Beruflich Dokumente

Kultur Dokumente

Balance of Payments, Developing-Country Debt, and The Macroeconomic Stabilization Controversy

Hochgeladen von

Anonymous CSZ5IVaT3x0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten28 SeitenOriginaltitel

TodaroSmith_EconDev_ch13 (2).ppt

Copyright

© © All Rights Reserved

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten28 SeitenBalance of Payments, Developing-Country Debt, and The Macroeconomic Stabilization Controversy

Hochgeladen von

Anonymous CSZ5IVaT3xCopyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 28

Chapter 13

Balance of

Payments,

Developing-Country

Debt, and the

Macroeconomic

Stabilization

Controversy

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

The Balance of Payments

Account

• General considerations:

– Balance of Payments (BOP)

– Current Account

– Surplus and Deficit

– Capital Account

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-2

Table 13.1 A Schematic Balance of

Payments Account

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-3

The Balance of Payments

Account

• General considerations (cont’d)

– Cash Account or International Reserve Account

– Three forms:

• Hard currency

• Gold

• Deposits with IMF

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-4

Table 13.2 Credits and Debits in

the Balance of Payments Account

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-5

The Balance of Payments

Account

• A hypothetical illustration: deficits and debts

– Current Account

– Capital Account

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-6

Table 13.3 A Hypothetical Balance of

Payments Table for a Developing

Nation

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-7

Table 13.4 Before and After the

Debt Crisis

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-8

The Balance of Payments

Account

– A hypothetical illustration: deficits and debts

(cont’d)

• Inflow

• Outflow

• Amortization

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-9

Financing and Reducing

Payments Deficits

• Some initial policy issues

– International reserves

– Restrictive fiscal and monetary policies:

• Structural adjustment

• Stabilization policies

– Special drawing rights (SDRs)

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-10

Financing and Reducing

Payments Deficits

• Trends in LDC Balance of Payments

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-11

Table 13.5 Summary of LDC Payments

Balances on Current Account, 1980–

2006 (billions of dollars)

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-12

The Debt Crisis of the 1980s

• Background and analysis

– External debt

– Debt service

– Basic transfer

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-13

The Debt Crisis of the 1980s

Net capital inflow, FN, is

FN dD (13.1)

Basic transfer, BT, is

BT dD rD (d r ) D (13.2)

Where d is percent increase in total debt

D is total debt

r is the average interest rate

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-14

The Debt Crisis of the 1980s

• Origins of the Debt Crisis

– OPEC oil price increase

– Increased borrowing

– Excess of imports

– Lagging exports

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-15

Figure 13.1 The Mechanics of

Petrodollar Recycling

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-16

The Debt Crisis of the 1980s

• Origins of the Debt Crisis (cont’d)

– Debt-servicing obligations

– Debt-service payments

– Debt-servicing difficulty

– Oil shocks

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-17

The Debt Crisis of the 1980s

• Origins of the Debt Crisis (cont’d)

– Developing countries’ two options:

• Curtail imports and restrictive fiscal and monetary

measures

• More external borrowing

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-18

Attempts at Alleviation: Macroeconomic

Instability, IMF Stabilization Policies,

and Their Critics

• The IMF stabilization program

– Macroeconomic instability

– Stabilization policies

– Four basic components of IMF stabilization program:

• Liberalization of foreign exchange and imports control

• Devaluation of the official exchange rate

• Stringent domestic anti-inflation program

• Opening up of the economy to international commerce

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-19

Attempts at Alleviation: Macroeconomic

Instability, IMF Stabilization Policies,

and Their Critics

• The IMF stabilization program (cont’d)

– Such policies can be politically unpopular

because they hurt the lower- and middle-income

groups.

– Less radical observers view the IMF as neither

a developmental nor an antidevelopmental

institution.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-20

Attempts at Alleviation: Macroeconomic

Instability, IMF Stabilization Policies,

and Their Critics

• The IMF stabilization program (cont’d)

– Tactics for debt relief:

• Debtors’ cartel

• Restructuring

• Brady Plan

• Debt for equity swaps

• Debt for nature swaps

• Debt repudiation

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-21

“Odious Debt” and its

Prevention

• What is odious debt?

– Sovereign debt used by an undemocratic

government in a manner contrary to the

interests of its people should be deemed invalid

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-22

Resolution and Continued

Vulnerabilities

• Highly indebted poor countries (HIPCs)

• Some progress but vulnerabilities remain

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-23

Table 13.6 Dimensions of the LDC

Debt Burden, 1970–2007

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-24

Figure 13.2 Current Account

Balances

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-25

Case Study: South Korea

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-26

Concepts for Review

• Amortization • Current account

• Balance of payments • Debt-for-equity swaps

• Basic transfer • Debt-for-nature swaps

• Brady plan • Debtors’ cartel

• Capital account • Debt repudiation

• Capital flight • Debt service

• Cash account • Deficit

• Conditionality

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-27

Concepts for Review (cont’d)

• Euro • Odious debt

• External debt • Restructuring

• Hard currency • Special drawing rights

• Highly indebted poor (SDRs)

countries (HIPCs) • Stabilization policies

• International reserve • Structural adjustment

account loans

• International reserves • Surplus

• Macroeconomic

instability

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 13-28

Das könnte Ihnen auch gefallen

- Balance of Payments, Developing-Country Debt, and The Macroeconomic Stabilization ControversyDokument25 SeitenBalance of Payments, Developing-Country Debt, and The Macroeconomic Stabilization ControversyFahad khanNoch keine Bewertungen

- Finance and Fiscal Policy For DevelopmentDokument32 SeitenFinance and Fiscal Policy For DevelopmentFahad khanNoch keine Bewertungen

- Urban GeoDokument60 SeitenUrban GeoAymi PrasenanNoch keine Bewertungen

- Filipino Culture, Customs and Traditions: About DatingDokument2 SeitenFilipino Culture, Customs and Traditions: About DatingMherNoch keine Bewertungen

- History 17 SyllabusDokument7 SeitenHistory 17 Syllabusapi-385609689% (9)

- Sse14 Premil NotesDokument4 SeitenSse14 Premil NotesJing Jing DelaraNoch keine Bewertungen

- Chapter Market DevelopmentDokument30 SeitenChapter Market Developmentopaze45Noch keine Bewertungen

- Module 4 Developing Virtue As HabitDokument41 SeitenModule 4 Developing Virtue As HabitJustin Paul GallanoNoch keine Bewertungen

- SSC 2Dokument5 SeitenSSC 2Shan Taleah RealNoch keine Bewertungen

- The Development of Instructional Media On Physics Subject To Increase The Class EffectivenessDokument5 SeitenThe Development of Instructional Media On Physics Subject To Increase The Class EffectivenessHapsari PeniNoch keine Bewertungen

- NSSCO Geography SyllabusDokument33 SeitenNSSCO Geography Syllabusmukwame100% (1)

- Module 3 AnswerDokument26 SeitenModule 3 AnswermarvsNoch keine Bewertungen

- New Comparative Economic HistoryDokument8 SeitenNew Comparative Economic HistoryglamisNoch keine Bewertungen

- HRM Course SyllabusDokument13 SeitenHRM Course Syllabusemen penaNoch keine Bewertungen

- TodaroSmith EconDev ch02Dokument48 SeitenTodaroSmith EconDev ch02Rodina MuhammedNoch keine Bewertungen

- GEOGRAPHY 3 (OBTL) AaaDokument9 SeitenGEOGRAPHY 3 (OBTL) AaaJonathan Luke MallariNoch keine Bewertungen

- Readings in Philippine HistoryDokument82 SeitenReadings in Philippine HistoryEarth BrionesNoch keine Bewertungen

- Final Module in Ss 13Dokument13 SeitenFinal Module in Ss 13marvsNoch keine Bewertungen

- Urbanization and Rural-Urban Migration: Theory and PolicyDokument38 SeitenUrbanization and Rural-Urban Migration: Theory and PolicyEphreen Grace MartyNoch keine Bewertungen

- Module 2 AnswersDokument5 SeitenModule 2 AnswersmarvsNoch keine Bewertungen

- Course Number Course Title Credit Unit/s Hours Per Week: Isabela State UniversityDokument17 SeitenCourse Number Course Title Credit Unit/s Hours Per Week: Isabela State UniversityAlvior Elipane EirolNoch keine Bewertungen

- (Template) Pink Module 2.0Dokument98 Seiten(Template) Pink Module 2.0Mia Mones Lunsayan BrionesNoch keine Bewertungen

- STS SYllabus-BEEdDokument19 SeitenSTS SYllabus-BEEdGlaiza SabandalNoch keine Bewertungen

- SSE 107 Macroeconomics SG 5Dokument8 SeitenSSE 107 Macroeconomics SG 5Aila Erika EgrosNoch keine Bewertungen

- SSE 108 Module-2-Classification-and-Characteristics-of-EconomicsDokument7 SeitenSSE 108 Module-2-Classification-and-Characteristics-of-EconomicsJames Bryan M. PrimaNoch keine Bewertungen

- Final Module SSE 206 Asian StudiesDokument587 SeitenFinal Module SSE 206 Asian StudiesLorna NuñezNoch keine Bewertungen

- Rizal Life, Works, and WritingsDokument7 SeitenRizal Life, Works, and WritingsZelop DrewNoch keine Bewertungen

- Ancient History Stage 6 Syllabus 2017Dokument97 SeitenAncient History Stage 6 Syllabus 2017Ashley Da SilvaNoch keine Bewertungen

- Instrumental Methods of Teaching Social StudiesDokument21 SeitenInstrumental Methods of Teaching Social StudiesNiyonzima100% (1)

- Sales Management Module 4 StudentsDokument7 SeitenSales Management Module 4 StudentsJan AcostaNoch keine Bewertungen

- Places and Landscape ModuleDokument5 SeitenPlaces and Landscape ModuleQueenby MelalabsNoch keine Bewertungen

- Lecture-1-Introduction To Instructional MediaDokument26 SeitenLecture-1-Introduction To Instructional MediaPhoebe MengulloNoch keine Bewertungen

- Law Related StudiesDokument6 SeitenLaw Related StudiesRichelle Ann Salinas BorjaNoch keine Bewertungen

- Human Geography Syllabus 6th EditionDokument4 SeitenHuman Geography Syllabus 6th EditionDavey JonesNoch keine Bewertungen

- Module 6 IBTDokument3 SeitenModule 6 IBTSha Sha100% (1)

- Population and Demography - Chapter 11Dokument23 SeitenPopulation and Demography - Chapter 11John Carlo Leynes BrunoNoch keine Bewertungen

- Trends and Issues ModuleDokument6 SeitenTrends and Issues ModuleQueenby MelalabsNoch keine Bewertungen

- Module 2 PPT Ge Readings in Philippine History 1Dokument31 SeitenModule 2 PPT Ge Readings in Philippine History 1Flores, Mary Natielyn GraceNoch keine Bewertungen

- Teaching Social Studies in Elementary Grades BEED 2Dokument27 SeitenTeaching Social Studies in Elementary Grades BEED 2Arcelita Aninon MagbanuaNoch keine Bewertungen

- Course Guide For Gec19 RizalDokument9 SeitenCourse Guide For Gec19 RizalNoah Ras LobitañaNoch keine Bewertungen

- MODULE 2 SSEd-123-Socio Cultural Anthropology - 2nd Sem - AY 2020-2021Dokument70 SeitenMODULE 2 SSEd-123-Socio Cultural Anthropology - 2nd Sem - AY 2020-2021Daizel Anne De CastroNoch keine Bewertungen

- The Political EnvironmentDokument22 SeitenThe Political EnvironmentTwain Clyde FernandesNoch keine Bewertungen

- Course Outline On Places and LandscapesDokument12 SeitenCourse Outline On Places and LandscapesMicheleNoch keine Bewertungen

- Chapter 2 and 3Dokument14 SeitenChapter 2 and 3Merren MontaNoch keine Bewertungen

- Economics 151 RLS UP DilimanDokument3 SeitenEconomics 151 RLS UP DilimanRafael SolisNoch keine Bewertungen

- Rizal's TimelineDokument3 SeitenRizal's TimelineGao DencioNoch keine Bewertungen

- Strategic Management - Module 7 - History of Strategic ManagementDokument4 SeitenStrategic Management - Module 7 - History of Strategic ManagementEva Katrina R. Lopez100% (1)

- Cultural RelativismDokument18 SeitenCultural RelativismremolinovientomaloNoch keine Bewertungen

- Category of Post: Principal Paper I - English Language Profeciency Test SyllabusDokument265 SeitenCategory of Post: Principal Paper I - English Language Profeciency Test Syllabusfairoz_globalNoch keine Bewertungen

- Filipino Images of The NationDokument26 SeitenFilipino Images of The NationLuisa ElagoNoch keine Bewertungen

- Ss 16 Syllabus 13-14Dokument5 SeitenSs 16 Syllabus 13-14Rose Ann RayoNoch keine Bewertungen

- Tla Cltnllznge Of: Chapt Er ZDokument7 SeitenTla Cltnllznge Of: Chapt Er ZMark ZlomislicNoch keine Bewertungen

- Virtue Ethics FinalDokument19 SeitenVirtue Ethics FinalAlna JaeNoch keine Bewertungen

- N or S U: Subject: Beed 5 (Good Manners and Right Conduct)Dokument24 SeitenN or S U: Subject: Beed 5 (Good Manners and Right Conduct)samantha izza may adarnaNoch keine Bewertungen

- Rizal ModuleDokument18 SeitenRizal ModuleEddie Magsalay jr.Noch keine Bewertungen

- Teaching Approaches Module 1Dokument10 SeitenTeaching Approaches Module 1marvsNoch keine Bewertungen

- School of Business: Philippine College FoundationDokument6 SeitenSchool of Business: Philippine College FoundationJoselyn Marfel100% (1)

- Asia As Home of The Earliest Man in AsiaDokument21 SeitenAsia As Home of The Earliest Man in AsiaDarius BatallaNoch keine Bewertungen

- Finance and Fiscal Policy For DevelopmentDokument28 SeitenFinance and Fiscal Policy For DevelopmentNguyen Van CongNoch keine Bewertungen

- Money and Financial MarketsDokument28 SeitenMoney and Financial Marketsuzma buttNoch keine Bewertungen

- SBI AB-Contact DetailsDokument3 SeitenSBI AB-Contact Detailsjmaccen123Noch keine Bewertungen

- Reading 5 Currency Exchange Rates - Understanding Equilibrium Value - AnswersDokument27 SeitenReading 5 Currency Exchange Rates - Understanding Equilibrium Value - Answerstristan.riolsNoch keine Bewertungen

- MODULE 3 - Chapter 7 (Economic Integration and Cooperation)Dokument13 SeitenMODULE 3 - Chapter 7 (Economic Integration and Cooperation)Aangela Del Rosario CorpuzNoch keine Bewertungen

- Ex Rates 19 03 19Dokument9 SeitenEx Rates 19 03 19Anonymous jTY4ExMNoch keine Bewertungen

- Currency WarsDokument25 SeitenCurrency Warsdivrastogi100% (2)

- Dornbusch 13 - International LinkagesDokument6 SeitenDornbusch 13 - International LinkagesjoshambrosioNoch keine Bewertungen

- General Agreement On Trade and Tariff (GATT) /WTODokument21 SeitenGeneral Agreement On Trade and Tariff (GATT) /WTOSri RakshaNoch keine Bewertungen

- Institutions International Financial: by Sachin N. ShettyDokument33 SeitenInstitutions International Financial: by Sachin N. ShettyPrasseedha Raghavan100% (1)

- Agreement On Subsidies and Countervailing MeasuresDokument62 SeitenAgreement On Subsidies and Countervailing MeasuresShazaf KhanNoch keine Bewertungen

- The Contemporary WorldDokument98 SeitenThe Contemporary WorldJeca AlvaradoNoch keine Bewertungen

- Answer Sheet History Tcwcollege Prelimtq Gec 9 2020 2021Dokument3 SeitenAnswer Sheet History Tcwcollege Prelimtq Gec 9 2020 2021Wenceslao Cañete IIINoch keine Bewertungen

- Understanding Canadian Business William Nickels 10th Edition - Test BankDokument53 SeitenUnderstanding Canadian Business William Nickels 10th Edition - Test BankalishcathrinNoch keine Bewertungen

- McKinnon (1993)Dokument45 SeitenMcKinnon (1993)Bautista GriffiniNoch keine Bewertungen

- Legal Opinion - GSP Migration ConditionalityDokument16 SeitenLegal Opinion - GSP Migration ConditionalityFIDH FIDHNoch keine Bewertungen

- Tariffs and Trade BarriersDokument7 SeitenTariffs and Trade BarriersVara PrasadNoch keine Bewertungen

- Rupee Appreciation - Its Impact On Indian EconomyDokument60 SeitenRupee Appreciation - Its Impact On Indian Economynikhil100% (1)

- Summary of Chapter 3 Understanding Business DindaDokument3 SeitenSummary of Chapter 3 Understanding Business DindaDinda LambangNoch keine Bewertungen

- G20 Brief For Website - 27.10 1 1Dokument6 SeitenG20 Brief For Website - 27.10 1 1Vigneshraj VigneshrajNoch keine Bewertungen

- 6TH Lecture - Foreign Direct Investments - FdiDokument73 Seiten6TH Lecture - Foreign Direct Investments - FdiAurelia RijiNoch keine Bewertungen

- Balance of PaymentDokument8 SeitenBalance of Paymentnishant vermaNoch keine Bewertungen

- Asian Forex MagazineDokument8 SeitenAsian Forex Magazinemylaila87Noch keine Bewertungen

- Incoterms QuizDokument4 SeitenIncoterms QuizGicille Morales100% (1)

- SBR 4 Group 2 RenaultDokument20 SeitenSBR 4 Group 2 Renaultshahbaaz syed100% (2)

- Brazil, Russia, India, China, South Africa (BRICS) - A BriefDokument6 SeitenBrazil, Russia, India, China, South Africa (BRICS) - A BriefInspire rajNoch keine Bewertungen

- AbbreviationsDokument3 SeitenAbbreviationscyber254Noch keine Bewertungen

- Bretton Woods System Vs EMUDokument5 SeitenBretton Woods System Vs EMUIORDACHE GEORGE100% (1)

- Pols 3334Dokument10 SeitenPols 3334ZhelinNoch keine Bewertungen

- The Eurocurrency MarketDokument52 SeitenThe Eurocurrency Marketcktan170885100% (1)

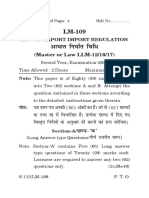

- LM Import Export Question PaperDokument4 SeitenLM Import Export Question PaperBuddhaNoch keine Bewertungen

- 403 Ib Ib MCQDokument13 Seiten403 Ib Ib MCQDr. Rakesh BhatiNoch keine Bewertungen