Beruflich Dokumente

Kultur Dokumente

PFS: Financial Aspect - Project Financing and Evaluation

Hochgeladen von

Bjoy Dalisay0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

54 Ansichten31 SeitenReport

Originaltitel

Chapter 26

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenReport

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

54 Ansichten31 SeitenPFS: Financial Aspect - Project Financing and Evaluation

Hochgeladen von

Bjoy DalisayReport

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 31

Chapter 26

PFS : FINANCIAL ASPECT – PROJECT

FINANCING AND EVALUATION

DETERMINING FUNDS

REQUIREMENTS AND PROFITABILITY

- to evaluate the economic viability of the project and

its financial requirements, the following statement may

be prepared.

Projected Statement of Comprehensive Income

(Operating cost ratios (i.e. COS, SAE, to Sale)

Projected Statement of Financial Position

Projected Cash Flow Statement

Sources of Financing

I. Equity

II. Loan Financing

a) Short-term loans

b) Long-term loans

PRIOR TO CALCULATING THE BEP, THE FOLLOWING

ASSUMPTIONS SHOULD BE OBSERVED:

1. Production costs are function of the volume of production

or of sales (e.g. utilization of equipment)

2. Volume of production equals volume of sales

3. Fixed operating costs are the same for every volume of

production

4. Variable unit cost vary in proportion to the volume of

production

5. Unit sale price for a product or product mix are the same

for all levels of output (sales) overtime. The sales value is

therefore a linear function of the units sales prices and the

quantity sold

• 6. Data from normal year of operation should

be taken

• 7. The level of unit sale prices, variables and

fixed operating costs remain constant

• 8. Single product is manufactured or, if

several similar ones are produced, the mix

should be convertible into a single product

• 9. Product mix should remain the same

overtime

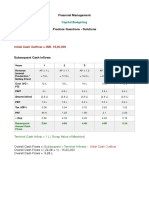

PAYBACK PERIOD

The payback method simply measures how

long (in years and/or months) it takes to recover the

initial investment.

The maximum acceptable payback period is

determined by management.

If the payback period is less than the

maximum acceptable payback period, accept the

project.

If the payback period is greater than the

maximum acceptable payback period, reject the

project.

PROS AND CONS OF PAYBACK PERIODS

The payback method is widely used by large

firms to evaluate small projects and by small firms to

evaluate most projects.

It is simple, intuitive, and considers cash

flows rather than accounting profits.

It also gives implicit consideration to the

timing of cash flows and is widely used as a

supplement to other methods such as Net Present

Value and Internal Rate of Return.

One major weakness of the payback

method is that the appropriate payback period

is a subjectively determined number.

It also fails to consider the principle of

wealth maximization because it is not based on

discounted cash flows and thus provides no

indication as to whether a project adds to firm

value.

Thus, payback fails to fully consider the

time value of money.

CONFLICTING RANKINGS

Conflicting rankings between two or more

projects using NPV and IRR sometimes occurs because

of differences in the timing and magnitude of cash flows.

This underlying cause of conflicting rankings is

the implicit assumption concerning the reinvestment of

intermediate cash inflows—cash inflows received prior to

the termination of the project.

NPV assumes intermediate cash flows are

reinvested at the cost of capital, while IRR assumes that

they are reinvested at the IRR.

WHICH APPROACH IS BETTER?

On a purely theoretical basis, NPV is the better approach

because:

NPV assumes that intermediate cash flows are

reinvested at the cost of capital whereas IRR assumes

they are reinvested at the IRR,

Certain mathematical properties may cause a

project with non-conventional cash flows to have zero or

more than one real IRR.

Despite its theoretical superiority, however,

financial managers prefer to use the IRR because of the

preference for rates of return.

Das könnte Ihnen auch gefallen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Financial Management-Compre-ReviewerDokument22 SeitenFinancial Management-Compre-ReviewerDaily TaxPHNoch keine Bewertungen

- Oblicon Reviewer Final DDokument119 SeitenOblicon Reviewer Final DRoselle CasiguranNoch keine Bewertungen

- Capital RestructuringDokument19 SeitenCapital RestructuringGaurav KumarNoch keine Bewertungen

- Taxation (Basic Principles)Dokument8 SeitenTaxation (Basic Principles)Mariah Jans SasumanNoch keine Bewertungen

- Foundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsDokument30 SeitenFoundations of Multinational Financial Management: Alan Shapiro John Wiley & SonssonaliNoch keine Bewertungen

- Revision 1 ST TermDokument33 SeitenRevision 1 ST Term_dinashNoch keine Bewertungen

- PPBM Assignment: Comparison of Lifebuoy With Rexona and MargoDokument9 SeitenPPBM Assignment: Comparison of Lifebuoy With Rexona and MargodwarakanathdasNoch keine Bewertungen

- Systems Development Life CycleDokument10 SeitenSystems Development Life CycleEth_JagerNoch keine Bewertungen

- Chapter 2 - Retail Strategic Planning and Operations ManagementDokument23 SeitenChapter 2 - Retail Strategic Planning and Operations ManagementCedrick LabaoskiNoch keine Bewertungen

- Module 1 The Nature of Strategic Management2Dokument8 SeitenModule 1 The Nature of Strategic Management2Julienne LobchoyNoch keine Bewertungen

- Module 1 - General PrinciplesDokument11 SeitenModule 1 - General PrinciplesJANE ARVEE ALLYNETTE LEYNES100% (1)

- Ford SWOT Analysis 2013Dokument3 SeitenFord SWOT Analysis 2013Vilgia DelarhozaNoch keine Bewertungen

- Answer of Case StudyDokument85 SeitenAnswer of Case StudyAyesha KhanNoch keine Bewertungen

- Capital Markets Q&ADokument14 SeitenCapital Markets Q&AMachinimaC0dNoch keine Bewertungen

- Chapter # 16 - Marketing GloballyDokument23 SeitenChapter # 16 - Marketing GloballyAnonymous gf3tINCNoch keine Bewertungen

- Porters Five Forces Analysis - 16 - 9Dokument4 SeitenPorters Five Forces Analysis - 16 - 9Srinivas NandikantiNoch keine Bewertungen

- An Introduction To Integrated Marketing CommunicationDokument57 SeitenAn Introduction To Integrated Marketing CommunicationPooja SheoranNoch keine Bewertungen

- Role of Financial IntermediariesDokument5 SeitenRole of Financial Intermediarieskevalpatel83Noch keine Bewertungen

- Short Essay 1: UnrestrictedDokument8 SeitenShort Essay 1: UnrestrictedSatesh KalimuthuNoch keine Bewertungen

- IBA Business AdminDokument135 SeitenIBA Business AdminSHENIEL NANA AMA ENTSUAHNoch keine Bewertungen

- Lecture Notes - Welfare EconomicsDokument23 SeitenLecture Notes - Welfare EconomicsJacksonNoch keine Bewertungen

- Portfolio Investment - ScribdDokument134 SeitenPortfolio Investment - Scribdanchal19870% (1)

- Institute of Accounts Business and Finance Business Administration DepartmentDokument35 SeitenInstitute of Accounts Business and Finance Business Administration Departmentjanna ria libatiuqeNoch keine Bewertungen

- Theory of Demand ReflectionDokument2 SeitenTheory of Demand ReflectionJacklynlim LkcNoch keine Bewertungen

- Personal Selling Meaning & ObjectivesDokument9 SeitenPersonal Selling Meaning & ObjectivesrachealllNoch keine Bewertungen

- Topic2 - 1 Sole Proprietorship and Partnership 2017Dokument84 SeitenTopic2 - 1 Sole Proprietorship and Partnership 2017顺兴Noch keine Bewertungen

- Hill PPT 12e ch02Dokument30 SeitenHill PPT 12e ch02raywelNoch keine Bewertungen

- Sell or Process Further Case AnalysisDokument23 SeitenSell or Process Further Case AnalysisRosslyn Dayrit50% (2)

- Handouts For The Law On ContractsDokument5 SeitenHandouts For The Law On ContractsHannah Jane UmbayNoch keine Bewertungen

- Holly Fashions Ratio Analysis Corporate PDFDokument6 SeitenHolly Fashions Ratio Analysis Corporate PDFAgha Muhammad MujahidNoch keine Bewertungen

- Structure and Scope of SupplyDokument3 SeitenStructure and Scope of SupplyHuten VasellNoch keine Bewertungen

- Work Samples and Simulations MSDMDokument4 SeitenWork Samples and Simulations MSDMMaulana SyamsuNoch keine Bewertungen

- Industry AnalysisDokument25 SeitenIndustry AnalysisPrashant TejwaniNoch keine Bewertungen

- Financial Management (Chapter 4: Financial Analysis-Sizing Up Firm Performance)Dokument24 SeitenFinancial Management (Chapter 4: Financial Analysis-Sizing Up Firm Performance)Steven consueloNoch keine Bewertungen

- Operations Strategy: David A. Collier and James R. EvansDokument47 SeitenOperations Strategy: David A. Collier and James R. EvansSeanmigue TomaroyNoch keine Bewertungen

- SUMMARY OF ChAPTER 4: EXTERNAL ASSESSMENTDokument10 SeitenSUMMARY OF ChAPTER 4: EXTERNAL ASSESSMENTnoor74900Noch keine Bewertungen

- Finals YasDokument64 SeitenFinals YasEstudyanteNoch keine Bewertungen

- MBA Strategic Management Unit IIDokument16 SeitenMBA Strategic Management Unit IImansi_veerwal0% (1)

- Section 203, 204 and 222 and 223 of NIRCDokument2 SeitenSection 203, 204 and 222 and 223 of NIRCKristine Jay Perez-CabusogNoch keine Bewertungen

- Redundancy, Termination, Layoff and RetrenchmentDokument15 SeitenRedundancy, Termination, Layoff and Retrenchmentnorsiah_shukeriNoch keine Bewertungen

- Central Bank Is The Lender of Last ResortDokument5 SeitenCentral Bank Is The Lender of Last ResortchstuNoch keine Bewertungen

- Regulation of Certifying AuthoritiesDokument14 SeitenRegulation of Certifying AuthoritiesHARSHIT KUMARNoch keine Bewertungen

- OM Chapter 17Dokument34 SeitenOM Chapter 17Abdallah HashemNoch keine Bewertungen

- FM CH 15 PDFDokument50 SeitenFM CH 15 PDFLayatmika SahooNoch keine Bewertungen

- Obligations and ContractsDokument23 SeitenObligations and ContractsacousticsynthNoch keine Bewertungen

- Chapter 6 - Strategy Evaluation and ControlDokument9 SeitenChapter 6 - Strategy Evaluation and ControlmaiaaaaNoch keine Bewertungen

- CWDO and Bagwis Application Form (Blank)Dokument11 SeitenCWDO and Bagwis Application Form (Blank)Lhem NavalNoch keine Bewertungen

- Topic 3 - Starting A BusinessDokument18 SeitenTopic 3 - Starting A BusinessHafiz MohamedNoch keine Bewertungen

- M, LLKLDokument14 SeitenM, LLKLSophia PerezNoch keine Bewertungen

- Invitation LetterDokument1 SeiteInvitation LetterMohibur RahmanNoch keine Bewertungen

- Merger FinalDokument24 SeitenMerger FinalMd SufianNoch keine Bewertungen

- Short-Term Finance and PlanningDokument27 SeitenShort-Term Finance and PlanningMiftahul Agusta100% (1)

- Legal Aspects of Business Master NotesDokument44 SeitenLegal Aspects of Business Master NotesSenthil Kumar GanesanNoch keine Bewertungen

- Week 3 - Business Level Strategy - ResumeDokument4 SeitenWeek 3 - Business Level Strategy - ResumeVinaNoch keine Bewertungen

- Managerial EconomicsDokument5 SeitenManagerial EconomicsAnand SahuNoch keine Bewertungen

- How Companies Are Directed, Ruled and Controlled: Corporate Governance Is AboutDokument50 SeitenHow Companies Are Directed, Ruled and Controlled: Corporate Governance Is AboutnkNoch keine Bewertungen

- FFM Chapter 8Dokument5 SeitenFFM Chapter 8Dawn CaldeiraNoch keine Bewertungen

- Capital Budgeting at Birla CementDokument61 SeitenCapital Budgeting at Birla Cementrpsinghsikarwar0% (1)

- Colbourne College Unit 14 Week 6Dokument29 SeitenColbourne College Unit 14 Week 6gulubhata41668Noch keine Bewertungen

- Gabriel Aeron - EnglishDokument8 SeitenGabriel Aeron - EnglishBjoy DalisayNoch keine Bewertungen

- TableDokument2 SeitenTableBjoy DalisayNoch keine Bewertungen

- Gabriel Aeron - EnglishDokument8 SeitenGabriel Aeron - EnglishBjoy DalisayNoch keine Bewertungen

- Cover LetterDokument11 SeitenCover LetterBjoy DalisayNoch keine Bewertungen

- Financial Plan. Docs 1Dokument20 SeitenFinancial Plan. Docs 1Bjoy DalisayNoch keine Bewertungen

- Mother TongueDokument1 SeiteMother TongueBjoy DalisayNoch keine Bewertungen

- Transcript of PFS: Financial Aspect - Investment CostsDokument7 SeitenTranscript of PFS: Financial Aspect - Investment CostsBjoy DalisayNoch keine Bewertungen

- Law On SalesDokument66 SeitenLaw On SalesBjoy DalisayNoch keine Bewertungen

- Marketing PlanDokument5 SeitenMarketing PlanBjoy DalisayNoch keine Bewertungen

- Selling Calendar: This Will Be The Proponents Schedule For Selling Their ProductsDokument2 SeitenSelling Calendar: This Will Be The Proponents Schedule For Selling Their ProductsBjoy DalisayNoch keine Bewertungen

- SalesDokument8 SeitenSalesBjoy DalisayNoch keine Bewertungen

- Rizal in Brussels, 1890Dokument22 SeitenRizal in Brussels, 1890Blessie Joy Dalisay100% (3)

- EAM - August - 2012Dokument2 SeitenEAM - August - 2012Sri Ch.V.Krishna Reddy Assistant Professor (Sr,)Noch keine Bewertungen

- Ajith ProjectDokument89 SeitenAjith ProjectAnonymous MhCdtwxQINoch keine Bewertungen

- Profile On The Production of Fiberglass Reinforced PlasticsDokument28 SeitenProfile On The Production of Fiberglass Reinforced Plasticsmitesh20281Noch keine Bewertungen

- Internal Rate of Return - Wikipedia, The Free EncyclopediaDokument8 SeitenInternal Rate of Return - Wikipedia, The Free EncyclopediaOluwafemi Samuel AdesanmiNoch keine Bewertungen

- Paper12 SolutionDokument21 SeitenPaper12 Solutionpunu904632Noch keine Bewertungen

- Each Question Carries Mark: Objective TypeDokument10 SeitenEach Question Carries Mark: Objective TypeSyed Fawad MarwatNoch keine Bewertungen

- Session 2: Capital Investment Appraisal (An Introduction)Dokument41 SeitenSession 2: Capital Investment Appraisal (An Introduction)ttzaxsanNoch keine Bewertungen

- Yaoure Pea Report 25apr2014Dokument413 SeitenYaoure Pea Report 25apr2014Carlos PereaNoch keine Bewertungen

- Vijayanagara Sri Krishnadevaraya University: Department of Post-Graduate Studies and Research in CommerceDokument47 SeitenVijayanagara Sri Krishnadevaraya University: Department of Post-Graduate Studies and Research in Commercevenkatesh nNoch keine Bewertungen

- Accounting 203 Chapter 12 TestDokument3 SeitenAccounting 203 Chapter 12 TestAnbang XiaoNoch keine Bewertungen

- Chapter 12Dokument2 SeitenChapter 12Mikasa MikasaNoch keine Bewertungen

- Chapter 11Dokument60 SeitenChapter 11Ey EmNoch keine Bewertungen

- Sensitivity AnalysisDokument23 SeitenSensitivity AnalysisKamrul Hasan0% (1)

- Practice Exam 1Dokument22 SeitenPractice Exam 1Kunguru Kizito100% (1)

- MGT201 Pass PaperDokument55 SeitenMGT201 Pass PaperNaresh ShewaniNoch keine Bewertungen

- Slides1 14 PDFDokument240 SeitenSlides1 14 PDFVinay KumarNoch keine Bewertungen

- Investment Office ANRS: Project Profile On The Establishment of Banana PlantationDokument24 SeitenInvestment Office ANRS: Project Profile On The Establishment of Banana Plantationbig john100% (3)

- Absorbent CottonDokument27 SeitenAbsorbent CottonTrầnChíTrungNoch keine Bewertungen

- Which Type of Benchmarking Is The Company Using?Dokument20 SeitenWhich Type of Benchmarking Is The Company Using?Aslam SiddiqNoch keine Bewertungen

- Chapter 13Dokument65 SeitenChapter 13Abdullah khanNoch keine Bewertungen

- Ocean Carriers Reports - Final Case SolutionDokument9 SeitenOcean Carriers Reports - Final Case SolutionNadia VirkNoch keine Bewertungen

- FFM Chapter 8Dokument5 SeitenFFM Chapter 8Dawn CaldeiraNoch keine Bewertungen

- Soalan Webex 3Dokument2 SeitenSoalan Webex 3lenakaNoch keine Bewertungen

- Managerial Finance 2 4 % - 2 - 2Dokument5 SeitenManagerial Finance 2 4 % - 2 - 2Yara AzizNoch keine Bewertungen

- Instructions For Using Texas Instruments BA II Plus CalculatorDokument3 SeitenInstructions For Using Texas Instruments BA II Plus Calculatorsir bookkeeperNoch keine Bewertungen

- Topic 3 Economic Study MethodsDokument52 SeitenTopic 3 Economic Study MethodsJayson Dela Cruz OmictinNoch keine Bewertungen

- Capital Budgeting - SolutionDokument5 SeitenCapital Budgeting - SolutionAnchit JassalNoch keine Bewertungen

- Shri Ganesh Dal Mill Is A Prominent Name in The Dal IndustryDokument9 SeitenShri Ganesh Dal Mill Is A Prominent Name in The Dal IndustryNeerajSinghNoch keine Bewertungen

- Week Nine - Strategic Accounting Issues in Multinational CorporationsDokument40 SeitenWeek Nine - Strategic Accounting Issues in Multinational CorporationsCoffee JellyNoch keine Bewertungen

- Various Criteria For Investment DecisionsDokument15 SeitenVarious Criteria For Investment DecisionsIshu SainiNoch keine Bewertungen