keine Bewertungen

- Preferred Stock FeaturesDokument2 SeitenPreferred Stock FeaturesLJBernardoNoch keine Bewertungen

- Depository Receipts in India: With A Special Reference To Indian Depository ReceiptsDokument18 SeitenDepository Receipts in India: With A Special Reference To Indian Depository Receiptsnikhil rajpurohitNoch keine Bewertungen

- Cost of Capital ExcelDokument9 SeitenCost of Capital ExcelBlossom KaurNoch keine Bewertungen

- Securities and MarketsDokument51 SeitenSecurities and MarketsBilal JavedNoch keine Bewertungen

- Fundamental Equity Analysis & Analyst Recommendations - S&P ASIA 50 Index ComponentsDokument103 SeitenFundamental Equity Analysis & Analyst Recommendations - S&P ASIA 50 Index ComponentsQ.M.S Advisors LLCNoch keine Bewertungen

- TGS BrouchuresDokument10 SeitenTGS BrouchuresRealm PhangchoNoch keine Bewertungen

- RAHUL SINGH Mini Project - A STUDY ON STOCK MARKET VOLATILITY OF INDIAN MNC'SDokument76 SeitenRAHUL SINGH Mini Project - A STUDY ON STOCK MARKET VOLATILITY OF INDIAN MNC'SharshNoch keine Bewertungen

- Solman Chapter 3Dokument6 SeitenSolman Chapter 3Kyla RoxasNoch keine Bewertungen

- Exercise 5 - Group 2Dokument1 SeiteExercise 5 - Group 2Thi Kim Ngan BuiNoch keine Bewertungen