Beruflich Dokumente

Kultur Dokumente

8270 IOMS Chap1

Hochgeladen von

Rafa SambeatOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

8270 IOMS Chap1

Hochgeladen von

Rafa SambeatCopyright:

Verfügbare Formate

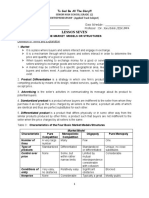

Part I.

Getting started

Chapter 1. What is Markets and Strategies?

Slides

Industrial Organization: Markets and Strategies

Paul Belleflamme and Martin Peitz

Cambridge University Press 2009

Introduction to Part I

Markets

Play a central role in the allocation of goods

Affect production decisions

Goal of Markets and Strategies

Present the role of imperfectly competitive

markets for private and social decisions

Issues related to markets and strategies

Extremely large array!

Firms take thousands of strategic decisions

.... reacting to particular market conditions

.... and affecting the well-being of market participants.

Cambridge University

Introduction to Part I

Product

differentiation

Horizontal

merger

Pricing

strategies

Entry

deterrence

Cambridge University

Introduction to Part I

Organization of Part I

Chapter 1

Roadmap

Markets & strategies

Chapter 2

Players in markets: firms & consumers

Profit maximization, utility maximization

Market interaction

Cambridge University

Chapter 1 - Markets

Markets

Allow buyers and sellers to exchange goods and

services in return for a monetary payment.

Myriad of different varieties

Our main focus

A small number of sellers set price, quantity and other

variables strategically.

A large number of buyers react non-strategically to

supply conditions.

Usually, buyers = final consumers (B2C)

In some instances, buyers = other firms (B2B)

Cambridge University

Chapter 1 - Market power

Market power

How do markets operate?

Perfectly competitive paradigm: both sides of the

market are price-takers

OK for industries with small entry barriers and large number

of small firms.

Our focus: markets in which firms have market power

An incremental price increase does not lead to a loss of all of

the demand.

Applies to large firms, but also to small ones.

Market power and its sources are at the core of

this course.

Cambridge University

Chapter 1 - Number of firms

Number of firms in an industry

Natural oligopoly

Supply and demand conditions are such that only a

limited number of firms can enjoy positive profits.

Positive profits are not competed away.

Government-sponsored oligopolies

Goal of competition policy: avoid monopolization

But, governments sometimes restrict entry. Why?

Avoid socially wasteful duplication of certain investments

Regulated monopolies

Spectrum auctions for mobile telephony

Patent protection to foster innovation (see Part VII)

Creation of national champions

Cambridge University

Chapter 1 - Number of firms (2)

Case.

Case. Alcoas

Alcoas natural

natural monopoly

monopoly

1886:

1886: process

process of

of smelting

smelting aluminium

aluminium is

is patented

patented

AAsmall

small number

number of

of firms

firms use

use the

the patent

patent and

and start

start to

to

dominate

dominate the

the industry.

industry.

Most

Most successful:

successful: Alcoa

Alcoa (ALuminum

(ALuminum COmpany

COmpany of

of America)

America)

How?

How?

Large

Large economies

economies of

of scale

scale

Alcoa

Alcoa develops

develops markets

markets for

for its

its

growing

output

(intermediate

and

final

aluminium

products)

growing output (intermediate and final aluminium products)

Production

Production intensive

intensive in

in energy

energy

in

in 1893,

1893, Alcoa

Alcoa signs

signs in

in

advance

advance for

for hydroelectric

hydroelectric power

power produced

produced at

at Niagara

Niagara Falls

Falls

Production

Production intensive

intensive in

in bauxite

bauxite

Alcoa

Alcoa stakes

stakes out

out all

all the

the best

best

sources

sources of

of North

North American

American bauxite

bauxite for

for itself.

itself.

Efficiency

Efficiency gains

gains

Entry

Entry more

more difficult,

difficult, even

even after

after expiration

expiration of

of

patents

patents

Other

Other factors

factors

Public

Public policy,

policy,tariff

tariff protection,

protection, limited

limited antitrust

antitrust

check

check before

before 1914.

1914.

Cambridge University

Chapter 1 - Strategies

Strategies

Decision theory vs. Game theory

Decision theory isolated choices monopoly

Game theory strategic interaction oligopoly

Nash equilibrium

Prediction of market outcome when firms interact

strategically

Main concepts used in this course

Best-response function

Pure-, mixed-strategy Nash equilibrium

Subgame perfect Nash equilibrium

Bayesian Nash equilibrium

Perfect Bayesian Nash equilibrium

Cambridge University

Chapter 1 - Contents

Contents

Part I. Getting started

Chapter 1. What is Markets and Strategies?

Chapter 2. Firms, consumers and the market

Part II. Market power

Chapter 3. Static imperfect competition

Chapter 4. Dynamic aspects of imperfect competition

Part III. Sources of market power

Chapter 5. Product differentiation

Chapter 6. Advertising

Chapter 7. Consumer inertia

Part IV. Pricing and market segmentation

Chapter 8. Group and personalized pricing

Chapter 9. Menu pricing

Chapter 10. Intertemporal price discrimination

Chapter 11. Bundling and tying

Cambridge University

10

Chapter 1 - Contents (2)

Contents (contd)

Part V. Product quality and information

Chapter 12. Asymmetric information and signaling

Chapter 13. Marketing tools for experience goods

Part VI. Theory of competition policy

Chapter 14. Cartels and collusion

Chapter 15. Horizontal mergers

Chapter 16. Strategic incumbents

Chapter 17. Vertically related markets, vertical restraints and

mergers

Part VII. R&D and intellectual property

Chapter 18. Innovation and R&D

Chapter 19. Intellectual property

Cambridge University

11

Chapter 1. What is Markets and Strategies

Contents (contd)

Part VIII. Networks, standards and systems

Chapter 20. Markets with network goods

Chapter 21. Strategies for network goods

Part IX. Market intermediation

Chapter 22. Markets with intermediated goods

Chapter 23. Information and reputation in intermediated product

markets

Cambridge University

12

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Part IV. Theory of Competition PolicyDokument33 SeitenPart IV. Theory of Competition PolicyRafa SambeatNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- MeteoDokument1 SeiteMeteoRafa SambeatNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- 4 - DifferentiationDokument32 Seiten4 - DifferentiationRafa SambeatNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- ARDokument1 SeiteARRafa SambeatNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Category Management - A Pervasive, New Vertical/ Horizontal FormatDokument5 SeitenCategory Management - A Pervasive, New Vertical/ Horizontal FormatbooklandNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Solution Manualch13Dokument33 SeitenSolution Manualch13StoneCold Alex Mochan80% (5)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Chapter-1 Introduction To EconomicsDokument114 SeitenChapter-1 Introduction To Economicshailu tasheNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Econ Report ScriptDokument8 SeitenEcon Report ScriptEun HaeNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- CLASS 12 Economics MCQsDokument116 SeitenCLASS 12 Economics MCQsJamesNoch keine Bewertungen

- Chapter Five Analysis of Market StructureDokument11 SeitenChapter Five Analysis of Market Structurehayelom nigusNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Micro Economy Today 14Th Edition Schiller Solutions Manual Full Chapter PDFDokument35 SeitenMicro Economy Today 14Th Edition Schiller Solutions Manual Full Chapter PDFJessicaGarciabtcmr100% (11)

- Applied Economics Reviewer: What is EconomicsDokument12 SeitenApplied Economics Reviewer: What is EconomicsHannah Pauleen G. LabasaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Monopolistic CompetitionDokument4 SeitenMonopolistic CompetitionCookie LayugNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- ECON 300 Practice Quiz TwoDokument12 SeitenECON 300 Practice Quiz Twosam lissenNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- External Analysis: Industry Structure, Competitive Forces, and Strategic GroupsDokument44 SeitenExternal Analysis: Industry Structure, Competitive Forces, and Strategic GroupsDiadre DachiviantNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Types of Market StructuresDokument25 SeitenTypes of Market StructuresAngelo Mark Pacis100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- ECON 2 Module CHAP 5 Market Structure and Imperfect CompetitionDokument15 SeitenECON 2 Module CHAP 5 Market Structure and Imperfect CompetitionAngelica MayNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- ECON 1580 Discussion Assignment Unit 4Dokument1 SeiteECON 1580 Discussion Assignment Unit 4TesfahunNoch keine Bewertungen

- Managerial Economics MCQ With AnswersDokument65 SeitenManagerial Economics MCQ With AnswersPankaj MaryeNoch keine Bewertungen

- Module 8 Managing Competitive, Monopolistic, and Monopolistically Competitive Markets NotesDokument9 SeitenModule 8 Managing Competitive, Monopolistic, and Monopolistically Competitive Markets NotesHazel PabloNoch keine Bewertungen

- Types of Market StructuresDokument2 SeitenTypes of Market StructuresSneha Venkat99Noch keine Bewertungen

- Multinational Firms Theories ComparedDokument35 SeitenMultinational Firms Theories ComparedlinhtrunggNoch keine Bewertungen

- Applied Eco Module 5Dokument8 SeitenApplied Eco Module 5Joeppli Jacob MarceloNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Understanding Economics: Perfect CompetitionDokument26 SeitenUnderstanding Economics: Perfect CompetitionImroz MahmudNoch keine Bewertungen

- SHS LESSON 7 Market Models or StructuresDokument12 SeitenSHS LESSON 7 Market Models or StructuresPaul AnteNoch keine Bewertungen

- Nature Structure & System: Agricultural Marketing in IndiaDokument14 SeitenNature Structure & System: Agricultural Marketing in IndiaAnil KumarNoch keine Bewertungen

- Enterprise and Venture CapitalDokument336 SeitenEnterprise and Venture CapitalvadymkochNoch keine Bewertungen

- 4.2. Perfect CompetitionDokument31 Seiten4.2. Perfect CompetitionAshwini SakpalNoch keine Bewertungen

- ch11 PDFDokument65 Seitench11 PDFMohammed AljabriNoch keine Bewertungen

- The Antitrust Case Against AppleDokument36 SeitenThe Antitrust Case Against AppleSean JohnsonNoch keine Bewertungen

- Optimal Output and Pricing Strategies for FirmsDokument18 SeitenOptimal Output and Pricing Strategies for Firmsendiolalain aNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Original PDF Economics 2nd Edition by Daron Acemoglu PDFDokument41 SeitenOriginal PDF Economics 2nd Edition by Daron Acemoglu PDFwendy.ramos733100% (30)

- Iloveeconomics 470@gmalDokument8 SeitenIloveeconomics 470@gmalzaidashraf007Noch keine Bewertungen

- Applied Economics All ModuleDokument18 SeitenApplied Economics All ModuleSamantha ValienteNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)