Beruflich Dokumente

Kultur Dokumente

Che Laws and Ethics (Investments and Setting Up Business in The Philippines)

Hochgeladen von

Ebook Download0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten19 SeitenThe document discusses different types of businesses that can be established in the Philippines. It describes proprietorships, partnerships, and corporations as the main types of business structures according to ownership. It also outlines service businesses, merchandising businesses, manufacturing businesses, and other businesses according to their operations. The document then explains foreign business organizations that can be set up in the Philippines such as branch offices, representative offices, regional headquarters, and regional operating headquarters.

Originalbeschreibung:

CHE 181 Lecture - Investments and.....

Originaltitel

CHE 181 Lecture - Investments and.....

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document discusses different types of businesses that can be established in the Philippines. It describes proprietorships, partnerships, and corporations as the main types of business structures according to ownership. It also outlines service businesses, merchandising businesses, manufacturing businesses, and other businesses according to their operations. The document then explains foreign business organizations that can be set up in the Philippines such as branch offices, representative offices, regional headquarters, and regional operating headquarters.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

11 Ansichten19 SeitenChe Laws and Ethics (Investments and Setting Up Business in The Philippines)

Hochgeladen von

Ebook DownloadThe document discusses different types of businesses that can be established in the Philippines. It describes proprietorships, partnerships, and corporations as the main types of business structures according to ownership. It also outlines service businesses, merchandising businesses, manufacturing businesses, and other businesses according to their operations. The document then explains foreign business organizations that can be set up in the Philippines such as branch offices, representative offices, regional headquarters, and regional operating headquarters.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 19

MALAYAN COLLEGES

LAGUNA

CHE LAWS AND ETHICS

(Investments and Setting Up Business in the

Philippines)

Learning Objectives

• Discuss the various business types that are

allowed to be established in the Philippines as

a Philippine Company

• Tackle business/office types upon registering

as a Foreign Company in the Philippines.

Types of Business in the Philippines

What do you want to be in your business?

• Proprietor

• Partner

• Stockholder

What do you want for a business?

• Offer a service

• Sale tangible products

Types of Business in the Philippines

Selecting of best kind of business to start, you

must assess yourself including the following:

• Skills

• Financial resources

• Team

Different Classification of Business

• Service Business

– this provides intangible goods or services to customers. It

usually generates profit by charging for labor or other

services rendered to consumers, government or other

companies.

• Merchandising business

– this purchase products from other businesses or

manufacturers and sell them to customers. Merchandising

companies usually have merchandising inventories in their

current assets account. They usually generate profit by

providing markup price on their goods available for sale.

These businesses include retailers and trading companies.

Different Classification of Business

• Manufacturing business

– this converts raw materials, labors and overhead into

finished products that are available for sale to

customers.

• Other businesses.

– this includes businesses that can’t be classified as

service, merchandising or manufacturers. Examples

are agriculture and mining companies. These

companies are engaged in producing or exploration of

raw or natural materials, such as plants and minerals.

Types of business according to

ownership structures

• Proprietorship

• Partnership

• Corporation

– Stock Corporation

– Non-stock Corporation

Types of business according to

ownership structures

• Proprietorship

– is a business that is owned by a single individual who

has full control and authority in running this kind of

business. The owner, called proprietor, owns all the

assets and is solely responsible for all the liabilities of

the company. He or she enjoys all the profits but also

suffers all losses of this business. The proprietor and

his proprietorship business/businesses is considered

as one taxpayer, sharing a single TIN (Taxpayer

Identification Number) for tax purposes. A sole

proprietorship must apply for a business trade name

and be registered with the Department of Trade and

Industry.

Types of business according to

ownership structures

• Partnership

– is a business that is owned by two or more individuals or

partners. Under the Civil Code of the Philippines, a partnership

is considered as juridical person, having a separate legal

personality from that of its owners (partners). Partnerships may

either be general partnerships, where the partners have

unlimited liability for the debts and obligation of the

partnership, or limited partnerships, where one or more general

partners have unlimited liability and the limited partners have

liability only up to the amount of their capital contributions. A

partnership with more than three thousand pesos (P3,000.00)

capital must register with Securities and Exchange Commission

(SEC). Partnerships are generally treated like corporations for

income tax computation purposes.

Types of business according to

ownership structures

• Corporation

– is a business that is owned by its shareholders (natural

or juridical persons). A corporation is composed of

juridical persons established under the Corporation

Code and regulated by the SEC with a personality

separate and distinct from that of its stockholders.

The liability of the shareholders of a corporation is

limited only to the amount of their share capital. It

consists of at least five to 15 incorporators, each of

whom must hold at least one share and must be

registered with the SEC. Minimum paid up capital is

P5,000. A corporation in the Philippines can either be

stock or non-stock company regardless of nationality.

Types of business according to

ownership structures

a. Stock Corporation

– This is a corporation with capital stock divided into

shares and authorized to distribute to the holders

of such shares dividends or allotments of the

surplus profits on the basis of the shares held.

b. Non-stock Corporation.

– This is a corporation organized principally for

public purposes such as foundations, charitable,

educational, cultural, or similar purposes and does

not issue shares of stock to its members.

Organized under Foreign Laws

• The following are types of business forms in

the Philippines which are organized under

Foreign Laws (according to DTI)

– Branch Office

– Representative Office

– Regional Headquarters (RHQs)

– Regional Operating Headquarters (ROHQs)

Organized under Foreign Laws

• Branch Office

– is a foreign corporation organized and existing

under foreign laws that carries out business

activities of the head office and derives income

from the host country. It is required to put up a

minimum paid up capital of US$200,000, which

can be reduced to US$100,000 if activity involves

advanced technology, or company employs at

least 50 direct employees. Registration with the

SEC is mandatory.

Organized under Foreign Laws

• Representative Office

– is a foreign corporation organized and existing under foreign

laws. It does not derive income from the host country and is

fully subsidized by its head office. It deals directly with clients of

the parent company as it undertakes such activities as

information dissemination, acts as a communication center, and

promotes company products, as well as quality control of

products for export. It is required to have an initial minimum

inward remittance in the amount of US$30,000 to cover its

operating expenses and must be registered with the SEC. Under

Republic Act (RA) 8756, any multinational company may

establish a Regional Headquarter (RHQ) or Regional Operating

Head Quarter (ROHQ) as long as they are existing under laws

other than the Philippines, with branches, affiliates, and

subsidiaries in the Asia Pacific Region and other foreign markets.

Organized under Foreign Laws

• Regional Headquarters (RHQs)

– An RHQ undertakes activities that shall be limited to

acting as supervisory, communication, and

coordinating center for its subsidiaries, affiliates, and

branches in the Asia-Pacific region. It acts as an

administrative branch of a multinational company

engaged in international trade. It does not derive

income from sources within the Philippines and does

not participate in any manner in the management of

any subsidiary or branch office it might have in the

Philippines. Required capital is US$50,000 annually to

cover operating expenses.

Organized under Foreign Laws

• Regional Operating Headquarters (ROHQs)

• An ROHQ performs the following qualifying services to its affiliates,

subsidiaries, and branches in the Philippines.

– General administration and planning

– Business planning and coordination

– Sourcing/procurement of raw materials components Corporate finance

advisory services

– Marketing control and sales promotion

– Training and personnel management

– Logistic services

– Research and development (R&D) services and product development

– Technical support and communications

– Business development

– Derives income in the Philippines

– Required capital: US$200,000 – one time remittance

“Excellence and Virtue”

Das könnte Ihnen auch gefallen

- Types of Business in The PhilippinesDokument6 SeitenTypes of Business in The PhilippinesBelle JizNoch keine Bewertungen

- Types of Business EnterpriseDokument2 SeitenTypes of Business EnterprisealperenogluNoch keine Bewertungen

- Doing Business in The PhilippinesDokument10 SeitenDoing Business in The Philippinesgilberthufana446877Noch keine Bewertungen

- Different Classifications of BusinessDokument4 SeitenDifferent Classifications of BusinessMegumi HimeNoch keine Bewertungen

- Doing Business in The Philippines 2015Dokument10 SeitenDoing Business in The Philippines 2015fightingmaroonNoch keine Bewertungen

- Introduction To Business ImplementationDokument31 SeitenIntroduction To Business ImplementationDumplings DumborNoch keine Bewertungen

- Types of Business Entities in PhilippinesDokument1 SeiteTypes of Business Entities in PhilippineslingneNoch keine Bewertungen

- Characteristics & Legal Bases of A BusinessDokument28 SeitenCharacteristics & Legal Bases of A BusinessJames Anthony TorresNoch keine Bewertungen

- Different Types of OrganizationsDokument30 SeitenDifferent Types of Organizationsgunarathneisuri11Noch keine Bewertungen

- IntroductionDokument53 SeitenIntroductionhippop kNoch keine Bewertungen

- Introduction To Business ImplementationDokument3 SeitenIntroduction To Business ImplementationRellie Castro100% (1)

- Corporate Formation and The Stockholders - EquityDokument39 SeitenCorporate Formation and The Stockholders - EquityChocochipNoch keine Bewertungen

- Capitol University: 1. Sole ProprietorshipDokument3 SeitenCapitol University: 1. Sole ProprietorshipHenry Alver BautistaNoch keine Bewertungen

- STEPSDokument35 SeitenSTEPSRochel HatagueNoch keine Bewertungen

- AssignmentDokument3 SeitenAssignmentHaziel LadananNoch keine Bewertungen

- Entrep ReportDokument28 SeitenEntrep ReportIan RamosNoch keine Bewertungen

- 01 Types of Business OrganizationsDokument2 Seiten01 Types of Business OrganizationsJAMES ANDROE TANNoch keine Bewertungen

- Guide To Setting Up A Company in The PhilippinesDokument11 SeitenGuide To Setting Up A Company in The PhilippinesNestieNoch keine Bewertungen

- Lesson 1 NOTES The Role of Business in Social and Economic DevelopmentDokument1 SeiteLesson 1 NOTES The Role of Business in Social and Economic DevelopmentSafh SalazarNoch keine Bewertungen

- OrgMan - Basic Concepts of Small Family BusinessDokument11 SeitenOrgMan - Basic Concepts of Small Family BusinessDIVINA GRACE RODRIGUEZ0% (1)

- Evidencia 5 Summary Export Import Theory V2Dokument23 SeitenEvidencia 5 Summary Export Import Theory V2Erika TovarNoch keine Bewertungen

- The Insider Secret of Business: Growing Successful Financially and ProductivelyVon EverandThe Insider Secret of Business: Growing Successful Financially and ProductivelyNoch keine Bewertungen

- Module 16 - Quarter 2Dokument8 SeitenModule 16 - Quarter 2Billy Joe Mendillo SalumbidesNoch keine Bewertungen

- Entrepreneurship Unit 1 Understanding Businesses: DR Ella Kangaude-NkataDokument24 SeitenEntrepreneurship Unit 1 Understanding Businesses: DR Ella Kangaude-NkataMartin ChikumbeniNoch keine Bewertungen

- Forms of Business OrganizationDokument20 SeitenForms of Business OrganizationAenna Carmille TangubNoch keine Bewertungen

- Starting A Business: 1.4.1 The Main Feature of Different Forms of Business OrganizationDokument8 SeitenStarting A Business: 1.4.1 The Main Feature of Different Forms of Business Organizationhassan haniNoch keine Bewertungen

- Forms of Business Ownership and RegistrationDokument26 SeitenForms of Business Ownership and Registrationchrissa padolinaNoch keine Bewertungen

- Taller 15 InglesDokument12 SeitenTaller 15 InglesEdna Tatiana CasallasNoch keine Bewertungen

- BusEthSocResp Weeks 1-2Dokument7 SeitenBusEthSocResp Weeks 1-2Christopher Nanz Lagura CustanNoch keine Bewertungen

- Chapter 7: Forms of Small Business Ownership, Registering and OrganizingDokument77 SeitenChapter 7: Forms of Small Business Ownership, Registering and OrganizingEmerson CruzNoch keine Bewertungen

- Actividad 15 Evidencia 5: Summary "Export-Import Theory"Dokument6 SeitenActividad 15 Evidencia 5: Summary "Export-Import Theory"ivan vilchezNoch keine Bewertungen

- Module 7Dokument28 SeitenModule 7Tin ZamudioNoch keine Bewertungen

- Module 5 Applied EconomicsDokument19 SeitenModule 5 Applied Economicsjxnnx sakura33% (3)

- Instructor: Ovais VOHRA Ovaisvohra@aydin - Edu.tr Note 09 2021Dokument28 SeitenInstructor: Ovais VOHRA Ovaisvohra@aydin - Edu.tr Note 09 2021iremNoch keine Bewertungen

- Business Ethics Reviewer (1st Periodical)Dokument20 SeitenBusiness Ethics Reviewer (1st Periodical)casumbalmckaylacharmianNoch keine Bewertungen

- BusinessDokument46 SeitenBusinessAvishya JaswalNoch keine Bewertungen

- Overseas Company Incorporation: Adv. (CS) Ameya Munagekar, CPA (USA)Dokument32 SeitenOverseas Company Incorporation: Adv. (CS) Ameya Munagekar, CPA (USA)Ravi Sankar ELTNoch keine Bewertungen

- MBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 2Dokument23 SeitenMBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 2Jesse Rielle CarasNoch keine Bewertungen

- Compliance Requirements Business and Its RequirementsDokument32 SeitenCompliance Requirements Business and Its RequirementsDon Cabasi100% (1)

- Curacao Private Foundation Info SheetDokument4 SeitenCuracao Private Foundation Info SheetRicardo NavaNoch keine Bewertungen

- Fundamentals of Accounting Business and Management 1Dokument140 SeitenFundamentals of Accounting Business and Management 1Marie FeNoch keine Bewertungen

- Entrepreneurship LAS 5 Q4 Week 5 6Dokument10 SeitenEntrepreneurship LAS 5 Q4 Week 5 6Desiree Jane SaleraNoch keine Bewertungen

- Summary Export Import TheoryDokument8 SeitenSummary Export Import TheoryAndrés Felipe Pacheco DimasNoch keine Bewertungen

- Foreign Corporations in The PhilippinesDokument3 SeitenForeign Corporations in The PhilippinesRyan BalladaresNoch keine Bewertungen

- Week 6Dokument3 SeitenWeek 6Anabel BahintingNoch keine Bewertungen

- Evidencia 5 Summary Export Import Theory Grupo Numero 6Dokument12 SeitenEvidencia 5 Summary Export Import Theory Grupo Numero 6Valeria ArizaNoch keine Bewertungen

- Business EthicsDokument50 SeitenBusiness EthicsAvegail Ocampo TorresNoch keine Bewertungen

- 04 EnterpriseDokument4 Seiten04 EnterpriseJasmína PolaneckáNoch keine Bewertungen

- Notebook 1. Introduction To Accounting - Business and Its RequirementsDokument4 SeitenNotebook 1. Introduction To Accounting - Business and Its RequirementsCherry RodriguezNoch keine Bewertungen

- Export-Import Theory: Centro de Servicios Financieros SenaDokument7 SeitenExport-Import Theory: Centro de Servicios Financieros SenaArnobis Diaz ospinaNoch keine Bewertungen

- Group2 Ent 101Dokument37 SeitenGroup2 Ent 101Jazzie AlbaricoNoch keine Bewertungen

- CHAPTER 5 ME. The Business OrganizationDokument19 SeitenCHAPTER 5 ME. The Business OrganizationVanessa CarlonNoch keine Bewertungen

- Advantage and Disadvantages of Business OrganizationDokument3 SeitenAdvantage and Disadvantages of Business OrganizationJustine VeralloNoch keine Bewertungen

- Doing Business in Tanzania, Questions and AnswersDokument26 SeitenDoing Business in Tanzania, Questions and Answersimran hameerNoch keine Bewertungen

- Chapter 1Dokument12 SeitenChapter 1mayhipolito01Noch keine Bewertungen

- Modules NCBIDokument38 SeitenModules NCBIBianca Mae UmaliNoch keine Bewertungen

- Foreign Corporations: Dizon, Jehann Romero, EdlynDokument39 SeitenForeign Corporations: Dizon, Jehann Romero, EdlynEdlyn Favorito RomeroNoch keine Bewertungen

- Law On Cooperative HandoutsDokument8 SeitenLaw On Cooperative Handoutsxara mizpahNoch keine Bewertungen

- Important Information - Foreign Business in PHDokument4 SeitenImportant Information - Foreign Business in PHGraze IsidroNoch keine Bewertungen

- Agricultural Application PDFDokument34 SeitenAgricultural Application PDFEbook DownloadNoch keine Bewertungen

- Geothermal Power Generating Systems: John Kenneth A. Mañalong CHE190 - B03Dokument19 SeitenGeothermal Power Generating Systems: John Kenneth A. Mañalong CHE190 - B03Ebook DownloadNoch keine Bewertungen

- GeothermalDokument21 SeitenGeothermalEbook DownloadNoch keine Bewertungen

- Geothermal Power Generating Systems: Zserlene Faye B. ManaloDokument14 SeitenGeothermal Power Generating Systems: Zserlene Faye B. ManaloEbook DownloadNoch keine Bewertungen

- GeothermalDokument22 SeitenGeothermalEbook DownloadNoch keine Bewertungen

- GeothermalDokument16 SeitenGeothermalEbook DownloadNoch keine Bewertungen

- History Solar-EnergyDokument14 SeitenHistory Solar-EnergyEbook DownloadNoch keine Bewertungen

- EIS OutlineDokument2 SeitenEIS OutlineEbook DownloadNoch keine Bewertungen

- Agricultural Application PDFDokument34 SeitenAgricultural Application PDFEbook DownloadNoch keine Bewertungen

- Hongkong Safety Manpower RequirementsDokument15 SeitenHongkong Safety Manpower RequirementsNaeem IqbalNoch keine Bewertungen

- Philippines - Water District Development Sector PDFDokument96 SeitenPhilippines - Water District Development Sector PDFEbook DownloadNoch keine Bewertungen

- Che 191-1: Solid Waste ManagementDokument51 SeitenChe 191-1: Solid Waste ManagementEbook DownloadNoch keine Bewertungen

- IEER OutlineDokument1 SeiteIEER OutlineEbook DownloadNoch keine Bewertungen

- Applications of Solar EnergyDokument18 SeitenApplications of Solar EnergyEbook DownloadNoch keine Bewertungen

- PaperSukantaAzad 11Dokument7 SeitenPaperSukantaAzad 11vu anh ducNoch keine Bewertungen

- Lecture 3 - Safety Audit and Inspection PDFDokument18 SeitenLecture 3 - Safety Audit and Inspection PDFEbook DownloadNoch keine Bewertungen

- 5 Enzyme KineticsDokument39 Seiten5 Enzyme KineticsEbook Download100% (1)

- Lecture 1 - Safety StandardsDokument33 SeitenLecture 1 - Safety StandardsEbook DownloadNoch keine Bewertungen

- Lecture 2 - Industrial SafetyDokument32 SeitenLecture 2 - Industrial SafetyEbook DownloadNoch keine Bewertungen

- Lecture 1 - Safety StandardsDokument33 SeitenLecture 1 - Safety StandardsEbook DownloadNoch keine Bewertungen

- Metal & Alloys: D. Navaja MSE101Dokument27 SeitenMetal & Alloys: D. Navaja MSE101Ebook DownloadNoch keine Bewertungen

- Metal Heat Treatment: D. Navaja MSE101Dokument21 SeitenMetal Heat Treatment: D. Navaja MSE101Ebook DownloadNoch keine Bewertungen

- Metal Forming and Fabrication: D. Navaja MSE 101Dokument48 SeitenMetal Forming and Fabrication: D. Navaja MSE 101Ebook DownloadNoch keine Bewertungen

- Lecture 1 - Safety StandardsDokument18 SeitenLecture 1 - Safety StandardsEbook DownloadNoch keine Bewertungen

- Algae: An OverviewDokument18 SeitenAlgae: An OverviewEbook DownloadNoch keine Bewertungen

- Che 191-1: Solid Waste ManagementDokument43 SeitenChe 191-1: Solid Waste ManagementEbook DownloadNoch keine Bewertungen

- Lecture 3 RecyclingDokument26 SeitenLecture 3 RecyclingEbook DownloadNoch keine Bewertungen

- Dist-020H CO2 AbsorberDokument9 SeitenDist-020H CO2 AbsorberudokasNoch keine Bewertungen

- RX 008H CombustionDokument4 SeitenRX 008H CombustionEbook DownloadNoch keine Bewertungen

- CombustiónDokument13 SeitenCombustiónRodrigo Hernandez Lopez50% (2)

- James Brady Vs City of Myrtle Beach DRCDokument6 SeitenJames Brady Vs City of Myrtle Beach DRCMyrtleBeachSC newsNoch keine Bewertungen

- Vnmci 506 - RDokument28 SeitenVnmci 506 - RPhebe JacksinghNoch keine Bewertungen

- 14 FVC Labor Union-PTGWO V Samahang Nagkakaisang Manggagawa Sa FVC-SIGLODokument13 Seiten14 FVC Labor Union-PTGWO V Samahang Nagkakaisang Manggagawa Sa FVC-SIGLOKorin Aldecoa0% (1)

- Shafer Vs Judge Nov 14, 1988Dokument2 SeitenShafer Vs Judge Nov 14, 1988Alvin-Evelyn GuloyNoch keine Bewertungen

- ERNESTINA BERNABE, Petitioner, vs. CAROLINA ALEJO As Guardian Ad Litem For The Minor ADRIAN BERNABE, RespondentDokument9 SeitenERNESTINA BERNABE, Petitioner, vs. CAROLINA ALEJO As Guardian Ad Litem For The Minor ADRIAN BERNABE, RespondentAnsai CaluganNoch keine Bewertungen

- HPCL, 3/C, DR Ambedkar Road, Near Nehru Memorial Hall, Camp, Pune-411001Dokument1 SeiteHPCL, 3/C, DR Ambedkar Road, Near Nehru Memorial Hall, Camp, Pune-411001Sangram MundeNoch keine Bewertungen

- Doas 5MDokument2 SeitenDoas 5MkhanNoch keine Bewertungen

- 125 Bautista vs. Gonzales - 1990Dokument6 Seiten125 Bautista vs. Gonzales - 1990JanWacnangNoch keine Bewertungen

- Dog Park Letter To Mayor CohenDokument2 SeitenDog Park Letter To Mayor Cohendatkinso9057100% (2)

- Business Associations Keyed To Ramseyer Bainbridge and Klein 7th EdDokument7 SeitenBusiness Associations Keyed To Ramseyer Bainbridge and Klein 7th EdMissy MeyerNoch keine Bewertungen

- Discharge of TortsDokument14 SeitenDischarge of TortsSatakshi AnandNoch keine Bewertungen

- IPAP vs. OchoaDokument15 SeitenIPAP vs. OchoaDaryl YangaNoch keine Bewertungen

- Hartford Accident & Indemnity Co. v. W.S. DickeyDokument2 SeitenHartford Accident & Indemnity Co. v. W.S. DickeyKaren Selina AquinoNoch keine Bewertungen

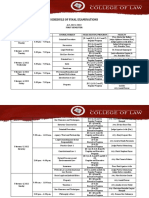

- 1st Sem 2021 22 Finals ScheduleDokument5 Seiten1st Sem 2021 22 Finals ScheduleRyan ChristianNoch keine Bewertungen

- The Punjab Consumer Protection Act 2005Dokument10 SeitenThe Punjab Consumer Protection Act 2005Asif MalikNoch keine Bewertungen

- Capital Ins. & Surety Co., Inc. vs. SadangDokument6 SeitenCapital Ins. & Surety Co., Inc. vs. SadangToni LorescaNoch keine Bewertungen

- The Public Liability Insurance Act, 1991Dokument8 SeitenThe Public Liability Insurance Act, 1991Karsin ManochaNoch keine Bewertungen

- Dela Rama Vs Mendiola - Not Yet Digested, To Follow Ang Digest TodayDokument7 SeitenDela Rama Vs Mendiola - Not Yet Digested, To Follow Ang Digest TodaySugar Fructose GalactoseNoch keine Bewertungen

- The Real Thirteenth Article of AmendmentDokument13 SeitenThe Real Thirteenth Article of AmendmentnaebyosNoch keine Bewertungen

- John Stephen Larkin v. Patrick Savage, John Doe, John Rittenhouse, Charles Campisi, Anthony Cartusciello, and P.O. Lodyzinski, 318 F.3d 138, 2d Cir. (2003)Dokument5 SeitenJohn Stephen Larkin v. Patrick Savage, John Doe, John Rittenhouse, Charles Campisi, Anthony Cartusciello, and P.O. Lodyzinski, 318 F.3d 138, 2d Cir. (2003)Scribd Government DocsNoch keine Bewertungen

- Philippine Heart Center Vs LGU of Quezon CityDokument3 SeitenPhilippine Heart Center Vs LGU of Quezon CityRiena MaeNoch keine Bewertungen

- Sample Personal GuaranteeDokument5 SeitenSample Personal Guaranteekikocherry100% (6)

- Evidence Final DraftDokument7 SeitenEvidence Final DraftAyashkant ParidaNoch keine Bewertungen

- Reflection PaperDokument3 SeitenReflection Paperapi-280120031Noch keine Bewertungen

- 619-Valdez Vs TabisulaDokument1 Seite619-Valdez Vs Tabisula001nooneNoch keine Bewertungen

- Powers of Parliament To Decide CitizenshipDokument9 SeitenPowers of Parliament To Decide CitizenshipRahul Dave B-3 / SYLLBNoch keine Bewertungen

- Form 7: Application For Allotment of Designated Partner Identification NumberDokument4 SeitenForm 7: Application For Allotment of Designated Partner Identification NumberVijay VaghelaNoch keine Bewertungen

- Hinzo 1983 ComplaintDokument31 SeitenHinzo 1983 ComplaintjustinhorwathNoch keine Bewertungen

- Assignment On Burden of ProofDokument15 SeitenAssignment On Burden of Proofbhavana75% (8)

- Gayoso Vs Twenty TwoDokument8 SeitenGayoso Vs Twenty TwoEnnavy YongkolNoch keine Bewertungen