Beruflich Dokumente

Kultur Dokumente

Pay For Performance and Financial Incentives: Global Edition 12e

Hochgeladen von

Nisreen Al-shareOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pay For Performance and Financial Incentives: Global Edition 12e

Hochgeladen von

Nisreen Al-shareCopyright:

Verfügbare Formate

HUMAN RESOURCE MANAGEMENT

Global Edition 12e

Chapter 12

Pay for Performance

and Financial

Incentives

Part 4 Compensation

PowerPoint Presentation by Charlie Cook

Copyright © 2011 Pearson Education GARY DESSLER The University of West Alabama

WHERE WE ARE NOW…

Copyright © 2011 Pearson Education 12–2

LEARNING OUTCOMES

1. Explain how you would apply five motivation theories in

formulating an incentive plan.

2. Discuss the main incentives for individual employees.

3. Discuss the pros and cons of commissions versus

straight pay incentives for salespeople.

4. Describe the main incentives for managers and

executives.

5. Name and define the most popular organizationwide

variable pay plans.

6. Outline the steps in designing effective incentive plans.

Copyright © 2011 Pearson Education 12–3

Motivation, Performance, and Pay

• Incentives

Financial rewards paid to workers whose production exceeds a

predetermined standard.

• Frederick Taylor

Popularized scientific management and the use of financial

incentives in the late 1800s.

Systematic soldiering

Fair day’s work

• Linking Pay and Performance

Understanding the motivational

bases of incentive plans

Copyright © 2011 Pearson Education 12–4

The Hierarchy of Needs

• Maslow’s Hierarchy of Needs:

Physiological (food, water, warmth)

Security (a secure income, knowing one has a job)

Social (friendships and camaraderie)

Self-esteem (respect)

Self-actualization (becoming a whole person)

• Maslow’s prepotency process principle:

People are motivated first to satisfy each lower-order need

and then, in sequence, each of the higher-level needs.

Copyright © 2011 Pearson Education 12–5

Herzberg’s Hygiene–Motivator Theory

• Hygienes (extrinsic job factors)

Satisfy lower-level needs

Inadequate working conditions, salary, and incentive pay can

cause dissatisfaction and prevent satisfaction.

• Motivators (intrinsic job factors)

Satisfy higher-level needs

Job enrichment (challenging job, feedback, and recognition)

addresses higher-level (achievement, self-actualization) needs.

• Premise:

The best way to motivate someone is to organize the job so that

doing it provides feedback and challenge that helps satisfy the

person’s higher-level needs.

Copyright © 2011 Pearson Education 12–6

Demotivators and Edward Deci

• Intrinsically motivated behaviors are motivated by the

individual’s underlying need for competence and self-

determination.

Offering an extrinsic reward for an intrinsically-motivated act

can conflict with the acting individual’s internal sense of

responsibility.

Some behaviors are best motivated by job challenge and

recognition, others by financial rewards.

Copyright © 2011 Pearson Education 12–7

Victor Vroom’s Expectancy Theory

• Motivation is a function of:

Expectancy: the belief that effort will lead to performance.

Instrumentality: the connection between performance and

the appropriate reward.

Valence: the value the person places on the reward.

• Motivation = (E x I x V)

If any factor (E, I, or V) is zero, then there is no motivation

to work toward the reward.

Employee confidence building and training, accurate

appraisals, and knowledge of workers’ desired rewards can

increase employee motivation.

Copyright © 2011 Pearson Education 12–8

Behavior Modification /

Reinforcement Theory

• B. F. Skinner’s Principles

To understand behavior one must understand

the consequences of that behavior.

Behavior that leads to a positive consequence (reward)

tends to be repeated, while behavior that leads to a negative

consequence (punishment) tends not to be repeated.

Behavior can be changed by providing properly scheduled

rewards (or punishments).

Copyright © 2011 Pearson Education 12–9

Incentive Pay Terminology

• Pay-for-Performance Plan

Ties employee’s pay to the employee’s performance

• Variable Pay Plan

Is an incentive plan that ties a group or team’s pay to some

measure of the firm’s (or the facility’s) overall profitability

Example: profit-sharing plans

May include incentive plans for individual employees

Copyright © 2011 Pearson Education 12–10

Employee Incentives and the Law

• FLSA Wage Calculations and Incentive Payments

Bonuses included in overtime calculations:

Those promised to newly hired employees

Those provided for in union contracts or other agreements

Those announced to induce employees to work more

productively, steadily, rapidly, or efficiently or to induce them

to remain with the firm

Bonuses excluded from overtime calculations:

Christmas and gift bonuses not based on hours worked.

Bonuses so substantial that employees don’t consider them

a part of their wages

Purely discretionary bonuses in which the employer retains

discretion over how much, if anything, to pay

Copyright © 2011 Pearson Education 12–11

Types of Employee Incentive Plans

Individual Employee Incentive

and Recognition Programs

Sales Compensation

Programs

Pay-for-Performance Team/Group-based

Plans Variable Pay Programs

Organizationwide Incentive

Programs

Executive Incentive

Compensation Programs

Copyright © 2011 Pearson Education 12–12

Individual Incentive Plans

• Piecework Plans

The worker is paid a sum (“piece rate”)

for each unit he or she produces.

Straight piecework

Standard hour plan

Copyright © 2011 Pearson Education 12–13

Pros and Cons of Piecework

• Easily understandable, equitable,

and powerful incentives

• Employee resistance to changes

in standards or work processes

affecting output

• Quality problems caused by

an overriding output focus

• Possibility of violating minimum

wage standards

• Employee dissatisfaction when

incentives either cannot be earned

or are withdrawn

Copyright © 2011 Pearson Education 12–14

Individual Incentive Plans (cont’d)

• Merit Pay

Is a permanent cumulative salary increase the firm awards

to an individual employee based on his or her individual

performance

Can detract from performance if awarded across the board

Becomes permanent ongoing reward for past performance

• Merit Pay Options

Give annual lump-sum merit raises that do not make the

raise part of an employee’s base salary.

Tie merit awards to both individual and organizational

performance.

Copyright © 2011 Pearson Education 12–15

TABLE 12–1 Merit Award Determination Matrix (an Example)

Company Performance (Weight = 0.50)

Employee Performance

Rating (Weight = .50) Outstanding Excellent Good Marginal Unacceptable

Outstanding 1.00 0.90 0.80 0.70 0.00

Excellent 0.90 0.80 0.70 0.60 0.00

Good 0.80 0.70 0.60 0.50 0.00

Marginal — — — — —

Unacceptable — — — — —

To determine the dollar value of each employee’s incentive award: (1) multiply the

employee’s annual, straight-time wage or salary as of June 30 times his or her maximum

incentive award and (2) multiply the resultant product by the appropriate percentage figure

from this table.

Example: if an employee had an annual salary of $20,000 on June 30 and a maximum

incentive award of 7% and if her performance and the organization’s performance were

both “excellent,” the employee’s award would be $1,120 ($20,000 × 0.07 × 0.80 = $1,120).

Copyright © 2011 Pearson Education 12–16

Incentives for Professional Employees

• Professional Employees

Are those whose work involves the application

of learned knowledge to the solution of the

employer’s problems.

Lawyers, doctors, economists, and engineers

• Possible Incentives

Bonuses, stock options and grants, profit sharing

Better vacations, more flexible work hours

Improved pension plans

Equipment for home offices

Copyright © 2011 Pearson Education 12–17

Nonfinancial and Recognition Awards

• Effects of Recognition-Based Awards

Recognition has a positive impact on performance,

either alone or in conjunction with financial rewards.

Day-to-day recognition from supervisors, peers, and

team members is important.

• Ways to Use Recognition

Social recognition

Performance-based recognition

Performance feedback

Copyright © 2011 Pearson Education 12–18

FIGURE 12–1 Social Recognition and Related Positive

Reinforcement Managers Can Use

• Challenging work assignments • Being provided with ample

• Freedom to choose own work encouragement

activity • Being allowed to set own goals

• Having fun built into work • Compliments

• More of preferred task • Expression of appreciation in

• Role as boss’s stand-in when he front of others

or she is away • Note of thanks

• Role in presentations to top • Employee-of-the-month award

management • Special commendation

• Job rotation • Bigger desk

• Encouragement of learning and • Bigger office or cubicle

continuous improvement

Copyright © 2011 Pearson Education 12–19

Online and IT-Supported Awards

• Information Technology and Incentives

Enterprise incentive management (EIM)

Software that automates planning, calculation,

modeling, and management of incentive

compensation plans

Enabling companies to align their employees

with corporate strategy and goals

• Online Award Programs

Programs offered by online incentives firms that

improve and expedite the awards process

Broader range of awards

More immediate rewards

Copyright © 2011 Pearson Education 12–20

Incentives for Salespeople

• Salary Plan

Straight salaries

Best for: prospecting (finding new clients),

account servicing, training customer’s sales force,

or participating in national and local trade shows

• Commission Plan

Pay is a percentage of sales results.

Keeps sales costs proportionate to sales revenues

May cause a neglect of nonselling duties

Can create wide variation in salesperson’s income

Likelihood of sales success may be linked to external

factors rather than to salesperson’s performance

Can increase turnover of salespeople

Copyright © 2011 Pearson Education 12–21

Incentives for Salespeople (cont’d)

• Combination Plan

Pay is a combination of salary and

commissions, usually with a sizable

salary component.

Plan gives salespeople a floor

(safety net) to their earnings.

Salary component covers company-

specified service activities.

Plans tend to become complicated,

and misunderstandings can result.

Copyright © 2011 Pearson Education 12–22

Specialized Commission Plans

• Commission-plus-Drawing-Account Plan

Commissions are paid but a draw on future

earnings helps the salesperson to get through

low sales periods.

• Commission-plus-Bonus Plan

Pay is mostly based on commissions.

Small bonuses (“spiffs”) are paid for directed

activities like selling add-ons or slow-moving

items.

Copyright © 2011 Pearson Education 12–23

Maximizing Sales Force Results: Setting Sales Quotas

• Should quotas be locked in for a period of time?

• Have quotas been communicated to the sales force

within one month of the start of the period?

• Does the sales force know exactly how its quotas are set?

• Do you combine bottom-up information (like account forecasts)

with top-down requirements (like the company business plan)?

• Do 60% to 70% of the sales force generally hit their quota?

• Do high performers hit their targets consistently?

• Do low performers show improvement over time?

• Are quotas stable through the performance period?

• Are returns and debookings reasonably low?

• Has your firm generally avoided compensation-related lawsuits?

• Is 10% of the sales force achieving higher performance than previously?

• Is 5% to 10% of the sales force achieving below-quota performance

and receiving coaching?

Copyright © 2011 Pearson Education 12–24

Incentives for Managers and Executives

• Executive Total Reward Package

Base salary (cash)

Short-term incentives (bonuses)

Long-term incentives (e.g., stock options)

• Sarbanes-Oxley Act of 2002

Makes executives and the board of directors

personally liable for violating their fiduciary

responsibilities to their shareholders.

Requires the CEO and CFO to repay bonuses,

incentives, or equity-based compensation

received following issuance of a financial

statement that the firm must restate.

Copyright © 2011 Pearson Education 12–25

Short- and Long-Term Incentives

• Short-Term Incentives: The Annual Bonus

Plans intended to motivate short-term performance

of managers and tied to company profitability.

Issues in awarding bonuses

Eligibility basis

Fund size basis

Individual performance award

Long-term incentives

Stock options

Performance shares

Indexed options

Premium price options

Stock appreciation rights

Perks

Copyright © 2011 Pearson Education 12–26

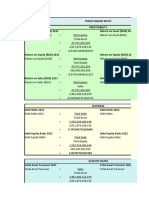

TABLE 12–2 Multiplier Approach to Determining Annual Bonus

Company’s Performance (Based on Sales Targets, Weight = 0.50)

Individual Performance

(Based on Appraisal, Weight = .50) Excellent Good Fair Poor

Excellent 1.00 0.90 0.80 0.70

Good 0.80 0.70 0.60 0.50

Fair 0.00 0.00 0.00 0.00

Poor 0.00 0.00 0.00 0.00

Note: To determine the dollar amount of a manager’s award, multiply the maximum possible

(target) bonus by the appropriate factor in the matrix.

Copyright © 2011 Pearson Education 12–27

Creating an Executive Compensation Plan

1. Define the strategic context for the executive

compensation program.

2. Shape each component of the package to focus

the manager on achieving the firm’s strategic goals.

3. Check the executive compensation plan for

compliance with all legal and regulatory

requirements and for tax effectiveness.

4. Install a process for reviewing and evaluating

the executive compensation plan whenever

a major business change occurs.

Copyright © 2011 Pearson Education 12–28

Team/Group Incentive Plans

• Team (or Group) Incentive Plans

Incentives are based on team’s performance.

• How to Design Team Incentives

Set individual work standards.

Set work standards for each team member

and then calculate each member’s output.

Members are paid based on one of three formulas:

All receive the same pay earned by the highest producer.

All receive the same pay earned by the lowest producer.

All receive the same pay equal to the average pay

earned by the group.

Copyright © 2011 Pearson Education 12–29

Pros and Cons of Team Incentives

• Pros

Reinforces team planning and problem solving

Helps ensure collaboration

Encourages a sense of cooperation

Encourages rapid training of new members

• Cons

Pay is not proportionate to an individual’s effort

Rewards “free riders”

Copyright © 2011 Pearson Education 12–30

Organizationwide Incentive Plans

• Profit-Sharing Plans

Current profit-sharing (cash) plans

Employees receive cash shares of the firm’s profits

at regular intervals.

Deferred profit-sharing plans

A predetermined portion of profits based on the

employee’s contribution to the firm’s profits is

placed in each employee’s retirement account

under a trustee’s supervision.

Employees’ income taxes on the distributions are

deferred, often until the employee retires.

Copyright © 2011 Pearson Education 12–31

Gainsharing Plans

Scanlon Plan

Components

Benefits

Philosophy of Involvement

Identity Competence sharing

cooperation system

formula

Copyright © 2011 Pearson Education 12–32

Implementing a Gainsharing Plan

1. Establish general plan objectives.

2. Choose specific performance measures.

3. Decide on a funding formula.

4. Decide on a method for dividing and distributing

the employees’ share of the gains.

5. Choose the form of payment.

6. Decide how often to pay bonuses.

7. Develop the involvement system.

8. Implement the plan.

Copyright © 2011 Pearson Education 12–33

At-Risk Variable Pay Plans

• Put some portion of the employee’s

weekly pay at risk.

If employees meet or exceed

their goals, they earn incentives.

If they fail to meet their goals, they

forego some of the pay they would

normally have earned.

Copyright © 2011 Pearson Education 12–34

Organizationwide Incentive Plans (cont’d)

• Employee Stock Ownership Plan (ESOP)

A firm annually contributes its own stock—or cash

(with a limit of 15% of compensation) to be used to

purchase the stock—to a trust established for the

employees.

The trust holds the stock in individual employee

accounts and distributes it to employees upon

separation from the firm if the employee has worked

long enough to earn ownership of the stock.

Copyright © 2011 Pearson Education 12–35

Advantages of ESOPs

• For the Company

Can take a tax deduction equal to the fair market value

of the shares transferred to the ESOP trustee

Gets an income tax deduction for dividends paid

on ESOP-owned stock

Can borrow against ESOP in trust and then repay

the loan in pretax rather than after-tax dollars

• For the Employees

Develop a sense of ownership in and commitment to the firm.

Do not pay taxes on ESOP earnings until they receive

a distribution.

• For the Shareholders of Closely-Held Corporations

Can place assets into an ESOP trust which will allow them to

purchase other marketable securities to diversify their holdings

Copyright © 2011 Pearson Education 12–36

Implementing an Effective Incentive Plan

1. Ask: Does it make sense to use an incentive here?

2. Link the incentive with your strategy.

3. Make sure the program is motivational.

4. Set complete standards.

5. Be scientific in analyzing the effects of the plan.

Copyright © 2011 Pearson Education 12–37

Why Incentive Plans Fail

• Performance pay can’t replace good management.

• You get what you pay for.

• “Pay is not a motivator.”

• Rewards punish.

• Rewards rupture relationships.

• Rewards can have unintended consequences.

• Rewards may undermine responsiveness.

• Rewards undermine intrinsic motivation.

Copyright © 2011 Pearson Education 12–38

TABLE 12–3 Express Auto Compensation System

Express Auto Team Responsibility of Team Current Compensation Method

1. Sales force Persuade buyer to Very small salary (minimum wage) with

purchase a car. commissions. Commission rate increases

with every 20 cars sold per month.

2. Finance office Help close the sale; Salary, plus bonus for each $10,000

persuade customer to financed with the company

use company finance

plan.

3. Detailing Inspect cars delivered Piecework paid on the number of cars

from factory, clean, and detailed per day.

make minor adjustments.

4. Mechanics Provide factory warranty Small hourly wage, plus bonus based on

service, maintenance, (1) number of cars completed per day and

and repair. (2) finishing each car faster than the

standard estimated time to repair

5. Receptionists/ Primary liaison between Minimum wage

phone service customer and sales

personnel force, finance, and

mechanics

Copyright © 2011 Pearson Education 12–39

KEY TERMS

financial incentives merit pay (merit raise)

fair day’s work annual bonus

scientific management movement stock option

expectancy golden parachutes

instrumentality team (or group) incentive plan

valence organizationwide incentive plans

behavior modification profit-sharing plan

variable pay Scanlon plan

piecework gainsharing plan

straight piecework at-risk variable pay plans

standard hour plan employee stock ownership plan (ESOP)

Copyright © 2011 Pearson Education 12–40

All rights reserved. No part of this publication may be reproduced,

stored in a retrieval system, or transmitted, in any form or by any

means, electronic, mechanical, photocopying, recording, or

otherwise, without the prior written permission of the publisher.

Printed in the United States of America.

Copyright © 2011 Pearson Education 12–41

Das könnte Ihnen auch gefallen

- Best Practices: Evaluating Performance: How to Appraise, Promote, and FireVon EverandBest Practices: Evaluating Performance: How to Appraise, Promote, and FireBewertung: 5 von 5 Sternen5/5 (2)

- Human Resource 08Dokument28 SeitenHuman Resource 08Mainul HossainNoch keine Bewertungen

- Rewards and Employee Production in Relevance To Performance ManagementDokument19 SeitenRewards and Employee Production in Relevance To Performance ManagementNatasha Singh50% (2)

- Pay Systems Currently in VogueDokument96 SeitenPay Systems Currently in VoguePoonam KaushalNoch keine Bewertungen

- Human Resource Management 4: Fundamentals ofDokument42 SeitenHuman Resource Management 4: Fundamentals ofKhyle AcebedoNoch keine Bewertungen

- Alcohol: Ethanol, Methanol and Ethylene GlycolDokument90 SeitenAlcohol: Ethanol, Methanol and Ethylene GlycolNisreen Al-share100% (1)

- Compensation and Benefits: Vidhya SethiDokument19 SeitenCompensation and Benefits: Vidhya SethiSneha ChavanNoch keine Bewertungen

- Sy0 601 01Dokument17 SeitenSy0 601 01SABRINA NUR AISHA AZAHARI100% (1)

- Job Challenge Profile, Participant Workbook and SurveyVon EverandJob Challenge Profile, Participant Workbook and SurveyNoch keine Bewertungen

- GDPR V ISO 27001 Mapping TableDokument12 SeitenGDPR V ISO 27001 Mapping Tablemr KNoch keine Bewertungen

- Chapter 9 - Pay For PerformanceDokument29 SeitenChapter 9 - Pay For PerformanceAnonymous Io54FfF0S100% (1)

- Strategic CompensationDokument45 SeitenStrategic CompensationAnjum ShakeelaNoch keine Bewertungen

- A Great CEODokument2 SeitenA Great CEOnochip10100% (1)

- Logistics and Supply Chain Management 1A: IntroductionDokument22 SeitenLogistics and Supply Chain Management 1A: IntroductionAriicco RsaNoch keine Bewertungen

- International Business: Environments & OperationsDokument24 SeitenInternational Business: Environments & OperationsNisreen Al-shareNoch keine Bewertungen

- Internal MedicineDokument190 SeitenInternal MedicineNisreen Al-shareNoch keine Bewertungen

- I. Pre-Merger Insights - 1 Acquisition FactoryDokument12 SeitenI. Pre-Merger Insights - 1 Acquisition FactoryRadoslav RobertNoch keine Bewertungen

- Dessler HRM12e PPT 7bDokument41 SeitenDessler HRM12e PPT 7bMirul AzimiNoch keine Bewertungen

- Pay For Performance and Financial Incentives: Gary DesslerDokument35 SeitenPay For Performance and Financial Incentives: Gary DesslerNaeem KhanNoch keine Bewertungen

- Finance Thesis TopicDokument9 SeitenFinance Thesis TopicMAk Khan33% (3)

- The Social Function of BusinessDokument10 SeitenThe Social Function of BusinessJupiter WhitesideNoch keine Bewertungen

- Buying and MerchandisingDokument155 SeitenBuying and MerchandisingMJ100% (2)

- Chapter 15 Data Managment Maturity Assessment - DONE DONE DONEDokument16 SeitenChapter 15 Data Managment Maturity Assessment - DONE DONE DONERoche ChenNoch keine Bewertungen

- Pay For Performance and Financial IncentivesDokument34 SeitenPay For Performance and Financial Incentivesnhungnguyen20031113Noch keine Bewertungen

- AUC Pay For Performance and Financial Incentives 1624733038Dokument78 SeitenAUC Pay For Performance and Financial Incentives 1624733038hagar elshahawanyNoch keine Bewertungen

- Pay For Performance and Financial IncentivesDokument41 SeitenPay For Performance and Financial IncentivesMostafaAhmedNoch keine Bewertungen

- Pay For Performance and Financial Incentives: Part Four - CompensationDokument32 SeitenPay For Performance and Financial Incentives: Part Four - CompensationSachi Anand ViswanathanNoch keine Bewertungen

- Pay For Performance and Financial IncentivesDokument14 SeitenPay For Performance and Financial IncentivesZureiz Nauman AfzalNoch keine Bewertungen

- Pay For Performance and Financial Incentives: Part Four - CompensationDokument16 SeitenPay For Performance and Financial Incentives: Part Four - CompensationnewaznahianNoch keine Bewertungen

- Pay For Performance and Financial Incentives: M. Khasro Miah PH.DDokument45 SeitenPay For Performance and Financial Incentives: M. Khasro Miah PH.Dshaf0085Noch keine Bewertungen

- Dessler HRM12e PPT 12Dokument18 SeitenDessler HRM12e PPT 12Moiz AdnanNoch keine Bewertungen

- Pay For Performance and Financial IncentivesDokument45 SeitenPay For Performance and Financial IncentivesVania AnnisaNoch keine Bewertungen

- Compensation and BenefitsDokument82 SeitenCompensation and BenefitsSmith RainerNoch keine Bewertungen

- Human Resource Human Resource Management ManagementDokument7 SeitenHuman Resource Human Resource Management ManagementMuneir86Noch keine Bewertungen

- HRM ch08Dokument43 SeitenHRM ch08Cabdixakiim-Tiyari Cabdillaahi AadenNoch keine Bewertungen

- Pay For Performance AND Financial Incentives: By: Farhan Khalid (18) AmanDokument20 SeitenPay For Performance AND Financial Incentives: By: Farhan Khalid (18) AmanFarhan KhalidNoch keine Bewertungen

- Print HR PDFDokument51 SeitenPrint HR PDFTanYanXuan0% (1)

- Human Resource Management Dessler 13th Edition Solutions ManualDokument17 SeitenHuman Resource Management Dessler 13th Edition Solutions ManualMikeOsbornenjoi100% (31)

- Human Resource Management 14 Edition Chapter 9 & 10 CompensationDokument43 SeitenHuman Resource Management 14 Edition Chapter 9 & 10 CompensationTanvir AhmedNoch keine Bewertungen

- Training and Developing EmployeesDokument19 SeitenTraining and Developing EmployeesAbraham ZeusNoch keine Bewertungen

- Variable Pay & Executive Compensation Submmitted BY Shweta Nayak SuchitraDokument63 SeitenVariable Pay & Executive Compensation Submmitted BY Shweta Nayak SuchitrabsbhavaniNoch keine Bewertungen

- Garry Dessler Human Resource Management: Pay For Performance and Financial IncentivesDokument32 SeitenGarry Dessler Human Resource Management: Pay For Performance and Financial Incentivesrabia khanNoch keine Bewertungen

- Unit 4 Motivating EmployeesDokument22 SeitenUnit 4 Motivating EmployeesSmit ShahNoch keine Bewertungen

- Employee Compensation and BenefitsDokument22 SeitenEmployee Compensation and BenefitsRazaul IslamNoch keine Bewertungen

- Pay For Performance and Financial Incentives: Presented By: Aeint Pyae SoneDokument18 SeitenPay For Performance and Financial Incentives: Presented By: Aeint Pyae SoneAeintNoch keine Bewertungen

- Chapter 1Dokument38 SeitenChapter 1Lama Al khulaifiNoch keine Bewertungen

- Pay For Performance and Financial Incentives: T TwelveDokument14 SeitenPay For Performance and Financial Incentives: T TwelveNouman AhmadNoch keine Bewertungen

- Compensation Management: By:-Abhilash DobhalDokument29 SeitenCompensation Management: By:-Abhilash DobhalPooja GairolaNoch keine Bewertungen

- Intrinsic Rewards VS Extrinsic RewardsDokument15 SeitenIntrinsic Rewards VS Extrinsic RewardsAbdullah ghauriNoch keine Bewertungen

- Compensation ManagementDokument23 SeitenCompensation Managementsunitsarker54Noch keine Bewertungen

- Pay For Performance & Financial Incentives: Presented By: FSZDokument26 SeitenPay For Performance & Financial Incentives: Presented By: FSZRashedul IslamNoch keine Bewertungen

- HRM CH 12Dokument28 SeitenHRM CH 12Eiimae VillanuevaNoch keine Bewertungen

- CompensationmanagementDokument31 SeitenCompensationmanagementAlameluNoch keine Bewertungen

- CompensationDokument23 SeitenCompensationling lingNoch keine Bewertungen

- Comp and Benefit EmbaDokument127 SeitenComp and Benefit EmbaSneha KadamNoch keine Bewertungen

- Compensation Reward ManagementDokument109 SeitenCompensation Reward ManagementEyob KassaNoch keine Bewertungen

- CompensationDokument55 SeitenCompensationJeeta Sarkar100% (1)

- 9 MotivationDokument22 Seiten9 MotivationSalman ZubaerNoch keine Bewertungen

- Pay For Performance and Financial IncentivesDokument36 SeitenPay For Performance and Financial IncentivesAtabur RahmanNoch keine Bewertungen

- HRM Unit-4 Motivational StrategiesDokument64 SeitenHRM Unit-4 Motivational Strategiesrdeepak99Noch keine Bewertungen

- 12 Pay For Performance and Financial IncentivesDokument14 Seiten12 Pay For Performance and Financial IncentivesSilvia MNoch keine Bewertungen

- COMPENSATION 1 - Pay Plans - Basic IssuesDokument48 SeitenCOMPENSATION 1 - Pay Plans - Basic IssuesArefin Wisea AblagNoch keine Bewertungen

- History: Reward Management Is Concerned WithDokument8 SeitenHistory: Reward Management Is Concerned Withloveset08Noch keine Bewertungen

- Compensation and Reward Management: Dr. Soni AgrawalDokument28 SeitenCompensation and Reward Management: Dr. Soni AgrawalKshitij SharmaNoch keine Bewertungen

- Aim of Reward ManagementDokument10 SeitenAim of Reward ManagementNusrat LiyaNoch keine Bewertungen

- HR-Compensation, Incentives & Rewards-RaviDokument10 SeitenHR-Compensation, Incentives & Rewards-Ravipravinpawar28Noch keine Bewertungen

- Employee Behavior and Motivation: Instructor Lecture PowerpointsDokument26 SeitenEmployee Behavior and Motivation: Instructor Lecture PowerpointsAugie HerdaniNoch keine Bewertungen

- MotivationDokument4 SeitenMotivationNoah HealeyNoch keine Bewertungen

- Chapter 8Dokument5 SeitenChapter 8Anndrea PalmariaNoch keine Bewertungen

- Model Answer: Literature review on Employee motivation, rewards and performanceVon EverandModel Answer: Literature review on Employee motivation, rewards and performanceNoch keine Bewertungen

- Fusion or Fizzle: How Leaders Leverage Training to Ignite ResultsVon EverandFusion or Fizzle: How Leaders Leverage Training to Ignite ResultsNoch keine Bewertungen

- How Work Environment Affects The Employee Engagement in A Telecommunication CompanyDokument9 SeitenHow Work Environment Affects The Employee Engagement in A Telecommunication CompanyNisreen Al-shareNoch keine Bewertungen

- AbeermafrqDokument2 SeitenAbeermafrqNisreen Al-shareNoch keine Bewertungen

- Employee Engagement at Reliance HR Services - An Empirical StudyDokument4 SeitenEmployee Engagement at Reliance HR Services - An Empirical StudyNisreen Al-shareNoch keine Bewertungen

- RRRRRRDokument23 SeitenRRRRRRNisreen Al-shareNoch keine Bewertungen

- Charles W. L. Hill / Gareth R. Jones: External Analysis: The Identification of Opportunities and ThreatsDokument25 SeitenCharles W. L. Hill / Gareth R. Jones: External Analysis: The Identification of Opportunities and ThreatsNisreen Al-shareNoch keine Bewertungen

- Quality of Work-Life Model For Teachers of Private Universities in PakistanDokument23 SeitenQuality of Work-Life Model For Teachers of Private Universities in PakistanNisreen Al-shareNoch keine Bewertungen

- أسئلة امتحان الإقامة PDFDokument10 Seitenأسئلة امتحان الإقامة PDFNisreen Al-shareNoch keine Bewertungen

- Quality of Work Life and Employee Engagement Management EssayDokument9 SeitenQuality of Work Life and Employee Engagement Management EssayNisreen Al-shareNoch keine Bewertungen

- PediatricDokument98 SeitenPediatricNisreen Al-shareNoch keine Bewertungen

- GyneDokument43 SeitenGyneNisreen Al-shareNoch keine Bewertungen

- CDM Note5Dokument14 SeitenCDM Note5Nisreen Al-shareNoch keine Bewertungen

- By DR - Mohammad Z. Abu Sheikha@: +pigmented Stones (Black Stone - Non Infected) (Brown Stone - Infected)Dokument11 SeitenBy DR - Mohammad Z. Abu Sheikha@: +pigmented Stones (Black Stone - Non Infected) (Brown Stone - Infected)Nisreen Al-shareNoch keine Bewertungen

- Chapter 2Dokument40 SeitenChapter 2Nisreen Al-shareNoch keine Bewertungen

- Research Note: Emergency Contraception: The International Planned Parenthood Federation's ExperienceDokument2 SeitenResearch Note: Emergency Contraception: The International Planned Parenthood Federation's ExperienceNisreen Al-shareNoch keine Bewertungen

- Operations Management: ForecastingDokument64 SeitenOperations Management: ForecastingNisreen Al-shareNoch keine Bewertungen

- Ch4 Recording Transactions and Balancing The Ledgers v6Dokument13 SeitenCh4 Recording Transactions and Balancing The Ledgers v6Soputivong NhemNoch keine Bewertungen

- Reading Material OFFIcers IIDokument103 SeitenReading Material OFFIcers IIbaba2303Noch keine Bewertungen

- Banking Financial Institutions.Dokument18 SeitenBanking Financial Institutions.Jhonrey BragaisNoch keine Bewertungen

- Hreinn ThormarDokument17 SeitenHreinn ThormarJyothi RameshNoch keine Bewertungen

- Felix Amante Senior High School San Pablo, Laguna: The Purple Bowl PHDokument8 SeitenFelix Amante Senior High School San Pablo, Laguna: The Purple Bowl PHcyrel ocfemiaNoch keine Bewertungen

- Millward Brown Methodology - For WebDokument5 SeitenMillward Brown Methodology - For WebAnkit VermaNoch keine Bewertungen

- Informations Systems and Operations ManagementDokument9 SeitenInformations Systems and Operations Managementprivilege1911Noch keine Bewertungen

- Welcome To Oyo Rooms: Founder and CEO:-Ritesh AgarwalDokument10 SeitenWelcome To Oyo Rooms: Founder and CEO:-Ritesh AgarwalNitin MishraNoch keine Bewertungen

- Dubois Et Fils Shareholder BenefitsDokument5 SeitenDubois Et Fils Shareholder BenefitsCrowdfundInsiderNoch keine Bewertungen

- BP010 Business and Process StrategyDokument13 SeitenBP010 Business and Process StrategyparcanjoNoch keine Bewertungen

- Countax CTX 300 SeriesDokument22 SeitenCountax CTX 300 SeriesMuhammad HumayunNoch keine Bewertungen

- NEW LOAN-APPLICATION-FORM November 2021 v2 PDFDokument4 SeitenNEW LOAN-APPLICATION-FORM November 2021 v2 PDFjohnson mwauraNoch keine Bewertungen

- Chapter 22 - Statement of Cash FlowsDokument17 SeitenChapter 22 - Statement of Cash Flowsprasad guthiNoch keine Bewertungen

- Group Discussions PointsDokument8 SeitenGroup Discussions PointsmrkhandhediaNoch keine Bewertungen

- About APSCA D 021Dokument2 SeitenAbout APSCA D 021VANoch keine Bewertungen

- Proyeksi INAF - Kelompok 3Dokument43 SeitenProyeksi INAF - Kelompok 3Fairly 288Noch keine Bewertungen

- Assignment On Case 1.1 and Case 1.2: Submitted ToDokument4 SeitenAssignment On Case 1.1 and Case 1.2: Submitted ToEhsan AbirNoch keine Bewertungen

- Chapter 16 DCF With Inflation and Taxation: Learning ObjectivesDokument19 SeitenChapter 16 DCF With Inflation and Taxation: Learning ObjectivesDani ShaNoch keine Bewertungen

- Final Project Business Plan 1. General GuidelinesDokument13 SeitenFinal Project Business Plan 1. General GuidelinesMehrozNoch keine Bewertungen

- Factura Comercial RealizadaDokument1 SeiteFactura Comercial Realizadafernando jose chuquijajas rodriguezNoch keine Bewertungen

- DIRECTION: Read The Statement Carefully and Choose The Answer That Best Described The Statement. Write Your Answer in Your Answer SheetDokument3 SeitenDIRECTION: Read The Statement Carefully and Choose The Answer That Best Described The Statement. Write Your Answer in Your Answer SheetGenelita B. PomasinNoch keine Bewertungen