Beruflich Dokumente

Kultur Dokumente

7.income Tax On Salaries

Hochgeladen von

Suraj Kumar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten9 Seitentax related

Originaltitel

7.Income Tax on Salaries

Copyright

© © All Rights Reserved

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldentax related

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten9 Seiten7.income Tax On Salaries

Hochgeladen von

Suraj Kumartax related

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

INCOME TAX ON SALARIES.

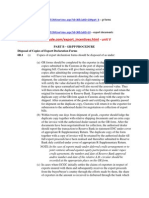

1.The levy of income tax in India is at

present governed by two acts.

a)The Income Tax Act,1961

b)The Finance Act passed each year by

the

Parliament.

2.Income Tax is leviable annually for each

Financial Year commencing on the 1st day

of April and ending on the 31st day March

following.

3.Income tax on salaries is computed on

annual basis and recovered as TDS on

monthly basis for the sake of our

INCOME TAX ON SALARIES

4.For the purpose of computing IT on salaries

the term salary includes following elements:

a)Pay as defined in FR 9(21),leave salary and

advance of pay.

b)Bonus

c) Dearness allowance

d)Compensatory allowance

e)House rent allowance-subject to exemption

f) Value of Rent Free quarters

g) Fees retainable by the employees.

h) Honoraria

INCOME TAX ON SALARIES

i)Reimbursement of tuition fees.

j) Subsistence allowance

k) Interim relief

l) Overtime allowance

m) Government Contribution to the NPS.

5.Following items are not to be taken in to

account for the purpose of computing IT on

salaries :

a)Sumptuary allowance and uniform

allowance

b) Reimbursement of cost of medical

treatment subject to limits

INCOME TAX ON SALARIES

c) Value of LTC

b) cash equivalent of leave salary received at the

time of retirement.

c) TA granted for tour on duty and for transfer

d) Composite hill compensatory allowance

e) Border area /remote area /tribal area

difficult area /disturbed area allowance.

f) Conveyance allowance

g) CEA and hostel subsidy subject to limits

h) Any allowance granted for encouraging the

academic, research and other professional

pursuit

i) Transport allowance up to Rs.1600/- for orthopedically

handicapped persons and Rs.800/- for others (pm)

j) Any payment from GPF

INCOME TAX ON SALARIES

6.The salary income of a person is calculated on the total

salary due to him(whether paid or not) as per the guidelines

provided above.

7.From the total income so arrived at(gross salary) the

following deductions to the extent permissible are to be

allowed to get taxable salary

a) HRA exemption to the extent admissible

b) Accrued interest/interest paid on HBA and

income from house property if it is a minus figure.

c) Donation to any recognized charitable trust/

fund such as Prime Ministers National relief fund

d) Professional tax paid to local bodies.

e) For handicapped employees an amount of Rs.50000 or

Rs.1,00,000/- as the case may be

INCOME TAX ON SALARIES

8. With this taxable salary if the person is having any

other income from other sources as informed by him

the same is to be added

9.From the taxable salary, following elements

of various forms of savings are to be

deducted to the extent admissible.

a)Subscription to PF,LIC,PLI policies

b) Subscription to any authorized pension

fund

c) Subscription to New pension Scheme

d) Subscri. to Long term infrastructure funds

e) Subscri. to any medical insurance/CGHS

10.The total amount of savings is limited to a

maximum of Rs.1,00,000/.

INCOME TAX ON SALARIES

11.Thus the amount of taxable income is to

arrived as follows.

a)Total salary income -________

b)less total of exempted

items( such as HRA exemption) -- ________(-)

c ) Gross Taxable income -_______

d) less savings(limited to maximum)

_________(-)

e) Net taxable salary

__________

----------

INCOME TAX ON SALARIES

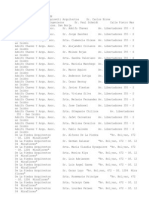

12.After arriving the net taxable income IT has to

be calculated as follows. Education cess @3% of

IT is to levied in all cases.

NET TAXABLE

INCOME

RATE OF INCOME TAX

WOMENEMPLOYEE

S

OTHERS

Up to Rs.1,80,000

NIL

NIL

Rs1,80,001Rs.1,90,000

NIL

10% of income

exceeding

Rs.1,80,000

Rs1,90,001Rs.2,50,000

10% of income

exceeding

Rs.1,90,000

10% of income

exceeding

Rs.1,80,000

Rs2,50,001Rs.5,00,000

10% of income

exceeding

Rs.1,90,000

10% of income

exceeding

Rs.1,80,000

INCOME TAX ON SALARIES

13.The IT and education cess so

arrived at is to be dived by 12 and

the same is to be recovered on

monthly basis.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Assignment COM&RotnDokument4 SeitenAssignment COM&RotnSuraj KumarNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grade 9anglesDokument5 SeitenGrade 9anglesSuraj KumarNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Motion in Two and Three Dimension IIDokument14 SeitenMotion in Two and Three Dimension IISuraj KumarNoch keine Bewertungen

- Solids and FluidsDokument26 SeitenSolids and FluidsSuraj KumarNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Basic Integration ProblemsDokument4 SeitenBasic Integration ProblemsSuraj KumarNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Scanned by CamscannerDokument8 SeitenScanned by CamscannerSuraj KumarNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Land Meant For Petrol Station or Has The Potential For Petrol StationDokument2 SeitenLand Meant For Petrol Station or Has The Potential For Petrol StationselvarajNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- National Review Center (NRC)Dokument3 SeitenNational Review Center (NRC)Malou Almiro SurquiaNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Exam2 Solutions 40610 2008Dokument8 SeitenExam2 Solutions 40610 2008blackghostNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Basic Documents and Transactions Related To Bank DepositsDokument15 SeitenBasic Documents and Transactions Related To Bank DepositsJessica80% (5)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Table of ContensDokument17 SeitenTable of ContensEcha SkeskeneweiiNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Part B - GR/PP Procedure Disposal of Copies of Export Declaration Forms 6B.1Dokument3 SeitenPart B - GR/PP Procedure Disposal of Copies of Export Declaration Forms 6B.1Vimala Selvaraj VimalaNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Kiat Penulisan Proposal PKM Unand - CahyadiDokument43 SeitenKiat Penulisan Proposal PKM Unand - CahyadinugrahaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Stitch Classes and Stitch DefectsDokument59 SeitenStitch Classes and Stitch DefectsMaanvizhi Moorthi100% (1)

- IE CH 05-AnsDokument4 SeitenIE CH 05-AnsHuo ZenNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Lucian A 1Dokument17 SeitenLucian A 1keylaelizabehtNoch keine Bewertungen

- PIT HomeworkDokument2 SeitenPIT HomeworkNhi Nguyen0% (1)

- Economic Cycles: Historical Evidence, Classification and ExplicationDokument29 SeitenEconomic Cycles: Historical Evidence, Classification and ExplicationkyffusNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Beauty of The GP Co-Investment Structure - CrowdStreetDokument6 SeitenThe Beauty of The GP Co-Investment Structure - CrowdStreetJerry WilliamsonNoch keine Bewertungen

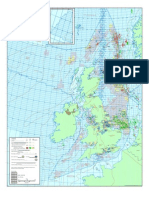

- North Sea Oil and Gas Wall MapDokument1 SeiteNorth Sea Oil and Gas Wall Mapbarnibar1Noch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Business London's 20 Under 40 - London's New Economic TrailblazersDokument2 SeitenBusiness London's 20 Under 40 - London's New Economic TrailblazersrtractionNoch keine Bewertungen

- Mankiw Chapter 31Dokument3 SeitenMankiw Chapter 31Atin Ayuni100% (1)

- 2016 HSC Maths General 2Dokument40 Seiten2016 HSC Maths General 2HIMMZERLANDNoch keine Bewertungen

- Partnership LiquidationDokument20 SeitenPartnership LiquidationIvhy Cruz Estrella0% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Terex LiftaceDokument2 SeitenTerex LiftaceEduardo SaaNoch keine Bewertungen

- Textile & Apparel IndustryDokument13 SeitenTextile & Apparel IndustryGOKANoch keine Bewertungen

- Superior Commercial Vs Kunnan Enterprises - DigestDokument3 SeitenSuperior Commercial Vs Kunnan Enterprises - DigestGayeGabrielNoch keine Bewertungen

- Deregulation of Energy Sector in NigeriaDokument15 SeitenDeregulation of Energy Sector in NigeriaWilliam BabigumiraNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Price Elasticity of Supply (PES)Dokument23 SeitenPrice Elasticity of Supply (PES)SyedNoch keine Bewertungen

- TKM Training ManualDokument34 SeitenTKM Training ManualRajaraamanSrinivasNoch keine Bewertungen

- Chapter11.Flexible Budgeting and The Management of Overhead and Support Activity CostsDokument34 SeitenChapter11.Flexible Budgeting and The Management of Overhead and Support Activity CostsStephanie Ann AsuncionNoch keine Bewertungen

- 06 GDP and Economic GrowthDokument3 Seiten06 GDP and Economic GrowthAkash Chandak0% (2)

- The Shift Towards Umbrella Branding Is Inescapable': Anandakuttan B UnnithanDokument1 SeiteThe Shift Towards Umbrella Branding Is Inescapable': Anandakuttan B UnnithanSandeep SinghNoch keine Bewertungen

- Ec-101 - Final PDFDokument2 SeitenEc-101 - Final PDFarjunv_14Noch keine Bewertungen

- Econ Practice Exam 2Dokument15 SeitenEcon Practice Exam 2MKNoch keine Bewertungen

- Accounting Cycle Project-ROMANDokument22 SeitenAccounting Cycle Project-ROMANAbid Hasan Roman75% (4)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)