Beruflich Dokumente

Kultur Dokumente

ME 291 Engineering Economy: Annual Worth Analysis

Hochgeladen von

Ehsan Ur Rehman0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

6 Ansichten18 SeitenGIKI Engineering Economy Lectures

Originaltitel

Lecture17-18

Copyright

© © All Rights Reserved

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenGIKI Engineering Economy Lectures

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

6 Ansichten18 SeitenME 291 Engineering Economy: Annual Worth Analysis

Hochgeladen von

Ehsan Ur RehmanGIKI Engineering Economy Lectures

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 18

ME 291

Engineering

ME-291 Engineering Economy

Economy

Lecture 17

Chapter 6

Annual Worth Analysis

Faculty of Mechanical Engineering

Ghulam Ishaq Khan Institute, Topi, Swabi

© Faculty of Mechanical Engineering, GIKI

Annual Worth Analysis (AWA)

• AW value is equivalent to the PW and FW values at

ME-291 Engineering Economy

the MARR for n years.

AW = PW(A/P, i, n)=FW(A/F, i, n)

• When all cash flow estimates are converted to an AW

value, this value applies for every year of the life-

cycle, and for each additional life cycle.

• Advantage: The AW value has to be calculated for

only one life cycle. Therefore, it is not necessary to

use LCM of lives, as it is for PW or FW analysis.

• Some Applications:

• Asset replacement & retention (maintenance) time

studies to minimize annual costs.

• Break even studies and make or buy studies etc.

© Faculty of Mechanical Engineering, GIKI

Three fundamental assumptions of

the AW method

When alternatives being compared have different lives,

ME-291 Engineering Economy

the AW method makes the assumptions that:

• The services provided are needed for the indefinite

future (forever).

• The selected alternative will be repeated for

succeeding life cycles in exactly the same manner as

for the first life cycle.

• All cash flows will have the same estimated values in

every life cycle.

© Faculty of Mechanical Engineering, GIKI

Example 6.1

• Consider a location A, which has a 6-year life cycle. The

ME-291 Engineering Economy

diagram shows cash flows for all three life cycles (first cost

$15,000; annual cost $3500; deposit return $1000).

Demonstrate the equivalence at interest rate=15% of PW

over the three life cycles and AW over one cycle. If the 18

years LCM is considered, the PW calculated is $ -45,036.

© Faculty of Mechanical Engineering, GIKI

Example 6.1 (Contd…)

ME-291 Engineering Economy

© Faculty of Mechanical Engineering, GIKI

Example 6.1 (Contd…)

• AW = -15, 000(A/P, 15%, 6) + 1000(A/F,

ME-291 Engineering Economy

15%, 6) – 3500 = $ -7349

• Using PW for 18 years:

• AW = -45, 036(A/P, 15%, 18) = $ -7349

• Using FW and AW equivalence relation:

• FW = PW(F/P, 15%, 18) = -45, 036(12.3755)

• FW = $ -557, 343

• AW = -557, 343(A/F, 15%, 18) = $ -7351

© Faculty of Mechanical Engineering, GIKI

Capital Recovery and AW

An alternative should have the following cash flow estimates:

ME-291 Engineering Economy

– Initial investment P

– Salvage value S

– Annual amount A

The AW is comprised of two components: Capital recovery of

the initial investment P at a stated interest rate (usually the

MARR) and the equivalent annual amount A. The symbol

CR is used for the capital recovery component.

AW = - CR – A

- ive sign here represents costs

CR is the equivalent annual cost of owning the asset plus

return on initial investment.

CR = - [ P ( A / P , i , n ) – S ( A / F , i , n ) ]

© Faculty of Mechanical Engineering, GIKI

Example 6.2

ME-291 Engineering Economy

© Faculty of Mechanical Engineering, GIKI

Example 6.2 (Contd…)

• CR = -{[8.0 + 5.0(P/F, 12%, 1)](A/P, 12%, 8)

ME-291 Engineering Economy

– 0.5(A/F, 12%, 8)}

• CR = $ -2.47 million

• It means that every year of 8 years, the

equivalent total revenue from the tracker

must be at $ -2.47 million just to recover the

initial present worth investment plus the

required return of 12%. This does not include

AOC of $ 0.9 million.

• AW = -2.47 – 0.9 = $ -3.37 million per year

© Faculty of Mechanical Engineering, GIKI

Evaluating alternatives by Annual

Worth Analysis

• The rules are the same as that of PW

ME-291 Engineering Economy

• For mutually exclusive alternatives, calculate AW at

the MARR.

– One alternative: AW≥0, MARR is met or exceeded

– Two or more alternatives: choose the lowest cost

or highest income (numerically largest) AW value.

© Faculty of Mechanical Engineering, GIKI

Example 6.3

ME-291 Engineering Economy

© Faculty of Mechanical Engineering, GIKI

Example 6.3 (Contd..)

• The CR and AW answer the first two questions (a

ME-291 Engineering Economy

and b)

• CR = 5(4600)(A/P, 10%, 5) – 5(300)(A/F, 10%, 5) =

$ 5822

• $ 1200 < CR so project is not viable financially.

© Faculty of Mechanical Engineering, GIKI

Example 6.3 (Contd..)

• AW = -5822 + 550 – 50(A/G, 10%, 5)

ME-291 Engineering Economy

• AW = $ -5362

• This shows once again that alternative is

clearly not financially viable at MARR =

10%

• Note that estimated $ 1200 income per year

has reduced the required annual amount

from $ 5822 to $ 5362

• To do Computer analysis, use NPV and PMT

functions………..see the solution in book.

• NPV is used to determine P and PMT finds

the equivalent A value.

© Faculty of Mechanical Engineering, GIKI

AW of a Permanent Investment

• This section discusses the annual worth equivalent of

ME-291 Engineering Economy

the Capitalized Cost.

• A=Pi

• Effect same as Capitalized cost.

• For the evaluation of public sector projects, such as

flood control, irrigation canals, bridges, and other

large scale projects.

• Cash flows recurring at regular or irregular intervals

are handled exactly as in conventional AW

computations; they are converted to the equivalent

uniform annual amounts A for one cycle.

© Faculty of Mechanical Engineering, GIKI

Example 6.5

ME-291 Engineering Economy

© Faculty of Mechanical Engineering, GIKI

Example 6.6

ME-291 Engineering Economy

Excel sheet

© Faculty of Mechanical Engineering, GIKI

Problem 6.7

ME-291 Engineering Economy

© Faculty of Mechanical Engineering, GIKI

Problem 6.16

ME-291 Engineering Economy

© Faculty of Mechanical Engineering, GIKI

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Section 1Dokument4 SeitenSection 1Ehsan Ur RehmanNoch keine Bewertungen

- Professional Solar Mounting SystemDokument20 SeitenProfessional Solar Mounting SystemEhsan Ur RehmanNoch keine Bewertungen

- Zwick Armaturen GMBH - Double Block & Bleed ValveDokument2 SeitenZwick Armaturen GMBH - Double Block & Bleed ValveEhsan Ur RehmanNoch keine Bewertungen

- Factory Accepting TestDokument2 SeitenFactory Accepting TestEhsan Ur RehmanNoch keine Bewertungen

- Schulz Compressor Manual (English) FinalDokument31 SeitenSchulz Compressor Manual (English) FinalEhsan Ur RehmanNoch keine Bewertungen

- Mounting Structure PV SystemsDokument36 SeitenMounting Structure PV SystemsEhsan Ur RehmanNoch keine Bewertungen

- UPS Battery Systems - ENDokument16 SeitenUPS Battery Systems - ENChris Tan100% (2)

- Shell MESC Number 774133.010.1 (NEAREST)Dokument2 SeitenShell MESC Number 774133.010.1 (NEAREST)Ehsan Ur Rehman100% (1)

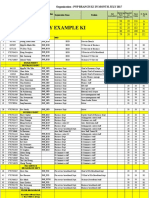

- Sr. No. Description Location Address Qty PO No. PO DateDokument1 SeiteSr. No. Description Location Address Qty PO No. PO DateEhsan Ur RehmanNoch keine Bewertungen

- Boundary Layer - Wind EnergyDokument27 SeitenBoundary Layer - Wind EnergyEhsan Ur RehmanNoch keine Bewertungen

- Zwick Armaturen GMBH - Company ProfileDokument2 SeitenZwick Armaturen GMBH - Company ProfileEhsan Ur RehmanNoch keine Bewertungen

- Wind Turbine BladesDokument5 SeitenWind Turbine BladesEhsan Ur RehmanNoch keine Bewertungen

- Zwick Armaturen GMBH - Reference List MOL - Hungary (2010-2015)Dokument1 SeiteZwick Armaturen GMBH - Reference List MOL - Hungary (2010-2015)Ehsan Ur RehmanNoch keine Bewertungen

- Lecture Frequency ControlDokument35 SeitenLecture Frequency ControlEhsan Ur RehmanNoch keine Bewertungen

- Sample Papers DPE 2017Dokument73 SeitenSample Papers DPE 2017sajidmughal333Noch keine Bewertungen

- Iecex Certification: Certified Ex EquipmentDokument1 SeiteIecex Certification: Certified Ex EquipmentEhsan Ur RehmanNoch keine Bewertungen

- NERC Balancing and Frequency Control 040520111Dokument53 SeitenNERC Balancing and Frequency Control 040520111pongpumNoch keine Bewertungen

- Procedure For Recruitment, Selection & Mobilization of ManpowerDokument6 SeitenProcedure For Recruitment, Selection & Mobilization of ManpowerEhsan Ur RehmanNoch keine Bewertungen

- Design of Electrical Power Supply System in An Oil and Gas RefineryDokument70 SeitenDesign of Electrical Power Supply System in An Oil and Gas Refinerydaniel_silabanNoch keine Bewertungen

- Optimal Rotor Tip Speed Ratio PDFDokument10 SeitenOptimal Rotor Tip Speed Ratio PDFHani M. El-TouniNoch keine Bewertungen

- PVWatts Calculator11Dokument1 SeitePVWatts Calculator11IslamNoch keine Bewertungen

- Return On Solar InverstmentDokument27 SeitenReturn On Solar InverstmentEhsan Ur RehmanNoch keine Bewertungen

- Land - Use RequirementsDokument47 SeitenLand - Use RequirementsgaddipatimalliNoch keine Bewertungen

- Structural Considerations For Solar Installers PDFDokument144 SeitenStructural Considerations For Solar Installers PDFTarik AhasanNoch keine Bewertungen

- Abb Furse Earthing A4 8pp Brochure FinalDokument8 SeitenAbb Furse Earthing A4 8pp Brochure FinalTony BombataNoch keine Bewertungen

- Eaton Motor Control Basic WiringDokument14 SeitenEaton Motor Control Basic Wiringalmuamar5026100% (1)

- 7 Ways To Achieve Operations Reliability: Asset Performance ManagementDokument11 Seiten7 Ways To Achieve Operations Reliability: Asset Performance ManagementEhsan Ur RehmanNoch keine Bewertungen

- Aip 15 32Dokument1 SeiteAip 15 32shakir hussainNoch keine Bewertungen

- AEE Webinar Green BuildingsDokument1 SeiteAEE Webinar Green BuildingsEhsan Ur RehmanNoch keine Bewertungen

- Design of Earthing System For HV Ac SubstationDokument9 SeitenDesign of Earthing System For HV Ac Substationwas00266Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Camless EnginesDokument4 SeitenCamless EnginesKavya M BhatNoch keine Bewertungen

- PNP Ki in July-2017 AdminDokument21 SeitenPNP Ki in July-2017 AdminSina NeouNoch keine Bewertungen

- Spring 2010 - CS604 - 1 - SolutionDokument2 SeitenSpring 2010 - CS604 - 1 - SolutionPower GirlsNoch keine Bewertungen

- Unit 2 - Industrial Engineering & Ergonomics - WWW - Rgpvnotes.inDokument15 SeitenUnit 2 - Industrial Engineering & Ergonomics - WWW - Rgpvnotes.inSACHIN HANAGALNoch keine Bewertungen

- Hw10 SolutionsDokument4 SeitenHw10 Solutionsbernandaz123Noch keine Bewertungen

- Homeopatija I KancerDokument1 SeiteHomeopatija I KancermafkoNoch keine Bewertungen

- UFO Yukon Spring 2010Dokument8 SeitenUFO Yukon Spring 2010Joy SimsNoch keine Bewertungen

- Ahmad Syihabudin: BiodataDokument2 SeitenAhmad Syihabudin: BiodatabhjjqrgrwmNoch keine Bewertungen

- A2Dokument4 SeitenA2Akshay KumarNoch keine Bewertungen

- DCN Dte-Dce and ModemsDokument5 SeitenDCN Dte-Dce and ModemsSathish BabuNoch keine Bewertungen

- Liquitex Soft Body BookletDokument12 SeitenLiquitex Soft Body Booklethello belloNoch keine Bewertungen

- Report DR JuazerDokument16 SeitenReport DR Juazersharonlly toumasNoch keine Bewertungen

- Honda IzyDokument16 SeitenHonda IzyTerry FordNoch keine Bewertungen

- LEMBAR JAWABAN CH.10 (Capital Budgeting Techniques)Dokument4 SeitenLEMBAR JAWABAN CH.10 (Capital Budgeting Techniques)Cindy PNoch keine Bewertungen

- Low Speed Aerators PDFDokument13 SeitenLow Speed Aerators PDFDgk RajuNoch keine Bewertungen

- DS Important QuestionsDokument15 SeitenDS Important QuestionsLavanya JNoch keine Bewertungen

- Rights of Parents in IslamDokument11 SeitenRights of Parents in Islamstoneage989100% (2)

- Positive Psychology in The WorkplaceDokument12 SeitenPositive Psychology in The Workplacemlenita264Noch keine Bewertungen

- Daewoo 710B PDFDokument59 SeitenDaewoo 710B PDFbgmentNoch keine Bewertungen

- Lesson 1 Q3 Figure Life DrawingDokument10 SeitenLesson 1 Q3 Figure Life DrawingCAHAPNoch keine Bewertungen

- Dessler HRM12e PPT 01Dokument30 SeitenDessler HRM12e PPT 01harryjohnlyallNoch keine Bewertungen

- Green Dot ExtractDokument25 SeitenGreen Dot ExtractAllen & UnwinNoch keine Bewertungen

- Advertisement: National Institute of Technology, Tiruchirappalli - 620 015 TEL: 0431 - 2503365, FAX: 0431 - 2500133Dokument4 SeitenAdvertisement: National Institute of Technology, Tiruchirappalli - 620 015 TEL: 0431 - 2503365, FAX: 0431 - 2500133dineshNoch keine Bewertungen

- Backwards Design - Jessica W Maddison CDokument20 SeitenBackwards Design - Jessica W Maddison Capi-451306299100% (1)

- Maha Vedha DikshaDokument1 SeiteMaha Vedha DikshaBallakrishnen SubramaniamNoch keine Bewertungen

- 21 Tara Mantra-Wps OfficeDokument25 Seiten21 Tara Mantra-Wps OfficeAlteo FallaNoch keine Bewertungen

- Albert Roussel, Paul LandormyDokument18 SeitenAlbert Roussel, Paul Landormymmarriuss7Noch keine Bewertungen

- The Rock Reliefs of Ancient IranAuthor (Dokument34 SeitenThe Rock Reliefs of Ancient IranAuthor (mark_schwartz_41Noch keine Bewertungen

- Coal Bottom Ash As Sand Replacement in ConcreteDokument9 SeitenCoal Bottom Ash As Sand Replacement in ConcretexxqNoch keine Bewertungen

- Veritas™ High Availability Agent For WebSphere MQ Installation and Configuration Guide / WebSphere MQ InstallationDokument64 SeitenVeritas™ High Availability Agent For WebSphere MQ Installation and Configuration Guide / WebSphere MQ InstallationkarthickmsitNoch keine Bewertungen