Beruflich Dokumente

Kultur Dokumente

Case Econ08 PPT 21

Hochgeladen von

Chitrakalpa SenOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case Econ08 PPT 21

Hochgeladen von

Chitrakalpa SenCopyright:

Verfügbare Formate

PART V THE GOODS AND MONEY MARKETS

Chapter

21

Aggregate Expenditure

and Equilibrium Output

Prepared by:

Fernando & Yvonn Quijano

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

PART III THE GOODS AND MONEY MARKETS

Aggregate Expenditure

and Equilibrium Output

21

Chapter Outline

Aggregate Output and Aggregate

Income (Y)

Income, Consumption, and Saving (Y, C,

and S)

Explaining Spending Behavior

Planned Investment (I)

Planned Aggregate Expenditure (AE)

Equilibrium Aggregate Output (Income)

The Saving/Investment Approach

to Equilibrium

Adjustment to Equilibrium

The Multiplier

The Multiplier Equation

The Size of the Multiplier in the Real

World

The Multiplier in Action: Recovering from

the Great Depression

Looking Ahead

Appendix: Deriving the Multiplier

Algebraically

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE EXPENDITURE

AND EQUILIBRIUM OUTPUT

The level of GDP, the overall price level, and

the level of employmentthree chief

concerns of macroeconomistsare

influenced by events in three broadly defined

markets:

Goods-and-services markets

Financial (money) markets

Labor markets

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE EXPENDITURE

AND EQUILIBRIUM OUTPUT

FIGURE 8.1 The Core of Macroeconomic Theory

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

aggregate output The total quantity of

goods and services produced (or

supplied) in an economy in a given

period.

aggregate income The total income

received by all factors of production in a

given period.

aggregate output (income) (Y) A

combined term used to remind you of the

exact equality between aggregate

output and aggregate income.

In any given period, there is an exact equality between aggregate output (production)

and aggregate income. You should be reminded of this fact whenever you encounter

the combined term aggregate output (income).

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

Think in Real Terms

When we talk about output (Y), we mean real

output, not nominal output.

The main point is to think of Y as being in real

termsthe quantities of goods and services

produced, not the dollars circulating in the

economy.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

INCOME, CONSUMPTION, AND SAVING

(Y, C, AND S)

FIGURE 8.2 Saving Aggregate Income Consumption

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

saving (S) The part of its income that a

household does not consume in a given

period. Distinguished from savings,

which is the current stock of accumulated

saving.

Saving income consumption

SYC

identity Something that is always true.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

EXPLAINING SPENDING BEHAVIOR

Household Consumption and Saving

Some determinants of aggregate consumption include:

1.

2.

3.

4.

Household income

Household wealth

Interest rates

Households expectations about the future

The higher your income is, the higher your consumption is likely to be. People with more

income tend to consume more than people with less income.

consumption function The relationship

between consumption and income.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

FIGURE 8.3 A Consumption Function for a Household

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

FIGURE 8.4 An Aggregate Consumption Function

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

Because the aggregate consumption function is a

straight line, we can write the following equation to

describe it:

C = a + bY

marginal propensity to consume

(MPC) That fraction of a change in

income that is consumed, or spent.

marginal propensity to consume slope of consumptio n function

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

C

Y

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

marginal propensity to save (MPS)

That fraction of a change in income that

is saved.

MPC + MPS 1

Because the MPC and the MPS are important

concepts, it may help to review their definitions.

The marginal propensity to consume (MPC) is the fraction of an increase in income

that is consumed (or the fraction of a decrease in income that comes out of

consumption). The marginal propensity to save (MPS) is the fraction of an increase in

income that is saved (or the fraction of a decrease in income that comes out of saving).

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

Numerical Example

AGGREGATE

AGGREGATE

INCOME, Y CONSUMPTION, C

(BILLIONS OF

(BILLIONS OF

DOLLARS)

DOLLARS)

100

80

160

100

175

200

250

400

400

600

550

800

700

1,000

850

FIGURE 8.5 An Aggregate Consumption Function Derived

from the Equation C = 100 + .75Y

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

Y

AGGREGATE AGGREGATE AGGREGATE

INCOME

CONSUMPTION

SAVING

(Billions of

(Billions of

(Billions of

Dollars)

Dollars)

Dollars)

0

80

100

160

-100

-80

100

200

175

250

-75

-50

400

400

600

550

50

800

1,000

700

850

100

150

FIGURE 8.6 Deriving a Saving Function from a Consumption Function

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

Where the consumption function is above the 45 line,

consumption exceeds income, and saving is negative.

Where the consumption function crosses the 45 line,

consumption is equal to income, and saving is zero.

Where the consumption function is below the 45 line,

consumption is less than income, and saving is

positive.

Note that the slope of the saving function is S/Y,

which is equal to the marginal propensity to save (MPS).

The consumption function and the saving function are mirror images of one another. No

information appears in one that does not also appear in the other. These functions tell us

how households in the aggregate will divide income between consumption spending and

saving at every possible income level. In other words, they embody aggregate household

behavior.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

PLANNED INVESTMENT (I)

What Is Investment?

investment Purchases by firms of new

buildings and equipment and additions to

inventories, all of which add to firms

capital stock.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

Actual versus Planned Investment

change in inventory Production minus

sales.

One component of investmentinventory changeis partly determined by how much

households decide to buy, which is not under the complete control of firms. If households

do not buy as much as firms expect them to, inventories will be higher than expected, and

firms will have made an inventory investment that they did not plan to make.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

desired, or planned, investment

Those additions to capital stock and

inventory that are planned by firms.

actual investment The actual amount

of investment that takes place; it

includes items such as unplanned

changes in inventories.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

FIGURE 8.7 The Planned Investment Function

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

AGGREGATE OUTPUT AND

AGGREGATE INCOME (Y)

PLANNED AGGREGATE EXPENDITURE (AE)

planned aggregate expenditure (AE)

The total amount the economy plans to

spend in a given period. Equal to

consumption plus planned investment:

AE C + I.

planned aggregate expenditur e consumptio n planned investment

AE C I

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

EQUILIBRIUM AGGREGATE OUTPUT (INCOME)

equilibrium Occurs when there is no

tendency for change. In the

macroeconomic goods market,

equilibrium occurs when planned

aggregate expenditure is equal to

aggregate output.

aggregate output Y

planned aggregate expenditure AE C + I

equilibrium: Y = AE, or Y = C + I

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

EQUILIBRIUM AGGREGATE OUTPUT (INCOME)

Y>C+I

aggregate output > planned aggregate expenditure

inventory investment is greater than planned

actual investment is greater than planned investment

C+I>Y

planned aggregate expenditure > aggregate output

inventory investment is smaller than planned

actual investment is less than planned investment

Equilibrium in the goods market is achieved only when aggregate output (Y) and planned

aggregate expenditure (C + I) are equal, or when actual and planned investment are equal.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

EQUILIBRIUM AGGREGATE OUTPUT (INCOME)

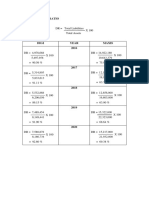

TABLE 8.1 Deriving the Planned Aggregate Expenditure Schedule and Finding

Equilibrium (All Figures in Billions of Dollars) The Figures in

Column 2 Are Based on the Equation C = 100 + .75Y.

(1)

(3)

(4)

(5)

(6)

AGGREGATE

CONSUMPTION (C)

PLANNED

INVESTMENT (I)

PLANNED

AGGREGATE

EXPENDITURE (AE)

C+I

UNPLANNED

INVENTORY

CHANGE

Y (C + I)

EQUILIBRIUM?

(Y = AE?)

100

175

25

200

100

No

200

250

25

275

75

No

400

400

25

425

25

No

500

475

25

500

Yes

600

550

25

575

+ 25

No

800

700

25

725

+ 75

No

1,000

850

25

875

+ 125

No

AGGREGATE

OUTPUT

(INCOME) (Y)

(2)

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

EQUILIBRIUM AGGREGATE OUTPUT (INCOME)

FIGURE 8.8 Equilibrium Aggregate

Output

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

EQUILIBRIUM AGGREGATE OUTPUT (INCOME)

THE SAVING/INVESTMENT APPROACH TO

EQUILIBRIUM

Because aggregate income must either be saved or spent, by

definition, Y C + S, which is an identity. The equilibrium

condition is Y = C + I, but this is not an identity because it

does not hold when we are out of equilibrium. By substituting

C + S for Y in the equilibrium condition, we can write:

C+S=C+I

Because we can subtract C from both sides of this equation,

we are left with:

S=I

Thus, only when planned investment equals saving will there

be equilibrium.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

EQUILIBRIUM AGGREGATE OUTPUT (INCOME)

FIGURE 8.9 Planned Aggregate Expenditure and Aggregate Output (Income)

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

EQUILIBRIUM AGGREGATE OUTPUT (INCOME)

FIGURE 8.10 The S = I Approach to Equilibrium

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

EQUILIBRIUM AGGREGATE OUTPUT (INCOME)

ADJUSTMENT TO EQUILIBRIUM

The adjustment process will continue as long as output (income) is below planned

aggregate expenditure. If firms react to unplanned inventory reductions by increasing

output, an economy with planned spending greater than output will adjust to equilibrium,

with Y higher than before. If planned spending is less than output, there will be

unplanned increases in inventories. In this case, firms will respond by reducing output.

As output falls, income falls, consumption falls, and so forth, until equilibrium is

restored, with Y lower than before.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

THE MULTIPLIER

multiplier The ratio of the change in the

equilibrium level of output to a change in

some autonomous variable.

autonomous variable A variable that is

assumed not to depend on the state of

the economythat is, it does not change

when the economy changes.

This added income does not vanish into thin air. It is paid to households that spend some

of it and save the rest. The added production leads to added income, which leads to

added consumption spending.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

THE MULTIPLIER

FIGURE 8.11 The Multiplier as Seen in the Planned Aggregate Expenditure Diagram

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

THE MULTIPLIER

THE MULTIPLIER EQUATION

Equilibrium will be restored only when saving has increased by exactly the amount of

the initial increase in I.

The marginal propensity to save may be expressed as:

S

MPS

Y

Because S must be equal to I for equilibrium to be

restored, we can substitute I for S and solve:

I

1

MPS

Y = I

therefore,

Y

MPS

,

or

multiplier

multiplier

MPC

MPS

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

THE MULTIPLIER

THE SIZE OF THE MULTIPLIER IN THE REAL

WORLD

In reality, the size of the multiplier is about 1.4. That is, a sustained increase in

autonomous spending of $10 billion into the U.S. economy can be expected to raise

real GDP over time by about $14 billion.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

REVIEW TERMS AND CONCEPTS

actual investment

aggregate income

aggregate output

aggregate output

(income) (Y)

autonomous variable

change in inventory

consumption function

desired, or planned,

investment

equilibrium

identity

investment

marginal propensity to consume (MPC)

marginal propensity to save (MPS)

multiplier

paradox of thrift

planned aggregate expenditure (AE)

saving (S)

1. S Y C

2. MPC slope of consumptio n function C

Y

3. MPC + MPS 1

4. AE C + I

5. Equilibrium condition: Y = AE or Y = C + I

6. Saving/investment approach to

equilibrium: S = I

7. Multiplier

1

1

MPS 1 - MPC

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

Appendix

DERIVING THE MULTIPLIER ALGEBRAICALLY

Recall that our consumption function is:

C = a + bY

where b is the marginal propensity to consume. In

equilibrium:

Y=C+I

Now we solve these two equations for Y in terms of I. By

substituting the first equation into the second, we get:

Y a1 2bY

3 I

C

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

Appendix

DERIVING THE MULTIPLIER ALGEBRAICALLY

This equation can be rearranged to yield:

Y bY = a + I

Y(1 b) = a + I

We can then solve for Y in terms of I by dividing through by (1

b):

1

Y (a I )

1 b

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

Appendix

DERIVING THE MULTIPLIER ALGEBRAICALLY

Now look carefully at this expression and think about

increasing I by some amount, I, with a held constant.

If I increases by I, income will increase by

Y I

b

Because b MPC, the expression becomes

Y I

MPC

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

CHAPTER 21: Aggregate Expenditure

and Equilibrium Output

Appendix

DERIVING THE MULTIPLIER ALGEBRAICALLY

The multiplier is

MPC

Finally, because MPS + MPC 1, MPS is equal to 1 MPC,

making the alternative expression for the multiplier 1/MPS,

just as we saw in this chapter.

2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and Fair

Das könnte Ihnen auch gefallen

- CH 28 Expenditure Multipliers The Keynesian ModelDokument58 SeitenCH 28 Expenditure Multipliers The Keynesian Modelanamshirjeel100% (2)

- Case Econ08 PPT 22Dokument40 SeitenCase Econ08 PPT 22Danan Imananda100% (1)

- Macroeconomic Issues and Policy: Fernando & Yvonn QuijanoDokument30 SeitenMacroeconomic Issues and Policy: Fernando & Yvonn Quijanoprasetyo caroko akbarNoch keine Bewertungen

- Chapter 6 - Money MarketDokument44 SeitenChapter 6 - Money MarketShantanu ChoudhuryNoch keine Bewertungen

- Chapter 09 GitmanDokument15 SeitenChapter 09 GitmanLBL_Lowkee100% (1)

- Chapter 23 - Measuring A Nation's IncomeDokument22 SeitenChapter 23 - Measuring A Nation's IncomeDannia PunkyNoch keine Bewertungen

- Course9 - Introduction To Economic FluctuationsDokument12 SeitenCourse9 - Introduction To Economic FluctuationsAngga ArsitekNoch keine Bewertungen

- Saving, Capital Accumulation and OutputDokument37 SeitenSaving, Capital Accumulation and OutputAkingbade Olajumoke MabelNoch keine Bewertungen

- Chapter 08 International Accounting - Additional Financial Reporting IssuesDokument29 SeitenChapter 08 International Accounting - Additional Financial Reporting Issuessasyaquiqe100% (2)

- Many of The Expansionary Periods During The Twentieth Century Occurred During WarsDokument1 SeiteMany of The Expansionary Periods During The Twentieth Century Occurred During WarsMarisa LeeNoch keine Bewertungen

- BAB 28 Pengangguran Dan InflasiDokument98 SeitenBAB 28 Pengangguran Dan InflasiPutri Shery yulianiNoch keine Bewertungen

- Chapter 20 Measuring GDP and Economic GrowthDokument4 SeitenChapter 20 Measuring GDP and Economic GrowthAnsonNoch keine Bewertungen

- Economics Business CycleDokument12 SeitenEconomics Business CycleYandex PrithuNoch keine Bewertungen

- Chapter 02 - Worldwide Accounting DiversityDokument24 SeitenChapter 02 - Worldwide Accounting DiversityShannonNoch keine Bewertungen

- Chapter Six Behavioral Foundation of MacroeconomicsDokument35 SeitenChapter Six Behavioral Foundation of MacroeconomicsMERSHANoch keine Bewertungen

- Overview of MacroeconomicsDokument10 SeitenOverview of Macroeconomicssnowblack.aggNoch keine Bewertungen

- C09 +chap+16 +Capital+Structure+-+Basic+ConceptsDokument24 SeitenC09 +chap+16 +Capital+Structure+-+Basic+Conceptsstanley tsangNoch keine Bewertungen

- TUGASDokument13 SeitenTUGASAnas SutrinoNoch keine Bewertungen

- Chapter 7 David N Hyman Eco PublicDokument32 SeitenChapter 7 David N Hyman Eco PublicBendyNoch keine Bewertungen

- Review Jurnal Moneter BismillahDokument5 SeitenReview Jurnal Moneter BismillahGalang IhsanNoch keine Bewertungen

- Case StudyDokument3 SeitenCase StudyLaiven RyleNoch keine Bewertungen

- ch03 5eDokument32 Seitench03 5eJean Carlos TorresNoch keine Bewertungen

- International Financial Management 13 Edition: by Jeff MaduraDokument26 SeitenInternational Financial Management 13 Edition: by Jeff MaduraJaime SerranoNoch keine Bewertungen

- Ekman-The Nature of IndustryDokument23 SeitenEkman-The Nature of IndustrysesiliaNoch keine Bewertungen

- Principles of Microeconomics Problem Set 9 Model AnswersDokument3 SeitenPrinciples of Microeconomics Problem Set 9 Model AnswersLi LuNoch keine Bewertungen

- ECON357 v2 Assignment 2B!!Dokument16 SeitenECON357 v2 Assignment 2B!!hannahNoch keine Bewertungen

- Ma Premium CH 13 Saving, Investment, and The Financial SystemDokument37 SeitenMa Premium CH 13 Saving, Investment, and The Financial SystemAna Ramos100% (1)

- Chapter-10 Market Risk Math Problems and SolutionsDokument6 SeitenChapter-10 Market Risk Math Problems and SolutionsruponNoch keine Bewertungen

- Chap011.Ppt-Pricing Business Strategy - Ppt-February 2017Dokument26 SeitenChap011.Ppt-Pricing Business Strategy - Ppt-February 2017AgnesNoch keine Bewertungen

- 13 International Cost of Capital Foreign InvestmentDokument26 Seiten13 International Cost of Capital Foreign InvestmentZulfa AprianiNoch keine Bewertungen

- Limit Pricing, Entry Deterrence and Predatory PricingDokument16 SeitenLimit Pricing, Entry Deterrence and Predatory PricingAnwesha GhoshNoch keine Bewertungen

- Stocks, Stock Valuation, and Stock Market EquilibriumDokument85 SeitenStocks, Stock Valuation, and Stock Market EquilibriumshimulNoch keine Bewertungen

- The Story of MacroeconomicsDokument32 SeitenThe Story of MacroeconomicsMohammadTabbalNoch keine Bewertungen

- Quiz#2 - Accounting and FinanceDokument11 SeitenQuiz#2 - Accounting and Financew.nursejatiNoch keine Bewertungen

- Solved Using The Cost Data Shown in Table 8 1 Calculate TheDokument1 SeiteSolved Using The Cost Data Shown in Table 8 1 Calculate TheM Bilal SaleemNoch keine Bewertungen

- Charles P. Jones, Investments: Analysis and Management, Eleventh Edition, John Wiley & SonsDokument23 SeitenCharles P. Jones, Investments: Analysis and Management, Eleventh Edition, John Wiley & SonsReza CahyaNoch keine Bewertungen

- GDP (Gross Domestic Product) : Abhishek Shukla Mba (It) IiitaDokument13 SeitenGDP (Gross Domestic Product) : Abhishek Shukla Mba (It) IiitaAbhishek ShuklaNoch keine Bewertungen

- CH 2 Science of MacroeconomicsDokument63 SeitenCH 2 Science of MacroeconomicsFirman DariyansyahNoch keine Bewertungen

- FIN535 Assignment 4Dokument8 SeitenFIN535 Assignment 4G Ruggy JonesNoch keine Bewertungen

- Tugas Cost of Capital QuestionsDokument7 SeitenTugas Cost of Capital Questionssmoky 22Noch keine Bewertungen

- Chapter 9 Economic Growth II. Technology, Empirics, and PolicyDokument7 SeitenChapter 9 Economic Growth II. Technology, Empirics, and PolicyJoana Marie CalderonNoch keine Bewertungen

- Utang Luar Negeri, Fiskal Dan Konsumsi Masyarakat - Lukkim - FEUNSDokument31 SeitenUtang Luar Negeri, Fiskal Dan Konsumsi Masyarakat - Lukkim - FEUNSLukman Hakim HassanNoch keine Bewertungen

- Chapter 18 Business Expansion PowerpointDokument16 SeitenChapter 18 Business Expansion Powerpointapi-384311544Noch keine Bewertungen

- Indicators of Economic GrowthDokument20 SeitenIndicators of Economic Growthchad23Noch keine Bewertungen

- The Promise of Constructivism in IRDokument31 SeitenThe Promise of Constructivism in IRVivian YingNoch keine Bewertungen

- CH 05Dokument16 SeitenCH 05Idris100% (1)

- Introduction To Management AccountingDokument37 SeitenIntroduction To Management AccountingAmelliaS.MurtiNoch keine Bewertungen

- The International Monetary System Chapter 11Dokument23 SeitenThe International Monetary System Chapter 11Ashi GargNoch keine Bewertungen

- CH 30 Money Growth and InflationDokument51 SeitenCH 30 Money Growth and Inflationveroiren100% (1)

- Macsg09: The Government and Fiscal PolicyDokument24 SeitenMacsg09: The Government and Fiscal PolicyJudith100% (1)

- Jurnal Anggaran PerusahaanDokument15 SeitenJurnal Anggaran PerusahaanMuhammad JuliantoNoch keine Bewertungen

- Chapt 11 Cost-Volume-Profit AnalysisDokument32 SeitenChapt 11 Cost-Volume-Profit AnalysisJumry Al-ashiddiqiNoch keine Bewertungen

- Managerial Economics Lecture NotesDokument21 SeitenManagerial Economics Lecture NotescprabhakaranNoch keine Bewertungen

- The Impact of Debt On Economic Growth A Case Study of IndonesiaDokument23 SeitenThe Impact of Debt On Economic Growth A Case Study of IndonesiaKe Yan OnNoch keine Bewertungen

- 09Dokument10 Seiten09Suryakant KaushikNoch keine Bewertungen

- Case Econ08 PPT 21Dokument38 SeitenCase Econ08 PPT 21Ronnie DeanNoch keine Bewertungen

- Aggregate Expenditure and Equilibrium Output - BAGUSDokument31 SeitenAggregate Expenditure and Equilibrium Output - BAGUSSupriYono100% (1)

- Chapter 23Dokument25 SeitenChapter 23Vince Orebey BelarminoNoch keine Bewertungen

- Keynesian Model of Income DeterminationDokument71 SeitenKeynesian Model of Income DeterminationHarjas anandNoch keine Bewertungen

- Macroeconomics: Case Fair OsterDokument29 SeitenMacroeconomics: Case Fair OsterThalia SandersNoch keine Bewertungen

- The Big Mac IndexDokument12 SeitenThe Big Mac IndexChitrakalpa SenNoch keine Bewertungen

- Problem Set #7 Solutions Econ 2106H, J. L.Turner: AVC AC Q Q Q Q Q QDokument3 SeitenProblem Set #7 Solutions Econ 2106H, J. L.Turner: AVC AC Q Q Q Q Q QChitrakalpa SenNoch keine Bewertungen

- Practice 3 SLNDokument24 SeitenPractice 3 SLNChitrakalpa SenNoch keine Bewertungen

- Managing GrowthDokument7 SeitenManaging GrowthChitrakalpa SenNoch keine Bewertungen

- ps1 Eco110Dokument9 Seitenps1 Eco110Chitrakalpa SenNoch keine Bewertungen

- Managerial Economics 1Dokument6 SeitenManagerial Economics 1Chitrakalpa SenNoch keine Bewertungen

- Hutch Working PaperDokument25 SeitenHutch Working PaperChitrakalpa SenNoch keine Bewertungen

- Bus 5111: Financial Management: Written Assignment Unit 1 Ratios CalculationDokument5 SeitenBus 5111: Financial Management: Written Assignment Unit 1 Ratios CalculationCharles IrikefeNoch keine Bewertungen

- Holydays Homework EcoDokument3 SeitenHolydays Homework EcoAkshita ChauhanNoch keine Bewertungen

- Lai Inc Had The Following Investment Transactions 1 Purchased Chang CorporationDokument1 SeiteLai Inc Had The Following Investment Transactions 1 Purchased Chang CorporationMiroslav GegoskiNoch keine Bewertungen

- Auction CatalogDokument128 SeitenAuction CatalogSanjay100% (1)

- Notes Chapter 1 ValuationDokument5 SeitenNotes Chapter 1 ValuationArielle CabritoNoch keine Bewertungen

- Ac101 ch7Dokument15 SeitenAc101 ch7infinite_dreamsNoch keine Bewertungen

- 1st Quiz AUD ProblemsDokument1 Seite1st Quiz AUD ProblemsGletzmar IgcasamaNoch keine Bewertungen

- Compensation Income - Fringe Benefit TaxDokument41 SeitenCompensation Income - Fringe Benefit Taxdelacruzrojohn600Noch keine Bewertungen

- JAIIB-PPB-Free Mock Test - JAN 2022Dokument3 SeitenJAIIB-PPB-Free Mock Test - JAN 2022kanarendranNoch keine Bewertungen

- 3 - 31 Powerful Excel FormulasDokument29 Seiten3 - 31 Powerful Excel FormulasmushahidNoch keine Bewertungen

- Challan Format (Specialist)Dokument1 SeiteChallan Format (Specialist)hgfvhgNoch keine Bewertungen

- 澳洲383797123 Gas bill PDFDokument2 Seiten澳洲383797123 Gas bill PDFZheng YangNoch keine Bewertungen

- Introduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011Dokument5 SeitenIntroduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011adnanNoch keine Bewertungen

- FINANCIAL MANAGEMENT Full ModuleDokument72 SeitenFINANCIAL MANAGEMENT Full Modulenegamedhane58Noch keine Bewertungen

- FIN 420 CASE STUDY Leverage RatioDokument4 SeitenFIN 420 CASE STUDY Leverage RatioNur AdibahNoch keine Bewertungen

- NCR T-265-ND 012023Dokument31 SeitenNCR T-265-ND 012023Patrick LorenzoNoch keine Bewertungen

- Check, DefinedDokument17 SeitenCheck, DefinedMykee NavalNoch keine Bewertungen

- FXOM Definitions EN PDFDokument10 SeitenFXOM Definitions EN PDFDenni SeptianNoch keine Bewertungen

- Risk Bearing Documents in International TradeDokument8 SeitenRisk Bearing Documents in International TradeSukrut BoradeNoch keine Bewertungen

- Transfer - RemittanceDokument3 SeitenTransfer - RemittanceEman MostafaNoch keine Bewertungen

- End of Season: Spring Summer 2021Dokument29 SeitenEnd of Season: Spring Summer 2021Abdaud RasyidNoch keine Bewertungen

- P1 Investment Appraisal MethodsDokument3 SeitenP1 Investment Appraisal MethodsSadeep Madhushan0% (1)

- External Debt Development and Management: Presentations On IndiaDokument22 SeitenExternal Debt Development and Management: Presentations On IndiaYasser KhanNoch keine Bewertungen

- Accounting Standards and Company Audit AnswersDokument9 SeitenAccounting Standards and Company Audit AnswersrinshaNoch keine Bewertungen

- Gmail - Expedia Travel Confirmation - Wed, Jul 19 - (Itinerary # 72593634072884)Dokument4 SeitenGmail - Expedia Travel Confirmation - Wed, Jul 19 - (Itinerary # 72593634072884)LUZ URREANoch keine Bewertungen

- Repos A Deep Dive in The Collateral PoolDokument7 SeitenRepos A Deep Dive in The Collateral PoolppateNoch keine Bewertungen

- Caiib Paper 4 Banking Regulations and Business Laws Capsule AmbitiousDokument223 SeitenCaiib Paper 4 Banking Regulations and Business Laws Capsule AmbitiouselliaCruzNoch keine Bewertungen

- KTT - CASH - TRANSFER - AGREEMENT - 2022 - 02 - 01 10B (1) SignedDokument11 SeitenKTT - CASH - TRANSFER - AGREEMENT - 2022 - 02 - 01 10B (1) SignedDEPO KELAPA BANG WAHYU100% (1)

- Brea ch05 BMM 7e SGDokument85 SeitenBrea ch05 BMM 7e SGSarosh Ata100% (1)

- Account StatementDokument132 SeitenAccount StatementBASHA SHAFIQNoch keine Bewertungen