Beruflich Dokumente

Kultur Dokumente

Returns To Alternative Savings Vehicles

Hochgeladen von

DownloadOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Returns To Alternative Savings Vehicles

Hochgeladen von

DownloadCopyright:

Verfügbare Formate

3

Returns to Alternative

Savings Vehicle

Key Words / Outline

Chapter

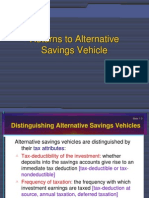

Distinguishing Alternative Savings

Slide 1Vehicles

2

Alternative savings vehicles are distinguished by

their tax attributes:

Tax-deductibility of the investment: whether deposits

into the savings accounts give rise to an immediate

tax deduction [tax-deductible or tax-nondeductible]

Frequency of taxation: the frequency with which

investment earnings are taxed [tax-deduction at

source, annual taxation, deferred taxation]

Applicable tax rate: the rate at which the investment

earnings are taxed [ordinary tax rate, special high

tax rate, or concessionary rate]

Alternative Savings Vehicles

(Intertemporally Constant Tax Rates)

Frequency Applicable

of taxation

tax rate

Slide 13

Savings

Vehicle

Taxdeductibility

of the

investment

After-tax accumulation

per after-tax Tk. I

invested [F]

No

Annually

Ordinary

I.[1+R(1t)]n

II

No

Deferred

Ordinary

I.(1+R)n (1t)+t.I

III

No

Annually

Capital gains

IV

No

Deferred

Capital gains I.(1+R)n (1tcg)+tcg.I

No

Never

Exempt

I.(1+R)n

VI

Yes

Deferred

Ordinary

[I.(1t)].(1+R)n (1t)

I.[1+R(1tcg)]n

or I.(1+R)n

Alternative Savings Vehicles

(Intertemporally Constant Tax Rates)

Savings

Vehicle

TaxFrequency

deductibility of taxation

of investment

Slide 14

Applicable

tax rate

Example in

the USA

No

Annually

Ordinary

Money Market Funds

II

No

Deferred

Ordinary

Single premium deferred

annuity

III

No

Annually

Capital

gains

Mutual Fund

IV

No

Deferred

Capital

gains

Foreign corporations

No

Never

Exempt

Insurance Policy

VI

Yes

Deferred

Ordinary

Pension

Alternative Savings Vehicles

(Intertemporally Constant Tax Rates)

Savings

Vehicle

TaxFrequency

deductibility of taxation

of investment

Slide 15

Applicable

tax rate

Example in

Bangladesh

No

Annually

Ordinary

Money Market Funds

II

No

Deferred

Ordinary

Term Securities [Defense

III

No

Annually

Capital

gains

-------***

IV

No

Deferred

Capital

gains

Corporate Investment in

Shares

No

Never

Exempt

Insurance Policy

VI

Yes

Deferred

Ordinary

--------

Savings Certificate]

***Income of the mutual fund of the person issuing such mutual fund is exempted u/p 30,

Part A, 6th Sch.

Slide 16

Alternative Savings Vehicles

(Intertemporally Constant Tax Rates)

Savings

Vehicle

Tax-deductibility

of investment

Frequency of

taxation

Applicable

tax rate

Example in

Bangladesh

III

No

Annually

Capital gains

------- ***

***Reduced tax rate (5%-15%) for initial 5-6 years allowed to prescribed new industries

established between 1.7.2009 to 30.6.2012 (vide SRO No. 172-Ain/Aykar/2009, dt. 1.7.2009).

[Tax Rates: 5% for first 2 years; 10% for next 2 years; 15% for next 1 year (industries in Dhaka and

Chittagong Divisions except for Rangamati, Bandarban and Khagrachari hill districts) and 5% for first 3

years; 10% for next 3 years (industries in other areas)].

Savings

Vehicle

Tax-deductibility

of investment

Frequency of

taxation

Applicable

tax rate

Example in

Bangladesh

VI

Yes

Deferred

Ordinary

--------***

*** Employers contributions towards Approved Pension Fund are tax-deductible [para 5(2), Part A, 1 st

Sch of ITO]

Income of the Fund (interest, dividend or capital gains) are exempted from tax [u/p 5(1)]

Pension received by employee is exempted u/p 8, Part A, 6 th Sch.

Slide 17

Alternative Savings Vehicles

(Intertemporally Constant Tax Rates)

Savings After-tax accumulation

per after-tax Tk. I

Vehicle

invested [F]

(USA)

I

II

III

IV

V

VI

I = Tk. 1

R = 7%

n=1

n=5

n=10

n=20

n=40

n=100

I.[1+R(1t)]n

1.05

1.27

1.61

2.60

6.78

119.55

I.(1+R)n (1t)+t.I

1.05

1.28

1.68

3.01

10.78

607.70

I.[1+R(1tcg)]n

1.06

1.34

1.78

3.18

10.09

323.67

I.(1+R)n (1tcg)+tcg.I

1.06

1.34

1.82

3.44

12.88

737.71

I.(1+R)n

1.07

1.40

1.97

3.87

14.97

867.72

[I.(1t)].(1+R)n (1t)

1.07

1.40

1.97

3.87

14.97

867.72

or I.(1+R)n

t = 30%

tcg = 15%

Alternative Savings Vehicles

(Intertemporally Constant Tax Rates)

Savings

Vehicle

(USA)

I

II

III

IV

V

VI

After-tax rate of

return

t = 30%

Slide 18

I = Tk. 1

R = 7%

n=1

n=5

n=10

n=20

n=40

n=100

[F I]1/n 1

4.90

4.90

4.90

4.90

4.90

4.90

[F I]1/n 1

4.90

5.09

5.31

5.66

6.12

6.62

[F I]1/n 1

5.95

5.95

5.95

5.95

5.95

5.95

[F I]1/n 1

5.95

6.06

6.18

6.37

6.60

6.83

[F I]1/n 1

7.00

7.00

7.00

7.00

7.00

7.00

[F I]1/n 1

7.00

7.00

7.00

7.00

7.00

7.00

tcg = 15%

Slide 19

Savings Vehicles I and II

(Intertemporally Constant Tax Rates)

Savings After-tax accumulation

per after-tax Tk. I

Vehicle

invested [F]

(USA)

I

II

I = Tk. 1

R = 7%

t = 30%

n=1

n=5

n=10

n=20

n=40

n=100

I.[1+R(1t)]n

1.05

1.27

1.61

2.60

6.78

119.55

I.(1+R)n (1t)+t.I

1.05

1.28

1.68

3.01

10.78

607.70

tcg = 15%

Comparison:

For investment horizons of only one period (n=1), Vehicle I and

Vehicle II are equivalent.

Except for n=1, the after-tax accumulation in Vehicle II always

exceeds that in Vehicle I.

The longer the holding period, the greater the difference in

accumulation.

Slide 110

Savings Vehicles I and II

(Intertemporally Constant Tax Rates)

Savings

Vehicle

(USA)

I

II

After-tax rate of

return

I = Tk. 1

R = 7%

n=1

n=5

n=10

n=20

n=40

n=100

[F I]1/n 1

4.90

4.90

4.90

4.90

4.90

4.90

[F I]1/n 1

4.90

5.09

5.31

5.66

6.12

6.62

(r)

t = 30%

tcg = 15%

Comparison:

All the after-tax annualized rates of return (r) are 4.9% in

Vehicle I.

But these rates increase in Vehicle II with the number of

holding periods.

In fact, in case of Vehicle II, as the number of periods becomes large,

the after-tax rate of return per period approaches the before tax rates

of return (R) of 7%.

Savings Vehicles II and III

(Intertemporally Constant Tax Rates)

Savings After-tax accumulation

per after-tax Tk. I

Vehicle

invested [F]

(USA)

t = 30%

Slide 111

I = Tk. 1

R = 7%

n=1

n=5

n=10

n=20

n=40

n=100

tcg = 15%

II

III

II

I.(1+R)n (1t)+t.I

1.05

1.28

1.68

3.01

10.78

607.70

I.[1+R(1tcg)]n

1.06

1.34

1.78

3.18

10.09

323.67

After-tax rate of

return (r)

4.90

5.09

5.31

5.66

6.12

6.62

III

After-tax rate of

return (r)

5.95

5.95

5.95

5.95

5.95

5.95

Comparison: Vehicle II may be more attractive than Vehicle III depending

on n and tcg. For example,

if tcg =0, Vehicle III always dominates Vehicle II, even for n=1

If 0<tcg<t, Vehicle III dominates Vehicle II for shorter n, but Vehicle II

dominates for longer n.

Slide 112

Savings Vehicle IV

(Intertemporally Constant Tax Rates)

Savings

Vehicle

After-tax accumulation

I = Tk. 1

R = 7%

t = 30%

tcg = 15%

n=1

n=5

n=10

n=20

n=40

n=100

I.[1+R(1t)]n

1.05

1.27

1.61

2.60

6.78

119.55

II

I.(1+R)n (1t)+t.I

1.05

1.28

1.68

3.01

10.78

607.70

III

I.[1+R(1tcg)]n

1.06

1.34

1.78

3.18

10.09

323.67

IV

I.(1+R)n (1tcg)+tcg.I

1.06

1.34

1.82

3.44

12.88

737.71

After-tax rate of return

4.90

4.90

4.90

4.90

4.90

4.90

II

After-tax rate of return

4.90

5.09

5.31

5.66

6.12

6.62

III

After-tax rate of return

5.95

5.95

5.95

5.95

5.95

5.95

IV

After-tax rate of return

5.95

6.06

6.18

6.37

6.60

6.83

Comparison:

Accumulation in Vehicle IV is similar to that for Vehicle II except that

income from Vehicle IV is taxed at more favourable tcg.

Vehicle IV is superior to Vehicles II & III except for special cases: tcg= 0

and tcg= t.

Slide 113

Savings Vehicle V

(Intertemporally Constant Tax Rates)

Savings

Vehicle

After-tax accumulation

I = Tk. 1

R = 7%

t = 30%

tcg = 15%

n=1

n=5

n=10

n=20

n=40

n=100

I.[1+R(1t)]n

1.05

1.27

1.61

2.60

6.78

119.55

II

I.(1+R)n (1t)+t.I

1.05

1.28

1.68

3.01

10.78

607.70

III

I.[1+R(1tcg)]n

1.06

1.34

1.78

3.18

10.09

323.67

IV

I.(1+R)n (1tcg)+tcg.I

1.06

1.34

1.82

3.44

12.88

737.71

I.(1+R)n

1.07

1.40

1.97

3.87

14.97

867.72

After-tax rate of return

4.90

4.90

4.90

4.90

4.90

4.90

II

After-tax rate of return

4.90

5.09

5.31

5.66

6.12

6.62

III

After-tax rate of return

5.95

5.95

5.95

5.95

5.95

5.95

IV

After-tax rate of return

5.95

6.06

6.18

6.37

6.60

6.83

After-tax rate of return

7.00

7.00

7.00

7.00

7.00

7.00

Comparison:

Accumulation in Vehicle V dominates that for Vehicle I through IV as long as the tcg is not 0%.

If tcg = 0, Vehicles III & IV generate exactly the same after-tax accumulations as in Vehicle V.

Slide 114

Savings Vehicle V

(Intertemporally Constant Tax Rates)

Savings

Vehicle

V

VI

After-tax accumulation

I = Tk. 1

R = 7%

t = 30%

tcg = 15%

n=1

n=5

n=10

n=20

n=40

n=100

I.(1+R)n

1.07

1.40

1.97

3.87

14.97

867.72

[I.(1t)].(1+R)n (1t)

1.07

1.40

1.97

3.87

14.97

867.72

After-tax rate of return

7.00

7.00

7.00

7.00

7.00

7.00

After-tax rate of return

7.00

7.00

7.00

7.00

7.00

7.00

or I.(1+R)n

V

VI

In Vehicle VI, the investment is tax-deductible; and investment earnings are tax deferred.

Comparison: When tax rates are constant over time, Vehicles V and VI are equivalent. Hence,

Accumulation in Vehicle VI dominates that for Vehicle I through IV as long as the tcg is not

0%.

If tcg = 0, Vehicles III & IV generate exactly the same after-tax accumulations as in Vehicle VI.

Slide 1Dominance Relations and Empirical Anomalies

15

Considering the previous 6 types of Savings Vehicles:

It is found that there are several strict dominance

relations among the savings vehicles, i.e., investors

would always prefer to avoid some of the savings

vehicles.

In the absence of frictions and restrictions, we would

never observe such tax-disfavoured vehicles as

Vehicle I (ordinary money market savings).

Yet, in the real world, money market savings command

a larger share of the savings than most tax-favoured

forms of savings.

The reasons stem largely from frictions and

restrictions.

Changes in Tax Rates over

Slide 1Time16

For pedagogical reasons, tax rates are assumed to be known and constant

and here, this assumption is relaxed.

Even without frictions and restrictions, the dominance relations among

savings vehicles disappear when we introduce intertemporal changes in tax

rates.

In this setting, Vehicles V and VI are no longer equivalent.

In particular, when tax rates are rising, Vehicle VI (pensions) become less

attractive and when tax rates are falling over time, Vehicle VI (pensions)

become more attractive.

Vehicle VI returns: [I.(1t0)].(1+R)n (1tn)

The subscript o indicates the tax rate in the period when the contribution is

made, assumed here to be the current period, and the subscript n indicates

the tax rate in the future period n when withdrawals are made.

When tn>t0, Vehicle V is superior. Conversely, when tn<t0, Vehicle VI is

superior.

Changes in Tax Rates over

Slide 1Time17

Vehicle VI returns: [I.(1t0)].(1+R)n (1tn)

When t0=50% and tn=28%, then

Vehicle VI return = 1.44(1+R)n

Thus, Vehicle VI provides an after-tax accumulation of

44% more than complete tax exemption.

When t0=31% and tn=40%, then

Vehicle VI return = .87(1+R)n

Thus, Vehicle VI provides an after-tax accumulation of

13% less than complete tax exemption.

End of the Chapter

Thank you.

Slide 118

Das könnte Ihnen auch gefallen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- Fast-Track Tax Reform: Lessons from the MaldivesVon EverandFast-Track Tax Reform: Lessons from the MaldivesNoch keine Bewertungen

- Session 03 - Returns To Alternative Savings VehiclesDokument18 SeitenSession 03 - Returns To Alternative Savings VehiclesTasminNoch keine Bewertungen

- Return of Private Foundation or Sectio N 9a7 @L (11 Nonexempt Charitable TrustDokument15 SeitenReturn of Private Foundation or Sectio N 9a7 @L (11 Nonexempt Charitable TrustalavifoundationNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument11 SeitenStandalone Financial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- kid 2Dokument5 Seitenkid 2amsaya2024Noch keine Bewertungen

- 8081-IRR Actual Scenario Sheet-20 Dec 12Dokument40 Seiten8081-IRR Actual Scenario Sheet-20 Dec 12pvpavanNoch keine Bewertungen

- kid 3Dokument10 Seitenkid 3amsaya2024Noch keine Bewertungen

- Chapter3 ExercisesDokument6 SeitenChapter3 ExercisesNguyễn PhươngNoch keine Bewertungen

- Emba 512Dokument3 SeitenEmba 512RaselNoch keine Bewertungen

- Financial and Forex Management Solved QuestionsDokument13 SeitenFinancial and Forex Management Solved QuestionskalbhorkNoch keine Bewertungen

- Tax Final Book With Cover Page 4th Sem 2021Dokument134 SeitenTax Final Book With Cover Page 4th Sem 2021H 0140 sayan sahaNoch keine Bewertungen

- C Corp V Flow Thru 3-26-12Dokument5 SeitenC Corp V Flow Thru 3-26-12JimcasartNoch keine Bewertungen

- Paper 11Dokument51 SeitenPaper 11eshwarsapNoch keine Bewertungen

- 2010 Form 990 For President and Fellows of Harvard CollegeDokument254 Seiten2010 Form 990 For President and Fellows of Harvard CollegeresponsibleharvardNoch keine Bewertungen

- Assignment No.02: Submitted To: Mam FatimaDokument10 SeitenAssignment No.02: Submitted To: Mam FatimassamminaNoch keine Bewertungen

- Minimum Alternate Tax MAT PDFDokument6 SeitenMinimum Alternate Tax MAT PDFmuskan khatriNoch keine Bewertungen

- Ca Final VatDokument34 SeitenCa Final VatSuhag PatelNoch keine Bewertungen

- Public CHAPTER 4Dokument15 SeitenPublic CHAPTER 4embiale ayaluNoch keine Bewertungen

- Basics On Income Tax PDFDokument10 SeitenBasics On Income Tax PDFHannan Mahmood TonmoyNoch keine Bewertungen

- (Updated July 2010) (2.2.1) Corporation Tax - General BackgroundDokument13 Seiten(Updated July 2010) (2.2.1) Corporation Tax - General BackgroundjfjkavanaghNoch keine Bewertungen

- IPCE May 2013 Taxation Suggested AnswerDokument13 SeitenIPCE May 2013 Taxation Suggested AnswerParasuram IyerNoch keine Bewertungen

- Taxation Answers and Marking Scheme6,719,75018,000,000180,0001,126,913Dokument12 SeitenTaxation Answers and Marking Scheme6,719,75018,000,000180,0001,126,913abby bendarasNoch keine Bewertungen

- Mat - PPT FinalDokument18 SeitenMat - PPT FinalAkash PatelNoch keine Bewertungen

- Advanced Taxation and Strategic Tax Planning PDFDokument11 SeitenAdvanced Taxation and Strategic Tax Planning PDFAnuk PereraNoch keine Bewertungen

- Value Added Tax Value Added Tax: Calculation of Net Tax and PaymentDokument32 SeitenValue Added Tax Value Added Tax: Calculation of Net Tax and PaymentAkter Uz Zaman100% (1)

- Return of Total Income and Tax ComputationDokument7 SeitenReturn of Total Income and Tax ComputationOmer PashaNoch keine Bewertungen

- Vikram Rathi - Taxing SituationsDokument2 SeitenVikram Rathi - Taxing SituationsVikram RathiNoch keine Bewertungen

- DC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsDokument4 SeitenDC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsTunzala ImanovaNoch keine Bewertungen

- Assignment On TaxationDokument13 SeitenAssignment On TaxationRabiul Karim ShipluNoch keine Bewertungen

- Understanding Taxation Level II Midterm Exam at Yanet CollegeDokument3 SeitenUnderstanding Taxation Level II Midterm Exam at Yanet CollegeBiniam Hunegnaw BitewNoch keine Bewertungen

- After-Tax Economic Analysis: Engineering EconomyDokument16 SeitenAfter-Tax Economic Analysis: Engineering EconomyTUẤN TRẦN MINHNoch keine Bewertungen

- NTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage CapitalDokument5 SeitenNTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage Capitalhati1Noch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Result)Dokument5 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Gurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesDokument16 SeitenGurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesBhavin PathakNoch keine Bewertungen

- Capital Gains ComputationDokument19 SeitenCapital Gains ComputationNandini AgarwalNoch keine Bewertungen

- FreedomWorks Inc 521349353 2009 061D5BE2SearchableDokument36 SeitenFreedomWorks Inc 521349353 2009 061D5BE2Searchablecmf8926Noch keine Bewertungen

- Return of Private Foundation: or Section A9a7 (A) (1) Nonexempt Charitable Trust Treated As A Private FoundationDokument15 SeitenReturn of Private Foundation: or Section A9a7 (A) (1) Nonexempt Charitable Trust Treated As A Private FoundationalavifoundationNoch keine Bewertungen

- Statutory Income Assessable Income Chargeable IncomeDokument4 SeitenStatutory Income Assessable Income Chargeable IncomeKelvin Lim Wei LiangNoch keine Bewertungen

- Tanzania Tax Guide 2012Dokument14 SeitenTanzania Tax Guide 2012Venkatesh GorurNoch keine Bewertungen

- Intermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 7Dokument15 SeitenIntermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 7JOLLYNoch keine Bewertungen

- F6PKN 2013 Jun Ans PDFDokument14 SeitenF6PKN 2013 Jun Ans PDFabby bendarasNoch keine Bewertungen

- F1 Answers May 2010Dokument12 SeitenF1 Answers May 2010mavkaziNoch keine Bewertungen

- Taxation: MD Mashiur Rahaman Robin KPMG-RRHDokument12 SeitenTaxation: MD Mashiur Rahaman Robin KPMG-RRHZidan ZaifNoch keine Bewertungen

- Tata JLR MergeDokument15 SeitenTata JLR MergeSiddharth SharmaNoch keine Bewertungen

- SEx 10Dokument24 SeitenSEx 10Amir Madani100% (3)

- Tax ReturnDokument7 SeitenTax Returnsyedfaisal_sNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Income Tax Ready Reckoner - Budget 2023-1Dokument14 SeitenIncome Tax Ready Reckoner - Budget 2023-1ಸೊಹನ್ ಕಲಂಗುಟ್ಕರ್Noch keine Bewertungen

- IT-2 2011 With Formula and Surcharge and Annex DDokument15 SeitenIT-2 2011 With Formula and Surcharge and Annex DPatti DaudNoch keine Bewertungen

- 9mys 2010 Dec A PDFDokument7 Seiten9mys 2010 Dec A PDFGabriel SimNoch keine Bewertungen

- Report About The Tax Related Implications of Different Investment AvenuesDokument3 SeitenReport About The Tax Related Implications of Different Investment AvenuesSHIVANI SINGH-IB 21IB333Noch keine Bewertungen

- Return of Private Foundation or Section 49 A7 @) (11 Nonexempt Charitable TrustDokument15 SeitenReturn of Private Foundation or Section 49 A7 @) (11 Nonexempt Charitable TrustalavifoundationNoch keine Bewertungen

- Reading 23 Residual Income Valuation - AnswersDokument47 SeitenReading 23 Residual Income Valuation - Answerstristan.riolsNoch keine Bewertungen

- Pawan 115ja JCDokument35 SeitenPawan 115ja JCKapasi TejasNoch keine Bewertungen

- 2009 Form 990 For Harvard Management CompanyDokument55 Seiten2009 Form 990 For Harvard Management CompanyresponsibleharvardNoch keine Bewertungen

- TXVNM 2019 Dec ADokument8 SeitenTXVNM 2019 Dec AMinh AnhNoch keine Bewertungen

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- Responding to Requests for Personal InformationDokument7 SeitenResponding to Requests for Personal InformationDownloadNoch keine Bewertungen

- Internal Audit Charter PDFDokument4 SeitenInternal Audit Charter PDFAishah Al NahyanNoch keine Bewertungen

- Monthly Salary CertificateDokument1 SeiteMonthly Salary CertificateAmit NaikNoch keine Bewertungen

- HR Manual TemplateDokument69 SeitenHR Manual TemplateGareth PohNoch keine Bewertungen

- Steps of An Internal AuditDokument3 SeitenSteps of An Internal AuditDownload100% (1)

- Netflix StrategyDokument3 SeitenNetflix StrategyDownload100% (1)

- Leave Policy of Diff OrgDokument7 SeitenLeave Policy of Diff OrgDownloadNoch keine Bewertungen

- Internal Audit ReportDokument4 SeitenInternal Audit ReportDownloadNoch keine Bewertungen

- Implicit Taxes Arbitrage Restrictions and FrictionsDokument33 SeitenImplicit Taxes Arbitrage Restrictions and FrictionsDownloadNoch keine Bewertungen

- AIS AssignmentDokument5 SeitenAIS AssignmentDownloadNoch keine Bewertungen

- Bangladesh Financial Reporting Standard (BFRS) and Environmental Accounting: A Case Study of Listed Manufacturing Companies in BangladeshDokument20 SeitenBangladesh Financial Reporting Standard (BFRS) and Environmental Accounting: A Case Study of Listed Manufacturing Companies in BangladeshAlif RussellNoch keine Bewertungen

- Bangladesh Financial Reporting Standard (BFRS) and Environmental Accounting: A Case Study of Listed Manufacturing Companies in BangladeshDokument20 SeitenBangladesh Financial Reporting Standard (BFRS) and Environmental Accounting: A Case Study of Listed Manufacturing Companies in BangladeshAlif RussellNoch keine Bewertungen

- Effective HRM Boosts Business PerformanceDokument23 SeitenEffective HRM Boosts Business PerformanceDownloadNoch keine Bewertungen

- Performance Evaluation of Dhaka Stock ExchangeDokument60 SeitenPerformance Evaluation of Dhaka Stock ExchangeDownloadNoch keine Bewertungen

- Case Study Royal Bank of CanadaDokument10 SeitenCase Study Royal Bank of Canadandgharat100% (1)

- Asset Quality, Credit Delivery and Management FinalDokument21 SeitenAsset Quality, Credit Delivery and Management FinalDebanjan DasNoch keine Bewertungen

- DTC Agreement Between Cyprus and United StatesDokument30 SeitenDTC Agreement Between Cyprus and United StatesOECD: Organisation for Economic Co-operation and DevelopmentNoch keine Bewertungen

- 1019989-Industrial Trainee-Publishing and Product License SupportDokument2 Seiten1019989-Industrial Trainee-Publishing and Product License SupportSravan KumarNoch keine Bewertungen

- ColdChainIq - Optimizing Cold Chain Logistics - SofrigamDokument4 SeitenColdChainIq - Optimizing Cold Chain Logistics - SofrigamIrinaGabrielaEnescuNoch keine Bewertungen

- QA Modul-1 PDFDokument24 SeitenQA Modul-1 PDFFarhan ShinigamiNoch keine Bewertungen

- DESIGNER BASKETS Vs Air Sea TransportDokument1 SeiteDESIGNER BASKETS Vs Air Sea TransportMarco CervantesNoch keine Bewertungen

- Business ProposalDokument4 SeitenBusiness ProposalCatherine Avila IINoch keine Bewertungen

- Audit BoyntonDokument27 SeitenAudit BoyntonMasdarR.MochJetrezzNoch keine Bewertungen

- SEED Experiment 5 PartaDokument6 SeitenSEED Experiment 5 PartaDhaval GamechiNoch keine Bewertungen

- Impact of Shelf Life On Fast Moving Consumer GoodsDokument50 SeitenImpact of Shelf Life On Fast Moving Consumer GoodsPragati SinghNoch keine Bewertungen

- Frequently Asked Questions Transition From UL 508C To UL 61800-5-1Dokument6 SeitenFrequently Asked Questions Transition From UL 508C To UL 61800-5-1nomeacueroNoch keine Bewertungen

- Q9 HazopDokument7 SeitenQ9 HazophemendraNoch keine Bewertungen

- Promo Pricing Strategies Reduce Prices Attract CustomersDokument20 SeitenPromo Pricing Strategies Reduce Prices Attract CustomersMarkDePazDiazNoch keine Bewertungen

- Casino PowerpointDokument23 SeitenCasino Powerpointmanami11Noch keine Bewertungen

- Template) PfmeaDokument1 SeiteTemplate) PfmeaPatrick170780Noch keine Bewertungen

- International Agent ContractDokument2 SeitenInternational Agent ContractCrKrishNoch keine Bewertungen

- Adv1 16-4Dokument1 SeiteAdv1 16-4M_Sarudi_Putra_4335Noch keine Bewertungen

- Customer equity value and lifetime revenue importanceDokument10 SeitenCustomer equity value and lifetime revenue importanceSniper ShaikhNoch keine Bewertungen

- Affidavit of GiftDokument2 SeitenAffidavit of GiftAnonymous puqCYDnQNoch keine Bewertungen

- Beams 12ge LN22Dokument51 SeitenBeams 12ge LN22emakNoch keine Bewertungen

- Design Principles For Industrie 4.0 Scenarios: A Literature ReviewDokument16 SeitenDesign Principles For Industrie 4.0 Scenarios: A Literature ReviewRogério MaxNoch keine Bewertungen

- AFS Tables Quick Reference GuideDokument14 SeitenAFS Tables Quick Reference GuideSharanNoch keine Bewertungen

- Approval of Permit To Use Loose-Leaf BooksDokument3 SeitenApproval of Permit To Use Loose-Leaf BooksJohnallen MarillaNoch keine Bewertungen

- Starbucks PDFDokument14 SeitenStarbucks PDFanimegod100% (1)

- Comparative Balance Sheets for Pin and San MergerDokument12 SeitenComparative Balance Sheets for Pin and San MergerFuri Fatwa DiniNoch keine Bewertungen

- API KHM DS2 en Excel v2Dokument436 SeitenAPI KHM DS2 en Excel v2Indra ZulhijayantoNoch keine Bewertungen

- Marketing Mix and PricingDokument11 SeitenMarketing Mix and PricingDiveshDuttNoch keine Bewertungen

- Hill V VelosoDokument3 SeitenHill V VelosoChaii CalaNoch keine Bewertungen

- Section25 Companies PDFDokument55 SeitenSection25 Companies PDFdreampedlar_45876997Noch keine Bewertungen