Beruflich Dokumente

Kultur Dokumente

11-Using The Work of Others

Hochgeladen von

Ne Bz0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

116 Ansichten19 SeitenAuditing theory

Originaltitel

11-Using the Work of Others

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAuditing theory

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

116 Ansichten19 Seiten11-Using The Work of Others

Hochgeladen von

Ne BzAuditing theory

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 19

Using the Work of Others

Prepared by: Christien Joy Pascual

Using the Work of others

Using the work of another auditor (PSA 600)

Purpose

The purpose of PSA 600 is to establish standards and

provide guidance when an auditor (Principal Auditor) who is

reporting on the financial statements of an entity, uses the

work of another auditor (other auditor) on financial

information of one or more components (division, branch,

subsidiary, joint venture, associated company) included in

the financial statements of the entity.

The Principal auditor’s Procedures

The principal auditor documents in working papers the

names of the other auditors, and the:

• components whose financial information was audited by

other auditors;

• their significance in the financial statements of the entity,

as a whole; and

• any conclusions reached regarding individual

components.

Cooperation between Auditors

Reporting Considerations

Considering the work of the Internal Auditor

(PSA 610)

Internal auditing is an appraisal activity

established within an entity for examining,

evaluating, and monitoring the adequacy and

effectiveness of the accounting and internal control

systems. Certain parts of internal auditing work may

be useful to the external auditor.

Activities included among the work of the

internal auditor:

• Review of the accounting and internal control systems,

and monitor their operations and recommend

improvements therein

• Examination of financial and operating information,

including the review of the means used to identify,

measure, classify and report such information and specific

inquiry into individual items and detailed testing of

transactions, balances and procedures

Activities included among the work of the

internal auditor:

• Review of the economy, efficiency and effectiveness of

operatons including nonfinancial controls of an entity

• Review of compliance with laws, regulations and other

external requirements and with policies, directives, and

other internal requirements of management.

Relationship of Internal and External

Auditors

Using the Work of an Expert/Specialist

(PSA 620)

It deals with the auditor’s responsibilities

regarding the use of an individual or

organization’s work in a field of expertise other

than accounting or auditing, when that work is

used to assist the auditor in obtaining

appropriate audit evidence.

Objective of the auditor

The work of an expert normally contains

information on the:

• Valuation of certain types of assets, as land, building,

machinery, work of art, precious stones;

• Determination of quantity or physical condition of assets,

as minerals underground or in stock piles, petroleum

reserve, and remaining life of plant and machinery;

• Determination of amounts using specialized techniques

or methods as actuarial valuation;

• Measurement of work completed or to be completed on

contracts in progress; and

• Legal opinion regarding interpretation of agreements,

statutes, and regulations.

When determining the work of an expert,

the auditor:

Considers the materiality of the financial statement item

being considered;

The risk of misstatement based on the nature and

complexity of the matter being considered;

The quantity and quality of other audit evidence available.

Competence and objectivity of the expert

• When planning to use the work of an expert, the

auditor should assess the professional competence

of the expert.

• The auditor should assess the objectivity of the

expert.

Assesing the work of the expert

The auditor assess the appropriateness

of the expert’s work as audit evidence

regarding the financial statement assertion.

Reference to an Expert

Das könnte Ihnen auch gefallen

- Internal Auditing (Online) - Syllabus - ConcourseDokument15 SeitenInternal Auditing (Online) - Syllabus - Concoursebislig water districtNoch keine Bewertungen

- Accounting Principles Volume 1 Canadian 7th Edition Geygandt Solutions ManualDokument93 SeitenAccounting Principles Volume 1 Canadian 7th Edition Geygandt Solutions Manualgeralddiaznqmcrpgodk100% (12)

- Test Bank For Accounting Information Systems 8th Edition by Hall PDFDokument17 SeitenTest Bank For Accounting Information Systems 8th Edition by Hall PDFriza147100% (2)

- Foreign Direct Investment, Privatization and Insolvency Regimes - PPTX ChapteDokument66 SeitenForeign Direct Investment, Privatization and Insolvency Regimes - PPTX ChapteNe Bz100% (2)

- Foreign Direct Investment, Privatization and Insolvency Regimes - PPTX ChapteDokument66 SeitenForeign Direct Investment, Privatization and Insolvency Regimes - PPTX ChapteNe Bz100% (2)

- AC414 - Audit and Investigations II - Audit of RecievablesDokument14 SeitenAC414 - Audit and Investigations II - Audit of RecievablesTsitsi AbigailNoch keine Bewertungen

- 09 - Auditing IT Using CAAT and TechniquesDokument24 Seiten09 - Auditing IT Using CAAT and TechniquesgoklasNoch keine Bewertungen

- Ware House 3PL ProcessesDokument119 SeitenWare House 3PL ProcessesSudeep SahuNoch keine Bewertungen

- Internal Control: Methodology For Evaluation Through Internal Control: Evaluation of Internal ControlDokument17 SeitenInternal Control: Methodology For Evaluation Through Internal Control: Evaluation of Internal ControlNanditaParmarNoch keine Bewertungen

- Ortega, Wendy B. Prof. Malanum Bsba FTM 3-4: What Is Credit Management?Dokument7 SeitenOrtega, Wendy B. Prof. Malanum Bsba FTM 3-4: What Is Credit Management?Mhabel MaglasangNoch keine Bewertungen

- Computer Assisted Audit Tools Chap-04Dokument30 SeitenComputer Assisted Audit Tools Chap-04I-am KumNoch keine Bewertungen

- AUDCIS - 2022 - Mod5 - Tools and Techniques in IT AuditDokument43 SeitenAUDCIS - 2022 - Mod5 - Tools and Techniques in IT AuditBea GarciaNoch keine Bewertungen

- Auditing and Assurance - Concepts and Applications - Heading PDFDokument4 SeitenAuditing and Assurance - Concepts and Applications - Heading PDFLuisitoNoch keine Bewertungen

- Auditing Problems Test Bank 2Dokument10 SeitenAuditing Problems Test Bank 2Ne BzNoch keine Bewertungen

- General and Application ControlsDokument8 SeitenGeneral and Application ControlsAnamir Bello CarilloNoch keine Bewertungen

- Empleyado Brochure PDFDokument3 SeitenEmpleyado Brochure PDFRose ManaloNoch keine Bewertungen

- Audit PlanningDokument9 SeitenAudit PlanninggumiNoch keine Bewertungen

- OpenCola Soft Drink RecipeDokument9 SeitenOpenCola Soft Drink Recipenicolas100% (3)

- Engagement Acceptance and Audit Planning PDFDokument107 SeitenEngagement Acceptance and Audit Planning PDFNicole TondoNoch keine Bewertungen

- Philippine Standards On AuditingDokument11 SeitenPhilippine Standards On AuditingNe Bz100% (1)

- Audit Under Computerized Information System CISDokument59 SeitenAudit Under Computerized Information System CISJohn David Alfred EndicoNoch keine Bewertungen

- Workshop On Stock in Trade - Physical Stock Taking & ValuationDokument48 SeitenWorkshop On Stock in Trade - Physical Stock Taking & Valuationfarah nadieya100% (1)

- Lecture 5 - Computer-Assisted Audit Tools and TechniquesDokument6 SeitenLecture 5 - Computer-Assisted Audit Tools and TechniquesViviene Madriaga100% (1)

- TOPIC 3d - Audit PlanningDokument29 SeitenTOPIC 3d - Audit PlanningLANGITBIRUNoch keine Bewertungen

- Chapter 3 CISDokument20 SeitenChapter 3 CISGwen Sula LacanilaoNoch keine Bewertungen

- At 5908 - Audit Planning Tapos NaDokument4 SeitenAt 5908 - Audit Planning Tapos NaPsc O. AENoch keine Bewertungen

- Computer Aided Audit ToolsDokument8 SeitenComputer Aided Audit ToolsRahul GargNoch keine Bewertungen

- First Preboard ExamsDokument4 SeitenFirst Preboard ExamsRandy PaderesNoch keine Bewertungen

- NG - Sendy FulfilmentDokument20 SeitenNG - Sendy FulfilmentAdebola AfolabiNoch keine Bewertungen

- Auditing in CIS Environment - IT Audit FundamentalsDokument9 SeitenAuditing in CIS Environment - IT Audit FundamentalsLuisitoNoch keine Bewertungen

- 2.2operational Audit - Objectives and Phases of Operational AuditsDokument14 Seiten2.2operational Audit - Objectives and Phases of Operational AuditsGia Sarah Barillo BandolaNoch keine Bewertungen

- Ecomically Pitch DeckDokument14 SeitenEcomically Pitch DeckADITYA N GOKHROONoch keine Bewertungen

- Institutional Invetsors, Governance Organizations and Legal InitiativesDokument61 SeitenInstitutional Invetsors, Governance Organizations and Legal InitiativesNe Bz50% (2)

- Group 4 - Assignment #6Dokument40 SeitenGroup 4 - Assignment #6Rhad Lester C. MaestradoNoch keine Bewertungen

- Chapter 3 AccountingDokument11 SeitenChapter 3 AccountingĐỗ ĐăngNoch keine Bewertungen

- Auditing in CIS Environment Review of Auditing ConceptsDokument8 SeitenAuditing in CIS Environment Review of Auditing ConceptsSani BautisTaNoch keine Bewertungen

- Fundamentals of Abm 1-Q3-W2-Module 2-Version3Dokument17 SeitenFundamentals of Abm 1-Q3-W2-Module 2-Version3MrBigbozz21100% (2)

- Computerised Information System (CIS)Dokument41 SeitenComputerised Information System (CIS)Arsyad Noraidi100% (1)

- Shopee - Fulfilled by Shopee Info Deck (External)Dokument33 SeitenShopee - Fulfilled by Shopee Info Deck (External)Shaleeena AiharaNoch keine Bewertungen

- Module 9 - Substantive Proc - Class Q - 23 JulyDokument47 SeitenModule 9 - Substantive Proc - Class Q - 23 JulyLindiweNoch keine Bewertungen

- Auditing in A Computerized EnvironmentDokument13 SeitenAuditing in A Computerized EnvironmentcaironsalamNoch keine Bewertungen

- Auditing Notes by Rehan Farhat ISA 300Dokument21 SeitenAuditing Notes by Rehan Farhat ISA 300Omar SiddiquiNoch keine Bewertungen

- Auditor's ReportDokument20 SeitenAuditor's ReportSivabalan AchchuthanNoch keine Bewertungen

- Auditing Expenditure CycleDokument16 SeitenAuditing Expenditure CycleShane Nuss RedNoch keine Bewertungen

- 2019 Third-Party Logistics Study: The State of Logistics OutsourcingDokument54 Seiten2019 Third-Party Logistics Study: The State of Logistics OutsourcingJJNoch keine Bewertungen

- Analysis and Design Accounting Information System PDFDokument5 SeitenAnalysis and Design Accounting Information System PDFHeilen PratiwiNoch keine Bewertungen

- Aud TheoDokument20 SeitenAud TheoMatthew Robert DesiderioNoch keine Bewertungen

- TOPIC 3 - Ethics & Internal AuditorDokument29 SeitenTOPIC 3 - Ethics & Internal AuditoradifhrzlNoch keine Bewertungen

- Management of A Public Accounting Firm: Professional FeesDokument18 SeitenManagement of A Public Accounting Firm: Professional FeesLaiza Mechelle Roxas MacaraigNoch keine Bewertungen

- Foundation of Internal AuditingDokument2 SeitenFoundation of Internal AuditingChristine PanjaitanNoch keine Bewertungen

- 3rd On-Line Quiz - Substantive Test For CashDokument3 Seiten3rd On-Line Quiz - Substantive Test For CashMJ YaconNoch keine Bewertungen

- Paper Tech IndustriesDokument20 SeitenPaper Tech IndustriesMargaret TaylorNoch keine Bewertungen

- Budgetary Control System and Inventory Management - Research Study - 150075041Dokument3 SeitenBudgetary Control System and Inventory Management - Research Study - 150075041aarohi bhattNoch keine Bewertungen

- Notre Dame University College of Business and Accountancy Cotabato CityDokument10 SeitenNotre Dame University College of Business and Accountancy Cotabato CityKarenmae Casas IntangNoch keine Bewertungen

- B07 UTP & WT Non Routine and Estimation ProcessDokument8 SeitenB07 UTP & WT Non Routine and Estimation ProcessJamey SimpsonNoch keine Bewertungen

- 13auditing in A CisDokument5 Seiten13auditing in A CisFranz CampuedNoch keine Bewertungen

- CH04 Revenue Cycle PDFDokument73 SeitenCH04 Revenue Cycle PDFZion Ilagan0% (1)

- Control, Govern-Wps OfficeDokument35 SeitenControl, Govern-Wps OfficeElieza Mae Dionisio BautistaNoch keine Bewertungen

- Chapter 4: Engagement Process and PlanningDokument20 SeitenChapter 4: Engagement Process and Planningdaniel100% (2)

- Project IN AuditingDokument9 SeitenProject IN AuditingToniNoch keine Bewertungen

- Preengagement and PlanningDokument4 SeitenPreengagement and PlanningAllyssa MababangloobNoch keine Bewertungen

- 1.0 Review of Financial StatementsDokument25 Seiten1.0 Review of Financial Statementsmujuni brianmjuNoch keine Bewertungen

- Audit Responsibilities and ObjectivesDokument25 SeitenAudit Responsibilities and ObjectivesNisa sudinkebudayaan100% (1)

- QuestionsDokument28 SeitenQuestionssohail merchant100% (1)

- Credit Management PartsDokument5 SeitenCredit Management Partsdarma bonarNoch keine Bewertungen

- Inventory valuation Complete Self-Assessment GuideVon EverandInventory valuation Complete Self-Assessment GuideBewertung: 4 von 5 Sternen4/5 (1)

- Internal AuditingDokument18 SeitenInternal AuditingJoana BarrionNoch keine Bewertungen

- Reviewer For PsychologyDokument35 SeitenReviewer For PsychologyNe BzNoch keine Bewertungen

- Evaluation 2nd Quiz Group 1Dokument2 SeitenEvaluation 2nd Quiz Group 1Ne BzNoch keine Bewertungen

- Valuing Diversity: A Midterm Report byDokument17 SeitenValuing Diversity: A Midterm Report byNe BzNoch keine Bewertungen

- PPEDokument20 SeitenPPEqueeneNoch keine Bewertungen

- Evaluation 1st Quiz Group 1Dokument2 SeitenEvaluation 1st Quiz Group 1Ne BzNoch keine Bewertungen

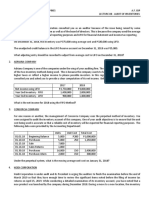

- Dann Corporation Working Balance Sheet Decemeber 31, 2016Dokument12 SeitenDann Corporation Working Balance Sheet Decemeber 31, 2016Ne BzNoch keine Bewertungen

- PWC Understanding Financial Statement Audit PDFDokument18 SeitenPWC Understanding Financial Statement Audit PDFAsNoch keine Bewertungen

- MGT 113ADokument107 SeitenMGT 113ANe BzNoch keine Bewertungen

- B. Preparing THDokument2 SeitenB. Preparing THNe BzNoch keine Bewertungen

- Nebit Kath Script Undone-1Dokument5 SeitenNebit Kath Script Undone-1Ne BzNoch keine Bewertungen

- Because DirectDokument1 SeiteBecause DirectNe BzNoch keine Bewertungen

- Nebit Kath Script Undone-1Dokument5 SeitenNebit Kath Script Undone-1Ne BzNoch keine Bewertungen

- Nebit Kath Script Undone-1Dokument5 SeitenNebit Kath Script Undone-1Ne BzNoch keine Bewertungen

- PremisesDokument2 SeitenPremisesNe BzNoch keine Bewertungen

- MGT Case Analysis AgainDokument3 SeitenMGT Case Analysis AgainNe BzNoch keine Bewertungen

- MGT Case Analysis AgainDokument3 SeitenMGT Case Analysis AgainNe BzNoch keine Bewertungen

- VAT Computation Part 2Dokument2 SeitenVAT Computation Part 2Ne BzNoch keine Bewertungen

- VAT Computation Part 2Dokument2 SeitenVAT Computation Part 2Ne BzNoch keine Bewertungen

- Tax Project-Italian GoodsDokument31 SeitenTax Project-Italian GoodsNe BzNoch keine Bewertungen

- Tax 101-Part 1Dokument8 SeitenTax 101-Part 1Ne BzNoch keine Bewertungen

- Donor's Tax ComputationDokument1 SeiteDonor's Tax ComputationNe BzNoch keine Bewertungen

- MBA711 - Answers To Book - Chapter 3Dokument17 SeitenMBA711 - Answers To Book - Chapter 3anonymathieu50% (2)

- Group 1 Handout RectifiedDokument11 SeitenGroup 1 Handout RectifiedNe BzNoch keine Bewertungen

- New Taxes Seen Lower On Income, Higher On Cars Inquirer NewsDokument5 SeitenNew Taxes Seen Lower On Income, Higher On Cars Inquirer NewsNe BzNoch keine Bewertungen

- Ifrs 3 Business Combinations Acca VDokument11 SeitenIfrs 3 Business Combinations Acca VArnold MoyoNoch keine Bewertungen

- International Financial Reporting A Practical Guide 8Th Edition Alan Melville Full ChapterDokument51 SeitenInternational Financial Reporting A Practical Guide 8Th Edition Alan Melville Full Chapterchris.bednarczyk590100% (4)

- Elpl 2009 10Dokument43 SeitenElpl 2009 10kareem_nNoch keine Bewertungen

- Hatsun AnalysisDokument68 SeitenHatsun AnalysisSelva LinksNoch keine Bewertungen

- Overview of Government AccountingDokument2 SeitenOverview of Government Accountingwhin LimboNoch keine Bewertungen

- Moderator: Mr. L.J. Muthivhi (CA), SADokument11 SeitenModerator: Mr. L.J. Muthivhi (CA), SANhlanhla MsizaNoch keine Bewertungen

- 10 Annual Report 2020 JumiaDokument89 Seiten10 Annual Report 2020 JumiaReal LoveNoch keine Bewertungen

- Refex Ibdst Annual RPTDokument171 SeitenRefex Ibdst Annual RPTJeet SinghNoch keine Bewertungen

- GB212 Syllabus FA.18 Sec. 3 and 4 R4Dokument8 SeitenGB212 Syllabus FA.18 Sec. 3 and 4 R4Aamir Khan50% (2)

- Q.1 What Are The Significant Factors of Financial Statements? Discuss The Various Tools of Financial Analysis?Dokument19 SeitenQ.1 What Are The Significant Factors of Financial Statements? Discuss The Various Tools of Financial Analysis?priyankaNoch keine Bewertungen

- Fabm2 Q1mod2 Statement of Comprehensive Income Frances Beraquit Bgo v1Dokument26 SeitenFabm2 Q1mod2 Statement of Comprehensive Income Frances Beraquit Bgo v1Monina Durana LegaspiNoch keine Bewertungen

- Cbea Applied Audit Lecture 08 Audit InventoriesDokument2 SeitenCbea Applied Audit Lecture 08 Audit InventoriesRenmar CruzNoch keine Bewertungen

- Chilaw Finance Limited Intro..Dokument115 SeitenChilaw Finance Limited Intro..Ebony West100% (1)

- Preweek Auditing Theory 2014Dokument86 SeitenPreweek Auditing Theory 2014Angelica AllanicNoch keine Bewertungen

- Accounting Skills in Recording Business Transactions-1 - 074113Dokument60 SeitenAccounting Skills in Recording Business Transactions-1 - 074113shabanzuhura706Noch keine Bewertungen

- AF301 Topic 4 Conceptual FrameworkDokument42 SeitenAF301 Topic 4 Conceptual FrameworkTanisha SinghNoch keine Bewertungen

- Useful To The Users of The Financial StatementsDokument3 SeitenUseful To The Users of The Financial StatementsBrian VillaluzNoch keine Bewertungen

- SEC MD&A Checklist 12-2008Dokument73 SeitenSEC MD&A Checklist 12-2008Alycia SkousenNoch keine Bewertungen

- Apuntes ContabilidadDokument206 SeitenApuntes ContabilidadclaudiazdeandresNoch keine Bewertungen

- Audit Report - HighlightedDokument11 SeitenAudit Report - Highlighteddewlate abinaNoch keine Bewertungen

- 75781bos61308 p6Dokument15 Seiten75781bos61308 p6pratimca592Noch keine Bewertungen

- Ciq Financials MethodologyDokument25 SeitenCiq Financials Methodologysanti_hago50% (2)

- Topic 1 - Review Q&A (Pearson)Dokument2 SeitenTopic 1 - Review Q&A (Pearson)$t@r0867% (3)

- Graded Quesions Complete Book0Dokument344 SeitenGraded Quesions Complete Book0Irimia Mihai Adrian100% (1)

- Hero Financial STMTDokument149 SeitenHero Financial STMTLaksh SinghalNoch keine Bewertungen

- Reporting Framework GuidelineDokument4 SeitenReporting Framework GuidelineHarris GuevarraNoch keine Bewertungen

- Module 10 - Analysis and Interpretation of Financial StatementsDokument16 SeitenModule 10 - Analysis and Interpretation of Financial StatementsGeneen LouiseNoch keine Bewertungen