Beruflich Dokumente

Kultur Dokumente

CAMEL

Hochgeladen von

AnkitTuteja0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

16 Ansichten20 Seiten Based on the information provided, the bank's performance in 1999-2000 would be rated as follows:

Capital Adequacy: 3

Asset Quality: 2

Management Efficiency: 3

Earnings Quality: 2

Liquidity Position: 3

The overall CAMEL rating for the bank in 1999-2000 would be 3, indicating a less than satisfactory performance.

Originalbeschreibung:

Originaltitel

CAMEL.ppt

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden Based on the information provided, the bank's performance in 1999-2000 would be rated as follows:

Capital Adequacy: 3

Asset Quality: 2

Management Efficiency: 3

Earnings Quality: 2

Liquidity Position: 3

The overall CAMEL rating for the bank in 1999-2000 would be 3, indicating a less than satisfactory performance.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

16 Ansichten20 SeitenCAMEL

Hochgeladen von

AnkitTuteja Based on the information provided, the bank's performance in 1999-2000 would be rated as follows:

Capital Adequacy: 3

Asset Quality: 2

Management Efficiency: 3

Earnings Quality: 2

Liquidity Position: 3

The overall CAMEL rating for the bank in 1999-2000 would be 3, indicating a less than satisfactory performance.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 20

Bank Management

•Bank and Banking

•CAMEL Model

Bank- A bank is a financial institution licensed by a

government to undertake activities like- borrowing and

lending money. A large number of other financial

activities are allowed over time.

Banking- Section 5(1) (b) of the Banking Regulation Act

1949 defines banking as the accepting, for the purpose

of lending or investment of deposits of money from

the public, repayable on demand or otherwise and

withdrawal by cheque, draft, order or otherwise.

Banking Company-Section 5(1) (c) defines banking

company as any company which transacts the business

of banking in India. The banking business as defined in

section 5(b) includes-a) acceptance of deposits from

the public, b) for the purpose of lending or investment,

c) repayable on demand or otherwise, and d)

withdrawal by means of any instrument whether a

cheque or otherwise.

The Indian financial system comprises the following institutions:

1.Commercial banks

a. Public sector

b. Private sector

c. Foreign banks

d. Cooperative institutions

(i) Urban cooperative banks

(ii) State cooperative banks

(iii) Central cooperative banks

2. Financial institutions

a. All-India financial institutions (AIFIs)

b. State financial corporations (SFCs)

c. State industrial development corporations

(SIDCs)

3. Nonbanking financial companies (NBFCs)

4. Capital market intermediaries

Types of banks in India- At present the Banks in

India can be classified as:

Reserve

Bank of India

Public Sector Private Co-operative Regional Foreign

Banks Sector Banks Banks Rural Banks Banks

i. Reserve Bank of India (RBI)-

RBI is the central monetary authority and apex banking

institution in India. As a regulator, it issues guidelines to all

the banks and monitor the overall banking environ in the

country.

ii. Public sector banks-

§ State bank Group with State Bank of India and its 7

associate banks (initially)

§ Nationalized banks

§ Regional rural banks sponsored by public sector banks

iii. Private sector banks-

§ Old generation private banks

§ New generation private banks

§ Foreign banks in India

§ Scheduled co-operative banks

§ Non scheduled banks

iv. Co-operative sector banks

§ State co-operative banks (SCBs)

§ Central co-operative banks (CCBs)

§ Primary Agriculture credit societies (PACS)

§ Land development banks (LDBs)

§ Urban co-operative banks (UCBs)

§ State land development banks (SLDBs)

v. Development banks

§ Export –Import bank of India (EXIM Bank)

§ Industrial Finance Corporation of India (IFCI)

§ Industrial Development bank of India (IDBI)

§ National bank for Agriculture and Rural Development

(NABARD)

§ Industrial Investment bank of India (IIBI)

§ Small Industries development bank of India (SIDBI)

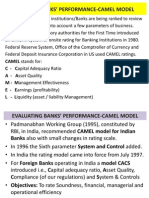

CAMEL Model

In 1995, RBI had set up a working group under the

chairmanship of Shri S. Padmanabhan to review the banking

supervision system and the committee made certain

recommendations. Based on such recommendations a rating

system for domestic and foreign banks based on the

international CAMELS model (combining financial

management, systems and control elements) was introduced

for the inspection cycle commencing from July 1998. It

recommended that the banks should be rated on a five point

scale (1 to 5) based on the lines of international CAMELS

rating model.

The operational efficiency of the banks may be examined

through the CAMEL (Capital adequacy, Asset quality,

Management efficiency, Earnings quality, and Liquidity

position) model. The efficiency parameters in the model are

well defined and embedded in a composite frame to rate the

operating performance as described below:

CAMEL Efficiency Parameters

The numerals in the braces are CAMEL ratings. The number (1) indicates the

highest rating, strongest performance, least degree of supervision concern, and

sound health, while (5) indicates lowest rating, inadequate performance and weak

health of bank and therefore receiving highest degree of supervisory concern. The

efficiency parameters identified in the (CAMEL) model are defined as below:

Sr. Efficiency Measurement Rating (on a five point scale)

No. Parameters Ratios

1 Capital Risk weighted capital less than 5 (5), 6-10 (4), 11-15 (3), 16-

Adequacy to Assets 20 (2), more than 20 (1)

2 Asset NPA to Advances more than 11 (5), 8-10 (4), 5-7 (3), 2–

Quality 4 (2), less than 1 (1)

3 Management Net Profit per less than 1 (5), 1 – 2 (4), 2 – 3 (3), 3 – 4

Efficiency Employee (2), more than 5 (1)

4 Earning Profit to Average 0-0.5 (5), 0.6-1.0 (4), 1.1-1.5 (3), 1.6-

Quality Assets 2.0 (2), more than 2.0 (1)

5 Liquidity Cash to Deposits less than 5 (5), 6 – 9 (4), 10-12 (3), 13-

Position 15 (2), more than 15 (1)

(i) Capital Adequacy (risk weighted capital to assets): It reflects the

financial condition of a bank to meet additional requirement of funds.

It specifies the quality and level of capital required in a bank. The

capital adequacy indicators are rated as per description given below:

CAMEL Model – Capital Adequacy Indicator(s)

Rating

Indicator(s)

1

Strong capital level that adequately support the risk profile.

2

Overall satisfactory level of capital that fairly support the bank’s risk profile

3

Less than satisfactory level of capital that does not fully support the bank’s

risk profile.

4

Deficient level of capital signifying a need for external (additional) capital.

5

Inadequate capital signifying an urgent need for external capital to sustain

the operations.

(ii) Asset quality (NPA to advances): It is judged in terms of potential

credit risk associated with the lending. It is a testing instrument to reflect

the ability of management in discovering and controlling risk. The assets

quality rating is assigned as per the description given below:

CAMEL Model – Asset Quality Indicator(s)

Rating Indicator(s)

1

Strong asset quality and very good credit monitoring and administration.

2

Satisfactory asset quality and credit monitoring and administration.

3

Less than satisfactory level of asset quality to call for improving bank’s

credit administration and risk management practices.

4

Poor credit administration and monitoring signifying an urgent need to

improve risk management for viability of the bank.

5

Critically deficient asset quality severely affecting bank viability.

(iii) Management Efficiency (net profit to employees): It is measured evaluation of

management and is subjective in nature. The net profit per employee is used to suggest

whether the manpower is efficiently utilized by the bank. The management efficiency

rating is assigned as per the description given below:

CAMEL Model – Management Efficiency Indicator(s)

Rating

Indicator(s)

1

Indicates higher efficiency of employees of the bank.

2

Indicates satisfactory levels of efficiency of management that can be improved further.

3

Indicates less than satisfactory level of management efficiency of the bank. There is an

urgent need for the bank to improve on its net profit.

4

Indicates a poor level of management efficiency of the bank. This shows that the bank is

not properly utilizing its manpower and is in serious trouble as far as efficiency of

management is concerned.

5

Indicates a critically deficient management efficiency of bank. This may be due to failure of

the bank to deploy its work force effectively.

(iv) Earnings Quality (net profit after tax to average assets): The earning of a bank

reflects its growth capacity and financial health. The earnings quality of a bank is

measured in terms of return on assets. A higher value of ROA denotes higher

profitability and high CAMEL rating for the bank. The earning quality rating is

assigned as per the description given below:

CAMEL Model – Earnings Quality Indicator(s)

Rating

Indicator(s)

1

Indicates strong earnings quality, more than sufficient to meet its operational and

other expenses, after having sufficient provisions for adequate capital levels.

2

Indicates satisfactory level of earnings quality to maintain adequate capital level

and meet its operational and other expenses.

3

Indicates less than satisfactory level of earnings barely sufficient to meet its

expenses.

4

Indicates poor earnings quality of the bank, not sufficient to meet its expenses.

5

Indicates a critically deficient level of earnings quality and the bank may face the

threat of losing its capital.

(v) Liquidity Position (cash to deposit): Liquidity in a bank implies the cash

position of a bank and ability of a bank to meet its day to day cash needs.

However, sometimes due to various reasons, a bank may suddenly experience

huge withdrawals. In this study, the liquidity of a bank is measured by using cash

to deposit ratio. The liquidity position rating is assigned as per the description

given below:

CAMEL Model – Liquidity Position Indicator(s)

Rating Indicator (s)

1

Indicates strong liquidity level of the bank.

2

Indicates satisfactory liquidity levels and better fund management by the bank.

3

Indicates less than satisfactory level of liquidity position. There is some sense of

weakness with the bank’s fund management practices.

4

Indicates a poor level of liquidity position of the bank. The bank may not be able

to meet present and anticipated sudden withdrawals.

5

Indicates a critically deficient liquidity position, external assistance needed to tide

over the liquidity crunch.

Example for exercise:

Year Capital Asset Mgt.Efficiency Earning Liquidity

Adequacy(%) Quality(%) (Absolute) Quality(%) (%)

1999-00 11.74 0.95 0.027 0.93 3.91

2000-01 11.90 0.87 0.044 1.39 3.82

2001-02 12.7 0.83 0.061 1.73 11.47

2002-03 13.48 0.74 0.066 1.75 8.96

2003-04 5.96 0.58 0.050 1.18 9.59

2004-05 5.58 0.24 0.058 1.22 4.35

2005-06 5.75 0.22 0.062 1.19 5.79

2006-07 4.76 0.34 0.043 0.66 6.55

Composite 8.98 0.59 0.051 1.25 6.81

Score

(CS)

Das könnte Ihnen auch gefallen

- Regional Rural Banks of India: Evolution, Performance and ManagementVon EverandRegional Rural Banks of India: Evolution, Performance and ManagementNoch keine Bewertungen

- Camel Rating: A Comprehensive Criteria: C Capital, A Asset, M Management, E Earnings and L LiquidityDokument1 SeiteCamel Rating: A Comprehensive Criteria: C Capital, A Asset, M Management, E Earnings and L LiquiditysakibarsNoch keine Bewertungen

- Final Ok Work1111Dokument33 SeitenFinal Ok Work1111Ramu KhandaleNoch keine Bewertungen

- CAMELS Rating SystemDokument3 SeitenCAMELS Rating SystemrajchalNoch keine Bewertungen

- Aashi Gupta (FE1702) - Prakhar Sikka (FE1730)Dokument12 SeitenAashi Gupta (FE1702) - Prakhar Sikka (FE1730)Suprabha GambhirNoch keine Bewertungen

- January 2015 1420177010 13Dokument2 SeitenJanuary 2015 1420177010 13poojaNoch keine Bewertungen

- Camel Final PPT 03Dokument13 SeitenCamel Final PPT 03Ishan Shah0% (1)

- Camel Framework in Banks - Indian ScenarioDokument3 SeitenCamel Framework in Banks - Indian Scenarioanjusawlani86Noch keine Bewertungen

- A Study of Performance Evaluation OF Top 6 Indian BanksDokument12 SeitenA Study of Performance Evaluation OF Top 6 Indian BanksKeval PatelNoch keine Bewertungen

- Camels RatingDokument12 SeitenCamels RatingImtiaz AhmedNoch keine Bewertungen

- Final ProjectDokument90 SeitenFinal ProjectdgpatNoch keine Bewertungen

- Performance Evaluation of A Bank (CBM)Dokument34 SeitenPerformance Evaluation of A Bank (CBM)Vineeth MudaliyarNoch keine Bewertungen

- Capital Adequecy2Dokument6 SeitenCapital Adequecy2meetkamal3Noch keine Bewertungen

- Camels Model of Performance Evaluation of Banks: By, Tripura, Sishira.P, S.Neha, Mythili.MDokument30 SeitenCamels Model of Performance Evaluation of Banks: By, Tripura, Sishira.P, S.Neha, Mythili.MMythili MadapatiNoch keine Bewertungen

- Research Proposal - Dissertation - 2018-23Dokument21 SeitenResearch Proposal - Dissertation - 2018-23Abhijeet MondalNoch keine Bewertungen

- Commercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Dokument8 SeitenCommercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Dhruti BhatiaNoch keine Bewertungen

- CAMELS ApproachDokument12 SeitenCAMELS ApproachAreeb AsifNoch keine Bewertungen

- Evaluating Banks' Performance-Camel ModelDokument8 SeitenEvaluating Banks' Performance-Camel ModelhariselvarajNoch keine Bewertungen

- History CamelDokument2 SeitenHistory CamelSumi PgNoch keine Bewertungen

- BaselDokument28 SeitenBaselKavithaNoch keine Bewertungen

- CB AssignmentDokument6 SeitenCB AssignmentVaishnavi khotNoch keine Bewertungen

- Financial Health of BanksDokument26 SeitenFinancial Health of BanksVINITHANoch keine Bewertungen

- Camel: C - Capital AdequacyDokument2 SeitenCamel: C - Capital AdequacybinduNoch keine Bewertungen

- On Capital AdequacyDokument46 SeitenOn Capital Adequacymanishasain75% (8)

- Risk Management & Basel IIIDokument31 SeitenRisk Management & Basel IIIsatishNoch keine Bewertungen

- 3.0. Performance Measurement of Banking SectorDokument15 Seiten3.0. Performance Measurement of Banking SectorFarzana Akter 28Noch keine Bewertungen

- Write UpDokument2 SeitenWrite Upnehaaa78Noch keine Bewertungen

- Financial Performance of Icici Bank by Stewartraj Dharmaraj Project Guide-Prof: - Evonne SakhraniDokument14 SeitenFinancial Performance of Icici Bank by Stewartraj Dharmaraj Project Guide-Prof: - Evonne SakhraniStewart DuraiNoch keine Bewertungen

- Conceptual Framework of Camel Analysis: Chapter-1Dokument11 SeitenConceptual Framework of Camel Analysis: Chapter-1poojaNoch keine Bewertungen

- Executive SummaryDokument56 SeitenExecutive SummaryMurali Balaji M CNoch keine Bewertungen

- Amrutha ValliDokument14 SeitenAmrutha ValliSai KishoreNoch keine Bewertungen

- Risk Based Capital Management For Banks: Janata Bank Staff College DhakaDokument39 SeitenRisk Based Capital Management For Banks: Janata Bank Staff College DhakaUdita GopalkrishnaNoch keine Bewertungen

- CAMEL AnalysisDokument11 SeitenCAMEL AnalysisChirag AbrolNoch keine Bewertungen

- A Comparative Study On Financial Performance of Public, Private and Foreign Banks in IndiaDokument21 SeitenA Comparative Study On Financial Performance of Public, Private and Foreign Banks in IndiaMINESHNoch keine Bewertungen

- Day 2 Slides (Rev)Dokument48 SeitenDay 2 Slides (Rev)AHMAD RANANoch keine Bewertungen

- Day 2 Slides (Rev)Dokument48 SeitenDay 2 Slides (Rev)AHMAD RANANoch keine Bewertungen

- CAMELS and PEARLS Applied To Financial Management of Commercial Bank in VietnamDokument44 SeitenCAMELS and PEARLS Applied To Financial Management of Commercial Bank in VietnamDan LinhNoch keine Bewertungen

- CAMELSDRAFTVIJAIDokument49 SeitenCAMELSDRAFTVIJAIMurali Balaji M CNoch keine Bewertungen

- Indian Banks and BASEL AccordDokument38 SeitenIndian Banks and BASEL AccordHimanshu KumarNoch keine Bewertungen

- Camel - Rating - Bank Management - MBA-FA20Dokument19 SeitenCamel - Rating - Bank Management - MBA-FA20Sudheer VishwakarmaNoch keine Bewertungen

- IJRAR1BXP010Dokument19 SeitenIJRAR1BXP010Abhi DNoch keine Bewertungen

- CAMELDokument7 SeitenCAMELKhanal NilambarNoch keine Bewertungen

- Mahatma Education Society's Pillai College of Arts, Commerce and Science (Autonomous) New Panvel ISO 9001:2015 CertifiedDokument10 SeitenMahatma Education Society's Pillai College of Arts, Commerce and Science (Autonomous) New Panvel ISO 9001:2015 CertifiedAbizer KachwalaNoch keine Bewertungen

- Camels RatingDokument30 SeitenCamels RatingAbhishek BarmanNoch keine Bewertungen

- Camels Model AnalysisDokument11 SeitenCamels Model AnalysisAlbert SmithNoch keine Bewertungen

- Analyzing Dubai Islamic Bank's Performance Using The CAMEL ApproachDokument8 SeitenAnalyzing Dubai Islamic Bank's Performance Using The CAMEL Approachventures.acolyteNoch keine Bewertungen

- ALM PPT FinalDokument49 SeitenALM PPT FinalNishant SinhaNoch keine Bewertungen

- ExtraDokument12 SeitenExtraSujit Kumar YadavNoch keine Bewertungen

- BASLE II A Simplified ExplanationDokument5 SeitenBASLE II A Simplified ExplanationmanaskaushikNoch keine Bewertungen

- Performance of Banks: The Theoretical ApproachDokument29 SeitenPerformance of Banks: The Theoretical ApproachSingh VirgoNoch keine Bewertungen

- Capital Adequacy Mms 2011Dokument121 SeitenCapital Adequacy Mms 2011Aishwary KhandelwalNoch keine Bewertungen

- Finance Notes For RBI Grade B - Phase 2Dokument106 SeitenFinance Notes For RBI Grade B - Phase 2abinash67% (3)

- CamelDokument10 SeitenCamelSimki JainNoch keine Bewertungen

- Camels RatingDokument22 SeitenCamels Ratingmaryam rajputtNoch keine Bewertungen

- Chapter 16 MGT of Equity CapitalDokument29 SeitenChapter 16 MGT of Equity CapitalRafiur Rahman100% (1)

- Camels & Pearls Rating System in VietnamDokument41 SeitenCamels & Pearls Rating System in VietnamgiangNoch keine Bewertungen

- 6.4.3. Applying The CAMEL Framework: PublicationsDokument5 Seiten6.4.3. Applying The CAMEL Framework: PublicationsAnjali KatarukaNoch keine Bewertungen

- Internship Report On National Bank of Pakistan (NBP)Dokument41 SeitenInternship Report On National Bank of Pakistan (NBP)Saad KhanNoch keine Bewertungen

- Risk Management: Capital Management & Profit PlanningDokument25 SeitenRisk Management: Capital Management & Profit Planningharry2learnNoch keine Bewertungen

- Legality of Object & ConsiderationDokument26 SeitenLegality of Object & Considerationjjmaini13100% (1)

- 20q Rev1 Ep&e SoboceDokument17 Seiten20q Rev1 Ep&e SoboceEdwin QuispeNoch keine Bewertungen

- Role of RBI in Control of Credit - Economics Project Class 12 (2019-20)Dokument22 SeitenRole of RBI in Control of Credit - Economics Project Class 12 (2019-20)Anonymous JbDKaC78% (134)

- FATCACRS Self Declaration Form (Individual) - FinalDokument4 SeitenFATCACRS Self Declaration Form (Individual) - FinalAqmal KamarudinNoch keine Bewertungen

- Elecom Rules and GuidelinesDokument5 SeitenElecom Rules and GuidelinesElmer NaturaNoch keine Bewertungen

- EthicsDokument4 SeitenEthicsbomama01Noch keine Bewertungen

- Executive SummaryDokument40 SeitenExecutive SummaryEarl Louie M. MasacayanNoch keine Bewertungen

- PaperforRecyclingQuality Control GuidelinesWITHANNEX - (Are La Baza EN643)Dokument14 SeitenPaperforRecyclingQuality Control GuidelinesWITHANNEX - (Are La Baza EN643)Violeta&Florin GasparNoch keine Bewertungen

- Notice: Antidumping: Carbazole Violet Pigment 23 From— TaiwanDokument3 SeitenNotice: Antidumping: Carbazole Violet Pigment 23 From— TaiwanJustia.comNoch keine Bewertungen

- ShuchiDokument2 SeitenShuchiAlkaNoch keine Bewertungen

- SafetyDokument21 SeitenSafetyAllen Jay Vio100% (1)

- Learnership Application Form TETADokument12 SeitenLearnership Application Form TETAMthura Swartz0% (1)

- Builders Association of IndiaDokument8 SeitenBuilders Association of IndiaDipanshuGuptaNoch keine Bewertungen

- 6 Sanggunian Panlungson NG Baguio V JadewellDokument4 Seiten6 Sanggunian Panlungson NG Baguio V JadewellKatherine NavarreteNoch keine Bewertungen

- Kalpataru Project ReportDokument18 SeitenKalpataru Project ReportPriyansh Soni100% (2)

- ASN Board AssessmentDokument4 SeitenASN Board AssessmentAgriSafeNoch keine Bewertungen

- Internal and External Audits HandbookDokument62 SeitenInternal and External Audits HandbookSokanha InNoch keine Bewertungen

- PNCC v. COURT OF APPEALSDokument4 SeitenPNCC v. COURT OF APPEALSRose De JesusNoch keine Bewertungen

- POC Performance Audit OverviewDokument12 SeitenPOC Performance Audit OverviewAnn Shelley PadillaNoch keine Bewertungen

- Republic Act No 8799Dokument27 SeitenRepublic Act No 8799einel dcNoch keine Bewertungen

- Grace Gural-Balaguer: Acctg 22 InstructorDokument59 SeitenGrace Gural-Balaguer: Acctg 22 InstructorMary CuisonNoch keine Bewertungen

- CHED Memorandum Order On Transnational EducationDokument10 SeitenCHED Memorandum Order On Transnational EducationRichard LaroyaNoch keine Bewertungen

- Compassionate Love of Christ Care FoundationDokument16 SeitenCompassionate Love of Christ Care FoundationOlusanya Pace-setter Michael57% (7)

- Partnership Day 1Dokument20 SeitenPartnership Day 1Mitch ELleNoch keine Bewertungen

- ISO 27001 Auditor Checklist PDFDokument9 SeitenISO 27001 Auditor Checklist PDFHack 786Noch keine Bewertungen

- W 4tDokument1 SeiteW 4tfredlox92% (13)

- Legal & Taxation Aspect of LeaseDokument7 SeitenLegal & Taxation Aspect of Leasesouvik.icfaiNoch keine Bewertungen

- Utpras New Forms - EvmnciiiDokument20 SeitenUtpras New Forms - EvmnciiiOrly G. UmaliNoch keine Bewertungen

- CranesDokument6 SeitenCraneshazopmanNoch keine Bewertungen

- Regulations: G N N - 391 Published On 14/5/2021Dokument6 SeitenRegulations: G N N - 391 Published On 14/5/2021david karasilaNoch keine Bewertungen