Beruflich Dokumente

Kultur Dokumente

The "Best" Investor Pitch Deck Outline: (Your Logo Here)

Hochgeladen von

Abhijit PathakOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The "Best" Investor Pitch Deck Outline: (Your Logo Here)

Hochgeladen von

Abhijit PathakCopyright:

Verfügbare Formate

The “Best” Investor Pitch Deck Outline

0) Cover Slide

1) Elevator Pitch Slide

2) Team (If not impressive, move slide to after “Your Solution” to show who built it and why)

3) Board Members & advisors & Future Hires (Optional, combine w/ team slide)

4) Market Opportunity: Define Market, Size & Target Customer

5) Market Problem & Current Solutions: What need do you fill?

6) Your Solution (1-5 slides)

7) Traction & Awards (Optional, if none yet. Can be right after Elevator if impressive)

8) Market Fit / Competition (Optional, can be explained in slides 5 & 6)

9) Competitive Advantages (Optional, can be explained in slides 5 & 6)

10) Business Model: Key Revenue Streams

11) Market Approach & Strategy: Key Expenses / Time-Efforts / How you grow

12) Financial Projections 5 Slide Deck: 4, 5, 6, 2, combine: 10, 12, & 14

10 Slide Deck: Don’t include optional slides

13) Exit Strategy (Optional) 15-25 Slide Deck: Slides 1-15 + add’l slides: Market

14) The Ask: Capital Raise / $ Uses / Intros Size vs. Target Client, Your Solution (1-5), Traction

15) Closing Slide: Questions? Contact Details (1-3), Market Fit vs. Competition, Marketing

Approach vs. Business Strategy, $ Raise vs. $ Uses

{your logo here} 1

Potential Appendix Slides

• Timeline: History, Milestones & Prior Funding

• Detailed Value Proposition to Clients / Users / Partners

• Detailed Financials: Revenue and expense breakdown, showing % of total revenue / expenses

• Average Revenue Per User (ARPU)? Per Client Size?

• Life-time Value of Customer (Churn Rate?) vs. Cost to Acquire Customer

• Breakeven Analysis: Base-case vs. Bare-bones case. # Clients / $ Revenue needed?

• Pipeline of potential clients, % likelihood of closing, revenue potential from pipeline

• Partnership Agreements / Structures

• Proprietary aspects not discussed in core deck

• Additional Strategy Slides: Ex. Architecture, How to avoid/limit circumvention, Funnel system of

business operations, Growth strategy

• Capital Structure: Ownership of founders & current investors

• Competitors Capital Raises / Investors

• Head Count (# Employees) Projections / Key Hires Needed

• Additional Screen Shots from Demo

• Summary Slide: Why We’ll Be Successful (Add if deck > 15 slides, otherwise too redundant)

{your logo here} 2

Cover Slide

• Logo / Name of Company

• Purpose of Presentation: “Investor Presentation”

• Date: Optional - if you send a deck with an old

date, you look outdated (is it taking you a while to

raise the round?). We recommend never using a

date – also people know today’s date

• Other Potential Additions:

• Logos of accelerator, awards, publications featuring company

• Slogan

• Name of Presenter / CEO

{your logo here} 3

Elevator Pitch Slide

Create a brief one liner that describes:

• Short and memorable

• What’s the core problem (describe pain) in the

marketplace and the solution you’re providing?

• What’s your vision? Ultimate

solution/business/service for customers/users?

• Graphically show this if possible

• Try: making it relatable… as in “We are X for Y”

– (“We are Airbnb for Event Spaces”)

– (“We are the Starbucks of Frozen Yogurt”)

{your logo here} 4

Team (if not strong, move to later)

• Core Team: The Founders & Chiefs that are critical to success

• Show a well-rounded team, technical AND business- if you are

lacking in an area, show advisors

• Photos (Optional- Don’t put in if mostly students)

• Relevant Experiences / Successes (Exits?) / Failures (Good war

stories?)

• Leadership Experience/ Education – whichever is impressive

• Don’t write sentences, do 1-3 brief bullets per person, or even

better do 1 key bullet per person

“We are the right team who can execute this

business plan because...”

{your logo here} 5

Board / Advisors / Future Hires

• Board of Directors? (Startups shouldn’t have BODs! Wait

until after Series A round to establish a board)

• Board of Advisors? (Give 0.1%-1% to advisors, no more!)

• What’s their relevancy / support, other than big names?

• Are they investing? Big points if “Yes”!

– If “No”, be careful. Your big fancy advisors will go from being a

positive to a negative. If they are successful and have capital, they

should invest, otherwise it shows lack of real support. Have a good

reason for why not if asked.

• Reference key holes in management or operations that

need to be filled (intros needed?)

– Few companies have the perfect team from the start, recognize

that and solve it

{your logo here} 6

Market Opportunity

• What is the General Market Focus?

• Name it. Size it: Units / Revenue? Growth?

• What is the Total Addressable Market

• What’s Your Target Market? The sub-sector of the General Market?

• Name it. Size it: Units / Revenue? Growth?

• Define Target Client? Key characteristics?

• Ex. Small vs. Large businesses, independents vs. agencies,

examples of ideal clients or individuals

• Clients’ Current Needs?

• Describe any important market evolutions or trends and

why we’re at an inflection point now

{your logo here} 7

Market Problem / Current Solutions

• Big Market Problem? Big Un-met Need?

– You can’t create demand (only market leaders can)

• Current Solutions = Current Problems?

– Biggest competition = Status quo, changing customer behavior, even if

old systems are inferior, they exist everywhere, you don’t

• Clearly show the pain of the problem or convey the strong

desire that is being unfilled, don’t just say it

• “Solve your clients' number-one problem,” Cyrus Massoumi,

CEO of ZocDoc. Not their 4th or 10th problem. What keeps

them up at night or really bothers them?

• Conclusion: The market has evolved and the current solutions

don’t fulfill/solve the clients’ current BIG needs/problems. There

is a BIG opportunity here!

{your logo here} 8

Your Solution / Demo

• Show > Tell: ~1-5 slides of your product / service

• Show a live demo when presenting or show screenshots of

key parts (Have screenshots within presentation prepared

anyway, demos love to fail)

• Don’t show a video, it can fail to play and takes away from

your precious time

• Tell a story: Future client or an example of current client

• Show core value proposition to client

– Better, Faster, Cheaper (More Economical)

{your logo here} 9

Traction / Performance / Awards

• Timeline / Key Milestones

• See, other people think we’re awesome!

• Accelerator programs (we graduated!)

• Awards: #1 Best Startup / # 1 Best DEMO

• Lots of articles about us: TechCrunch / Forbes / CNN / FOX

• We’re growing fast! We’ve got lots of clients/users, some

are brand name clients, look at our monthly growth, and

we have a growing pipeline that will generate lots of $

• We’re performing amazingly for clients, look at these

results!

– Customer success stories/testimonials

• See our key business metrics, we’re doing great!

{your logo here} 10

Market Fit / Competition

• Show how you fit into the Market Landscape

• Your advantages?

• Indirect Competitors vs. Direct Competitors?

• Your biggest competitor is the status quo! Why will

customers switch to you vs. the incumbent?

• Are you changing customer behavior?

• Types of Diagrams/Charts:

• Market Landscape Comparison

• Feature List Comparison

Pitch why you’re 10x better, not just 3x better!

{your logo here} 11

Market Landscape (Example 1)

Industry Segment 1

Indirect

Competitor

Logos

Direct Direct

Competitor Competitor Competitor

Logos Logos Logos

Industry Indirect Indirect Industry

Segment 2 Competitor Your Logo Competitor Segment 3

Logos Logos

Direct Competitor Direct

Competitor Logos

Competitor

Logos Logos

Indirect

Competitor

Logos

Industry Segment 4

{your logo here} 12

Market Landscape (Example 2)

Your

Co. A Your

High

Logo Co. A

Logo

Quality

Quality

Co. D Co. D

Low

Co. B Co. C

Co. B Co. C

Expensive Discounted

Economical

Economical

{your logo here} 13

Feature List Comparison

Company Feature 1 Feature 2 Feature 3 Feature 4 Feature 5 Feature 6 Feature 7 Total

Your Company 7

Competi tor A 4

Competi tor B 4

Competi tor C 3

Competi tor D 2

Competi tor E 2

Indi rect Competi tor A 2

Indi rect Competi tor B 3

Indi rect Competi tor C 3

Indi rect Competi tor D 3

Indi rect Competi tor E 3

This often makes you look 2-3x better,

not 10x, so maybe only have as an

appendix slide

{your logo here} 14

Competitive Advantages

• Current Competitive Advantages?

• Sustainable Competitive Advantages?

• Unfair Competitive Advantages?

• Patents? (Status, International?)

• Key Relationships / Partnerships?

• Barriers to Entry for New Players?

• Money, Time, Expertise, Relationships, Patents

• Competitor’s Competitive Advantages / Weaknesses?

{your logo here} 15

Revenue Model

• How do you make money? Key revenue streams?

• Pricing? Flat fee or %? Why that rate?

• Recurring Revenue Frequency?

• Is there a big difference between Gross vs. Net Revenue?

• High Volume vs. Low Volume Business?

• Example showing basic math:

• 100 Clients x A Units x B Fee = $C Revenue

• Easy to apply multiples: 10x, 100x clients

• Cash collections: Immediately? 30-90 Days?

• Expected conversion rate to get a paid client?

• Expected ARPU (Average Revenue Per User)?

• Life-time Value of Customer?

{your logo here} 16

Expense Model (Marketing / Strategy)

• Key Expenses / Time-Efforts Needed To Generate Revenue?

• Channels: How to reach / market to customers?

• Strategy: How to convert, acquire or close clients?

• Unique Strategic Relationships / Partnerships?

• Potential for leverage or scalability to grow fast economically?

• How long is sales cycle to get a client?

• Average Cost to Acquire a Customer?

• Cost to Maintain a Customer & Build Recurring Sales?

• Monthly burn rate, now vs. after funding?

{your logo here} 17

Financial Projections

• # Years Projected:

• Startups: 6 year projections (accounts for ~1 yr of getting started)

• Early-mid stage: 1-2 year historical, 3-5 year projections

• Target Market Size vs. Acquired Clients:

• Total # Clients in Target Market (Show each year with growth)

• # Free Users vs. # Active Revenue Generating Users (shows

conversion rate)

• % Penetrated (shows entrepreneur’s sanity: growing from 0% to 1%-

5% penetration is usually sane, 50%-100% is usually insanity)

• High Level Financials:

• Revenue, Expenses, EBITDA, EBITDA Margin %

• Optional: Break out key revenue streams or Gross vs. Net Revenue

• Optional: Break out key expenses (Ex. # Employees)

{your logo here} 18

Financial Projections

By year 5:

Revenue = $30-50M+, EBITDA = $10M+

• Investors look for exits of 6-12x+ EBITDA = $100M+ Sale of Company

EBITDA margins usually range 10%-40%

• Look up public companies in your industry or reports to see what is normal

{your logo here} 19

Exit Strategy

• Acquisition: Most likely exit option for companies

• Name potential companies (any unique relationships with them?)

• Name types / categories of companies that could acquire you

• Why would they acquire you, how do you fit into their strategy?

• Why won’t they try to build it themselves?

• Financial Buyer: Will your company generate excess cash

flow that could make it attractive to financial buyers to

generate a return?

• IPO: The least likely exit for a company, but a possibility.

Often not preferred to founders or investors compared to

top two choices, due to required holding period and

volatility, etc.

{your logo here} 20

Capital Raise / Use of Proceeds

• The Ask: How much are you raising and with what general terms (equity, debt, Convertible

Note) and the timing

• Capital Raise:

• Stage / Size? Ex. Seed Round: up to $500K, Series A: $2-3M

• Investment Terms: Ex: Pre-Money Valuation Expectations / Range, Discount into next round?,

Valuation Cap?, Dividend / Interest Rate?, Liquidation Preferences?

• Current Investors in Round: Founders, Key Angels, VCs

• Monthly Burn Rate? / How long will new $ last (runway)?

• Prior Investment Rounds: Size? Investors? Valuation? Key Terms?

• Use of Proceeds: (Name It / $ Amount / % of Capital Raised)

• How much raised? From whom?

• Sales & Marketing

• Hire key employees

• Founders salaries (Don’t be greedy!!!)

• Build out / further develop technology

• File patents

• Achieve Milestones: 1st Client? Get to Breakeven? 3x Rev Growth?

{your logo here} 21

Closing Slide

• Your Logo (Big & in Middle) / Link to site

• Any Questions?

• Contact Info: Name / E-mail / Phone

After all questions have been asked by the investor, ask

“What’s the next step in the process?”

Remember:

Goal of Meeting =

Get the Next Meeting

{your logo here} 22

Before The Pitch

• Get introduced to an Angel or VC, they don’t respond well to random calls/e-mails

• Review portfolio companies of Angels / VCs before sending them your investor deck

• Investors don’t invest in companies that compete directly with a portfolio company (shocking!)

• If there are strategic companies in their portfolio, they can make introductions to them even if they

don’t invest, such as potential clients, strategic partners, future acquirers, etc.

• Review investment criteria of Angels / VCs before sending investor deck

• Make sure you fit their industry focus (ex. Energy) or business type focus (Ex. B2B / B2C)

• Check the size of capital they invest ($250K? $1M? $3M+), the company stage (Startup/Early

Stage/Growth Stage, etc.), or required financial metrics (Ex. Min of $1M in Revenue or EBITDA)

• Review investor backgrounds to find useful overlaps or who best to speak with at fund

• Practice, Practice, Practice! Nail down flow, slide transitions, timing, clarity of concepts,

key mental frameworks, stories, answers to likely questions, etc.

• Arrival: Arrive 10 minutes early to set up computer, projector, get access to Wi-Fi, etc.

• Attire: Business casual is usually fine, but in doubt, wear a suit or ask them

• Ask the investors to provide a quick background on themselves and the fund ONLY if

there’s time. (You may just learn something and people love talking about themselves!)

• Can also ask who will be at the meeting (your audience) so you know their technical level

{your logo here} 23

Preparing the Pitch Deck

• There are no correct # of slides, only key pieces that need to be covered

• Don’t be afraid of leaving things out of pitch, especially for short pitches, all other slides are back-up

• Follow their pitch rules- for ex. no more than X people, slides, minutes

• Use images (big) more than words, and very simple graphics and diagrams

• Keep slides clean, no clutter: ~2-5 bullets with each ~5-10 words/bullet

• Show, Don’t Tell: Don’t be cocky, show AMAZING results!

• Key Takeaways: Concisely summarize main points at the top or bottom of slides

– Show real validators to prove your points, supported by strong emotional validators

– The Right Opportunity: Clearly convey a Big Market + Big Problem + The Right Solution

– The Right Team: Qualities - Integrity, Credibility, Passion, Experienced, Knowledgeable, Skilled,

Leadership, Confidence, Commitment, Visionary, Realist, Coachable, Doers

• Consistent Formatting: Caps vs. lowercase, colors, font type & size, spacing, etc.

• Font Type: Arial (Easy to read)/ Font Size: Only use size 20 or larger

• Don’t use dashes “-” as bullets, they look negative, use other styled bullets

• Add page numbers (Bottom right of page)

• Dark backgrounds with light text colors project well (some print options allow for the

white background for printing.)

{your logo here} 24

How to Pitch Effectively

• Open by saying your name, title/role, and company name (Allows audience to get familiar

with your voice before you start pitching, and it’s just polite!)

• The Quick Hook: Grab the emotional attention of the audience within the first 1 minute, or

take the audience with you on a STORY

• Team: Likewise tell the personal story of why you are invested in this company, and say

what is relevant about each team member in the company. Use pictures of team if

older/shows experience.

• Pitch your vision, not just what you currently have or are

• Reference things people know / understand, don’t make people think or question you

• One Joke: Make audience laugh at least once, but don’t do a comedy routine

• <10 min presentations – Only one person presents, the CEO who can sell

• Don’t read slides or stare at projector screen! Look forward / connect with your audience

• Don’t speak too fast, people listen better when you speak slower and you sound wiser!

• Don’t use industry acronyms / terminology, or reference companies they won’t know

• Don’t show a video, do show a quick DEMO or screen shots (pictures fail less often)

• If you run out of time, learn to skip to the end and the “ask” – your purpose for being there

{your logo here} 25

Handouts and After Pitch

• Prepare various presentations (PDF’s) using 1 PPT file with all core

slides and appendix slides

1) 1st Meeting PDF: Send Core Slide Deck (No Appendix Slides), when presenting use

PPT so you can access appendix slides during Q&A if needed

2) Follow-up Meeting PDF: Additional slides (they may have requested you to create)

and some appendix slides

3) Full Due Diligence PDF: All slides and all appendix slides (possibly requiring NDA)

(This is usually once they have drafted a term sheet)

• Deck should be clear enough to explain itself and not need you

– When presenting, have add’l insight to share on each slide = Your “added

value”

– They often use the pitch deck now as a standalone business plan

• Afterwards, don’t forget to follow up and get feedback. Don’t just keep

reusing the same pitch deck- revise it based on their feedback.

{your logo here} 26

Top Investor Questions

Company Questions:

• What’s the history of the company? When did you start operating?

• Why did you create this company?

• How did you meet/find your team members? Why are you / team right people to execute this

business?

• Target market size? Minimum market penetration needed for success?

• What’s your traction? (MVP done?, user/revenue growth?, key milestones?)

• Why will you fail? Biggest challenges?

• Why will you succeed? Unfair / sustainable advantages?

• Show how you achieve the magic ratio: ARPU / Life-time Value > Cost to Acquire / Maintain a

Customer

Capital Raising Questions:

• What’s the capital raising history of the company? How much / what terms?

• When did you start raising this round? What investors have committed?

• Have you invested any of your own money?

• Are your advisors investing?

• What’s your valuation? Terms?

• How much cash is in the bank? What’s your monthly burn rate (expenses not covered by

operating cash flow from revenues)? = Runway (Cash / Burn Rate)

• Use of proceeds and expected results/milestones?

{your logo here} 27

Words of Wisdom

• Be 10x better (at one thing vs. doing 10x more things), Being

2-3x better isn’t good enough

• Focus on your customers’ #1 problem, not 10th problem

• Prepare yourself for rejection, ask why and learn

• There are lots of great ideas, but few can execute them

• Time is your biggest enemy! Build quick and cheap, and

iterate, iterate, iterate…pivot when needed

• Biggest Competition: Companies with equally great ideas and

teams, but more traction at your stage

• Best Opportunity: A big growing market, with a big problem,

and a simple solution (not overly complicated)

• You don’t know, the market does! Ask often.

{your logo here} 28

Das könnte Ihnen auch gefallen

- 200+ Top Public VC Firms DatabaseDokument43 Seiten200+ Top Public VC Firms DatabaserowieNoch keine Bewertungen

- Strategy 13 Presentation - Social Emotional LearningDokument29 SeitenStrategy 13 Presentation - Social Emotional Learningapi-588940234Noch keine Bewertungen

- Healthtech Venture CapitalDokument28 SeitenHealthtech Venture CapitalFelipe Hernan Herrera SalinasNoch keine Bewertungen

- PE/VC Firms With Women, Minority FoundersDokument14 SeitenPE/VC Firms With Women, Minority FoundersdavidtollNoch keine Bewertungen

- The "Best" Investor Pitch Deck Outline: (Your Logo Here)Dokument28 SeitenThe "Best" Investor Pitch Deck Outline: (Your Logo Here)Ranjith KS100% (1)

- VC'sDokument42 SeitenVC'sElchai GranotNoch keine Bewertungen

- Swiss wealth firms contact dataDokument1 SeiteSwiss wealth firms contact dataIZ SaintedNoch keine Bewertungen

- Family OfficeDokument3 SeitenFamily OfficeDougNoch keine Bewertungen

- GameDev Friendly Investors List From ACHIEVERS HUBDokument7 SeitenGameDev Friendly Investors List From ACHIEVERS HUBSarahNoch keine Bewertungen

- Discounted Cash Flow Analysis - Uber Technologies, Inc. (Unlevered DCF)Dokument9 SeitenDiscounted Cash Flow Analysis - Uber Technologies, Inc. (Unlevered DCF)Haysam TayyabNoch keine Bewertungen

- EBook - Venture Capital & PE - DemoDokument161 SeitenEBook - Venture Capital & PE - DemoRony JamesNoch keine Bewertungen

- List of All Incubators Seed FundsDokument3 SeitenList of All Incubators Seed FundsaznboyxNoch keine Bewertungen

- The Diary of Anne Frank PacketDokument24 SeitenThe Diary of Anne Frank Packetcnakazaki1957Noch keine Bewertungen

- BankingTechMagazineFebruary2020DigitalEdition PDFDokument29 SeitenBankingTechMagazineFebruary2020DigitalEdition PDFDunja BezdrovNoch keine Bewertungen

- Active Investor List by Trace CohenDokument53 SeitenActive Investor List by Trace Cohens4shivNoch keine Bewertungen

- MeetFounders UK EU August 2021 HandoutDokument13 SeitenMeetFounders UK EU August 2021 HandoutAndrew BottNoch keine Bewertungen

- 2008 Global Private Equity & Venture Capital Contact DirectoryDokument3 Seiten2008 Global Private Equity & Venture Capital Contact Directorywww.gazhoo.com100% (5)

- Zodius Capital II Fund Launch 070414Dokument2 SeitenZodius Capital II Fund Launch 070414avendusNoch keine Bewertungen

- Over 40 top mezzanine and equity partnersDokument3 SeitenOver 40 top mezzanine and equity partnersafkdsjfdlsjNoch keine Bewertungen

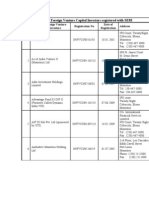

- A-List of Foreign Venture Capital Investors Registered With SEBIDokument24 SeitenA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhNoch keine Bewertungen

- Digital Marketing For Financial Summit - AttendeesDokument12 SeitenDigital Marketing For Financial Summit - Attendeeskarthik83.v209Noch keine Bewertungen

- List of Merchant BankersDokument10 SeitenList of Merchant Bankersnikee patelNoch keine Bewertungen

- 29 RSCH - Startup Presentations To Angel-Seed Stage Investors and Partners - 7.07Dokument24 Seiten29 RSCH - Startup Presentations To Angel-Seed Stage Investors and Partners - 7.07Anonymous IRg5e4100% (2)

- Ebook Top 58 Venture Capital Firms PDFDokument61 SeitenEbook Top 58 Venture Capital Firms PDFPratyutpanna DasNoch keine Bewertungen

- Economics and The Theory of Games - Vega-Redondo PDFDokument526 SeitenEconomics and The Theory of Games - Vega-Redondo PDFJaime Andrés67% (3)

- Top Healthcare Funds and Investors in IndiaDokument2 SeitenTop Healthcare Funds and Investors in Indialuvisfact7616Noch keine Bewertungen

- Top 100 Tech Startup Logos and NamesDokument54 SeitenTop 100 Tech Startup Logos and NamesAsish VaranasiNoch keine Bewertungen

- Fintech VC Panels & Pitches HandoutDokument7 SeitenFintech VC Panels & Pitches HandoutAndrew BottNoch keine Bewertungen

- 100 Top Venture Capital FirmsDokument12 Seiten100 Top Venture Capital FirmsAtrij DixitNoch keine Bewertungen

- Transforming the Business of Fashion GloballyDokument12 SeitenTransforming the Business of Fashion GloballyTarun ThadaniNoch keine Bewertungen

- Ecommerce & Marketplace VC Panels & Pitches HandoutDokument6 SeitenEcommerce & Marketplace VC Panels & Pitches HandoutAndrew BottNoch keine Bewertungen

- Accelerator / Incubator Website CountryDokument561 SeitenAccelerator / Incubator Website CountryАсхат ЖанабайNoch keine Bewertungen

- Manos Accelerator - List of Accelerators and IncubatorsDokument49 SeitenManos Accelerator - List of Accelerators and Incubatorstripathi.ankit557Noch keine Bewertungen

- June 2010 Family Office Conference AgendaDokument11 SeitenJune 2010 Family Office Conference Agendacraig2786100% (1)

- YC Seed Deck TemplateDokument11 SeitenYC Seed Deck TemplateRoaldDahlNoch keine Bewertungen

- List of PEGA Interview Questions and AnswersDokument33 SeitenList of PEGA Interview Questions and Answersknagender100% (1)

- Top Indian VC and PE funds by sector focusDokument4 SeitenTop Indian VC and PE funds by sector focusRakesh Kumar Singh100% (1)

- DL School ListDokument242 SeitenDL School ListAbhijit PathakNoch keine Bewertungen

- List of VCFsDokument3 SeitenList of VCFspoddar_ruchitaNoch keine Bewertungen

- VC ListDokument16 SeitenVC ListDavid SavageNoch keine Bewertungen

- Series A-C funding rounds for 15 startups in Oct 2015Dokument15 SeitenSeries A-C funding rounds for 15 startups in Oct 2015qwertyNoch keine Bewertungen

- Global Unicorn Company 2019Dokument34 SeitenGlobal Unicorn Company 2019rickyNoch keine Bewertungen

- Focus Group Discussion PDFDokument40 SeitenFocus Group Discussion PDFroven desu100% (1)

- TPG Capital: Capital Funds Behind Private Equity Economic CentralisationDokument6 SeitenTPG Capital: Capital Funds Behind Private Equity Economic CentralisationCarl Cord100% (1)

- Techstars Investors Europe tcm213-234388 PDFDokument1 SeiteTechstars Investors Europe tcm213-234388 PDFIrina LaninaNoch keine Bewertungen

- Asian Top InfluencersDokument33 SeitenAsian Top InfluencersRientzo Fachrur RoziNoch keine Bewertungen

- Self ReflectivityDokument7 SeitenSelf ReflectivityJoseph Jajo100% (1)

- Partnership DeedDokument4 SeitenPartnership DeedAnshumanTripathiNoch keine Bewertungen

- List of VCFsDokument3 SeitenList of VCFspoddar_ruchitaNoch keine Bewertungen

- African Fintech Startups Database (Finnovating For Africa 2021) - Sheet1Dokument24 SeitenAfrican Fintech Startups Database (Finnovating For Africa 2021) - Sheet1ImeNNoch keine Bewertungen

- Asus X553MA Repair Guide Rev2.0Dokument7 SeitenAsus X553MA Repair Guide Rev2.0UMA AKANDU UCHENoch keine Bewertungen

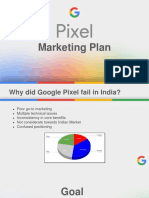

- Group 9 - Google Pixel Marketing PlanDokument41 SeitenGroup 9 - Google Pixel Marketing PlanNISHITA MALPANINoch keine Bewertungen

- CONNECT WITH INVESTORS IN OUR NETWORKDokument110 SeitenCONNECT WITH INVESTORS IN OUR NETWORKbhavikNoch keine Bewertungen

- Company Name PocDokument9 SeitenCompany Name PocJhon ArunNoch keine Bewertungen

- Forbes Global 2000 List 2019 Someka V1Dokument25 SeitenForbes Global 2000 List 2019 Someka V1SayyidRamiAlRifaiNoch keine Bewertungen

- Note On Angel InvestingDokument18 SeitenNote On Angel InvestingSidakachuntuNoch keine Bewertungen

- Should You Write the Executive Summary First or Last and WhyDokument31 SeitenShould You Write the Executive Summary First or Last and WhyJayan PrajapatiNoch keine Bewertungen

- The Formulation of Strategy 3-Strategies For Leaders-Followers-Challengers and NichersDokument16 SeitenThe Formulation of Strategy 3-Strategies For Leaders-Followers-Challengers and NichersPuneet DattaNoch keine Bewertungen

- Software Companies List USADokument13 SeitenSoftware Companies List USAAshish D100% (1)

- Givegivegivegivecorpcorpcorpcorp Productsproductsproductsproductsproductsproductsproductsproducts& ServicesservicesservicesservicesservicesservicesservicesservicesDokument17 SeitenGivegivegivegivecorpcorpcorpcorp Productsproductsproductsproductsproductsproductsproductsproducts& ServicesservicesservicesservicesservicesservicesservicesservicesAde SulaemanNoch keine Bewertungen

- Publicis - Luxury Digital Trends 2010Dokument47 SeitenPublicis - Luxury Digital Trends 2010Sarah BastienNoch keine Bewertungen

- Ali PayDokument4 SeitenAli PayAhmed GulNoch keine Bewertungen

- CB Insights Global Unicorn Club 2019Dokument20 SeitenCB Insights Global Unicorn Club 2019Yash Joglekar0% (1)

- Fintech Collection Report 2021 - TransUnionDokument22 SeitenFintech Collection Report 2021 - TransUnionArnelit PhilipNoch keine Bewertungen

- Hawaii's Top CEO'sDokument1 SeiteHawaii's Top CEO'sHonolulu Star-AdvertiserNoch keine Bewertungen

- List of Hospitality and Travel Awards 2019 - National & InternationalDokument6 SeitenList of Hospitality and Travel Awards 2019 - National & InternationalDiksha SinghNoch keine Bewertungen

- Capital DirectoryDokument467 SeitenCapital DirectoryWorla DewornuNoch keine Bewertungen

- Flo Biz - Sample DeckDokument8 SeitenFlo Biz - Sample DeckRishivanth ThulasiramanNoch keine Bewertungen

- 100 Most Influential People in FinanceDokument6 Seiten100 Most Influential People in FinanceDonnah Estigoy NeridaNoch keine Bewertungen

- Northeast India AdventureDokument4 SeitenNortheast India AdventureAbhijit PathakNoch keine Bewertungen

- Pitch MRDokument15 SeitenPitch MRAbhijit PathakNoch keine Bewertungen

- Agri LG PlanDokument5 SeitenAgri LG PlanAbhijit PathakNoch keine Bewertungen

- MHW Fund Requisition 23 SeptDokument3 SeitenMHW Fund Requisition 23 SeptAbhijit PathakNoch keine Bewertungen

- Cost Sheet - Branding Plan 2.xlxDokument1 SeiteCost Sheet - Branding Plan 2.xlxAbhijit PathakNoch keine Bewertungen

- Docs For Listing PDFDokument1 SeiteDocs For Listing PDFAbhijit PathakNoch keine Bewertungen

- New Class History PDFDokument1 SeiteNew Class History PDFAbhijit PathakNoch keine Bewertungen

- Cost Sheet - Branding Plan 2.xlxDokument1 SeiteCost Sheet - Branding Plan 2.xlxAbhijit PathakNoch keine Bewertungen

- Sample TrackerDokument1 SeiteSample TrackerAbhijit PathakNoch keine Bewertungen

- Tender Dummy File PDFDokument1 SeiteTender Dummy File PDFAbhijit PathakNoch keine Bewertungen

- MHW Fund Requisition 24 25 OctDokument3 SeitenMHW Fund Requisition 24 25 OctAbhijit PathakNoch keine Bewertungen

- Format Tender PDFDokument1 SeiteFormat Tender PDFAbhijit PathakNoch keine Bewertungen

- Cost Sheet - Branding PlanDokument1 SeiteCost Sheet - Branding PlanAbhijit PathakNoch keine Bewertungen

- Zain Catalog 03Dokument2 SeitenZain Catalog 03Abhijit PathakNoch keine Bewertungen

- Costing SampleDokument21 SeitenCosting SampleAchanNoch keine Bewertungen

- 5 Year Financial PlanDokument29 Seiten5 Year Financial PlanFrankieNoch keine Bewertungen

- The "Best" Investor Pitch Deck Outline: (Your Logo Here)Dokument28 SeitenThe "Best" Investor Pitch Deck Outline: (Your Logo Here)Abhijit PathakNoch keine Bewertungen

- Account TrackerDokument3 SeitenAccount TrackerAbhijit PathakNoch keine Bewertungen

- Dubai Group Tour - 23 March 2018Dokument2 SeitenDubai Group Tour - 23 March 2018Abhijit PathakNoch keine Bewertungen

- Vinayak May 18 AttendanceDokument1 SeiteVinayak May 18 AttendanceAbhijit PathakNoch keine Bewertungen

- Value Proposition OverviewDokument11 SeitenValue Proposition OverviewAbhijit PathakNoch keine Bewertungen

- Pro NewDokument11 SeitenPro NewAbhijit PathakNoch keine Bewertungen

- Fundraising Plan Sample TemplateDokument12 SeitenFundraising Plan Sample TemplateAbhijit PathakNoch keine Bewertungen

- Costing SampleDokument21 SeitenCosting SampleAchanNoch keine Bewertungen

- Business Plan Sample-2Dokument13 SeitenBusiness Plan Sample-2Abhijit PathakNoch keine Bewertungen

- Upload 26Dokument1 SeiteUpload 26Abhijit PathakNoch keine Bewertungen

- Travel BillDokument1 SeiteTravel BillAbhijit PathakNoch keine Bewertungen

- Cloud Security Training and Awareness Programs For OrganizationsDokument2 SeitenCloud Security Training and Awareness Programs For OrganizationsdeeNoch keine Bewertungen

- DBIRS SyllabusDokument2 SeitenDBIRS SyllabusAshitosh KadamNoch keine Bewertungen

- Writing A Formal Letter To The PresidentDokument1 SeiteWriting A Formal Letter To The PresidentPiaAnaisNoch keine Bewertungen

- Reasons Why Coca Cola Has A Large Market Share in Kenya and The WorldDokument9 SeitenReasons Why Coca Cola Has A Large Market Share in Kenya and The WorldAludahNoch keine Bewertungen

- Socio-cultural influences on educationDokument4 SeitenSocio-cultural influences on educationofelia acostaNoch keine Bewertungen

- Canna DispensariesDokument35 SeitenCanna DispensariesWaf Etano100% (1)

- PPC2000 Association of Consultant Architects Standard Form of Project Partnering ContractDokument5 SeitenPPC2000 Association of Consultant Architects Standard Form of Project Partnering ContractJoy CeeNoch keine Bewertungen

- Project Planning and Management Unit 1Dokument13 SeitenProject Planning and Management Unit 1Savant100% (1)

- Biotox Gold 2.0-2021 Relaunch ReviewDokument6 SeitenBiotox Gold 2.0-2021 Relaunch ReviewChinthaka AbeygunawardanaNoch keine Bewertungen

- Rubik Clock Solution 1Dokument2 SeitenRubik Clock Solution 1Ionel PaunNoch keine Bewertungen

- PS Neo HSK2LCD ICON LED RF Keypad v1 0 Installation Guide R001 en FR Es PoDokument40 SeitenPS Neo HSK2LCD ICON LED RF Keypad v1 0 Installation Guide R001 en FR Es Po7seguridadNoch keine Bewertungen

- Lab Report AcetaminophenDokument5 SeitenLab Report Acetaminophenapi-487596846Noch keine Bewertungen

- Historical Source Author Date of The Event Objective of The Event Persons Involved Main ArgumentDokument5 SeitenHistorical Source Author Date of The Event Objective of The Event Persons Involved Main ArgumentMark Saldie RoncesvallesNoch keine Bewertungen

- Comparing Financial Performance of Conventional and Islamic BanksDokument9 SeitenComparing Financial Performance of Conventional and Islamic BanksIkbal HardiyantoNoch keine Bewertungen

- Food Science, Technology & Nutitions - Woodhead - FoodDokument64 SeitenFood Science, Technology & Nutitions - Woodhead - FoodEduardo EstradaNoch keine Bewertungen

- Powers of Central Govt under Environment Protection ActDokument13 SeitenPowers of Central Govt under Environment Protection Actsirajudeen INoch keine Bewertungen

- Rhetorical Analysis ArticleDokument6 SeitenRhetorical Analysis Articleapi-242472728Noch keine Bewertungen

- New Company Profile.Dokument8 SeitenNew Company Profile.Allen AsirNoch keine Bewertungen

- Examples of IELTS Speaking Part 1 QuestionsDokument15 SeitenExamples of IELTS Speaking Part 1 QuestionsThanh TrầnNoch keine Bewertungen

- Silicone Bonding BrochureDokument4 SeitenSilicone Bonding BrochureAmir ShahzadNoch keine Bewertungen

- Sight Reduction Tables For Marine Navigation: B, R - D, D. SDokument12 SeitenSight Reduction Tables For Marine Navigation: B, R - D, D. SGeani MihaiNoch keine Bewertungen

- ManuscriptDokument2 SeitenManuscriptVanya QuistoNoch keine Bewertungen

- Math-149 MatricesDokument26 SeitenMath-149 MatricesKurl Vincent GamboaNoch keine Bewertungen