Beruflich Dokumente

Kultur Dokumente

Poland A2 Motorway

Hochgeladen von

harsh100%(2)100% fanden dieses Dokument nützlich (2 Abstimmungen)

901 Ansichten9 SeitenPoland A2 motorway case

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenPoland A2 motorway case

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

100%(2)100% fanden dieses Dokument nützlich (2 Abstimmungen)

901 Ansichten9 SeitenPoland A2 Motorway

Hochgeladen von

harshPoland A2 motorway case

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

Polands A2 Motorway

- Case Analysis

Bhanu | Divya | Harsh | Namita

The Project

AWSA, had won an exclusive concession to build

and operate the proposed A2 Motorway

A 934 million Project

BOT model to build and operate a 254 km

Motorway.

Part of the Polish Governments program of

upgrading and expanding the countrys

transportation infrastructure.

The challenge of this project was its size, traffic

forecast, financial projection & significant

experience in structuring project of this size.

Poland and the Toll Motorways Act 1994

A natural land bridge between Eastern and

Western Europe

Government approved construction of toll

motorways(2,600km)

Authorized the government to grant

concessions on a competitive tender basis

Also authorized the government to guarantee

financing

The Concession Agreement

In 1997, AWSA awarded 30 years BOT concession

agreement.

AWSA was owned by 10 Polish firms with diversified

commercial interests

AWSA was obligated to finish Phase 1 within 6.25 years

after financial close

Land leased by Government

Local permit by AWSA

Compensation to AWSA if permit gets delay due to

government authorities.

The government had the right to terminate the concession

(on deadline & payment)

Design, Construction and Financing

Fixed-price design and construction contract.

(16 million and 622 million respectively)

15% advance payment, remaining on monthly

basis)

Government was responsible to construct

feeder & parallel/by-pass roads

Liquidated damages for each day of delay by

contractors

Operation

10-year renewable contract to operate and

maintain.

Routine maintenance - Operating Company

Heavy maintenance AWSA

Revenue from tolls, petrol stations, roadside

restaurants, and eventually hotels

Concession agreement contained

commitments by the government to generate

satisfactory traffic volume.

Insurance Arrangements

During construction, all risk coverage for property

damage up to the full design and construction

cost US$ 667 million, declining to US$100 million

per event post completion

Insurance for lost profits due to delay in

completion set at 30 days' projected gross

revenues

After completion, business interruption insurance

would cover revenue losses for up to 12 months

Third-party liability insurance was US$ 50 million

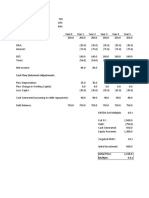

Financing Plan

934 million - Total estimated cost

Financing plan was based on a model created

by Deutsche Bank

1.5 DSCR to be maintain

Source of Fund

Subordinated debt and

Commercial Banks Zero coupon bonds

equity

Senior secured project

Three tranches AWSA shareholders

loan

266 million (face

242 million 235 million

amount at 800 million)

Financing Plan cont.

Loan rate = spread over 6-month LIBOR (180 bp to 235 bp)

Cash "waterfall" mechanism

1. Current operating expenses

2. Capital expenditure and maintenance reserve accounts

3. Current interest and principal payments on senior debt

4. Senior debt service reserve account

5. All remaining cash to the zero coupon bond sinking fund

Senior debt contracts would be governed by U.K. common

law, rest by Poland's civil law system

Das könnte Ihnen auch gefallen

- Poland S A2 MotorwayDokument7 SeitenPoland S A2 MotorwayAndy Vibgyor100% (1)

- Poland A2 Motorway: PSF Group Assignment Maulik Parekh Rahul Mohandas Shankar MohantyDokument14 SeitenPoland A2 Motorway: PSF Group Assignment Maulik Parekh Rahul Mohandas Shankar MohantyMaulik Parekh100% (2)

- Poland MotorwayDokument16 SeitenPoland MotorwayPrateek Agarwal100% (2)

- PMF A8 Poland's A2 MotorwayDokument6 SeitenPMF A8 Poland's A2 MotorwaySanjeet Kumar100% (1)

- Poland's A2 Motorway Case: Abhinav - Bala - Harsh - SandeepDokument14 SeitenPoland's A2 Motorway Case: Abhinav - Bala - Harsh - SandeepSuhas PothedarNoch keine Bewertungen

- Gemi Chad CameronDokument13 SeitenGemi Chad CameronavijeetboparaiNoch keine Bewertungen

- Day4 03 C2Dokument21 SeitenDay4 03 C2Sreenandan NambiarNoch keine Bewertungen

- POLAND'S A2 Motorway - FinalDokument12 SeitenPOLAND'S A2 Motorway - FinalAbinash Behera100% (2)

- Poland A2 MotorwayDokument8 SeitenPoland A2 MotorwayArun Kumar K100% (3)

- Poland A2Dokument5 SeitenPoland A2KhanZsuriNoch keine Bewertungen

- Polands A2Dokument8 SeitenPolands A2aanya17Noch keine Bewertungen

- Poland'S A2Dokument8 SeitenPoland'S A2mastermind_2848154100% (1)

- BP Amoco (B)Dokument32 SeitenBP Amoco (B)Arnab RoyNoch keine Bewertungen

- Project Finance CaseDokument15 SeitenProject Finance CaseDennies SebastianNoch keine Bewertungen

- Assignment Questions Poland A2 ExpresswayDokument5 SeitenAssignment Questions Poland A2 ExpresswayTran Tuan Linh100% (1)

- Petrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Dokument1 SeitePetrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Shrikant KrNoch keine Bewertungen

- Chad Cameroon Case FinalDokument28 SeitenChad Cameroon Case FinalAbhi Krishna ShresthaNoch keine Bewertungen

- Chad CameroonDokument17 SeitenChad CameroonAshish BhartiNoch keine Bewertungen

- Petrozuata Case StudyDokument20 SeitenPetrozuata Case StudyBasit Ali Chaudhry100% (1)

- Guide Questions Liability Management at General MotorsDokument1 SeiteGuide Questions Liability Management at General MotorsZtreat Nohanih0% (1)

- Petrolera Zueta, Petrozuata CDokument6 SeitenPetrolera Zueta, Petrozuata CAnkur SinhaNoch keine Bewertungen

- Chad Cameroon PipelineDokument12 SeitenChad Cameroon PipelineUmang ThakerNoch keine Bewertungen

- Group2 - Hong Kong DisneyLandDokument10 SeitenGroup2 - Hong Kong DisneyLandNidhiAgarwalNoch keine Bewertungen

- Maersk LineDokument10 SeitenMaersk LinePankhoori VidyaNoch keine Bewertungen

- Financing The Mozal Project Case SolutionDokument4 SeitenFinancing The Mozal Project Case SolutionSebastian100% (2)

- Petrozuata Case AnalysisDokument7 SeitenPetrozuata Case AnalysisAmyo Roy100% (9)

- AJC CaseDokument46 SeitenAJC CaseHemachandar Vaida100% (1)

- Appendix 2 - A2 Motorway in PolandDokument52 SeitenAppendix 2 - A2 Motorway in PolandSDPAS100% (1)

- Petrozuata Analysis WriteupDokument5 SeitenPetrozuata Analysis Writeupgkfernandes0% (1)

- Risks Petrolera Zuata Petrozuata CaDokument9 SeitenRisks Petrolera Zuata Petrozuata CahdvdfhiaNoch keine Bewertungen

- Case: Calpine Corporation: The Evolution From Project To Corporate FinanceDokument7 SeitenCase: Calpine Corporation: The Evolution From Project To Corporate FinanceKshitishNoch keine Bewertungen

- Mozal ProjectDokument7 SeitenMozal Projectprajeshgupta100% (1)

- AJC Case Analysis.Dokument4 SeitenAJC Case Analysis.sunny rahulNoch keine Bewertungen

- Petrolera Zuata Petrozuata CA. AnswerDokument8 SeitenPetrolera Zuata Petrozuata CA. AnswerKelvinItemuagbor100% (1)

- GCI & GRI ProblemDokument2 SeitenGCI & GRI ProblemAnimesh GuptaNoch keine Bewertungen

- Case 3 Group 7Dokument11 SeitenCase 3 Group 7sub312Noch keine Bewertungen

- PMF B Group 6 Poland A2Dokument7 SeitenPMF B Group 6 Poland A2Kiran KannanNoch keine Bewertungen

- Mozal ExcelDokument4 SeitenMozal Excelderek4wellNoch keine Bewertungen

- Petrozuata and Articles Handout 2020Dokument12 SeitenPetrozuata and Articles Handout 2020Darshan Gosalia0% (1)

- Henkel - Umbrella Branding and Globalization DecisionsDokument28 SeitenHenkel - Umbrella Branding and Globalization DecisionsFez Research Laboratory100% (3)

- Calpine Corp. The Evolution From Project To Corporate FinanceDokument4 SeitenCalpine Corp. The Evolution From Project To Corporate FinanceDarshan Gosalia100% (1)

- Chasecase PaperDokument10 SeitenChasecase PaperadtyshkhrNoch keine Bewertungen

- Group4 LoctiteDokument2 SeitenGroup4 LoctiteCaptn Pawan DeepNoch keine Bewertungen

- Ashok LeylandDokument2 SeitenAshok LeylandparulNoch keine Bewertungen

- Australia Japan CableDokument22 SeitenAustralia Japan CableRounak Bhagwat86% (7)

- BP Amoco (A) & (B)Dokument23 SeitenBP Amoco (A) & (B)Manish SinhaNoch keine Bewertungen

- CSX - Conrail - Group 13Dokument10 SeitenCSX - Conrail - Group 13Saquib HasnainNoch keine Bewertungen

- Petrolera Zuata, Petrozuata C. A. Case AnalysisDokument10 SeitenPetrolera Zuata, Petrozuata C. A. Case Analysisshivam saraffNoch keine Bewertungen

- Chad Cameroon Petroleum Development andDokument24 SeitenChad Cameroon Petroleum Development andYourick Evans Pouga MbockNoch keine Bewertungen

- Maersk Ltd.Dokument10 SeitenMaersk Ltd.Shilpie ChakravartyNoch keine Bewertungen

- BBM Group AssignmentDokument5 SeitenBBM Group AssignmentKirat Chhabra100% (1)

- AJCDokument42 SeitenAJCShashank Kanodia100% (1)

- ConrailM&a Group7Dokument15 SeitenConrailM&a Group7Saquib HasnainNoch keine Bewertungen

- The Costs and Benefits of A $3 Billion Factory:: Should Development Aid Be Used To Expand The MOZAL Mega-Project?Dokument19 SeitenThe Costs and Benefits of A $3 Billion Factory:: Should Development Aid Be Used To Expand The MOZAL Mega-Project?jvoth5186Noch keine Bewertungen

- Iridium Case - Team 3Dokument7 SeitenIridium Case - Team 3Kasak GuptaNoch keine Bewertungen

- BP Amoco - A Case Study On Project FinanceDokument11 SeitenBP Amoco - A Case Study On Project Financevinay5209100% (2)

- AJC CaseDokument18 SeitenAJC CaseAbhinava Chanda100% (1)

- Maersk Case AnalysisDokument6 SeitenMaersk Case AnalysisVaishnav SureshNoch keine Bewertungen

- Lecture - 1 - Introduction To International Project FinanceDokument75 SeitenLecture - 1 - Introduction To International Project FinanceJoga RoxanaNoch keine Bewertungen

- Cursul 1 - Introducere in Finantarea ProiectelorDokument27 SeitenCursul 1 - Introducere in Finantarea ProiectelorAna-Maria IonescuNoch keine Bewertungen

- Valuation of SharesDokument11 SeitenValuation of SharesShashikant ZarekarNoch keine Bewertungen

- GenderDokument29 SeitenGenderDISCOVERYNoch keine Bewertungen

- 8 Facts About Stephen Hawking PDFDokument2 Seiten8 Facts About Stephen Hawking PDFharshNoch keine Bewertungen

- Case Study - NEXA FinalDokument6 SeitenCase Study - NEXA Finalharsh0% (1)

- MULTIstage Cic Decimation FilterDokument4 SeitenMULTIstage Cic Decimation FilterharshNoch keine Bewertungen

- Bank Negara Malaysia - The Central Bank of Malaysia - Who Owns It?Dokument17 SeitenBank Negara Malaysia - The Central Bank of Malaysia - Who Owns It?RedzaNoch keine Bewertungen

- 109 04 Simple LBO ModelDokument2 Seiten109 04 Simple LBO ModelTrần Bảo YếnNoch keine Bewertungen

- Paper 1. 29780225Dokument43 SeitenPaper 1. 29780225L.Noch keine Bewertungen

- Financing Companies in Chap 11: How To Do It, How To Profit From ItDokument18 SeitenFinancing Companies in Chap 11: How To Do It, How To Profit From ItJefferMangelsNoch keine Bewertungen

- Easterly Government Properties (DEA) - The Long-Term Treasury of REITs - Seeking AlphaDokument20 SeitenEasterly Government Properties (DEA) - The Long-Term Treasury of REITs - Seeking Alphapta123Noch keine Bewertungen

- The Matrix and The ConstitutionDokument48 SeitenThe Matrix and The Constitutionitaintme100% (4)

- Petitioners, vs. vs. Respondents Americo H. Acosta Bonifacio M. Abad Vicente CuisonDokument9 SeitenPetitioners, vs. vs. Respondents Americo H. Acosta Bonifacio M. Abad Vicente CuisonJuana Dela VegaNoch keine Bewertungen

- Cir Vs de PrietoDokument7 SeitenCir Vs de PrietoG FNoch keine Bewertungen

- Bar Q and A ObliconDokument146 SeitenBar Q and A ObliconPilacan Karyl100% (10)

- Simple InterestDokument19 SeitenSimple InterestHJNoch keine Bewertungen

- (PDF) The Revised Altman Z'-Score Model Verifying Its Validity As A Predictor of Corporate Failure in The Case of UK Private ComDokument1 Seite(PDF) The Revised Altman Z'-Score Model Verifying Its Validity As A Predictor of Corporate Failure in The Case of UK Private ComHelena Leyla MalimaneNoch keine Bewertungen

- Analysis of Credit Risk, Liquidity and Profitability of The Trade Bank of Iraq For The Period (2012-2021)Dokument25 SeitenAnalysis of Credit Risk, Liquidity and Profitability of The Trade Bank of Iraq For The Period (2012-2021)Ali Abdulhassan AbbasNoch keine Bewertungen

- Final AccountsDokument5 SeitenFinal AccountsGopal KrishnanNoch keine Bewertungen

- Motion To Dismiss Amended ComplaintDokument22 SeitenMotion To Dismiss Amended Complaintwinstons2311Noch keine Bewertungen

- Afs ProjectDokument37 SeitenAfs ProjectNuman RoxNoch keine Bewertungen

- SECTION 9 and Section 11. (JONES LAW, 1916)Dokument9 SeitenSECTION 9 and Section 11. (JONES LAW, 1916)Ki PieNoch keine Bewertungen

- Acknowledgement of Indebtedness (Pengakuan Hutang)Dokument2 SeitenAcknowledgement of Indebtedness (Pengakuan Hutang)ridhofauzisNoch keine Bewertungen

- Passion Capital Term Sheet: Important DecisionsDokument1 SeitePassion Capital Term Sheet: Important DecisionsPassion CapitalNoch keine Bewertungen

- Cancellation of Mortgage SampleDokument1 SeiteCancellation of Mortgage SampleEsli Adam Rojas100% (6)

- (DIGEST) Rehabilitation Finance Corp V CADokument2 Seiten(DIGEST) Rehabilitation Finance Corp V CAJet Siang100% (3)

- Secured Transactions Flow ChartDokument10 SeitenSecured Transactions Flow ChartAnonymous vXdxDlwKO89% (9)

- Accountancy ImpQ CH04 Admission of A Partner 01Dokument18 SeitenAccountancy ImpQ CH04 Admission of A Partner 01praveentyagiNoch keine Bewertungen

- Abdi Jundi ResDokument43 SeitenAbdi Jundi ResBobasa S AhmedNoch keine Bewertungen

- Airbnb Agreement Full TextDokument7 SeitenAirbnb Agreement Full TextJustin SpeersNoch keine Bewertungen

- Assignment #5: Please Refer To Sheet Q3' of Attached Excel For WorkingDokument4 SeitenAssignment #5: Please Refer To Sheet Q3' of Attached Excel For WorkingAditi RawatNoch keine Bewertungen

- Esteem Auto PVT - LTDDokument58 SeitenEsteem Auto PVT - LTDPrashantbha RajputNoch keine Bewertungen

- Ms. Sharon A. Bactat Prof. Suerte R. Dy: Sabactat@mmsu - Edu.ph Srdy@mmsu - Edu.phDokument26 SeitenMs. Sharon A. Bactat Prof. Suerte R. Dy: Sabactat@mmsu - Edu.ph Srdy@mmsu - Edu.phCrisangel de LeonNoch keine Bewertungen

- Bond - A Long-Term Debt Instrument Treasury Bonds - Bonds Issued by The FederalDokument1 SeiteBond - A Long-Term Debt Instrument Treasury Bonds - Bonds Issued by The FederalCarlos Vincent OliverosNoch keine Bewertungen

- Eng. Mortgage DeedDokument4 SeitenEng. Mortgage DeedKiran VenugopalNoch keine Bewertungen

- Facts:: Gutierrez Hermanos vs. Orense Gr. No. L-9188 1914Dokument4 SeitenFacts:: Gutierrez Hermanos vs. Orense Gr. No. L-9188 1914pjNoch keine Bewertungen