Beruflich Dokumente

Kultur Dokumente

Corporate Finance Bharati Airtel

Hochgeladen von

David William0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

88 Ansichten11 SeitenThis document presents information on Bharti Airtel's capital structure, sources of financing, and dividend policy from 2013 to 2017. It shows that the company's debt ratio has remained stable between 0.43 to 0.46 over this period while its net debt to shareholders' equity has increased from 1.01 to 1.35 times. Credit metrics like interest coverage and debt ratios indicate the company has maintained good financial health and experienced no financial distress. The document also outlines the company's dividend policy and trends in key financial metrics over time.

Originalbeschreibung:

Finance and Capital Structure of Bharati Airtel

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document presents information on Bharti Airtel's capital structure, sources of financing, and dividend policy from 2013 to 2017. It shows that the company's debt ratio has remained stable between 0.43 to 0.46 over this period while its net debt to shareholders' equity has increased from 1.01 to 1.35 times. Credit metrics like interest coverage and debt ratios indicate the company has maintained good financial health and experienced no financial distress. The document also outlines the company's dividend policy and trends in key financial metrics over time.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

88 Ansichten11 SeitenCorporate Finance Bharati Airtel

Hochgeladen von

David WilliamThis document presents information on Bharti Airtel's capital structure, sources of financing, and dividend policy from 2013 to 2017. It shows that the company's debt ratio has remained stable between 0.43 to 0.46 over this period while its net debt to shareholders' equity has increased from 1.01 to 1.35 times. Credit metrics like interest coverage and debt ratios indicate the company has maintained good financial health and experienced no financial distress. The document also outlines the company's dividend policy and trends in key financial metrics over time.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 11

Bharti Airtel

Capital structure, sources of

financing & dividend policy

Presentation by :

Ankit Vora - 80118170000

Hiren Shah - 80118170031

Niharikaa Mehra - 80118170000

Suchitra Madidi - 80118170000

David William - 80118170000

Capital Structure

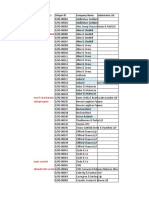

Particulars Mar '13 Mar '14 Mar '15 Mar '16 Mar '17

Shareholder's Equity (Rs Mn) 5,03,217 5,97,560 6,19,564 6,67,693 6,74,563

Net Debt (Rs Mn) 5,83,567 6,05,416 6,68,417 8,35,106 9,13,999

Capital Employed (Rs Mn) 10,86,784 12,02,976 12,87,981 15,02,799 15,88,562

Debt Ratio 0.46 0.48 0.43 0.44 0.46

Net Debt to Shareholders Equity (Times) 1.16 1.01 1.08 1.25 1.35

aa

Capital Structure

Credit Rating & Financial Distress

Particulars Mar '17 Mar '16 Mar '15 Mar '14 Mar '13

Long Term Debt / Equity 1.33 2.12 0.73 0.92 1.22

Total Debt/Equity 1.52 2.26 1.07 1.27 1.45

Interest Coverage ratio 8.43 7.06 8.43 7.58 6.79

Credit Rating & Financial Distress

Current Ratio Asset Utilization Interest Coverage Ratio

2 300 253.18 15

1.49 1.5 1.51 12.11

1.5 250 211.25 195.8

0.99 200 166.92 10

142.58 7.42

1

150 4.91

4.01 4.01

0.5 0.21 100 5

50

0

2017 2016 2015 2014 2013 0 0

2017 2016 2015 2014 2013 2017 2016 2015 2014 2013

Airtel Industry

Days in Receivable Inventory Turnover Ratio Debt to Market Value

50,000.00 73%

80%

25.00 20.53 21.50 64%

18.01

20.00 16.13 17.63 40,000.00

60% 46% 46% 50%

30,000.00

15.00

40%

10.00 20,000.00

5.00 10,000.00 20%

0.00 0.00 0%

2017 2016 2015 2014 2013 2017 2016 2015 2014 2013 2017 2016 2015 2014 2013

Credit Rating & Financial Distress

Cash Flow from Operations Operating Profit Margin Earnings per Share

25000 38.04 37.04 20

40 35.01 32.65 15.21

20000 29.7 12.97

15

15000 30 9.51

20 10 7.01 5.99

10000

5000 10 5

0 0 0

2017 2016 2015 2014 2013 2017 2016 2015 2014 2013 2017 2016 2015 2014 2013

Return on Capital Employed Net Debt to EBIDTA Credit Rating

10 2.66

8.32 8.05 3 2.46 2.51 Moodys Rating :

8 6.65 2.5 2.08 2.19

6.45 Airtel - Baa3

5.68

2

6 Vodafone Baa1

1.5

4

1

2 0.5 No Financial Distress

0 0

2017 2016 2015 2014 2013 2017 2016 2015 2014 2013

Credit Rating & Financial Distress

Dividend Policy

Dividend Policy

Dividend Policy

thank you

Das könnte Ihnen auch gefallen

- Airline Industry Analysis FinalDokument18 SeitenAirline Industry Analysis FinalBraveenvarmaNoch keine Bewertungen

- 2012 2013 2014 2015 2016 NPM GPM OpmDokument14 Seiten2012 2013 2014 2015 2016 NPM GPM OpmSaurabh GuptaNoch keine Bewertungen

- Vie Key Indicators 2021Dokument4 SeitenVie Key Indicators 2021Nguyên NguyễnNoch keine Bewertungen

- KBC BelgiaDokument2 SeitenKBC BelgiaBogdan StanicaNoch keine Bewertungen

- KBC Return of Assets KBC Return of EquitiesDokument2 SeitenKBC Return of Assets KBC Return of EquitiesBogdan StanicaNoch keine Bewertungen

- Financial Analysis of Mozaffar Hossain Spinning Mills: Submitted byDokument12 SeitenFinancial Analysis of Mozaffar Hossain Spinning Mills: Submitted byEhsanul AzimNoch keine Bewertungen

- Corpo FinDokument24 SeitenCorpo FinShaikh Saifullah KhalidNoch keine Bewertungen

- Internsip Presentation On Financial Performance Analysis of NCC Bank Limited A Study On Madhunaghat BranchDokument19 SeitenInternsip Presentation On Financial Performance Analysis of NCC Bank Limited A Study On Madhunaghat BranchShafayet JamilNoch keine Bewertungen

- Presented D by Ankit Vardhan (10DF016) Abhishek Charaborty (10DF017) Satish Umar (10DF 018) (PDGM FC)Dokument23 SeitenPresented D by Ankit Vardhan (10DF016) Abhishek Charaborty (10DF017) Satish Umar (10DF 018) (PDGM FC)Satish KumarNoch keine Bewertungen

- Activ Net 9 13 OKDokument57 SeitenActiv Net 9 13 OKOvidiu DascaluNoch keine Bewertungen

- Rekap Harga TBS CPODokument98 SeitenRekap Harga TBS CPOGlobal MapindoNoch keine Bewertungen

- Appraisal of Dividend Policy of Navana CNG Limited: Presented by Easmin Ara Eity ID: 2018-2-10-048Dokument11 SeitenAppraisal of Dividend Policy of Navana CNG Limited: Presented by Easmin Ara Eity ID: 2018-2-10-048Movie SenderNoch keine Bewertungen

- Pie ChartDokument14 SeitenPie ChartPhalangmiki NohriangNoch keine Bewertungen

- Vedanta LimitedDokument16 SeitenVedanta LimitedtanyaNoch keine Bewertungen

- Answer To The Question No. A: Considering Profitability RatioDokument8 SeitenAnswer To The Question No. A: Considering Profitability RatioMd Al-AminNoch keine Bewertungen

- Yardstick Educational Initiatives (FZE) : Information Checklist and Tracker Last Updated On: 11/30/2021Dokument8 SeitenYardstick Educational Initiatives (FZE) : Information Checklist and Tracker Last Updated On: 11/30/2021Dishant KhanejaNoch keine Bewertungen

- Vardhman Textile Financial Ratio AnalysisDokument6 SeitenVardhman Textile Financial Ratio Analysisnishant singhalNoch keine Bewertungen

- Afa Assignment: Ratio AnalysisDokument7 SeitenAfa Assignment: Ratio AnalysisKathir VelNoch keine Bewertungen

- Analsis of Scotch FocastDokument24 SeitenAnalsis of Scotch FocastRichard Osahon EseleNoch keine Bewertungen

- PS 2Dokument6 SeitenPS 2Nikky Bless LeonarNoch keine Bewertungen

- Group 07 22657 Sandeep S SDokument21 SeitenGroup 07 22657 Sandeep S SSandeep ShirasangiNoch keine Bewertungen

- Dividend Policy Analysis: Submitted To: Prof. Sougata RayDokument8 SeitenDividend Policy Analysis: Submitted To: Prof. Sougata Raysubhasis mahapatraNoch keine Bewertungen

- Computing The Value of A Growing Finite AnnuityDokument10 SeitenComputing The Value of A Growing Finite AnnuityMahmood AhmadNoch keine Bewertungen

- Featherstone Dry Mix Pvt. Ltd. Serial Particulars Units: Sales 848.25 1050.53Dokument39 SeitenFeatherstone Dry Mix Pvt. Ltd. Serial Particulars Units: Sales 848.25 1050.53saubhik goswamiNoch keine Bewertungen

- Business Simulation Team-HDokument12 SeitenBusiness Simulation Team-Hpawan vermaNoch keine Bewertungen

- RP Infra Cma ReportDokument12 SeitenRP Infra Cma ReportJitendra NikhareNoch keine Bewertungen

- Financial Performance Report General Tyres and Rubber Company-FinalDokument29 SeitenFinancial Performance Report General Tyres and Rubber Company-FinalKabeer QureshiNoch keine Bewertungen

- Curret Ratio Acid Test RatioDokument7 SeitenCurret Ratio Acid Test RatioNIKHIL MATHEWNoch keine Bewertungen

- Corporate Valuation DeonDokument9 SeitenCorporate Valuation Deondeonlopes057Noch keine Bewertungen

- InputsDokument14 SeitenInputsRavi tejaNoch keine Bewertungen

- Strategy MGN600Dokument19 SeitenStrategy MGN600Manjit KaurNoch keine Bewertungen

- PEST Analysis of PakistanDokument36 SeitenPEST Analysis of PakistanArslan Ahmed RajputNoch keine Bewertungen

- FIM TPDokument7 SeitenFIM TPAfroza VabnaNoch keine Bewertungen

- Table For Saudi ArabiaDokument7 SeitenTable For Saudi ArabiaAlfishan RehmatNoch keine Bewertungen

- Introduction To Financial Modeling 2Dokument25 SeitenIntroduction To Financial Modeling 2Habib AhmadNoch keine Bewertungen

- MegaDokument7 SeitenMegaPatriciaNoch keine Bewertungen

- Annual Report 2075 76 EnglishDokument200 SeitenAnnual Report 2075 76 Englishram krishnaNoch keine Bewertungen

- Adv Excel Session-4 References Sort FilterDokument259 SeitenAdv Excel Session-4 References Sort FilterRitik TaranNoch keine Bewertungen

- Discount Rate 8% Years CF 0 - 600 1 100 2 100 3 100 4 100 5 100 6 100 7 100 8 100 9 100 10 100 NPV 71.01 IRR 10.56% Yes I Will Purchase The AssetDokument21 SeitenDiscount Rate 8% Years CF 0 - 600 1 100 2 100 3 100 4 100 5 100 6 100 7 100 8 100 9 100 10 100 NPV 71.01 IRR 10.56% Yes I Will Purchase The AssetM ShahZeb KhanNoch keine Bewertungen

- Real GDP at Current Price Russia IndiaDokument9 SeitenReal GDP at Current Price Russia IndiaCarlos AlphonceNoch keine Bewertungen

- Stock Exchange (20 Years)Dokument9 SeitenStock Exchange (20 Years)ALISHA NAYAKNoch keine Bewertungen

- Exide IndustriesDokument55 SeitenExide IndustriesSALONI JaiswalNoch keine Bewertungen

- Chapter - 1Dokument24 SeitenChapter - 1mrinal halderNoch keine Bewertungen

- UntitledDokument109 SeitenUntitledPradip Kumar ShahNoch keine Bewertungen

- Telematics DataDokument19 SeitenTelematics DataRenauld SNoch keine Bewertungen

- Financiero SmuckersDokument9 SeitenFinanciero SmuckerserickNoch keine Bewertungen

- Wipro SFM - CIA1.1 2Dokument12 SeitenWipro SFM - CIA1.1 2Saloni Jain 1820343Noch keine Bewertungen

- Equity Research of Stockbroking Companies: Group MembersDokument20 SeitenEquity Research of Stockbroking Companies: Group MembersShilpi KumariNoch keine Bewertungen

- Capital StructureDokument4 SeitenCapital StructureBindiya SinhaNoch keine Bewertungen

- IndiaMART 1631988858Dokument13 SeitenIndiaMART 1631988858NAMIT GADGENoch keine Bewertungen

- Dairy Crest Valuation - Sample ModelDokument29 SeitenDairy Crest Valuation - Sample ModelSelvi balanNoch keine Bewertungen

- Corporate FinanceDokument5 SeitenCorporate FinanceDessiree ChenNoch keine Bewertungen

- Declining BalanceDokument15 SeitenDeclining BalanceGigih Adi PambudiNoch keine Bewertungen

- Financial Model For A Potential M&A TransactionDokument206 SeitenFinancial Model For A Potential M&A TransactionZheena OcampoNoch keine Bewertungen

- GDP (Usd Billion) & GDP Per Capital (Usd)Dokument8 SeitenGDP (Usd Billion) & GDP Per Capital (Usd)Minh HảiNoch keine Bewertungen

- GDP (Usd Billion) & GDP Per Capital (Usd)Dokument8 SeitenGDP (Usd Billion) & GDP Per Capital (Usd)Minh HảiNoch keine Bewertungen

- Data T NG H P Ksan Có VR 28 03Dokument197 SeitenData T NG H P Ksan Có VR 28 03Huyền Lê Thị KhánhNoch keine Bewertungen

- Adv Excel Session-4 - References - Sort - FilterDokument251 SeitenAdv Excel Session-4 - References - Sort - FiltersksinghknpNoch keine Bewertungen

- Internal Forces G, HDokument6 SeitenInternal Forces G, HRui JiaNoch keine Bewertungen

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesVon EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesBewertung: 5 von 5 Sternen5/5 (3)

- Company Name Email Address Contact NumberDokument10 SeitenCompany Name Email Address Contact NumberBagabaldo FamilyNoch keine Bewertungen

- Annual Report: Sapphire Textile Mills LimitedDokument236 SeitenAnnual Report: Sapphire Textile Mills Limitedfatima1234Noch keine Bewertungen

- Corporation Joint AccountsDokument6 SeitenCorporation Joint AccountsNineteen AùgùstNoch keine Bewertungen

- Web Table 28. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2013Dokument1 SeiteWeb Table 28. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2013Iordache G. IulianNoch keine Bewertungen

- Eps SS Jun 2018Dokument4 SeitenEps SS Jun 2018MalNoch keine Bewertungen

- Sbi LifeDokument377 SeitenSbi LifeNihal YnNoch keine Bewertungen

- Gvca Members Directory 1484Dokument6 SeitenGvca Members Directory 1484Naeem UddinNoch keine Bewertungen

- 12 - Iepf Div 2015 16 2 IntDokument136 Seiten12 - Iepf Div 2015 16 2 IntRimoNoch keine Bewertungen

- Instrument List A-30Dokument2 SeitenInstrument List A-30Maldives IslandsNoch keine Bewertungen

- WTM/SM/CFD/CMD-1/15312/2021-22 Securities and Exchange Board of India A I E - P O Cum S C N U S 11 (1), 11 (4) 11B (1) S E B I A, 1992Dokument27 SeitenWTM/SM/CFD/CMD-1/15312/2021-22 Securities and Exchange Board of India A I E - P O Cum S C N U S 11 (1), 11 (4) 11B (1) S E B I A, 1992Pratim MajumderNoch keine Bewertungen

- NasdaqDokument135 SeitenNasdaqShivam AggarwalNoch keine Bewertungen

- Redemption of Preference SharesDokument9 SeitenRedemption of Preference SharesRahul VermaNoch keine Bewertungen

- B7110-001 Financial Statement Analysis and Valuation PDFDokument3 SeitenB7110-001 Financial Statement Analysis and Valuation PDFLittleBlondie0% (2)

- Company Law 2Dokument12 SeitenCompany Law 2MAHI8888Noch keine Bewertungen

- ACCA P4 Class Notes June 2011 VersionDokument454 SeitenACCA P4 Class Notes June 2011 VersionAbigail Charles100% (1)

- Collateral ManagersDokument3 SeitenCollateral ManagersZerohedgeNoch keine Bewertungen

- Law Firms List - 3Dokument16 SeitenLaw Firms List - 3Reena ShauNoch keine Bewertungen

- Afghanistan: Pls-Cadd Users ListDokument15 SeitenAfghanistan: Pls-Cadd Users ListAhsan MahmoodNoch keine Bewertungen

- A Study On The Corporate Governance Issues at SATYAMDokument18 SeitenA Study On The Corporate Governance Issues at SATYAMSomiya91% (22)

- Pengaruh Kualitas Audit Dan Keefektifan Komite Audit Terhadap Manajemen LabaDokument21 SeitenPengaruh Kualitas Audit Dan Keefektifan Komite Audit Terhadap Manajemen LabathesaNoch keine Bewertungen

- 酒田战法当沖Dokument228 Seiten酒田战法当沖calvinrabbitNoch keine Bewertungen

- Alumni DataDokument29 SeitenAlumni DataGurmeet kaurNoch keine Bewertungen

- Team League Table: Enginuity 2020 CompetitionDokument5 SeitenTeam League Table: Enginuity 2020 Competitionsudhir12345Noch keine Bewertungen

- 03 - ERP-XH-16-224 HRSG Preferred Vendor List - REV00Dokument3 Seiten03 - ERP-XH-16-224 HRSG Preferred Vendor List - REV00smartleo_waloNoch keine Bewertungen

- Chapter 17Dokument30 SeitenChapter 17Amanda AyarinovaNoch keine Bewertungen

- All Products Jan'21 Payout StructureDokument21 SeitenAll Products Jan'21 Payout StructuremadirajunaveenNoch keine Bewertungen

- Chapter 10 - Solution ManualDokument56 SeitenChapter 10 - Solution Manualjk2592Noch keine Bewertungen

- Paper On Corporate BondsDokument4 SeitenPaper On Corporate BondsSaurabh BhatnagarNoch keine Bewertungen

- TLV - 20191216165648 - Raport Curent Extindere Program de Rascumparare Actiuni ENDokument1 SeiteTLV - 20191216165648 - Raport Curent Extindere Program de Rascumparare Actiuni ENAndrei NitaNoch keine Bewertungen

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap016 PDFDokument50 SeitenSolution Manual Advanced Financial Accounting 8th Edition Baker Chap016 PDFYopie ChandraNoch keine Bewertungen