Beruflich Dokumente

Kultur Dokumente

Cash Journal: Manage A Company S Cash Transaction

Hochgeladen von

Sachin Singh0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

49 Ansichten9 SeitenCashier confif FICO

Originaltitel

EUT Cashier

Copyright

© © All Rights Reserved

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCashier confif FICO

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

49 Ansichten9 SeitenCash Journal: Manage A Company S Cash Transaction

Hochgeladen von

Sachin SinghCashier confif FICO

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

CASH JOURNAL

Manage a company‘s Cash

Transaction

SAP AG 2002, Title of Presentation, Speaker Name 1

CASHIER - Scope

CASH PAYMENT

CASH RECEIPT

CASH DEPOSIT

CASH WITHDRAWAL

SAP AG 2002, Title of Presentation, Speaker Name 2

CASH JOURNAL

System automatically calculates and displays

Opening and closing balances, and

Receipts and payments totals

Multiple cash journals can be setup for each

company code

Postings can be made to G/L accounts, as well as

vendor and customer accounts

SAP AG 2002, Title of Presentation, Speaker Name 3

FEATURES

Entering, saving, and posting cash journal entries

Displaying follow-on documents

Defining cash journal business transactions

Printing the cash journal Six Business Transaction for

different types of transactions.

Printing receipts

Deleting cash journal entries saved

Displaying all cash journal documents that have been

deleted

Changing the cash journal

SAP AG 2002, Title of Presentation, Speaker Name 4

Posting documents in CASH JOURNAL

Menu: Accounting Financial accounting

General ledger Document entry Cash journal

posting

Enter a company code and a cash journal number

Select either the Receipts or Payments tab

Enter a business transaction

Save and Post

SAP AG 2002, Title of Presentation, Speaker Name 5

Reversing CASH JOURNAL transaction

Deleting a document that has been entered

Deleting a document that has been saved

Deleting posted documents

SAP AG 2002, Title of Presentation, Speaker Name 6

Deleting Document Entered

Select ‘Delete Row’ icon

SAP AG 2002, Title of Presentation, Speaker Name 7

Deleting Document Saved

Select ‘Delete Row’ icon

Note:

It will appear in the list of deleted cash journal

documents

A document cannot be deleted if

A receipt had already been printed or

A cheque has been printed and

presented to the bank

SAP AG 2002, Title of Presentation, Speaker Name 8

Deleting Posted Document

The document can no longer be deleted in the cash journal.

Instead, a reverse posting should be made

To carry out an reverse posting for an incorrect cash transaction

Switch to the tab for the other posting direction (receipts or

expenses), and then

Enter a posting in the same amount and with the same

account assignments

Note:

Any tax amounts have to be posted to the same tax accounts

The same tax codes must be used

SAP AG 2002, Title of Presentation, Speaker Name 9

Das könnte Ihnen auch gefallen

- Dokumentasi 3 - Config Submodule General Ledger AccountingDokument182 SeitenDokumentasi 3 - Config Submodule General Ledger AccountingPuspaOktavianiNoch keine Bewertungen

- General Ledger PDFDokument33 SeitenGeneral Ledger PDFSahitee BasaniNoch keine Bewertungen

- RebateDokument66 SeitenRebateprasadpandit123100% (2)

- Asset Accounting WBS AssignedDokument22 SeitenAsset Accounting WBS Assignedtieuquan42Noch keine Bewertungen

- SAP Financials Accounts ReceivablesDokument17 SeitenSAP Financials Accounts ReceivablesAyubPinjarNoch keine Bewertungen

- Lab Siak Sap: Nama: Nugraha Aditya Pradana NPM: 1406623316 Kelas: SIAK ADokument19 SeitenLab Siak Sap: Nama: Nugraha Aditya Pradana NPM: 1406623316 Kelas: SIAK AambarNoch keine Bewertungen

- First Steps in SAP Financial Accounting (FI) : Ann CacciottoliDokument10 SeitenFirst Steps in SAP Financial Accounting (FI) : Ann CacciottolimanishNoch keine Bewertungen

- Intro S4HANA Using Global Bike Exercises FI GUI en v3.3Dokument6 SeitenIntro S4HANA Using Global Bike Exercises FI GUI en v3.3Tuệ Nguyễn Ngọc GiaNoch keine Bewertungen

- SAP FICO Training Program in 90 DaysDokument15 SeitenSAP FICO Training Program in 90 DaysMohammed Nawaz ShariffNoch keine Bewertungen

- SAP OwnDokument26 SeitenSAP OwnMirza MohammedNoch keine Bewertungen

- SAP - FICO New ContentDokument27 SeitenSAP - FICO New ContentAprajita Saraf0% (1)

- GL TrainingDokument160 SeitenGL TrainingDiwakar Saribala100% (1)

- Financial Accounting (FI)Dokument25 SeitenFinancial Accounting (FI)Tuệ Nguyễn Ngọc GiaNoch keine Bewertungen

- Intro S4HANA Using Global Bike Exercises FI en v4.1Dokument10 SeitenIntro S4HANA Using Global Bike Exercises FI en v4.1HugoPrieto2Noch keine Bewertungen

- Accrual Engine: Solution Management FinancialsDokument32 SeitenAccrual Engine: Solution Management FinancialsateeqbajwaNoch keine Bewertungen

- 2.1. SAP FICO INTRO 1Dokument12 Seiten2.1. SAP FICO INTRO 1Sahana MNoch keine Bewertungen

- Cash Journal - Concept, Config, ManualDokument24 SeitenCash Journal - Concept, Config, ManualKamonchai KNoch keine Bewertungen

- General Ledger: With A Focus On Accounting in SAP!Dokument23 SeitenGeneral Ledger: With A Focus On Accounting in SAP!ib1995Noch keine Bewertungen

- Task 2Dokument32 SeitenTask 2Alisher ShokhanovNoch keine Bewertungen

- Qustion AnsDokument23 SeitenQustion Ansjay koshtiNoch keine Bewertungen

- Fico NotesDokument160 SeitenFico NotesvnroshanNoch keine Bewertungen

- Exercise Display A Chart of Accounts. TaskDokument19 SeitenExercise Display A Chart of Accounts. TaskEzequeil AzraelNoch keine Bewertungen

- Foreign Currency Valuation PDFDokument12 SeitenForeign Currency Valuation PDFyunesk100% (3)

- Recording Transactions for a Service BusinessDokument11 SeitenRecording Transactions for a Service BusinessMark Kevin JavierNoch keine Bewertungen

- Fi ErpDokument26 SeitenFi ErpEmmaNoch keine Bewertungen

- Financial Accounting (FI) Case Study: Product Motivation PrerequisitesDokument37 SeitenFinancial Accounting (FI) Case Study: Product Motivation PrerequisitesThùy LêNoch keine Bewertungen

- Sap FicoDokument43 SeitenSap FicoDhiraj PawarNoch keine Bewertungen

- Fico PDFDokument148 SeitenFico PDFAniruddha ChakrabortyNoch keine Bewertungen

- General Ledger Master Data MaintenanceDokument12 SeitenGeneral Ledger Master Data MaintenanceRavi Kumar JS100% (1)

- Cuenta Financiera FI-AP - Fiori - en - v3.3Dokument38 SeitenCuenta Financiera FI-AP - Fiori - en - v3.3Fiorella Azaña ParionaNoch keine Bewertungen

- SAP Basic ConceptsDokument9 SeitenSAP Basic Conceptsganesanmani1985Noch keine Bewertungen

- SAP FS00 Tutorial: General Ledger Master Data MaintenanceDokument12 SeitenSAP FS00 Tutorial: General Ledger Master Data MaintenanceERPDocs100% (1)

- DAY2Dokument16 SeitenDAY2Jancy SunishNoch keine Bewertungen

- Business Processes in Financial: Mysap Erp FinancialsDokument35 SeitenBusiness Processes in Financial: Mysap Erp Financialsjung jeyooNoch keine Bewertungen

- Case Study FI enDokument37 SeitenCase Study FI enMohini GiriNoch keine Bewertungen

- Intro S4HANA Using Global Bike Case Study FI-AP Fiori en v3.3Dokument38 SeitenIntro S4HANA Using Global Bike Case Study FI-AP Fiori en v3.3Marina AponteNoch keine Bewertungen

- FI 1: Display Financial StatementDokument11 SeitenFI 1: Display Financial StatementArsh DawraNoch keine Bewertungen

- Case Related Invoice ProcessingDokument11 SeitenCase Related Invoice ProcessingAndres SalazarNoch keine Bewertungen

- Intro ERP Using GBI Case Study FI (A4) en v2.30Dokument21 SeitenIntro ERP Using GBI Case Study FI (A4) en v2.30Jonathan David Sanchez AbantoNoch keine Bewertungen

- Fi Overview 3Dokument87 SeitenFi Overview 3Sushil KumarNoch keine Bewertungen

- Initial Plan TasksDokument14 SeitenInitial Plan TasksAdrian TastarNoch keine Bewertungen

- SAP New General Ledger ConfigurationDokument51 SeitenSAP New General Ledger ConfigurationParas GourNoch keine Bewertungen

- 25052022-Intro ERP Using GBI Case Study FI en v3.1Dokument25 Seiten25052022-Intro ERP Using GBI Case Study FI en v3.1Trixi Morales FernandezNoch keine Bewertungen

- Cash Journal Creation Nomac-F9Dokument15 SeitenCash Journal Creation Nomac-F9Srinu GourishettyNoch keine Bewertungen

- FI Configuration-S - 4 Hana 1809Dokument43 SeitenFI Configuration-S - 4 Hana 1809SUDIPTADATTARAYNoch keine Bewertungen

- SAP FICO MaterialDokument24 SeitenSAP FICO MaterialNeelam Singh100% (1)

- Exercise 4. 2 - Financial Accotg - SAP FrioriDokument18 SeitenExercise 4. 2 - Financial Accotg - SAP FriorileoNoch keine Bewertungen

- Sap Fi General Ledger Frequently Used ProceduresDokument88 SeitenSap Fi General Ledger Frequently Used Proceduresvenkat6299Noch keine Bewertungen

- Sap Fi GL Enduser Step by Step MaterialDokument99 SeitenSap Fi GL Enduser Step by Step MaterialZafar AdilNoch keine Bewertungen

- Basic Processes in Finance Procurement and Sales 1659849966Dokument36 SeitenBasic Processes in Finance Procurement and Sales 1659849966Pradeesh dhanapalNoch keine Bewertungen

- Sap Fico Training TutorialDokument7 SeitenSap Fico Training TutorialKurella RamyasreeNoch keine Bewertungen

- SAP Chart of Accounts Master Data ConfigurationDokument15 SeitenSAP Chart of Accounts Master Data ConfigurationManoj KumarNoch keine Bewertungen

- SAP EWT PresentationDokument22 SeitenSAP EWT PresentationSachin SinghNoch keine Bewertungen

- SAP FICO - AP - User Manual OverviewDokument59 SeitenSAP FICO - AP - User Manual Overviewbakkali_bilalNoch keine Bewertungen

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)Von EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Bewertung: 3 von 5 Sternen3/5 (1)

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursVon EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNoch keine Bewertungen

- Objective Name of The Employee / Team DepartmentDokument6 SeitenObjective Name of The Employee / Team DepartmentSachin SinghNoch keine Bewertungen

- DTP0042 - Batch Job Creation and Execution v1.0Dokument1 SeiteDTP0042 - Batch Job Creation and Execution v1.0Sachin SinghNoch keine Bewertungen

- Unit Testing in BSC FICADokument39 SeitenUnit Testing in BSC FICASachin SinghNoch keine Bewertungen

- Sap LabsDokument91 SeitenSap LabsSachin Singh100% (2)

- Fs - Rebate Amount MessageDokument7 SeitenFs - Rebate Amount MessageSachin SinghNoch keine Bewertungen

- Sap SD PricingDokument3 SeitenSap SD PricingSachin SinghNoch keine Bewertungen

- Sap Isu ModelDokument4 SeitenSap Isu ModelSachin SinghNoch keine Bewertungen

- FICA TablesDokument7 SeitenFICA TablesSachin SinghNoch keine Bewertungen

- SD-FICA IntegrationDokument1 SeiteSD-FICA IntegrationSachin SinghNoch keine Bewertungen

- Fi GLDokument1 SeiteFi GLSachin SinghNoch keine Bewertungen

- Dunning Objects ListsDokument1 SeiteDunning Objects ListsSachin SinghNoch keine Bewertungen

- Key Consideration While MigrationDokument12 SeitenKey Consideration While MigrationSachin SinghNoch keine Bewertungen

- SAP User RoleDokument1 SeiteSAP User RoleSachin SinghNoch keine Bewertungen

- CrossCompany InterCompany TransactionsDokument8 SeitenCrossCompany InterCompany TransactionspaiashokNoch keine Bewertungen

- Restrict Cash Receipts Over Rs. 2 Lakh in SAPDokument6 SeitenRestrict Cash Receipts Over Rs. 2 Lakh in SAPSachin SinghNoch keine Bewertungen

- SAP EWT PresentationDokument22 SeitenSAP EWT PresentationSachin SinghNoch keine Bewertungen

- Master Data TablesDokument2 SeitenMaster Data TablesSachin SinghNoch keine Bewertungen

- Create Purchase Orders, Sales Orders, Post Documents and Manage MaterialsDokument1 SeiteCreate Purchase Orders, Sales Orders, Post Documents and Manage MaterialsSachin SinghNoch keine Bewertungen

- Isu - Fica TablesDokument5 SeitenIsu - Fica TablesSachin SinghNoch keine Bewertungen

- BBP PreceduresDokument6 SeitenBBP PreceduresSachin SinghNoch keine Bewertungen

- ABAP - Dynamic Variant Processing With STVARVDokument12 SeitenABAP - Dynamic Variant Processing With STVARVrjcamorim100% (1)

- FI TablesDokument6 SeitenFI TablesSachin SinghNoch keine Bewertungen

- User Manual For STO ProcessDokument14 SeitenUser Manual For STO ProcessSachin SinghNoch keine Bewertungen

- Right Solution Asset ManagementDokument20 SeitenRight Solution Asset ManagementSachin SinghNoch keine Bewertungen

- DFKKOPW, You Can View The Details of Y1 Like Posting Date, Doc Date, Amount EtcDokument2 SeitenDFKKOPW, You Can View The Details of Y1 Like Posting Date, Doc Date, Amount EtcSachin SinghNoch keine Bewertungen

- Eut Fi All MasDokument20 SeitenEut Fi All MasSachin SinghNoch keine Bewertungen

- 01 Investment ManagementDokument19 Seiten01 Investment ManagementSachin SinghNoch keine Bewertungen

- Construction Firm Denied Insurance Claims After FireDokument3 SeitenConstruction Firm Denied Insurance Claims After FireJericAquipelNoch keine Bewertungen

- FlowchartDokument3 SeitenFlowchartSarah SazaliNoch keine Bewertungen

- Intermediate Debt and Leasing: Debagus SubagjaDokument12 SeitenIntermediate Debt and Leasing: Debagus SubagjaDebagus SubagjaNoch keine Bewertungen

- 000 Rebuttal of NOD LetterDokument3 Seiten000 Rebuttal of NOD LetterSnaps1978100% (1)

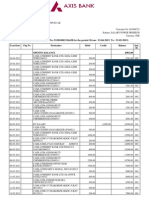

- Statement JUN2019 073481524-Unlocked PDFDokument16 SeitenStatement JUN2019 073481524-Unlocked PDFKumar Shashi50% (2)

- Banking Awareness IBPS Guide PDFDokument41 SeitenBanking Awareness IBPS Guide PDFsanthana lakshmiNoch keine Bewertungen

- AuditWPsDokument2 SeitenAuditWPsJane LubangNoch keine Bewertungen

- Books of Prime Entry Powerpoint AllllllllDokument32 SeitenBooks of Prime Entry Powerpoint AllllllllbensonNoch keine Bewertungen

- Professional Indemnity Form PDFDokument1 SeiteProfessional Indemnity Form PDFNilima NarkhedeNoch keine Bewertungen

- DigiPay v1Dokument18 SeitenDigiPay v1KAVEEN PRASANNAMOORTHYNoch keine Bewertungen

- Project Finance (Smart Task 1)Dokument14 SeitenProject Finance (Smart Task 1)Aseem VashistNoch keine Bewertungen

- HDFCDokument20 SeitenHDFCRaj ParohaNoch keine Bewertungen

- A Comparative Study of Financial Permormance of State Bank of India and ICICI BankDokument10 SeitenA Comparative Study of Financial Permormance of State Bank of India and ICICI Bankprteek kumarNoch keine Bewertungen

- The FEDERAL BANK LIMITED Email: Careers@Federalbank - Co.in Website: WWW - Federalbank.co - inDokument12 SeitenThe FEDERAL BANK LIMITED Email: Careers@Federalbank - Co.in Website: WWW - Federalbank.co - inaravindmkaranavarNoch keine Bewertungen

- Account StatementDokument3 SeitenAccount StatementJobz ForuNoch keine Bewertungen

- Account Statement From 1 Jan 2018 To 31 Dec 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument7 SeitenAccount Statement From 1 Jan 2018 To 31 Dec 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSwamick ChoudhuryNoch keine Bewertungen

- Banking NotesDokument4 SeitenBanking Notesshanti priyaNoch keine Bewertungen

- Full Charge Bookkeeper, AccountantDokument2 SeitenFull Charge Bookkeeper, Accountantapi-72678201Noch keine Bewertungen

- TSLA 2019 Product Guide Interactive PDFDokument98 SeitenTSLA 2019 Product Guide Interactive PDFjaytech O. kerimNoch keine Bewertungen

- Annex A-RMC 26-2018Dokument2 SeitenAnnex A-RMC 26-2018Anonymous LC5kFdtc100% (1)

- PSO 3100 Clinical Governance Quality in Prison HealthcareDokument11 SeitenPSO 3100 Clinical Governance Quality in Prison HealthcareA RizaNoch keine Bewertungen

- Online StatementDokument4 SeitenOnline StatementDan0% (1)

- Travel and Expense PolicyDokument6 SeitenTravel and Expense PolicyLee Cogburn100% (1)

- 08-Timesheet FORKLIFTDokument14 Seiten08-Timesheet FORKLIFTahmad AinurNoch keine Bewertungen

- Security Bank V Cuenca DigestDokument3 SeitenSecurity Bank V Cuenca DigestJermone MuaripNoch keine Bewertungen

- Construction Project Controlled Insurance Program CIP FlyerDokument8 SeitenConstruction Project Controlled Insurance Program CIP FlyerMark DodsonNoch keine Bewertungen

- Reading Comprehension ExerciseDokument23 SeitenReading Comprehension Exercisestephen vaiNoch keine Bewertungen

- DPA5053 Company Law: Prepared byDokument12 SeitenDPA5053 Company Law: Prepared byPavitra MohanNoch keine Bewertungen

- Swot AnalysisDokument4 SeitenSwot AnalysisMariel TinolNoch keine Bewertungen

- A Study of Customer Preference Towards Product and Services of Axis Bank With Respect To Pimpalgaon Branch.Dokument15 SeitenA Study of Customer Preference Towards Product and Services of Axis Bank With Respect To Pimpalgaon Branch.Pavan ShindeNoch keine Bewertungen